Professional Documents

Culture Documents

receipt_(25)[1]

receipt_(25)[1]

Uploaded by

AllandexCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

receipt_(25)[1]

receipt_(25)[1]

Uploaded by

AllandexCopyright:

Available Formats

For General Tax Questions

e-Return Acknowledgment Contact KRA Call Centre

Tel: +254 (020) 4999 999

Receipt Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

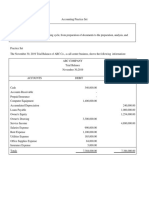

Personal Information and Return Filing Details

PIN A005521926M Return Period 01/01/2023 - 31/12/2023

CHRISPHINE ONYANGO NDIEGE

Name and Address

AHERO, AHERO, Nyando District, 40109, 99.

PIN of Spouse Name of Spouse

N.A N.A

(If Applicable) (If Applicable)

Tax Obligation(Form Income Tax Resident

Original or Amended Original

Name) Individual(IT1)

Station Kisumu Acknowledgement 23/06/2024 14:35:39

Return Number KRA202449347568 Barcode

Return Summary

Sr. No. Particulars Self Amount (Ksh) Spouse Amount (Ksh)

1. Adjusted Taxable Income 0.00 0.00

2. Employment Income 1,050,672.00 0.00

3. Income from Estate(s)/Trust(s) / Settlement(s) 0.00 0.00

4. Gross Total Income 1,050,672.00 0.00

5. Deductions 51,864.85 0.00

6. Taxable Income 998,807.15 0.00

7. Tax Payable 237,042.14 0.00

8. Reliefs 28,800.00 0.00

9. Tax Credits 208,242.05 0.00

10. Tax Due / (Refund Due) 0.10 0.00

11. Tax Due / (Refund Due) (Combined) 0.95

Note : We acknowledge receiving your Return through KRA Web Portal . You can track your status by using search

code from web portal.

Search Code: 310298499757LCV

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- Video Portero VelotiDocument5 pagesVideo Portero Velotijuangamez82No ratings yet

- LLM Ist SEM NOTES - CONSTITUTIONAL LAW - IDocument72 pagesLLM Ist SEM NOTES - CONSTITUTIONAL LAW - Imohdkhalid74-1100% (5)

- Equipment Transfer Agreement TemplateDocument3 pagesEquipment Transfer Agreement TemplateNicole Santoalla0% (2)

- Receipt - 2024-06-17T135725.746Document1 pageReceipt - 2024-06-17T135725.746shelmith cyberNo ratings yet

- ReceiptDocument1 pageReceipttoroitich Titus markNo ratings yet

- ReceiptDocument1 pageReceiptfastweb cyberNo ratings yet

- Receipt - 2024-06-17T160151.332Document1 pageReceipt - 2024-06-17T160151.332shelmith cyberNo ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- ReceiptDocument1 pageReceiptTitus LeteipaNo ratings yet

- Receipt 7Document1 pageReceipt 7Agnes WanjaNo ratings yet

- NasadDocument1 pageNasadBhonhieNo ratings yet

- receipt - 2024-06-30T141434.530Document1 pagereceipt - 2024-06-30T141434.530ngarijane126No ratings yet

- ReceiptDocument1 pageReceiptdaniel toposNo ratings yet

- Receipt 11Document1 pageReceipt 11zeketechcyberNo ratings yet

- ReceiptDocument1 pageReceiptframkarugahNo ratings yet

- ReceiptDocument1 pageReceiptfastweb cyberNo ratings yet

- Receipt 1Document1 pageReceipt 1geotech cyberNo ratings yet

- ReceiptDocument1 pageReceiptkevin knoxNo ratings yet

- Receipt (45)Document1 pageReceipt (45)toncap enterprisesNo ratings yet

- Kenya Tax ReceiptDocument1 pageKenya Tax ReceiptVictor OsodoNo ratings yet

- receipt (3)Document1 pagereceipt (3)expresstechnologiescyberNo ratings yet

- ReceiptDocument1 pageReceiptnashonochieng28No ratings yet

- Receipt - 2024-06-28T193958.785Document1 pageReceipt - 2024-06-28T193958.785clique cyberNo ratings yet

- receipt (8)Document1 pagereceipt (8)software consultantsNo ratings yet

- ReceiptDocument1 pageReceiptfadhilibenjamin254No ratings yet

- Receipt - 2024-06-17T101630.252Document1 pageReceipt - 2024-06-17T101630.252MARENDE CYBERNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsStephen NjeruNo ratings yet

- Hillan Kipchumba Ronoh's KRA Tax Returns 2022Document1 pageHillan Kipchumba Ronoh's KRA Tax Returns 2022Alvin RoddyNo ratings yet

- ReceiptDocument1 pageReceiptfrankline nyabutoNo ratings yet

- ReceiptDocument1 pageReceiptbondede2023No ratings yet

- KRA202301353274Document1 pageKRA202301353274Musyoka UrbanusNo ratings yet

- Susan Wangu Wachira 2023 RETURNSDocument1 pageSusan Wangu Wachira 2023 RETURNSipadtechcyberNo ratings yet

- Suter AbrahamDocument1 pageSuter Abrahamsuterkirop2No ratings yet

- ReceiptDocument1 pageReceiptErick OgwenoNo ratings yet

- Receipt 8Document1 pageReceipt 8filexwasike001No ratings yet

- Receipt MUNYASYA ELIZABETHDocument1 pageReceipt MUNYASYA ELIZABETHAngellah MutisyaNo ratings yet

- Receipt 20Document1 pageReceipt 20eliphazNo ratings yet

- ReceiptDocument1 pageReceiptDennis MwangiNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptKen NjorogeNo ratings yet

- ReceiptDocument1 pageReceiptsimonpeternekesaNo ratings yet

- KRA202310990621Document1 pageKRA202310990621spandyno1No ratings yet

- ReceiptDocument1 pageReceiptjosepholuyaNo ratings yet

- Receipt (21)Document1 pageReceipt (21)sigeibrian21No ratings yet

- Jane Auma KRA Receipt 2024Document1 pageJane Auma KRA Receipt 2024pyustarsNo ratings yet

- receipt-257Document1 pagereceipt-257ngarijane126No ratings yet

- ReceiptDocument1 pageReceiptMohamed WeyimiNo ratings yet

- receipt (4)Document1 pagereceipt (4)douglasNo ratings yet

- Receipt - 2024-06-30T203949.706Document1 pageReceipt - 2024-06-30T203949.706COUNTY CYBERNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFAnne MainaNo ratings yet

- receipt_(23)[1]Document1 pagereceipt_(23)[1]AllandexNo ratings yet

- receipt-4Document1 pagereceipt-4elmatadoh77No ratings yet

- ReceiptDocument1 pageReceiptmwendwabenjamin431No ratings yet

- NICHOLASDocument1 pageNICHOLASvera atienoNo ratings yet

- receipt - 2024-07-04T083419.373Document1 pagereceipt - 2024-07-04T083419.373morphinekip01No ratings yet

- ReceiptDocument1 pageReceiptjohn belhaNo ratings yet

- receiptDocument1 pagereceiptKelvinNo ratings yet

- ReceiptDocument1 pageReceiptMohamed WeyimiNo ratings yet

- ReceiptDocument1 pageReceiptmoraalinet244No ratings yet

- ReceiptDocument1 pageReceiptRono NicholasNo ratings yet

- Receipt - 2024-06-25T121729.102Document1 pageReceipt - 2024-06-25T121729.102ipadtechcyberNo ratings yet

- E Return Sammy WachiraDocument1 pageE Return Sammy WachiraShortageNo ratings yet

- receipt (4)Document1 pagereceipt (4)josekajos37No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- LogDocument36 pagesLogAndi Nabila RamadhaniNo ratings yet

- G.R. No. 82631 - Southeast Asian Fisheries Development Center VDocument5 pagesG.R. No. 82631 - Southeast Asian Fisheries Development Center VBluebells33No ratings yet

- Readings in RPHDocument10 pagesReadings in RPHEarl Joshua SampagaNo ratings yet

- Weekly Internship Report For 4th WeekDocument5 pagesWeekly Internship Report For 4th WeekWarda Khawar100% (1)

- ABC CompanyDocument11 pagesABC CompanyA DiolataNo ratings yet

- Amicus Curiae Brief NCLA 22-3179Document19 pagesAmicus Curiae Brief NCLA 22-3179LeferianNo ratings yet

- InvestmentDocument24 pagesInvestmentAnadeo Llamas CunialNo ratings yet

- The Bolsheviks and The Chinese Revolution, 1919-1927 by Alexander Pantsov, Review by Gregor BentonDocument4 pagesThe Bolsheviks and The Chinese Revolution, 1919-1927 by Alexander Pantsov, Review by Gregor BentondanielgaidNo ratings yet

- Mark Fisher DialogueDocument13 pagesMark Fisher DialogueEzequiel FanegoNo ratings yet

- Leaflet - HDFC Balanced Advantage Fund - June 2024Document3 pagesLeaflet - HDFC Balanced Advantage Fund - June 2024DeepakNo ratings yet

- G12 Hello Unit 1 Longman Revision Mr. Mohamed El-SheikhDocument7 pagesG12 Hello Unit 1 Longman Revision Mr. Mohamed El-SheikhMohamed RafatNo ratings yet

- Datark (1) (2) (2) (2) (1)Document3 pagesDatark (1) (2) (2) (2) (1)Aly BenNo ratings yet

- The Fathers of The Church. A New Translation. Volume 31.Document408 pagesThe Fathers of The Church. A New Translation. Volume 31.Patrologia Latina, Graeca et Orientalis100% (7)

- ADR Sec 35 - Group 2 Fundamentals of ADR Report (Angiwan, Bandal Sanchez, Sobrevega)Document8 pagesADR Sec 35 - Group 2 Fundamentals of ADR Report (Angiwan, Bandal Sanchez, Sobrevega)Jeanrose B. CarenanNo ratings yet

- Adobe Scan 22-Aug-2023Document1 pageAdobe Scan 22-Aug-2023Er. Sakshi ChauhanNo ratings yet

- Ethics, Fraud, and Internal ControlDocument48 pagesEthics, Fraud, and Internal ControlabmyonisNo ratings yet

- People Vs CaoileDocument13 pagesPeople Vs Caoilezatarra_12No ratings yet

- People vs. KamadDocument2 pagesPeople vs. KamadGia DimayugaNo ratings yet

- Failures TeddyDocument7 pagesFailures Teddysayanroy36No ratings yet

- Galman V Sandiganbayan 144 SCRA 392 (1986)Document1 pageGalman V Sandiganbayan 144 SCRA 392 (1986)Neil bryan MoninioNo ratings yet

- T DocumentDocument54 pagesT DocumentMohd RazaNo ratings yet

- x02 Midterm - BarQ2Document2 pagesx02 Midterm - BarQ2ezmailer75100% (1)

- LEA121 Introduction To Industrial Security ConceptDocument35 pagesLEA121 Introduction To Industrial Security ConceptC-Maine OdaragNo ratings yet

- Business Math Lesson1 Week 3Document6 pagesBusiness Math Lesson1 Week 3REBECCA BRIONES0% (1)

- But The Fruit of The Spirit Is LoveDocument1 pageBut The Fruit of The Spirit Is LovextneNo ratings yet

- Problem Areas in Legal EthicsDocument23 pagesProblem Areas in Legal Ethicsybun0% (1)

- ACC 309 Milestone 2 Management BriefDocument4 pagesACC 309 Milestone 2 Management BriefAngela PerrymanNo ratings yet

![receipt_(23)[1]](https://imgv2-2-f.scribdassets.com/img/document/749071894/149x198/559a7a5655/1720522375?v=1)