Professional Documents

Culture Documents

Assignment on FS Analysis

Assignment on FS Analysis

Uploaded by

Alyssa M. JamilCopyright:

Available Formats

You might also like

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Revised Accounting 16Document20 pagesRevised Accounting 16Jennifer GarnetteNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Handout ManAcc2 PDFDocument16 pagesHandout ManAcc2 PDFmobylay0% (1)

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- Finance 1Document6 pagesFinance 1cherryannNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- Module 1 - Financial Statement Analysis - P2Document4 pagesModule 1 - Financial Statement Analysis - P2Jose Eduardo GumafelixNo ratings yet

- Forecasting 2Document4 pagesForecasting 2Gva Umayam0% (1)

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Assignment 1Document2 pagesAssignment 1Mitch wongNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- (Ust-Jpia) Acc5115 Ifr Sce and SCF ReviewerDocument5 pages(Ust-Jpia) Acc5115 Ifr Sce and SCF Revieweraly kayleNo ratings yet

- Exercise 10 Statement of Cash Flows - 054935Document3 pagesExercise 10 Statement of Cash Flows - 054935Hoyo VerseNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Managment Accountant ACCOW, OpenT, KPP WBDocument6 pagesManagment Accountant ACCOW, OpenT, KPP WBFarahAin FainNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- TQ in Financial Management (Pre-Final)Document8 pagesTQ in Financial Management (Pre-Final)Christine LealNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Name of Learner: - Grade and Section - Module 2 - Quarter 1 What's inDocument4 pagesName of Learner: - Grade and Section - Module 2 - Quarter 1 What's inErica Cyra IbitaNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- CAG v.11.0 1st Wave QuestionsDocument7 pagesCAG v.11.0 1st Wave QuestionsIan Paolo CaylanNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- Review On FinmanDocument7 pagesReview On FinmanMoira C. VilogNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- 1 - Financial Statement Analysis - QuestionsDocument3 pages1 - Financial Statement Analysis - QuestionsMon RamNo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Gov't Acctg_Solman_C12-16Document57 pagesGov't Acctg_Solman_C12-16Alyssa M. JamilNo ratings yet

- Copy-AUDIT_OF_LIABILITIESDocument21 pagesCopy-AUDIT_OF_LIABILITIESAlyssa M. JamilNo ratings yet

- TABLE 3.F.12. Capital StockDocument1 pageTABLE 3.F.12. Capital StockAlyssa M. JamilNo ratings yet

- IS 22 LessonsDocument14 pagesIS 22 LessonsAlyssa M. JamilNo ratings yet

- Dutch-Bangla Bank Limited Agent Banking DivisionDocument2 pagesDutch-Bangla Bank Limited Agent Banking DivisionAbdul KarimNo ratings yet

- Sbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberDocument1 pageSbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberRaghavendra Rao0% (1)

- PUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIADocument40 pagesPUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIAEstelle Gadia100% (1)

- Coa Lo Doc & CR Rev SheetDocument8 pagesCoa Lo Doc & CR Rev SheetMisc EllaneousNo ratings yet

- Banking Crisis ProjectDocument9 pagesBanking Crisis Projectpanda catNo ratings yet

- Thomas I. Palley (Auth.) - Financialization - The Economics of Finance Capital Domination-Palgrave Macmillan UK (2013)Document238 pagesThomas I. Palley (Auth.) - Financialization - The Economics of Finance Capital Domination-Palgrave Macmillan UK (2013)David KornbluthNo ratings yet

- Bangar Sir Summary PDFDocument172 pagesBangar Sir Summary PDFHimanshu Jeerawala0% (1)

- Lecture No.1 (Intro To Money & Banking)Document17 pagesLecture No.1 (Intro To Money & Banking)Usama MubasherNo ratings yet

- Money The Nature and Function of MoneyDocument9 pagesMoney The Nature and Function of MoneySenelwa AnayaNo ratings yet

- Statement 1553606570215 PDFDocument5 pagesStatement 1553606570215 PDFsonuNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- APT PracticeDocument21 pagesAPT PracticeAyush SinghNo ratings yet

- JAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314Document5 pagesJAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314sushant gawdeNo ratings yet

- Current Macroeconomic and Financial Situation of NepalDocument9 pagesCurrent Macroeconomic and Financial Situation of NepalMonkey.D. LuffyNo ratings yet

- Risk Management: Atty. Fernando S. PeñarroyoDocument48 pagesRisk Management: Atty. Fernando S. PeñarroyoEmmanuel CaguimbalNo ratings yet

- Pandyan Grama Bank Pandyan Grama Bank: IOBA0PGB001) IOBA0PGB001)Document3 pagesPandyan Grama Bank Pandyan Grama Bank: IOBA0PGB001) IOBA0PGB001)Tilak AmmuNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- SoFiMoneyStatement - 2023 12 31Document4 pagesSoFiMoneyStatement - 2023 12 31minhdang03062017No ratings yet

- IX EnglPAPERDocument4 pagesIX EnglPAPERSUNIL KUMARNo ratings yet

- Forex Trading 1Document6 pagesForex Trading 1Pablo Gabrio88% (8)

- RBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFDocument9 pagesRBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFMayank ParekhNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- GboDocument5 pagesGborosechaithuNo ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Alm Guidelines by RBIDocument10 pagesAlm Guidelines by RBIPranav ViraNo ratings yet

- SAP - FICO Course ContentDocument10 pagesSAP - FICO Course Contentchaitanya vutukuriNo ratings yet

- Circular Annual - XIIDocument3 pagesCircular Annual - XIIKrrish AmbwaniNo ratings yet

Assignment on FS Analysis

Assignment on FS Analysis

Uploaded by

Alyssa M. JamilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment on FS Analysis

Assignment on FS Analysis

Uploaded by

Alyssa M. JamilCopyright:

Available Formats

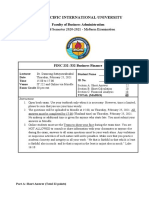

Assignment on FS Analysis:

1. The current assets of Canon Enterprise consists of cash, accounts receivable, and inventory. The following

information is available:

Credit sales 75% of total sales

Inventory turnover 5 times

Working capital P1, 120, 000

Current ratio 2.00 to 1

Quick ratio 1. 25 to 1

Average collection period 42 days

Working days 360

What is the estimated inventory amount: ____________________________________________

2. Selected data from Claudine Company’s year- end financial statements are presented below. The difference

between average and ending inventory is immaterial.

Current ratio 2.0

Quick ratio 1.5

Current liabilities P120,000

Inventory turnover (based on cost of sales) 8 times

Gross profit margin 40 %

Claudine’s net sales for the year were: _______________________________________________

3. Selected information from the accounting records of the Cruise Company is as follows:

Net A/R at December 31, 2020 P 900,000

Net A/R at December 31, 2021 P 1,000,000

Accounts receivable turnover 5 to 1

Inventories at December 31, 2020 P 1, 100,000

Inventories at December 31, 2021 P 1, 200,000

Inventory turnover 4 to 1

What was the gross margin for 2021? _____________________________________

4. Selected financial data of Chiller Corporation for the year ended December 31, 2020 is presented below:

Operating income P900,000

Interest expense (100,000)

Income before income taxes 800,000

Income tax (320,000)

Net income 480,000

Preferred stock dividends (200,000)

Net income available to common stockholders 280,000

Common stock dividends were P120,000. The payout ratio is : ________________________________________

5. The balance sheets of Character Company at the end of each of the first two years of operations indicate the

following:

2020 2019

Total current assets P 600,000 P 560,000

Total investments 60,000 40,000

Total property , plant and equipment 900,000 700,000

Total current liabilities 150,000 80,000

Total long- term liabilities 350,000 250,000

Preferred 9 % stock, P100 par 100,000 100,000

Common stock, P10 par 600,000 600,000

Paid – in capital in excess of par – common stock 60,000 60,000

Retained earnings 300,000 210,000

Net income is P115,000 and interest expense is P30,000 for 2020.

What is the rate earned on total assets for 2010? ______________________________________________

What is the rate earned on stockholders’ equity for 2020? ____________________________________

What is the earning per share on common stock for 2020? ___________________________________

If the market price is P30, what is the price- earnings ratio on common stock for 2020? ________________________________

You might also like

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- 10 FS Analysis Sample Exam Discussion KEYDocument10 pages10 FS Analysis Sample Exam Discussion KEYrav danoNo ratings yet

- Revised Accounting 16Document20 pagesRevised Accounting 16Jennifer GarnetteNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Handout ManAcc2 PDFDocument16 pagesHandout ManAcc2 PDFmobylay0% (1)

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- Wrigley CaseDocument12 pagesWrigley Caseresat gürNo ratings yet

- Finance 1Document6 pagesFinance 1cherryannNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- MAS311 Financial Management Exercises Financial Statement AnalysisDocument4 pagesMAS311 Financial Management Exercises Financial Statement AnalysisLeanne QuintoNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Activity 1Document2 pagesActivity 1Cristine Joy BenitezNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- PERMALINO - Learning Activity 19. Working Capital ManagementDocument3 pagesPERMALINO - Learning Activity 19. Working Capital ManagementAra Joyce PermalinoNo ratings yet

- Module 1 - Financial Statement Analysis - P2Document4 pagesModule 1 - Financial Statement Analysis - P2Jose Eduardo GumafelixNo ratings yet

- Forecasting 2Document4 pagesForecasting 2Gva Umayam0% (1)

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Assignment 1Document2 pagesAssignment 1Mitch wongNo ratings yet

- Managerial Finance - Midterm ExamDocument4 pagesManagerial Finance - Midterm ExamNerissaNo ratings yet

- (Ust-Jpia) Acc5115 Ifr Sce and SCF ReviewerDocument5 pages(Ust-Jpia) Acc5115 Ifr Sce and SCF Revieweraly kayleNo ratings yet

- Exercise 10 Statement of Cash Flows - 054935Document3 pagesExercise 10 Statement of Cash Flows - 054935Hoyo VerseNo ratings yet

- Financial ManagementDocument18 pagesFinancial ManagementkatrinacruzvizcondeNo ratings yet

- Managment Accountant ACCOW, OpenT, KPP WBDocument6 pagesManagment Accountant ACCOW, OpenT, KPP WBFarahAin FainNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Financial Ratio Questions 1Document7 pagesFinancial Ratio Questions 1Afnan QusyairiNo ratings yet

- TQ in Financial Management (Pre-Final)Document8 pagesTQ in Financial Management (Pre-Final)Christine LealNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Name of Learner: - Grade and Section - Module 2 - Quarter 1 What's inDocument4 pagesName of Learner: - Grade and Section - Module 2 - Quarter 1 What's inErica Cyra IbitaNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Financial Analysis Test 2Document8 pagesFinancial Analysis Test 2Alaitz GNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- CAG v.11.0 1st Wave QuestionsDocument7 pagesCAG v.11.0 1st Wave QuestionsIan Paolo CaylanNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- Review On FinmanDocument7 pagesReview On FinmanMoira C. VilogNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- 1 - Financial Statement Analysis - QuestionsDocument3 pages1 - Financial Statement Analysis - QuestionsMon RamNo ratings yet

- Fm2quizb4 QoDocument10 pagesFm2quizb4 QoYe YongshiNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Gov't Acctg_Solman_C12-16Document57 pagesGov't Acctg_Solman_C12-16Alyssa M. JamilNo ratings yet

- Copy-AUDIT_OF_LIABILITIESDocument21 pagesCopy-AUDIT_OF_LIABILITIESAlyssa M. JamilNo ratings yet

- TABLE 3.F.12. Capital StockDocument1 pageTABLE 3.F.12. Capital StockAlyssa M. JamilNo ratings yet

- IS 22 LessonsDocument14 pagesIS 22 LessonsAlyssa M. JamilNo ratings yet

- Dutch-Bangla Bank Limited Agent Banking DivisionDocument2 pagesDutch-Bangla Bank Limited Agent Banking DivisionAbdul KarimNo ratings yet

- Sbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberDocument1 pageSbi Cbs Screen Number Fee Type Sbi Cbs Screen Number Sbi Cbs Screen NumberRaghavendra Rao0% (1)

- PUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIADocument40 pagesPUBLIC FINANCE OF PHILIPPINES AND THAILAND by ESTELLE GADIAEstelle Gadia100% (1)

- Coa Lo Doc & CR Rev SheetDocument8 pagesCoa Lo Doc & CR Rev SheetMisc EllaneousNo ratings yet

- Banking Crisis ProjectDocument9 pagesBanking Crisis Projectpanda catNo ratings yet

- Thomas I. Palley (Auth.) - Financialization - The Economics of Finance Capital Domination-Palgrave Macmillan UK (2013)Document238 pagesThomas I. Palley (Auth.) - Financialization - The Economics of Finance Capital Domination-Palgrave Macmillan UK (2013)David KornbluthNo ratings yet

- Bangar Sir Summary PDFDocument172 pagesBangar Sir Summary PDFHimanshu Jeerawala0% (1)

- Lecture No.1 (Intro To Money & Banking)Document17 pagesLecture No.1 (Intro To Money & Banking)Usama MubasherNo ratings yet

- Money The Nature and Function of MoneyDocument9 pagesMoney The Nature and Function of MoneySenelwa AnayaNo ratings yet

- Statement 1553606570215 PDFDocument5 pagesStatement 1553606570215 PDFsonuNo ratings yet

- How Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentDocument2 pagesHow Much Will A Two-Week, $250 Pay-Day Loan Cost?: Payday Loan-Single PaymentbootybethathangNo ratings yet

- APT PracticeDocument21 pagesAPT PracticeAyush SinghNo ratings yet

- JAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314Document5 pagesJAIIB Paper 4 Module A Unit 1 Retail Banking Introduction (RBWM) - B7e20c2b Bf12 4775 9290 Ec32fd5f6314sushant gawdeNo ratings yet

- Current Macroeconomic and Financial Situation of NepalDocument9 pagesCurrent Macroeconomic and Financial Situation of NepalMonkey.D. LuffyNo ratings yet

- Risk Management: Atty. Fernando S. PeñarroyoDocument48 pagesRisk Management: Atty. Fernando S. PeñarroyoEmmanuel CaguimbalNo ratings yet

- Pandyan Grama Bank Pandyan Grama Bank: IOBA0PGB001) IOBA0PGB001)Document3 pagesPandyan Grama Bank Pandyan Grama Bank: IOBA0PGB001) IOBA0PGB001)Tilak AmmuNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- SoFiMoneyStatement - 2023 12 31Document4 pagesSoFiMoneyStatement - 2023 12 31minhdang03062017No ratings yet

- IX EnglPAPERDocument4 pagesIX EnglPAPERSUNIL KUMARNo ratings yet

- Forex Trading 1Document6 pagesForex Trading 1Pablo Gabrio88% (8)

- RBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFDocument9 pagesRBI NOTIFICATION ON TRA ACCOUNT IECD - No.16 - 08.12.01 - 2001-02 PDFMayank ParekhNo ratings yet

- Rbse Class 12 Accountancy Question Paper 2020Document10 pagesRbse Class 12 Accountancy Question Paper 2020rajwanikajal24No ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- GboDocument5 pagesGborosechaithuNo ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- Adjusting Entries (Depreciation)Document2 pagesAdjusting Entries (Depreciation)Mark Johnson LeeNo ratings yet

- Alm Guidelines by RBIDocument10 pagesAlm Guidelines by RBIPranav ViraNo ratings yet

- SAP - FICO Course ContentDocument10 pagesSAP - FICO Course Contentchaitanya vutukuriNo ratings yet

- Circular Annual - XIIDocument3 pagesCircular Annual - XIIKrrish AmbwaniNo ratings yet