Professional Documents

Culture Documents

Factsheet PAXWX.O 2021-08-24-12-15-26

Factsheet PAXWX.O 2021-08-24-12-15-26

Uploaded by

Johnny FavouriteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet PAXWX.O 2021-08-24-12-15-26

Factsheet PAXWX.O 2021-08-24-12-15-26

Uploaded by

Johnny FavouriteCopyright:

Available Formats

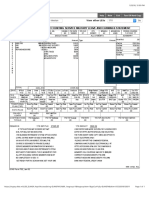

Pax Sustainable Alloc Fund;Individual Investor

Data updated as of Tuesday, 24 de August de 2021

FUND IDENTIFIERS LIPPER LEADERS KEY: United States Overall

ISIN Code US7042231065

Valor 960722

CUSIP 704223106

Lipper ID 40000643

Highest - 5 ∙ 4 ∙ 3 ∙ 2 ∙ 1 – Lowest

FUND OBJECTIVE

The Fund seeks to provide its shareholders with a diversified holding of securities of companies which offer primarily income and conservation of principal and

secondarily possible long-term growth of capital, using both economic and social criteria.

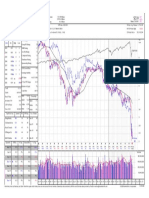

PERCENTAGE GROWTH (Monday, 23 de August de 2021) $10,000 RE-INVESTED AND ROLLING MONTHLY PERFORMANCE

Percentage growth of fund, benchmark and sector for total return, gross, no initial charges, fund Rolling monthly and 10,000 re-invested for total return, no initial charges, fund currency.

currency.

CALENDAR YEAR PERFORMANCE ANALYSIS (Monday, 23 de August de 2021)

Name 2016 2017 2018 2019 2020 YTD

Pax Sustainable Alloc Fund;Individual Investor 5,81 13,16 -4,08 20,83 16,24 13,04

LGC - Lipper Global Mixed Asset USD Aggressive 5,95 16,48 -7,81 20,28 12,19 10,99

FM - S&P 500 TR 11,96 21,83 -4,38 31,49 18,40 20,39

RF - US Treasury Bills 3 Months TR 0,31 0,92 1,93 2,06 0,36 0,03

Past performance is not necessarily a guide to future performance and investors should remember that past performance is not a guarantee of future results. You may not get back the amount originally

invested. Percentage Growth calculated over displayed time periods aligned to the month end, total return, gross, no initial charges, in the fund currency. The benchmark used throughout this Fund Factsheet

is the LGC Index. All Technical Analysis calculations are calculated over 3 years in the fund currency using the benchmark listed above and the Risk-Free benchmark: US Treasury Bills 3 Months TR.

FUND OVERVIEW TECHNICAL ANALYSIS 3 YEARS (Saturday, 31 de July de 2021)

NAV/Bid/Offer (Tuesday, 24 de August de Alpha 0,19

USD 29,5800 / 0 / 29,58

2021) Beta 0,58

Fund Size (Friday, 30 de July de 2021) USD 1.627.466.068 R-Squared 0,97

Launch Date Tuesday, 10 de August de 1971 Standard Deviation 10,97

Domicile USA Sharpe Ratio 0,30

Geographical Focus United States of America Information Ratio -0,15

Actual Annual Management Fee 0,0500 % Tracking Error 2,30

Max Initial Charge -- Correlation 0,98

Max Redemption Charge -- Return/Risk 0,35

Min Investment USD 1000 Maximum Drawdown -11,10

Promoter Impax Asset Management Treynor Ratio 1,63

Fund Company Impax Asset Management LLC

Page 1 of 1

Copyright 2021 Lipper Limited, a Refinitiv company. All rights reserved. Any copying, re-publication or re-distribution of Lipper content, including by caching, framing or similar

means, is expressly prohibited without the prior written consent of Lipper. The information contained in this Fund Fact Sheet has been obtained from or is based upon sources

believed to be reliable but is not warranted to be accurate or complete. Lipper Leaders status is calculated monthly using data available at the time of calculation. Lipper, other

members of Refinitiv and their data providers shall not be liable for any errors in the content, or for any actions taken in reliance thereon. This publication does not constitute an

offer to purchase shares in the funds referred to, nor does information about Lipper Leader funds constitute a recommendation to buy or sell mutual funds. Lipper Leaders

analyse past fund performance, and investors should remember that past performance is not a guarantee of future results. Read the fund prospectus for full details. Lipper and

the Lipper logo are trademarks and registered trademarks of Refinitiv. For additional information on other Lipper services, please visit the Lipper public website

www.lipperweb.com or contact us at: https://my.refinitiv.com/content/mytr/en/myrefinitivsupport.html.

You might also like

- Zambia E Visa Cover LetterDocument4 pagesZambia E Visa Cover Letterbcqta9j6No ratings yet

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- 201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Document1 page201 East 4th Street, Suite 800 Cincinnati OH 45202 513.852.4899Tera's TarotNo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- S&P 500 Index Etf: HorizonsDocument4 pagesS&P 500 Index Etf: HorizonsChrisNo ratings yet

- Portfolio Monitor: Monthly Report For THOMAS WINKE June 07, 2010 Marcelparcel PortfolioDocument55 pagesPortfolio Monitor: Monthly Report For THOMAS WINKE June 07, 2010 Marcelparcel Portfolioapi-26195599No ratings yet

- Prudential Public Limited Company (PUK)Document2 pagesPrudential Public Limited Company (PUK)Carlos FrancoNo ratings yet

- PUK Earnings DateDocument2 pagesPUK Earnings DateCarlos FrancoNo ratings yet

- PUK Earnings Date182021Document2 pagesPUK Earnings Date182021Carlos FrancoNo ratings yet

- S&P/TSX Capped Composite Index Etf: HorizonsDocument4 pagesS&P/TSX Capped Composite Index Etf: HorizonsCelestien LaperierreNo ratings yet

- 06 2012 MH07418Document1 page06 2012 MH07418ereeshaisaacsNo ratings yet

- Absa Dividend Income FundDocument2 pagesAbsa Dividend Income FundGontse SitholeNo ratings yet

- USD STMT Aug To Oct 2020 For KOMDocument3 pagesUSD STMT Aug To Oct 2020 For KOMsimple footballNo ratings yet

- Aset SahamDocument69 pagesAset SahamAlif SyarifudinNo ratings yet

- Crude Oil 2X Daily Bull Etf: BetaproDocument4 pagesCrude Oil 2X Daily Bull Etf: BetaproHelen ZhangNo ratings yet

- Marijuana Life Sciences Index Etf: HorizonsDocument4 pagesMarijuana Life Sciences Index Etf: HorizonsAlex CajelaisNo ratings yet

- Infosys Technologies Ltd. Equity: Filing & Other Info Peer Group ChartingDocument26 pagesInfosys Technologies Ltd. Equity: Filing & Other Info Peer Group Chartinglaxmantej77No ratings yet

- COSCO - PH Cosco Capital Inc. Financial Statements - WSJDocument1 pageCOSCO - PH Cosco Capital Inc. Financial Statements - WSJjannahaaliyahdNo ratings yet

- Fundcard: Edelweiss Low Duration Fund - Direct PlanDocument4 pagesFundcard: Edelweiss Low Duration Fund - Direct PlanYogi173No ratings yet

- Legg Mason Value Fund - Dec 2022 PDFDocument2 pagesLegg Mason Value Fund - Dec 2022 PDFJeanmarNo ratings yet

- Financial Opportunities 2Q 2022Document3 pagesFinancial Opportunities 2Q 2022ag rNo ratings yet

- Factsheet For Fidelity Mutual FundDocument2 pagesFactsheet For Fidelity Mutual FundewaidaebaaNo ratings yet

- LALCO_2019Q1Document2 pagesLALCO_2019Q1v.vatsalavong2017No ratings yet

- S&P/TSX 60 Index Etf: HorizonsDocument4 pagesS&P/TSX 60 Index Etf: HorizonsLesterNo ratings yet

- Banco Santander Sa AdrDocument1 pageBanco Santander Sa AdrchristianNo ratings yet

- Indices Other Stories:: FRI 24 MAR 2017Document3 pagesIndices Other Stories:: FRI 24 MAR 2017JajahinaNo ratings yet

- Policy Valuation: Created On 12 March 2020Document3 pagesPolicy Valuation: Created On 12 March 2020Alexandre Magno Bernardo FontouraNo ratings yet

- Brigham Exploration (BEXP)Document2 pagesBrigham Exploration (BEXP)andrewbloggerNo ratings yet

- ABYT Independent Research Report 20071217Document16 pagesABYT Independent Research Report 20071217minihero0806No ratings yet

- Valve Adj.Document1 pageValve Adj.Antoni ZelayaNo ratings yet

- payerStatementsByDate PDFDocument2 pagespayerStatementsByDate PDFд. ЭркаNo ratings yet

- Listed Companies Highlights: Financial FocusDocument1 pageListed Companies Highlights: Financial FocusT'Tee MiniOns'TmvsNo ratings yet

- 05 28 23Document1 page05 28 23bukharisyedrNo ratings yet

- Equity Pension Fund IIDocument1 pageEquity Pension Fund IISrigandh's WealthNo ratings yet

- Activity 1 Cash Count - MagoDocument4 pagesActivity 1 Cash Count - MagoPhebe Keith MagoNo ratings yet

- Barings Global Senior Secured Bond FundDocument4 pagesBarings Global Senior Secured Bond FundFrancis MejiaNo ratings yet

- 2020 12 December PublicDocument2 pages2020 12 December Publicsumit.bitsNo ratings yet

- Jkload 2Document3 pagesJkload 2Jay OsloNo ratings yet

- S&P 500 Index Etf: HorizonsDocument4 pagesS&P 500 Index Etf: HorizonsCelestien LaperierreNo ratings yet

- Disbursement Voucher Checking Account MOOEDocument7 pagesDisbursement Voucher Checking Account MOOEMark Patrics Comentan VerderaNo ratings yet

- OSK 2Q10 - Cut To HoldDocument4 pagesOSK 2Q10 - Cut To Holdlimml63No ratings yet

- 2012ADocument190 pages2012As88831139No ratings yet

- Psychedelic Stock Index Etf: HorizonsDocument4 pagesPsychedelic Stock Index Etf: HorizonsananNo ratings yet

- Sample New Fidelity Acnt STMT Pages 8Document1 pageSample New Fidelity Acnt STMT Pages 8Temp 123No ratings yet

- AprilDocument3 pagesAprilLathaRajRajandrenNo ratings yet

- Top Story:: FRI 15 JAN 2021Document8 pagesTop Story:: FRI 15 JAN 2021JajahinaNo ratings yet

- Statement of AccountDocument3 pagesStatement of AccountrenitnglNo ratings yet

- 9.50% IDBI BANK LIMITED 2030 - The Fixed IncomeDocument3 pages9.50% IDBI BANK LIMITED 2030 - The Fixed Incomeqn7b7shm82No ratings yet

- AAPL.O Apple Inc. Profile - ReutersDocument7 pagesAAPL.O Apple Inc. Profile - ReutersSheryl PajaNo ratings yet

- ANALYSIS SDCL PartDocument6 pagesANALYSIS SDCL PartSanjeev JhaNo ratings yet

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDocument4 pagesTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNo ratings yet

- Bisbull 38Document9 pagesBisbull 38readerNo ratings yet

- ValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08Document4 pagesValueResearchFundcard MiraeAssetTaxSaverFund DirectPlan 2019mar08pqwertyNo ratings yet

- Jamna Auto Share Price, Jamna Auto Stock Price, JDocument2 pagesJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989No ratings yet

- Annual Statement Amanah Saham Nasional For The Financial Year Ending 31/12/2017Document1 pageAnnual Statement Amanah Saham Nasional For The Financial Year Ending 31/12/2017Pearl MalaekaNo ratings yet

- S&P/TSX 60 Index Etf: HorizonsDocument4 pagesS&P/TSX 60 Index Etf: HorizonsCelestien LaperierreNo ratings yet

- Sspofadv 4Document1 pageSspofadv 4Antoni Zelaya0% (1)

- Sspofadv 4Document1 pageSspofadv 4blackson knightsonNo ratings yet

- Debt Reduction Calculator - TemplateDocument4 pagesDebt Reduction Calculator - TemplateKhwaja101No ratings yet

- Actual Inventory of SHS Teachers & PersonnelDocument16 pagesActual Inventory of SHS Teachers & PersonnelHelen Joy Grijaldo JueleNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- KHK HandbookDocument37 pagesKHK HandbookA JoshiNo ratings yet

- Marketing Management Final Exam Case StuDocument2 pagesMarketing Management Final Exam Case Stumahmoud sakrNo ratings yet

- Tropy 2015Document258 pagesTropy 2015Jamie TanNo ratings yet

- Budget Operations Manual For Local Government UnitsDocument247 pagesBudget Operations Manual For Local Government UnitsJean Rema GonjoranNo ratings yet

- Sandhya Rani Das 0472200100004006Document7 pagesSandhya Rani Das 0472200100004006gautambarbhuiya29905gNo ratings yet

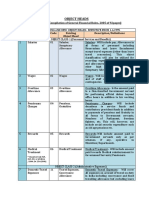

- Object Head List PDFDocument6 pagesObject Head List PDFLal ZahawmaNo ratings yet

- Consumer Behavior of The Selected Rizal Technological University Students During Covid-19 PandemicDocument7 pagesConsumer Behavior of The Selected Rizal Technological University Students During Covid-19 PandemicArsenio N. RojoNo ratings yet

- Fulfillment Process Presentation Final Team 5Document11 pagesFulfillment Process Presentation Final Team 5Bhargav MehtaNo ratings yet

- Script Call RoleplayDocument6 pagesScript Call RoleplayLương Thị TâmNo ratings yet

- 1902 January 2018 ENCS FinalDocument2 pages1902 January 2018 ENCS FinalrbelduaNo ratings yet

- 700 Transport Gurney: Operations and Maintenance ManualDocument27 pages700 Transport Gurney: Operations and Maintenance Manualsec.ivbNo ratings yet

- SALES - Case DigestDocument2 pagesSALES - Case DigestBuen LibetarioNo ratings yet

- MR4 - G2 Research ReportDocument66 pagesMR4 - G2 Research Reportngân hà maNo ratings yet

- BSBMKG547 Student Assessment Guide - Task 2Document24 pagesBSBMKG547 Student Assessment Guide - Task 2lisasripruekNo ratings yet

- Preparation of Final AccountsDocument13 pagesPreparation of Final AccountsDr Sarbesh MishraNo ratings yet

- The Nature of Managerial Economics Economics EssayDocument86 pagesThe Nature of Managerial Economics Economics EssayCoke Aidenry SaludoNo ratings yet

- ProspectusDocument2 pagesProspectusJuliana Mae FradesNo ratings yet

- 3691 - 7130555536323033 PDFDocument3 pages3691 - 7130555536323033 PDFJuan Pablo MarinNo ratings yet

- Metabical Case Study SolutionDocument7 pagesMetabical Case Study SolutionAshutosh PatkarNo ratings yet

- Ultimate CX Ebook51Document39 pagesUltimate CX Ebook51vvsshivaprasadNo ratings yet

- Irina ShamaevaDocument2 pagesIrina Shamaevaapi-20350857100% (1)

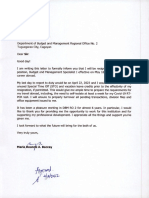

- Dbm-Roii-Letter of Resignation of MS Maria Roanne A BaccayDocument10 pagesDbm-Roii-Letter of Resignation of MS Maria Roanne A BaccayJale Ann A. EspañolNo ratings yet

- FOS Lesson PlanDocument6 pagesFOS Lesson PlanReymond SumayloNo ratings yet

- Build-Up Rate Calculation For 1M3 of Selected Concrete Grade Using Concrete MixerDocument4 pagesBuild-Up Rate Calculation For 1M3 of Selected Concrete Grade Using Concrete MixerMRNo ratings yet

- Central Government Role in Road Infrastructure Development and Economic Growth in The Form of Future Study: The Case of IndonesiaDocument12 pagesCentral Government Role in Road Infrastructure Development and Economic Growth in The Form of Future Study: The Case of IndonesiaRidho ridhoNo ratings yet

- About Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Document19 pagesAbout Fixed Coupon Central Government Securities (Also Called Gsecs or Gilts)Parv SalechaNo ratings yet

- Amcat - 4Document31 pagesAmcat - 4Saurabh MalikNo ratings yet

- St. Paul University Philippines Tuguegarao City, Cagayan: Requirement For The Degree of Master of Business AdministrationDocument3 pagesSt. Paul University Philippines Tuguegarao City, Cagayan: Requirement For The Degree of Master of Business AdministrationSam MatammuNo ratings yet

- The Importance of LogisticsDocument4 pagesThe Importance of LogisticsJohn Paul van Dalen LunaNo ratings yet