Professional Documents

Culture Documents

Intermodal-Report-Week-14-2017

Intermodal-Report-Week-14-2017

Uploaded by

habibiCopyright:

Available Formats

You might also like

- Ocean CarriersDocument7 pagesOcean CarriersMarc de Neergaard100% (2)

- Voyage Planning Annex 24 Solas VDocument6 pagesVoyage Planning Annex 24 Solas VSingniS100% (1)

- Fearnley Market Report December 2018Document20 pagesFearnley Market Report December 2018Charles GohNo ratings yet

- Plipdeco Haulier Inspection ChecklistDocument2 pagesPlipdeco Haulier Inspection ChecklistHemas AvicennaNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-23-2017Document9 pagesIntermodal-Report-Week-23-2017habibiNo ratings yet

- Intermodal-Report-Week-11-2017Document9 pagesIntermodal-Report-Week-11-2017habibiNo ratings yet

- Intermodal-Report-Week-1-2017Document9 pagesIntermodal-Report-Week-1-2017habibiNo ratings yet

- Intermodal-Report-Week-25-2017Document9 pagesIntermodal-Report-Week-25-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-13-2017Document9 pagesIntermodal-Report-Week-13-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-12-2017Document10 pagesIntermodal-Report-Week-12-2017habibiNo ratings yet

- Intermodal-Report-Week-29-2017Document8 pagesIntermodal-Report-Week-29-2017habibiNo ratings yet

- KAPALDocument8 pagesKAPALBudi PrayitnoNo ratings yet

- Intermodal Report Week 7 2018Document9 pagesIntermodal Report Week 7 2018Ekta JaiswalNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-27-2017Document8 pagesIntermodal-Report-Week-27-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-10-2017Document9 pagesIntermodal-Report-Week-10-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-22-2017Document8 pagesIntermodal-Report-Week-22-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-24-2017Document9 pagesIntermodal-Report-Week-24-2017habibiNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal-Report-Week-20-2017Document9 pagesIntermodal-Report-Week-20-2017habibiNo ratings yet

- Braemar_compressed-18Document2 pagesBraemar_compressed-18Jerome E. FranciscoNo ratings yet

- Intermodal-Report-Week-26-2017Document8 pagesIntermodal-Report-Week-26-2017habibiNo ratings yet

- Intermodal-Report-Week-2-2017Document9 pagesIntermodal-Report-Week-2-2017habibiNo ratings yet

- Intermodal-Report-Week-17-2017Document9 pagesIntermodal-Report-Week-17-2017habibiNo ratings yet

- ShippingDocument76 pagesShippingJulienPanero-JollivetNo ratings yet

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Shipping Market Review May 2015Document98 pagesShipping Market Review May 2015jmurcia78No ratings yet

- Up Stream DrillingRigsFocus - April2018Document17 pagesUp Stream DrillingRigsFocus - April2018cvrap99No ratings yet

- Weekly Recap: Let The Bodies Hit The FloorDocument7 pagesWeekly Recap: Let The Bodies Hit The FloorsirdquantsNo ratings yet

- Fearnley 1 FOSAS Summary Report 2018Document44 pagesFearnley 1 FOSAS Summary Report 2018Charles GohNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- ALLIED Weekly Market Report 01-02-2019Document12 pagesALLIED Weekly Market Report 01-02-2019nNo ratings yet

- Willis Marine Market Review November 2009Document20 pagesWillis Marine Market Review November 2009Indra SatriaNo ratings yet

- Intermodal-Report-Week-21-2017Document9 pagesIntermodal-Report-Week-21-2017habibiNo ratings yet

- DSI Example DW DWDocument59 pagesDSI Example DW DWmucopNo ratings yet

- Chart of The Week: Inside This IssueDocument13 pagesChart of The Week: Inside This IssueAdrian Marin100% (1)

- AnalysisDocument2 pagesAnalysisZhieh LorNo ratings yet

- Allied Weekly Market Review Week 25Document13 pagesAllied Weekly Market Review Week 25Mai PhamNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- MISC AnnualReportDocument273 pagesMISC AnnualReportMozek WaNogoriNo ratings yet

- Pareto Conference SummaryDocument7 pagesPareto Conference SummaryMelvin LeongNo ratings yet

- 5 Currents Steer Global MaritimeDocument1 page5 Currents Steer Global MaritimetobyfutureNo ratings yet

- Bimco Reflections 2017 SDocument16 pagesBimco Reflections 2017 SMeleti Meleti MeletiouNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Market Report Week 24Document19 pagesMarket Report Week 24ChetanNo ratings yet

- White Paper Shipbuilding - EnglDocument19 pagesWhite Paper Shipbuilding - EnglRENGANATHAN PNo ratings yet

- The Platou Report 2014Document30 pagesThe Platou Report 2014Tze Yi Tay100% (1)

- LNG Shipping July 2021Document38 pagesLNG Shipping July 2021Royden DSouzaNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- Common Stocks As Long Term InvestmentsFrom EverandCommon Stocks As Long Term InvestmentsRating: 3.5 out of 5 stars3.5/5 (2)

- Machines-ringspinningDocument41 pagesMachines-ringspinninghabibiNo ratings yet

- Machines-rovingframeDocument21 pagesMachines-rovingframehabibiNo ratings yet

- Machines-ringframeDocument57 pagesMachines-ringframehabibiNo ratings yet

- Remsha - Identifying Economic Obsolescence (NEW FILE)Document17 pagesRemsha - Identifying Economic Obsolescence (NEW FILE)habibiNo ratings yet

- Chemical Engineering Process in Cement ProductionDocument18 pagesChemical Engineering Process in Cement ProductionhabibiNo ratings yet

- Machines-drawframeDocument46 pagesMachines-drawframehabibiNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Buoyage SystemDocument10 pagesBuoyage SystemhutsonianpNo ratings yet

- Ras Tanura PortDocument16 pagesRas Tanura Portpgupta71No ratings yet

- Notice of Readiness: Unit FourteenDocument11 pagesNotice of Readiness: Unit FourteenPavel ViktorNo ratings yet

- Lifeboat in DetailsDocument10 pagesLifeboat in Detailsjaber hasan talalNo ratings yet

- 5 Why and Titanic Cause MapDocument2 pages5 Why and Titanic Cause MapAnil KumarNo ratings yet

- Nav 3 Mid-TermDocument2 pagesNav 3 Mid-TermKENT LOUIE ESTENZONo ratings yet

- Sailing Directions Philippine Islands 2017Document374 pagesSailing Directions Philippine Islands 2017Rachel Erica Buesing100% (1)

- Ship Construction 2020Document108 pagesShip Construction 2020Cap Karim ElSherbini100% (3)

- GRAIN NCB FORM - SF 47.25CUFT, MT Trimmed - 2014Document7 pagesGRAIN NCB FORM - SF 47.25CUFT, MT Trimmed - 2014Winston RodriguesNo ratings yet

- List of Shipping Companies in Nigeria SDocument6 pagesList of Shipping Companies in Nigeria SKilo MarineNo ratings yet

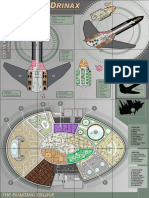

- TPOD Deckplans PosterDocument1 pageTPOD Deckplans PosterRyan KlonczNo ratings yet

- Labor JurisprudenceDocument1 pageLabor JurisprudenceArrow PabionaNo ratings yet

- All About History Book of The Titanic Sixth EditionDocument180 pagesAll About History Book of The Titanic Sixth EditionCristina Butragueño Gigorro100% (7)

- Haiti PlanDocument6 pagesHaiti PlanĐÌNH HIẾU PHẠMNo ratings yet

- TRA ZUE: Zurich, Switzerland LSZH/ZRH RNAV (GNSS) Rwy 14Document1 pageTRA ZUE: Zurich, Switzerland LSZH/ZRH RNAV (GNSS) Rwy 14Muhammad hamzaNo ratings yet

- Bill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportDocument1 pageBill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportMoineeNo ratings yet

- Ultrasonic Thickness Measurement of ShipsDocument120 pagesUltrasonic Thickness Measurement of ShipsEka Setiawan100% (2)

- NAV 3 Lesson 5 Keeping A LogDocument8 pagesNAV 3 Lesson 5 Keeping A LogMico Santos100% (1)

- Buenos Aires, Argentina Sabe/Aep Rnpzrwy31: JeppesenDocument1 pageBuenos Aires, Argentina Sabe/Aep Rnpzrwy31: Jeppesenfrancisco buschiazzoNo ratings yet

- GarbageRecordBook ExampleDocument2 pagesGarbageRecordBook ExampleiomerkoNo ratings yet

- FASSMER FAS PP 0008 - Rettungsbootsbau PDFDocument11 pagesFASSMER FAS PP 0008 - Rettungsbootsbau PDFDan PredaNo ratings yet

- Ilorin MetropolisDocument1 pageIlorin MetropolisabdulNo ratings yet

- Narrow Seas: For Any Age of Sail GameDocument23 pagesNarrow Seas: For Any Age of Sail GameAIM Investor JournalNo ratings yet

- Navantia BuquesDocument20 pagesNavantia Buquesmatteo_1234100% (1)

- Curs 5 EEDI Rev 2020 EN - PpsDocument38 pagesCurs 5 EEDI Rev 2020 EN - PpsPanda On FireNo ratings yet

- Chapter 1 Intro To SSDocument17 pagesChapter 1 Intro To SSUmairah AzmanNo ratings yet

- North Sails Rigging Manual 2008 CamDocument25 pagesNorth Sails Rigging Manual 2008 CamnorthsailsNo ratings yet

- SHIPS PARTICULAR RCL NatunaDocument4 pagesSHIPS PARTICULAR RCL NatunaWigy adhisetyoNo ratings yet

Intermodal-Report-Week-14-2017

Intermodal-Report-Week-14-2017

Uploaded by

habibiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermodal-Report-Week-14-2017

Intermodal-Report-Week-14-2017

Uploaded by

habibiCopyright:

Available Formats

Weekly Market Report

Issue: Week 14 | Tuesday 11th April 2017

Market insight Chartering (Wet: Soft - / Dry: Stable + )

Holidays in the East halted the BDI advance last week, while with the

By Vassilis Vassiliou

exception of Capes the rest of the market remained upbeat. The BDI

Ship-repair Broker, Interyards S. A. closed today (11/04/2017) at 1,262 points, up by 31 points compared to

yesterday’s levels (10/04/2017) and increased by 7 points when com-

The first quarter of 2017 started relatively busy for the ship repair sector,

pared to previous Tuesday’s closing (04/04/2017). The crude carriers

with most of the repair facilities being nearly fully occupied till the first half

market is still trying to find a stable foot, while recent activity in the

of the year. Compared to the very silent first half of the previous year, there

Middle East is signaling a more stable market in the following days. The

is an enormous increase in the demand for dry-docking slots, which is more

BDTI on Monday (10/04/2017) was at 776, decreased by 5 points and

than justified. Apart from the obvious, i.e. that the physical number of ves-

the BCTI at 661, a decrease of 78 points compared to prior Monday’s

sels due for special survey is greater compared to last year past, we have

(03/02/2017) levels.

also observed that some non-Greek shipping companies have the tendency

to bring the dry-docking schedule earlier to avoid the imminent implementa- Sale & Purchase (Wet: Soft - / Dry: Stable +)

tion of the ballast water management regulations. Dry Bulk SnP activity remains stable, with Sellers and Buyers currently

assessing their respective strategies following the substantial apprecia-

On the other hand, as far as Greek shipping companies are concerned, this tion in asset values during the past couple of months. On the tanker side

strategy has not found solid ground, as the great majority of the Owners we had the sale of the “BURSA” (51,149dwt-blt 08, S. Korea), which was

have agreed to proceed with the de-harmonization of the IOPP certificate, sold to Norwegian owner, DSD Shipping, for a price in the region of

as a way to avoid the BWMS regulation altogether. The first wave of the high $17.4m. On the dry bulker side we had the sale of the “HANJIN SANTA-

demand for ship repairs came during the Chinese New Year. This was mainly NA” (58,627dwt-blt 12, S. Korea), which was sold to Singaporean owner,

due to the lack of good employment options for a number of dry bulk own- Wilmar, for a price in the region of $12.5m.

ers trading spot at that time, who took the advantage of the low market by

using that period to repair their vessels. Newbuilding (Wet: Stable - / Dry: Stable+ )

The newbuilding market continues to enjoy healthier activity in the

Despite the increased demand for dry-docking slots, shipyards pricing poli-

more conventional sectors compared to last year, while it seems that

cies have not changed. Price levels are maintained almost at the same rec-

ordering in the dry bulk sector has now become a weekly thing, with

ord-low level as the year before. In some cases, shipyards’ prices have slight-

another Kamsarmax order popping up during the past days. Greek own-

ly increased their prices, but even in those cases the increase has not been

ers, who appear to be behind a few of those latest dry bulk orders, have

proportional to the spike in slot demand. As a general observation therefore

started to display increased interest, particularly in Kamsarmax vessels,

we can say that shipyards didn’t manage to get the full advantage of the

possibly due to the potential value upside in this size if the market keeps

increased demand during Q1 2017 and that since the repair market prices

improving. Activity in the tanker sector has at the same time remained

remain at record low levels, they still offer an excellent opportunity for re-

very much upbeat during the past weeks despite the fact that earnings

pairs. Additionally, It is anticipated the second half of the year will be

in the sector are admittedly well below their 2015 and 2016 averages.

smoother, with the shipyards’ workload slightly lower compared to now.

Indeed, it seems that competition among shipbuilders and the conse-

As far as the Greek market is concerned, Chinese yards remain on top of quent attractive newbuilding prices have been luring more and more

Owners’ choice, with one out of two Greek vessels being repaired in that owners towards the newbuilding option, with the number of orders

area. While the first-class Chinese shipyards are focusing in big projects and during last month more than doubling compared to February. In terms

tanker vessels, the most ‘value for money’ Chinese shipyards offering are of recently reported deals, South Korean owner, Hyundai Merchant

those to fill all of their slots first, giving by rule of thumb a 40 days’ notice Marine, placed an order for five firm and five optional VLCCs (318,000

requirement for a slot. Thus, the gap is filled by the medium, less-known dwt) at Daewoo, S. Korea for a price around $79.0m.

shipyards, with relatively short reference list of foreign vessels, which are

Demolition (Wet: Firm + / Dry: Firm +)

directly benefiting from the repair congestion. Those shipyards during the

slack period of 2016 where unknown to the majority of ship-owners but Sentiment in the demolition market remained upbeat last week, with

they are now building up their reputation. reported sales evidencing the strong momentum of the past couple of

months and breakers in both India and Pakistan still displaying strong

The investments on the repair facilities worldwide are at the same time

appetite and deep pockets. Despite this admittedly strong market, signs

moving onwards. There are several additional dry-docks to be delivered

that prices are close to reaching a plateau have slowly started to be-

during 2017 in Turkey area. With last year’s speculations proving correct,

come more visible. From one hand, during the course of the past days

Hyundai Heavy Industries has announced that their fifth dock at Ulsan will

we have been seeing Bangladeshi buyers, who have in the past months

be used for repair works. In addition, a new repair shipyard is about to start

monopolized activity more than a few times, to slowly move back to the

operations in the Zhoushan area in China. All those expansions are about to

sidelines. This is bound to relax competition among breakers in the re-

put an extra pressure to the repair market sector, which will promote com-

gion sooner rather than later and result in effect in lower demo levels.

petition to higher levels and will squeeze further the repair prices.

On top of that, and maybe even more importantly, the market in China

Last but not least, the repair market, being always heavily concentrated on appears to have also softened lately, with local steel prices coming un-

the IMO implementation of the Ballast Treatment System convention, is der considerable pressure during the past few weeks and should this

waiting the next convention (MEPC 71) to be materialized and to give fur- trend resume for longer we won’t be surprised to see a pullback in the

ther answers, the date of which was again pushed back, and is now ex- Indian subcontinent market as well . Average prices this week for tank-

pected to take place at the beginning of July 2017. ers were at around 280-390 $/ldt and dry bulk units received about 270-

370 $/ldt.

Tanker Market

Spot Rates Indicative Period Charters

Week 14 Week 13 2016 2015

$/day - 12 mos - 'FPMC P HERO' 2011 115,000 dwt

Vessel Routes WS WS

$/day $/day ±% $/day $/day - - $15,500/day - St Ship

points points

265k MEG-JAPAN 55 19,822 47 14,829 33.7% 41,068 65,906 - 12 mos - 'MERKUR O' 2004 74,999 dwt

VLCC

280k MEG-USG 30 6,913 26 4,312 60.3% 44,269 49,575 - - $13,250/day - Koch

260k WAF-USG 65 30,159 60 28,421 6.1% 53,995 76,251

130k MED-MED 85 11,314 95 18,534 -39.0% 29,930 50,337

Suezmax

TD3 TD6 TD9 DIRTY - WS RATES

130k WAF-USAC 75 13,959 85 18,579 -24.9% 23,591 40,490 520

470

130k BSEA-MED 85 12,409 95 19,489 -36.3% 29,930 50,337 420

80k MEG-EAST 120 14,368 115 13,388 7.3% 20,111 34,131 370

WS poi nts

320

Aframax

80k MED-MED 105 13,470 120 18,065 -25.4% 20,684 37,127 270

80k UKC-UKC 110 17,963 110 18,528 -3.0% 26,526 39,338 220

170

70k CARIBS-USG 95 6,332 93 6,094 3.9% 20,501 36,519 120

70

75k MEG-JAPAN 100 8,537 112 11,232 -24.0% 16,480 30,482 20

Clean

55k MEG-JAPAN 112 7,728 132 11,299 -31.6% 12,891 24,854

37K UKC-USAC 190 15,221 205 18,186 -16.3% 10,622 19,973

30K MED-MED 160 8,759 200 15,153 -42.2% 9,056 24,473

55K UKC-USG 115 8,910 115 9,106 -2.2% 15,726 27,228

TC1 TC2 TC5 TC6 CLEAN - WS RATES

Dirty

55K MED-USG 115 9,135 115 9,369 -2.5% 14,879 26,083 270

50k CARIBS-USAC 110 6,125 112 7,326 -16.4% 15,549 27,146 240

WS poi nts 210

180

150

TC Rates 120

$/day Week 14 Week 13 ±% Diff 2016 2015 90

60

300k 1yr TC 27,000 27,000 0.0% 0 38,108 46,135

VLCC

300k 3yr TC 28,500 28,000 1.8% 500 34,379 42,075

150k 1yr TC 18,500 18,750 -1.3% -250 27,363 35,250

Suezmax

150k 3yr TC 19,000 19,500 -2.6% -500 25,653 33,219

Indicative Market Values ($ Million) - Tankers

110k 1yr TC 16,000 16,750 -4.5% -750 22,396 26,808

Aframax Apr-17 Mar-17

110k 3yr TC 17,000 17,000 0.0% 0 20,948 24,729 Vessel 5yrs old ±% 2016 2015 2014

avg avg

75k 1yr TC 13,000 13,000 0.0% 0 19,127 23,596

Panamax VLCC 300KT DH 61.0 61.0 0.0% 68.7 81.2 73.8

75k 3yr TC 14,000 14,250 -1.8% -250 18,592 20,580

Suezmax 150KT DH 41.0 41.2 -0.5% 49.7 59.7 50.4

52k 1yr TC 12,750 12,750 0.0% 0 15,410 17,865

MR Aframax 110KT DH 29.0 29.6 -2.0% 36.8 45.5 38.9

52k 3yr TC 13,750 13,500 1.9% 250 15,681 16,638

LR1 75KT DH 28.0 28.2 -0.7% 32.9 36.1 33.0

36k 1yr TC 11,500 11,500 0.0% 0 14,380 16,101

Handy MR 52KT DH 22.0 22.0 0.0% 25.0 27.6 27.5

36k 3yr TC 13,000 13,000 0.0% 0 14,622 15,450

Chartering Sale & Purchase

The crude carriers market hasn’t still managed to catch a break. Last week In the Aframax sector we had the sale of the “KANATA SPIRIT” (113,022dwt

rates for the different sizes were moving towards opposite directions, while -blt 99, S. Korea), which was sold to undisclosed buyers, for a price in the

the one hopeful sign is probably the fact that VLs seem to be getting strong- region of $7.8m.

er and this positive improvement might eventually feed through to the rest In the MR sector we had the sale of the “BURSA” (51,149dwt-blt 08, S. Ko-

of the market if it is sustained for a bit longer. At the same time, period rea), which was sold to Norwegian owner, DSD Shipping, for a price in the

business revived a bit but numbers were below last dones, while oil prices region of $17.4m.

have managed to move again to the mid-USD50/barrel level on the back of

escalating conflict in Syria that for now seems to have outweighed the fact

that US drilling activity has gone straight up for a 12th week in a row.

The improvement that took place in the VL Middle East market during the

week prior resumed throughout the first days of April as well, with rates

firming across both the westbound and eastbound route on the back of

firm enquiry, while the West Africa market also ended the week on a much

more positive note.

The West Africa Suezmax market remained under pressure last week

amidst soft demand and healthy tonnage availability in the region, while

too many prompt vessels led to a softer Black Sea/Med market. Aframax

rates were pointing downwards across most routes on Friday, with owners

ballasting in the Med feeling most of the pressure as fresh enquiry in the

region was unable to match a quickly lengthening tonnage list.

© Intermodal Research 11/04/2017 2

Dry Bulk Market

Baltic Indices Indicative Period Charters

Week 14 Week 13

Point $/day 2016 2015 - 12 mos - 'STELLA JADE' 2012 175,932 dwt

07/04/2017 31/03/2017

Diff ±% - Singapore 6 Apr - $ 15,100/day - Anglo American

Index $/day Index $/day Index Index

BDI 1,223 1,297 -74 676 713 - 5 to 7 mos - 'EDELWEISS' 2004 73,624 dwt

BCI 2,173 $15,570 2,597 $18,864 -424 -17.5% 1,030 1,009 - Cai Lan - $ 10,300/day - Cofco Agri

BPI 1,427 $11,443 1,374 $11,025 53 3.8% 695 692

Baltic Indices

BSI 886 $9,813 881 $9,214 5 6.5% 601 663 BCI BPI BSI BHSI BDI

3,000

BHSI 547 $8,020 540 $7,909 7 1.4% 364 365

2,500

2,000

Index

1,500

1,000

500

Period 0

Week Week

$/day ±% Diff 2016 2015

14 13

180K 6mnt TC 16,500 17,500 -5.7% -1,000 7,842 9,969

Capesize

180K 1yr TC 15,500 17,000 -8.8% -1,500 7,582 10,263

Average T/C Rates

180K 3yr TC 15,000 15,500 -3.2% -500 8,728 11,243

25000 Av erage of the 4 T / C AVR 4TC BPI AV R 5TC BSI AVR 6TC BHSI

76K 6mnt TC 11,000 11,000 0.0% 0 6,492 7,921

Handysize Supramax Panamax

76K 1yr TC 11,000 11,000 0.0% 0 6,558 7,705 20000

76K 3yr TC 10,750 10,750 0.0% 0 7,068 8,724 15000

$/day

55K 6mnt TC 10,750 10,750 0.0% 0 6,582 8,162

10000

55K 1yr TC 10,500 10,500 0.0% 0 6,851 7,849

5000

55K 3yr TC 10,250 10,250 0.0% 0 6,827 8,181

30K 6mnt TC 8,500 8,500 0.0% 0 5,441 6,690 0

30K 1yr TC 8,250 8,250 0.0% 0 5,511 6,897

30K 3yr TC 8,250 8,250 0.0% 0 5,950 7,291

Chartering Indicative Market Values ($ Million) - Bulk Carriers

Holidays in Asia at the beginning of last week weighed on the performance Vessel 5 yrs old Apr-17 avg Mar-17 avg ±% 2016 2015 2014

of Capesize rates, which in turn cost the BDI more than 70 points during

the first week of Q2. Despite this downward movement though, sentiment Capesize 180k 32.0 28.9 10.7% 23.2 33.4 47.5

remains firm, with the rest of the sizes enjoying further upside in the past Panamax 76K 19.0 17.9 6.1% 13.4 17.5 24.8

days and the performance of the Panamax market in particular further Supramax 56k 16.0 15.6 2.6% 12.2 16.6 25.2

boosting owners’ psychology. Saying that, a pullback due to the upcoming Handysize 30K 12.0 11.8 1.7% 9.4 13.8 20.0

Easter holidays is widely expected, given the strength of the market during

the past weeks though, we don’t expect dramatic volatility in the case that

rates do move south. The period market is at the same time still enjoying Sale & Purchase

healthy enquiry, with quite a few longer period contracts being fixed dur-

In the Kamsarmax sector we had the sale of the “UNITED OCEAN”

ing the past days, while numbers remain overall firm here as well.

(81,918dwt-blt 14, Japan), which was sold to Greek owner, Dryships, for a

The Capesize market noted a big leg down last week on the back of a quiet price in the region of $23.5m.

market in the East, fact which quickly affected sentiment and rates ex- In the Supramax sector we had the sale of the “HANJIN SANTANA”

Brazil as well. The paper market remained positive nonetheless for anoth- (58,627dwt-blt 12, S. Korea), which was sold to Singaporean owner, Wil-

er week, while period business sustained its volumes, with numbers a bit mar, for a price in the region of $12.5m.

off compared to those of the week prior though.

The Atlantic Panamax market displayed particular strength at the same

time, with strong enquiry in both the north Atlantic and East Coast South

America regions paying significant premiums, while the market in the East

eased a bit despite the fact that enquiry started to pick up closer to the

weekend.

The smaller sizes also felt the impact of holidays in Asian trade, while the

Atlantic market on the other hand remained upbeat overall, with the ex-

ception of the USG, where demand remains short of expectations for yet

another week.

© Intermodal Research 11/04/2017 3

Secondhand Sales

Bulk Carriers

Size Name Dwt Built Yard M/E SS due Gear Price Buyers Comments

DAEWOO-

U.S Ba s ed

CAPE CPO ASIA 179,558 2011 MANGALIA, MAN-B&W Ma r-21 $ 29.3m

(JP Morga n)

Roma ni a

KMAX UNITED OCEAN 81,918 2014 TSUNEISHI, Ja pa n MAN-B&W Jul -19 $ 23.5m Greek (Drys hi ps )

HUDONG-

PMAX NINGBO WHALE 76,039 2012 ZHONGHUA, MAN-B&W Jul -17 $ 16.0m undi s cl os ed

Chi na

STX

PMAX IMPERIAL 75,527 2007 SHIPBUILDING, S. MAN-B&W $ 13.6m

Korea

Greek (Na vi os )

STX

PMAX LIBERTAS 74,930 2007 SHIPBUILDING, S. MAN-B&W Aug-17 $ 13.7m

Korea

SPP SHIPBUILDING 4 X 30t Si nga porea n

SMAX HANJIN SANTANA 58,627 2012 MAN-B&W Jul -17 $ 12.5m

- SAC, S. Korea CRANES (Wi l ma r)

TSUNEISHI HEAVY 4 X 30t U.K Ba s ed

SMAX TOPFLIGHT 52,544 2005 B&W Aug-20 $ 8.2m

CEBU, Phi l i ppi nes CRANES (Uni on Ma ri time)

TSUNEISHI HEAVY 4 X 30t

SMAX CASTA DIVA 52,415 2006 B&W Ma r-21 $ 9.5m Greek

CEBU, Phi l i ppi nes CRANES

ZHEJIANG

4 X 40t

SMAX TOMINI MELODY 50,785 2006 SHIPBUILDING, Ma K Apr-16 undi s cl os ed undi s cl os ed

CRANES

Chi na

NAIKAI ZOSEN - 4 X 30t Ja pa nes e

HANDY JIN YU 37,800 2012 MAN-B&W Jun-17 $ 15.0m

INNOSHI, Ja pa n CRANES (Inui Stea ms hi p)

JIANGMEN 4 X 30,5t

HANDY CLIPPER SELO 32,389 2011 MAN-B&W Feb-16 $ 9.2m undi s cl os ed

NANYANG, Chi na CRANES

HAKODATE DOCK - 4 X 30t Honk Kong Ba s ed

HANDY NONA BULKER 31,922 2009 Mi ts ubi s hi undi s cl os ed

HAKODA, Ja pa n CRANES (Ta yl or Ma ri time)

4 X 30,5t

HANDY EMANET 28,350 1996 IMABARI, Ja pa n Mi ts ubi s hi Ja n-21 $ 3.2m Turki s h

CRANES

Tankers

Size Name Dwt Built Yard M/E SS due Hull Price Buyers Comments

SAMSUNG HI, S.

AFRA KANATA SPIRIT 113,022 1999 B&W Aug-19 DH $ 7.8m undi s cl os ed

Korea

Norwegi a n

MR BURSA 51,149 2008 STX, S. Korea MAN-B&W Dec-18 DH $ 17.4m

(DSD Shi ppi ng)

HANGZHOU Turki s h

SMALL DUBAI 3,799 2009 Wa rts i l a Jul -19 DH undi s cl os ed

DONGFENG, Chi na (Arka s Shi ppi ng)

SMALL YANEE 3,021 1987 HIGAKI, Ja pa n Ha ns hi n $ 0.7m undi s cl os ed

© Intermodal Research 11/04/2017 4

Secondhand Sales

Containers

Size Name Teu Built Yard M/E SS due Gear Price Buyers Comments

POST HANJIN NEW HYUNDAI SAMHO

8,586 2011 Wartsila $ 25.0m S. Korean

PMAX YORK , S. Korea

POST CONTI HYUNDAI HI, S.

7,471 2005 MAN-B&W $ 14.0m undisclosed

PMAX VANCOUVER Korea

JIANGSU NEW

PMAX HS EVEREST 4,771 2014 YANGZIJIAN, MAN-B&W May-19 $ 20.0m

China

undisclosed

JIANGSU NEW

PMAX HS MARCO POLO 4,771 2014 YANGZIJIAN, MAN-B&W May-19 $ 20.0m

China

RIO HYUNDAI SAMHO,

PMAX 4,300 2008 MAN-B&W $ 10.6m undisclosed

CHARLESTON S. Korea

KVAERNER

SUB 3 X 45t

WEHR OSTE 2,524 2002 WARNOW, B&W $ 3.9m undisclosed

PMAX CRANES

Germany

Ferries

Name Loa(m) Pass Cars Built Yard M/E SS due Price Buyers Comments

PANAGIOTAKIS Cummins Canadian

AQUA SPIRIT 75.4 1,000 96 2000 Oct-12 CAD $12.6m

SALAMIS, Greece Wartsila (BC Ferries)

© Intermodal Research 11/04/2017 5

Newbuilding Market

Indicative Newbuilding Prices (million$) The newbuilding market continues to enjoy healthier activity in the more

conventional sectors compared to last year, while it seems that ordering in

Week Week

Vessel ±% 2016 2015 2014 the dry bulk sector has now become a weekly thing, with another Kam-

14 13 sarmax order popping up during the past days. Greek owners, who appear to

Capesize 180k 41.5 41.5 0.0% 43.2 50 56 be behind a few of those latest dry bulk orders, have started to display in-

Bulkers

Kamsarmax 82k 25.0 25.0 0.0% 24.8 28 30 creased interest, particularly in Kamsarmax vessels, possibly due to the po-

Ultramax 63k 23.0 23.0 0.0% 23 25 27 tential value upside in this size if the market keeps improving. Activity in the

Handysize 38k 20.0 19.5 2.6% 20 21 23 tanker sector has at the same time remained very much upbeat during the

VLCC 300k 78.0 78.0 0.0% 88.5 96 99 past weeks despite the fact that earnings in the sector are admittedly well

below their 2015 and 2016 averages. Indeed, it seems that competition

Tankers

Suezmax 160k 53.0 53.0 0.0% 58 64 65

among shipbuilders and the consequent attractive newbuilding prices have

Aframax 115k 43.0 43.0 0.0% 48 53 54 been luring more and more owners towards the newbuilding option, with

LR1 75k 40.0 40.0 0.0% 42.5 46 46 the number of orders during last month more than doubling compared to

MR 50k 32.5 32.5 0.0% 33.7 36 37 February.

LNG 160k cbm 189.0 189.0 0.0% 189 190 186

In terms of recently reported deals, South Korean owner, Hyundai Merchant

LGC LPG 80k cbm 71.0 71.0 0.0% 74.1 77 78

Gas

Marine, placed an order for five firm and five optional VLCCs (318,000 dwt)

MGC LPG 55k cbm 64.0 64.0 0.0% 65.7 68 67 at Daewoo, S. Korea for a price around $79.0m.

SGC LPG 25k cbm 42.0 42.0 0.0% 42.8 45 44

Tankers Newbuilding Prices (m$) Bulk Carriers Newbuilding Prices (m$)

VLCC Suezmax Aframax LR1 MR Capesize Panamax Supramax Handysize

180 110

140 90

mi l lion $

mi l lion $

70

100

50

60

30

20 10

Newbuilding Orders

Units Type Size Yard Delivery Buyer Price Comments

South Korean around

5+5 Tanker 318,000 dwt Daewoo, S. Korea - LOI stage

(Hyundai Merchant Marine) $79.0m

4+2 Bulker 82,000 dwt Penglai Jinglu, China 2019 Greek (Chartworld) undisclosed Tier II

Xiamen Shipbuilding,

1+1 RoPax 63,000 GT 2020 Finnish (Viking line) $ 201.0m 2,800 pax

China

CSSC Offshore/Marine,

1 RoPax 1,800 pax 2019 Algerian (ENTMV) undisclosed

China

Eastern Shipbuilding

3 Passenger 4,570 GT 2019 U.S Based (NYCDOT) undisclosed 4,500 pax

Group, U.S.A

© Intermodal Research 11/04/2017 6

Demolition Market

Indicative Demolition Prices ($/ldt) Sentiment in the demolition market remained upbeat last week, with report-

Week Week ed sales evidencing the strong momentum of the past couple of months and

Markets ±% 2016 2015 2014 breakers in both India and Pakistan still displaying strong appetite and deep

14 13

pockets. Despite this admittedly strong market, signs that prices are close to

Bangladesh 385 385 0.0% 287 360 469 reaching a plateau have slowly started to become more visible. From one

Tanker

India 385 375 2.7% 283 361 478 hand, during the course of the past days we have been seeing Bangladeshi

Pakistan 390 390 0.0% 284 366 471 buyers, who have in the past months monopolized activity more than a few

China 280 280 0.0% 176 193 313 times, to slowly move back to the sidelines. This is bound to relax competi-

Bangladesh 365 365 0.0% 272 341 451 tion among breakers in the region sooner rather than later and result in

Dry Bulk

India 365 355 2.8% 268 342 459 effect in lower demo levels. On top of that, and maybe even more important-

ly, the market in China appears to have also softened lately, with local steel

Pakistan 370 370 0.0% 267 343 449

prices coming under considerable pressure during the past few weeks and

China 270 270 0.0% 160 174 297 should this trend resume for longer we won’t be surprised to see a pullback

in the Indian subcontinent market as well . Average prices this week for tank-

ers were at around 280-390 $/ldt and dry bulk units received about 270-370

$/ldt.

One of the highest prices amongst recently reported deals was paid by Indian

breakers for the Sub Panamax Container “MSC ALICE” (43,170dwt-13,803ldt-

blt 88), which received $390/ldt.

Tanker Demolition Prices Dry Bulk Demolition Prices

Bangladesh India Pakistan China 550 Bangladesh India Pakistan China

520 450

420 350

$/l dt

$/l dt

320 250

220 150

120 50

Demolition Sales

Name Size Ldt Built Yard Type $/ldt Breakers Comments

MITSUBISHI Indian sub-cont

MOZAMBIQUE 82,275 28,440 1998 CONT $ 398/Ldt undisclosed

NAGASAKI, Japan

BOTSWANA 81,819 26,362 1998 IHI - KURE, Japan CONT $ 355/Ldt Indian

MSC ALICE 43,170 13,803 1988 DAEWOO,S. Korea CONT $ 390/Ldt Indian

SZCZECINSKA as-is Singapore incl. 200T bunkers

MANDALAY STAR 12,559 5,265 1996 CONT $ 360/Ldt Indian

STOCZNIA, Poland

SZCZECINSKA as-is Singapore incl. 150T bunkers

YANGON STAR 12,575 5,230 1994 CONT $ 360/Ldt Indian

STOCZNIA, Poland

BREMER VULKAN Indian sub-cont

FRONTIER 13,464 4,967 1987 CONT $ 395/Ldt undisclosed

SCHIFFBA, Germany

as-is Jebel Ali

FANJA 8,480 3,542 2000 ZHONGHUA, China GC $ 390/Ldt undisclosed

© Intermodal Research 11/04/2017 7

Commodities & Ship Finance

Market Data Basic Commodities Weekly Summary

W-O-W Oil WTI $ Oil Brent $ Gold $

7-Apr-17 6-Apr-17 5-Apr-17 4-Apr-17 3-Apr-17

Change % 60 1,300

10year US Bond 2.370 2.340 2.360 2.350 2.350 -1.2% 55

S&P 500 2,355.54 2,357.49 2,352.95 2,360.16 2,358.84 -0.3%

oil 50 1,250 gold

Stock Exchange Data

Nasdaq 5,877.81 5,878.95 5,864.48 5,898.61 5,894.68 -0.6%

Dow Jones 20,656.10 20,662.95 20,648.15 20,689.24 20,650.21 0.0% 45

FTSE 100 7,349.37 7,303.20 7,331.68 7,321.82 7,282.69 0.4% 40 1,200

FTSE All-Share UK 4,010.28 3,986.22 3,996.54 3,990.30 3,970.98 0.5%

CAC40 5,135.28 5,121.44 5,091.85 5,101.13 5,085.91 0.2%

Xetra Dax 12,225.06 12,230.89 12,217.54 12,282.34 12,257.20 -0.3%

Nikkei 18,664.63 18,664.63 18,597.06 18,861.27 18,810.25 -0.8%

Hang Seng 24,267.30 24,267.30 24,267.30 24,273.72 24,400.80 0.6%

DJ US Maritime 233.39 234.37 229.61 230.11 227.48 0.8% Bunker Prices

$/€ 1.06 1.06 1.07 1.07 1.07 -0.7% W-O-W

7-Apr-17 31-Mar-17

$/₤ 1.24 1.25 1.25 1.24 1.25 -1.4% Change %

Currencies

¥/$ 111.08 110.89 110.41 110.84 110.72 -0.3% Rotterdam 464.0 443.0 4.7%

MDO

$ / NoK 0.12 0.12 0.12 0.12 0.12 -0.4% Houston 495.0 479.0 3.3%

Yuan / $ 6.90 6.90 6.90 6.89 6.89 0.1%

Singapore 490.0 485.0 1.0%

Won / $ 1,137.87 1,131.03 1,128.10 1,125.03 1,117.13 1.8%

Rotterdam 294.0 273.5 7.5%

380cst

$ INDEX 101.18 100.67 100.56 100.54 100.54 0.8%

Houston 284.0 269.0 5.6%

Singapore 312.5 297.5 5.0%

Maritime Stock Data Market News

Stock W-O-W “Nord/LB losses climb to $2bn

Company Curr. 07-Apr-17 31-Mar-17

Exchange Change % Shipping loss provisions surpass $3bn as bank looks

AEGEAN MARINE PETROL NTWK NYSE USD 12.40 12.05 2.9% to slash exposure to industry by $3bn by 2018

CAPITAL PRODUCT PARTNERS LP NASDAQ USD 3.46 3.57 -3.1% SHIPPING loss provisions accounted for the majority

of Nord/LB’s €1.96bn ($2.09bn) loss in 2016 as the

COSTAMARE INC NYSE USD 6.23 6.66 -6.5% lender looks to downsize its burdensome shipping

DANAOS CORPORATION NYSE USD 1.75 1.75 0.0% portfolio in the near future. The loss was a reversal

of a €518m consolidated net profit the German

DIANA SHIPPING NYSE USD 5.92 4.62 28.1%

lender generated in 2015. While the bank’s net

DRYSHIPS INC NASDAQ USD 0.70 1.65 -57.6% interest income slid from €1.97bn to €1.74bn in

2016, the loss was primarily spurred by a €2.26bn

EAGLE BULK SHIPPING NASDAQ USD 5.29 5.69 -7.0%

increase in loan loss provisions, which amounted to

EUROSEAS LTD. NASDAQ USD 1.35 1.44 -6.2% €2.96bn. The bank set aside €2.94bn for ship financ-

GLOBUS MARITIME LIMITED NASDAQ USD 3.42 4.65 -26.5% ing risks alone, compared with €840m in 2015.

Last year Nord acquired German lender Bremer

NAVIOS MARITIME ACQUISITIONS NYSE USD 1.65 1.72 -4.1%

Landesbank, which suffered from its exposure to

NAVIOS MARITIME HOLDINGS NYSE USD 1.94 1.87 3.7% the shipping industry. BLB’s shipping provisions

were a big part of Nord’s own losses for 2016. “The

NAVIOS MARITIME PARTNERS LP NYSE USD 2.15 2.07 3.9%

loss posted by Nord/LB for 2016 as a result of the

SAFE BULKERS INC NYSE USD 2.51 2.20 14.1% huge increase in risk provisioning for ship financing

SEANERGY MARITIME HOLDINGS CORP NASDAQ USD 0.88 0.82 7.3% is painful, especially on this scale,” Nord/LB manag-

ing board chairman Thomas Bürkle said.

STAR BULK CARRIERS CORP NASDAQ USD 12.71 11.88 7.0%

The bank is actively trying to alleviate this pain. It

STEALTHGAS INC NASDAQ USD 3.86 3.99 -3.3% slashed its shipping portfolio from €19bn to

TSAKOS ENERGY NAVIGATION NYSE USD 4.80 4.79 0.2% €16.8bn in 2016 and hopes to decrease it to some-

where between €12bn and €14bn in 2018, including

TOP SHIPS INC NASDAQ USD 0.50 1.08 -53.7% a €3bn reduction in 2017...” (Lloyd’s List)

The information contained in this report has been obtained from various sources, as reported in the market. Intermodal Shipbr okers Co. believes such information to be factual and reliable without mak-

ing guarantees regarding its accuracy or completeness. Whilst every care has been taken in the production of the above review, no liability can be accepted for any loss or damage incurred in any way

whatsoever by any person who may seek to rely on the information and views contained in this material. This report is being produced for the internal use of the intended recipients only and no re-

producing is allowed, without the prior written authorization of Intermodal Shipbrokers Co.

Compiled by Intermodal Research & Valuations Department | research@intermodal.gr

Ms. Eva Tzima | e.tzima@intermodal.gr

Mr. George Panagopoulos | g.panagopoulos@intermodal.gr

If you wish to subscribe to our reports please contact us directly by phone or by e-mailing, faxing or posting the below form,

which can also be found on our website.

Tel: +30 210 6293 300 Intermodal Shipbrokers Co.

Fax:+30 210 6293 333-4 17th km Ethniki Odos Athens-Lamia & 3 Agrambelis St.

Email: research@intermodal.gr 145 64 N.Kifisia,

Website: www.intermodal.gr Athens - Greece

Your Contact Details

Full Name: Title:

Company: Position:

Address:

Address:

Telephone:

E-mail:

Company Website:

© Intermodal Shipbrokers Co 11/04/2017 9

You might also like

- Ocean CarriersDocument7 pagesOcean CarriersMarc de Neergaard100% (2)

- Voyage Planning Annex 24 Solas VDocument6 pagesVoyage Planning Annex 24 Solas VSingniS100% (1)

- Fearnley Market Report December 2018Document20 pagesFearnley Market Report December 2018Charles GohNo ratings yet

- Plipdeco Haulier Inspection ChecklistDocument2 pagesPlipdeco Haulier Inspection ChecklistHemas AvicennaNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-23-2017Document9 pagesIntermodal-Report-Week-23-2017habibiNo ratings yet

- Intermodal-Report-Week-11-2017Document9 pagesIntermodal-Report-Week-11-2017habibiNo ratings yet

- Intermodal-Report-Week-1-2017Document9 pagesIntermodal-Report-Week-1-2017habibiNo ratings yet

- Intermodal-Report-Week-25-2017Document9 pagesIntermodal-Report-Week-25-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-13-2017Document9 pagesIntermodal-Report-Week-13-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-12-2017Document10 pagesIntermodal-Report-Week-12-2017habibiNo ratings yet

- Intermodal-Report-Week-29-2017Document8 pagesIntermodal-Report-Week-29-2017habibiNo ratings yet

- KAPALDocument8 pagesKAPALBudi PrayitnoNo ratings yet

- Intermodal Report Week 7 2018Document9 pagesIntermodal Report Week 7 2018Ekta JaiswalNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-27-2017Document8 pagesIntermodal-Report-Week-27-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-10-2017Document9 pagesIntermodal-Report-Week-10-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-22-2017Document8 pagesIntermodal-Report-Week-22-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-24-2017Document9 pagesIntermodal-Report-Week-24-2017habibiNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal-Report-Week-20-2017Document9 pagesIntermodal-Report-Week-20-2017habibiNo ratings yet

- Braemar_compressed-18Document2 pagesBraemar_compressed-18Jerome E. FranciscoNo ratings yet

- Intermodal-Report-Week-26-2017Document8 pagesIntermodal-Report-Week-26-2017habibiNo ratings yet

- Intermodal-Report-Week-2-2017Document9 pagesIntermodal-Report-Week-2-2017habibiNo ratings yet

- Intermodal-Report-Week-17-2017Document9 pagesIntermodal-Report-Week-17-2017habibiNo ratings yet

- ShippingDocument76 pagesShippingJulienPanero-JollivetNo ratings yet

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Shipping Market Review May 2015Document98 pagesShipping Market Review May 2015jmurcia78No ratings yet

- Up Stream DrillingRigsFocus - April2018Document17 pagesUp Stream DrillingRigsFocus - April2018cvrap99No ratings yet

- Weekly Recap: Let The Bodies Hit The FloorDocument7 pagesWeekly Recap: Let The Bodies Hit The FloorsirdquantsNo ratings yet

- Fearnley 1 FOSAS Summary Report 2018Document44 pagesFearnley 1 FOSAS Summary Report 2018Charles GohNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- ALLIED Weekly Market Report 01-02-2019Document12 pagesALLIED Weekly Market Report 01-02-2019nNo ratings yet

- Willis Marine Market Review November 2009Document20 pagesWillis Marine Market Review November 2009Indra SatriaNo ratings yet

- Intermodal-Report-Week-21-2017Document9 pagesIntermodal-Report-Week-21-2017habibiNo ratings yet

- DSI Example DW DWDocument59 pagesDSI Example DW DWmucopNo ratings yet

- Chart of The Week: Inside This IssueDocument13 pagesChart of The Week: Inside This IssueAdrian Marin100% (1)

- AnalysisDocument2 pagesAnalysisZhieh LorNo ratings yet

- Allied Weekly Market Review Week 25Document13 pagesAllied Weekly Market Review Week 25Mai PhamNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- MISC AnnualReportDocument273 pagesMISC AnnualReportMozek WaNogoriNo ratings yet

- Pareto Conference SummaryDocument7 pagesPareto Conference SummaryMelvin LeongNo ratings yet

- 5 Currents Steer Global MaritimeDocument1 page5 Currents Steer Global MaritimetobyfutureNo ratings yet

- Bimco Reflections 2017 SDocument16 pagesBimco Reflections 2017 SMeleti Meleti MeletiouNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Market Report Week 24Document19 pagesMarket Report Week 24ChetanNo ratings yet

- White Paper Shipbuilding - EnglDocument19 pagesWhite Paper Shipbuilding - EnglRENGANATHAN PNo ratings yet

- The Platou Report 2014Document30 pagesThe Platou Report 2014Tze Yi Tay100% (1)

- LNG Shipping July 2021Document38 pagesLNG Shipping July 2021Royden DSouzaNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- Common Stocks As Long Term InvestmentsFrom EverandCommon Stocks As Long Term InvestmentsRating: 3.5 out of 5 stars3.5/5 (2)

- Machines-ringspinningDocument41 pagesMachines-ringspinninghabibiNo ratings yet

- Machines-rovingframeDocument21 pagesMachines-rovingframehabibiNo ratings yet

- Machines-ringframeDocument57 pagesMachines-ringframehabibiNo ratings yet

- Remsha - Identifying Economic Obsolescence (NEW FILE)Document17 pagesRemsha - Identifying Economic Obsolescence (NEW FILE)habibiNo ratings yet

- Chemical Engineering Process in Cement ProductionDocument18 pagesChemical Engineering Process in Cement ProductionhabibiNo ratings yet

- Machines-drawframeDocument46 pagesMachines-drawframehabibiNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Buoyage SystemDocument10 pagesBuoyage SystemhutsonianpNo ratings yet

- Ras Tanura PortDocument16 pagesRas Tanura Portpgupta71No ratings yet

- Notice of Readiness: Unit FourteenDocument11 pagesNotice of Readiness: Unit FourteenPavel ViktorNo ratings yet

- Lifeboat in DetailsDocument10 pagesLifeboat in Detailsjaber hasan talalNo ratings yet

- 5 Why and Titanic Cause MapDocument2 pages5 Why and Titanic Cause MapAnil KumarNo ratings yet

- Nav 3 Mid-TermDocument2 pagesNav 3 Mid-TermKENT LOUIE ESTENZONo ratings yet

- Sailing Directions Philippine Islands 2017Document374 pagesSailing Directions Philippine Islands 2017Rachel Erica Buesing100% (1)

- Ship Construction 2020Document108 pagesShip Construction 2020Cap Karim ElSherbini100% (3)

- GRAIN NCB FORM - SF 47.25CUFT, MT Trimmed - 2014Document7 pagesGRAIN NCB FORM - SF 47.25CUFT, MT Trimmed - 2014Winston RodriguesNo ratings yet

- List of Shipping Companies in Nigeria SDocument6 pagesList of Shipping Companies in Nigeria SKilo MarineNo ratings yet

- TPOD Deckplans PosterDocument1 pageTPOD Deckplans PosterRyan KlonczNo ratings yet

- Labor JurisprudenceDocument1 pageLabor JurisprudenceArrow PabionaNo ratings yet

- All About History Book of The Titanic Sixth EditionDocument180 pagesAll About History Book of The Titanic Sixth EditionCristina Butragueño Gigorro100% (7)

- Haiti PlanDocument6 pagesHaiti PlanĐÌNH HIẾU PHẠMNo ratings yet

- TRA ZUE: Zurich, Switzerland LSZH/ZRH RNAV (GNSS) Rwy 14Document1 pageTRA ZUE: Zurich, Switzerland LSZH/ZRH RNAV (GNSS) Rwy 14Muhammad hamzaNo ratings yet

- Bill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportDocument1 pageBill of Lading: Cable: CSHKAC Telex: 87986 CSHKAHX Port-to-Port or Combined TransportMoineeNo ratings yet

- Ultrasonic Thickness Measurement of ShipsDocument120 pagesUltrasonic Thickness Measurement of ShipsEka Setiawan100% (2)

- NAV 3 Lesson 5 Keeping A LogDocument8 pagesNAV 3 Lesson 5 Keeping A LogMico Santos100% (1)

- Buenos Aires, Argentina Sabe/Aep Rnpzrwy31: JeppesenDocument1 pageBuenos Aires, Argentina Sabe/Aep Rnpzrwy31: Jeppesenfrancisco buschiazzoNo ratings yet

- GarbageRecordBook ExampleDocument2 pagesGarbageRecordBook ExampleiomerkoNo ratings yet

- FASSMER FAS PP 0008 - Rettungsbootsbau PDFDocument11 pagesFASSMER FAS PP 0008 - Rettungsbootsbau PDFDan PredaNo ratings yet

- Ilorin MetropolisDocument1 pageIlorin MetropolisabdulNo ratings yet

- Narrow Seas: For Any Age of Sail GameDocument23 pagesNarrow Seas: For Any Age of Sail GameAIM Investor JournalNo ratings yet

- Navantia BuquesDocument20 pagesNavantia Buquesmatteo_1234100% (1)

- Curs 5 EEDI Rev 2020 EN - PpsDocument38 pagesCurs 5 EEDI Rev 2020 EN - PpsPanda On FireNo ratings yet

- Chapter 1 Intro To SSDocument17 pagesChapter 1 Intro To SSUmairah AzmanNo ratings yet

- North Sails Rigging Manual 2008 CamDocument25 pagesNorth Sails Rigging Manual 2008 CamnorthsailsNo ratings yet

- SHIPS PARTICULAR RCL NatunaDocument4 pagesSHIPS PARTICULAR RCL NatunaWigy adhisetyoNo ratings yet