Professional Documents

Culture Documents

AFAR-22 (Full PFRS vs. PFRS for SMEs)

AFAR-22 (Full PFRS vs. PFRS for SMEs)

Uploaded by

Ide VelcoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AFAR-22 (Full PFRS vs. PFRS for SMEs)

AFAR-22 (Full PFRS vs. PFRS for SMEs)

Uploaded by

Ide VelcoCopyright:

Available Formats

ReSA - THE REVIEW SCHOOL OF ACCOUNTANCY

CPA Review Batch 45 May 2023 CPA Licensure Examination

AFAR-22

ADVANCED FINANCIAL ACCOUNTING & REPORTING (AFAR) A. DAYAG A. CRUZ

FULL PFRS vs. PFRS for SMEs

Business Combination and Goodwill

Item Full PFRS SME

Definitions and terminology

1. Business combination • “…is a transaction or other event • “bringing together separate

in which an acquirer obtains entities or businesses into one

control of one or more businesses.” reporting entity”

2. Contingent • Initially recognized as part of the • Initially recognized in the cost of

Consideration consideration transferred the combination only if it meets

regardless of the probability of probability and ‘reliably

payment measurable’ criteria.

• Non-occurrence of a future event • If future event does not occur,

(e.g. not meeting earnings target) then any adjustments to the

is not considered to be a cost of the business

measurement period adjustment – combination are made against

therefore not adjusted against goodwill.

goodwill.

3. Costs incurred in a business combination

Direct costs • Expensed • Capitalized

Indirect costs Expensed Expensed

Costs to issue and Debited to APIC/Share Debited to APIC/Share

register stocks Premium Premium

Costs to issue debt/bonds Debited to BIC Debited to BIC

4. Recognizing and measuring assets acquired and liabilities assumed on initial recognition

Identifiable intangible • Recognized separately from • Requires recognition if their fair

assets goodwill if it is either value can be measured

contractual-legal or separable reliably

5. Exceptions to recognition or measurement principles, or both, on initial recognition

Contingent liabilities • Recognize only where there is a • Requires recognition of possible

present obligation that arises from obligations if their fair value

past events and its fair value can can be measured reliably.

be measured reliably.

6. Accounting Method

Terms Used • Acquisition Method • Purchase Method

Measuring goodwill/ Options:

bargain purchase gain 1. Full fair Value

(Full-Goodwill)

2. Proportionate share of Proportionate share of

identifiable net assets identifiable net assets

(Partial- Goodwill) (Partial-Goodwill)

Valuation of goodwill • Cost less impairment losses • Cost less impairment losses and

amortization (life should be

presumed to be 10 years)

Consolidated and Separate Financial Statements

7. Accounting for investment in Either: Either:

subsidiaries, jointly (a) at cost, or (a) at cost less impairment, or

controlled entities (JCE) (b) in accordance with PFRS 9, (b) at fair value with changes in

and associates or fair value recognized in P&L

(c) Equity method (PAS 27) (FVTPL)

(c) Equity Method (effective

1/1/2017)

Page 1 of 2 0915-2303213 www.resacpareview.com

ReSA – THE REVIEW SCHOOL OF ACCOUNTANCY

FULL PFRS vs. PFRS for SMEs AFAR-22

8. Non-controlling Interests NCI can be measured using either:

(NCI)in the acquiree) 1. Fair value of NCI

(full goodwill); or NCI are stated at the non –

2. Proportionate interest in the fair controlling (NCI) interest

value of net identifiable assets portion of the fair value of the

of the entity acquired net assets of the entity

(partial goodwill) acquired (partial goodwill)

Construction Contracts

Full PFRSs and the PFRS for SMEs share the same principles for accounting and reporting. However, the PFRSs

for SMEs are drafted in simple language and provide less guidance on how to apply the principles.

Revenue

PFRS 15 Sec 23 – Revenue (old standard)

pending revisions to conform with

PFRS 15.

Foreign Currency

Full PFRSs and the PFRS for SMEs share the same principles for accounting and reporting. The key differences

are:

1. Simplified language and application guidance in the PFRS for SMEs.

2. The PFRS for SMEs does not allow or require cumulative exchange differences that relate to a

foreign operation that were previously recognized in other comprehensive income to be

reclassified from equity to profit or loss (as a reclassification adjustment) when the gain or loss

on disposal of the foreign operation is recognized. The Full PFRSs does.

Hedging

Some of the key differences between Full PFRSs and PFRS for SMEs are as follows:

1. The IFRS for SMEs gives SMEs a choice of following Sections 11 and 12 or PFRS 9 in accounting for

all of their financial instruments.

2. Hedge accounting is not permitted with an option-based hedging strategy. Because hedging

with options involves incurring a cost, SMEs are more likely to use forward contracts as hedging

instruments than options.

Hyperinflation

Full PFRSs and the PFRS for SMEs share the same principles for accounting and reporting. The key differences

are:

1. Simplified language and application guidance in the PFRS for SMEs.

2. The PFRS for SMEs does not set out specific procedures for the translation of the results and

financial position of an entity whose functional currency is the currency of a hyperinflationary

economy into a different presentation currency. Full PFRSs does.

Once in a Long While

Once in a long while, someone special walks into your life and really makes a difference.

They take the time to show you so many little ways that you matter,

They see and hear the worst in you and ugliest in you, but they don’t walk away in fact,

they may care about you.

Their heart break with yours, their tears fall with yours, their laughter is shared with yours.

Once in a long while, somebody special walks into your life and then has to go and separate ways.

Every time you see a certain gesture, hear a certain laugh or phrase or return to a certain place,

it reminds you of them.

Your eyes filled with tears, and a big smile comes across your face,

and then you thank GOD that someone can still touch your heart so deeply.

You remember their words, their looks, their expressions,

you remember how much of themselves they gave – not just to you, but to all.

You remember the strength that amazed you, the courage that impressed you, and the love that touched you…

To live your life on your own way

To reach for the goals you have set for yourself

To be YOURSELF as what you want to be….That is SUCCESS.

Trust yourself for you know more than you think you do.

To achieve all that is possible, we must attempt the impossible.

No one but HIMSELF can fill the emptiness of our soul.

GOD’s LOVE is like a river that keeps on flowing…

Page 2 of 2 0915-2303213 www.resacpareview.com

You might also like

- Black Card - Unlimited CreditDocument2 pagesBlack Card - Unlimited Credithewetiel100% (1)

- Pfrs For Smes Vs Full PfrsDocument78 pagesPfrs For Smes Vs Full PfrsKatherine Salvatore0% (1)

- Sme VS PFRSDocument17 pagesSme VS PFRSDesai SarvidaNo ratings yet

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaNo ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- 07 Handout 1.1Document6 pages07 Handout 1.1jeyahNo ratings yet

- Lesson 12Document6 pagesLesson 12Jamaica bunielNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSfenildivyaNo ratings yet

- The Philippine Financial Reporting Standards: PFRS Updates TrainingDocument74 pagesThe Philippine Financial Reporting Standards: PFRS Updates TrainingMara Shaira Siega100% (1)

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- AuditingDocument9 pagesAuditingLiezel MonteronNo ratings yet

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- Shareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSDocument15 pagesShareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSvdforeNo ratings yet

- The Principle of Financial Accounting MeasurementDocument12 pagesThe Principle of Financial Accounting Measurementjiaozitang100% (1)

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- PFRS For SMEs - Summary NotesDocument5 pagesPFRS For SMEs - Summary NotesMaha Bianca Charisma CastroNo ratings yet

- Webinar PPT SMEspptxDocument34 pagesWebinar PPT SMEspptxChristine Joyce MagoteNo ratings yet

- Chapter 5 AGDocument51 pagesChapter 5 AGrunescapealt452No ratings yet

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- IFRS 9 (IND As 109) Standards and Principles and Their Implications On BusinessDocument14 pagesIFRS 9 (IND As 109) Standards and Principles and Their Implications On BusinessBukrNo ratings yet

- Analysis of Financial Statements: International Financial Reporting StandardsDocument22 pagesAnalysis of Financial Statements: International Financial Reporting Standardsvvs176975No ratings yet

- Gtal - 2016 Ifrs9 Financial InstrumentsDocument11 pagesGtal - 2016 Ifrs9 Financial InstrumentsErlanNo ratings yet

- Ifrs9 For Corporates PDFDocument64 pagesIfrs9 For Corporates PDFeunice chungNo ratings yet

- 01 112212 081 11821091237 23052024 114824amDocument81 pages01 112212 081 11821091237 23052024 114824amhassnain4252No ratings yet

- 3005 Business CombinationDocument4 pages3005 Business CombinationTatianaNo ratings yet

- IFRS 9 - ImpairmentDocument14 pagesIFRS 9 - ImpairmentIris SarigumbaNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Gaap vs. IfrsDocument5 pagesGaap vs. Ifrsمحاسب.أحمد شعبانNo ratings yet

- SmmeDocument9 pagesSmmemicadeguzman.1313No ratings yet

- Week 5 - Chapter 4Document45 pagesWeek 5 - Chapter 4AJNo ratings yet

- ADVACC NOTES - Business CombinationDocument5 pagesADVACC NOTES - Business CombinationAlyaNo ratings yet

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

- Ifrs 9Document80 pagesIfrs 9Veer Pratab SinghNo ratings yet

- Presentation of FS & Its' AuditingDocument27 pagesPresentation of FS & Its' AuditingTeamAudit Runner GroupNo ratings yet

- Bdo - Ifrs 9Document8 pagesBdo - Ifrs 9fildzah dessyanaNo ratings yet

- IFRS 9 WebinarDocument18 pagesIFRS 9 WebinarMovie MovieNo ratings yet

- IFRS Assignment 4Document3 pagesIFRS Assignment 4Sandeep BodduNo ratings yet

- Financial Instruments Ifrs 9Document29 pagesFinancial Instruments Ifrs 9chalojunior16No ratings yet

- Accntg4 Ifrs Sme 4Document11 pagesAccntg4 Ifrs Sme 4Shariine BestreNo ratings yet

- DIFFERENCES Between FASB and The Indonesian Conceptual FrameworkDocument17 pagesDIFFERENCES Between FASB and The Indonesian Conceptual FrameworkBella TjendriawanNo ratings yet

- 74701bos60485 Inter p1 cp5 U7Document38 pages74701bos60485 Inter p1 cp5 U7Gurusaran SNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- IFRS 9 - Financial Instrument (Final) V2Document23 pagesIFRS 9 - Financial Instrument (Final) V2mfaisal3No ratings yet

- P 2Document4 pagesP 2Julious CaalimNo ratings yet

- Credit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRDocument73 pagesCredit Audit - Positive Score Areas in Pre Sanction - Tips On Value Statements in Credit Auditable Accounts Upto Rs 50 CRHaRa TNo ratings yet

- IAI - ICAEW IFRS 9 - 12 Aug 19Document47 pagesIAI - ICAEW IFRS 9 - 12 Aug 19Jay horayNo ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- Ifrs 9 Financial InstrumentsDocument6 pagesIfrs 9 Financial InstrumentsTinashe MashoyoyaNo ratings yet

- Business Analysis and Valuation 3 4Document23 pagesBusiness Analysis and Valuation 3 4Budi Yuda PrawiraNo ratings yet

- Comparison With FULL PFRSDocument5 pagesComparison With FULL PFRSMica R.No ratings yet

- Annual Report of IOCL 91Document1 pageAnnual Report of IOCL 91Nikunj ParmarNo ratings yet

- IFRS 9-Part 1-Intro-CPD-November 2015Document28 pagesIFRS 9-Part 1-Intro-CPD-November 2015Ivane KutibashviliNo ratings yet

- IFRS 9-Part 1-Intro-CPD-November 2015Document28 pagesIFRS 9-Part 1-Intro-CPD-November 2015Ivane KutibashviliNo ratings yet

- National Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPDocument10 pagesNational Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPEshetieNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Income Statement and Balance Sheet FormatDocument3 pagesIncome Statement and Balance Sheet FormatEdu TainmentNo ratings yet

- Chapter Two Ethiopian Banking SectorDocument8 pagesChapter Two Ethiopian Banking SectorshimelisNo ratings yet

- Silicon Valley Bank Unit EconomicsDocument5 pagesSilicon Valley Bank Unit EconomicsPierpaolo VergatiNo ratings yet

- Lembar Kerja Ud Buana-1Document20 pagesLembar Kerja Ud Buana-1Akhmad Riza ANo ratings yet

- CH 14 Country and Political RiskDocument32 pagesCH 14 Country and Political Riskklm klmNo ratings yet

- Test Bank For Intermediate Accounting 17th by Kieso DownloadDocument56 pagesTest Bank For Intermediate Accounting 17th by Kieso Downloadjasondaviskpegzdosmt100% (29)

- Jackson Teaching NoteDocument10 pagesJackson Teaching NoteKhalid SediqiNo ratings yet

- BVA CheatsheetDocument3 pagesBVA CheatsheetMina ChangNo ratings yet

- Memorial (FINAL-Print)Document19 pagesMemorial (FINAL-Print)Kartikey VarshneyNo ratings yet

- Income From Acquisition P (450,000) APIC: ( (P2,550,000 - P1,200,000) - P35,000 ) P1,315,000Document28 pagesIncome From Acquisition P (450,000) APIC: ( (P2,550,000 - P1,200,000) - P35,000 ) P1,315,000Love FreddyNo ratings yet

- Similarity and Difference Between Accounting Concept and ConventionDocument23 pagesSimilarity and Difference Between Accounting Concept and ConventionravisankarNo ratings yet

- AFAR - Part 2Document13 pagesAFAR - Part 2Myrna Laquitan100% (1)

- GL DescriptionDocument22 pagesGL Descriptionsanyu1208No ratings yet

- OrientDocument6 pagesOrientAda AdelineNo ratings yet

- Week 3 - Chapter 3Document68 pagesWeek 3 - Chapter 3Dre ThathipNo ratings yet

- In Primary MarketDocument3 pagesIn Primary MarketAshishNo ratings yet

- Fmch11 Capital Budgeting Risk AnalysisDocument24 pagesFmch11 Capital Budgeting Risk AnalysisbintanNo ratings yet

- Buffett Wisdom On CorrectionsDocument2 pagesBuffett Wisdom On CorrectionsChrisNo ratings yet

- Partnership Dissolution - Retirement, Withdrawal EtcDocument6 pagesPartnership Dissolution - Retirement, Withdrawal EtcAisea Juliana VillanuevaNo ratings yet

- YASHDA - Financial AccountingDocument11 pagesYASHDA - Financial Accountingpramod7jainNo ratings yet

- Horizontal Accounting Excel TemplateDocument2 pagesHorizontal Accounting Excel Templatekoool lool100% (1)

- Brookstone Ob-Gyn Associates (A) : Tthe Crimson Press Curriculum Center Tthe Crimson Group, IncDocument5 pagesBrookstone Ob-Gyn Associates (A) : Tthe Crimson Press Curriculum Center Tthe Crimson Group, IncDr-YousefMHassan100% (1)

- AppleDocument75 pagesAppleAbhisek MohantyNo ratings yet

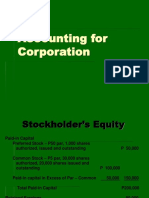

- Accounting For CorporationDocument11 pagesAccounting For CorporationMaricar D. VillarazaNo ratings yet

- CHAPTER 25 Statement of Financial Position (Concept Map)Document1 pageCHAPTER 25 Statement of Financial Position (Concept Map)kateyy99No ratings yet

- Capital BudgetingDocument49 pagesCapital Budgetingthkrarun100No ratings yet

- A. On April 1, 2015, Ben Ten Company Leased Equipment To Ironman Corporation. TheDocument2 pagesA. On April 1, 2015, Ben Ten Company Leased Equipment To Ironman Corporation. TheAvox EverdeenNo ratings yet

- Ladrillo Investor PresentationDocument16 pagesLadrillo Investor PresentationMOVIES SHOPNo ratings yet

- Uttam Singh Duggal & Co. LTD., v. United Bank of India and OthersDocument2 pagesUttam Singh Duggal & Co. LTD., v. United Bank of India and OthersHimanginiNo ratings yet