Professional Documents

Culture Documents

24070200254868_ChallanForm

24070200254868_ChallanForm

Uploaded by

rcmpaintproducts0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views2 pages24070200254868_ChallanForm

24070200254868_ChallanForm

Uploaded by

rcmpaintproductsCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

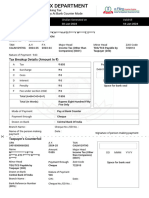

INCOME TAX DEPARTMENT

Challan Form For Making Tax

Payment Through Pay At Bank Counter Mode

CRN Challan Generated on Valid till

24070200254868 02-Jul-2024 17-Jul-2024

ITNS No. : 281

Name : L**E I*******E C*********N OF I***A

e-mail ID : bo****@licindia.com

Mobile No. : 96XXXXXX25

TAN A.Y. F.Y. Major Head Minor Head ZAO Code

MRIL00152F 2025-26 2024-25 Corporation Tax (0020) TDS/TCS Payable by 055960

Taxpayer (200)

Nature of Payment : 94D

Tax Breakup Details (Amount In ₹)

A Tax ₹ 2,99,957 For Use In Receiving Bank

B Surcharge ₹0 Debit to A/c / Cheque credited on

C Cess ₹0

D Interest ₹0 DD MMM YYYY

E Penalty ₹0 Space for bank seal

F Fee under section 234E ₹0

Total (A+B+C+D+E+F) ₹ 2,99,957

Total (In Words) Rupees Two Lakh Ninety

Nine Thousand Nine

Hundred And Fifty Seven

Only

Mode of Payment : Pay at Bank Counter

Payment through : Cheque

Drawn on Bank : IDBI Bank

Branch Name : Cheque No./DD No. :

Name of the person making Date :

Signature of person making payment

payment :

Taxpayer’s Counterfoil

CRN A.Y. TAN

24070200254868 2025-26 MRIL00152F

Name Amount Major Head

L**E I*******E C*********N ₹ 2,99,957 Corporation Tax DD MMM YYYY

OF I***A (0020)

Minor Head Payment through ZAO Code Space for bank seal

TDS/TCS Payable by Cheque 055960

Taxpayer (200)

Drawn on Bank Nature of Payment

IDBI Bank 94D

Branch Name : CIN : Date :

Bank Reference Number Cheque No./DD No. :

(BRN) :

You might also like

- Pay Slip TemplateDocument3 pagesPay Slip TemplateRachiel Kintos100% (1)

- Taxmannsfinanceact 2023 IncometaxpublicationcompDocument32 pagesTaxmannsfinanceact 2023 Incometaxpublicationcompmirzapur.upsarkarNo ratings yet

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- Empleyado Brochure PDFDocument3 pagesEmpleyado Brochure PDFRose ManaloNo ratings yet

- 24070200260867_ChallanFormDocument1 page24070200260867_ChallanFormrcmpaintproductsNo ratings yet

- 24070200262241_ChallanFormDocument1 page24070200262241_ChallanFormrcmpaintproductsNo ratings yet

- 24070200259164_ChallanFormDocument1 page24070200259164_ChallanFormrcmpaintproductsNo ratings yet

- 24070200257065_ChallanFormDocument1 page24070200257065_ChallanFormrcmpaintproductsNo ratings yet

- Tds Pakka TalabDocument2 pagesTds Pakka Talabdpmuftp2012No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- 24062700105033_ChallanFormDocument1 page24062700105033_ChallanFormasinghas72No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- Tds Challan Radha NagarDocument2 pagesTds Challan Radha Nagardpmuftp2012No ratings yet

- ChallanFormDocument2 pagesChallanFormConsumer Cooperative Medicine JPCNo ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- Tds Vinoba NagarDocument2 pagesTds Vinoba Nagardpmuftp2012No ratings yet

- ChallanFormDocument1 pageChallanFormiemjalaalNo ratings yet

- ChallanFormDocument1 pageChallanFormspmusrinivasaraoNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormArun JadhavNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormvinodvadageri367No ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormkuldip SinghNo ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- ChallanFormDocument1 pageChallanForm15Suman SahaNo ratings yet

- ChallanFormDocument2 pagesChallanFormSuhail88038No ratings yet

- ChallanFormDocument1 pageChallanFormVipin MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- ChallanFormDocument1 pageChallanFormsyedaafreen.inNo ratings yet

- ChallanFormDocument1 pageChallanFormSHIVAPPA HEBBALNo ratings yet

- ChallanFormDocument1 pageChallanFormGaurav SardanaNo ratings yet

- ChallanFormDocument1 pageChallanFormnews24into7into365No ratings yet

- 24071000357001_ChallanFormDocument1 page24071000357001_ChallanFormitsmylifestyleswamyNo ratings yet

- ChallanFormDocument1 pageChallanFormACAS LLPNo ratings yet

- ChallanFormDocument1 pageChallanFormhp agencyNo ratings yet

- ChallanFormDocument1 pageChallanFormomNo ratings yet

- ChallanFormDocument1 pageChallanFormmanjuskkNo ratings yet

- ChallanFormDocument2 pagesChallanFormtheniqcabcalltaxiNo ratings yet

- 24070900119732_ChallanFormDocument2 pages24070900119732_ChallanForminfo.sadhikariNo ratings yet

- TAX ChallanFormDocument1 pageTAX ChallanFormzaiddparkar1No ratings yet

- ChallanFormDocument1 pageChallanFormSudhanshu MishraNo ratings yet

- ChallanFormDocument1 pageChallanFormAman GargNo ratings yet

- Income Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)Document1 pageIncome Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)DilleshNo ratings yet

- Opus 94c Mar 12.5.24 24Document1 pageOpus 94c Mar 12.5.24 24vlogwithfun06No ratings yet

- MandateFormDocument1 pageMandateFormJ. K. MuduliNo ratings yet

- BWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerDocument1 pageBWSPR2200Q 23122900076834ICIC DTAX 29122023 TaxPayerbuyindianlocalsNo ratings yet

- Ganesh TextileDocument1 pageGanesh TextileRounak MundhraNo ratings yet

- AHMS39964B 23060701240154ICIC DTAX 07062023 TaxPayerDocument1 pageAHMS39964B 23060701240154ICIC DTAX 07062023 TaxPayersrm finservNo ratings yet

- 24050600482999SBIN ChallanReceiptDocument1 page24050600482999SBIN ChallanReceipttaxhouse37No ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- Etax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Document1 pageEtax Cyber Receipt Challan No./Itns 281: Details of Payment Amount in Rs. 0 0 0 0 0Aryana BalanNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptSqaure PodNo ratings yet

- Payment - 02-05-2024 11 - 0505 - 0909Document1 pagePayment - 02-05-2024 11 - 0505 - 0909kenyfred7No ratings yet

- 24030701423838SBIN ChallanReceiptDocument1 page24030701423838SBIN ChallanReceiptFiroz AliNo ratings yet

- 24030400014921RBIS ChallanReceiptDocument1 page24030400014921RBIS ChallanReceiptaccounthoNo ratings yet

- challan (9)Document2 pageschallan (9)sdalipore1974No ratings yet

- Fact To RemediesDocument2 pagesFact To Remediesmalickayubu9No ratings yet

- MandateFormDocument1 pageMandateFormBaid GroupNo ratings yet

- Piduguralla Municipality: ReceiptDocument1 pagePiduguralla Municipality: ReceiptSHAIK AJEESNo ratings yet

- Income Tax Calculator For MaleDocument10 pagesIncome Tax Calculator For MaleSri GuganNo ratings yet

- Qesco Online BillDocument2 pagesQesco Online BillFazal TanhaNo ratings yet

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiNo ratings yet

- Vocabulary Letter: Paid Leave - Baja RemuneradaDocument2 pagesVocabulary Letter: Paid Leave - Baja RemuneradaAlexander QuiñonezNo ratings yet

- Income Tax EthiopiaDocument13 pagesIncome Tax EthiopiaAmir Sultan100% (1)

- CIR Vs LedesmaDocument2 pagesCIR Vs LedesmaAnonymous wvx7n36No ratings yet

- 5.alternative Tax RegimeDocument30 pages5.alternative Tax RegimeMuthu nayagamNo ratings yet

- E-Way Bill 02.07.2021Document1 pageE-Way Bill 02.07.2021sathish pullela8No ratings yet

- 01 Seatwork VAT Subject TransactionDocument2 pages01 Seatwork VAT Subject TransactionJaneLayugCabacunganNo ratings yet

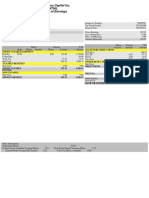

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Dwnload Full Corporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Solutions Manual PDFlinzigaumond2915z100% (19)

- 501c4s For The WealthyDocument276 pages501c4s For The WealthyJohn GrundNo ratings yet

- Abft1024 L7 - LtyDocument9 pagesAbft1024 L7 - Ltylfc778No ratings yet

- Saldo Anomali WINS November 2022Document1 pageSaldo Anomali WINS November 2022Andhika SaragiNo ratings yet

- Noreen Ali Case Study SolutionDocument5 pagesNoreen Ali Case Study SolutionChintu WatwaniNo ratings yet

- Wapda Tender 018 Civil WorksDocument1 pageWapda Tender 018 Civil WorksSajidNo ratings yet

- Layoff FAQ For ManagersDocument2 pagesLayoff FAQ For ManagersScott HornNo ratings yet

- APSecurity Data Access TemplateDocument5 pagesAPSecurity Data Access TemplateERPNU TechNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- Rfbt1 Oblico Lecture NotesDocument40 pagesRfbt1 Oblico Lecture NotesGizel BaccayNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument2 pagesTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Helvering v. Independent Life Ins. Co., 292 U.S. 371 (1934)Document5 pagesHelvering v. Independent Life Ins. Co., 292 U.S. 371 (1934)Scribd Government DocsNo ratings yet

- List OSS Notes For GST - V2 - 1 Mar17Document3 pagesList OSS Notes For GST - V2 - 1 Mar17Vishal YadavNo ratings yet