Professional Documents

Culture Documents

IFB_OfferPdf (42)

IFB_OfferPdf (42)

Uploaded by

heyitsmeherekkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFB_OfferPdf (42)

IFB_OfferPdf (42)

Uploaded by

heyitsmeherekkCopyright:

Available Formats

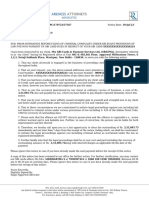

Settlement Letter 08-Jul-24

Borrower Name: V MOHAMMED YASER UPI ID: <LoanNumber>.retail@idfcbank

Address: NO. 12/1, SHEIKH AHMED STREET,MELVISHARAM VELLORE,

VELLORE,TAMIL NADU,632509

INDIA

SUB: Settlement/One Time Settlement (OTS) of your Loan Account No./Nos: 87988391

with erstwhile Capital First Ltd.(now merged with IDFC First Bank Ltd) (herein after referred to as “the Bank”.)

Ref: Your letter No.SET-13408042 dated:08-Jul-24 for Settlement/OTS

Dear Sir/Madam,

With reference to the above, we are pleased to inform you that your request for Settlement/OTS has been approved by the Bank, subject to

following conditions:-

1. You should pay the Settlement /OTS amount of Rs. 30,000.00 (Thirty Thousand Rupees) as per the schedule below.

Due Date Amount

08-Jul-24 30,000.00/-

2. That if the Settlement/OTS amount needs to be made by you in either cheque or by way of demand draft as per schedule above on or before

the date specified (the"Due Date"). Please further note that in the event you fail to deposit the entire sum of Rs. 30,000.00/- on or

before 31-Jul-24, as per schedule above, then this offer shall be deemed to have lapsed and you shall be liable to pay to the Bank such

amounts/sums/charges as may be determined by the Bank in this regard.

3. That the Bank has the right to withdraw the OTS offer if it comes to know subsequently that you have furnished false or misleading or

incorrect or untrue information or any material information having bearing on the OTS decision. The decision of the Bank in this regard shall be

final.

4. That if payment is made by way of Demand Draft/Cheque , the OTS offer would be valid subject to realization of said Draft/Cheque from the

respective bank branch.

Kindly also note that this is a one-time offer, and is without any prejudice to the rights of the Bank under the Agreement(s) that have been

executed between V MOHAMMED YASER and the Bank.

Upon realization of the entire payment, your above Loan account number will stand closed. Any legal case, complaint, notice initiated

by you against the Bank will have to be compulsorily withdrawn. Non withdrawal of such legal case, complaint, notice filed against the

Bank will render this Settlement/One Time Settlement (OTS) letter voidable. The Bank would initiate steps for withdrawal of legal

case(s), if any filed against you.

Please note that under Credit Information Companies (Regulations) Act 2005, information of loan repayment is shared with Credit

Information Companies. Bank categorically appraises the borrower that If the loan dues are paid off under compromise settlement

plan, the status of the borrower shall be displayed as “Settled” in the records of Credit Information Companies which may act as

hindrance in case of any credit assistance is sought by borrower at any future date; alternatively if the loan liability is paid in full then

the status in the records of Credit Information Companies shall be displayed as “Closed”.

In case of any clarification please call on 1860-500-9900 or write to customer.care@idfcfirstbank.com

Yours sincerely,

Name : Veronika M

Emp Id : 176287

Central Team Negotiator - TW

IDFC FIRST Bank Ltd.

This is a system generated letter & does not require signature

IDFC FIRST Bank Limited (formerly IDFC Bank Limited)

IDFC FIRST Bank, 9th Floor, INS Tower, G Block, Bandra Kurla Complex, Mumbai -400051 Tel:+91 22 7132 5500 Fax:+91 22 2654 0354

Registered Office:KRM Towers, 7th Floor, No 1,Harrington Road, Chetpet, Chennai 600031 Tel:+91 44 4564 4000 Fax:+91 44 4564 4022

CIN. L65110TN2014PLC097792 customer.care@idfcfirstbank.com, www.idfcfirstbank.com

You might also like

- Settlement Letter 3359100Document3 pagesSettlement Letter 3359100Mahesh DangodeNo ratings yet

- Project Synopsis - McomDocument15 pagesProject Synopsis - McomICLIPTERNo ratings yet

- Letter PDFDocument3 pagesLetter PDFPalvi SharmaNo ratings yet

- Settlement LetterDocument2 pagesSettlement LetterKirtan PatelNo ratings yet

- SATYA PAL SINGH - Settlement LetterDocument6 pagesSATYA PAL SINGH - Settlement LetterPradeep KapoorNo ratings yet

- HDFC Loan Closure010Document3 pagesHDFC Loan Closure010Aditya Adi Singh100% (1)

- Cash Bean - Pay Day Loan - 190812020137600271 PDFDocument3 pagesCash Bean - Pay Day Loan - 190812020137600271 PDFmanojNo ratings yet

- IFB OfferPdf (38)Document1 pageIFB OfferPdf (38)heyitsmeherekkNo ratings yet

- IFB OfferPdf (40)Document1 pageIFB OfferPdf (40)heyitsmeherekkNo ratings yet

- IFB OfferPdf (41)Document1 pageIFB OfferPdf (41)heyitsmeherekkNo ratings yet

- IFB OfferPdf (39)Document1 pageIFB OfferPdf (39)heyitsmeherekkNo ratings yet

- Nimoju KiranDocument1 pageNimoju KirankirankpsrNo ratings yet

- IFB OfferPdf SumanDocument1 pageIFB OfferPdf Sumansakshisharma4679No ratings yet

- GGJLDocument1 pageGGJLchandan.psdNo ratings yet

- IFB - OfferPdf-ANIL SRIVASTAVADocument1 pageIFB - OfferPdf-ANIL SRIVASTAVAsakshisharma4679No ratings yet

- IFB OfferPdfDocument1 pageIFB OfferPdfgauravraaz7474No ratings yet

- IFB - OfferPdf - 2024-01-31T141948.242Document1 pageIFB - OfferPdf - 2024-01-31T141948.242vighnarthaagency2255No ratings yet

- SD JoinDocument1 pageSD Joinchandan.psdNo ratings yet

- IFB OfferPdf KunalDocument2 pagesIFB OfferPdf KunalKunal ChamoliNo ratings yet

- 48002801 (1)Document1 page48002801 (1)info.sadhikariNo ratings yet

- IFB OfferPdfDocument1 pageIFB OfferPdfsandeshanubhavne1987No ratings yet

- Idfc letterDocument2 pagesIdfc letternagursharief95No ratings yet

- IFB OfferPdf-81222996Document1 pageIFB OfferPdf-81222996dakshinnamaNo ratings yet

- Thir U MuruganDocument2 pagesThir U MuruganthirumuruganNo ratings yet

- Bhgsteg 2532Document1 pageBhgsteg 2532servicewithcare786No ratings yet

- Kamakshi SLDocument2 pagesKamakshi SLPavan KumarNo ratings yet

- People ManagementDocument1 pagePeople Managementtrikha.rajatNo ratings yet

- No Objection Certificate (NOC) - 140428301Document1 pageNo Objection Certificate (NOC) - 140428301Vinay ViniNo ratings yet

- No Objection Certificate (NOC) - 104973833 - 12564910Document1 pageNo Objection Certificate (NOC) - 104973833 - 12564910Amit PrajapatiNo ratings yet

- Legal Notice 1231859 26862565Document2 pagesLegal Notice 1231859 26862565Manthan ShahNo ratings yet

- Satya Noc PDFDocument1 pageSatya Noc PDFpulapa umamaheswara raoNo ratings yet

- Welcome Letter 131706428Document3 pagesWelcome Letter 131706428rupesh.gunjan90823No ratings yet

- SettlementLetter (117) - BRITTODocument2 pagesSettlementLetter (117) - BRITTOadvshahithNo ratings yet

- SanjayDocument1 pageSanjaychandan.psdNo ratings yet

- No Objection Certificate (NOC) - 214646404Document1 pageNo Objection Certificate (NOC) - 214646404sachinkumarmalra792000No ratings yet

- Account Opening Form: Individual Account (Single/Joint)Document5 pagesAccount Opening Form: Individual Account (Single/Joint)Ali ShoaibNo ratings yet

- No Objection Certificate (NOC) - 145947012Document1 pageNo Objection Certificate (NOC) - 145947012sirikrishnaNo ratings yet

- MPDFDocument1 pageMPDFAll India Brahmin MorchaNo ratings yet

- PDFDocument1 pagePDFSandeep RajbharNo ratings yet

- Reply To Loan Recall NoticeDocument3 pagesReply To Loan Recall Noticesomya agarwalNo ratings yet

- HSW7473Document1 pageHSW7473faizanshaikh84548No ratings yet

- Legal Department Delhi Shashi Bhushan KumarDocument1 pageLegal Department Delhi Shashi Bhushan Kumarshivamraj780840100% (1)

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- 146358pre Arbitration B2B B2C - 15 May 2024 - v1Document2 pages146358pre Arbitration B2B B2C - 15 May 2024 - v1advocate572No ratings yet

- Confidential: Aakash KhemDocument1 pageConfidential: Aakash Khemkaushikajay.officialNo ratings yet

- Welcome Letter 193521762Document3 pagesWelcome Letter 193521762Deeptej Singh MatharuNo ratings yet

- HDFC Loan ClosureDocument3 pagesHDFC Loan Closuresantoshkverma1972No ratings yet

- ND THDocument5 pagesND THjyash8475No ratings yet

- No Objection Certificate (NOC) - 140028285Document1 pageNo Objection Certificate (NOC) - 140028285Manoj BishtNo ratings yet

- HDFC Loan ClosureDocument3 pagesHDFC Loan Closuresantoshkverma1972No ratings yet

- Legal Notice 2006397 XXXXXXXXXX6392 PDFDocument2 pagesLegal Notice 2006397 XXXXXXXXXX6392 PDFAyush KumarNo ratings yet

- ND THDocument5 pagesND THjyash8475No ratings yet

- MR Anup Basak Subhaspally W No 8 Kharagpur - WBG - 721301Document1 pageMR Anup Basak Subhaspally W No 8 Kharagpur - WBG - 721301Anup BasakNo ratings yet

- Welcome Letter 162032006Document6 pagesWelcome Letter 162032006faizalkapadia737No ratings yet

- MPDFDocument1 pageMPDFartika.ashuNo ratings yet

- Wa0006.Document1 pageWa0006.ssm.thisaiyanvilaihdbfsNo ratings yet

- Money Transfer Form - NewDocument2 pagesMoney Transfer Form - Newbitane_meNo ratings yet

- Welcome Letter - 40076922 - 20713455Document3 pagesWelcome Letter - 40076922 - 20713455sarathbharathi27No ratings yet

- Settlement Letter 5102053 2023-04-07Document2 pagesSettlement Letter 5102053 2023-04-07Venkatesh DoodamNo ratings yet

- MPDFDocument1 pageMPDFPushpendra YadavNo ratings yet

- Streetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityFrom EverandStreetwise Credit And Collections: Maximize Your Collections Process to Improve Your ProfitabilityRating: 5 out of 5 stars5/5 (1)

- Tugas AKM IIDocument3 pagesTugas AKM IIDaniel TanakaNo ratings yet

- 95th JAIBB LAPBDocument4 pages95th JAIBB LAPBPial122No ratings yet

- Dey's Sample PDF - Economics-XII Exam Handbook 2021-22 - Term-IDocument82 pagesDey's Sample PDF - Economics-XII Exam Handbook 2021-22 - Term-Iicarus falls67% (3)

- Housing FinanceDocument9 pagesHousing FinanceGeri NicoleNo ratings yet

- LLAW2014 QuestionpaperDocument2 pagesLLAW2014 Questionpapercyq200321No ratings yet

- Palma, Ian Jeric MagtalasDocument2 pagesPalma, Ian Jeric MagtalasIan PalmaNo ratings yet

- Business Finance - Loan AmortizationDocument30 pagesBusiness Finance - Loan AmortizationJo HarahNo ratings yet

- Kakaobank: Company PresentationDocument40 pagesKakaobank: Company PresentationKien NguyenNo ratings yet

- AmalgamationDocument3 pagesAmalgamationSowmya Upadhya G SNo ratings yet

- Student LoanDocument4 pagesStudent LoanTejas PotdarNo ratings yet

- Cash BudgetDocument11 pagesCash BudgetDarshan JoshiNo ratings yet

- Internshipprojectreportallahabadbank-170706183254 (1) MMN (6) NMNNJHDocument37 pagesInternshipprojectreportallahabadbank-170706183254 (1) MMN (6) NMNNJHmaheshgutam8756No ratings yet

- Project Finance SCDL Paper Solved Exam Paper - 9Document4 pagesProject Finance SCDL Paper Solved Exam Paper - 9Deepak SinghNo ratings yet

- Casa Mira Iloilo Pricelist v2 SD Only 1st 50 UnitsDocument4 pagesCasa Mira Iloilo Pricelist v2 SD Only 1st 50 UnitsRandy AgotNo ratings yet

- Module 1 - ACCT 4005Document29 pagesModule 1 - ACCT 4005yahye ahmedNo ratings yet

- CALTEX (PHILIPPINES), INC. vs. COURT OF APPEALS & SECURITY BANK & TRUST COMPANYDocument1 pageCALTEX (PHILIPPINES), INC. vs. COURT OF APPEALS & SECURITY BANK & TRUST COMPANYTrudgeOnNo ratings yet

- Domestic-Application-Form Citi Bank OdDocument16 pagesDomestic-Application-Form Citi Bank Odmadhukar sahayNo ratings yet

- Audit of Cash Consolidated Valix ProblemsDocument7 pagesAudit of Cash Consolidated Valix ProblemsJulie Mae Caling MalitNo ratings yet

- ICICI Mortgage PACustomer 7727036138 7 29 2023Document5 pagesICICI Mortgage PACustomer 7727036138 7 29 2023shubhamkumarrajput92No ratings yet

- Chapter 5Document31 pagesChapter 5Emi NguyenNo ratings yet

- US DataDocument44 pagesUS DataFazila KhanNo ratings yet

- Balance Per Books, End. XX XX: Add: Credit Memos (CM)Document7 pagesBalance Per Books, End. XX XX: Add: Credit Memos (CM)Misiah Paradillo JangaoNo ratings yet

- Skill Loan Scheme - Ministry of Skill Development and Entrepreneurship - Goverment of IndiaDocument2 pagesSkill Loan Scheme - Ministry of Skill Development and Entrepreneurship - Goverment of IndiaSailesh NimmagaddaNo ratings yet

- Checkingstatement - 02 10 2023Document4 pagesCheckingstatement - 02 10 2023Super broly Jiren x gogetaNo ratings yet

- Massage Addict Financing Package - RBC 2023Document2 pagesMassage Addict Financing Package - RBC 2023lageishon.mNo ratings yet

- CALILAP-ASMERON Vs DBPDocument1 pageCALILAP-ASMERON Vs DBPMargie Marj Galban100% (1)

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Executive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersDocument43 pagesExecutive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersTabassum Iffat TannieNo ratings yet

- DianaDocument26 pagesDianayogieNo ratings yet