Professional Documents

Culture Documents

C04054_valuation_01_Sep_2023_1693547002427

C04054_valuation_01_Sep_2023_1693547002427

Uploaded by

JOGI Safetech Pvt. Ltd.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C04054_valuation_01_Sep_2023_1693547002427

C04054_valuation_01_Sep_2023_1693547002427

Uploaded by

JOGI Safetech Pvt. Ltd.Copyright:

Available Formats

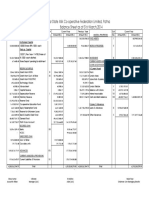

VIKASAMORGANIZATION

Investor Wise Scheme Summary - Valuation Report As on Date : 31-08-2023

Chetan Arvindlal Singwala Your Relationship Handler

Address : 61,Sakar Raw House,Nr. Jogani Nagar Chandrasekhar Azad Marg,Adajan, Surat Name : VIKASAMORGANIZATION

City : Surat Off-Address : 7 Subhashnagar SocietyB/h.St.Xavier SchoolGhod Dod Road Surat

E-Mail : casingwala_2929@yahoo.co.in City : Surat

Mobile : 9998223061 Pincode : 395001

Phone : 0261-2653960

Mobile : 9825186968

E-Mail : vip_bhatt123@yahoo.co.in

Sr. Scheme Sub Type Amount Div.Reinv. No Of Unit Current Value Div R Div P Total Annualized Abs. %Holding Tenure

No. (Rs.) (Rs.) (Rs.) (Rs.) (Rs.) (Rs.) Return (%) Return(%)

Chetan Arvindlal Singwala

1 DSP Focus Fund - Gr Focused 1,80,000.00 0.00 16,234.436 6,22,785.43 0.00 0.00 6,22,785.43 12.15 245.99 14.13 LT

2 DSP T.I.G.E.R. Fund - Gr Thematic 70,000.00 0.00 1,867.141 3,90,927.05 0.00 0.00 3,90,927.05 12.23 458.47 8.87 LT

3 Franklin India Equity Advantage Large and Mid 1,20,000.00 0.00 4,711.147 6,41,268.61 0.00 0.00 6,41,268.61 12.93 434.39 14.54 LT

Fund - Gr Cap

ICICI Prudential Infrastructure

4 Fund - Gr Thematic 1,20,000.00 0.00 4,629.044 5,63,910.14 0.00 0.00 5,63,910.14 11.98 369.93 12.79 LT

5 Nippon India Growth Fund - Gr Mid Cap 3,55,996.20 0.00 536.374 14,42,558.99 0.00 0.00 14,42,558.99 17.69 305.22 32.72 Both

6 Nippon India Large Cap Fund - Gr Large Cap 10,000.00 0.00 977.995 63,031.19 0.00 0.00 63,031.19 12.14 530.31 1.43 LT

7 Sundaram Focused Fund - Gr Focused 1,20,000.00 0.00 5,346.284 6,57,817.48 0.00 0.00 6,57,817.48 13.06 448.18 14.92 LT

Sundaram Infrastructure

8 Advantage Fund - Gr Thematic 7,317.50 0.00 418.315 26,681.72 0.00 0.00 26,681.72 14.76 264.63 0.61 LT

Sub Total 9,83,313.70 0.00 34,720.736 44,08,980.61 0.00 0.00 44,08,980.61 13.79 348.38 100.00

Return : 13.79% | Weighted Avg. Abs. Return : 348.38% | Gain / (Loss) : Rs. 34,25,666.91

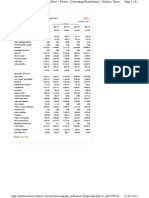

Himadri Chetankumar Singwala

9 Nippon India Small Cap Fund - Gr Small Cap 4,61,998.50 0.00 23,313.436 28,24,585.97 0.00 0.00 28,24,585.97 25.68 511.38 100.00 LT

Sub Total 4,61,998.50 0.00 23,313.436 28,24,585.97 0.00 0.00 28,24,585.97 25.68 511.38 100.00

Return : 25.68% | Weighted Avg. Abs. Return : 511.38% | Gain / (Loss) : Rs. 23,62,587.47

Ilaben Chetankumar Singwala

HDFC Balanced Advantage Fund

10 Bal Adv 1,20,000.00 0.00 1,751.614 6,49,188.44 0.00 0.00 6,49,188.44 13.04 440.99 19.91 LT

Gr

11 HDFC Infrastructure Fund - Gr Thematic 10,000.00 0.00 1,000.000 31,249.00 0.00 0.00 31,249.00 7.64 212.49 0.96 LT

12 HSBC Large Cap Fund - Gr Large Cap 20,000.00 0.00 213.232 75,476.27 0.00 0.00 75,476.27 8.61 277.38 2.31 LT

13 ICICI Prudential Multi-Asset Fund - Multi AA 12,620.00 0.00 117.224 63,102.79 0.00 0.00 63,102.79 13.97 400.02 1.94 LT

Gr

14 Kotak Infrastructure and Economic Thematic 5,000.00 0.00 488.998 22,275.81 0.00 0.00 22,275.81 10.10 345.52 0.68 LT

Reform Fund - Gr

15 Mirae Asset Large Cap Fund - Gr Large Cap 1,80,000.00 0.00 9,754.112 8,43,740.44 0.00 0.00 8,43,740.44 15.08 368.74 25.88 LT

16 Nippon India Small Cap Fund - Gr Small Cap 5,96,549.98 0.00 12,746.551 15,44,333.88 0.00 0.00 15,44,333.88 21.65 158.88 47.36 Both

Sundaram Large & Midcap Fund - Large and Mid

17 Gr Cap 12,159.10 0.00 507.202 31,309.48 0.00 0.00 31,309.48 14.22 157.50 0.96 LT

Sub Total 9,56,329.08 0.00 26,578.933 32,60,676.11 0.00 0.00 32,60,676.11 16.67 240.96 100.00

Return : 16.67% | Weighted Avg. Abs. Return : 240.96% | Gain / (Loss) : Rs. 23,04,347.03

Rushi Chetankumar Singwala Rep by

| Anti Money Laundering | Terms of use | Disclaimer | Privacy Policy |

VIKASAMORGANIZATION

Sr. Amount Div.Reinv. Current Value Div R Div P Total Annualized Abs.

No. Scheme Sub Type (Rs.) (Rs.) No Of Unit (Rs.) (Rs.) (Rs.) (Rs.) Return (%) Return(%) %Holding Tenure

18 Mirae Asset Great Consumer Fund Thematic 4,018.59 0.00 204.041 14,099.85 0.00 0.00 14,099.85 18.22 250.87 1.24 LT

- Gr

19 Mirae Asset Large Cap Fund - Gr Large Cap 1,92,000.00 0.00 12,599.733 10,89,889.50 0.00 0.00 10,89,889.50 15.40 467.65 95.70 LT

Large and Mid

20 Nippon India Vision Fund Gr Cap 8,007.92 0.00 35.786 34,917.69 0.00 0.00 34,917.69 15.88 336.04 3.07 LT

Sub Total 2,04,026.51 0.00 12,839.560 11,38,907.04 0.00 0.00 11,38,907.04 15.45 458.22 100.00

Return : 15.45% | Weighted Avg. Abs. Return : 458.22% | Gain / (Loss) : Rs. 9,34,880.53

Grand Total 26,05,667.79 0.00 97,452.665 1,16,33,149.73 0.00 0.00 1,16,33,149.73 16.49 346.46

Return : 16.49% | Weighted Avg.Abs. Return : 346.46% | Gain / (Loss) : Rs. 90,27,481.94

Current Value of your Total Investment is Rs. 1,16,33,149.73/-

| Anti Money Laundering | Terms of use | Disclaimer | Privacy Policy |

VIKASAMORGANIZATION

VALUATION

Type Wise Sub Type Wise Asset Wise

Note :

1) Annualized Return is calculated on an Absolute basis for < 1 Year And on XIRR basis for >= 1 Year.

2) This Report is Strictly Private and confidential only for clients of NJ India Invest .The Information given above is correct and to the best of our knowledge. For any discrepancy on the same contact the nearest Office of NJ India Invest.

Disclaimer:

NJ India Invest Private Limited (NJ) is a mutual fund distributor (ARN 0155) registered with AMFI. The information contained herein does not constitute, and should not be construed as, investment advice or a recommendation to buy, sell, or

otherwise transact in any security or investment product or an invitation, offer or solicitation to engage in any investment activity. It is strongly recommended that you seek professional investment advice before taking any investment decision. Any

investment decision that you take should be based on an assessment of your risks in consultation with your investment adviser.

To the extent that any information is regarding the past performance of securities or investment products, please note such information is not a reliable indicator of future performance and should not be relied upon as a basis for an investment

decision. Past performance does not guarantee future performance and the value of investments and the income from them can fall as well as rise. No investment strategy is without risk and markets influence investment performance. Investment

markets and conditions can change rapidly, and investors may not get back the amount originally invested and may lose all of their investment. Mutual fund investments are subject to market risks, read all scheme related documents carefully

before investing.

The information given above is correct and to the best of our knowledge. For any discrepancy on the same contact the nearest office of NJ India Invest or email us at grievance@njgroup.in.

| Anti Money Laundering | Terms of use | Disclaimer | Privacy Policy |

You might also like

- Introduction To Financial Markets PDFDocument230 pagesIntroduction To Financial Markets PDF0796105632100% (3)

- DuffphelpsDocument1 pageDuffphelpsG ChaddiNo ratings yet

- Level II of CFA Program Mock Exam 1 - Questions (AM)Document35 pagesLevel II of CFA Program Mock Exam 1 - Questions (AM)Faizan UllahNo ratings yet

- MF Val RPT 970921Document2 pagesMF Val RPT 970921bibhu059No ratings yet

- Assignment-1: Banking and InsuranceDocument17 pagesAssignment-1: Banking and Insuranceslachrummy4No ratings yet

- Null 9Document2 pagesNull 9Praj JainNo ratings yet

- RISHI21 - Alpha Bluechip - LUMPSUMDocument4 pagesRISHI21 - Alpha Bluechip - LUMPSUMPower of Stock MarketNo ratings yet

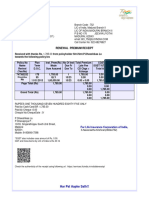

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!Whatsapp Lovers statusNo ratings yet

- Unrealised Profit and Loss RM - 3060655 - 30 08 21 10 17 37Document1 pageUnrealised Profit and Loss RM - 3060655 - 30 08 21 10 17 37san RayNo ratings yet

- Balance Sheet of State Bank of India: - in Rs. Cr.Document17 pagesBalance Sheet of State Bank of India: - in Rs. Cr.Sunil KumarNo ratings yet

- Soa 1697422949512Document1 pageSoa 1697422949512ABHIJIT BISWASNo ratings yet

- BS As On 23-09-2023Document28 pagesBS As On 23-09-2023Farooq MaqboolNo ratings yet

- Nikita Patil: Ipo: Shriram Transport Finance Co)Document17 pagesNikita Patil: Ipo: Shriram Transport Finance Co)Visal SasidharanNo ratings yet

- Cash Flow of ICICI Bank - in Rs. Cr.Document12 pagesCash Flow of ICICI Bank - in Rs. Cr.Neethu GesanNo ratings yet

- Combine Client Wise Summary ReportDocument1 pageCombine Client Wise Summary Reportakshat tvNo ratings yet

- Fundamental Analysis of PNB Ltd.Document19 pagesFundamental Analysis of PNB Ltd.Ashutosh Gupta100% (1)

- Punjab and Sind BankDocument13 pagesPunjab and Sind Banksimran jeetNo ratings yet

- Sachin Singh (0811) Dec PayslipDocument1 pageSachin Singh (0811) Dec Payslipsinghsachin1781No ratings yet

- Rabi - MF - Valuation Statement - As On 31mar2018Document3 pagesRabi - MF - Valuation Statement - As On 31mar2018Rabindra SinghNo ratings yet

- Balance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.Document4 pagesBalance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.nawazNo ratings yet

- ICICI Bank - Consolidated Balance Sheet Banks - Private Sector Consolidated Balance Sheet of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument1 pageICICI Bank - Consolidated Balance Sheet Banks - Private Sector Consolidated Balance Sheet of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- HDFC BankDocument4 pagesHDFC BankKshitiz BhandulaNo ratings yet

- Balance Sheet of State Bank of IndiaDocument5 pagesBalance Sheet of State Bank of Indiakanishtha1No ratings yet

- FM Group 03Document25 pagesFM Group 03Mohammad IslamNo ratings yet

- Bihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014Document1 pageBihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014SATYAM KUMARNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!JaveedNo ratings yet

- JeyapriyaDocument1 pageJeyapriyaYazh EnterpriseNo ratings yet

- Balance Sheet of Axis Bank: - in Rs. Cr.Document37 pagesBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNo ratings yet

- PrmPayRcpt 89212402 PDFDocument1 pagePrmPayRcpt 89212402 PDFAnonymous T2AW3CzNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Balance Sheet of Tata MotorsDocument2 pagesBalance Sheet of Tata MotorsPRIYAM XEROXNo ratings yet

- Kyb 2023Document10 pagesKyb 2023RudraNo ratings yet

- Company Secretary N.K.SinhaDocument4 pagesCompany Secretary N.K.SinhaMohit KeswaniNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Working Capital AnalysisDocument9 pagesWorking Capital AnalysisDr Siddharth DarjiNo ratings yet

- Provisional Financial - Mar 2021Document8 pagesProvisional Financial - Mar 2021Anamika NandiNo ratings yet

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocument2 pagesData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesPraful ThakreNo ratings yet

- Cma Ms K.K. EngineeringDocument10 pagesCma Ms K.K. EngineeringamanhyficNo ratings yet

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- Frs Project - Tata Steel AnalysisDocument12 pagesFrs Project - Tata Steel AnalysisSubhasish mahapatraNo ratings yet

- HTTP WWW - MoneycontrolDocument1 pageHTTP WWW - MoneycontrolPavan PoliNo ratings yet

- DheeshikaDocument1 pageDheeshikaYazh EnterpriseNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!Sandeep Kumar SawNo ratings yet

- CalculationDocument14 pagesCalculationSanjeev JhaNo ratings yet

- BST PROJECT FileDocument5 pagesBST PROJECT FileAR MASTERRNo ratings yet

- Asus Laptop2 Invoice Ganesh Prasad HDocument1 pageAsus Laptop2 Invoice Ganesh Prasad HganeshNo ratings yet

- Development Activities in 2010 - Department of IndustriesDocument17 pagesDevelopment Activities in 2010 - Department of IndustriesMuralideoNo ratings yet

- Cairna 1Document1 pageCairna 1Sai Ram BachuNo ratings yet

- Cairn PDFDocument1 pageCairn PDFSai Ram BachuNo ratings yet

- Company Info - Print FinancialsDocument1 pageCompany Info - Print FinancialsSanjay RanaNo ratings yet

- RC 2Document4 pagesRC 2Golden Mandhir Retail Private LimitedNo ratings yet

- Balance Sheet of JSLDocument2 pagesBalance Sheet of JSLmail2jimmiNo ratings yet

- Allocation Analysis-13-11-2023-08-08-56Document49 pagesAllocation Analysis-13-11-2023-08-08-56fortune144370No ratings yet

- Andhra Bank: Welcomes Press MeetDocument23 pagesAndhra Bank: Welcomes Press Meetrahul3678No ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANENo ratings yet

- Balance SheetDocument2 pagesBalance Sheetprathamesh tawareNo ratings yet

- Corporate Finance: Assignment - 1Document12 pagesCorporate Finance: Assignment - 1Ashutosh SharmaNo ratings yet

- Renewal Premium Receipt: Zindagi Ke Saath Bhi, Zindagi Ke Baad BhiDocument1 pageRenewal Premium Receipt: Zindagi Ke Saath Bhi, Zindagi Ke Baad BhiDasari ArunaNo ratings yet

- Asset Liability Management at HDFC BankDocument31 pagesAsset Liability Management at HDFC BankwebstdsnrNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Notes On Business Law - SecuritiesDocument8 pagesNotes On Business Law - SecuritiesNovelyn DuyoganNo ratings yet

- Free Cash Flow Estimate (In INR CR.)Document8 pagesFree Cash Flow Estimate (In INR CR.)abhiNo ratings yet

- MKT 670 - Chapter 1Document44 pagesMKT 670 - Chapter 1Leo AdamNo ratings yet

- Invest Like KYYDocument279 pagesInvest Like KYYiman aqifNo ratings yet

- How Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierDocument5 pagesHow Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierVictor Huaranga CoronadoNo ratings yet

- MacroPru Twitlog Annual - March 2014Document365 pagesMacroPru Twitlog Annual - March 2014Prudence MacroNo ratings yet

- Form Adv - March 2024Document44 pagesForm Adv - March 2024api-292394686No ratings yet

- CPRX Enero 2021 VDocument3 pagesCPRX Enero 2021 VAlejandro MNo ratings yet

- Media Nusantara Citra TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMedia Nusantara Citra TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Swot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesDocument4 pagesSwot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesAnooja SajeevNo ratings yet

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- 192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Document1 page192.168.9.12 Techexcel Railo Tomcat Webapps ROOT Reports History PDF 84 001088 24072023 11485151584670 114955Arjun LoharNo ratings yet

- Greetings For The Day.: Regards, Saahil KinkhabwalaDocument3 pagesGreetings For The Day.: Regards, Saahil Kinkhabwalasaahil kinkhabwalaNo ratings yet

- For AggrtradeDocument12 pagesFor Aggrtradehuho hoNo ratings yet

- Chap 7Document63 pagesChap 7Avanish VermaNo ratings yet

- Andrews' PitchforkDocument23 pagesAndrews' PitchforkDoug Arth89% (9)

- Impact of FII On Indian EconomyStock MarketDocument5 pagesImpact of FII On Indian EconomyStock MarketInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Preference of Salaried Class On Various Investment Options Available To The 4Document20 pagesPreference of Salaried Class On Various Investment Options Available To The 4Technology TipsNo ratings yet

- BFC5935 Portfolio Management and TheoryDocument36 pagesBFC5935 Portfolio Management and TheoryAlex YisnNo ratings yet

- Monetary or Non-Monetary - CPDbox - Making IFRS EasyDocument97 pagesMonetary or Non-Monetary - CPDbox - Making IFRS EasyRachelle Anne M PardeñoNo ratings yet

- Institutional Trading UrviDocument4 pagesInstitutional Trading UrviSunil JatharNo ratings yet

- IPO - Employee Dos DontsDocument4 pagesIPO - Employee Dos DontsSampada GovekarNo ratings yet

- Multiples HistoryDocument8 pagesMultiples HistoryСеня ПетренкоNo ratings yet

- Financial Statement Analysis (Fsa)Document32 pagesFinancial Statement Analysis (Fsa)Shashank100% (1)

- L5 Liquidity Risk - 20220216Document40 pagesL5 Liquidity Risk - 20220216Marcus WongNo ratings yet

- Chapter 5 IFDocument48 pagesChapter 5 IFcuteserese roseNo ratings yet

- COA Unit 4 Amalgamation ProblemsDocument7 pagesCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNo ratings yet