Professional Documents

Culture Documents

Web Class 21

Web Class 21

Uploaded by

kimjim0 ratings0% found this document useful (0 votes)

1 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views3 pagesWeb Class 21

Web Class 21

Uploaded by

kimjimCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

DEPARTMENT OF POLITICAL SCIENCE

AND

INTERNATIONAL RELATIONS

Posc 150

THE FEDERAL BUDGET

I. CONTENTS:

A. The federal budget

II. THE FEDERAL BUDGET:

A. Note the discussion pertains to the federal budget.

1. State and local finances are not included.

B. Popular perceptions and worries.

1. Run-away government spending is wrecking ours and our children’s future.

i. See for sure: “U.S. National Debt Clock.”

(http://www.brillig.com/debt_clock/)

2. George W. Bush: if taxes are not lowered “they” will find a way to spend

“your” money.

3. Government spending is inefficient and wasteful.

4. The government must conduct its affairs just like a business or family.

C. tImportant:

1. People try to perpetuate misconceptions and stereotypes in order to get

their way on issues.

i. To the extent that the federal budget is misunderstood by the public

citizens lose control over one aspect of their government that really

affects their lives.

1) The budget is certainly more important to them than any

scandal or personal misconduct.

2) This is why the mass media are so frustrating to me.

III. BUDGET BASICS:

A. Simple view

1. Revenues:

i. Income tax

ii. Pay roll

iii. Corporate

iv. Other taxes, fees

v. Note the importance of social security taxes.

vi. tNote what has been growing.

vii. Tax cut proposals.

1) Bush, “$1,083 average tax cut for 92 million Americans...”

2) BUT, most will receive far less than $1,000.

2. Outlays: what tax dollars buy:

Posc 150 Class 21 - The Federal Budget Page 2

i. Functions and super-functions.

3. Balance, deficit, surplus

4. National debt.

B. For the last 40 years until recently in the Clinton administration (about 1997) the

budget has seemed to be out of balance.

1. Trends in spending, revenue, deficits, debts.

2. tNow the CBO projects additional deficits through 2008.

IV. A MORE SUBTLE VIEW:

A. Changes in the composition of the budget

1. The usual way of looking at the budget can be misleading.

2. ‰Spending by function and agency does not reveal the total picture.

i. Look at the images and texts on the class web page.

1) Read “Political Economy”

B. •Discretionary spending:

1. Congress annually appropriates money for federal activities.

2. Biggest category by far is defense spending.

C. •Mandatory spending:

1. •Entitlements: recipients or beneficiaries are entitled to benefits if they

meet eligibility requirements.

i. Congress does not annually appropriate money for them in the

usual fashion.

ii. Costs go up with inflation, changes in demographics, state of the

economy, etc.

iii. Transfer programs such as Social Security, federal retirements,

veterans benefits.

iv. Means-tested and non-means tested entitlements

2. The biggest mandatory programs are social security, medicare, medicaid,

and interest on the national debt.

i. Only the last, medicaid, is devoted to helping the poor.

ii. The other two benefit the middle class.

3. Interest on the debt.

D. ‰Growth in entitlements and mandatory spending:

1. Major point: since the early 1970s spending on entitlements has increased

by leaps and bounds.

2. Contrary to popular belief, spending on discretionary programs has

remained more or less steady; in fact, for many categories it has decreased.

V. DIFFERENCES BETWEEN FEDERAL AND HOUSEHOLD OR BUSINESS

BUDGETS:

A. Politicians, editors--nearly everyone in fact--insists on comparing the federal

budget with business or household budgets.

B. ‰How the budget differs from “ordinary” budgets:

1. Ordinary budgets separate investment spending from consumption.

Posc 150 Class 21 - The Federal Budget Page 3

2. What is recorded in federal budget documents are expenditures

3. The federal budget does not.

i. Expenditures are not broken down into funds for consumption and

for assets.

4. •But, should investment be thought of the same way as spending for

consumption?

i. What government “spending” buys:

1) Human capital

a) Education, training, health, psychological and social

well-being sufficient to make the labor productive.

2) Infrastructure

3) Research and development

C. The uses of public debts and deficits.

1. Structural versus fiscal deficits.

2. Pump priming in recessions.

3. See Heilbroner and Thurow.

D. Measuring the debt

1. Gross versus net debt = liabilities minus assets.

2. Debt as portion of the economy.

3. Who owns the debt?

i. Government (public) versus private holders.

VI. NEXT TIME:

A. Second test

B. Reading:

1. Strongly recommended: Jeff Faux and Max Sawicky, “Social Investment

and the Budget Debate,” (September 22, 1999 Issue Brief #134) in Cyber

Reserve Room or directly: (http://www.epinet.org/Issuebriefs/IB134.pdf).

2. ‰Strongly recommended: “The Federal Budget,” under “Political

Economy” in the Cyber Reserve Room.

i. These short reading provide some back up to Heilbroner and

Thurow and the class discussion.

3. Recommended: OMB, “A Citizen’s Guide To The Budget,” in Cyber

reserve Room or directly

http://w3.access.gpo.gov/usbudget/fy2000/guidetoc.html

4. Recommended: “National Budget Simulation,” at

http://garnet.berkeley.edu:3333/budget/budget.html

5. Recommended: CBO, “The Budget And Economic Outlook.”

http://www.cbo.gov/showdoc.cfm?index=3019&sequence=0&from=7

6. Recommended: CBO, “Glossary of Budgetary and Economic Terms” in

Cyber Reserve room or

http://www.cbo.gov/showdoc.cfm?index=4032&sequence=14

You might also like

- Separation Document - Ss293 1707en PDocument13 pagesSeparation Document - Ss293 1707en PMark LordNo ratings yet

- Philippine Public DebtDocument20 pagesPhilippine Public Debtmark genove100% (3)

- How To Read and Interpret Financial Statements - A Guide To Understanding What The Numbers Really MeanDocument179 pagesHow To Read and Interpret Financial Statements - A Guide To Understanding What The Numbers Really MeanMushahid Aly Khan100% (6)

- Principles of Macroeconomics 1st Edition Mateer Test Bank instant download all chapterDocument55 pagesPrinciples of Macroeconomics 1st Edition Mateer Test Bank instant download all chapterrembeskopaci55100% (5)

- Instant Download PDF Principles of Macroeconomics 1st Edition Mateer Test Bank Full ChapterDocument55 pagesInstant Download PDF Principles of Macroeconomics 1st Edition Mateer Test Bank Full Chapterachmalxumba100% (8)

- Full download Principles of Macroeconomics 1st Edition Mateer Test Bank all chapter 2024 pdfDocument44 pagesFull download Principles of Macroeconomics 1st Edition Mateer Test Bank all chapter 2024 pdfbuurtosse100% (8)

- PociceDocument3 pagesPociceishaan adultNo ratings yet

- Principles of Macroeconomics 1st Edition Mateer Test BankDocument32 pagesPrinciples of Macroeconomics 1st Edition Mateer Test Bankbirdmanzopiloter7te2100% (34)

- Principles of Macroeconomics 1St Edition Mateer Test Bank Full Chapter PDFDocument40 pagesPrinciples of Macroeconomics 1St Edition Mateer Test Bank Full Chapter PDFmarthalouisaq6x100% (15)

- Public ExpenditureDocument53 pagesPublic ExpenditureAwoke BerihunNo ratings yet

- Unit 6 Test - GovernmentDocument3 pagesUnit 6 Test - GovernmentMs. Rosalyn ForemanNo ratings yet

- AttachmentDocument26 pagesAttachmentsuleymangetieNo ratings yet

- Public Finance and Taxation Chapter 1 & 2Document31 pagesPublic Finance and Taxation Chapter 1 & 2adisesegedeNo ratings yet

- PROEL 13 Public Finance March132023Document21 pagesPROEL 13 Public Finance March132023Mary Joy DayaoNo ratings yet

- Chapter 25 - Problem SetDocument2 pagesChapter 25 - Problem SetMinh AnhNo ratings yet

- Ass 4Document11 pagesAss 4Sneha BasnetNo ratings yet

- Group 6 - Tut 1 - 20022Document5 pagesGroup 6 - Tut 1 - 20022thuthuy.fis.hanuNo ratings yet

- Savings and Investment Process: True-False QuestionsDocument28 pagesSavings and Investment Process: True-False QuestionsDuyen Pham DieuNo ratings yet

- John Leur C. Virtucio Written ReportDocument12 pagesJohn Leur C. Virtucio Written ReportLeMignonD.RoxasNo ratings yet

- The 21st Century Plan For America's LeadershipDocument18 pagesThe 21st Century Plan For America's LeadershipAndySternNo ratings yet

- Research Paper Final - Fouad SalehDocument13 pagesResearch Paper Final - Fouad Salehapi-466403567No ratings yet

- Federal Budget Simulation Understanding The Federal BudgetDocument48 pagesFederal Budget Simulation Understanding The Federal BudgetJosh ColvinNo ratings yet

- Chapter 2-Meaning and Scope of Public FinanceDocument21 pagesChapter 2-Meaning and Scope of Public FinanceyebegashetNo ratings yet

- Lecture On Public Finance Econ 301: Overview of The Course What Is Public Finance ? ExpenditureDocument10 pagesLecture On Public Finance Econ 301: Overview of The Course What Is Public Finance ? Expendituresaad aliNo ratings yet

- Social Problems 14th Edition Eitzen Solutions Manual 1Document36 pagesSocial Problems 14th Edition Eitzen Solutions Manual 1melissajonesiznjarqtxb100% (32)

- Tut 3 Group 2Document8 pagesTut 3 Group 2Nguyễn Ngọc Thuỳ Dung 1Q-20No ratings yet

- Intros 5Document25 pagesIntros 5drfendiameenNo ratings yet

- ProjectDocument22 pagesProjectbollab654No ratings yet

- IOUSA Not OK: An Analysis of The Deficit Disaster Story in The Film IOUSADocument21 pagesIOUSA Not OK: An Analysis of The Deficit Disaster Story in The Film IOUSACenter for Economic and Policy Research100% (3)

- Similarities Between Public Finance and Private FinanceDocument18 pagesSimilarities Between Public Finance and Private FinanceMelkamu100% (2)

- Unit 4-5Document18 pagesUnit 4-5Thảo TrầnNo ratings yet

- Seminar-3Document14 pagesSeminar-3Hân Đức NguyễnNo ratings yet

- (ECO) Chapter 8 Public Finance in IndiaDocument11 pages(ECO) Chapter 8 Public Finance in IndiaMehfooz PathanNo ratings yet

- Eco P3Document5 pagesEco P3John ManlapazNo ratings yet

- NSTP Week 3 NOTESDocument4 pagesNSTP Week 3 NOTESChristine JoyceNo ratings yet

- KCMJune 10Document3 pagesKCMJune 10amit.chokshi2353No ratings yet

- Unit 4-5 CW-Trần Hồng QuânDocument18 pagesUnit 4-5 CW-Trần Hồng QuânLan Anh Ngô ThịNo ratings yet

- Seminar 3: QuestionDocument9 pagesSeminar 3: QuestionHong NguyenNo ratings yet

- Tutorial 3 - Group 6Document9 pagesTutorial 3 - Group 6thuthuy.fis.hanuNo ratings yet

- Pub - FinDocument21 pagesPub - Finjay diazNo ratings yet

- Economics Module - IIIDocument23 pagesEconomics Module - IIINeet 720No ratings yet

- Solution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherDocument18 pagesSolution Manual For Introduction To Finance Markets Investments and Financial Management 14th Edition by MelicherLuisMurraymrzye100% (93)

- Quiz 547Document7 pagesQuiz 547Haris NoonNo ratings yet

- A.P. Civics Notes: Chapter 16: "Economic Policy"Document5 pagesA.P. Civics Notes: Chapter 16: "Economic Policy"malik javedNo ratings yet

- Scert: 12 Economy Chapter-9Document39 pagesScert: 12 Economy Chapter-9tamilrockers downloadNo ratings yet

- Crisis SolutionDocument3 pagesCrisis SolutionTolera ArarsaNo ratings yet

- Common Sense EconomicsDocument5 pagesCommon Sense EconomicsEDUARDO JR QUIDTANo ratings yet

- Deficit Spending - Tim Geithner and Gross Domestic BloatDocument1 pageDeficit Spending - Tim Geithner and Gross Domestic Bloat6115oversightNo ratings yet

- 03 Aug 2020: UPSC Exam Comprehensive News Analysis: A. GS 1 RelatedDocument10 pages03 Aug 2020: UPSC Exam Comprehensive News Analysis: A. GS 1 RelatedMahendra GuptaNo ratings yet

- American Govt Review Questions-Chapter-15Document12 pagesAmerican Govt Review Questions-Chapter-15Michael ZhengNo ratings yet

- Enlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansFrom EverandEnlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansNo ratings yet

- Unit 13Document14 pagesUnit 13Lekhutla TFNo ratings yet

- Current Affairs Quiz (11th June 2024) (Date - 11-06-2024)Document5 pagesCurrent Affairs Quiz (11th June 2024) (Date - 11-06-2024)Jyothi Sri KaradiNo ratings yet

- Week ThreeDocument23 pagesWeek Threeecgbogbojama82No ratings yet

- English Handout Class 5Document4 pagesEnglish Handout Class 5word04832No ratings yet

- F-Cubed Principle FlottmannDocument16 pagesF-Cubed Principle FlottmannJay FlottmannNo ratings yet

- Economic PolicymakingDocument2 pagesEconomic Policymakingapi-286182524No ratings yet

- Role of Public FinanceDocument13 pagesRole of Public FinanceUlaga50% (2)

- SS2 WEEK 2 - Budget and Public Debt - Ending 21-05-2022 3rd TermDocument7 pagesSS2 WEEK 2 - Budget and Public Debt - Ending 21-05-2022 3rd Termlenee letambariNo ratings yet

- English Handout Class 5Document4 pagesEnglish Handout Class 5Rajat kumarNo ratings yet

- Ibps Po Pre Practice Set Vijay Tripathi PDFDocument131 pagesIbps Po Pre Practice Set Vijay Tripathi PDFDuvva VenkateshNo ratings yet

- China and the US Foreign Debt Crisis: Does China Own the USA?From EverandChina and the US Foreign Debt Crisis: Does China Own the USA?No ratings yet

- Sustainability ProjectDocument13 pagesSustainability ProjectkimjimNo ratings yet

- Chemistry Unit ReviewDocument5 pagesChemistry Unit ReviewkimjimNo ratings yet

- Web Class 17Document3 pagesWeb Class 17kimjimNo ratings yet

- Introduction Ecosystem Service.v9Document17 pagesIntroduction Ecosystem Service.v9kimjimNo ratings yet

- Getting To Know The EarthDocument2 pagesGetting To Know The EarthkimjimNo ratings yet

- Interactions Among Living Things - 2014 - NewDocument29 pagesInteractions Among Living Things - 2014 - NewkimjimNo ratings yet

- Pol-Economy 2019 Class4bisDocument24 pagesPol-Economy 2019 Class4biskimjimNo ratings yet

- It Is Better To Have A Permanent Income Than To Be FascinatingDocument40 pagesIt Is Better To Have A Permanent Income Than To Be FascinatingkimjimNo ratings yet

- L02 Preferences and Utility 2014Document89 pagesL02 Preferences and Utility 2014kimjimNo ratings yet

- L01 Economics 2014Document32 pagesL01 Economics 2014kimjimNo ratings yet

- Pol-Economy 2019 Class3Document47 pagesPol-Economy 2019 Class3kimjimNo ratings yet

- Prof. John Munro: Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument30 pagesProf. John Munro: Munro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument42 pagesMunro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- Pol-Economy 2019 Class2Document32 pagesPol-Economy 2019 Class2kimjimNo ratings yet

- Pr0F. John Munro Economics 301Y1: Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument49 pagesPr0F. John Munro Economics 301Y1: Munro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- Pol-Economy 2019 5Document33 pagesPol-Economy 2019 5kimjimNo ratings yet

- Pol-Economy 2019 Class1Document31 pagesPol-Economy 2019 Class1kimjimNo ratings yet

- 03-Defining SustainabilityDocument4 pages03-Defining SustainabilitykimjimNo ratings yet

- Module #25 NotesDocument38 pagesModule #25 NoteskimjimNo ratings yet

- EVS Lecture II 8 EndangeredandEndemicSpeciesofIndiaDocument12 pagesEVS Lecture II 8 EndangeredandEndemicSpeciesofIndiakimjimNo ratings yet

- Prof. John H. Munro: Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument39 pagesProf. John H. Munro: Munro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- 07 Med Eng AgriDocument61 pages07 Med Eng AgrikimjimNo ratings yet

- Dispersion & Mixing: Environmental Transport and FateDocument9 pagesDispersion & Mixing: Environmental Transport and FatekimjimNo ratings yet

- Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument45 pagesMunro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- 02POPMEDocument74 pages02POPMEkimjimNo ratings yet

- The Problem of Turbulent Dispersion: Turbulence in FluidsDocument25 pagesThe Problem of Turbulent Dispersion: Turbulence in FluidskimjimNo ratings yet

- Introduction To Air Pollution Air Pollution: Environmental Transport and FateDocument11 pagesIntroduction To Air Pollution Air Pollution: Environmental Transport and FatekimjimNo ratings yet

- Biological Wastewater Treatment - Part 1: (Nazaroff & Alvarez-Cohen, Section 6.E - Augmented)Document11 pagesBiological Wastewater Treatment - Part 1: (Nazaroff & Alvarez-Cohen, Section 6.E - Augmented)kimjimNo ratings yet

- Biological Wastewater Treatment - Part 2: (Nazaroff & Alvarez-Cohen, Section 6.E - Augmented)Document12 pagesBiological Wastewater Treatment - Part 2: (Nazaroff & Alvarez-Cohen, Section 6.E - Augmented)kimjimNo ratings yet

- Ghana SDI CalculationsDocument9 pagesGhana SDI Calculationsmmubashirm504No ratings yet

- BOI Application FormDocument11 pagesBOI Application Formien_dsNo ratings yet

- List Data VendorsDocument1 pageList Data VendorsjrladduNo ratings yet

- Ch20 InvestmentAppraisalDocument32 pagesCh20 InvestmentAppraisalsohail merchantNo ratings yet

- Lesson 6 - Obligations With A Period (Student's Copy)Document10 pagesLesson 6 - Obligations With A Period (Student's Copy)Eunice AmbrocioNo ratings yet

- EffectiveManagementofThirdPartyClaims SanjayDattaDocument28 pagesEffectiveManagementofThirdPartyClaims SanjayDattasouravroy.sr5989No ratings yet

- Bank Alfalah Management ReportDocument17 pagesBank Alfalah Management ReportUrooj AliNo ratings yet

- Gmail - (Request On Hold) 21-09-2022 14 - 45 - 25aaaDocument2 pagesGmail - (Request On Hold) 21-09-2022 14 - 45 - 25aaaDocuments DeltasNo ratings yet

- FA2Document3 pagesFA2lulughoshNo ratings yet

- GFA 712S - 2019 Test 1 MemoDocument8 pagesGFA 712S - 2019 Test 1 MemoNolan TitusNo ratings yet

- Tugas Kelompok 5Document4 pagesTugas Kelompok 5Bought By UsNo ratings yet

- Bajaj Capital LimitedDocument1 pageBajaj Capital LimitedSunny JohnsonNo ratings yet

- TPH Day4Document100 pagesTPH Day4adyani_0997100% (1)

- Advocates For Truth in Lending, Inc. vs. Bangko Sentral Monetary BoardDocument2 pagesAdvocates For Truth in Lending, Inc. vs. Bangko Sentral Monetary BoardylourahNo ratings yet

- Chapter 1 - Risk and Its ManagementDocument6 pagesChapter 1 - Risk and Its ManagementAbeer AlSalem67% (3)

- Investment AlternativesDocument11 pagesInvestment Alternativesoureducation.inNo ratings yet

- New Mooe FormsDocument14 pagesNew Mooe FormsMark Lorence CezarNo ratings yet

- Forward Markets Commission FMC Economics Study Material Amp NotesDocument3 pagesForward Markets Commission FMC Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Computerized Digest Complete2010Document215 pagesComputerized Digest Complete2010Rupert Villarico100% (1)

- 20161003.NTPU.巴拿馬文件大解密 (BL) PDFDocument81 pages20161003.NTPU.巴拿馬文件大解密 (BL) PDFJamieNo ratings yet

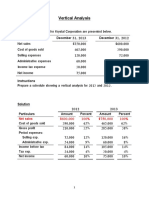

- Vertical Analysis SolutionsDocument5 pagesVertical Analysis SolutionsSamer IsmaelNo ratings yet

- Costing PDFDocument4 pagesCosting PDFFRANCIS JOSEPHNo ratings yet

- Imperial College MSC Management 2022 23Document10 pagesImperial College MSC Management 2022 23b9czpyr5qnNo ratings yet

- RimDocument21 pagesRimmartinhochihangNo ratings yet

- Insular Life Vs Ebrado 80 Scra 181Document2 pagesInsular Life Vs Ebrado 80 Scra 181roy rubaNo ratings yet

- OutsourcingDocument55 pagesOutsourcingNagesh MoreNo ratings yet

- GBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort CodeDocument1 pageGBP Statement: Account Holder IBAN (To Receive GBP From UK Only) UK Sort Code13KARATNo ratings yet

- Allotment of Shares and DebenturesDocument15 pagesAllotment of Shares and DebenturesNidharshanaa V RNo ratings yet