Professional Documents

Culture Documents

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Uploaded by

askkCopyright:

Available Formats

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- IB Quick & Dirty Cheat SheetDocument2 pagesIB Quick & Dirty Cheat SheetChavi SinghNo ratings yet

- Manchester CaseDocument16 pagesManchester Casesalman siddiquiNo ratings yet

- Vodafone Vs Mannesmann: Case Study of A Hostile TakeoverDocument29 pagesVodafone Vs Mannesmann: Case Study of A Hostile TakeoverAnastasia EL SayyedNo ratings yet

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- R45 Private Equity Valuation Edited IFT Notes PDFDocument27 pagesR45 Private Equity Valuation Edited IFT Notes PDFAyush JhunjhunwalaNo ratings yet

- Mergers Acquisitions Fact Sheet (Digital)Document2 pagesMergers Acquisitions Fact Sheet (Digital)Emperor OverwatchNo ratings yet

- Current RatioDocument2 pagesCurrent RatioHafiz UllahNo ratings yet

- Stracos Notes 1Document1 pageStracos Notes 1bangtan sonyeondanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Ratios ASDocument6 pagesRatios ASkhadija mazharNo ratings yet

- Ca Inter FM Formula SheetDocument7 pagesCa Inter FM Formula SheetmewtwovarceusNo ratings yet

- To Test Name of RatioDocument12 pagesTo Test Name of RatioSurendra DevadigaNo ratings yet

- Joint Arrangement PFRS 11Document4 pagesJoint Arrangement PFRS 11Mary Shiela Garcia MalayaNo ratings yet

- Financial Accounting and Reporting Exam - FORMULAE SHEETDocument1 pageFinancial Accounting and Reporting Exam - FORMULAE SHEETDiivay AgarwalNo ratings yet

- Level 1 Assessment Financial Analysis ProdegreeDocument4 pagesLevel 1 Assessment Financial Analysis ProdegreePrá ChîNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- 4 Summary of Commonly Used Ratios (AS & A Level)Document3 pages4 Summary of Commonly Used Ratios (AS & A Level)Musthari KhanNo ratings yet

- IFRS 3 Business CombinationDocument5 pagesIFRS 3 Business CombinationImraz IqbalNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Bonds Payable HandoutDocument15 pagesBonds Payable Handoutlady gwaeyngNo ratings yet

- Synergies and ValuationDocument16 pagesSynergies and ValuationPaul GhanimehNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Debt Invetment: Summary: InvestmentDocument3 pagesDebt Invetment: Summary: InvestmentEphine PutriNo ratings yet

- Financial ManagementDocument22 pagesFinancial ManagementSapan AnandNo ratings yet

- C1M4 QRGDocument1 pageC1M4 QRGFatih SahinNo ratings yet

- Aequal LOEpsjDocument1 pageAequal LOEpsjgraphic masterNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- Pas 7Document3 pagesPas 7Sacedon, Trishia Mae C.No ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- FSA Part2Document19 pagesFSA Part2trangNo ratings yet

- Exam 1 Formula Sheet (1) - 2Document2 pagesExam 1 Formula Sheet (1) - 2haleeNo ratings yet

- Acc 1Document45 pagesAcc 1wengkeii07No ratings yet

- Formula Sheet PDFDocument3 pagesFormula Sheet PDFmadhav1111No ratings yet

- Demo LeverageDocument18 pagesDemo LeverageIftikhar baigNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Financial Analysis1Document21 pagesFinancial Analysis1Umay PelitNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Formula Sheet: Pay Back PeriodDocument3 pagesFormula Sheet: Pay Back PeriodtejaswiNo ratings yet

- FS Analysis FormulasDocument3 pagesFS Analysis FormulasCzarhiena SantiagoNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management FormulasDaniel Kahn GillamacNo ratings yet

- Debt InvestmentsDocument3 pagesDebt InvestmentsYhenni XiaoNo ratings yet

- Formula Indirect Method of Cash FlowDocument1 pageFormula Indirect Method of Cash FlowFarnaz CharandabiNo ratings yet

- Financial Ratios: I. ProfitabilityDocument2 pagesFinancial Ratios: I. ProfitabilityJose Francisco TorresNo ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- Cost of Capital This OneDocument9 pagesCost of Capital This OneAmandeep Singh MankuNo ratings yet

- Notes For L3Document11 pagesNotes For L3yuyin.gohyyNo ratings yet

- Lesson 9Document4 pagesLesson 9malik123ggNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Finance BasicsDocument4 pagesFinance BasicsCole HollandNo ratings yet

- C1M4 QRGDocument1 pageC1M4 QRGsherifabayomy3No ratings yet

- FL_CFA_Formula_Sheet_FRA Landscape (SS)5Document2 pagesFL_CFA_Formula_Sheet_FRA Landscape (SS)5Raj SharmaNo ratings yet

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDocument49 pagesMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- FM Formulae SheetDocument4 pagesFM Formulae Sheetatishayjjj123No ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- DCF Valuation: Formula: 3 MethodsDocument1 pageDCF Valuation: Formula: 3 Methodsmadhav madhavNo ratings yet

- Educational Qualifications & Achievements: TH NDDocument1 pageEducational Qualifications & Achievements: TH NDaskkNo ratings yet

- Academic Qualifications and AwardsDocument1 pageAcademic Qualifications and AwardsaskkNo ratings yet

- Educational Qualifications: CompetitionsDocument1 pageEducational Qualifications: CompetitionsaskkNo ratings yet

- 3Document2 pages3askkNo ratings yet

- MFE 06 - Financial Market - Case StudyDocument8 pagesMFE 06 - Financial Market - Case StudyKushan Chanaka AmarasingheNo ratings yet

- Chapter 1 - Business Combinations Statutory Merger and Statutory ConsolidationDocument4 pagesChapter 1 - Business Combinations Statutory Merger and Statutory ConsolidationKaori MiyazonoNo ratings yet

- Fin 520 NoteDocument10 pagesFin 520 NoteEmanuele OlivieriNo ratings yet

- Private EquityDocument25 pagesPrivate EquityAman SinghNo ratings yet

- LBO AnalysisDocument7 pagesLBO AnalysisLeonardoNo ratings yet

- Financial Management and Corporate FinanceDocument2 pagesFinancial Management and Corporate FinanceshriyaNo ratings yet

- Angel Investor Venture CapitalDocument6 pagesAngel Investor Venture CapitalPRK21MS1099 GOPIKRISHNAN JNo ratings yet

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- 4th ClassDocument42 pages4th ClassShreeya SigdelNo ratings yet

- Darshana Bhat Final Summer ProjectDocument81 pagesDarshana Bhat Final Summer ProjectcoolujjwaljainNo ratings yet

- Takeovers Leveraged BuyoutsDocument3 pagesTakeovers Leveraged BuyoutsMinh Châu Tạ ThịNo ratings yet

- OBN - Small Banks - Issue 32 (November 2020)Document2 pagesOBN - Small Banks - Issue 32 (November 2020)Nate TobikNo ratings yet

- Chapter 21Document8 pagesChapter 21Huế ThùyNo ratings yet

- 1995 - Stern and Stewart - EVADocument17 pages1995 - Stern and Stewart - EVAAbdulAzeemNo ratings yet

- Mergers, Acquisitions and Divestments: Economic & Financial Aspects of Corporate ControlDocument5 pagesMergers, Acquisitions and Divestments: Economic & Financial Aspects of Corporate ControldnesudhudhNo ratings yet

- Private Equity NotesDocument5 pagesPrivate Equity NotesSaad KundiNo ratings yet

- Reviewer Pfrs 3 Business CombinationsDocument4 pagesReviewer Pfrs 3 Business CombinationsKryzzel Anne JonNo ratings yet

- Concept Map 2Document8 pagesConcept Map 2mike raninNo ratings yet

- M3 - Business Combination, Statutory Merger and Statutory ConsolidationDocument35 pagesM3 - Business Combination, Statutory Merger and Statutory ConsolidationJohn Michael A. PaclibareNo ratings yet

- Direct Lending: Benefits, Risks and Opportunities: OaktreeDocument13 pagesDirect Lending: Benefits, Risks and Opportunities: OaktreeIshan ShuklaNo ratings yet

- Simon and PaulDocument4 pagesSimon and PaulHeneir FloresNo ratings yet

- TYBAF Question Bank FM IIIDocument28 pagesTYBAF Question Bank FM IIISamuel LeitaoNo ratings yet

- Compliance Relating To Buy-Back of SharesDocument17 pagesCompliance Relating To Buy-Back of Sharesswaraj_chaw1485No ratings yet

- Defence Against Hostile TakeoversDocument2 pagesDefence Against Hostile TakeoversAhmad AfghanNo ratings yet

- Swap RatioDocument13 pagesSwap RatioasifanisNo ratings yet

- Corporate Restructuring - Reconfiguration of A CorporationDocument18 pagesCorporate Restructuring - Reconfiguration of A Corporationishita pancholiNo ratings yet

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Uploaded by

askkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Mergers + Acquisitions Fact Sheet (Digital) - FE Training - Goldman Sachs

Uploaded by

askkCopyright:

Available Formats

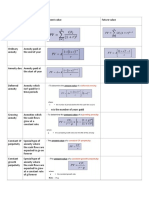

Mergers & Acquisitions

FACT SHEET

Sources & Equity purchase price Acquirer’s cash used

Uses of Funds Refinanced net debt

Revolving credit facility

Transaction fees

Long term debt

OWC adjustment

Pension deficits,

operating leases, other

claims on the business Other Equity issued

USES SOURCES

Offer Premium % = (Offer price ÷ Target unaffected price) − 1

s

ch

Equity Purchase Price = Target diluted shares outstanding × Offer price

a.k.a Acquisition Equity Value

Sa

Acquisition Enterprise Value = Acquisition equity value + Target net debt and debt equivalents

Advisory Equity Issuance Debt Issuance

an

Fees

% OF ACQUISITION EV % OF FUNDS RAISED

dm

Consolidation

ol

Consolidated Balance = Acquirer account balance + Target account balance +/− Transaction effects

G

Balance Sheet Transaction Effects Income Statement

◦ Zero out the Target’s ◦ Step ups and Step downs ◦ Increase / Decrease in ◦ Additional Depreciation /

shareholders’ equity interest expense Amortization

◦ Changes in Cash / Equity /

◦ Zero out the Target’s goodwill Debt for deal financing ◦ Decrease in interest income ◦ Tax impacts from all

and add deal goodwill transactions effects

◦ Synergies

Target shares

Exchange Ratio = New shares issued ÷ or = Offer price ÷ Acquirer price × Stock %

purchased

Acquisition PE Multiple = Offer price ÷ Target EPS

Debt PE Multiple = 1 ÷ After-tax cost of debt

Synergies to Breakeven = Max(0, (Acquirer EPS − Pro forma EPS) × Pro forma shares) ÷ (1 − Tax rate)

© 2022 Financial Edge Training www.fe.training

Mergers & Acquisitions

FACT SHEET

Goodwill

Consolidated Goodwill = Acquirer goodwill + Target goodwill + (Deal goodwill − Target goodwill)

Shareholder equity

Deal Goodwill = Equity purchase price − + Implied goodwill for NCI share

bought at fair value if applicable

Shareholder Equity Target shareholder equity Target Asset step ups/ Asset step downs/

= − + −

Bought at Fair Value bought at book value goodwill liability step downs liability step ups

Implied Goodwill for NCI Share = NCI fair value − (Target equity on BS × (1 − % purchased))

s

ch

Non-Controlling Interests (NCI) Sa

Ending NCI = Beginning NCI + NCI % of net income − NCI % of dividends paid

an

Accretion and Dilution

+ Acquirer net income

dm

+ Target net income

= Combo net income before adjustments

+/− Post-tax adjustments including synergies, interest expense + Acquirer shares outstanding

/income and incremental depreciation and amortization + New shares issued

ol

Pro Forma Earnings Per Share = Pro forma net income ÷ Pro forma shares outstanding

G

Deal EPS Accretion/Dilution = (Pro forma EPS ÷ Acquirer EPS) − 1

Ownership

Post-deal

Acquirer Post-deal Ownership = Acquirer shares outstanding ÷ Pro forma shares outstanding

Target Post-deal Ownership = New shares issued ÷ Pro forma shares outstanding

Acquisition EV plus

ROIC = (Target NOPAT + (Synergies × (1 − Target marginal tax rate))) ÷

Invested Capital

transaction costs

Return On

Target NOPAT = Target EBIT × (1 − Effective tax rate)

Acquisition EV = Equity purchase price + Target net debt and debt equivalents

© 2022 Financial Edge Training www.fe.training

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- IB Quick & Dirty Cheat SheetDocument2 pagesIB Quick & Dirty Cheat SheetChavi SinghNo ratings yet

- Manchester CaseDocument16 pagesManchester Casesalman siddiquiNo ratings yet

- Vodafone Vs Mannesmann: Case Study of A Hostile TakeoverDocument29 pagesVodafone Vs Mannesmann: Case Study of A Hostile TakeoverAnastasia EL SayyedNo ratings yet

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- R45 Private Equity Valuation Edited IFT Notes PDFDocument27 pagesR45 Private Equity Valuation Edited IFT Notes PDFAyush JhunjhunwalaNo ratings yet

- Mergers Acquisitions Fact Sheet (Digital)Document2 pagesMergers Acquisitions Fact Sheet (Digital)Emperor OverwatchNo ratings yet

- Current RatioDocument2 pagesCurrent RatioHafiz UllahNo ratings yet

- Stracos Notes 1Document1 pageStracos Notes 1bangtan sonyeondanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Commonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Document4 pagesCommonsize Analysis - Horizontal Commonsize Analysis - Vertical Dupont Analysis (Roe)Sufiana TanNo ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Ratios ASDocument6 pagesRatios ASkhadija mazharNo ratings yet

- Ca Inter FM Formula SheetDocument7 pagesCa Inter FM Formula SheetmewtwovarceusNo ratings yet

- To Test Name of RatioDocument12 pagesTo Test Name of RatioSurendra DevadigaNo ratings yet

- Joint Arrangement PFRS 11Document4 pagesJoint Arrangement PFRS 11Mary Shiela Garcia MalayaNo ratings yet

- Financial Accounting and Reporting Exam - FORMULAE SHEETDocument1 pageFinancial Accounting and Reporting Exam - FORMULAE SHEETDiivay AgarwalNo ratings yet

- Level 1 Assessment Financial Analysis ProdegreeDocument4 pagesLevel 1 Assessment Financial Analysis ProdegreePrá ChîNo ratings yet

- Formula Sheet-FinalDocument3 pagesFormula Sheet-FinalMuhammad MussayabNo ratings yet

- 4 Summary of Commonly Used Ratios (AS & A Level)Document3 pages4 Summary of Commonly Used Ratios (AS & A Level)Musthari KhanNo ratings yet

- IFRS 3 Business CombinationDocument5 pagesIFRS 3 Business CombinationImraz IqbalNo ratings yet

- Gross Profit Net Profit/ EBIT: Return On Capital EmployesDocument9 pagesGross Profit Net Profit/ EBIT: Return On Capital Employesshekhar371No ratings yet

- Bonds Payable HandoutDocument15 pagesBonds Payable Handoutlady gwaeyngNo ratings yet

- Synergies and ValuationDocument16 pagesSynergies and ValuationPaul GhanimehNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- Debt Invetment: Summary: InvestmentDocument3 pagesDebt Invetment: Summary: InvestmentEphine PutriNo ratings yet

- Financial ManagementDocument22 pagesFinancial ManagementSapan AnandNo ratings yet

- C1M4 QRGDocument1 pageC1M4 QRGFatih SahinNo ratings yet

- Aequal LOEpsjDocument1 pageAequal LOEpsjgraphic masterNo ratings yet

- Operating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingDocument5 pagesOperating Cash Flow Per Share (Net Income + Depreciation + Amortization) / Common Shares OutstandingzacchariahNo ratings yet

- Pas 7Document3 pagesPas 7Sacedon, Trishia Mae C.No ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- FSA Part2Document19 pagesFSA Part2trangNo ratings yet

- Exam 1 Formula Sheet (1) - 2Document2 pagesExam 1 Formula Sheet (1) - 2haleeNo ratings yet

- Acc 1Document45 pagesAcc 1wengkeii07No ratings yet

- Formula Sheet PDFDocument3 pagesFormula Sheet PDFmadhav1111No ratings yet

- Demo LeverageDocument18 pagesDemo LeverageIftikhar baigNo ratings yet

- Ratio FormulasDocument3 pagesRatio Formulasakk59No ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Financial Analysis1Document21 pagesFinancial Analysis1Umay PelitNo ratings yet

- Accounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmDocument2 pagesAccounting Principles Second Canadian Edition Rapid Review: Weygandt, Kieso, Kimmel, TrenholmGurinder Pal SinghNo ratings yet

- Formula Sheet: Pay Back PeriodDocument3 pagesFormula Sheet: Pay Back PeriodtejaswiNo ratings yet

- FS Analysis FormulasDocument3 pagesFS Analysis FormulasCzarhiena SantiagoNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management FormulasDaniel Kahn GillamacNo ratings yet

- Debt InvestmentsDocument3 pagesDebt InvestmentsYhenni XiaoNo ratings yet

- Formula Indirect Method of Cash FlowDocument1 pageFormula Indirect Method of Cash FlowFarnaz CharandabiNo ratings yet

- Financial Ratios: I. ProfitabilityDocument2 pagesFinancial Ratios: I. ProfitabilityJose Francisco TorresNo ratings yet

- CORP Finance II Exam NotesDocument12 pagesCORP Finance II Exam NotesTeddie MowerNo ratings yet

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Document12 pagesFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- Cost of Capital This OneDocument9 pagesCost of Capital This OneAmandeep Singh MankuNo ratings yet

- Notes For L3Document11 pagesNotes For L3yuyin.gohyyNo ratings yet

- Lesson 9Document4 pagesLesson 9malik123ggNo ratings yet

- LLH9e Ch03 SolutionsManual FINALDocument68 pagesLLH9e Ch03 SolutionsManual FINALIgnjat100% (1)

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- Finance BasicsDocument4 pagesFinance BasicsCole HollandNo ratings yet

- C1M4 QRGDocument1 pageC1M4 QRGsherifabayomy3No ratings yet

- FL_CFA_Formula_Sheet_FRA Landscape (SS)5Document2 pagesFL_CFA_Formula_Sheet_FRA Landscape (SS)5Raj SharmaNo ratings yet

- Merger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationDocument49 pagesMerger Model - Blank Template: Control Panel Outputs Sensitivities Model Comps Data Diluted Shares CalculationGugaNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- FM Formulae SheetDocument4 pagesFM Formulae Sheetatishayjjj123No ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- DCF Valuation: Formula: 3 MethodsDocument1 pageDCF Valuation: Formula: 3 Methodsmadhav madhavNo ratings yet

- Educational Qualifications & Achievements: TH NDDocument1 pageEducational Qualifications & Achievements: TH NDaskkNo ratings yet

- Academic Qualifications and AwardsDocument1 pageAcademic Qualifications and AwardsaskkNo ratings yet

- Educational Qualifications: CompetitionsDocument1 pageEducational Qualifications: CompetitionsaskkNo ratings yet

- 3Document2 pages3askkNo ratings yet

- MFE 06 - Financial Market - Case StudyDocument8 pagesMFE 06 - Financial Market - Case StudyKushan Chanaka AmarasingheNo ratings yet

- Chapter 1 - Business Combinations Statutory Merger and Statutory ConsolidationDocument4 pagesChapter 1 - Business Combinations Statutory Merger and Statutory ConsolidationKaori MiyazonoNo ratings yet

- Fin 520 NoteDocument10 pagesFin 520 NoteEmanuele OlivieriNo ratings yet

- Private EquityDocument25 pagesPrivate EquityAman SinghNo ratings yet

- LBO AnalysisDocument7 pagesLBO AnalysisLeonardoNo ratings yet

- Financial Management and Corporate FinanceDocument2 pagesFinancial Management and Corporate FinanceshriyaNo ratings yet

- Angel Investor Venture CapitalDocument6 pagesAngel Investor Venture CapitalPRK21MS1099 GOPIKRISHNAN JNo ratings yet

- Practice Technicals 3Document6 pagesPractice Technicals 3tigerNo ratings yet

- 4th ClassDocument42 pages4th ClassShreeya SigdelNo ratings yet

- Darshana Bhat Final Summer ProjectDocument81 pagesDarshana Bhat Final Summer ProjectcoolujjwaljainNo ratings yet

- Takeovers Leveraged BuyoutsDocument3 pagesTakeovers Leveraged BuyoutsMinh Châu Tạ ThịNo ratings yet

- OBN - Small Banks - Issue 32 (November 2020)Document2 pagesOBN - Small Banks - Issue 32 (November 2020)Nate TobikNo ratings yet

- Chapter 21Document8 pagesChapter 21Huế ThùyNo ratings yet

- 1995 - Stern and Stewart - EVADocument17 pages1995 - Stern and Stewart - EVAAbdulAzeemNo ratings yet

- Mergers, Acquisitions and Divestments: Economic & Financial Aspects of Corporate ControlDocument5 pagesMergers, Acquisitions and Divestments: Economic & Financial Aspects of Corporate ControldnesudhudhNo ratings yet

- Private Equity NotesDocument5 pagesPrivate Equity NotesSaad KundiNo ratings yet

- Reviewer Pfrs 3 Business CombinationsDocument4 pagesReviewer Pfrs 3 Business CombinationsKryzzel Anne JonNo ratings yet

- Concept Map 2Document8 pagesConcept Map 2mike raninNo ratings yet

- M3 - Business Combination, Statutory Merger and Statutory ConsolidationDocument35 pagesM3 - Business Combination, Statutory Merger and Statutory ConsolidationJohn Michael A. PaclibareNo ratings yet

- Direct Lending: Benefits, Risks and Opportunities: OaktreeDocument13 pagesDirect Lending: Benefits, Risks and Opportunities: OaktreeIshan ShuklaNo ratings yet

- Simon and PaulDocument4 pagesSimon and PaulHeneir FloresNo ratings yet

- TYBAF Question Bank FM IIIDocument28 pagesTYBAF Question Bank FM IIISamuel LeitaoNo ratings yet

- Compliance Relating To Buy-Back of SharesDocument17 pagesCompliance Relating To Buy-Back of Sharesswaraj_chaw1485No ratings yet

- Defence Against Hostile TakeoversDocument2 pagesDefence Against Hostile TakeoversAhmad AfghanNo ratings yet

- Swap RatioDocument13 pagesSwap RatioasifanisNo ratings yet

- Corporate Restructuring - Reconfiguration of A CorporationDocument18 pagesCorporate Restructuring - Reconfiguration of A Corporationishita pancholiNo ratings yet