Professional Documents

Culture Documents

Intermodal-Report-Week-23-2017

Intermodal-Report-Week-23-2017

Uploaded by

habibiCopyright:

Available Formats

You might also like

- Fearnley Market Report December 2018Document20 pagesFearnley Market Report December 2018Charles GohNo ratings yet

- Second-Hand Vs New Building - The Better OptionDocument5 pagesSecond-Hand Vs New Building - The Better OptionNikos Noulezas100% (2)

- Commodities - Switzerland's Most Dangerous BusinessFrom EverandCommodities - Switzerland's Most Dangerous BusinessRating: 3 out of 5 stars3/5 (1)

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-14-2017Document9 pagesIntermodal-Report-Week-14-2017habibiNo ratings yet

- Intermodal-Report-Week-11-2017Document9 pagesIntermodal-Report-Week-11-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-25-2017Document9 pagesIntermodal-Report-Week-25-2017habibiNo ratings yet

- Intermodal-Report-Week-13-2017Document9 pagesIntermodal-Report-Week-13-2017habibiNo ratings yet

- Intermodal-Report-Week-12-2017Document10 pagesIntermodal-Report-Week-12-2017habibiNo ratings yet

- Intermodal-Report-Week-1-2017Document9 pagesIntermodal-Report-Week-1-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-22-2017Document8 pagesIntermodal-Report-Week-22-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- KAPALDocument8 pagesKAPALBudi PrayitnoNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal Report Week 7 2018Document9 pagesIntermodal Report Week 7 2018Ekta JaiswalNo ratings yet

- Intermodal-Report-Week-29-2017Document8 pagesIntermodal-Report-Week-29-2017habibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-24-2017Document9 pagesIntermodal-Report-Week-24-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-10-2017Document9 pagesIntermodal-Report-Week-10-2017habibiNo ratings yet

- Intermodal-Report-Week-27-2017Document8 pagesIntermodal-Report-Week-27-2017habibiNo ratings yet

- Intermodal-Report-Week-17-2017Document9 pagesIntermodal-Report-Week-17-2017habibiNo ratings yet

- Intermodal-Report-Week-20-2017Document9 pagesIntermodal-Report-Week-20-2017habibiNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-2-2017Document9 pagesIntermodal-Report-Week-2-2017habibiNo ratings yet

- Intermodal-Report-Week-21-2017Document9 pagesIntermodal-Report-Week-21-2017habibiNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- Shipping Market Review May 2015Document98 pagesShipping Market Review May 2015jmurcia78No ratings yet

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- Braemar_compressed-18Document2 pagesBraemar_compressed-18Jerome E. FranciscoNo ratings yet

- Chart of The Week: Inside This IssueDocument13 pagesChart of The Week: Inside This IssueAdrian Marin100% (1)

- ShippingDocument76 pagesShippingJulienPanero-JollivetNo ratings yet

- ALLIED Weekly Market Report 01-02-2019Document12 pagesALLIED Weekly Market Report 01-02-2019nNo ratings yet

- Second-Hand Panamax Drybulker Vs New BuildingDocument5 pagesSecond-Hand Panamax Drybulker Vs New BuildingNikos NoulezasNo ratings yet

- Willis Marine Market Review November 2009Document20 pagesWillis Marine Market Review November 2009Indra SatriaNo ratings yet

- Fearnley 1 FOSAS Summary Report 2018Document44 pagesFearnley 1 FOSAS Summary Report 2018Charles GohNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Intermodal-Report-Week-26-2017Document8 pagesIntermodal-Report-Week-26-2017habibiNo ratings yet

- Pareto Conference SummaryDocument7 pagesPareto Conference SummaryMelvin LeongNo ratings yet

- Allied Weekly Market Review Week 28Document12 pagesAllied Weekly Market Review Week 28Mai PhamNo ratings yet

- Weekly Recap: Let The Bodies Hit The FloorDocument7 pagesWeekly Recap: Let The Bodies Hit The FloorsirdquantsNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Allied Weekly Market Review Week 03Document12 pagesAllied Weekly Market Review Week 03bill duanNo ratings yet

- Intermodal Weekly 01-2012Document8 pagesIntermodal Weekly 01-2012Wisnu KertaningnagoroNo ratings yet

- Marine Insurance MarketDocument20 pagesMarine Insurance MarketAnand VemugantiNo ratings yet

- BDO 2015 Annual Report Financial SupplementsDocument9 pagesBDO 2015 Annual Report Financial Supplementsnssj1234No ratings yet

- Market Commentary: - +ali / +NDocument8 pagesMarket Commentary: - +ali / +NTom LNo ratings yet

- The Platou Report 2014Document30 pagesThe Platou Report 2014Tze Yi Tay100% (1)

- Bimco Reflections 2017 SDocument16 pagesBimco Reflections 2017 SMeleti Meleti MeletiouNo ratings yet

- AnalysisDocument2 pagesAnalysisZhieh LorNo ratings yet

- Shipping Market Review May 2020Document80 pagesShipping Market Review May 2020stanleyNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- Machines-ringspinningDocument41 pagesMachines-ringspinninghabibiNo ratings yet

- Machines-rovingframeDocument21 pagesMachines-rovingframehabibiNo ratings yet

- Machines-ringframeDocument57 pagesMachines-ringframehabibiNo ratings yet

- Remsha - Identifying Economic Obsolescence (NEW FILE)Document17 pagesRemsha - Identifying Economic Obsolescence (NEW FILE)habibiNo ratings yet

- Chemical Engineering Process in Cement ProductionDocument18 pagesChemical Engineering Process in Cement ProductionhabibiNo ratings yet

- Machines-drawframeDocument46 pagesMachines-drawframehabibiNo ratings yet

- Intermodal-Report-Week-14-2017Document9 pagesIntermodal-Report-Week-14-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Master C/O 2/O 3/O C/E 1/E 2/E 3/E Qualification of OfficersDocument1 pageMaster C/O 2/O 3/O C/E 1/E 2/E 3/E Qualification of Officersmuhamad nurul aminNo ratings yet

- Wah Kwong VSL ListDocument4 pagesWah Kwong VSL ListcosmicmarineNo ratings yet

- Vessel Database: AIS Ship PositionsDocument3 pagesVessel Database: AIS Ship PositionsViraj SolankiNo ratings yet

- Data Tugas Rekayasa Dermaga Kelas PDocument1 pageData Tugas Rekayasa Dermaga Kelas PdianaNo ratings yet

- Arnol CV Coc IiDocument12 pagesArnol CV Coc Iikepelautan tanjung priokNo ratings yet

- Weekly SP Market Report Week Ending May 21st 2021 Week 20 Report No 20.21Document9 pagesWeekly SP Market Report Week Ending May 21st 2021 Week 20 Report No 20.21Sandesh Tukaram GhandatNo ratings yet

- SHIP - STATUS - REPORT Jan 30 2020 PDFDocument6 pagesSHIP - STATUS - REPORT Jan 30 2020 PDFrobertotelesNo ratings yet

- ATT-IV BARU HermanDocument2 pagesATT-IV BARU HermanAlfani Nur PrabudiNo ratings yet

- Collection of Main Particulars of VesselsDocument2 pagesCollection of Main Particulars of VesselsRahul PLNo ratings yet

- Wa0005.Document2 pagesWa0005.reskiyantoputradaud99No ratings yet

- NaveDocument33 pagesNaveLaura HumăNo ratings yet

- CSNS939W CenDocument18 pagesCSNS939W CenABALUNo ratings yet

- COSCO SHIPPING LinesDocument2 pagesCOSCO SHIPPING LinesKarim GeorgeNo ratings yet

- Break Bulk Cargo ShipsDocument5 pagesBreak Bulk Cargo ShipsMohamed Salah El DinNo ratings yet

- Ship RegisterDocument2 pagesShip RegisterAfkha Afriza 2No ratings yet

- Weekly SP Market Report Week Ending July 23rd 2021 Week 29 Report No 29.21Document6 pagesWeekly SP Market Report Week Ending July 23rd 2021 Week 29 Report No 29.21Sandesh Tukaram GhandatNo ratings yet

- MC-engines Danish Built EnginesDocument11 pagesMC-engines Danish Built Engineshpss77100% (2)

- CV Olo Sianipar Att3Document2 pagesCV Olo Sianipar Att3agum sulistyoNo ratings yet

- MR Tanker Calculation Sheet ConsolidatedDocument1 pageMR Tanker Calculation Sheet Consolidatednsa.paceNo ratings yet

- Reference List Svanehøj Deepwell and Booster Pumps For Gas CarriersDocument34 pagesReference List Svanehøj Deepwell and Booster Pumps For Gas CarriersDiego TorresNo ratings yet

- List Gambar Penerimaan Klas Rev2Document14 pagesList Gambar Penerimaan Klas Rev2Dolok Joko KenconoNo ratings yet

- HuugDocument9 pagesHuugAsffasdf asdasdNo ratings yet

- List of Ships The Class of Which Is Suspended On 2 Novembre 2 021Document14 pagesList of Ships The Class of Which Is Suspended On 2 Novembre 2 021Muh.Akhsanul KhaliqNo ratings yet

- ��HODEIDAH PORT POSITION ON THURSDAY 25.03.2021 - نسخةDocument2 pages��HODEIDAH PORT POSITION ON THURSDAY 25.03.2021 - نسخةمحمد المعافاNo ratings yet

- CV Muhammad Ikhsan ANT 3Document3 pagesCV Muhammad Ikhsan ANT 3Premium WeslyNo ratings yet

- Perusahaan PelayaranDocument3 pagesPerusahaan PelayaranStevian Geerbel Adrianes RAKKANo ratings yet

- Vessel Size Groups Major Ship Size Groups Include:: Handy and HandymaxDocument3 pagesVessel Size Groups Major Ship Size Groups Include:: Handy and HandymaxGiorgi KandelakiNo ratings yet

- CV. Farid Hardian Mulyana Ant IIIDocument2 pagesCV. Farid Hardian Mulyana Ant IIIKerok Oi OiNo ratings yet

- Curriculum VitaeDocument2 pagesCurriculum VitaePaula AcedoNo ratings yet

- 2010-07-15 Upload 7272611 wsms201007Document80 pages2010-07-15 Upload 7272611 wsms201007honeybunny91No ratings yet

Intermodal-Report-Week-23-2017

Intermodal-Report-Week-23-2017

Uploaded by

habibiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermodal-Report-Week-23-2017

Intermodal-Report-Week-23-2017

Uploaded by

habibiCopyright:

Available Formats

Weekly Market Report

Issue: Week 23| Tuesday 13th June 2017

Market insight Chartering (Wet: Soft - / Dry: Stable +)

Capes and Panamaxes healthier rates gave a small boost in the BDI

By Panos Tsilingiris which at the end of the week closed with a small increase. The BDI

SnP Broker closed today (13/06/2017) at 870 points, unchanged compared to yes-

terday’s levels (12/06/2017) and increased by 52 points when compared

The dry and the tanker shipping segments have dissimilar exposure to sup- to previous Tuesday’s closing (06/06/2017). The crude carriers failed to

ply-driven opportunity (or risk). While the vintage (i.e., over 15 years old) reverse the negative sentiment, while VL rates finally showed signs of

fleet is similar for both segments being shy one fifth of their respective life towards the end of last week. The negative rates for the tanker mar-

fleets, the dry bulk orderbook is at a historical low, while the crude one has ket continued for yet another week in both dirty and clean routes. The

grown alarmingly fast. only positice sign came from Vls with improved rates. The BDTI today

(13/06/2017) closed at 718, decreased by 19 points and the BCTI at 529,

In dry bulk, Handysizes and Panamaxes enjoy the tightest supply. Their vin- a decrease of 17 points compared to previous Tuesday’s (06/06/2017)

tage fleets are somewhat less than a quarter of their total fleets while their levels.

orderbooks are only about 7% of their fleet. There is ample fleet renewal

potential with the overage fleet being more than threefold the orderbook. Sale & Purchase (Wet: Firm +/ Dry: Firm + )

Only Capesizes exhibit a rather younger fleet with just one tenth of the fleet SnP activity remained particularly active with Buyers across both the

being over 15 years old and fleet renewal metric approaching parity. tanker and dry bulk second-hand markets. Adding to that the main in-

terest was for modern tonnage . On the tanker side we had the sale of

the “NORD INTEGRITY” (48,026dwt-blt 10, Japan), which was sold to

Greek buyer, for a price in the region of $17.5m. On the dry bulker side

we had the sale of the “PRECIOUS WIND” (52,551dwt-blt 01, Japan),

which was sold to Greek buyers, for a price in the region of $6.6m.

Newbuilding (Wet: Firm +/ Dry: Stable +)

It seems that the substantial orderbook in most tanker segments has yet

to impact the confidence of those owners who still see potential in new-

buildings. They are seemingly accepting the risk of ordering more ves-

sels -at undoubtedly competitive prices- and hoping that the market in

the future will offer healthier rates and higher earnings. Apart from

tankers, orders for bulkers also kept surfacing last week. We have been

Oil tankers are another story. Distressingly, the Panamax/LR1 orderbook also noticing that a number of orders are placed on the back of a time-

exceeds the vintage fleet. Aframaxes/Lr2s, Suezmaxes, and VLCCs have charter attached. The flat dry bulk market of the past weeks, together

about 15% of their fleets on order with the orderbook of the latter just with declining tanker rates and of course the slowdown in demolition

hitting 100 vessels. Only MR tankers are an exception exhibiting the lowest activity, are all factors that are bound to affect newbuilding appetite

orderbook (shy 9% of the fleet) and a renewal ratio of over 2 overaged units sooner rather than later, which could imply that newbuilding prices will

for each unit on order. remain overall attractive for at least until the end of this year. In terms

of recently reported deals, U.A.E owner,Tomini Shipping, placed an or-

der for three firm Ultramaxes (64,000 dwt) at CSI Jiangsu, in South Korea

for an undisclosed price and delivery set in 2019.

Demolition (Wet: Soft - / Dry: Soft -)

Having already covered the first half of 2017, it is interesting to conduct

a mini review on how the demo market has performed since the begin-

ning of the year. The demolition market witnessed a strong end to last

year, with a number of high priced sales taking place in the Indian sub-

continent, boosting sentiment and allowing for an equally strong market

during the first quarter of 2017 with everyone expecting prices to ex-

ceed 400 $/ldt, a number that we haven’t to witnessed since May 2015.

To conclude, notwithstanding the volatility, the world fleet’s utilization ratio However, the fragment of 400 $/ldt never broke and prices in the sec-

is a mere 80-85%. The world fleet is getting younger while average Vessel’s ond quarter started marginally to decline together with a notable demo

size larger. Vintage S&P prices will decline further as Vessels’ economic lives supply slowdown. Currently in the Indian Sub-Continent, Bangladesh

shorten. Regulations (and incentives?) will be a strong demolition force over and Pakistan face domestic policy changes, which together with the

the next years. However, risks still remain on the demand side with an aging Ramadan period have softened rates and have created an unclear pic-

economy of retiring consumers, an increasingly services-oriented growth, ture of how the market will perform over the next months. Average

the plateauing of offshoring, and renewable energy competing with fossil prices this week for tankers were at around $240-350/ldt and dry bulk

fuels, the latter being the raison d'être of international shipping. units received about 230-335 $/ldt.

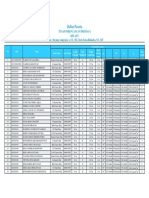

Tanker Market

Spot Rates Indicative Period Charters

Week 23 Week 22 2016 2015

$/day - 1 to 6 mos - 'MILLENNIUM' 1998 301,171 dwt

Vessel Routes WS WS

$/day $/day ±% $/day $/day - - $16,000/day - Trafigura

points points

265k MEG-JAPAN 52 20,148 52 19,449 3.6% 41,068 65,906 - 12 mos - 'HAFNIA LUPUS' 2011 50,500 dwt

VLCC

280k MEG-USG 27 7,113 27 7,582 -6.2% 44,269 49,575 - - $14,000/day - Clearlake

260k WAF-CHINA 55 17,982 53 17,221 4.4% 41,175 63,590

130k MED-MED 75 9,159 78 10,575 -13.4% 29,930 50,337

Suezmax

TD3 TD6 TD9 DIRTY - WS RATES

130k WAF-USAC 65 10,075 80 16,274 -38.1% 23,591 40,490 520

470

130k BSEA-MED 75 6,863 78 10,013 -31.5% 29,930 50,337 420

80k MEG-EAST 97 10,001 100 10,626 -5.9% 20,111 34,131 370

WS poi nts

320

Aframax

80k MED-MED 90 9,057 98 10,942 -17.2% 20,684 37,127 270

80k UKC-UKC 95 4,914 100 10,242 -52.0% 26,526 39,338 220

170

70k CARIBS-USG 93 4,995 115 11,784 -57.6% 20,501 36,519 120

70

75k MEG-JAPAN 90 7,297 87 6,383 14.3% 16,480 30,482 20

Clean

55k MEG-JAPAN 105 6,101 110 6,622 -7.9% 12,891 24,854

37K UKC-USAC 140 8,909 150 10,125 -12.0% 10,622 19,973

30K MED-MED 130 3,003 138 4,055 -25.9% 9,056 24,473

55K UKC-USG 115 9,349 115 9,388 -0.4% 15,726 27,228

TC1 TC2 TC5 TC6 CLEAN - WS RATES

Dirty

55K MED-USG 115 8,667 115 8,764 -1.1% 14,879 26,083 270

50k CARIBS-USAC 117 8,335 117 8,352 -0.2% 15,549 27,146 240

WS poi nts 210

180

150

TC Rates 120

$/day Week 23 Week 22 ±% Diff 2016 2015 90

60

300k 1yr TC 27,000 27,000 0.0% 0 38,108 46,135

VLCC

300k 3yr TC 28,500 28,500 0.0% 0 34,379 42,075

150k 1yr TC 18,500 18,500 0.0% 0 27,363 35,250

Suezmax

150k 3yr TC 19,000 19,000 0.0% 0 25,653 33,219

Indicative Market Values ($ Million) - Tankers

110k 1yr TC 15,000 15,000 0.0% 0 22,396 26,808

Aframax Jun-17 May-17

110k 3yr TC 17,000 17,000 0.0% 0 20,948 24,729 Vessel 5yrs old ±% 2016 2015 2014

avg avg

75k 1yr TC 13,000 13,000 0.0% 0 19,127 23,596

Panamax VLCC 300KT DH 62.0 61.5 0.8% 68.7 81.2 73.8

75k 3yr TC 14,000 14,000 0.0% 0 18,592 20,580

Suezmax 150KT DH 42.3 41.3 2.4% 49.7 59.7 50.4

52k 1yr TC 13,500 13,500 0.0% 0 15,410 17,865

MR Aframax 110KT DH 29.0 29.0 0.0% 36.8 45.5 38.9

52k 3yr TC 14,250 14,250 0.0% 0 15,681 16,638

LR1 75KT DH 28.0 28.0 0.0% 32.9 36.1 33.0

36k 1yr TC 11,500 11,500 0.0% 0 14,380 16,101

Handy MR 52KT DH 23.0 22.0 4.5% 25.0 27.6 27.5

36k 3yr TC 13,000 13,000 0.0% 0 14,622 15,450

Chartering Sale & Purchase

The tanker market has remained under pressure last week. The exception In the VLCC sector we had the sale of the “DS COMMANDER” (311,168dwt-

to this trend are VL rates which are struggling to remain at stable levels, blt 99, S. Korea), which was sold to Hong Kong based owner, Winson, for a

with owners in the sector hoping that the improvement is just around the price in the region of $16.5m.

corner. However, nothing can be predicted as there is still an unclear politi- In the MR sector we had the sale of the “NORD INTEGRITY” (48,026dwt-blt

cal rift between OPEC member Qatar and the rest of the organisation, that 10, Japan), which was sold to Greek buyer, for a price in the region of

has pushed oil prices to around $45/bbl. In addition, it will be interesting to $17.5m.

note how the market will react to the confusion on routes, that has led to

many charterers evaluating changes in their logistics. In detail, VLs could

load and unload to Qatar and U.A.E. However, with the new port ban, char-

terers are looking into altering their strategy and splitting up the cargo to

Suezmaxes, which are expected to rise if the situation remains unchanged

which brings the future of Vls into question.

The VL market outperformed the rest of the market for yet another week,

with improved rates and busier activity in the West Africa/China route.

Along with the West Africa market, we had improved rates in the Middle

East Gulf to China with rates staying at WS52.

The positive momentum for Suezmax rates last month in the West Africa

Market seems to have completely lost ground as rates dropped further this

week, while rates also dropped in the Black Sea to Mediterranean. The Med

Afra has at the same time kept struggling with oversupply of prompt ton-

nage in the region.

© Intermodal Research 13/06/2017 2

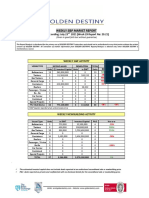

Dry Bulk Market

Baltic Indices Indicative Period Charters

Week 23 Week 22

Point $/day 2016 2015 - 13 to 16 mos - 'ALCMENE' 2010 93,193 dwt

09/06/2017 02/06/2017

Diff ±% - Fangcheng 31 May - $ 8,000/day - Cargill

Index $/day Index $/day Index Index

BDI 849 830 19 676 713 - 13 to 16 mos - 'MYRSINI' 2010 82,193 dwt

BCI 1,438 $11,021 1,374 $9,965 64 10.6% 1,030 1,009 - CJK in d/c 08/10 Jun - $ 8,650/day - RWE

BPI 813 $6,517 792 $6,358 21 2.5% 695 692

Baltic Indices

BSI 654 $7,406 674 $7,615 -20 -2.7% 601 663 BCI BPI BSI BHSI BDI

3,000

BHSI 425 $6,188 446 $6,503 -21 -4.8% 364 365

2,500

2,000

Index

1,500

1,000

500

0

Period

Week Week

$/day ±% Diff 2016 2015

23 22

180K 6mnt TC 14,250 14,000 1.8% 250 7,842 9,969

Capesize

180K 1yr TC 14,000 13,750 1.8% 250 7,582 10,263

Average T/C Rates

180K 3yr TC 14,250 14,000 1.8% 250 8,728 11,243

25000 Av erage of the 4 T / C AVR 4TC BPI AV R 5TC BSI AVR 6TC BHSI

76K 6mnt TC 8,250 8,250 0.0% 0 6,492 7,921

Handysize Supramax Panamax

20000

76K 1yr TC 9,000 9,000 0.0% 0 6,558 7,705

76K 3yr TC 9,750 9,750 0.0% 0 7,068 8,724 15000

$/day

55K 6mnt TC 9,750 9,750 0.0% 0 6,582 8,162 10000

55K 1yr TC 9,750 9,750 0.0% 0 6,851 7,849

5000

55K 3yr TC 9,750 9,750 0.0% 0 6,827 8,181

30K 6mnt TC 8,750 8,750 0.0% 0 5,441 6,690 0

30K 1yr TC 8,500 8,500 0.0% 0 5,511 6,897

30K 3yr TC 8,750 8,750 0.0% 0 5,950 7,291

Chartering Indicative Market Values ($ Million) - Bulk Carriers

After a series of disappointing weeks, the Dry Bulk market made a small Vessel 5 yrs old Jun-17 avg May-17 avg ±% 2016 2015 2014

rebound at the end of last week, with the performance of larger vessels

being mainly responsible for the slightly improved BDI. The period market Capesize 180k 33.0 33.0 0.0% 23.2 33.4 47.5

was also reflecting the improved sentiment in both Capes and Panamaxes. Panamax 76K 19.0 19.0 0.0% 13.4 17.5 24.8

Without a doubt, with the summer season approaching, it will be inter- Supramax 56k 16.5 16.5 0.0% 12.2 16.6 25.2

esting to see how charterers and owners will react to this admittedly numb

Handysize 30K 12.5 12.5 0.0% 9.4 13.8 20.0

market. In the meantime FFAs have slightly improved, with those contracts

for Supramaxes and Panamaxes enjoying most of the upside so far.

Sale & Purchase

Despite the holidays at the beginning of the week there was activity from

West Australia to China and as the week progressed, rates also improved In the Kamsarmax sector we had the sale of the “OCEAN PHOENIX I”

slightly. Healthier rates were also witnessed in the North Atlantic route (82,471dwt-blt 07, Japan), which was sold to Greek buyer, for a price in the

with rates rising to around $11,500/day. region of $13.5m.

In the Supramax sector we had the sale of the “PRECIOUS WIND”

The Atlantic Panamax showed some signs of recovery and rates eventually (52,551dwt-blt 01, Japan), which was sold to Greek buyers, for a price in

firmed up slightly. The main focus of activity was in the East Coast South the region of $6.6m.

America where despite those mixed rates, more cargoes have finally start-

ed surfacing, together with improved ballast bonus premiums, which all

allowed for higher expectations this current week.

Despite bigger vessels showing some signs of improvement, the rates for

the smaller sizes still struggled. Supramax rates were faring slightly better

in the East Coast South America, while the Handysize segment witnessed

another quiet week with Asian routes declining further and average earn-

ings moving down by almost 5%.

© Intermodal Research 13/06/2017 3

Secondhand Sales

Tankers

Size Name Dwt Built Yard M/E SS due Hull Price Buyers Comments

HYUNDAI HI, S. Hong Kong

VLCC DS COMMANDER 311,168 1999 B&W DH $ 16.5m

Korea Ba s ed (Wi ns on)

HYUNDAI SAMHO HYUNDAI SAMHO, S.

SUEZ 159,000 2017 MAN-B&W DH $ 57.5m

S852 Korea

Greek

(Del ta Ta nkers )

HYUNDAI SAMHO HYUNDAI SAMHO, S.

SUEZ 159,000 2017 YYY DH $ 57.5m

S853 Korea

SUNGDONG, S. Norwegi a n

SUEZ POLIEGOS 157,540 2017 Wa rts i l a Ja n-17 DH $ 54.0m i ncl . 14 yea rs BBB

Korea (Ocea n Yi el d)

TSUNEISHI - TADOT,

AFRA RUBY EXPRESS 106,516 2004 B&W Sep-19 DH $ 12.3m undi s cl os ed

Ja pa n

MR NORD INTEGRITY 48,026 2010 IWAGI, Ja pa n MAN-B&W DH $ 17.5m Greek

MR SANTRINA 36,457 1994 SESTRI, Ital y Sul zer Sep-19 DH $ 3.5m Sri La nka ba s ed

MR NAVIG8 SAIPH 25,194 2017 KITANIHON, Ja pa n MAN-B&W DH $ 33.4m s a l e a nd

Chi nes e l ea s eba ck dea l (7-

(CMB Lea s i ng) yr BB wi th P.O)

NAVIG8

MR 25,000 2017 KITANIHON, Ja pa n MAN-B&W DH $ 33.4m

SCEPTRUM

PROD/ KRASNOYE

AGDASH 13,030 2007 Wa rts i l a DH undi s cl os ed Turki s h

CHEM SORMOVO, Rus s i a

MURAKAMI HIDE,

SMALL DONG-A RIGEL 8,831 2003 MAN-B&W Ma r-18 DH $ 8.0m As i a ns

Ja pa n

MURAKAMI HIDE,

SMALL PELAGIA 3,348 1985 Aka s a ka Dec-21 DH $ 1.8m Sri La nka ba s ed

Ja pa n

Bulk Carriers

Size Name Dwt Built Yard M/E SS due Gear Price Buyers Comments

KMAX OCEAN PHOENIX I 82,471 2007 TSUNEISHI, Ja pa n MAN-B&W Dec-21 $ 13.5m Greek

SANOYAS

PMAX CORAL GARNET 75,674 2007 MAN-B&W Ma r-20 $ 13.0m Greek (Era s mus )

HISHINO, Ja pa n

HANTONG HI, 4 X 36t

SMAX PRIVAEGEAN 56,582 2011 MAN-B&W Ma y-21 $ 10.0m Greek (Starbul k)

Chi na CRANES

MITSUI CHIBA 4 X 30t

SMAX BW INDIGO 56,000 2011 MAN-B&W Sep-20 $ 15.4m Greek

ICHIHARA, Ja pa n CRANES

© Intermodal Research 13/06/2017 4

Secondhand Sales

Bulk Carriers Continued.

Size Name Dwt Built Yard M/E SS due Gear Price Buyers Comments

SHIN KURUSHIMA 4 X 30t

SMAX PRECIOUS WIND 52,551 2001 Mi ts ubi s hi Apr-21 $ 6.6m Greek

ONISHI, Ja pa n CRANES

ZHEJIANG

4 X 25t

HANDY JIA TAI 35,112 2011 YUEQING CHANG, MAN-B&W Dec-16 $ 6.8m Chi nes e

CRANES

Chi na

HYUNDAI MIPO, S. 4 X 30,5t

HANDY VOGE EMMA 36,839 2011 MAN-B&W Apr-16 $ 11.0m

Korea CRANES Norwegi a n

(Fea rnl ey Fi na nce &

HYUNDAI MIPO, S. 4 X 30,5t KS fund)

HANDY VOGE MIA 31,440 2011 MAN-B&W Ma y-16 $ 11.0m

Korea CRANES

SUNRISE YAMANISHI, 3 X 30,5t

SMALL 19,127 2007 MAN-B&W Ma y-20 $ 6.2m Turki s h

MIYAJIMA Ja pa n CRANES

Gas/LPG/LNG

Type Name Dwt Built Yard M/E SS due Cbm Price Buyers Comments

Vi etna mes e

LPG GAS EMPEROR 5,599 1994 KITANIHON, Ja pa n Mi ts ubi s hi Nov-14 4,913 $ 2.7m

(FGAS Petrol Co)

Vi etna mes e

LPG GAS ICON 5,588 1994 KITANIHON, Ja pa n Mi ts ubi s hi 5,012 $ 2.7m

(FGAS Petrol Co)

South Korea n

MURAKAMI HIDE,

LPG SIGAS SONJA 4866 2007 Mi ts ubi s hi 4,934 undi s cl os ed (Duck Ya ng

Ja pa n

Shi ppi ng)

TACHIBANA,

LPG LADY ELENA 4,288 1998 Mi ts ubi s hi Aug-18 3,454 $ 3.5m South Korea n

Ja pa n

LPG ANETTE KOSAN 3,844 2001 SHITANOE, Ja pa n Mi ts ubi s hi 3,446 $ 5.0m Indones i a n

DUNSTON HESSLE,

LPG GAMMAGAS 3,593 1992 Ma K Aug-17 4,311 $ 0.9m Turki s h (Arga z)

U. K.

Containers

Size Name Teu Built Yard M/E SS due Gear Price Buyers Comments

SUB AKER MTW, German (MPC

CAPE MELVILLE 2,742 2005 MAN-B&W Jun-20 $ 7.9m

PMAX Germany Container Ships)

SUB GDYNIA STOCZNIA 3 X 45t Brazilian (Log-In

AROSIA 2,732 2006 MAN-B&W Mar-21 $ 10.2m

PMAX SA, Poland CRANES Logistica)

MPP/General Cargo

Name Dwt Built Yard M/E SS due Gear Price Buyers Comments

2 X 30,5t

WATANABE

OS DREAM 10,762 1997 B&W CRNS,1 X $ 1.6m South Korean

ZOSEN, Japan

30t DCKS

© Intermodal Research 13/06/2017 5

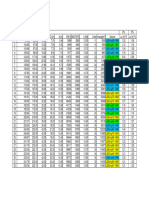

Newbuilding Market

Indicative Newbuilding Prices (million$) It seems that the substantial orderbook in most tanker segments has yet to

impact the confidence of those owners who still see potential in newbuild-

Week Week

Vessel ±% 2016 2015 2014 ings. They are seemingly accepting the risk of ordering more vessels -at un-

23 22 doubtedly competitive prices- and hoping that the market in the future will

Capesize 180k 42.0 42.0 0.0% 43.2 50 56 offer healthier rates and higher earnings. Apart from tankers, orders for bulk-

Bulkers

Kamsarmax 82k 25.0 25.0 0.0% 24.8 28 30 ers also kept surfacing last week. We have been also noticing that a number

Ultramax 63k 23.0 23.0 0.0% 23 25 27 of orders are placed on the back of a time-charter attached. The flat dry bulk

Handysize 38k 20.0 20.0 0.0% 20 21 23 market of the past weeks, together with declining tanker rates and of course

VLCC 300k 78.0 78.0 0.0% 88.5 96 99 the slowdown in demolition activity, are all factors that are bound to affect

newbuilding appetite sooner rather than later, which could imply that new-

Tankers

Suezmax 160k 53.0 53.0 0.0% 58 64 65

building prices will remain overall attractive for at least until the end of this

Aframax 115k 43.0 43.0 0.0% 48 53 54 year.

LR1 75k 40.0 40.0 0.0% 42.5 46 46

MR 50k 32.5 32.5 0.0% 33.7 36 37 In terms of recently reported deals, U.A.E owner, Tomini Shipping, placed an

order for three firm Ultramaxes (64,000 dwt) at CSI Jiangsu, in South Korea

LNG 160k cbm 188.0 188.0 0.0% 189 190 186

for an undisclosed price and delivery set in 2019.

LGC LPG 80k cbm 71.0 71.0 0.0% 74.1 77 78

Gas

MGC LPG 55k cbm 64.0 64.0 0.0% 65.7 68 67

SGC LPG 25k cbm 42.0 42.0 0.0% 42.8 45 44

Tankers Newbuilding Prices (m$) Bulk Carriers Newbuilding Prices (m$)

VLCC Suezmax Aframax LR1 MR Capesize Panamax Supramax Handysize

180 110

140 90

mi l lion $

mi l lion $

70

100

50

60

30

20 10

Newbuilding Orders

Units Type Size Yard Delivery Buyer Price Comments

2 Tanker 320,000 dwt Nantong COSCO, China 2019-2020 mid $70.0m Tier III

2 Tanker 320,000 dwt Dalian COSCO, China 2019-2020 mid $70.0m Tier III

2+2 Tanker 320,000 dwt CSSC OME, China 2019-2020 mid $70.0m Tier III

2+2 Tanker 320,000 dwt SWS, China 2019-2020 Chinese (COSCO) mid $70.0m Tier III

3 Tanker 158,000 dwt SWS, China 2019-2020 undisclosed

5 Tanker 120,000 dwt CSSC OME, China 2019-2020 undisclosed

Hudong Zhonghua,

2 Tanker 75,000 dwt 2019-2020 undisclosed

China

3 Bulker 325,000 dwt Hyundai HI, S. Korea 2019-2020 S. Korean (Polaris Shipping) undisclosed against COA to Vale

U.A.E based

3 Bulker 64,000 dwt CSI Jiangsu, China 2019 undisclosed

(Tomini Shipping)

T/C period for 8-yrs+ 2-yr

1 Bulker 63,000 dwt Imabari, Japan 2020 Norwegian (Belships ASA) undisclosed

option, with po at 4-yr

Damen Galati,

2 RoPax 300 pax 2020 Canadian (BC Ferries) undisclosed

Romania

1 RoPax 543 pax Mitsubishi HI, Japan 2019 Japanese (Taiheiyo Ferry) undisclosed 310 cars

© Intermodal Research 13/06/2017 6

Demolition Market

Indicative Demolition Prices ($/ldt) Having already covered the first half of 2017, it is interesting to conduct a

Week Week mini review on how the demo market has performed since the beginning of

Markets ±% 2016 2015 2014 the year. The demolition market witnessed a strong end to last year, with a

23 22

number of high priced sales taking place in the Indian subcontinent, boosting

Bangladesh 340 350 -2.9% 287 360 469 sentiment and allowing for an equally strong market during the first quarter

India 345 350 -1.4% 283 361 478

Tanker

of 2017 with everyone expecting prices to exceed 400 $/ldt, a number that

Pakistan 345 345 0.0% 284 366 471 we haven’t to witnessed since May 2015. However, the fragment of 400 $/ldt

China 240 240 0.0% 176 193 313 never broke and prices in the second quarter started marginally to decline

Turkey 245 245 0.0% 181 225 333 together with a notable demo supply slowdown. Currently in the Indian Sub-

Continent, Bangladesh and Pakistan face domestic policy changes, which

Bangladesh 320 330 -3.0% 272 341 451

together with the Ramadan period have softened rates and have created an

Dry Bulk

India 325 330 -1.5% 268 342 459 unclear picture of how the market will perform over the next months. Aver-

Pakistan 325 325 0.0% 267 343 449 age prices this week for tankers were at around $240-350/ldt and dry bulk

China 230 230 0.0% 160 174 297 units received about 230-335 $/ldt.

Turkey 235 235 0.0% 174 216 322

One of the highest prices amongst recently reported deals was paid by Indian

breakers for the RoRo carrier “MAPLE ACE II” (15,361dwt-10,247ldt-blt 92),

which received $330/ldt.

Tanker Demolition Prices Dry Bulk Demolition Prices

Bangladesh India Pakistan China Turkey Bangladesh India Pakistan China Turkey

400 400

300 300

$/l dt

$/l dt

200 200

100 100

Demolition Sales

Name Size Ldt Built Yard Type $/ldt Breakers Comments

MITSUBISHI green recycling

ORE SOSSEGO 264,164 44,969 1991 MISC $ 333/Ldt Indian

NAGASAKI, Japan

SHIN KURUSHIMA green recycling

MAPLE ACE II 15,361 10,247 1992 RORO $ 330/Ldt Indian

ONISHI, Japan

SEA ANEMOS 2,709 3,602 1980 NISHI, Japan RORO $ 220/Ldt Turkish

NO 8 KOKAMARU 2,999 1,589 1994 SHIN KOCHI, Japan TANKER $ 215/Ldt Chinese

© Intermodal Research 13/06/2017 7

Commodities & Ship Finance

Market Data Basic Commodities Weekly Summary

W-O-W Oil WTI $ Oil Brent $ Gold $

9-Jun-17 8-Jun-17 7-Jun-17 6-Jun-17 5-Jun-17

Change % 60 1,300

10year US Bond 2.200 2.190 2.180 2.150 2.180 1.9% 55

S&P 500 2,431.77 2,433.79 2,433.14 2,429.33 2,436.10 -0.2%

oil 50 gold

Stock Exchange Data

Nasdaq 6,207.92 6,321.76 6,297.38 6,275.06 6,295.68 -1.4%

Dow Jones 21,271.97 21,182.53 21,173.69 21,136.23 21,184.04 0.4% 45

FTSE 100 7,527.33 7,449.98 7,478.62 7,524.95 7,525.76 0.0% 40 1,250

FTSE All-Share UK 4,111.63 4,076.65 4,086.98 4,105.93 4,114.40 -0.1%

CAC40 5,299.71 5,264.24 5,265.53 5,269.22 5,307.89 -0.8%

Xetra Dax 12,815.72 12,815.72 12,713.58 12,672.49 12,690.12 1.0%

Nikkei 20,013.26 19,909.26 19,984.62 19,979.90 20,170.82 -0.8%

Hang Seng 26,030.29 26,063.06 25,974.16 25,997.14 25,862.99 0.6%

DJ US Maritime 224.69 222.39 222.23 222.56 222.88 0.8% Bunker Prices

$/€ 1.12 1.12 1.13 1.13 1.13 -0.8% W-O-W

9-Jun-17 2-Jun-17

$/₤ 1.28 1.27 1.30 1.29 1.29 -1.1% Change %

Currencies

¥/$ 110.36 109.86 109.90 109.50 110.40 0.0% Rotterdam 425.0 441.0 -3.6%

MDO

$ / NoK 0.12 0.12 0.12 0.12 0.12 -1.0% Houston 455.0 470.0 -3.2%

Yuan / $ 6.80 6.79 6.79 6.80 6.80 -0.2%

Singapore 445.0 455.0 -2.2%

Won / $ 1,125.30 1,122.55 1,124.15 1,118.46 1,117.95 0.6%

Rotterdam 275.5 290.5 -5.2%

380cst

$ INDEX 97.27 96.92 96.75 96.64 96.80 0.6%

Houston 271.0 285.0 -4.9%

Singapore 291.0 302.5 -3.8%

Maritime Stock Data

Stock W-O-W Market News

Company Curr. 09-Jun-17 02-Jun-17

Exchange Change % “Boxship fund raises $75m in private placement

AEGEAN MARINE PETROL NTWK NYSE USD 5.70 6.05 -5.8% OSLO-based MPC Containerships has raised

CAPITAL PRODUCT PARTNERS LP NASDAQ USD 3.41 3.36 1.5% NKr645m ($75.7m) through a private placement to

support its vessel acquisition programme.

COSTAMARE INC NYSE USD 6.83 6.64 2.9%

DANAOS CORPORATION NYSE USD 1.35 1.30 3.8%

The placement fell within the company’s target of

DIANA SHIPPING NYSE USD 3.99 3.73 7.0% $50m to $100m, with some of parent company

DRYSHIPS INC NASDAQ USD 1.97 2.30 -14.3% MPC Capital’s shareholders injecting up to $25m.

Fifteen million new shares were issued at NKr43 per

EAGLE BULK SHIPPING NASDAQ USD 5.00 4.43 12.9% share with Fearnley Securities as the placement’s

EUROSEAS LTD. NASDAQ USD 1.28 1.28 0.0% manager and bookrunner.

GLOBUS MARITIME LIMITED NASDAQ USD 1.29 1.19 8.4%

NAVIOS MARITIME ACQUISITIONS NYSE USD 1.50 1.61 -6.8% Since its founding by MPC Capital in April 2017,

MPC Containerships has already invested $80m,

NAVIOS MARITIME HOLDINGS NYSE USD 1.27 1.08 17.6% including the acquisitions of seven vessels last

NAVIOS MARITIME PARTNERS LP NYSE USD 1.69 1.57 7.6% month. This latest fundraising effort comes as the

company has run through most of its $100m initial

SAFE BULKERS INC NYSE USD 2.30 1.82 26.4% investment.

SEANERGY MARITIME HOLDINGS CORP NASDAQ USD 0.71 0.62 14.5%

STAR BULK CARRIERS CORP NASDAQ USD 8.93 7.93 12.6% The boxship investment fund, which began trading

STEALTHGAS INC NASDAQ USD 3.11 3.20 -2.8% on the Norwegian OTC market in late April, is tar-

geting vessels of 1,000 teu-3,000 teu capacity. An

TSAKOS ENERGY NAVIGATION NYSE USD 4.40 4.28 2.8% initial public offering with a reputable stock ex-

TOP SHIPS INC NASDAQ USD 0.26 0.29 -10.3% change in 2017 is also in its sights.....” (Lloyd’s List)

The information contained in this report has been obtained from various sources, as reported in the market. Intermodal Shipbr okers Co. believes such information to be factual and reliable without mak-

ing guarantees regarding its accuracy or completeness. Whilst every care has been taken in the production of the above review, no liability can be accepted for any loss or damage incurred in any way

whatsoever by any person who may seek to rely on the information and views contained in this material. This report is being produced for the internal use of the intended recipients only and no re-

producing is allowed, without the prior written authorization of Intermodal Shipbrokers Co.

Compiled by Intermodal Research & Valuations Department | research@intermodal.gr

Ms. Eva Tzima | e.tzima@intermodal.gr

Mr. George Panagopoulos | g.panagopoulos@intermodal.gr

If you wish to subscribe to our reports please contact us directly by phone or by e-mailing, faxing or posting the below form,

which can also be found on our website.

Tel: +30 210 6293 300 Intermodal Shipbrokers Co.

Fax:+30 210 6293 333-4 17th km Ethniki Odos Athens-Lamia & 3 Agrambelis St.

Email: research@intermodal.gr 145 64 N.Kifisia,

Website: www.intermodal.gr Athens - Greece

Your Contact Details

Full Name: Title:

Company: Position:

Address:

Address:

Telephone:

E-mail:

Company Website:

© Intermodal Shipbrokers Co 13/06/2017 9

You might also like

- Fearnley Market Report December 2018Document20 pagesFearnley Market Report December 2018Charles GohNo ratings yet

- Second-Hand Vs New Building - The Better OptionDocument5 pagesSecond-Hand Vs New Building - The Better OptionNikos Noulezas100% (2)

- Commodities - Switzerland's Most Dangerous BusinessFrom EverandCommodities - Switzerland's Most Dangerous BusinessRating: 3 out of 5 stars3/5 (1)

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-14-2017Document9 pagesIntermodal-Report-Week-14-2017habibiNo ratings yet

- Intermodal-Report-Week-11-2017Document9 pagesIntermodal-Report-Week-11-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-25-2017Document9 pagesIntermodal-Report-Week-25-2017habibiNo ratings yet

- Intermodal-Report-Week-13-2017Document9 pagesIntermodal-Report-Week-13-2017habibiNo ratings yet

- Intermodal-Report-Week-12-2017Document10 pagesIntermodal-Report-Week-12-2017habibiNo ratings yet

- Intermodal-Report-Week-1-2017Document9 pagesIntermodal-Report-Week-1-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-22-2017Document8 pagesIntermodal-Report-Week-22-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- KAPALDocument8 pagesKAPALBudi PrayitnoNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal Report Week 7 2018Document9 pagesIntermodal Report Week 7 2018Ekta JaiswalNo ratings yet

- Intermodal-Report-Week-29-2017Document8 pagesIntermodal-Report-Week-29-2017habibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-24-2017Document9 pagesIntermodal-Report-Week-24-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-10-2017Document9 pagesIntermodal-Report-Week-10-2017habibiNo ratings yet

- Intermodal-Report-Week-27-2017Document8 pagesIntermodal-Report-Week-27-2017habibiNo ratings yet

- Intermodal-Report-Week-17-2017Document9 pagesIntermodal-Report-Week-17-2017habibiNo ratings yet

- Intermodal-Report-Week-20-2017Document9 pagesIntermodal-Report-Week-20-2017habibiNo ratings yet

- Intermodal Report Week 07 2021Document8 pagesIntermodal Report Week 07 2021Akın AKNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Intermodal-Report-Week-2-2017Document9 pagesIntermodal-Report-Week-2-2017habibiNo ratings yet

- Intermodal-Report-Week-21-2017Document9 pagesIntermodal-Report-Week-21-2017habibiNo ratings yet

- Intermodal Report Week 26 2021Document8 pagesIntermodal Report Week 26 2021Nguyen Le Thu HaNo ratings yet

- Intermodal Weekly Market Report 3rd February 2015, Week 5Document9 pagesIntermodal Weekly Market Report 3rd February 2015, Week 5Budi PrayitnoNo ratings yet

- Shipping Market Review May 2015Document98 pagesShipping Market Review May 2015jmurcia78No ratings yet

- Analysis: The Container Shipping Industry and Its Major Players in 2018Document11 pagesAnalysis: The Container Shipping Industry and Its Major Players in 2018Anonymous weJ9b9Z0eNo ratings yet

- Weeklyreport 05 02 2021Document5 pagesWeeklyreport 05 02 2021Luis Enrique LavayenNo ratings yet

- Braemar_compressed-18Document2 pagesBraemar_compressed-18Jerome E. FranciscoNo ratings yet

- Chart of The Week: Inside This IssueDocument13 pagesChart of The Week: Inside This IssueAdrian Marin100% (1)

- ShippingDocument76 pagesShippingJulienPanero-JollivetNo ratings yet

- ALLIED Weekly Market Report 01-02-2019Document12 pagesALLIED Weekly Market Report 01-02-2019nNo ratings yet

- Second-Hand Panamax Drybulker Vs New BuildingDocument5 pagesSecond-Hand Panamax Drybulker Vs New BuildingNikos NoulezasNo ratings yet

- Willis Marine Market Review November 2009Document20 pagesWillis Marine Market Review November 2009Indra SatriaNo ratings yet

- Fearnley 1 FOSAS Summary Report 2018Document44 pagesFearnley 1 FOSAS Summary Report 2018Charles GohNo ratings yet

- Tanker: Light at The End of The Tunnel?Document7 pagesTanker: Light at The End of The Tunnel?Eric WhitfieldNo ratings yet

- Intermodal-Report-Week-26-2017Document8 pagesIntermodal-Report-Week-26-2017habibiNo ratings yet

- Pareto Conference SummaryDocument7 pagesPareto Conference SummaryMelvin LeongNo ratings yet

- Allied Weekly Market Review Week 28Document12 pagesAllied Weekly Market Review Week 28Mai PhamNo ratings yet

- Weekly Recap: Let The Bodies Hit The FloorDocument7 pagesWeekly Recap: Let The Bodies Hit The FloorsirdquantsNo ratings yet

- GMS Ship Recycling - Weekly FactsDocument9 pagesGMS Ship Recycling - Weekly FactsTom LNo ratings yet

- Allied Weekly Market Review Week 03Document12 pagesAllied Weekly Market Review Week 03bill duanNo ratings yet

- Intermodal Weekly 01-2012Document8 pagesIntermodal Weekly 01-2012Wisnu KertaningnagoroNo ratings yet

- Marine Insurance MarketDocument20 pagesMarine Insurance MarketAnand VemugantiNo ratings yet

- BDO 2015 Annual Report Financial SupplementsDocument9 pagesBDO 2015 Annual Report Financial Supplementsnssj1234No ratings yet

- Market Commentary: - +ali / +NDocument8 pagesMarket Commentary: - +ali / +NTom LNo ratings yet

- The Platou Report 2014Document30 pagesThe Platou Report 2014Tze Yi Tay100% (1)

- Bimco Reflections 2017 SDocument16 pagesBimco Reflections 2017 SMeleti Meleti MeletiouNo ratings yet

- AnalysisDocument2 pagesAnalysisZhieh LorNo ratings yet

- Shipping Market Review May 2020Document80 pagesShipping Market Review May 2020stanleyNo ratings yet

- THE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORFrom EverandTHE DETERMINANTS OF PRICES OF NEWBUILDING IN THE VERY LARGE CRUDE CARRIERS (VLCC) SECTORNo ratings yet

- Machines-ringspinningDocument41 pagesMachines-ringspinninghabibiNo ratings yet

- Machines-rovingframeDocument21 pagesMachines-rovingframehabibiNo ratings yet

- Machines-ringframeDocument57 pagesMachines-ringframehabibiNo ratings yet

- Remsha - Identifying Economic Obsolescence (NEW FILE)Document17 pagesRemsha - Identifying Economic Obsolescence (NEW FILE)habibiNo ratings yet

- Chemical Engineering Process in Cement ProductionDocument18 pagesChemical Engineering Process in Cement ProductionhabibiNo ratings yet

- Machines-drawframeDocument46 pagesMachines-drawframehabibiNo ratings yet

- Intermodal-Report-Week-14-2017Document9 pagesIntermodal-Report-Week-14-2017habibiNo ratings yet

- Intermodal-Report-Week-30-2017Document9 pagesIntermodal-Report-Week-30-2017habibiNo ratings yet

- Intermodal-Report-Week-28-2017Document9 pagesIntermodal-Report-Week-28-2017habibiNo ratings yet

- Intermodal-Report-Week-18-2017Document9 pagesIntermodal-Report-Week-18-2017habibiNo ratings yet

- Intermodal-Report-Week-6-2017Document9 pagesIntermodal-Report-Week-6-2017habibiNo ratings yet

- Intermodal-Report-Week-19-2017_roroDocument9 pagesIntermodal-Report-Week-19-2017_rorohabibiNo ratings yet

- Intermodal-Report-Week-3-2017Document9 pagesIntermodal-Report-Week-3-2017habibiNo ratings yet

- Intermodal-Report-Week-9-2017Document10 pagesIntermodal-Report-Week-9-2017habibiNo ratings yet

- Intermodal-Report-Week-4-2017Document9 pagesIntermodal-Report-Week-4-2017habibiNo ratings yet

- Intermodal-Report-Week-8-2017Document10 pagesIntermodal-Report-Week-8-2017habibiNo ratings yet

- Intermodal-Report-Week-5-2017Document9 pagesIntermodal-Report-Week-5-2017habibiNo ratings yet

- Intermodal-Report-Week-7-2017Document9 pagesIntermodal-Report-Week-7-2017habibiNo ratings yet

- Master C/O 2/O 3/O C/E 1/E 2/E 3/E Qualification of OfficersDocument1 pageMaster C/O 2/O 3/O C/E 1/E 2/E 3/E Qualification of Officersmuhamad nurul aminNo ratings yet

- Wah Kwong VSL ListDocument4 pagesWah Kwong VSL ListcosmicmarineNo ratings yet

- Vessel Database: AIS Ship PositionsDocument3 pagesVessel Database: AIS Ship PositionsViraj SolankiNo ratings yet

- Data Tugas Rekayasa Dermaga Kelas PDocument1 pageData Tugas Rekayasa Dermaga Kelas PdianaNo ratings yet

- Arnol CV Coc IiDocument12 pagesArnol CV Coc Iikepelautan tanjung priokNo ratings yet

- Weekly SP Market Report Week Ending May 21st 2021 Week 20 Report No 20.21Document9 pagesWeekly SP Market Report Week Ending May 21st 2021 Week 20 Report No 20.21Sandesh Tukaram GhandatNo ratings yet

- SHIP - STATUS - REPORT Jan 30 2020 PDFDocument6 pagesSHIP - STATUS - REPORT Jan 30 2020 PDFrobertotelesNo ratings yet

- ATT-IV BARU HermanDocument2 pagesATT-IV BARU HermanAlfani Nur PrabudiNo ratings yet

- Collection of Main Particulars of VesselsDocument2 pagesCollection of Main Particulars of VesselsRahul PLNo ratings yet

- Wa0005.Document2 pagesWa0005.reskiyantoputradaud99No ratings yet

- NaveDocument33 pagesNaveLaura HumăNo ratings yet

- CSNS939W CenDocument18 pagesCSNS939W CenABALUNo ratings yet

- COSCO SHIPPING LinesDocument2 pagesCOSCO SHIPPING LinesKarim GeorgeNo ratings yet

- Break Bulk Cargo ShipsDocument5 pagesBreak Bulk Cargo ShipsMohamed Salah El DinNo ratings yet

- Ship RegisterDocument2 pagesShip RegisterAfkha Afriza 2No ratings yet

- Weekly SP Market Report Week Ending July 23rd 2021 Week 29 Report No 29.21Document6 pagesWeekly SP Market Report Week Ending July 23rd 2021 Week 29 Report No 29.21Sandesh Tukaram GhandatNo ratings yet

- MC-engines Danish Built EnginesDocument11 pagesMC-engines Danish Built Engineshpss77100% (2)

- CV Olo Sianipar Att3Document2 pagesCV Olo Sianipar Att3agum sulistyoNo ratings yet

- MR Tanker Calculation Sheet ConsolidatedDocument1 pageMR Tanker Calculation Sheet Consolidatednsa.paceNo ratings yet

- Reference List Svanehøj Deepwell and Booster Pumps For Gas CarriersDocument34 pagesReference List Svanehøj Deepwell and Booster Pumps For Gas CarriersDiego TorresNo ratings yet

- List Gambar Penerimaan Klas Rev2Document14 pagesList Gambar Penerimaan Klas Rev2Dolok Joko KenconoNo ratings yet

- HuugDocument9 pagesHuugAsffasdf asdasdNo ratings yet

- List of Ships The Class of Which Is Suspended On 2 Novembre 2 021Document14 pagesList of Ships The Class of Which Is Suspended On 2 Novembre 2 021Muh.Akhsanul KhaliqNo ratings yet

- ��HODEIDAH PORT POSITION ON THURSDAY 25.03.2021 - نسخةDocument2 pages��HODEIDAH PORT POSITION ON THURSDAY 25.03.2021 - نسخةمحمد المعافاNo ratings yet

- CV Muhammad Ikhsan ANT 3Document3 pagesCV Muhammad Ikhsan ANT 3Premium WeslyNo ratings yet

- Perusahaan PelayaranDocument3 pagesPerusahaan PelayaranStevian Geerbel Adrianes RAKKANo ratings yet

- Vessel Size Groups Major Ship Size Groups Include:: Handy and HandymaxDocument3 pagesVessel Size Groups Major Ship Size Groups Include:: Handy and HandymaxGiorgi KandelakiNo ratings yet

- CV. Farid Hardian Mulyana Ant IIIDocument2 pagesCV. Farid Hardian Mulyana Ant IIIKerok Oi OiNo ratings yet

- Curriculum VitaeDocument2 pagesCurriculum VitaePaula AcedoNo ratings yet

- 2010-07-15 Upload 7272611 wsms201007Document80 pages2010-07-15 Upload 7272611 wsms201007honeybunny91No ratings yet