Professional Documents

Culture Documents

Pdf_540477480300624

Pdf_540477480300624

Uploaded by

rcmpaintproductsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pdf_540477480300624

Pdf_540477480300624

Uploaded by

rcmpaintproductsCopyright:

Available Formats

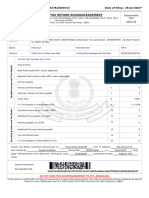

Acknowledgement Number:540477480300624 Date of filing : 30-Jun-2024*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2024-25

PAN AUWPG0164D

Name GOPAL

Address H105, R.M. Colony 7th Cross , Dindigul, Dindigul, DINDIGUL, 29-Tamil Nadu, 91-India, 624001

Status Individual Form Number ITR-2

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 540477480300624

Current Year business loss, if any 1 0

Total Income 2 4,86,060

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 0

(+) Tax Payable /(-) Refundable (7-8) 9 0

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

Interest payable u/s 115TE 12 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 (+) 0

Income Tax Return electronically transmitted on 30-Jun-2024 14:05:48 from IP address 120.60.198.214

and verified by GOPAL having PAN AUWPG0164D on 05-Jul-2024 using paper

ITR-Verification Form /Electronic Verification Code TUYZ7FM8EI generated through Aadhaar OTP mode

System Generated

Barcode/QR Code

AUWPG0164D02540477480300624d6ae319fcc44aabd942c4f0d85f06c958cdf3ec3

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

*If the return is verified after 30 days of transmission of return data electronically, then date of verification will be considered as date of

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT).”

You might also like

- InDesign and XML Tech RefDocument28 pagesInDesign and XML Tech RefMarius TNo ratings yet

- Arendt Feminism AlterityDocument21 pagesArendt Feminism AlterityWilliam Joseph CarringtonNo ratings yet

- SM D1463-M-ST D1703-M-ST Kubota STa 30 35 Workshop ManualDocument359 pagesSM D1463-M-ST D1703-M-ST Kubota STa 30 35 Workshop ManualГалина Карташова100% (2)

- Pdf_540052060300624Document1 pagePdf_540052060300624rcmpaintproductsNo ratings yet

- Pdf_592480460050724Document1 pagePdf_592480460050724rcmpaintproductsNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:385242360010624 Date of Filing: 01-Jun-2024Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:385242360010624 Date of Filing: 01-Jun-2024ymanish844No ratings yet

- PDF 485942960240624Document1 pagePDF 485942960240624divyanshudubeyNo ratings yet

- PDF 531374180290624Document1 pagePDF 531374180290624kangra2022No ratings yet

- PDF 546341630010724Document1 pagePDF 546341630010724amanhyficNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- ACK643099920100724 (1)Document1 pageACK643099920100724 (1)dineshcsharmacaNo ratings yet

- PDF 668143460250723Document1 pagePDF 668143460250723Modicare ConsultantNo ratings yet

- Pdf_584380570040724Document1 pagePdf_584380570040724Confucius Immortal RNo ratings yet

- ACK385949670070723Document1 pageACK385949670070723zq65525No ratings yet

- AttachmentDocument1 pageAttachmentNikhil KoundalNo ratings yet

- ACK566598060200723Document1 pageACK566598060200723Niragni Prasad PathakNo ratings yet

- Tejilal VDocument1 pageTejilal VNatraj IyerNo ratings yet

- Pdf_533345320290624Document1 pagePdf_533345320290624raktim.aegclNo ratings yet

- ACK695433840130724Document1 pageACK695433840130724knowthebest787No ratings yet

- ACK234925030230524Document1 pageACK234925030230524BIKRAM KUMAR BEHERANo ratings yet

- Ack 685218550130724Document1 pageAck 685218550130724jit biswasNo ratings yet

- Tanmay Dutta Itr-V 23-24 (Ev)Document1 pageTanmay Dutta Itr-V 23-24 (Ev)b2bservices007No ratings yet

- Ack 214294030140524Document1 pageAck 214294030140524Steve BurnsNo ratings yet

- ACK519782840270624Document1 pageACK519782840270624Ambati Madhava ReddyNo ratings yet

- ACK326987860300623Document1 pageACK326987860300623sudarshankarn08No ratings yet

- PDF 854542190300723Document1 pagePDF 854542190300723Sakshi JaiswalNo ratings yet

- PDF 615803240220723Document1 pagePDF 615803240220723mohammadgausraza229No ratings yet

- DownloadAcknowledgementPdfDocument1 pageDownloadAcknowledgementPdfwert07995No ratings yet

- ACK414045580100723Document1 pageACK414045580100723ggggNo ratings yet

- Itr RCPT-22-23Document1 pageItr RCPT-22-23homcoactNo ratings yet

- ACK427637620130624Document1 pageACK427637620130624tusharbansal825No ratings yet

- Pdf_458875620190624Document1 pagePdf_458875620190624consistencytusharNo ratings yet

- Itr SunitaDocument1 pageItr Sunitaayanbhargav3No ratings yet

- Itr 23-24 AnubhavDocument1 pageItr 23-24 AnubhavAnubhav MishraNo ratings yet

- Ack 261954020190623Document1 pageAck 261954020190623TANUJ CHAKRABORTYNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- ACK589037300050724Document1 pageACK589037300050724nanibondigaNo ratings yet

- PDF 252724010130923Document1 pagePDF 252724010130923amirahul2507No ratings yet

- Pdf_502528920260624Document1 pagePdf_502528920260624rohanNo ratings yet

- Ack 312603180280623Document1 pageAck 312603180280623info.ashokchoudhary.icaNo ratings yet

- PDF 145351270310723Document1 pagePDF 145351270310723khatrirajiv213No ratings yet

- ACK424567720110723Document1 pageACK424567720110723ramrandimcNo ratings yet

- Pdf_572505420030724Document1 pagePdf_572505420030724dablayogesh82No ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- Pdf_732347120160724(1)Document1 pagePdf_732347120160724(1)ajaykamboj898No ratings yet

- ACK382107810070723Document1 pageACK382107810070723smadvocate049No ratings yet

- PDF 608080650220723Document1 pagePDF 608080650220723Snehit RajNo ratings yet

- Setharam ItDocument1 pageSetharam Itseetharamn90No ratings yet

- Baupa1247e AckDocument1 pageBaupa1247e Ackasmodalimondal2000No ratings yet

- ITR 4Document1 pageITR 4rinku.bansal.j7No ratings yet

- VIJAYRAJ 30-Sep-2023 354555590Document1 pageVIJAYRAJ 30-Sep-2023 354555590SadiqNo ratings yet

- PDF 232971700230524Document1 pagePDF 232971700230524Steve BurnsNo ratings yet

- Pdf_465870500140723Document1 pagePdf_465870500140723ujjal2014No ratings yet

- PDF 548483700190723Document1 pagePDF 548483700190723bghosh00112233No ratings yet

- Itrv 1Document1 pageItrv 1mickieNo ratings yet

- Pdf_482590560230624Document1 pagePdf_482590560230624Sumit Laljibhai PatelNo ratings yet

- Pdf_543537890300624Document1 pagePdf_543537890300624optimus sales distributionNo ratings yet

- Ack 702682430260723Document1 pageAck 702682430260723nimaygabaNo ratings yet

- Pdf_551535790010724Document1 pagePdf_551535790010724knowthebest787No ratings yet

- Ayush K 23-24Document1 pageAyush K 23-24uk07artsNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:275118460220623 Date of Filing: 22-Jun-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:275118460220623 Date of Filing: 22-Jun-2023consultant.v.1001No ratings yet

- Pdf_586497300050724Document1 pagePdf_5864973000507248803281810No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Shaheed Suhrawardy Medical College HospitalDocument3 pagesShaheed Suhrawardy Medical College HospitalDr. Mohammad Nazrul IslamNo ratings yet

- Do's & Don'Ts For TurbochargersDocument7 pagesDo's & Don'Ts For Turbochargersvikrant GarudNo ratings yet

- Hydraulic Fracturing DesignDocument14 pagesHydraulic Fracturing DesignRichard ChanNo ratings yet

- Vision VAM 2020 (Social Justice) Welfare SchemesDocument59 pagesVision VAM 2020 (Social Justice) Welfare SchemesMansiNo ratings yet

- See Also:: Eighteenth Dynasty of Egypt Family TreeDocument1 pageSee Also:: Eighteenth Dynasty of Egypt Family TreeBilly FrankovickNo ratings yet

- Lab Report Et 2Document19 pagesLab Report Et 2Peach BabyNo ratings yet

- Medical Nutrition Therapy For Accessory OrgansDocument83 pagesMedical Nutrition Therapy For Accessory OrgansIan MendezNo ratings yet

- Voltage Stresses in Electric Submergible Pumps Operated by Variable Speed DrivesDocument26 pagesVoltage Stresses in Electric Submergible Pumps Operated by Variable Speed Drivesandresv10No ratings yet

- Submitted By: Anuj Baitule Bhaavan Devarapalli Lakshay Bansal Tej Satish Balla Nivesh DhoteDocument21 pagesSubmitted By: Anuj Baitule Bhaavan Devarapalli Lakshay Bansal Tej Satish Balla Nivesh DhoteTejSatishBallaNo ratings yet

- Four TemperamentsDocument11 pagesFour TemperamentsVũ Hằng GiangNo ratings yet

- Maddalena ContadorDocument2 pagesMaddalena ContadorCarlosNo ratings yet

- English Morphology: by Drs. I Wayan Suarnajaya, M.A., PH.DDocument33 pagesEnglish Morphology: by Drs. I Wayan Suarnajaya, M.A., PH.DDewa'd KrishnaDanaNo ratings yet

- Gravograph MachinesDocument2 pagesGravograph MachinesIndranil ChowdhuryNo ratings yet

- Eng1 Q3 Mod20 Asking-Permission V4Document21 pagesEng1 Q3 Mod20 Asking-Permission V4Silverangel Gayo100% (1)

- IELTS Writing Task1 TableDocument16 pagesIELTS Writing Task1 TableRakesh Kumar Sharma100% (1)

- Brunner Normal Intracranial Pressure 10-20 MMHGDocument16 pagesBrunner Normal Intracranial Pressure 10-20 MMHGlovely99_dyahNo ratings yet

- ImmigrationDocument4 pagesImmigrationJen AnnNo ratings yet

- Damper 140613085442 Phpapp01Document22 pagesDamper 140613085442 Phpapp01Andre Luis Fontes FerreiraNo ratings yet

- Spirit f1 ManualDocument38 pagesSpirit f1 ManualPedro Ponce SàezNo ratings yet

- PerformanceDocument10 pagesPerformancecsl1600No ratings yet

- TW316 PresentationDocument26 pagesTW316 PresentationCherylNo ratings yet

- Briefcase On Company Law Briefcase Series Michael Ottley Z LibraryDocument181 pagesBriefcase On Company Law Briefcase Series Michael Ottley Z Libraryhillaryambrose030No ratings yet

- Body Revolution Syllabus DraftDocument4 pagesBody Revolution Syllabus Draftapi-508557357No ratings yet

- Investigate The Impact of Social Media On Students: Cardiff Metropolitan UniversityDocument57 pagesInvestigate The Impact of Social Media On Students: Cardiff Metropolitan UniversityKarlo JayNo ratings yet

- Binding The Strongman in Jesus NameDocument5 pagesBinding The Strongman in Jesus NamePat Ruth HollidayNo ratings yet

- Eneos Sustina Product Data Sheet 2016Document2 pagesEneos Sustina Product Data Sheet 2016dan0410No ratings yet

- PST Notes 23Document2 pagesPST Notes 23Marielle UberaNo ratings yet