Professional Documents

Culture Documents

ssrn-4700517 (1)

ssrn-4700517 (1)

Uploaded by

sunidhipandey124Copyright:

Available Formats

You might also like

- Workplace Assignment (WPA) Paper 4 SHO NIOSHDocument56 pagesWorkplace Assignment (WPA) Paper 4 SHO NIOSHFiz92% (38)

- Isha Dissertation LLM Super Super FinalDocument68 pagesIsha Dissertation LLM Super Super Final97ishatiwariNo ratings yet

- Memorial RespondentDocument22 pagesMemorial RespondentRupesh BansodNo ratings yet

- Siddharth Badkul (500016158)Document106 pagesSiddharth Badkul (500016158)vishwaskh143No ratings yet

- TCLR Vol2Document165 pagesTCLR Vol2VarunNo ratings yet

- Tartaroglu DissertationDocument75 pagesTartaroglu Dissertationjavali77No ratings yet

- Certificate: B.A.LL.B (Hons.) 4Document107 pagesCertificate: B.A.LL.B (Hons.) 4Zuhair SiddiquiNo ratings yet

- Best Memorial RESPONDENTDocument35 pagesBest Memorial RESPONDENTAyush Pratap SinghNo ratings yet

- 6 Tnnlu-Cci National Moot Court, 2024: B T H S C O C A F U 53T o T C ADocument45 pages6 Tnnlu-Cci National Moot Court, 2024: B T H S C O C A F U 53T o T C A21bal018No ratings yet

- Corp PDFDocument16 pagesCorp PDFektaNo ratings yet

- Rift Valley University Chiro Campus: Collega of Business and EconomicsDocument35 pagesRift Valley University Chiro Campus: Collega of Business and EconomicsBobasa S AhmedNo ratings yet

- Jakkani CIR ProjectDocument40 pagesJakkani CIR ProjectNivasNo ratings yet

- Ravi Itc Internship Report 3Document75 pagesRavi Itc Internship Report 3Rahul ChoudharyNo ratings yet

- Tamil Nadu National Law School, Tiruchirappalli Banking Law ProjectDocument28 pagesTamil Nadu National Law School, Tiruchirappalli Banking Law ProjectPreyashi ShrivastavaNo ratings yet

- UMCS Respondent Final MemoDocument30 pagesUMCS Respondent Final MemodivyanshaNo ratings yet

- Justice N. Santosh Hegde National Moot Court Competition, 2024 Before The Hon'Ble Supreme Court of Nahira APPEAL NO. - / - OF 2024Document35 pagesJustice N. Santosh Hegde National Moot Court Competition, 2024 Before The Hon'Ble Supreme Court of Nahira APPEAL NO. - / - OF 2024Aarya shrivastavNo ratings yet

- Artificial Intelligence in FinanceDocument50 pagesArtificial Intelligence in FinancepatternprojectNo ratings yet

- Tender Document RcsDocument60 pagesTender Document RcsAnshika Jain0% (1)

- Piyush Garg FinallDocument117 pagesPiyush Garg Finallrishabh vatsNo ratings yet

- InvitationDocument4 pagesInvitationSai SatishNo ratings yet

- Summer Training Report ON Ethical Hacking: Bachelor of EngineeringDocument51 pagesSummer Training Report ON Ethical Hacking: Bachelor of EngineeringBiki KumarNo ratings yet

- MTech Final Project DocumentationDocument73 pagesMTech Final Project DocumentationRajashekar KongariNo ratings yet

- Hidayatullah National Law University, RaipurDocument107 pagesHidayatullah National Law University, RaipurSruti BansalNo ratings yet

- A New Artificial Intelligence StrategyDocument171 pagesA New Artificial Intelligence Strategyharrismalhotra4No ratings yet

- Choudhury - Spinning Straw Into GoldDocument57 pagesChoudhury - Spinning Straw Into GoldKofi BrobbeyNo ratings yet

- SSI eIDAS Legal Report Final 0Document150 pagesSSI eIDAS Legal Report Final 0yomamaNo ratings yet

- Monthly Current Affairs Consolidation (June 2023) Part-IDocument159 pagesMonthly Current Affairs Consolidation (June 2023) Part-Isanishchitha2311No ratings yet

- Cryptocurrencies 508 - 31dec2014Document196 pagesCryptocurrencies 508 - 31dec2014Boy Tai Hin100% (1)

- Credit Risk Management in BankingDocument109 pagesCredit Risk Management in BankingRajashekar GatlaNo ratings yet

- Dissertation Namibia Master of LawDocument67 pagesDissertation Namibia Master of LawRaboni ZitelinaNo ratings yet

- United Nations Publications - Promoting Business and Technology Incubation for Improved Competitiveness of Small and Medium-Sized Industries through Application of Modern and Efficient Technologies.pdfDocument337 pagesUnited Nations Publications - Promoting Business and Technology Incubation for Improved Competitiveness of Small and Medium-Sized Industries through Application of Modern and Efficient Technologies.pdfVEC MBA DeptNo ratings yet

- Intelligent Analytics For Industry 4.0 ApplicationsDocument313 pagesIntelligent Analytics For Industry 4.0 ApplicationsTxx LxxNo ratings yet

- ARCI 2022 ProceedingsDocument113 pagesARCI 2022 Proceedings6sun6sam6No ratings yet

- ReportDocument76 pagesReportSRI RAM MANOJNo ratings yet

- 19 OpDocument30 pages19 OpKartik GuptaNo ratings yet

- Khiazaran Ehab MSC No SigDocument135 pagesKhiazaran Ehab MSC No SiglorrainedelriooNo ratings yet

- Yahya ThesisDocument90 pagesYahya Thesisyazeed mohailanNo ratings yet

- Mini Project 15 FDocument38 pagesMini Project 15 F22R435 - MULLAINATHAN V HNo ratings yet

- Talmachi 2020 - The implications of Proptech on the real estate brokerage. The case study of Dubai, United Arab EmiratesDocument106 pagesTalmachi 2020 - The implications of Proptech on the real estate brokerage. The case study of Dubai, United Arab EmiratesminaNo ratings yet

- Electronic Court Case Management SystemDocument67 pagesElectronic Court Case Management SystemPinjari NazneenNo ratings yet

- 7 J H M N M C C: Ustice Idayatullah Emorial Ational OOT Ourt OmpetitionDocument42 pages7 J H M N M C C: Ustice Idayatullah Emorial Ational OOT Ourt OmpetitionSDNo ratings yet

- Swanepoel Analysis (2012)Document107 pagesSwanepoel Analysis (2012)Colias DubeNo ratings yet

- Ajita Bhandari - Non-Doctrinal Seminar Paper B672Document80 pagesAjita Bhandari - Non-Doctrinal Seminar Paper B672ajita bhandariNo ratings yet

- University of South Asia: Department of Management SciencesDocument60 pagesUniversity of South Asia: Department of Management SciencesYasirNo ratings yet

- Inner Pages - Contents To List of CasesDocument11 pagesInner Pages - Contents To List of CasesAbhishek ShivanandNo ratings yet

- Kago's LLM ThesisDocument211 pagesKago's LLM Thesisclarence ondabuNo ratings yet

- MamproposalDocument20 pagesMamproposalmohammedNo ratings yet

- Petitioner Arbitration Lakshmi PDFDocument32 pagesPetitioner Arbitration Lakshmi PDFsamyukthajinuNo ratings yet

- Report of The PIC CommissionDocument995 pagesReport of The PIC CommissionPrimedia BroadcastingNo ratings yet

- Before: EAM ODEDocument37 pagesBefore: EAM ODEAlaina FatimaNo ratings yet

- National Law University, DelhiDocument74 pagesNational Law University, DelhiNgọc Hà NguyễnNo ratings yet

- MG Final Research FinalDocument64 pagesMG Final Research Finalephremamanuel355No ratings yet

- The Final Frontier of Competition Competing For and With Human Capital by Black, J. StewartDocument237 pagesThe Final Frontier of Competition Competing For and With Human Capital by Black, J. StewartvikaynashNo ratings yet

- Uj 2493+Content1+Content1.1Document86 pagesUj 2493+Content1+Content1.1alnahariworkshopNo ratings yet

- Baseline ReportDocument201 pagesBaseline ReportBrian SamanyaNo ratings yet

- SSRN Id3857561Document112 pagesSSRN Id3857561Puerto RosarioNo ratings yet

- Working Paper 394Document56 pagesWorking Paper 394Sharath HanamaraddiNo ratings yet

- Charleston Code Assessment - DraftDocument198 pagesCharleston Code Assessment - DraftMatt RichardsonNo ratings yet

- India as Destination for Western retailers: Opportunities, Challenges and Strategic DecisionsFrom EverandIndia as Destination for Western retailers: Opportunities, Challenges and Strategic DecisionsNo ratings yet

- Impact Report 2020Document20 pagesImpact Report 2020Santosh AidamNo ratings yet

- L2301 Week 2 Lesson 1 Sources of Law of ContractDocument7 pagesL2301 Week 2 Lesson 1 Sources of Law of ContractElizabeth KhatiteNo ratings yet

- Indian Polity by Tutorials Point in English (For More Book - WWW - Nitin-Gupta - Com)Document99 pagesIndian Polity by Tutorials Point in English (For More Book - WWW - Nitin-Gupta - Com)Sahil MehraNo ratings yet

- The History of Corporate Governance: Brian R. CheffinsDocument38 pagesThe History of Corporate Governance: Brian R. CheffinsArshad ShaikhNo ratings yet

- Town and Country Planning OrdinanceDocument54 pagesTown and Country Planning OrdinancehoneybeeNo ratings yet

- السلطة التشريعية في النظام الجزائري من خلال آخر تعديل دستوري 2020Document10 pagesالسلطة التشريعية في النظام الجزائري من خلال آخر تعديل دستوري 2020ranianicha0No ratings yet

- Democracy in Albania, Shortcomings of Civil Society in Ddemocratization Due To The Communist Regime's Legacy - Klevisa Kovaci 2014Document30 pagesDemocracy in Albania, Shortcomings of Civil Society in Ddemocratization Due To The Communist Regime's Legacy - Klevisa Kovaci 2014nuhisterNo ratings yet

- Capacity Building Write-UpDocument3 pagesCapacity Building Write-UpArianna Dela CruzNo ratings yet

- POLITICAL LAW Part 1 144195Document137 pagesPOLITICAL LAW Part 1 144195Aubrey AquinoNo ratings yet

- Lecture WK 3 Institutional InvestorsDocument38 pagesLecture WK 3 Institutional InvestorsMinh Thư Phạm HuỳnhNo ratings yet

- Philippine Politics and Governance Quarter 1Document43 pagesPhilippine Politics and Governance Quarter 1Samantha Lopez100% (1)

- Smalskys UrbanovicoxfordencDocument19 pagesSmalskys UrbanovicoxfordencMaha Sara Nada PhDNo ratings yet

- Constitution Islands of Nyrmod Wiki FandomDocument1 pageConstitution Islands of Nyrmod Wiki Fandomshiloh2020aNo ratings yet

- Mcom Cbcs LatestDocument45 pagesMcom Cbcs Latestanoopsingh19992010No ratings yet

- Kalahi Cidss Project PhilippinesDocument62 pagesKalahi Cidss Project PhilippinesEmmanuele GregNo ratings yet

- Media As A Watchdog and Fourth Pillar of Democracy-Freedom of PressDocument9 pagesMedia As A Watchdog and Fourth Pillar of Democracy-Freedom of PressSugar Berry ArtsNo ratings yet

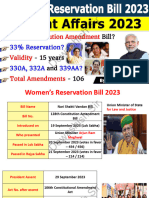

- Women's Reservation BillDocument14 pagesWomen's Reservation Billkamal123das12No ratings yet

- Stanica 2019Document18 pagesStanica 2019Maritza SuangoNo ratings yet

- Indian Polity Cracking IAS General Studies Prelims-DishaDocument105 pagesIndian Polity Cracking IAS General Studies Prelims-DishaPranit GordeNo ratings yet

- Thinking Responsibly About Responsible AI and The Dark Side of AIDocument13 pagesThinking Responsibly About Responsible AI and The Dark Side of AIRidm DNo ratings yet

- F4 Examiner'S Approach ArticleDocument2 pagesF4 Examiner'S Approach ArticlePriya NairNo ratings yet

- Administrative Law 3 - FinalDocument11 pagesAdministrative Law 3 - Finalhamisimwanaisha691No ratings yet

- Muli, Michael WambuaDocument106 pagesMuli, Michael Wambuajb PandaNo ratings yet

- E Governance NcertDocument8 pagesE Governance NcertashishNo ratings yet

- Hill, M. Hupe, P. The Three Action Levels of GovernanceDocument11 pagesHill, M. Hupe, P. The Three Action Levels of GovernancevaleriaNo ratings yet

- Investor Document January 2020Document147 pagesInvestor Document January 2020redevils86No ratings yet

- Examination Questions - IslamiyatDocument3 pagesExamination Questions - IslamiyatAijaz HyderNo ratings yet

- Guidelines For Grant ApplicantsDocument32 pagesGuidelines For Grant ApplicantsAndreea GrecuNo ratings yet

- Masters Syllabus (Accounting Department) PDFDocument13 pagesMasters Syllabus (Accounting Department) PDFprabir kumer RoyNo ratings yet

- Executive Order No. 003 S. 2023 - ORGANIZING THE BARANGAY DEVELOPMENT COUNCIL, EXECUTIVE COMMITTEE, AND SECRETARIAT OF BARANGAYDocument2 pagesExecutive Order No. 003 S. 2023 - ORGANIZING THE BARANGAY DEVELOPMENT COUNCIL, EXECUTIVE COMMITTEE, AND SECRETARIAT OF BARANGAYSAMMY SARMIENTO89% (9)

ssrn-4700517 (1)

ssrn-4700517 (1)

Uploaded by

sunidhipandey124Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ssrn-4700517 (1)

ssrn-4700517 (1)

Uploaded by

sunidhipandey124Copyright:

Available Formats

INSIDER TRADING IN INDIA: A STUDY OF THE

EMERGING ISSUES OF INSIDER TRADING WITH

REFERENCE TO SECURITIES LAWS

DISSERTATION SUBMITTED IN PARTIAL FULFILLMENT OF THE

REQUIREMENT

FOR THE DEGREE OF

MASTER OF LAWS (LL.M.)

(Session 2022-23)

Supervisor Submitted by

Mayank Shrivastava Akshat Mall

Assistant Professor Roll No:- 92

Enrolment ID No- 16/2022/686

Page I of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

HIDAYATULLAH NATIONAL LAW UNIVERSITY

NAYA RAIPUR (C.G.) 492002

DECLARATION

I, Akshat Mall, hereby declare that the Dissertation work titled “Insider Trading in India: A

Study of the emerging issues of Insider Trading with Reference to Securities Laws” is an original

work done by me under the supervision of Mr. Mayank Shrivastava, Hidayatullah National Law

University, Raipur.

I further affirm that to the best of my knowledge, this LL.M. Dissertation does not contain any

part which has been submitted for the award of any degree either in this University or in any

other Institution without proper citations. This dissertation work is done by me in adherence to

the HNLU-Anti-Plagiarism and Academic Integrity Policy 2020-21.

Date: Name & Signature of the Student

Page II of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

A W U N IV

AL L ER

ON

SI

I

TUL L A H NAT

TY

C H H A T T IS G A

RAIP

DIA

IN

R

YA

DA U

RH

HI

Hidayatullah National Law University

Nava Raipur Atal Nagar, Raipur- 492002 (C.G.)

Phone No. 0771-3057604, 3057603

Email: registrar@hnlu.ac.in, Website: www.hnlu.ac.in

FORWARDING CERTIFICATE

WHEREAS, under clause 9 of the Ordinance Governing LL.M. Degree Course of Study

and Examination, a student is required to write a Dissertation carrying 200 marks on the subject

approved in partial fulfillment of the requirement for the degree of MASTER OF LAWS of the

HIDAYATULLAH NATIONAL LAW UNIVERSITY;

AND WHEREAS, AKSHAT MALL has been permitted to write a Dissertation on

‘INSIDER TRADING IN INDIA: A STUDY OF THE EMERGING ISSUES OF INSIDER

TRADING WITH REFERENCE TO SECURITIES LAWS’ for LL.M. Examination of the

YEAR 2022 – 2023 of the HIDAYATULLAH NATIONAL LAW UNIVERSITY;

NOW THEREUPON, AKSHAT MALL has submitted the said dissertation which is

being forwarded to the CONTROLLER OF EXAMINATION, HIDAYATULLAH

NATIONAL LAW UNIVERSITY for necessary action.

Date: ………………

Supervisor:

Name and Designation

Page III of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

TABLE OF CONTENTS

ACKNOWLEDGEMENT…………………………………………………………………………........VIII

LIST OF ABBREVIATIONS……………………………………………………………………………..IX

PREFACE……………………………………………………………………………………………...….XI

CHAPTER I - INTRODUCTION TO INSIDER TRADING……………………………………1

1.1 RESEARCH PROBLEM…………………………..………………………………….4

1.2 SIGNIFICANCE OF RESEARCH…………………………..………………………..4

1.3 THEORITICAL CONNECTION…………………………..…………………………5

1.4 RESEARCH OBJECTIVES…………………………..……………..………………..5

1.5 RESEARCH QUESTIONS…………………………..……………..………………...6

1.6 HYPOTHESIS…………………………..……………..……………......………….....6

1.7 SCOPE…………………………..……………..……………..……………………….6

1.8 LIMITATIONS…………………………..……………..……………..……..………..6

1.9 LITERATURE REVIEW…………………………..……………..…………………..7

1.10 PROPOSED RESEARCH METHODOLOGY……………………………………...13

1.11 UNPUBLISHED PUBLIC SENSITIVE INFORMATION…………………………14

1.12 INSIDER…………………………..……………..……………..……………………14

1.13 INSIDER TRADING – WHEN IT IS LEGAL & WHEN NOT?………………...…15

1.14 WHY IS INSIDER TRADING CONSIDERED UNETHICAL?……………………17

1.15 EFFICACY OF CIVIL VERSUS CRIMINAL PROHIBITION…………………….19

CHAPTER II - CONCEPT, HISTORY & EVOLUTION OF INSIDER TRADING IN

INDIA………………………..………………………………………………………………..…20

2.1 HOW DID IT START?………………………………………………………………21

2.2 BOMBAY SECURITIES CONTRACT ACT 1925…………………………………22

2.3 MORRISON COMMITTEE 1936…………………………………………………...23

2.4 DEFENCE OF INDIA ACT 1939…………………………………………………...23

Page IV of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

2.5 CAPITAL ISSUES CONTROL ACT 1947…………………………………………24

2.6 THOMAS COMMITTEE 1948……………………………………………………...24

2.7 GORWALA COMMITTEE 1951…………………………………………………...25

2.8 BHABHA COMMITTEE 1952……………………………………………………...26

2.9 SECURITIES CONTRACT (REGULATION) ACT 1956………………………….26

2.10 SACHHAR COMMITTEE 1978…………………………………………………….26

2.11 PATEL COMMITTEE 1986………………………………………………………...27

2.12 HUSSAIN COMMITTEE 1989…………………………………………………......27

2.13 JOINT COMMITTEE TO ENQUIRE INTO IRREGULARITIES IN SECURITIES

1992…….…………………………………………………………………………….27

2.14 SECURITIES EXCHANGE BOARD OF INDIA ACT 1992………………………28

2.15 SEBI (INSIDER TRADING) REGULATIONS 1992………………………………29

2.16 BIRLA COMMITTEE 1999…………………………………………………………30

2.17 SODHI COMMITTEE 2013…………………………………………………………31

2.18 COMPANIES ACT 2013……………………………………………………………31

2.19 PROHIBITION OF INSIDER TRADING REGULATIONS 2015…………………32

2.20 VISWANATHAN COMMITTEE 2015……………………………………….…….33

2.21 PROHIBITION OF INSIDER TRADING REGULATION (AMENDMENTS) 2018

– 2022…………………………………………………………………………...……33

2.22 FINAL REMARKS…………………………………..…………………...…………34

CHAPTER III - LEGAL FRAMEWORK FOR INSIDER TRADING IN INDIA……………35

3.1 COMPANIES ACT 2013……………………………………………………………36

3.1.1 DEFINITION OF INSIDER TRADING & PUBLIC SENSITIVE

INFORMATION, PUNISHMENT FOR INSIDER TRADING UNDER

COMPANIES ACT 2013……………………………………………………36

3.1.2 POWERS OF CENTRAL GOVERNMENT FOR CURBING INSIDER

TRADING……………………………………………………………………37

3.2 SECURITIES EXCHANGE BOARD OF INDIA ACT 1992………………………39

3.2.1 FUNCTIONS OF BOARD…………………………………………………..39

Page V of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

3.2.2 PROHIBITION OF INSIDER TRADING, FRAUDULENT ACTIVITIES &

OTHER UNFAIR PRACTICES…………………………………………….40

3.2.3 MEASURES TO TACKLE INSIDER TRADING & OTHER UNFAIR

PRACTICES…………………………………………………………………40

3.2.4 POWER OF INVESTIGATION…………………………………………….42

3.2.5 CEASE AND DESIST PROCEEDINGS……………………………………42

3.2.6 PROHIBITION ON INSIDER TRADING………………………………….43

3.2.7 PENALTY IMPOSED FOR AN OFFENCE OF INSIDER TRADING……43

3.2.8 IMPRISONMENT & PENALTY……………………………………………44

3.3 SECURITIES EXCHANGE BOARD OF INDIA (PROHIBITION ON INSIDER

TRADING) REGULATION 2015…………………………………………………..45

3.3.1 DEFINITION CLAUSES……………………………………………………45

3.3.2 RESTRICTIONS IMPOSED ON INSIDERS……………………………….46

3.3.3 TRADING DURING POSSESSION OF UPSI (EXCEPTIONS)….……….47

3.3.4 TRADING PLANS…………………………………………………………..48

3.3.5 DISCLOSURES TO BE MADE BY INSIDER FOR TRADING………….48

3.3.6 DISCLOSURES REQUIRMENTS BY CERTAIN PERSON(S) ………….49

3.3.7 CODES OF CONDUCT AND FAIR DISCLOSURE………………………49

3.3.8 INSTITUTIONAL MECHANISM TO PREVENT INSIDER

TRADING………………………………………………………………...….50

3.3.9 SCHEDULES………………………………………………………………..50

CHAPTER IV - JUDICIAL PRONOUNCEMENTS RELATED TO INSIDER

TRADING……………………………………………………………………………………..…52

4.1 MAJOR FINDINGS IN THE LANDMARK JUDGMENTS……………………….54

4.2 FOREIGN CASES…………………………………………………………………...65

CHAPTER V - EMERGING ISSUES OF INSIDER TRADING……………………………...67

5.1 EVOLVING STANDARDS OF PROOF……………………………………………68

5.1.1 RAJEEV VASANT SHETH v SEBI…………………………………….68

5.1.2 BALRAM GARG v SEBI……………………………………………….69

Page VI of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

5.1.3 PIA JOHNSON v SEBI………………………………………………….70

5.1.4 HINDUSTAN LEVER LTD v SEBI…………………………………….71

5.1.5 SAMEER ARORA v SEBI………………………………………………72

5.1.6 RELIANCE INDUSTRIES LTD v SEBI………………………………..72

5.1.7 PREPONDERANCE OF PROBABILITIES………………………….…73

5.1.8 REASONABLE EXPECTATION…………………………………….…74

5.1.9 TRADE MADE FOR CORPORATE PURPOSES DOES NOT AMOUNT

TO A VIOLATION OF PIT REGULATIONS………………………….75

5.1.10 FINAL REMARKS………………………………………………….......75

5.2 REGULATION OF INSIDER TRADING: ASCERTAINING THE

EFFECTIVE………………………………………………………………………....77

5.2.1 INTANGIBILITY, FIRST ACCESSING PERSON & INFORMATION

NETWORK………..……………………………………………………..77

5.2.2 CIRCUMSTANTIAL EVIDENCE, SUBJECTIVISM, & STRATEGIC

BEHAVIOR……………………………………………………………...79

5.2.3 FINAL REMARKS…………..………………..………………………...81

5.3 ISSUES OF INSIDER TRADING AS A WHITE COLLAR CRIME………………83

5.3.1 POSITION IN INDIA……………………………………………………84

5.3.2 INSIDER TRADING AS WHITE COLLAR CRIME…………………..85

5.3.3 FINAL REMARKS……………………………………………………...88

CHAPTER VI – CONCLUSION & SUGGESTIONS…………………………………………90

6.1 SEBI’S NOT UPTO THE MARK APPROACH……………………………………90

6.2 SEBI 2021-2022 ANNUAL REPORT & CURRENT SITUATION………………..94

6.3 INSIDER TRADING – AN UNWINNABLE WAR wr.t STANDARDS OF

PROOF……………………………………………………………………………….95

6.4 POSSIBLE SOLUTIONS……………………………………..……………………..97

6.5 FINAL REMARKS………………………………………………………………….99

LIST OF REFERENCES/ BIBLIOGRAPHY……………………………………….…………101

Page VII of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

ACKNOWLEDGMENT

First and foremost, I am grateful to my supervisor, Mr. Mayank Shrivastava, Assistant Professor

of Law, HNLU, for his guidance and encouragement throughout the entire process. His expertise

and willingness to share his knowledge have been invaluable, and I have learned so much from

his insights and feedback.

I would express thanks to other faculty members for their encouragement, who provided valuable

feedback on various aspects of the research and helped me to refine my ideas.

To my family and friends, thank you for your unwavering support and understanding. Your

encouragement and belief in me have sustained me through the long hours of writing and

research.

Finally, I would like to thank everyone who generously gave their time and shared their

experiences with me. Their insights and perspectives have enriched this research and provided

valuable contributions to the field.

To everyone who has contributed to this dissertation in ways both big and small, thank you from

the bottom of my heart.

Page VIII of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

LIST OF ABBREVIATIONS

WORDS ABBREVIATIONS

And &

Adjudicating Officer AO

Bombay Stock Exchange BSE

Chief Executive Officer CEO

Companies Act CA

Code of Conduct CoC

Company Co.

Compliance Officer CO

Chapter Ch.

High Court HC

Indian Rupees INR

Issue of Capital and Disclosure Requirements ICDR

Limited Ltd.

Managing Director MD

Ministry of Corporate Affairs MCA

National Stock Exchange NSE

Number No.

Page Pg.

Paragraph Para.

Private Pvt.

Prohibition on Insider Trading PIT

Regulation Reg.

Public Sensitive Information PSI

Securities and Exchange Commission SEC

Securities Appellate Tribunal SAT

Securities Exchange Board of India SEBI

Page IX of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

Section Sec.

Securities Exchange Board of India Act, 1992 SEBI Act

Securities Contracts (Regulation) Act, 1956 SCRA

Supreme Court SC

Trading Plan TP

United Kingdom U.K

United States of America U.S

Unpublished Public Sensitive Information UPSI

Volume Vol.

White Collar Crime WCC

Whole Time Members WTM

Page X of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

PREFACE

In recent years, Insider Trading has emerged as one of the most pressing issues in securities

markets worldwide. The phrase "insider trading" basically is the practice of dealing securities by

an individual(s) having means or direct control over material information that could influence the

value of those securities and is not available in the public domain, and this information is used to

make profits or avoid losses. It is considered an illegal means to make gains/ avoid losses in

many countries as it continues to be a major challenge for regulators and law enforcement

agencies due to the complexity and the difficulty of detecting and prosecuting it.

A fair and just securities market require a synergetic relationship between the market regulator

and the market participants. One of the biggest impediments to forming a synergetic and

reciprocal relationship is information asymmetry and its abuse. Insiders with access to superior

information take advantage of such information asymmetry to their advantage at the loss of other

market participants. Thus, Insider trading is one of the biggest maladies of the securities market

and needs to be curbed to sustain the integrity of the market and protect the interests of

investors.

This dissertation aims to explore the emerging issues related to insider trading and their

implications on the securities market. It will take a look into the evolution of the Insider Trading

legal regime in India. Specifically, the study will investigate the legal framework and

enforcement mechanisms for insider trading and identify any gaps or weaknesses in the existing

regulatory framework. Additionally, the research will analyze the emerging issues of insider

trading and the challenges they pose for regulatory agencies.

The study is divided into six chapters, each addressing a specific aspect of Insider trading.

The first chapter provides an overview of the research and includes an introduction to the topic

along with the basic terminologies such as UPSI & Insiders. At the end of the Chapter, certain

concepts like the legality of Insider Trading, the ethical basis of Insider Trading, and the efficacy

of civil versus criminal prohibition on Insider Trading have been discussed.

The second chapter examines the historical evolution of the concept of Insider Trading along

with necessary legislation enacted to curb its practice, successive amendments in the law, the

Page XI of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

reason behind such amendments, along with all the Committees that were set up to analyze

various issues of Securities Law in India.

The legal provisions have been dealt with in the third chapter. It includes the fundamental

structure of law that covers Insider Trading and allied subjects. It entails definition, prohibitory

provisions, penalties, etc. It primarily features SEBI Act & PIT Regulations.

The next chapter focuses on judicial precedents on Insider Trading. The major findings of the

cases have been jotted down that have paved the path for the growth of Securities Law in India

and a few foreign judgments have also been included.

The fifth chapter talks about the challenges faced by regulators in detecting and prosecuting

Insider Trading as the standard to prove the offence has risen. The second issue discussed the

issue of Regulation faced by SEBI and the last issue deals with Insider Trading as WCC.

The final part includes a conclusion along with certain suggestions based on the research of this

dissertation that might help improve the situation of Insider Trading. It is followed by

Bibliography at the end.

Page XII of XII

Electronic copy available at: https://ssrn.com/abstract=4700517

_________________________________________________

CHAPTER I

INTRODUCTION TO INSIDER TRADING

_________________________________________________

Insider trading can be described as an offence in the field of securities law wherein an

individual(s) who has the means/ access to gain sensitive information which can influence the

prices of the securities that is publicly non-available, and the individual uses this information to

make trades in securities to make profits or avoid losses at the expense of other market

participants. The Securities & Exchange Board of India1 (SEBI) is the regulatory body that has

been bestowed with the powers to moderate the securities market and acts as a watchdog over the

commission of offences of Insider Trading as it affects the securities market at large. In

straightforward terms, it is "trading in securities by insiders who are in possession of or have

access to unpublished price-sensitive information (UPSI)"2.

Insider trading is performed by person(s) who are also known as insiders who have unique

access to specific types of strategic information about a company's stocks due to their

employment/ connection with the company. It is illegal in India and can result in significant fines

and penalties, as well as imprisonment. In other words, Insider trading is trading made by an

insider or someone who is a linked person(s), based upon the knowledge gained while

performing the insider's job.

While prima facie it may seem that only financial elements of the security market are affected by

Insider Trading but that is not the case. There is a breach of trust or in other words, a fiduciary

obligation on the part of the Insider when acting upon the UPSI of shares. This results in not only

monetary loss to the public but the trust amongst the members in the share market of the

company also take a hit and they might not indulge in future transactions when they know that

they don’t have fair opportunities to compete in the market. There is a sense of distrust among

1

Constituted on the Resolution by Department of Economic Affairs No.1 (44) SE/86.

2

Anil Kumar, “An Empirical study of Legal Insider Trading in India”, SSRN, July 2018, available at -

Determinants of Legal Insider Trading: Empirical Evidence from India by M Anil Kumar, Rajesh H. Acharya ::

SSRN..

Page 1 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

the investors as they believe that the playing field is not leveled and some individual(s) are in an

advantageous person to significantly avoid losses or gain profits.

Insider Trading gives people who have access to price information that is of sensitive nature and

is unpublished, hence giving an unfair edge to them over the general public as this information is

not published in public domains. When an insider manipulates a transaction that violates the

obligations that person has, it results in an overall reduction of trust in the security market, as the

insiders usually are employed in the company and owe a fiduciary duty towards the company

itself and the potential investors3. Knowing a company's confidential data can have a huge

impact on whether or not you invest and profit 4.

As it provides certain investors with an unfair edge in the stock market, it is considered unlawful

in the eyes of law. SEBI has strict regulations in place to prevent insider trading and monitors

trading activities closely to detect any suspicious activities.

Additionally, insider trading can lead to a misallocation of resources, as capital flows to

companies based on manipulated or incomplete information, rather than on their true

performance and prospects. An act of insider trading can result in severe lawful and reputational

consequences for the individual(s) as well as the firm. Therefore, studying insider trading can

help to identify the causes and consequences of this practice, and develop effective measures to

prevent and deter it5.

Thus, an ever-present requirement to holistically analyze the entire insider trading regime in

India is always needed as it is a type of financial transgression that undermines the fairness and

integrity of financial markets and it evolves with the amendments in law. When insiders trade

based on information that is not public, they have certain unfair advantages over others, as they

are aware of certain information which the rest are not, which can result in significant losses for

those who are devoid of such information. This can erode the trust and confidence of the

investors and public in the stock market, which is crucial for its stability and growth.

3

P Reddy Sathyanarayan, “Initiatives of SEBI in regulating insider trading practices in India”, Shodganga, 2019.

4

Arjun Nihal Singh, “Insider trading- Analysing the Indian Perspective”, SSRN, 2014, available at - Insider

Trading - Analysing the Indian Perspective by Arjun Singh :: SSRN.

5

Rojina Thapa, “Insider Trading: A Brief Overview of Legal Regime in USA, UK, India and Nepal”, Economic

Article Special Issue, Vol. 38, No. 293, 2010, available at - Insider Trading: A Brief Overview of Legal Regime in

USA, UK, India and Nepal by Rojina Thapa :: SSRN.

Page 2 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

The provisions related to Insider Trading have been mentioned in the Securities & Exchange

Board of India Act, 19926 (SEBI Act) mainly but it has been dealt with in detail by the

Regulations passed by SEBI in 2015 called SEBI (Prohibition of Insider Trading) Regulations 7.

There have been various amendments made to the regulations to broaden their scope and make

them more dynamic. It is observable from the various Amendments in the PIT Regulations that

SEBI is making an attempt to modify and adapt to the Insider Trading issues of the current times

and trying to make the market a more regulated and safer place for investors to put in their hard-

earned money.

6

SEBI Act, 1992, No 15, Acts of Parliament, 1992.

7

SEBI (Prohibition of Insider Trading) Regulations, 2015, Notification No. LAD-NRO/GN/2014-15/21/85.

Page 3 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.1 RESEARCH PROBLEM

Insider trading is a complex issue that has significant implications for the fairness and efficiency

of participation in the securities market for common investors. This unauthorized trading of

company securities based on non-public information can result in significant gains for insiders

while leading to losses for unsuspecting investors. This raises serious concerns about market

integrity and the potential for insider trading to undermine public trust in the stock market. To

address this issue, it is crucial to understand the extent of insider trading in India and its impact

on market integrity and fairness.

Therefore, the research problem is focused on investigating the prevalence of insider trading and

its implications for SEBI to provide insights into regulatory measures that can help deter and

prevent this practice. Hence, it has become essential to identify the loopholes in the existing

insider trading regime in India that allows for issues like enforcing Insider Trading as a WCC &

evolution of the standard of proof acceptable in a Court of Law, whether the Insider Trading

Regulations are effective or not.

1.2 SIGNIFICANCE OF RESEARCH

Research on insider trading is significant for several reasons.

Firstly, it helps to shed light on the extent and potential consequences arising out of the

commission of an act of insider trading on the functioning and integrity of the securities market

and the interests of investors, which is critical for policymakers and regulators to develop

effective measures to deter and prevent this practice.

Second, it helps to identify the factors that contribute to insider trading, such as weak regulatory

frameworks, corporate governance issues, etc, which can aid in targeted interventions to address

these underlying issues.

Third, research on insider trading can help to increase public awareness and understanding of

this issue, which can lead to greater demand for stronger enforcement and regulations.

Ultimately, the research can contribute to a more fair and efficient stock market that is better

equipped to guard all stakeholders and their interests. Hence, an imperative need to identify the

loopholes in the existing insider trading regime in India arises that allows for issues like Insider

Trading in the Event of Mergers & Acquisitions, enforcing Insider Trading as a WCC &

evolution of the standard of proof acceptable in a Court of Law.

Page 4 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.3 THEORETICAL CONNECTION

Theoretical connections to insider trading can be traced to several fields, including finance, law,

and ethics. Some of the theoretical connections are as follows:

Market efficiency: Insider trading can affect market efficiency by distorting prices and reducing

the informational efficiency of markets. Researchers can analyze and predict the outcome of acts

of insider trading bearing upon the regulatory and efficiency powers of the regulatory body in the

securities market and explore ways to prevent such practices.

Legal and regulatory frameworks: Insider trading is illegal in many countries, and laws and

regulations are in place to prevent it. Researchers can study the effectiveness of these legal and

regulatory frameworks and suggest ways to improve them.

Ethics and corporate governance: Insider trading raises ethical concerns and can undermine the

trust of investors in the financial markets. Researchers can study the ethical implications of

insider trading and explore ways to promote better corporate governance practices.

Risk management: Insider trading can pose a significant risk to investors and the financial system

as a whole. Researchers can study the risks associated with insider trading and explore ways to

manage them.

1.4 RESEARCH OBJECTIVES

The main objectives are –

To understand the origin, history & evolution of the Insider Trading regime,

To study legal provisions governing the regulation of insider trading practices in the Indian

securities market,

To analyze the major judicial precedents and determine the principles that have been

pronounced by the Courts,

To determine the evolving standards of proof needed to prove the crime in a Court of Law,

To study the effectiveness of the Insider Trading preventive Framework,

To identify issues of enforcement of Insider Trading as a White Collar Crime.

Page 5 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.5 RESEARCH QUESTIONS

The main questions are –

What is the point of origin and how the Insider Trading Framework evolved in India?

What is the legal regime for the prevention of Insider Trading?

What do the recent judgments say about the production of proofs in cases of Insider Trading

and whether it has become difficult to prove the crime of insider trading?

What are the elements/ evidence that does/ does not constitute a crime of Insider Trading?

Whether Insider Trading Framework could be effective?

Why is it difficult to prove Insider Trading as White Collar Crime?

1.6 HYPOTHESIS

The difficulty in proving offences of commission of Insider Trading in Courts has led to an

evolution of the standard of proof required to prove Insider Trading, due to the intricate

interpretation of the evidence by the Courts, thereby making it harder to prosecute Insider

Trading.

1.7 SCOPE

This study will focus on the offence of insider trading and the effectiveness of its preventive

regime in India to identify loopholes or flaws in the legal framework. It will investigate the legal

framework and enforcement mechanisms for insider trading, including the relevant statutes and

case laws. The study will use an analytical and doctrinal research design and will collect data

through legal document analysis, including court decisions and regulatory reports.

1.8 LIMITATIONS

The study will not investigate the potential effects of insider trading on securities market

outcomes or investor behavior. The research will not cover other countries beyond India but may

refer to some principles propounded in foreign judgments. The research will not cover other

types of financial misconduct beyond insider trading. The study is based on doctrinal

methodology and is limited to theoretical knowledge.

Page 6 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.9 LITERATURE REVIEW

A. Books & Commentaries

Bhuwneshwar Mishra’s book titled, “Law Relating to Insider Trading: A

Comprehensive Commentary on SEBI (Prohibition of Insider Trading) Regulations

2015”8, is one of the primary texts that are available on the topic of Insider Trading as it

was released in the year the Insider Regulations were released. The book covers the

history, objectives, scope, applications, and the need for these rules for the development

of the Corporate Sector in India. Bhuwneshwar attempts to provide an in-depth

breakdown of the framework surrounding the offence. The book explores the evolution

of insider trading regulation and various challenges and limitations of enforcing the

legal framework laws. Overall, "Law Relating to Insider Trading" gives a holistic

breakdown of financial misconduct and the attempt made at its regulation. The author

highlights the challenges and limitations of current regulation and proposes potential

solutions to improve its efficiency. The book is a valuable resource for policymakers,

practitioners, and academics interested in the topic. The book concludes by proposing

potential solutions to make progress in bringing efficiency to insider trading regulation.

These solutions include increasing the penalties for insider trading, improving the

efficiency of regulatory agencies, and increasing public awareness and education on

insider trading.

The author Kondaiah Jonnalagadda in his book “Securities Law”9 has attempted to

discuss the combined effect of Securities Law and Company Law w.r.t security-

corporate matters in India. He has discussed the topic with a detailed approach and

proposed potential solutions including increasing the penalties for insider trading,

improving the efficiency of regulatory agencies, and increasing public awareness and

education on insider trading. The book gives a holistic and comprehensive overview of

the legal regime and offers practical guidance on compliance with insider trading

regulations. The book is suitable for both legal professionals & non-lawyers alike.

8

Bhuwneshwar Mishra, Law Relating to Insider Trading: A Comprehensive Commentary on SEBI (Prohibition of

Insider Trading) Regulations 2015, Taxmann Publications, 1st Edition, 2015.

9

Kondaiah Jonnalagadda, Securities Law, Lexis Nexis Publications, 1st Edition, 2015.

Page 7 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

The book titled, “SEBI Act: A Legal Commentary on SEBI Act, 1992”10, authored by

Sumit Agarwal & Robin Joseph Baby, talks in detail about the legal regime under the

Act and SEBI’s role as legislator, executor, and judge to protect the securities market. It

takes the use of various judicial precedents to help explain the topic in detail along with

the amendments made and the reasoning behind making such changes. The authors of

the book believe that each provision of the SEBI Act is a subject of study in itself, and

through this book, they have made an attempt to present a detailed critique of each such

subject matter which might not have been discussed before. The book begins by

defining insider trading and providing examples of its occurrence in India. The author

then reviews the legal framework surrounding insider trading, including SEBI (PIT)

Regulations, 2015. The authors also examine the various legal tests used to determine

whether an individual has engaged in insider trading and then explore issues &

limitations of enforcing insider trading laws. These challenges include the difficulty in

proving insider trading, the potential for regulatory capture, and the lack of effective

enforcement mechanisms. The author also examines the potential unintended

consequences of insider trading laws, such as the chilling effect on legitimate market

activities and the potential harm to market efficiency and liquidity.

“Cyril Amarchand Mangaldas’s Treatise on Securities Law”11 is a book edited by Cyril

Shroff & U.K Sinha and of the recent works on the securities legal framework of India.

With a keen analysis of the evolution of the securities law in India, bolstered by

relevant discussions around how the law has played out in practice, this treatise seeks to

give a panoramic view of the regime on the securities market in India. It dives deep into

the key legislations governing the sphere, providing both theoretical and practical

know-how to its readers. It is a comprehensive book that provides a detailed analysis of

the Indian securities law framework. The book covers a wide range of topics related to

securities law, including insider trading, public offerings, and regulatory compliance.

The section on insider trading provides a thorough examination of the legal regime

surrounding insider trading. They explain the legal definition of insider trading and

10

Sumit Agarwal & Robin Joseph Baby, SEBI Act: A Legal commentary on SEBI Act, 1992, Taxmann Publications,

1st Edition, 2011.

11

Cyril Shroff & U.K Sinha, Cyril Amarchand Mangaldas’s Treatise on Securities Law, Thomas Reuters

Publications, 1st Edition, 2021.

Page 8 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

provide examples of classic, misappropriation, & tipper/tippee kinds of insider trading.

The authors explain the various disclosure requirements & restrictions imposed on

insiders and the penalties for violating these regulations. In addition, the book provides

practical guidance on compliance with insider trading regulations, including how to

identify and manage insider trading risks, and how to implement effective compliance

programs.

Gaurav Pingle in his book titled, “Handbook on Securities Laws”12, has emphasized the

important part of securities law from the POV of Company Secretaries and Compliance

Officers and has discussed various allied legislations like Depositories Act and the

various Regulations released by SEBI. He believes securities law must be understood

after complete comprehension of the important corporate law concepts and has made an

attempt to include the most recent updates and amendments in the laws to keep up to

date with the current regime of the securities law framework in India.

B. Articles

Robert W. McGee and Walter E. Block in their article "An Ethical Look at Insider

Trading"13 provide a critical examination of the ethical implications of insider trading.

The authors present arguments from both sides of the debate and evaluate them based

on various ethical theories. The authors begin by defining insider trading and providing

examples of its occurrence. They then explore the arguments in favor of insider trading,

which include the idea that it provides an incentive for individuals to gather and

disseminate valuable information. The authors also address the argument that it is a

victimless crime, as it involves consenting parties who are trading based on their own

informed decisions. However, the authors then present counterarguments against

insider trading, including the idea that it undermines the fairness and integrity of the

market, as well as the concept of "fiduciary duty" - the obligation of insiders to act in

the best interests of the company and its shareholders. The authors also examine the

potential harm caused to other market participants who do not possess the same

information and its impact on public trust and confidence in the market. Throughout the

article, the authors analyze the ethical implications of insider trading using various

12

Gaurav Pingle, Handbook on Securities Laws, Bloomsbury Publications, 1st Edition, 2021.

13

Robert W. McGee and Walter E. Block, “An Ethical Look at Insider Trading”, Insider Trading: Regulatory

Perspective, ICFAI University Press.

Page 9 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

ethical theories, including utilitarianism, deontology, and virtue ethics. They conclude

that while insider trading may have some potential benefits, it ultimately violates

fundamental ethical principles and should be prohibited. The authors effectively present

and evaluate arguments from both sides of the debate, and their analysis is supported by

a thorough review of relevant literature and ethical theories.

In the article "Can Regulation of Insider Trading Be Effective?"14 Dr. Alexandre Padilla

explores the efficiency of preventive regulations. The author provides a critical analysis

of the regulatory approaches to insider trading and evaluates their effectiveness based

on empirical evidence. The article begins by defining insider trading and its various

forms, including illegal insider trading, legal insider trading, and the use of inside

information for market manipulation. The author also critiques the assumptions

underlying insider trading regulations, including the idea that insider trading harms &

undermines investor confidence. He suggests that these assumptions may not hold in

reality and that insider trading may benefit the market by providing liquidity and

improving price discovery. However, the author acknowledges that insider trading can

be harmful in some cases, particularly when it involves selective disclosure of material

non-public information. He proposes a market-based solution to this problem, in which

issuers should disclose all material information in a standardized manner. The author

also challenges the assumptions underlying the laws and suggests alternative solutions

to prevent harm from insider trading.

In the article "Is the Law Effective in Protecting Markets from Insider Trading?"15 Dr.

Georgios I. Zekos evaluates the effectiveness of legal measures in preventing and

deterring insider trading. The author provides a critical analysis of the legal framework

and explores various challenges and limitations of enforcing these laws. The article

begins by defining insider trading and providing examples of its occurrence. The author

also reviews the various legal tests used to determine whether an individual has

engaged in any form of financial misconduct. The author argues that while the law

provides a strong deterrent effect against insider trading, its effectiveness is limited by

14

Dr. Alexandre Padilla , “Can Regulation of Insider Trading Be Effective”, Insider Trading : Regulatory

Perspective, ICFAI University Press.

15

Dr. Georgios I. Zekos, “Is the Law effective in protecting markets from insider trading?”, Hertfordshire Law

Journal, Volume 3, Issue 2-2005, pg 2-17, 2005.

Page 10 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

various challenges, including the difficulty in proving insider trading, the lack of

international coordination and cooperation, and the potential for regulatory capture. The

author suggests that these challenges may result in inconsistent enforcement and

arbitrary outcomes. The author also explores the potential unintended consequences of

insider trading laws, such as the chilling effect on legitimate market activities and the

potential harm to market efficiency and liquidity.

In "The Future of Insider Trading"16 by Juliette Overland, the author provides an

examination of the evolving landscape of insider trading regimes and explores potential

future developments in this area. The article examines the various challenges and

limitations of the current regulatory framework and proposes potential solutions to

improve the efficiency of preventive insider trading regulation. The article begins by

defining insider trading and providing examples of its occurrence. The author also

explores the challenges and limitations of current insider trading regulation, such as the

difficulty in detecting and prosecuting insider trading, the potential for regulatory

capture, and the lack of international cooperation and coordination. The author then

proposes potential solutions to improve the effectiveness of insider trading regulation.

These solutions include increasing the penalties for insider trading, implementing

stricter disclosure requirements, and improving enforcement mechanisms. The article

concludes by suggesting that the future of any preventive regulation will rely upon a

combination of lawful, technological, and cultural factors. The author suggests that

while insider trading is unlikely to ever be fully eliminated, a combination of legal

reforms, technological advancements, and cultural shifts may progress the efficiency of

the insider trading regime to reduce its occurrence.

Marc I. Steinberg, in the article "Insider Trading — A Comparative Perspective"17,

provides a comparison-based analysis of preventive laws across different countries. It

article explores the similarities and differences in the legal framework and regulatory

approach to insider trading in various jurisdictions. The article begins by defining

insider trading and providing examples of its occurrence. The author then reviews the

16

Juliette Overland, “The Future of Insider Trading”, Insider Trading: Regulatory Perspective, ICFAI University

Press.

17

Marc I. Steinberg, “Insider Trading — A Comparative Perspective”, Insider Trading: Regulatory Perspective,

ICFAI University Press, 2007.

Page 11 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

legal framework surrounding insider trading in different countries. The author

compares and contrasts the regulatory approach in each country, highlighting the

similarities and differences in the legal tests used to determine insider trading, the

penalties for performing insider trading, and the effectiveness of enforcement. He also

examines the challenges and limitations of regulating insider trading across different

jurisdictions. The author suggests that differences in legal frameworks, cultural norms,

and regulatory structures may make it difficult to achieve a uniform approach to insider

trading regulation. Overall, the article provides a well-researched and informative

comparative analysis of the preventive legal regime across different countries. He

highlights the similarities and differences in the legal framework and regulatory

approach to insider trading in various jurisdictions and explores the challenges and

limitations of regulating insider trading across different cultures and legal systems.

C. Cases

The first case is Rajeev Vasant Sheth v. SEBI18, in this case, the SAT quashed the

decision passed by the WTM, which found the promoters of the company guilty of

participating in the offence of Insider Trading and imposed a heavy penalty. The brief

facts are as follows, the company while facing certain financial difficulties held some

sales of shares so that the sum could be infused into the capital of the company which

was held to be permissible under the regulations. SEBI in its arguments alleged that the

said actions violated Regulation 4 of the Prohibition of Insider Trading Regulations.

The second case we are going to refer to is, Balram Garg v. SEBI19, in this case, it was

alleged by directors of PC Jewellers, that their relatives holding shares in the company

were involved in the crime of insider trading. The SAT believed that the allegations

made were correct and imposed fines on the guilty party who wasn’t content with the

decision and filed an appeal in the Supreme Court.

Our next case is Pia Johnson vs. SEBI20, in this case, Pia that is the appellant along with

her husband were employees at Indianbulls Company and this company had a

subsidiary named India Land and Properties Limited (ILPL) in which the parent

company wanted to sell their 100% investment. Now, Pia and her husband bought

18

Rajeev Vasant Sheth v. SEBI, Appeal No. 297 of 2020.

19

Balram Garg v. SEBI, 2022 SCC Online SC 472.

20

Pia Johnson vs. SEBI, Appeal No. 59 of 2020.

Page 12 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

shares of this subsidiary company, and subsequently on an investigation by SEBI it was

held that the transactions that were made by the parties were after they got knowledge

of UPSI of the subsidiary company. The WTM passed an order against the parties but

SAT was of a different opinion and set aside the earlier order made by them.

In Rakesh Agarwal v SEBI21, the Tribunal declared, “the insiders receive UPSI by

virtue of their connection and for corporate purposes only, such insiders owe a

fiduciary duty to the company not to misuse such information for an unlawful purpose

i.e. to make secret profits or personal gains for themselves22. Such insiders are either

required to disclose the said UPSI or to abstain from acting on the said

information/dealing in such securities altogether. This requirement has come to be

known as the ‘disclosure or abstain’ rule.”23 It can be ascertained that people who trade

based on UPSI as opposed to those who have suffered due to the absence of it in the

public domain stand on completely polar opposite footing. One gains profit while the

other suffers due to wrongful conduct and violation of fiduciary obligation. Therefore,

the disclosure or abstain rule has become very important to safeguard the interests of

the investors and the company.

1.10 PROPOSED RESEARCH METHODOLOGY

The doctrinal nature of this dissertation makes the research restricted only to the primary and

secondary sources like acts, judgments given by the courts, books, etc. All the data collected

from the sources have formed part of the research in the dissertation. Both descriptive and

explanatory research methodologies have been used to interpret and reproduce the data for the

dissertation.

21

Rakesh Agarwal v SEBI, Appeal No. 33 of 2001.

22

Chiarella v. US, 455 US 222.

23

supra 21, pg 25.

Page 13 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

Before we move ahead, we need to learn the two basic terminologies and concepts that are

relevant to Insider Trading in brief, which will help us better understand the topic at hand.

1.11 UNPUBLISHED PRICE SENSITIVE INFORMATION24

Unpublished Price Sensitive Information (UPSI) is cost-sensitive data about the corporate

functions of a company that is yet to be accessible freely by anyone, is connected to the

company's choices, and is usually related to any activity that causes alteration of shares prices of

a company in the market 25. UPSI includes “financial statements, dividend declarations, public

rights issues, merger or amalgamation information, stock buy-backs, information on de-mergers,

policy revisions, and changes in the company's operations.”26 Insider trading is a method of

unfair trading that involves the use of UPSI. It is not only unethical but also morally wrongful to

utilize such knowledge in the market to get an unjust benefit over those without the information.

The insiders of a company are allowed to make trades in their company's shares only on the

condition that all the transactions thus made will be disclosed in a record to ensure nothing

illegal occurred while the transactions occurred. SEBI along with its laws and constant

regulations attempts to curb the crime of Insider Trading so that the market can be protected and

is safe for the investors too.

1.12 INSIDER27

Insiders are individuals that are in some way employed within a company or are involved with a

company in such a way that they have access to information related to the price of shares of that

company. These insiders then use this information to make transactions that make them profits or

avoid losses depending upon the price change of the securities, before the release of the

information publicly. From the Partner and director to any officer or employee of a company,

any person holding some kind of official relationship with a company can become an insider.

Insiders may not directly get involved in the dealings but may inform some outsiders about this

UPSI which would allow them to make similar profits, this allows the insider to avoid any direct

suspicion of themselves. Thus, it becomes very difficult to identify the offenders in Insider

Trading.

24

SEBI (PIT), Reg. 2(1)(n).

25

Rajiv B Gandhi and others v SEBI, Appeal No. 50 of 2007.

26

supra 24.

27

SEBI (PIT), Reg. 2(b).

Page 14 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.13 INSIDER TRADING – WHEN IT IS LEGAL & WHEN NOT?

The first thought that comes to every mind is that Insider Trading is an offence but that is not the

case, Insider Trading’s legality depends upon the nature of the activity that constitutes Insider

Trading and whether compliance has been made with the legal framework. The main difference

between legal and illegal insider trading is whether the insider has violated securities laws or

regulations.

Legal insider trading 28 can be observed when insiders trade securities in the market but follow

the set of laws & regulations set forth that apply to such transactions. These insiders must report

their trades to the SEBI, make necessary disclosures, and must not use non-public information to

make their trades.

One such circumstance is when an insider makes trades in accordance with a trading plan which

has been pre-determined with the Compliance Officer and has been disclosed to the public at

large and approved by the company's CO or BOD. Such plans must be made in good faith, and

the trades must be made in compliance with the plan's terms and conditions. Another

circumstance where insider trading is permitted is when it is conducted by registered market

makers, who are authorized to facilitate trading in certain securities. In such cases, the market

makers are required to oblige strict requirements to ensure that their non - participation in

abusive or manipulative trading practices.

However, these limited circumstances should not be confused with legal insider trading. Rather,

they are exceptions that are designed to facilitate legitimate market activity and maintain market

liquidity. In all other cases, insider trading is illegal and can result in severe legal and

reputational consequences.

It has been argued by promoters who want to make Insider Trading legal that, Insiders profit

from their confidential information due to their skills, but outsiders, who will always act at their

discretion, won't be harmed. This illustrates the idea of "victimless crime." This justification for

insider trading disregards the problem of information use. There is no assurance that even if

everyone is provided with PSI, they would all use it in the same way. Analysis of stock market

28

L.P Anitha, “Critical Analysis on Laws relating to Insider Trading”, Shodganga, Chp. 3, at 137, December 2010,

available at - http://hdl.handle.net/10603/13173.

Page 15 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

information is necessary, and different people have different viewpoints and insiders will always

have an advantage over unaware investors.

Illegal insider 29 trading can be observed when insiders trade securities based on UPSI or when

they provide that information to others who then trade on it. This is a violation of securities laws

and is punishable by fines and imprisonment. Insider trading can also be illegal if it violates the

company's insider trading policies and codes of conduct 30. The securities market needs to have

advanced information processing capabilities to operate effectively and efficiently so that

investors must have the chance to transact fairly.

Everyone agrees that accurate pricing of securities benefits both businesses and society as a

whole. The market would determine the security's ‘proper’ price if all relevant facts had been

made available to the public. An accurate valuation of its securities, which results in less investor

uncertainty and better management effectiveness monitoring, also lowers the level of corruption.

Uncertainty is greatly aided by people who are directly connected to the operations of the

companies.

In cases where insider trading is legal, it can still be considered unethical if the insider uses their

access to information for personal gain and mere compliance with the regulatory framework may

not be enough31. This would happen in cases where the trading is made at the expense that other

shareholders and the company have suffered due to such trades.

29

Tibor R. Machan, “The case for the morality of insider trading”, Insider Trading: Regulatory perspectives, ICFAI

university press, 2007.

30

Vincent Barry, “Moral Issues in Business”, Wadsworth Publishing Company, pg 242, 1983.

31

Ashish Kumar Sana, “Insider trading in company securities: a comprehensive study with special reference to

Indian practices”, Chp. 2, pg 38-40, Calcutta University, 2009.

Page 16 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.14 WHY IS INSIDER TRADING CONSIDERED UNETHICAL?

Insider Trading is considered immoral or unethical because it entails taking advantage of

confidential information (UPSI) not available in the public domain and not accessible to the

general public. This can create an unjust benefit32 for individuals who have access to such

information, as they can make investment decisions based on such UPSI. Insider trading can also

undermine the reliability of securities markets and damage the confidence of the public in the

fairness of the system. Additionally, it can lead to losses suffered by other investors who do not

have the means to gain such UPSI and may make decisions based on incomplete or misleading

information. Therefore, insider trading is generally considered unethical and is prohibited by

laws and regulations in most countries.

The offence of Insider trading is considered an unethical financial crime for several reasons33.

It creates a position wherein an unfair advantage is with those who have access to UPSI,

allowing them to turn profits at the expense of other investors who do not have the same UPSI.

This undermines the integrity of financial markets, which are supposed to operate based on just

and equivalent rights to make use of the information for all participants.

Second, it breaches a fiduciary obligation imposed upon insiders towards the company &

investors. Insiders are typically privy to sensitive information and are obligated to operate for the

preeminent benefit of the corporation and its shareholders, avoiding the opportunity to use such

UPSI for personal gain.

Third, it weakens public trust in the evenhandedness and transparency of financial markets by

creating an impression that some participants have an unfair advantage over others and that the

markets are not operating on a level playing field.

For these reasons34, insider trading is widely considered to be unethical and can result in

significant legal and reputational consequences for those who engage in it.

32

Robert W. McGhee & Walter E. Block, “An ethical look at insider trading”, Insider Trading: Regulatory

perspectives, ICFAI university press, 2007.

33

Jennifer Moore, “What Is Really Unethical about Insider Trading?”, Springer Publications, Journal of Business

Ethics , Mar., 1990, Vol. 9, No. 3 (Mar., 1990), pp. 171-182, available at - https://www.jstor.org/stable/25072022.

Page 17 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

The rationale to prevent acts of such financial misconduct and the need to regulate has been

explained by the Attorney General as, "the obvious need and understandable concern.... about

the damage to public confidence which insider dealing is likely to cause and the clear intention

to prevent, so far as possible, what amounts to cheating when those with inside knowledge use

that knowledge to make a profit in their dealings with others.”35

Thus, Insider Trading is seen as a breach of fiduciary duty owed by the insider towards the

Company as well as the common investors who are unaware of the sensitive information which

has the potential to affect the price of securities of the company. This is the reason it is

considered unethical and invites a penalty of both fine and imprisonment. It is regarded as a

serious financial offence and hence it invited both fines and imprisonment to indicate any act of

Insider Trading would not be taken lightly by the Courts.

34

Nishith M. Desai & Krishna A. Allavaru, “Insider Trading: a comparative study”, Paper 11, available at -

http://www.mindspring.com/~nishith.

35

Attorney General’s Reference, No.1 of 1988 (1988) BCC 765.

Page 18 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

1.15 EFFICACY OF CIVIL VERSUS CRIMINAL PROHIBITION

The efficacy of civil liability against criminal liability to prevent offences has been a much-

debated topic36, while some hold the efficacy of criminal law for its influential deterrence others

doubt its suitability and are in favor of civil law as the requirement of evidence to prove an

offence is significantly less than the requirements in criminal law 37. While civil liability may be

easier to prove38 but the retribution for the civil offence may be not enough to strike fear in the

minds of potential insiders as opposed to the punishment of imprisonment that is imposed under

criminal law39.

The supporters of criminal action believe that an act of insider trading is more than a civil

offence and affects the public (investors) at large and accordingly, criminal law should be

imposed. Another reason is that fear of imprisonment might stop some insiders from engaging in

such activities, as criminal sanctions are a greater form of penalizing someone than civil

sanctions in addition to the stigma 40 attached to the criminal sanctions. This would create an

image in the minds of potential offenders that insider trading is taken seriously by the

government.

Further, it is believed offence of insider trading invites a social responsibility to prosecute due to

the number of victims it creates. The conviction behind a greater form of punishment has many

logical reasons supporting it; firstly, the potential harm to the reputation/ future opportunities of

the insiders who are usually at a high and established position in the society, the second is an

example would created in the minds of potential offenders with every successful conviction.

The current punishment for Insider Trading prescribed by the SEBI Act reflects both the civil

and criminal efficacies as this offence invites both heavy fines and imprisonment. Due to the

severity of the offence, any accusation by SEBI needs to be proven beyond doubt in the Court of

Law.

36

Roopanshi Sachar, “Discipline the insider in the capital market: Emerging challenges and way forward”,

University School of Law and legal studies Guru Gobind Singh Indraprastha University, 2018.

37

Bart Frijins & Aaron Gilbert, “Do criminal sanctions deter insider trading?”, 48 The Financial Review 205,

2013.

38

Nahar Mahala & Adi Talati, “Law Practice and Procedure on Insider Trading and Unfair Trade Practices”, 2

Commercial Law Publishers, Delhi, 2004.

39

Nidhi Tandon, “Insider Trading – is it an absolute liability offence?”, 59(2), Corporate Law Adviser, 178, 2004.

40

Smita Singh & Shibhani Saxena, “Judicial Effectiveness of criminal sanctions for Insider Trading and role played

by the intent”, 1 Company Law Journal 96, 2014.

Page 19 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

_________________________________________________

CHAPTER II

CONCEPT, HISTORY & EVOLUTION OF INSIDER TRADING IN INDIA

_________________________________________________

The chapter talks about the evolution of the Insider Trading legal regime along with all the

Committees that were set up to analyze and improve the securities market which lead to the

enactment of a legal framework to curb the offences of Insider Trading.

Insider Trading refers to transacting or dealing with a company’s securities based upon some

form of confidential data that is not accessible to the public, intending to make profits or avoid

losses. It is a contravention of the obligations of insiders who is usually an employee/ officer of

the company and they have a fiduciary duty to take actions that reflect the best interest of the

investors. It is not only an economic crime but also a social one as a lot of investing is done by

common folks in the hope of getting good returns on their investment and would like to be

afforded a fair opportunity to make such profits in a company.

The first organized security framework41 is said to be established in Bombay in the year 1875

and is considered to be one of the oldest 42 stock exchanges established in Asia 43. It was shortly

followed by the creation of the Ahmadabad Stock Exchange44 in 1894 and the Kolkata Stock

Exchange45 in 1904. Currently, there are seven46 recognized stock exchanges in India, with the

two prominent stock exchanges that are recognized being the Bombay Stock Exchange47 (BSE)

41

supra 28, at 137.

42

Smriti Chand, “History of Stock Exchange in India”, available at https://www.yourarticlelibrary.com/stock-

exchange/history-of-stock-exchange-in-india/23488.

43

Jitendra Mhakud and L.M.Bhole, “Financial Institutions and Markets: Structure, Growth and Innovations”, 718

(5th Ed.2009).

44

Shradha Rajgiri, “An Analysis of Insider Trading in India”, Pramana Research Journal Volume 9, Issue 3, at 2,

ISSN No - 2249-2976, 2019, available at https://www.pramanaresearch.org/gallery/prj-p565.pdf.

45

ibid.

46

List of Stock Exchanges, SEBI website, available at https://www.sebi.gov.in/stock-exchanges.html.

47

ibid.

Page 20 of 104

Electronic copy available at: https://ssrn.com/abstract=4700517

& National Stock Exchange48 (NSE) and they possess a mandate to have nation-wise

mercantilism49.

The concept, history & evolution of the concept of Insider Trading and the laws enacted to curb

it, is essential to understand how effective the legal framework to prevent the commission of an

offence of Insider Trading is in reality. The identification of loopholes in the legal regime would

help in better determining legal provisions that are more effective in halting the commission of

this offence. Whenever we discuss the present circumstances of any activity, it is essential to

understand its origin and evolution to be better informed about the activity50.

Insider Trading is traceable as long as back to the origin of the securities market, having plagued

the securities market for decades and it does not only have financial consequences but also social

ones. It is a misdemeanor against the morality of conducting business healthily and as of now the

laws that have been implemented are struggling to detect the evolved form of Insider Trading. It

is considered to be an illegal activity throughout the corporate sector, hence the government has

been in constant deliberation51 on how to improve the regulatory mechanism of the security

market and so throughout the last century, many committees were set up from time to time to

tackle this issue and curb Insider Trading. These Committees through their reports have made

various recommendations to the government on how to improve the existing structure which has