Professional Documents

Culture Documents

IA1 CCE Part 2

IA1 CCE Part 2

Uploaded by

2100593Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IA1 CCE Part 2

IA1 CCE Part 2

Uploaded by

2100593Copyright:

Available Formats

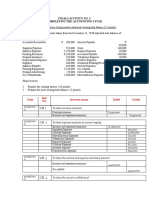

Intermediate Accounting 1

Petty Cash Fund & Bank Reconciliation

1. The petty cash fund of P200 for Colin Company appeared as follows on December 31,2023:

Cash P95.60

Petty cash vouchers

Freight in P19.40

Postage 40.00

Balloons for a special occasion 18.00

Meals 25.00

Required:

1. Briefly describe when the petty cash fund should be replenished. Because there is cash on hand, is

there a need to replenish the fund at year end on December 31? Explain.

2. Prepare in general journal form the entry to replenish the fund.

3. On December 31, the oUice manager gives instructions to increase the petty cash fund by P100.

Make the appropriate journal entry.

2. Dengue Company has a petty cash fund with an imprest balance of P10,000. On the balance sheet date,

the following items were seen on the petty cash drawer:

Bills 500

Coins 30

Expense Receipts

Xerox 1,200

Transportation 600

Representation 2,900

Postdated check from an employee 1,000

Employee check marked NSF 1,500

IOU from employee 2,500

Required:

1. How much is the petty cash shortage or overage?

2. How much is the balance of the Petty Cash Fund?

3. Apathy corporation provided the following information:

Apathy Company

Month of December

Date Check Withdrawal Deposit Balance

2 100,000 100,000

18 104 10,000 90,000

20 101 5,000 85,000

22 106 25,000 60,000

27 50,000 110,000

29 10,000 120,000

29 108 40,000 80,000

29 CM 30,000 110,000

31 DM / SC 2,000 108,000

Intermediate Accounting 1 – Cash and Cash Equivalents Part 2

First Bank

Date Deposit Date Check Amount

1 100,000 4 101 5,000

21 50,000 6 102 15,000

27 10,000 8 103 40,000

31 80,000 8 104 10,000

10 105 30,000

14 106 25,000

28 107 50,000

The credit made by the bank on December 29 represents the proceeds of a note receivable from a

customer which was given to the bank for collection by the entity on December 26.

Required:

1. Prepare bank reconciliation using the adjusted method.

2. Prepare the adjusting entries.

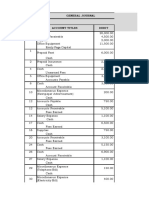

4. The following data were taken from the cash journals of Xantous Company:

Cash Receipts Journal Cash Disbursement Journal

Date Debit cash Check No. Credit cash

Feb 2 2,000,000 117 200,000

6 400,000 118 900,000

9 800,000 119 800,000

10 200,000 120 50,000

15 1,200,000 121 550,000

20 1,300,000 122 180,000

24 550,000 123 1,000,000

28 450,000 124 120,000

125 250,000

6,900,000 4,500,000

The following information was taken from the credit memo of February 28:

Face of the note 250,000

Interest in the note 30,000

Maturity value of the note 280,000

Collection charge 10,000

Credit to your account 270,000

Required: Prepare bank reconciliation on February 28, showing the book balance before and after

adjustments.

5. Endemic company provided the following data for the purpose of reconciling the cash balance per

book with the cash balance per bank statement on December 31.

Balance per bank statement P 2,000,000

Balance per book 850,000

Outstanding check, including certified check of P100,000 500,000

Deposit in transit 200,000

December NSF check, of which P50,000 had been redeposited and cleared by 150,000

December 27

Intermediate Accounting 1 – Cash and Cash Equivalents Part 2

Erroneous credit to Endemic account representing proceeds of loan granted to another 300,000

entity

Proceeds of note collected by bank for endemic net of service charge of P20,000 750,000

Required: What is the cash balance to be reported on December 31?

6. Adversary Company kept all cash in a checking account. an examination of the accounting records and

bank statement for the month of June revealed the following information:

• The cash balance per book on June 30 is P8,500,000.

• A deposit of P1,000,000 that was placed in the bank’s night depository on June 30 does not appear

on the bank statement.

• The bank statement shows on June 30, the bank collected note for Adversary company and credited

the proceeds of P950,000 to the entity’s account.

• Check outstanding in June 30 amount to P300,000.

• Adversary Company discovered that a check written in June for P200,000 in payment of an account

payable had been recorded in the entity’s records as P20,000.

• Included with the June bank statement was NSF check for P250,000 that Adversary Company had

received from customer on June 26.

• The bank statement shows a P20,000 service charge for June.

Required: What is the cash in bank to be reported in the statement of financial position on June 30?

7. Timex Company provided the following data relating to the cash transactions and bank account for the

month of July:

Cash balance per ledger ?

Cash balance per bank statement ?

Debit memo for July service charge 5,000

Deposit of July 31 not recorded by bank until August 1 450,000

Outstanding check, including certified check of P50,000 750,000

Proceeds from bank loan not recorded in the ledger 500,000

Proceeds from customer note, face P400,000 collected by bank, collection fee of P15,000 435,000

A creditor check had been entered in the book as P20,000 and was erroneously deducted 200,000

by bank at

A customer check was returned by bank DAIF 50,000

Correct cash balance 3,000,000

Required:

1. What is the cash balance per ledger?

2. What is the cash balance per bank statement?

Intermediate Accounting 1 – Cash and Cash Equivalents Part 2

You might also like

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- Bank Reconciliation: Sample ProblemsDocument39 pagesBank Reconciliation: Sample ProblemsXENA LOPEZ78% (9)

- (Atkinson 2000) Artikel Fundamental Aspects of Hot Isostatic Pressing - An OverviewDocument20 pages(Atkinson 2000) Artikel Fundamental Aspects of Hot Isostatic Pressing - An OverviewChristian MohammadNo ratings yet

- Problems For Proof of Cash and Bank ReconDocument2 pagesProblems For Proof of Cash and Bank ReconTine Vasiana DuermeNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- CPAR AP - Audit of CashDocument9 pagesCPAR AP - Audit of CashJohn Carlo CruzNo ratings yet

- Chapter - II Review of Literature Review of LiteratureDocument24 pagesChapter - II Review of Literature Review of LiteratureeshuNo ratings yet

- Exercises Problem in Bank ReconciliationDocument2 pagesExercises Problem in Bank ReconciliationRoseiii AnnNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- CHAPTER2 - Bank Recon - IllustrationDocument14 pagesCHAPTER2 - Bank Recon - IllustrationReighjon Ashley C. TolentinoNo ratings yet

- Bank Reconciliation Roi Book Center 1Document4 pagesBank Reconciliation Roi Book Center 1Shane Nicole DagatanNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Module 2 ProblemsDocument15 pagesModule 2 ProblemsCristina TayagNo ratings yet

- Unit 2 Illustration ProblemDocument1 pageUnit 2 Illustration ProblemCharlene RodrigoNo ratings yet

- Ae 15 Bs Acc 1 Home Based ActivityDocument4 pagesAe 15 Bs Acc 1 Home Based ActivityMae Ann RaquinNo ratings yet

- Ae 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Document4 pagesAe 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Mae Ann RaquinNo ratings yet

- Espanola Far 201 QuizDocument7 pagesEspanola Far 201 QuizCINDY MAE SARAH ESPANOLANo ratings yet

- Sol. Man. - Chapter 2 - Cash & Cash Equivalents - Ia Part 1aDocument6 pagesSol. Man. - Chapter 2 - Cash & Cash Equivalents - Ia Part 1aMiguel AmihanNo ratings yet

- Second Exam Msa1 ReviewerDocument4 pagesSecond Exam Msa1 ReviewerPaul Marben PolinarNo ratings yet

- Problem No.1 - Ch6 Cost Flow AssumptionDocument3 pagesProblem No.1 - Ch6 Cost Flow AssumptionFoong Chan PingNo ratings yet

- Lecture No.2 Petty Cash Fund Bank Recon Lecture Problem SolvingDocument2 pagesLecture No.2 Petty Cash Fund Bank Recon Lecture Problem Solvingdelrosario.kenneth996No ratings yet

- DocxDocument25 pagesDocxPhilip Castro67% (3)

- Completing The Accounting ProcessDocument23 pagesCompleting The Accounting ProcessFretchie Anne C. LauroNo ratings yet

- Audit of Cash and Cash Equivalents - Set BDocument5 pagesAudit of Cash and Cash Equivalents - Set BZyrah Mae SaezNo ratings yet

- AE 111 Midterm Summative Assessment 3 SolutionsDocument12 pagesAE 111 Midterm Summative Assessment 3 SolutionsDjunah ArellanoNo ratings yet

- Proof of CashDocument3 pagesProof of CashLorence Patrick LapidezNo ratings yet

- Bank Recon Home ActivitiesDocument2 pagesBank Recon Home ActivitiesZero OneNo ratings yet

- Bank ReconciliationDocument5 pagesBank ReconciliationUwuuUNo ratings yet

- Samsona, Melanie 2018-1383Document9 pagesSamsona, Melanie 2018-1383Melanie SamsonaNo ratings yet

- FarrrDocument19 pagesFarrrlysaNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- Bank ReconciliationDocument6 pagesBank ReconciliationLorence Patrick LapidezNo ratings yet

- Audit of Cash and Cash: EquivalentDocument14 pagesAudit of Cash and Cash: EquivalentJoseph SalidoNo ratings yet

- Exercises - Cash and ReceivablesDocument8 pagesExercises - Cash and ReceivablesjpNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Virginia LittonDocument13 pagesVirginia LittonHazel Ann DuermeNo ratings yet

- Intacc Problems Empleo and RoblesDocument44 pagesIntacc Problems Empleo and RoblesChristen HerceNo ratings yet

- Lesson 7.4Document7 pagesLesson 7.4crisjay ramosNo ratings yet

- Accounts Trial Balance DebitDocument8 pagesAccounts Trial Balance Debitmaria bianca palmaNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- Debits and Credits - Bad DebtDocument25 pagesDebits and Credits - Bad DebtRevilyn Grace Bangayan100% (1)

- Solution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsDocument21 pagesSolution: (18,025 + 3,125 - 2,875 + 125) 18,400: Use The Following Information For The Next Three QuestionsJovel Paycana100% (5)

- ACCOB1 Quiz 1 RequirementDocument33 pagesACCOB1 Quiz 1 RequirementjanericachuaNo ratings yet

- Bank Accounting MonographDocument3 pagesBank Accounting MonographScribdTranslationsNo ratings yet

- Problem AssignmentDocument13 pagesProblem AssignmentKeana De GuzmanNo ratings yet

- Act. 4Document4 pagesAct. 4DorisNo ratings yet

- Bank Reconciliation and Proof of Cash Problems 01 04 - 043916Document2 pagesBank Reconciliation and Proof of Cash Problems 01 04 - 043916azazelrallosNo ratings yet

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- CB Lecture Notes - 2014 RevisedDocument10 pagesCB Lecture Notes - 2014 RevisedArramaeNo ratings yet

- WTB IT ToolsDocument12 pagesWTB IT ToolsJustine FloresNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- Soal AKM 2015Document24 pagesSoal AKM 2015Siti Armayani RayNo ratings yet

- FM 1Document18 pagesFM 1huleNo ratings yet

- Activity Worksheet PreparationDocument16 pagesActivity Worksheet PreparationLowelle Cielo PacotNo ratings yet

- IA1 CCE Part 3Document4 pagesIA1 CCE Part 32100593No ratings yet

- IA1 CCE Part 1Document5 pagesIA1 CCE Part 12100593No ratings yet

- LinearDocument18 pagesLinear2100593No ratings yet

- week 9-3Document8 pagesweek 9-32100593No ratings yet

- week 7Document10 pagesweek 72100593No ratings yet

- Brosura Lensmetru TL 100Document2 pagesBrosura Lensmetru TL 100StanicaNo ratings yet

- Procedural Guide - Concur Expense Exception ApproverDocument21 pagesProcedural Guide - Concur Expense Exception Approverpsp210295No ratings yet

- Sample Skillshare Class Outline - Dylan MierzwinskiDocument4 pagesSample Skillshare Class Outline - Dylan MierzwinskiBBMS ResearcherNo ratings yet

- Realworld Upgrade ISRroutersDocument2 pagesRealworld Upgrade ISRroutersFarman ATeeqNo ratings yet

- Incident Record FormDocument2 pagesIncident Record FormMark Joel AguilaNo ratings yet

- BCDA PROJ Clark-Airport-InfoMemo 20180507Document76 pagesBCDA PROJ Clark-Airport-InfoMemo 20180507jeddNo ratings yet

- Infrared Portable Space Heater: Model No.: DR-968Document16 pagesInfrared Portable Space Heater: Model No.: DR-968sigilum_deiNo ratings yet

- Strategic Management IBM: Raghu Ranjani Ranjitha Renston Renuka Rupa Sahana Sandeep Sathwik ShilpaDocument32 pagesStrategic Management IBM: Raghu Ranjani Ranjitha Renston Renuka Rupa Sahana Sandeep Sathwik ShilpaFaheem KvNo ratings yet

- Air Flow Rate Calculation For Fire Smoke Exhaust System: Vietnam Nisshin Technomic Phase 2 ProjectDocument8 pagesAir Flow Rate Calculation For Fire Smoke Exhaust System: Vietnam Nisshin Technomic Phase 2 Projecttiger vuNo ratings yet

- MPS 55R118 01583021L 09 2011Document2 pagesMPS 55R118 01583021L 09 2011vinayak_patil72No ratings yet

- Rkvy (Status Note Meeting Dated 13.06.2024)Document6 pagesRkvy (Status Note Meeting Dated 13.06.2024)chandwanivinayNo ratings yet

- Admit Card 2019-20 Odd-SemDocument2 pagesAdmit Card 2019-20 Odd-SemRajitram PalNo ratings yet

- 1 s2.0 S0360128509000604 Main PDFDocument37 pages1 s2.0 S0360128509000604 Main PDFNurul AkmamNo ratings yet

- Midyear 23 24.t1 t3Document3 pagesMidyear 23 24.t1 t3mylinafabi5No ratings yet

- Multiple Choice Questions Chapter 3 - Organisation of DataDocument6 pagesMultiple Choice Questions Chapter 3 - Organisation of DataAvanthikaNo ratings yet

- FIBRS Incident Report: Pembroke Pines Police Department 9500 Pines BLVD Pembroke Pines, FLDocument5 pagesFIBRS Incident Report: Pembroke Pines Police Department 9500 Pines BLVD Pembroke Pines, FLbrianna sahibdeenNo ratings yet

- Lifebuoy - Superfast Handwash - WarcDocument13 pagesLifebuoy - Superfast Handwash - WarcVaishaliNo ratings yet

- Rapier LoomDocument19 pagesRapier LoomMayur PatilNo ratings yet

- David's Guide For Blog NameDocument26 pagesDavid's Guide For Blog NameDivyansh BoraNo ratings yet

- Introduction To Auto CadDocument31 pagesIntroduction To Auto CadazhiNo ratings yet

- Product NameDocument3 pagesProduct NameAyush NarayanNo ratings yet

- CONTRACT TO SELL (Sample)Document3 pagesCONTRACT TO SELL (Sample)arne navarra100% (1)

- Absorption and Diffusion of Hydrogen in SteelsDocument12 pagesAbsorption and Diffusion of Hydrogen in SteelsadipanNo ratings yet

- KEI Catalogue PdfToWordDocument47 pagesKEI Catalogue PdfToWordammu pallaviNo ratings yet

- M.Sc. Nguyen Thi Thanh Tam International School - DTUDocument25 pagesM.Sc. Nguyen Thi Thanh Tam International School - DTUDũng NguyễnNo ratings yet

- Executive Diploma in Network & Cyber SecurityDocument10 pagesExecutive Diploma in Network & Cyber SecurityKYAW SHWE WINNo ratings yet

- GE Oil & Gas Nuovo Pignone: Title: Part List: Drawing: Gear BoxDocument1 pageGE Oil & Gas Nuovo Pignone: Title: Part List: Drawing: Gear BoxMohammed ElarbedNo ratings yet

- Case SummaryDocument11 pagesCase SummaryAditya ChaudharyNo ratings yet