Professional Documents

Culture Documents

Essentials of Financial Management (1) (1)

Essentials of Financial Management (1) (1)

Uploaded by

tilak kumar vadapalliCopyright:

Available Formats

You might also like

- Tutor Notes: CIPS Level 4 Diploma in Procurement and SupplyDocument20 pagesTutor Notes: CIPS Level 4 Diploma in Procurement and SupplyAlaeldin Amir100% (4)

- Student Handbook ACC3015 2018 - 19 DLDocument123 pagesStudent Handbook ACC3015 2018 - 19 DLThara DasanayakaNo ratings yet

- 2292 Crisis CaseDocument19 pages2292 Crisis Caseapi-582414624No ratings yet

- Exercise 2: X TFC TPP APP MPP TV C AVC MC AFC ATCDocument2 pagesExercise 2: X TFC TPP APP MPP TV C AVC MC AFC ATCrico enteroneNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- New Course Outline - Corporate FinanceDocument4 pagesNew Course Outline - Corporate Financeraju kumarNo ratings yet

- Financial Management SyllabusDocument13 pagesFinancial Management Syllabusharshgupta.16018No ratings yet

- School: Batch: 2018-20 Program: Mba Current Academic Year: 2019 Branch: Semester: IIDocument4 pagesSchool: Batch: 2018-20 Program: Mba Current Academic Year: 2019 Branch: Semester: IIparas pantNo ratings yet

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNo ratings yet

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanNo ratings yet

- Acc 202Document25 pagesAcc 202herueuxNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- MBBA128L - Basic Financial AccountingDocument4 pagesMBBA128L - Basic Financial AccountingAashna AhujaNo ratings yet

- FM108 Prelim HandoutsDocument8 pagesFM108 Prelim HandoutsKarl Dennis TiansayNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- File 1647930802 0007971 CorporateFinance-SyllabusDocument3 pagesFile 1647930802 0007971 CorporateFinance-SyllabusTanya gargNo ratings yet

- CF - SyllabusDocument5 pagesCF - SyllabusRishabhNo ratings yet

- MGT 401Document6 pagesMGT 401Ali Akbar MalikNo ratings yet

- TLEP AFM Batch-2022-24Document26 pagesTLEP AFM Batch-2022-24Devesh YadavNo ratings yet

- H11FM RebrandDocument9 pagesH11FM Rebrandrajbhandarisamyukta03No ratings yet

- Masters of Business Administration: (Financial Strategy and Policy)Document12 pagesMasters of Business Administration: (Financial Strategy and Policy)Tanveer AhmedNo ratings yet

- Saintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914Document7 pagesSaintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914SNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- FInancial Management1 - PrelimDocument52 pagesFInancial Management1 - PrelimEscalante, Alliah S.No ratings yet

- BUS 230 Intro To Finance Begrakyan Fall 2022 BDocument11 pagesBUS 230 Intro To Finance Begrakyan Fall 2022 BOvsanna HovhannisyanNo ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementisamad820No ratings yet

- Basic AccountingDocument5 pagesBasic AccountingSougata SamadderNo ratings yet

- Shikha - Bhatia@imi - Edu: Page 1 of 6Document6 pagesShikha - Bhatia@imi - Edu: Page 1 of 6Daksh AnejaNo ratings yet

- A2 1StrategicCorporatefinanceDocument187 pagesA2 1StrategicCorporatefinanceMANIRAGABA Alphonse100% (1)

- Financial Accounting: Type of Course: Course Duration: Exam Date: Prof. Varadraj BapatDocument1 pageFinancial Accounting: Type of Course: Course Duration: Exam Date: Prof. Varadraj Bapatpritam BhowmikNo ratings yet

- Lect Plan Financial ManagementDocument4 pagesLect Plan Financial Managementlokesh_arya1No ratings yet

- Financial Management: Week 1Document314 pagesFinancial Management: Week 1Hien NguyenNo ratings yet

- SMS MBA FT&PT Syllabus 2021 2 1 1Document20 pagesSMS MBA FT&PT Syllabus 2021 2 1 1Jerom JosephNo ratings yet

- SyllabusDocument2 pagesSyllabusNitin DNo ratings yet

- Intermediate Financial Accounting IntroductionDocument14 pagesIntermediate Financial Accounting Introductionyicunz8No ratings yet

- FM Pgpwe 2024Document4 pagesFM Pgpwe 2024ANKIT SHARMANo ratings yet

- Financial Manamegent Prelim ModuleDocument52 pagesFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- IRLL Course File 2023Document14 pagesIRLL Course File 2023Hema LathaNo ratings yet

- 1MIE21Document1 page1MIE21sibi chandanNo ratings yet

- 19MST22Document1 page19MST22sibi chandanNo ratings yet

- H11FMDocument9 pagesH11FMsimlaislamNo ratings yet

- Afm-Class - 1Document19 pagesAfm-Class - 1Anil SharmaNo ratings yet

- FA - SNU - Course Outline - Monsoon 2023Document6 pagesFA - SNU - Course Outline - Monsoon 2023heycontigo186No ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- MCOM2001 Managerial Decisions AccountingDocument241 pagesMCOM2001 Managerial Decisions AccountingspymeherNo ratings yet

- Business Finance Course Outline 2020 - 2021Document4 pagesBusiness Finance Course Outline 2020 - 2021lindamaameesiquansahNo ratings yet

- Financial Accounting Course Outline Fall 2023-Undergraduate LevelDocument6 pagesFinancial Accounting Course Outline Fall 2023-Undergraduate LevelUmer SiddiquiNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- ACCT2121 Ch1Document32 pagesACCT2121 Ch1johannachannnnnnNo ratings yet

- RS Financial ManagementDocument139 pagesRS Financial ManagementVishwas ShettyNo ratings yet

- Course Outline FM 2 (1.5)Document5 pagesCourse Outline FM 2 (1.5)KaranNo ratings yet

- ACCT224 Course Outline Term 1 AY2022-23Document12 pagesACCT224 Course Outline Term 1 AY2022-23yong kianNo ratings yet

- Sem 1Document32 pagesSem 1yolosNo ratings yet

- Management AccountingDocument3 pagesManagement AccountingC ANo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Strategic Management-IENT2011-UG IV SemDocument2 pagesStrategic Management-IENT2011-UG IV Semkanagala PoojithaNo ratings yet

- BCOM Syllabus Session 2023-24 VI SemesterDocument12 pagesBCOM Syllabus Session 2023-24 VI Semesteraizah25102000No ratings yet

- Course Pack-FM (2021) (Copy)Document131 pagesCourse Pack-FM (2021) (Copy)lakshaypopli9No ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- Financial MGTDocument179 pagesFinancial MGTyogeshjadhav333No ratings yet

- Bba III Sem SyllabusDocument13 pagesBba III Sem SyllabusaromoishaNo ratings yet

- FIN301 - Financial ManagementDocument8 pagesFIN301 - Financial ManagementSHANILA AHMED KHANNo ratings yet

- WCM in Jocil - Siva Teja BonalDocument113 pagesWCM in Jocil - Siva Teja Bonaltilak kumar vadapalliNo ratings yet

- 13 Full Mock Test of ManagementDocument295 pages13 Full Mock Test of Managementtilak kumar vadapalliNo ratings yet

- Ulip ProjectDocument31 pagesUlip Projecttilak kumar vadapalliNo ratings yet

- Lecture 1 UHV 2022Document11 pagesLecture 1 UHV 2022tilak kumar vadapalliNo ratings yet

- UHV ManualDocument52 pagesUHV Manualtilak kumar vadapalliNo ratings yet

- Unit-6 Management Complete NotesDocument78 pagesUnit-6 Management Complete Notestilak kumar vadapalli100% (1)

- Co-Po B2 Ehs405Document9 pagesCo-Po B2 Ehs405tilak kumar vadapalliNo ratings yet

- Engineering InsuranceDocument18 pagesEngineering Insurancetilak kumar vadapalliNo ratings yet

- Lecture 2 UHV 2022Document32 pagesLecture 2 UHV 2022tilak kumar vadapalliNo ratings yet

- Claim SettlementDocument10 pagesClaim Settlementtilak kumar vadapalliNo ratings yet

- Logical Reasoning BookDocument192 pagesLogical Reasoning Booktilak kumar vadapalliNo ratings yet

- Co-Po Format B10 EHS405Document12 pagesCo-Po Format B10 EHS405tilak kumar vadapalliNo ratings yet

- Set 4 Business Stats MaDocument2 pagesSet 4 Business Stats Matilak kumar vadapalliNo ratings yet

- Unit 3 EdDocument14 pagesUnit 3 Edtilak kumar vadapalliNo ratings yet

- Systematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market TimingDocument4 pagesSystematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market Timingtilak kumar vadapalliNo ratings yet

- Reading Passage For Ugc Net Paper-1Document52 pagesReading Passage For Ugc Net Paper-1tilak kumar vadapalliNo ratings yet

- A Literature Review On Investors Perception TowarDocument227 pagesA Literature Review On Investors Perception Towartilak kumar vadapalliNo ratings yet

- Statistics Assignment - COURSERADocument2 pagesStatistics Assignment - COURSERAtilak kumar vadapalliNo ratings yet

- Unit IV-NewDocument13 pagesUnit IV-Newtilak kumar vadapalliNo ratings yet

- Concept Map 9Document2 pagesConcept Map 9Alyssa Abbas DiatorNo ratings yet

- Changing: WorkplaceDocument241 pagesChanging: Workplaceapi-243366401No ratings yet

- Profit and LossDocument29 pagesProfit and LossOmkar MandalNo ratings yet

- P3M3 - Project Management Self-AssessmentDocument22 pagesP3M3 - Project Management Self-AssessmentVật Tư Trực TuyếnNo ratings yet

- Jsa For Admin BuildingDocument5 pagesJsa For Admin Buildingmohamed yasinNo ratings yet

- Tender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsDocument39 pagesTender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsState House Kenya33% (3)

- F2 Mha Mock 3Document12 pagesF2 Mha Mock 3Annas SaeedNo ratings yet

- Financial Results For The Year 2019 20Document35 pagesFinancial Results For The Year 2019 20Akshaya SwaminathanNo ratings yet

- 2021 FRANE Scholarship Winners Press Release 1Document2 pages2021 FRANE Scholarship Winners Press Release 1Aiden RiveraNo ratings yet

- Artificial Intelligence Made Simple - Why I Write and My 20 Year PlanDocument3 pagesArtificial Intelligence Made Simple - Why I Write and My 20 Year PlanLucas CensiNo ratings yet

- Critical Spares 3Document3 pagesCritical Spares 3mdkhandaveNo ratings yet

- MB 310 DumpsDocument27 pagesMB 310 DumpsbhupathireddyNo ratings yet

- Analytics-Translator-The-New-Must-Have-Role (McKinsey 2018)Document4 pagesAnalytics-Translator-The-New-Must-Have-Role (McKinsey 2018)Enrique BoresNo ratings yet

- Hossam Hamida Operations Manager ResumeDocument7 pagesHossam Hamida Operations Manager ResumedreyesfinuliarNo ratings yet

- Risk Assessment and Opportunity Assessment Matrix TableDocument1 pageRisk Assessment and Opportunity Assessment Matrix TableWin AsharNo ratings yet

- 5568 Digit UniliverDocument30 pages5568 Digit UniliverAhsinNo ratings yet

- Exercise 1 3 Chapter 2Document2 pagesExercise 1 3 Chapter 2Riza Mae AlceNo ratings yet

- Ppe ChecklistDocument1 pagePpe ChecklistIvan BaraćNo ratings yet

- NegotiationDocument29 pagesNegotiationNina LeeNo ratings yet

- Bosch 10 Years Motor Warranty Vacuum CleanersDocument244 pagesBosch 10 Years Motor Warranty Vacuum CleanersأنيسNo ratings yet

- KayOne Corporate ProfileDocument13 pagesKayOne Corporate ProfileKayOne ConsultingNo ratings yet

- PP Master 2010.12.08Document94 pagesPP Master 2010.12.08PRODUSINo ratings yet

- Synopsis Sagar Project - A Study On The Need of CRM in OrganizatonDocument3 pagesSynopsis Sagar Project - A Study On The Need of CRM in OrganizatonViraja GuruNo ratings yet

- Costing Methods LMS UEWDocument17 pagesCosting Methods LMS UEWPrince Nanaba EphsonNo ratings yet

- Gazette Notice Audit Committees For County Government Vol - CXVIII No - .40Document22 pagesGazette Notice Audit Committees For County Government Vol - CXVIII No - .40REJAY89No ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Researcher To Entrepreneur!: K.C.ByronDocument31 pagesResearcher To Entrepreneur!: K.C.Byronbrian aguilarNo ratings yet

Essentials of Financial Management (1) (1)

Essentials of Financial Management (1) (1)

Uploaded by

tilak kumar vadapalliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Essentials of Financial Management (1) (1)

Essentials of Financial Management (1) (1)

Uploaded by

tilak kumar vadapalliCopyright:

Available Formats

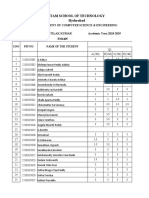

School of Business, GITAM Deemed to be University

ESSENTIALS OF L T P S J C

FINA 2001 FINANCIAL MANAGEMENT

3 0 0 0 0 3

Pre-requisite financial accounting and analysis, cost and management accounting

Co-requisite NONE

Preferable NONE

exposure

Course Description:

Finance is the life blood of the business. Financial Management is one of the key areas of

management. This Course helps in understanding of the fundamentals of financial management

in terms of investment; financing and dividend policy. This course is designed to familiarize the

students with the basic concepts and practices of Financial Management.

Course Educational Objectives:

1. To familiarize the students with the basic concepts of Financial Management.

2. To give thorough understanding of the practices of basic Financial Management

3.

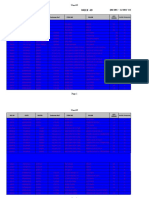

UNIT 1 Financial Management - An Introduction 8 hours

Meaning and Definition of financial Management, Goals of Financial Management, Finance

Functions, Organisation of finance function, Interface between Finance and other business

functions, Financial Planning, Steps in Financial Planning, Factors Affecting Financial Plans,

Time Value of Money.

UNIT 2 Investment Decisions 8 hours

Introduction to Capital Budgeting, Importance of capital Budgeting, Capital Budgeting

Process, Techniques of Capital Budgeting - Accounting Rate of Return, Pay Back Period, Net

Present Value, Internal Rate of Return and Profitability Index.

BBA, w.e.f 21-22 admitted batch

School of Business, GITAM Deemed to be University

UNIT 3 Financing Decisions 8 hours

Cost of Capital - Cost of Debt, Cost of Preference Shares, Cost of Equity Shares, Cost of Retained

Earnings, Weighted Average Cost of Capital; Leverages – Introduction – Types of Leverages –

Measurement of Operating Leverage, Financial Leverage and Combined Leverage ; Capital

Structure – Introduction, Features of Ideal Capital Structure, Factors affecting Capital Structure,

Theories of Capital Structure - Net Income Approach, Net Operating Income Approach, Modigliani

and Miller Approach and Traditional Approach

UNIT 4 Working Capital Management 8 hours

Introduction – Concepts of Working Capital, Objective of Working Capital Management,

Need for Working Capital, Operating Cycle, Determinants of Working Capital, Estimation of

Working Capital.

UNIT 5 Dividend Decisions 8 hours

Introduction, Forms of Dividends, Types of Dividend Policies, determinants of Dividend Policy -

Theories of Dividend Policy - Walter Model, Gordon Model, Modigliani and Miller Model – Bonus

Shares and Stock Split – Legal, procedural and Tax Aspects of Dividend Policy.

Text Books:

1.R.K. Sharma &Shashi K. Gupta(2014),Financial Management.Ludhiana:Kalyani Publications.

References:

1. I.M. Pandey (2010),Financial Management,NewDelhi:Vikas Publications.

2. M.Y. Khan & P.K. Jain. (2013), Financial Management.New Delhi: Tata McGraw Hill

Course Outcomes:

On completing this course, the student will be able to:

● Students can make optimum decisions pertaining to raising funds, making investments

and managing the assets of a corporation, big or small.

● Students learn to manage finances with the ultimate goal of creating value.

● Students can perform working capital management.

● Students can execute dividend decisions and can design a dividend policy.

● Students can take financial decisions and design financial strategies.

BBA, w.e.f 21-22 admitted batch

School of Business, GITAM Deemed to be University

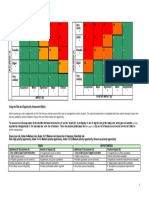

CO-PO Mapping:

PO1 PO2 PO3 PO4 PO5 PO6 PO7 PS01 PSO2 PSO3 PSO4

CO1 1 0 0 0 0 0 0 1 0

CO2 1 2 0 1 0 0 0 1 1

CO3 2 2 3 2 1 0 0 2 1

CO4 3 2 2 1 1 0 0 2 1

CO5 3 2 2 1 1 0 0 2 1

Note: 1 - Low Correlation 2 - Medium Correlation 3 - High Correlation

APPROVED IN:

BOS :28TH APRIL, 2021 ACADEMIC COUNCIL: 1ST APRIL, 2022

SDG No. & Statement:

GOAL 4: Quality Education

SDG Justification:

Quality Education: Students will be learning about the recent updates of Accounting & Finance with

special reference to Performance Management Concepts Strategic Level papers.

BBA, w.e.f 21-22 admitted batch

You might also like

- Tutor Notes: CIPS Level 4 Diploma in Procurement and SupplyDocument20 pagesTutor Notes: CIPS Level 4 Diploma in Procurement and SupplyAlaeldin Amir100% (4)

- Student Handbook ACC3015 2018 - 19 DLDocument123 pagesStudent Handbook ACC3015 2018 - 19 DLThara DasanayakaNo ratings yet

- 2292 Crisis CaseDocument19 pages2292 Crisis Caseapi-582414624No ratings yet

- Exercise 2: X TFC TPP APP MPP TV C AVC MC AFC ATCDocument2 pagesExercise 2: X TFC TPP APP MPP TV C AVC MC AFC ATCrico enteroneNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- New Course Outline - Corporate FinanceDocument4 pagesNew Course Outline - Corporate Financeraju kumarNo ratings yet

- Financial Management SyllabusDocument13 pagesFinancial Management Syllabusharshgupta.16018No ratings yet

- School: Batch: 2018-20 Program: Mba Current Academic Year: 2019 Branch: Semester: IIDocument4 pagesSchool: Batch: 2018-20 Program: Mba Current Academic Year: 2019 Branch: Semester: IIparas pantNo ratings yet

- Scope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnDocument4 pagesScope & Objective of The Course: Analysis of Cost and Key Factors To Optimize ReturnPrabhjeet KalsiNo ratings yet

- Course Outline Financial Management-2018-19Document4 pagesCourse Outline Financial Management-2018-19Jayesh MahajanNo ratings yet

- Acc 202Document25 pagesAcc 202herueuxNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- MBBA128L - Basic Financial AccountingDocument4 pagesMBBA128L - Basic Financial AccountingAashna AhujaNo ratings yet

- FM108 Prelim HandoutsDocument8 pagesFM108 Prelim HandoutsKarl Dennis TiansayNo ratings yet

- FINF315 FinManDocument4 pagesFINF315 FinManYash BhardwajNo ratings yet

- File 1647930802 0007971 CorporateFinance-SyllabusDocument3 pagesFile 1647930802 0007971 CorporateFinance-SyllabusTanya gargNo ratings yet

- CF - SyllabusDocument5 pagesCF - SyllabusRishabhNo ratings yet

- MGT 401Document6 pagesMGT 401Ali Akbar MalikNo ratings yet

- TLEP AFM Batch-2022-24Document26 pagesTLEP AFM Batch-2022-24Devesh YadavNo ratings yet

- H11FM RebrandDocument9 pagesH11FM Rebrandrajbhandarisamyukta03No ratings yet

- Masters of Business Administration: (Financial Strategy and Policy)Document12 pagesMasters of Business Administration: (Financial Strategy and Policy)Tanveer AhmedNo ratings yet

- Saintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914Document7 pagesSaintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914SNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- FInancial Management1 - PrelimDocument52 pagesFInancial Management1 - PrelimEscalante, Alliah S.No ratings yet

- BUS 230 Intro To Finance Begrakyan Fall 2022 BDocument11 pagesBUS 230 Intro To Finance Begrakyan Fall 2022 BOvsanna HovhannisyanNo ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- Financial ManagementDocument7 pagesFinancial Managementisamad820No ratings yet

- Basic AccountingDocument5 pagesBasic AccountingSougata SamadderNo ratings yet

- Shikha - Bhatia@imi - Edu: Page 1 of 6Document6 pagesShikha - Bhatia@imi - Edu: Page 1 of 6Daksh AnejaNo ratings yet

- A2 1StrategicCorporatefinanceDocument187 pagesA2 1StrategicCorporatefinanceMANIRAGABA Alphonse100% (1)

- Financial Accounting: Type of Course: Course Duration: Exam Date: Prof. Varadraj BapatDocument1 pageFinancial Accounting: Type of Course: Course Duration: Exam Date: Prof. Varadraj Bapatpritam BhowmikNo ratings yet

- Lect Plan Financial ManagementDocument4 pagesLect Plan Financial Managementlokesh_arya1No ratings yet

- Financial Management: Week 1Document314 pagesFinancial Management: Week 1Hien NguyenNo ratings yet

- SMS MBA FT&PT Syllabus 2021 2 1 1Document20 pagesSMS MBA FT&PT Syllabus 2021 2 1 1Jerom JosephNo ratings yet

- SyllabusDocument2 pagesSyllabusNitin DNo ratings yet

- Intermediate Financial Accounting IntroductionDocument14 pagesIntermediate Financial Accounting Introductionyicunz8No ratings yet

- FM Pgpwe 2024Document4 pagesFM Pgpwe 2024ANKIT SHARMANo ratings yet

- Financial Manamegent Prelim ModuleDocument52 pagesFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- IRLL Course File 2023Document14 pagesIRLL Course File 2023Hema LathaNo ratings yet

- 1MIE21Document1 page1MIE21sibi chandanNo ratings yet

- 19MST22Document1 page19MST22sibi chandanNo ratings yet

- H11FMDocument9 pagesH11FMsimlaislamNo ratings yet

- Afm-Class - 1Document19 pagesAfm-Class - 1Anil SharmaNo ratings yet

- FA - SNU - Course Outline - Monsoon 2023Document6 pagesFA - SNU - Course Outline - Monsoon 2023heycontigo186No ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- MCOM2001 Managerial Decisions AccountingDocument241 pagesMCOM2001 Managerial Decisions AccountingspymeherNo ratings yet

- Business Finance Course Outline 2020 - 2021Document4 pagesBusiness Finance Course Outline 2020 - 2021lindamaameesiquansahNo ratings yet

- Financial Accounting Course Outline Fall 2023-Undergraduate LevelDocument6 pagesFinancial Accounting Course Outline Fall 2023-Undergraduate LevelUmer SiddiquiNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- ACCT2121 Ch1Document32 pagesACCT2121 Ch1johannachannnnnnNo ratings yet

- RS Financial ManagementDocument139 pagesRS Financial ManagementVishwas ShettyNo ratings yet

- Course Outline FM 2 (1.5)Document5 pagesCourse Outline FM 2 (1.5)KaranNo ratings yet

- ACCT224 Course Outline Term 1 AY2022-23Document12 pagesACCT224 Course Outline Term 1 AY2022-23yong kianNo ratings yet

- Sem 1Document32 pagesSem 1yolosNo ratings yet

- Management AccountingDocument3 pagesManagement AccountingC ANo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Strategic Management-IENT2011-UG IV SemDocument2 pagesStrategic Management-IENT2011-UG IV Semkanagala PoojithaNo ratings yet

- BCOM Syllabus Session 2023-24 VI SemesterDocument12 pagesBCOM Syllabus Session 2023-24 VI Semesteraizah25102000No ratings yet

- Course Pack-FM (2021) (Copy)Document131 pagesCourse Pack-FM (2021) (Copy)lakshaypopli9No ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- Financial MGTDocument179 pagesFinancial MGTyogeshjadhav333No ratings yet

- Bba III Sem SyllabusDocument13 pagesBba III Sem SyllabusaromoishaNo ratings yet

- FIN301 - Financial ManagementDocument8 pagesFIN301 - Financial ManagementSHANILA AHMED KHANNo ratings yet

- WCM in Jocil - Siva Teja BonalDocument113 pagesWCM in Jocil - Siva Teja Bonaltilak kumar vadapalliNo ratings yet

- 13 Full Mock Test of ManagementDocument295 pages13 Full Mock Test of Managementtilak kumar vadapalliNo ratings yet

- Ulip ProjectDocument31 pagesUlip Projecttilak kumar vadapalliNo ratings yet

- Lecture 1 UHV 2022Document11 pagesLecture 1 UHV 2022tilak kumar vadapalliNo ratings yet

- UHV ManualDocument52 pagesUHV Manualtilak kumar vadapalliNo ratings yet

- Unit-6 Management Complete NotesDocument78 pagesUnit-6 Management Complete Notestilak kumar vadapalli100% (1)

- Co-Po B2 Ehs405Document9 pagesCo-Po B2 Ehs405tilak kumar vadapalliNo ratings yet

- Engineering InsuranceDocument18 pagesEngineering Insurancetilak kumar vadapalliNo ratings yet

- Lecture 2 UHV 2022Document32 pagesLecture 2 UHV 2022tilak kumar vadapalliNo ratings yet

- Claim SettlementDocument10 pagesClaim Settlementtilak kumar vadapalliNo ratings yet

- Logical Reasoning BookDocument192 pagesLogical Reasoning Booktilak kumar vadapalliNo ratings yet

- Co-Po Format B10 EHS405Document12 pagesCo-Po Format B10 EHS405tilak kumar vadapalliNo ratings yet

- Set 4 Business Stats MaDocument2 pagesSet 4 Business Stats Matilak kumar vadapalliNo ratings yet

- Unit 3 EdDocument14 pagesUnit 3 Edtilak kumar vadapalliNo ratings yet

- Systematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market TimingDocument4 pagesSystematic Transfer Plan (STP) : An Alternative Investment Strategy To Reduce Risk of Market Timingtilak kumar vadapalliNo ratings yet

- Reading Passage For Ugc Net Paper-1Document52 pagesReading Passage For Ugc Net Paper-1tilak kumar vadapalliNo ratings yet

- A Literature Review On Investors Perception TowarDocument227 pagesA Literature Review On Investors Perception Towartilak kumar vadapalliNo ratings yet

- Statistics Assignment - COURSERADocument2 pagesStatistics Assignment - COURSERAtilak kumar vadapalliNo ratings yet

- Unit IV-NewDocument13 pagesUnit IV-Newtilak kumar vadapalliNo ratings yet

- Concept Map 9Document2 pagesConcept Map 9Alyssa Abbas DiatorNo ratings yet

- Changing: WorkplaceDocument241 pagesChanging: Workplaceapi-243366401No ratings yet

- Profit and LossDocument29 pagesProfit and LossOmkar MandalNo ratings yet

- P3M3 - Project Management Self-AssessmentDocument22 pagesP3M3 - Project Management Self-AssessmentVật Tư Trực TuyếnNo ratings yet

- Jsa For Admin BuildingDocument5 pagesJsa For Admin Buildingmohamed yasinNo ratings yet

- Tender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsDocument39 pagesTender No. SH/014/2017-2019 For Supply of Seeds, Farm Inputs and ImplementsState House Kenya33% (3)

- F2 Mha Mock 3Document12 pagesF2 Mha Mock 3Annas SaeedNo ratings yet

- Financial Results For The Year 2019 20Document35 pagesFinancial Results For The Year 2019 20Akshaya SwaminathanNo ratings yet

- 2021 FRANE Scholarship Winners Press Release 1Document2 pages2021 FRANE Scholarship Winners Press Release 1Aiden RiveraNo ratings yet

- Artificial Intelligence Made Simple - Why I Write and My 20 Year PlanDocument3 pagesArtificial Intelligence Made Simple - Why I Write and My 20 Year PlanLucas CensiNo ratings yet

- Critical Spares 3Document3 pagesCritical Spares 3mdkhandaveNo ratings yet

- MB 310 DumpsDocument27 pagesMB 310 DumpsbhupathireddyNo ratings yet

- Analytics-Translator-The-New-Must-Have-Role (McKinsey 2018)Document4 pagesAnalytics-Translator-The-New-Must-Have-Role (McKinsey 2018)Enrique BoresNo ratings yet

- Hossam Hamida Operations Manager ResumeDocument7 pagesHossam Hamida Operations Manager ResumedreyesfinuliarNo ratings yet

- Risk Assessment and Opportunity Assessment Matrix TableDocument1 pageRisk Assessment and Opportunity Assessment Matrix TableWin AsharNo ratings yet

- 5568 Digit UniliverDocument30 pages5568 Digit UniliverAhsinNo ratings yet

- Exercise 1 3 Chapter 2Document2 pagesExercise 1 3 Chapter 2Riza Mae AlceNo ratings yet

- Ppe ChecklistDocument1 pagePpe ChecklistIvan BaraćNo ratings yet

- NegotiationDocument29 pagesNegotiationNina LeeNo ratings yet

- Bosch 10 Years Motor Warranty Vacuum CleanersDocument244 pagesBosch 10 Years Motor Warranty Vacuum CleanersأنيسNo ratings yet

- KayOne Corporate ProfileDocument13 pagesKayOne Corporate ProfileKayOne ConsultingNo ratings yet

- PP Master 2010.12.08Document94 pagesPP Master 2010.12.08PRODUSINo ratings yet

- Synopsis Sagar Project - A Study On The Need of CRM in OrganizatonDocument3 pagesSynopsis Sagar Project - A Study On The Need of CRM in OrganizatonViraja GuruNo ratings yet

- Costing Methods LMS UEWDocument17 pagesCosting Methods LMS UEWPrince Nanaba EphsonNo ratings yet

- Gazette Notice Audit Committees For County Government Vol - CXVIII No - .40Document22 pagesGazette Notice Audit Committees For County Government Vol - CXVIII No - .40REJAY89No ratings yet

- Cost Notes888Document29 pagesCost Notes888yojNo ratings yet

- Researcher To Entrepreneur!: K.C.ByronDocument31 pagesResearcher To Entrepreneur!: K.C.Byronbrian aguilarNo ratings yet