Professional Documents

Culture Documents

Ebcl Hacking June 2023 (1)

Ebcl Hacking June 2023 (1)

Uploaded by

Muhammed MusharafCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ebcl Hacking June 2023 (1)

Ebcl Hacking June 2023 (1)

Uploaded by

Muhammed MusharafCopyright:

Available Formats

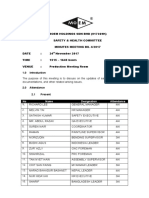

1|Page

CS EXECUTIVE

HACKING EBCL

IT IS THE PRIORITY OF TOPICS AND NOT COVERAGE OF 100% OF

SYLLABUS

IT IS NOT AN ASSURANCE OF COMING IN EXAM, BUT IT IS THE

HACKING OF PAST EXAMINATION AND SHARING VIEW.

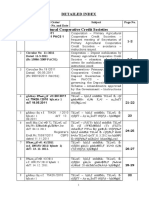

Sr.No TOPIC Page.No

1 RBI ACT 1934 2-3

2 FEMA 1999 4

3 FEMA CURRENT & CAPITAL ACCOUNT TRANSACTION 5-6

LIBERALIZED REMITTANCE SCHEME

4 FEMA-FOREIGN DIRECT INVESTMENT IN INDIA 7-9

5 FEMA-DIRECT INVESTMENT OUTSIDE INDIA 10

6 EXTERNAL COMMERCIAL BORROWINGS 11

7 FOREIGN CONTRUBUTION (REGULATION) ACT2010 12 - 14

8 FOREIGN TRADE POLICY AND PROCEDURES 15 - 19

9 NON BANKING FINANCE COMPANIES 20

10 SPECIAL ECONOMIC ZONES ACT 2005 21 - 24

11 COMPETITON ACT 2002 25 - 30

12 CONSUMER PROTECTION ACT 2019 31 - 34

13 ESSENTIAL COMMODITIES ACT 1955 35 - 39

14 LEGAL METROLOGY ACT 2009 40 - 42

15 TRANSFER OF PROPERTY ACT 1882 43 - 50

16 TRANSFER OF PROPERTY ACT 1882 51 - 52

17 BENAMI TRANSACTION (PROHIBITION) ACT 1988 53 - 55

18 PREVENTION OF MONEY LAUNDERING ACT 2002 56 - 59

19 CONTRACT ACT 1872 60 - 65

20 SPECIFIC RELEIF ACT 1963 66 - 67

21 SALE OF GOODS ACT 1930 68 - 74

22 PARTNERSHIP ACT 1932 75 - 77

23 NEGOTIABLE INSTRUMENT ACT 1881 78 - 83

CA MAYUR AGARWAL

CA Mayur Agarwal Inspire Academy

2|Page

Chapter 1: RBI ACT 1934

PAST PAPER CONCEPTS

Functions of RBI

RBI is a banker of bank

How Monetary policy committee constituted under the RBI act 1934 and its functions.

Reserve bank of India as custodian of foreign exchange reserve

LESSONS TO BE ROUNDED OFF

The Preamble to the Reserve Bank of India Act, 1934 under which it was constituted,

specifies its objective as regulation of the issue of Bank notes and the keeping of

reserves with a view to securing monetary stability in India, generally to operate the

currency and credit system of the country to its advantage and operation of the

monetary policy framework in India.

The Central Board of Directors is at the top of the Reserve Bank’s organizational

structure. Appointed by the Government under the provisions of the Reserve Bank of

India Act, 1934, the Central Board has the primary authority and responsibility for the

oversight of the Reserve Bank. It delegates specific functions to the Local Boards and

various committees. The Governor is the Reserve Bank’s chief executive

The Government of India on the advice of the Reserve Bank decides on the various

denominations of the currency notes to be printed. The Reserve Bank coordinates

with the Government in designing the banknotes, including their security features.

Monetary policy refers to the policy of the central bank with regard to the use of

monetary instruments under its Control to achieve the goals specified in the Act.

The Reserve Bank of India (RBI) is vested with the responsibility of conducting

monetary policy. This responsibility is explicitly mandated under the Reserve Bank of

India Act, 1934.

The primary objective of monetary policy is to maintain price stability while keeping

in mind the objective of growth. Price stability is a necessary precondition to

sustainable growth.

Repo Rate is the fixed interest rate at which the Reserve Bank provides overnight

liquidity to banks against the collateral of government and other approved securities

under the liquidity adjustment facility (LAF).

Reverse Repo Rate is the fixed interest rate at which the Reserve Bank absorbs

liquidity, on an overnight basis, from banks against the collateral of eligible

government securities under the liquidity adjustment facility (LAF)

CA Mayur Agarwal Inspire Academy

3|Page

HIGHLITED PART IN MODULE

Origin of the Reserve Bank of India at a glance

CA Mayur Agarwal Inspire Academy

4|Page

Chapter 2: FEMA 1999

PAST PAPER CONCEPTS

SECTION 2(n) Foreign exchange

SECTION 2(o) Foreign security

SECTION 2(u) Person

SECTION 2(c) Authorised person

SECTION 4 Person resident India can acquire, hold, own, possess or transfer any

foreign exchange only after compliance

REGULATION 3 Limit for possession and retention of foreign currency or foreign

coins

SECTION 2(y) Repatriate to India

Section 8 Realization & repatriation of foreign exchange

SECTION 9 Exemption from realization and repatriation in certain cases

SECTION 11 RBI’S power to issue directions to authorised person

SECTION 10(1) & (2) Authorization to act as authorized person

SECTION 8 A person resident in India shall take all reasonable steps to realize and

repatriate

SECTION 15 Compounding of offence

SECTION 15(1) Power to compound contravention

SECTION 15(2) No further proceedings after compounding 16 SECTION 13 Penalty

SECTION 18 Establishment of appellate tribunal

SECTION 19(1) Appeal to Appellate tribunal

SECTION 20 Composition of Appellate tribunal

LESSONS TO BE ROUNDED OFF

The Foreign Exchange Management Act has repealed the FERA.

The Foreign Exchange Management Act, 1999 is an Act to facilitate external

tradeand payments and for promo ng the orderly development and

maintenance of foreign exchange market in India.

Foreign Exchange Management Act, 1999 extends to the whole of India.

The Act alsoapplies to all branches, offices and agencies outside India

owned or controlled by a person resident in India and also to any

contraven on there under commi edoutside India by any person to whom

this Act applies.

FEMA makes provisions for dealings in foreign exchange. Broadly, all Current

Account Transac ons are free. However Central Government can impose

reasonablerestric ons by issuing Rules.

CA Mayur Agarwal Inspire Academy

5|Page

Chapter 3: FEMA CURRENT & CAPITAL ACCOUNT

TRANSACTION, LIBERALISED REMITTANCE SCHEME

PAST PAPER CONCEPTS

SECTION 2(j) Current account transaction

SECTION 5 Provision regarding CAT

RULE 3 Transaction for which drawal of foreign exchange is prohibited

RULE 4 Foreign exchange can be drawn with prior approval of CG

RULE 5 Foreign exchange can be drawn with prior approval of RBI

REGULATION 3 Restriction on acquisition and transfer of immovable property

outside India

REGULATION 5 Acquisition and transfer of immovable property outside India

LESSONS TO BE ROUNDED OFF

As liberalization measure to facilitate resident individuals to remit funds abroad for

permitted current or capital account transactions or combination of both Reserve Bank

of India issues Liberalised Remittance Scheme.

The Scheme is available to all resident individuals including minors.

Remittances under the Scheme can be consolidated in respect of family members

subject to individual

Family members complying with its terms and conditions.

For private visits abroad, other than to Nepal and Bhutan, any resident individual can

obtain foreign exchange up to an aggregate amount of USD 2,50,000, from an

Authorised Dealer in any one financial year, irrespective of the number of visits

undertaken during the year.

The individual will have to designate a branch of an AD through which all the

remittances under the Scheme will be made. The resident individual seeking to make

the remittance should furnish Form A2 for purchase of foreign exchange under LRS.

HIGHLITED PART IN MODULE

Permissible capital account transactions by an individual under LRS

CA Mayur Agarwal Inspire Academy

6|Page

Prohibited Transactions

Prohibition on drawal of foreign exchange for certain transactions

CA Mayur Agarwal Inspire Academy

7|Page

Chapter 4: FEMA – FOREIGN DIRECT INVESTMENT IN INDIA

PAST PAPER CONCEPTS

RULE 6 A person resident in India may subscribe, purchase, or sell capital instrument

RULE 7 A person resident outside India having instrument in an India may

make investment in capital instrument

Automatic route and government route

Depository receipts

Person of Indian origin

Distinguish depository receipts and foreign currency convertible bonds

Method of funding of FDI under FEMA

Foreign currency convertible bond

Sectors where FDI is prohibited

Intent and obligation of FDI under FEMA

RBI approval is not mandatory for transfer of capital instrument from resident

tonon-resident

Eligibility criteria for forming the trust under Indian trust act

Condition to allot sweat equity share to resident outside India

LLP is permitted in FDI

Sectors where FDI is prohibited

LESSONS TO BE ROUNDED OFF

“FDI” or “Foreign Direct Investment” means investment through equity

instruments by a person resident outside India in an unlisted Indian company; or in

ten per cent or more of the post issue paid- up equity capital on a fully diluted basis

of a listed Indian company.

A non-resident entity can invest in India, subject to the FDI Policy except in those

sectors/activities which are prohibited. However, an entity of a country, which shares

land border with India or where the beneficial owner of an investment into India is

situated in or is a citizen of any such country, can invest only under the Government

route.

A citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the

Government route, in sectors/activities other than defence, space, atomic energy and

sectors/activities prohibited for foreign investment.

Indian companies can issue capital against Foreign Direct Investment.

Indian companies which are eligible to issue shares to person’s resident outside India

under the FDI Policy may be allowed to retain the share subscription amount in a

Foreign Currency Account, with the prior approval of RBI.

CA Mayur Agarwal Inspire Academy

8|Page

FDI is permitted under the automatic route in Limited Liability Partnership (LLPs)

operating in sectors/ activities where 100% FDI is allowed through the automatic

route and there are no FDI-linked performance conditions.

FDI is allowed under the automatic route without prior approval either of the

Government or the Reserve Bank of India in all activities/sectors as specified in the

consolidated FDI Policy, issued by the Government of India from time to time.

FDI in activities not covered under the automatic route requires prior approval of the

Government. Proposals for foreign investment under Government route, are

considered by respective Administrative Ministry/Department.

If a person violates/contravenes any FDI Regulations, by way of breach/non-

adherence/non- compliance/ contravention of any rule, regulation, notification, press

note, press release, circular, direction or order issued in exercise of the powers under

FEMA or contravenes any conditions subject to which an authorization is issued by

the Government of India/ Reserve Bank of India, he shall, upon adjudication, be liable

to a penalty.

HIGHLITED PART IN MODULE

GENERAL CRITERIA

CA Mayur Agarwal Inspire Academy

9|Page

Remittance of profit/surplus

Requests for closure of the BO/LO/PO and submit the application along with following

documents for remittance of winding up proceeds of BO/LO/PO to the designated AD

Category- I bank

Copy of the Reserve Bank’s/AD Category- I bank’s approval

Auditor’s certificate

Confirmation from the applicant/parent company that no legal proceedings is

pending in any court in India;

A report from the Registrar of Companies regarding compliance with the

provisions of the companies Act, 2013;

The designated AD category- I bank has to ensure that the BO/LO/PO had filed their

respective AACs; and

Any other document/s, specified by reserve Bank of India / AD category-I bank

Designated AD category- I bank may allow remittance of winding up proceeds in respect of

offices of bank and insurance companies, after obtaining copies of permission of closure

from the sectoral regulators along with the documents mentioned above.

CA Mayur Agarwal Inspire Academy

10 | P a g e

Chapter 5: FEMA DIRECT INVESTMENT OUTSIDE INDIA

PAST PAPER CONCEPTS

RULE 4 PRI may purchase a foreign security out of funds in RFC account

REGULATION 6(1) Indian party may make investment in JV/WOS

REGULATION 3 Restriction on acquisition or transfer of immovable property outside

India

REGULATION 5 Acquisition or transfer of immovable property outside India

SECTION 6(4) Person resident in India may hold, own, transfer or invest in foreign

currency

Eligibility criteria for overseas investment by proprietorship and registered trust

Proprietorship concerns

Registered trust

Eligibility criteria for trust

LESSONS TO BE ROUNDED OFF

Overseas investments (or financial commitment) in Joint Ventures (JV) and

Wholly OwnedSubsidiaries (WOS) have been recognised as important avenues for

promoting global business by Indian entrepreneurs.

“Financial Commitment” means the amount of direct investment by way of

contributionto equity, loan and 100 per cent of the amount of guarantees and 50

per cent of the performance guarantees issued by an Indian Party to or on behalf

of its overseas Joint Venture Company or Wholly Owned Subsidiary.

Indian party/ Resident Individual is required to route all transactions in respect of a

particular overseas JV/WOS only through one branch of an Authorized Dealer. This

branch would be the ‘designated Authorised Dealer’ in respect of that JV/WOS and

all transactions and communications relating to the investment in that particular

JV/WOS are to be reportedonly through this ‘designated’ branch of an Authorized

Dealer.

An Indian Party is a company incorporated in India or a body created under

an Act ofParliament or

a partnership firm registered under the Indian Partnership Act 1932 or a Limited

Liability Partnership (LLP) incorporated under the LLP Act, 2008 and any other

entity in India as maybe notified by the Reserve Bank.When more than one such

company, body or entity makes investment in the foreign JV / WOS, such

combination will also form an “Indian Party”.

An Indian Party receive share certificates or any other documentary evidence of

investment in the foreign JV / WOS as an evidence of investment and submit the same

to the designated AD within 6 months and repatriate to India, all dues receivable from

the foreign JV / WOS, like dividend, royalty, technical fees etc.

CA Mayur Agarwal Inspire Academy

11 | P a g e

Chapter 6: EXTERNAL COMMERCIAL BORROWINGS

PAST PAPER CONCEPTS

Foreign currency convertible bond

External commercial borrowing

FCCB and ECB

FCCB and FCEB

ECB and the types

Advantages of FCEB over FCCB

Benefits of FCCB

Conversion of ECB into equity

Who can access ECB

End use of ECB under approval route

Parking of ECB

Conversion of ECB into equity is permissible

LESSONS TO BE ROUNDED OFF

External Commercial Borrowings are commercial loans raised by eligible resident

entities from recognised non-resident entities and should conform to parameters such

as minimum maturity, permitted and non-permitted end-uses, maximum all-in-cost

ceiling, etc.

External Commercial Borrowings Framework enables permitted resident entities to

borrow from recognized non-resident entities.

For conversion of ECB dues into equity, the exchange rate prevailing on the date of

the agreement between the parties concerned for such conversion or any lesser rate

can be applied with a mutual agreement with the ECB lender.

Under External Commercial Borrowings Framework, borrowers may approach the

RBI with an application in prescribed format Form ECB for examination through their

AD Category I bank. Such cases shall be considered keeping in view the overall

guidelines, macroeconomic situation and merits of the specific proposals.

Borrowings under ECB Framework are subject to reporting requirements Loan

Registration Number, Changes in terms and conditions of ECB and Reporting of

actual transactions.

CA Mayur Agarwal Inspire Academy

12 | P a g e

Chapter 7: FOREIGN CONTRIBUTION (REGULATION) ACT, 2010

PAST PAPER CONCEPTS

SECTION 2(1)(h): Foreign contribution

Legalise foreign donation and hospitality to office bearers of political parties

SECTION 3: Person prohibited from accepting foreign contribution (repeated)

SECTION 4: Exemption to the prohibition of accepting

SECTION 6 Person cannot receive foreign hospitality visiting any country

without prior permission of CG

SECTION 9: Power of the CG to prohibit receipt

SECTION 14: Cancellation of certificate

SECTION 16: Application for renewal of certificate

SECTION 28: Confiscation of article or currency or security obtained in

contravention of the act

SECTION 29: Adjudication of confiscation

SECTION 30: Procedure for confiscation

SECTION 34: Penalties and punishment

SECTION 35: Punishment for contravention of any provision of the act

SECTION 39: Offence by companies

SECTION 41: Composition of certain offence

LESSONS TO BE ROUNDED OFF

FCRA, 2010 regulate the acceptance and utilisation of foreign contribution or

foreign hospitality by certain individuals or associations or companies and to

prohibit acceptance and utilisation of foreign contribution or foreign hospitality

for any activities detrimental tothe national interest and for matters connected

therewith or incidental thereto.

In order to streamline the provisions of the Foreign Contribution (Regulation)

Act, 2010 bystrengthening the compliance mechanism, enhancing

transparency and accountability in thereceipt and utilisation of foreign

contribution worth thousands of crores of rupees every ear and facilitating

genuine non-Governmental organisations or associations who are working for

the welfare of the society, Parliament enacted the Foreign Contribution

(Regulation) Amendment Act, 2020.

The Act provides that persons having definite cultural, economic, educational,

religious and social programmes should get themselves registered with the

Government of India before accepting any ‘foreign contribution’. In case a person

falling in the above category is not registered with the Central Government, it can

accept foreign contribution only after obtaining prior permission of the Central

Government.

Central Government is empowered to prohibit any person or organisation not

specified inthe Act from accepting any foreign contribution and to require any

CA Mayur Agarwal Inspire Academy

13 | P a g e

person or class of persons, not specified in it to obtain prior permission of the

Central Government before accepting any foreign hospitality.

Associations which were granted certificates of registration, such registration shall

be validfor a period of five years.

Any offence punishable under this act (whether committed by an individual or

associationor any officer or employee thereof), not being an offence punishable

with imprisonment only, may, before the institution of any prosecution, be

compounded by such officers or authorities and for such sums as the central

government may, by notification in the official gazette, specify in this behalf.

HIGHLITED PART IN MODULE

Who cannot receive foreign contribu on?

As defined in Section 3(1) of FCRA, 2010, the following are prohibited to receive

foreign contribution:

Candidate for election; Correspondent, columnist, cartoonist, editor, owner, printer or

publisher of a registered newspaper; Public Servant, Judge, Government servant or

employee of any corporation or any other body controlled or owned by the

Government;

Member of any legislature; Political party or office bearer thereof; Organization of a

political nature as may be specified under sub-section (1) of Section 5 by the Central

Government.

Association or company engaged in the production or broadcast of audio news or

audio visual news or current affairs programmes through any electronic mode, or any

other electronic form as defined in clause (r) of sub-section (1) of Section 2 of the

InformationTechnology Act, 2000 or any other mode of mass communication;

Correspondent or columnist, cartoonist, editor, owner of the association or company

referred to in above point. Individuals or associations who have been prohibited from

receiving foreign contribution.

Who can receive foreign contribution?

Any “Person” can receive foreign contribution subject to the following conditions:-

It must have a definite cultural, economic, educational, religious or social programme. It must

obtain the FCRA registration/prior permission from the Central Government

It must not be prohibited under Section 3 of FCRA, 2010.

What is foreign hospitality?

CA Mayur Agarwal Inspire Academy

14 | P a g e

Foreign Hospitality means any offer, not being a purely casual one, made in cash or kind by

a foreign source for providing a person with the costs of travel to any foreign country or

territory or with free board, lodging, transport or medical treatment.

State the categories of persons requires prior approval from Ministry of Home Affairs before

accepting Foreign Hospitality?

The following categories of persons require prior approval from Ministry of Home

Affairs before accepting Foreign Hospitality:-

Members of a Legislature, Office bearers of political parties, Judges, Government

servants,Public Servants, Employees of any corporation or any other body owned or

controlled by the Government.

Provided that it shall not be necessary to obtain any such permission for an emergent medical

aide needed on account of sudden illness contracted during a visit outside India. But, where

such foreign hospitality has been received, the person receiving such hospitalityshall give an

intimation to the Central Government as to the receipt of such hospitality within one month

from the date of receipt of such hospitality, and the source from which, and the manner in

which, such hospitality was received.

CA Mayur Agarwal Inspire Academy

15 | P a g e

Chapter 8: FOREIGN TRADE POLICY & PROCEDURES

PAST PAPER CONCEPTS

Privileges of star export house

Board of trade

Advance authorization scheme

Short term and long term objectives

Privileges and trading house status holders

Describe SEIS and eligible services under service export

Capital goods and consumer goods

Capital goods and spares that have become obsolete/surplus may be exported,

transferred to another SEZ until but law does not permit to dispose of in domestic

tariff area on payment of applicable duties

Objective of service export and eligibility condition of obtaining benefits under FTP

LESSONS TO BE ROUNDED OFF

India’s Foreign Trade Policy (FTP) has, conventionally, been formulated for five

years at a time and reviewed annually. The focus of the FTP has been to provide a

framework of rules and procedures for exports and imports and a set of incentives for

promoting exports.

The Foreign Trade Policy is primarily focused on accelerating exports. This is sought

to be implemented through various schemes intended to exempt and remit indirect

taxes on inputs physically incorporated in the export product, import capital goods at

concessional duty, stimulate services exports and focus on specific markets and

products.

The Foreign Trade Policy, 2015-20, is notified by Central Government, in exercise of

powers conferred under Section 5 of the Foreign Trade (Development & Regulation)

Act, 1992 (No. 22 of 1992) [FT (D&R) Act], as amended. The Foreign Trade Policy,

2015-20 came into force with effect from 01.04.2015.

Capital Goods means any plant, machinery, equipment or accessories required for

manufacture or production, either directly or indirectly, of goods or for rendering

services, including those required for replacement, modernisation, technological up-

gradation or expansion. It includes packaging machinery and equipment, refrigeration

equipment, power generating sets, machine tools, equipment and instruments for

testing, research and development, quality and pollution control.

An Importer-Exporter Code (IEC) Number is a 10-digit number allotted to a person

that is mandatory for undertaking any export/import activities. Now the facility for

IEC in electronic form or e-IEC has also been operationalised.

CA Mayur Agarwal Inspire Academy

16 | P a g e

The objective of the Export from India Schemes is to provide rewards to exporters

to offset infrastructural inefficiencies and associated costs involved and to provide

exporters a level playing field.

Status Holders are business leaders who have excelled in international trade and

have successfully contributed to country’s foreign trade. Status Holders are

expected to not onlycontribute towards India’s exports but also provide guidance

and handholding to new entrepreneurs.

The objective of the Export Promotion Capital Goods(EPCG) Scheme is to

facilitate import of capital goods for producing quality goods and services to

enhance India’s export competitiveness.

Units undertaking to export their entire production of goods and services (except

permissible sales in DTA), may be set up under the Export Oriented Unit (EOU)

Scheme, Electronics Hardware Technology Park (EHTP) Scheme, Software

Technology Park (STP) Scheme or Bio-Technology Park (BTP) Scheme for

manufacture of goods, including repair, re-making, reconditioning, re-

engineering, rendering of services, development of software, agriculture including

agro-processing, aquaculture, animal husbandry, biotechnology, floriculture,

horticulture, pisciculture, viticulture, poultry and sericulture. Trading units are not

covered under the scheme.

HIGHLITED PART IN MODULE

PRINCIPLES OF RESTRICTIONS

CA Mayur Agarwal Inspire Academy

17 | P a g e

Export Obligation

DUTY FREE IMPORT AUTHORISATION SCHEME (DFIA)

CA Mayur Agarwal Inspire Academy

18 | P a g e

Eligibility of DFIA

Export through Exhibitions/Export Promotion Tours/Showrooms Abroad/Duty Free

Shops

CA Mayur Agarwal Inspire Academy

19 | P a g e

Quality Complaints/ Trade Disputes

CA Mayur Agarwal Inspire Academy

20 | P a g e

Chapter: 9 NON BANKING FINANCE COMPANIES

PAST PAPER CONCEPTS

Regula on regarding to acceptance of deposit by NBFC

Explain NBFC and powers of RBI vested in RBI Act for regula ng NBFC3 NBFC differ

from banks

SECTION 45-1A: Requirement for registra on of NBFC with RBI

NBFC systema cally important non deposit company and deposited taking company

direc ons

LESSONS TO BE ROUNDED OFF

The Reserve Bank of India is entrusted with the responsibility of regula ng

and supervising the Non-Banking Financial Companies by virtue of powers

vested inChapter III B of the Reserve Bank of India Act, 1934.

A Non-Banking Financial Company (NBFC) is a company registered under the

Companies Act, engaged in the business of loans and advances, acquisi on of

shares/stocks/bonds/debentures/ securi es issued by Government or local

authorityor other marketable securi es of a like nature, leasing, hire-purchase,

insurance business, chit business but does not include any ins tu on whose

principal business is that of agriculture ac vity, industrial ac vity, purchase or

sale of any goods (other than securi es) or providing any services and

sale/purchase/construc on of immovable property.

The Reserve Bank has been given the powers under the RBI Act 1934 to register,

laydown policy, issue direc ons, inspect, regulate, supervise and exercise

surveillance over NBFCs that meet the 50- 50 criteria of principal business.

The Reserve Bank can penalize NBFCs for viola ng the provisions of the RBI

Act orthe direc ons or orders issued by RBI under RBI Act.

CA Mayur Agarwal Inspire Academy

21 | P a g e

Chapter: 10 SPECIAL ECONOMIC ZONES ACT 2005

PAST PAPER CONCEPTS

SEZ are engines of growth

Features of SEZ

SECTION 2(u): Offshore banking unit

SECTION 5: Factors considered by CG while notifying and area as SEZ and

dischargingits functions

SECTION 3: Who can establish SEZ

SECTION 9: Power and functions of the board

SECTION 10: Board of approval is empowered to suspend the letter of

approval granted to the developer

SECTION 11: method of appointment and functions of the

developmentcommissioner

SECTION 12(2) Function of development commissioner

SECTION 14: Function and powers of approval committee

SECTION 15(8) Approve, modify or reject proposal

SECTION 34: SEZ cast upon the authority a duty to undertake such measures

for development, operation and management of SEZ

SECTION 40(1): Powered to suspend authority

SECTION 40(2): Effect of notification

SECTION 40(3): Extension of the period of supersession and

reconstitution of authority

SECTION 31(1): Constituted of authority

SECTION 31(2): Authority to be body corporate

SECTION 31(3): Head office

SECTION 31(4): Branch office

SECTION 31(9): Act of an authority not invalidated due to defect

LESSONS TO BE ROUNDED OFF

Special Economic Zones (SEZ) are growth engines that can boost manufacturing,

augment exports and generate employment. The SEZs require special fiscal and

regulatory regime in order to impart a hassle free operational regime encompassing

the state of the art infrastructure and support services.

Special Economic Zone (SEZ) is a specifically delineated duty free enclave and

is deemedto be foreign territory for the purposes of trade operations and duties

and tariffs.

SEZ units are governed by Special Economic Zones Act, 2005.

Central Government, State Government, or any other person, jointly or severally,

may establish a Special Economic Zone. Any person who, intends to set up a

Special Economic Zone, may, after identifying the area, make a proposal to the

State Government concerned for the purposes of setting up a Special Economic

CA Mayur Agarwal Inspire Academy

22 | P a g e

Zone.

Board of Approval granting of approval or rejecting proposal or modifying such

proposals for establishment of the Special Economic Zones.

Every Development Commissioner to take steps in order to discharge his

functions to ensure speedy development of the Special Economic Zone and

promotion of exports therefrom.

The Central Government to constitute by notification, a Committee for every

Special Economic Zone, to be called the Approval Committee to exercise the

powers and performthe functions as specified.

Any person, who intends to set up a Unit for carrying on the authorised operations

in a Special Economic Zone, to submit a proposal to the Development

Commissioner concerned.

An application for setting up and operation of an Offshore Banking Unit in a

SpecialEconomic Zone may be made to the Reserve Bank of India.

SEZ Act casts upon the SEZ Authority a duty to undertake such measures as it

thinks fit for the development, operation and management of the respective Special

Economic Zone.

Every person whether employed or residing or required to be present in a Special

Economic Zone shall be provided an identity card by every Development

Commissioner in prescribed form and containing specified particulars.

Provisions of the SEZ Act shall have effect notwithstanding anything inconsistent

therewith contained in any other law for the time being in force or in any

instrument havingeffect by virtue of any law other than this Act.

Any person aggrieved by any decision or order of the designated Court may file an

appeal to the High Court within sixty days from the date of communication of the

decision or order of the said court to him on any question of fact or law arising out of

such orders.

HIGHLITED PART IN MODULE

1) The salient features of the Act are as under:—

(i) ma ers rela ng to establishment of Special Economic Zone and for se ng up of units

therein, including requirements, obliga ons and en tlements;

(ii) ma ers rela ng to requirements for se ng up of off-shore banking units and units in

Interna onal Financial Service Center in Special Economic Zone, including fiscal

regime governing the opera on of such units;

(iii) the fiscal regime for developers of Special Economic Zones and units set up therein;

(iv) single window clearance mechanism at the Zone level;

(v) establishment of an Authority for each Special Economic Zone set up by the Central

Government to impart greater administra ve autonomy; and

(vi) designa on of special courts and single enforcement agency to ensure speedy trial

andinves ga on of no fied offences commi ed in Special Economic Zones.

CA Mayur Agarwal Inspire Academy

23 | P a g e

Guidelines for notifying Special Economic Zone

Sec on 5 s pulates broader guidelines to be considered by the Central Government, while

no fying any area as a Special Economic Zone or an area to be included in the SEZ and in

discharging its func ons under the Act. These include:

(a) genera on of addi onal economic ac vity;

(b) promo on of exports of goods and services;

(c) promo on of investment from domes c and foreign sources;

(d) crea on of employment opportuni es;

(e) development of infrastructure facili es; and

(f) maintenance of sovereignty and integrity of India, the security of the State and

friendlyrela ons with foreign States

The processing and non-processing areas

2) Duties, powers and functions of Board of Approval

The powers and func ons of the Board, inter alia, include:

(a) gran ng of approval or rejec ng proposal or modifying such proposals for

establishment of the Special Economic Zones;

(b) granting approval of authorised opera ons to be carried out in the Special Economic

Zonesby the Developer;

(c) gran ng of approval to the Developers or Units (other than the Developers or the Units

which are exempt from obtaining approval under any law or by the Central

Government) for foreign collabora ons and foreign direct investments (including

investments by a person resident outside India) in the Special Economic Zone for its

development,opera on and maintenance;

(d) gran ng of approval or rejec ng proposal for providing infrastructure facili es in a

SpecialEconomic Zone or modifying such proposals;

(e) gran ng, a licence to an industrial undertaking referred to in sec on 3(d) of IDR Act, if

CA Mayur Agarwal Inspire Academy

24 | P a g e

such undertaking is established, as a whole or part thereof, or proposed to be

established, ina Special Economic Zone;

(f) suspension of the le er of approval granted to a Developer and appointment of an

Administrator under Sec on 10(1) of the Act;

(g) disposing of appeals preferred under Sec on 15(4) and Sec on 16(4) of the Act;

(h) performing such other func ons as may be assigned to it by the Central Government.

Suspension of letter of approval and transfer of special economic zone in certain cases

The func ons of the Development Commissioner include :

(a) guide the entrepreneurs for se ng up of Units in the Special Economic Zone;

(b) ensure and take suitable steps for effec ve promo on of exports from the Special

Economic Zone;

(c) ensure proper coordina on with the Central Government or State Government

Departments concerned or agencies with respect to, or for above purposes;

(d) monitor the performance of the Developer and the Units in SEZ;

(e) discharge such other func ons as may be assigned to him by the Central

Governmentunder this Act or any other law for the me being in force; and

(f) any other func ons as may be delegated to him by the Board of approval.

CA Mayur Agarwal Inspire Academy

25 | P a g e

Chapter: 11 COMPETITION ACT 2002

PAST PAPER CONCEPTS

Conditions conductive to centralization

SECTION 2(c) Cartel

What is competition and what ways competition kill the competition

ARTICLES 38 AND 39: Evolution and development of Indian competition

There is close relationship between competition and economic efficiency

SECTION 2(f): Consumer

Competition act and MRTP Act

SECTION 2(1): Person

SECTION 19(3): Factors which competition commission of India takes into

consideration to determine that the agreement has an appreciable adverse effect

SECTION 3: Anti-competitive agreement

SECTION 3(3): Bid rigging and ways in which bid rigging may occur

Bid rigging, tie-in agreement, exclusive supply agreement and refusal to deal

SECTION 4: Competition act Does not prohibit dominance but the abuse of dominant

position

Abuse of dominance

Dominant position

Purpose of determining whether an enterprise enjoys dominant position or not

SECTION 6: Regulation of combination

Combination

SECTION 7: Establishment of commission

SECTION 8: Composition of commission

SECTION 9: Selection of chairperson and members

SECTION 10: Term of office of chairperson and member

SECTION 7: Duties, powers and functions of competition commission of India

SECTION 19(4): Commission while inquiring whether an enterprise enjoys a

dominant position or not

Order can be passed by CCI under SECTION 27

Who can appear before CCI

Jrisdiction of the CCI extends to acts/agreement taking place outside India which

affects competition in India

Process of selection of chairperson and member of CCI & what circumstance they

may remove by the CG

SECTION 41: Duties and powers of director general

SECTION 49Competition advocacy

Purpose of competition policy of India

CA Mayur Agarwal Inspire Academy

26 | P a g e

SECTION 39: CCI imposing monetary penalty be executed

SECTION 42: Penalty prescribed by competition act for contravention of the

competition commission

Competition appellate tribunal [SECTION 53A] Appellate tribunal

[SECTION 411 OF COMPANIES ACT] Qualifications

[SECTION 416 COMPANIES ACT] Resignation

[53S] Right to legal representative

SECTION 44: Consequences of making false statement by a person being party to

combination.

LESSONS TO BE ROUNDED OFF

• Competition Act, 2002 seeks to provide, keeping in view the economic development

of the country, for the establishment of Competition Commission to prevent practices

having adverse effect on competition, to promote and sustain competition in markets, to

protect the interests of consumers and to ensure freedom of trade carried on by other

participants in markets in India and for matters connected therewith or incidental thereto

besides repeal of MRTP Act and the dissolution of the MRTP Commission.

• No enterprise or association of enterprises or person or association of persons shall

enter into any agreement in respect of production, supply, distribution, storage, acquisition

or control of goods or provision of services, which causes or is likely to cause an

appreciable adverse effect on competition.

• Competition Act expressly prohibits any enterprise or group from abusing its dominant

position. Dominant Position meaning thereby a position of strength, enjoyed by an

enterprise or group, in the relevant market, in India, which enables it to operate

independently of competitive forces prevailing in the relevant market; or affect its

competitors or consumers or the relevant market in its favour.

• Competition Act prohibits any person or enterprise from entering into a combination

which causes or is likely to cause an appreciable adverse effect on competition within

the relevant market in India and if such a combination is formed it shall be void.

• While formulating a policy on the competition the Central/State Government may

make a reference to the Commission for its opinion on possible effect of such a policy

on the competition.

• Competition Appellate Tribunal to hear and dispose of appeals against the direction

issued or decision made or orders passed by the Commission under the Act, and to

adjudicate on claim of compensation.

• The Central Government or any State Government or the Commission or any statutory

authority or any local authority or any enterprise or any person aggrieved by any decision

or order of the Appellate Tribunal may file an appeal to the Supreme Court.

CA Mayur Agarwal Inspire Academy

27 | P a g e

HIGHLITED PART IN MODULE

Some of the conditions that are conducive to cartelization are:

high concentration - few

competitors high entry and

exit barriers

homogeneity of the products (similar

products) similar production costs

excess capacity

high dependence of the consumers on

the product history of collusion

WHAT IS AN ANTI-COMPETITIVE AGREEMENT?

An anti-competitive agreement is an agreement having appreciable adverse effect on

competition. Anti- competitive agreements include, but are not limited to:- agreement to

limit production and/or supply; agreement to allocate markets; agreement to fix price; bid

rigging or collusive bidding; conditional purchase/ sale (tie-in arrangement); exclusive

supply / distribution arrangement; resale price maintenance; and refusal to deal.

WHAT CONSTITUTES ABUSE OF DOMINANCE?

Dominance refers to a position of strength which enables an enterprise to operate

independently of competitive forces or to affect its competitors or consumers or the market

in its favour. Abuse of dominant position impedes fair competition between firms, exploits

consumers and makes it difficult for the other players to compete with the dominant

undertaking on merit. Abuse of dominant position includes:

• imposing unfair conditions or price,

• predatory pricing,

• limiting production/market or technical development ,

• creating barriers to entry,

• applying dissimilar conditions to similar transactions,

• denying market access, and

• using dominant position in one market to gain advantages in another market.

WHAT IS COMBINATION?

Broadly, combination under the Act means acquisition of control, shares, voting rights or

assets, acquisition of control by a person over an enterprise where such person has direct or

indirect control over another enterprise engaged in competing businesses, and mergers and

amalgamations between or amongst enterprises when the combining parties exceed the

thresholds set in the Act. The thresholds are specified in the Act in terms of assets or

turnover in India and outside India. Entering into a combination which causes or is likely to

CA Mayur Agarwal Inspire Academy

28 | P a g e

cause an appreciable adverse effect on competition within the relevant market in India is

prohibited and such combination shall be void.

Section 19(3) provides that while determining whether an agreement has appreciable

adverse effect on competition, the Commission shall give due regard to all or any of the

following factors, namely–

(a) creation of barriers to new entrants in the market;

(b) driving existing competitors out of the market;

(c) foreclosure of competition by hindering entry into the market;

(d) accrual of benefits to consumers;

(e) improvements in production or distribution of goods or provision of services;

(f) promotion of technical, scientific and economic development by means of

production or distribution of goods or provision of services.

Duties, Powers and Functions of Commission

As per Section 18 of the Act, duties of the CCI are:–

For the purpose of determining whether an enterprise enjoys dominant position or not

under Section 4, the Commission shall have due regard to all or any of the following

factors, namely–

(a) market share of the enterprise;

(b) size and resources of the enterprise;

(c) size and importance of the competitors;

(d) economic power of the enterprise including commercial advantages over competitors;

(e) vertical integration of the enterprises or sale or service network of such enterprises;

(f) dependence of consumers on the enterprise;

(g) monopoly or dominant position whether acquired as a result of any statute or by virtue

CA Mayur Agarwal Inspire Academy

29 | P a g e

of being a Government company or a public sector undertaking or otherwise;

(h) entry barriers including barriers such as regulatory barriers, financial risk, high capital

cost of entry, marketing entry barriers, technical entry barriers, economies of scale,

high cost of substitutable goods or service for consumers;

(i) countervailing buying power;

(j) market structure and size of market;

(k) social obligations and social costs;

(l) relative advantage, by way of the contribution to the economic development, by the

enterprise enjoying a dominant position having or likely to have an appreciable

adverse effect on competition;

(m) any other factor which the Commission may consider relevant for the inquiry.

The Commission shall have due regard to all or any of the factors for the purposes of

determining whether the combination would have the effect of or is likely to have an

appreciable adverse effect on competition in the relevant market, namely –

(a) actual and potential level of competition through imports in the market;

(b) extent of barriers to entry into the market;

(c) level of combination in the market;

(d) degree of countervailing power in the market;

(e) likelihood that the combination would result in the parties to the combination being able

to significantly and sustainably increase prices or profit margins;

(f) extent of effective competition likely to sustain in a market;

(g) extent to which substitutes are available or are likely to be available in the market;

(h) market share, in the relevant market, of the persons or enterprise in a combination,

individually and as a combination;

(i) likelihood that the combination would result in the removal of a vigorous and

effective competitor or competitors in the market;

(j) nature and extent of vertical integration in the market;

(k) possibility of a failing business;

(l) nature and extent of innovation;

(m) relative advantage, by way of the contribution to the economic development, by

any combination having or likely to have appreciable adverse effect on competition;

(n) whether the benefits of the combination outweigh the adverse impact of the combination,

if any.

CA Mayur Agarwal Inspire Academy

30 | P a g e

CA Mayur Agarwal Inspire Academy

31 | P a g e

Chapter: 12 CONSUMER PROTECTION ACT 21019

PAST PAPER CONCEPTS

SECTION 2(9): Basic rights of consumer

Commercial purpose

SECTION 2(7): Consumer

SECTION 2(11): Deficiency in service

SECTION 2(10): Defects in goods

SECTION 2(5): Complainant

SECTION 2(41): Restrictive trade practices

SECTION 34: Pecuniary and territorial jurisdiction of the district forum

SECTION 39: Nature and scope of remedies

Composition and jurisdiction of national commission

Process of filling an appeal

Contract of service and contract for service

LESSONS TO BE ROUNDED OFF

Consumer Protection Act, 2019 provides for protection of the interests of

consumers and for the said purpose, to establish authorities for timely and effective

administration and settlement of consumers’ disputes and for matters connected

therewith or incidental thereto.

Consumer means any person who (i) buys any goods for a consideration which has

been paid or promised or partly paid and partly promised, or under any system of

deferred payment and includes any user of such goods other than the person who

buys such goods for consideration paid or promised or partly paid or partly

promised, or under any system of deferred payment, when such use is made with

the approval of such person, but does not include a person who obtains such goods

for resale or for any commercial purpose; or (ii) hires or avails of any service for a

consideration which has been paid or promised or partly paid and partly promised,

or under any system of deferred payment and includes any beneficiary of such

service other than the person who hires or avails of the services for consideration

paid or promised, or partly paid and partly promised, or under any system of

deferred payment, when such services are availed of with the approval of the first

mentioned person, but does not include a person who avails of such service for any

commercial purpose.

The expression “commercial purpose” does not include use by a person of goods

bought and used by him exclusively for the purpose of earning his livelihood, by

means of self-employment and the expressions “buys any goods” and “hires or

avails any services” includes offline or online transactions through electronic

means or by teleshopping or direct selling or multi-level marketing.

Direct selling means marketing, distribution and sale of goods or provision of

CA Mayur Agarwal Inspire Academy

32 | P a g e

services through a network of sellers, other than through a permanent retail

location.

E-Commerce means buying or selling of goods or services including digital

products over digital or electronic network.

Electronic service provider means a person who provides technologies or processes to

enable a product seller to engage in advertising or selling goods or services to a

consumer and includes any online market place or online auction sites.

Endorsement in relation to an advertisement, means any message, verbal statement,

demonstration; or depiction of the name, signature, likeness or other identifiable

personal characteristics of an individual; or depiction of the name or seal of any

institution or organisation, which makes the consumer to believe that it reflects the

opinion, finding or experience of the person making such endorsement.

Express warranty means any material statement, affirmation of fact, promise or

description relating to a product or service warranting that it conforms to such

material statement, affirmation, promise or description and includes any sample or

model of a product warranting that the whole of such product conforms to such

sample or model.

Product liability means the responsibility of a product manufacturer or product seller,

of any product or service, to compensate for any harm caused to a consumer by such

defective product manufactured or sold or by deficiency in services relating thereto.

Section 10 empowers the Central Government to establish a Central Consumer

Protection Authority to be known as the Central Authority to regulate matters relating

to violation of rights of consumers, unfair trade practices and false or misleading

advertisements which are prejudicial to the interests of public and consumers and to

promote, protect and enforce the rights of consumers as a class.

District Commission shall have jurisdiction to entertain complaints where the value of

the goods or services paid as consideration does not exceed one crore rupees.

State Commission shall have jurisdiction to entertain complaints where the value of

the goods or services paid as consideration, exceeds rupees one crore, but does not

exceed rupees ten crore.

National Commission shall have jurisdiction to entertain Complaints where the value

of the goods or services paid as consideration exceeds rupees ten crore.

Product liability action may be brought by a complainant against a product

manufacturer or a product service provider or a product seller, as the case may be, for

any harm caused to him on account of a defective product.

HIGHLITED PART IN MODULE

Who is a not a consumer?

A person who obtains;

goods free of charge

who avails services free of charge

CA Mayur Agarwal Inspire Academy

33 | P a g e

who obtains goods for resale or for any commercial purposes

who avails services for any commercial purposes

who avails services under contract of service

As per the provisions of the Act, commercial purpose does not include use by a

person of goods bought and used by him exclusively for the purposes of earning

his livelihood by means of self- employment.

While determining the penalty, regard shall be had to the following, namely:–

(a) the population and the area impacted or affected by such offence;

(b) the frequency and duration of such offence;

(c) the vulnerability of the class of persons likely to be adversely affected by such offence;

and

(d) the gross revenue from the sales effected by virtue of such offence.

Vexatious Search

The Director General or any other officer, exercising powers under section 22, who

knows that there are no reasonable grounds for so doing, and yet–

(a) searches, or causes to be searched any premises; or

(b) eizes

any record, register or other document or article, shall, for every such offence, be

punished with imprisonment for a term which may extend to one year, or with fine which

may extend to ten thousand rupees or with both.

Appeal against order of District Commission

There are certain restriction on appeal, unless the person fulfil the following conditions

namely-

No appeal by a person, who is required to pay any amount in terms of an order of the

District Commission, shall be entertained by the State Commission unless the

appellant has deposited fifty per cent. of that amount in the manner as may be

prescribed.

No appeal shall lie from any order passed under sub-section (1) of section 81 by the

District Commission pursuant to a settlement by mediation under section 80.

According to Section 47(4), a complaint shall be instituted in a State Commission within

the limits of whose jurisdiction,–

(a) the opposite party or each of the opposite parties, where there are more than one, at the

time of the institution of the complaint, ordinarily resides or carries on business or has

a branch office or personally works for gain; or

(b) any of the opposite parties, where there are more than one, at the time of the institution

of the complaint, actually and voluntarily resides, or carries on business or has a branch

office or personally works for gain, provided in such case, the permission of the State

Commission is given; or

(c) the cause of action, wholly or in part, arises; or

(d) the complainant resides or personally works for gain.

CA Mayur Agarwal Inspire Academy

34 | P a g e

MEDIATION

A consumer mediation cell shall consist of such persons as may be prescribed. Every

consumer mediation cell shall maintain–

(a) a list of empanelled mediators;

(b) a list of cases handled by the cell;

(c) record of proceeding; and

(d) any other information as may be specified by regulations.

Duty of Mediator to Disclose Certain Fact

According to the Section 77 of the Act, it shall be the duty of the mediator to disclose–

(a) any personal, professional or financial interest in the outcome of the consumer

dispute;

(b) the circumstances which may give rise to a justifiable doubt as to his independence

or impartiality; and such other facts as may be specified by regulations.

CA Mayur Agarwal Inspire Academy

35 | P a g e

Chapter: 13 ESSENTIAL COMMODITIES ACT 1995

PAST PAPER CONCEPTS

Evaluate the efficacy of ECA in controlling the procedure, supply and distribution

of essential commodities in the country

Tea is food stuff? Does it have ant nutritional value?

SECTION 2(a) Essential commodities

Power of the CG to control production supply and distribution

SECTION 3(4) Who appoint authorised controller? State functions and liabilities

SECTION 6A (1) Confiscation of essential commodities seized in contravention of

section 3 Seizer and Confiscation

Explain in brief Seizer and Confiscation

Mens rea

LESSONS TO BE ROUNDED OFF

Essential Commodities Act, 1955 has been enacted to provide in the interest of the

general public for the

control of the production, supply and distribution of and trade and

commerce in, certain commodities.

Section 2A dealing with Essential commodities declaration, etc. defines the

“essential commodity” as to means a commodity specified in the Schedule to the

Act.

Central Government has been empowered to administer the provisions of the

Act by issuing orders/ directions notified in the official gazette and by

delegating the authority to State Governments and administrators of Union

Territories.

An essential commodity which has been seized could be confiscated. Therefore,

confiscation is an action posterior to the seizure of the essential commodity. A

commodity that has not been seized cannot be confiscated. Seizure itself does not

imply confiscation.

Mens rea or guilty mind is an essential ingredient of the offence punishable under the

Act.

Culpable mental state, which includes intention, motive, knowledge of a fact

and the belief in a fact.

Where an offence is committed by a company, if it is proved that the offence had

been committed with the consent or connivance of or is attributable to any neglect

on the part of any Director, Manager, Secretary or other officer of the company,

such a person shall be deemed to be guilty of that offence, and is liable to be

proceeded against and punished accordingly.

The Act expressly provides that no Civil Court can grant any injunction or make

any order for any other relief against the Central or State Government or any

public officer, in respect of any act done, r purporting to be done, by such person

in his official capacity under the Act, or any Order made thereunder, until after

notice of the application for such injunction or other report is given to the

Government or to such officer.

CA Mayur Agarwal Inspire Academy

36 | P a g e

HIGHLITED PART IN MODULE

Schedule to the Act lists out following commodities:

(1) drugs: The explanation clarifies that for the purposes of this Schedule, “drugs” has the

meaning assigned to it in clause (b) of Section 3 of the Drugs and Cosmetics Act,

1940;

(2) fertilizer, whether inorganic, organic or mixed;

(3) foodstuffs, including edible oilseeds and oils;

(4) hank yarn made wholly from cotton;

(5) petroleum and petroleum products;

(6) raw jute and jute textiles;

(7)

(i) seeds of food-crops and seeds of fruits and vegetables;

(ii) seeds of cattle fodder; and

(iii) jute seeds.

IN S. Samuel, MD. Harrisons Malayava v. Union of India, AIR 2004 SC 218, Supreme

Court held that Tea is not foodstuff. Even in a wider sense, foodstuffs will not include tea

as tea either in the form of the leaves or in the form of beverage, does not go into the

preparation of food proper to make it more palatable and digestible.

Tea leaves are not eaten. Tea is a beverage produced by steeping tea leaves or buds of

the tea plants in the boiled water. Such tea is consumed hot or cold for its flavour, taste

and its quality as a stimulant. The stimulating effect is caused by the presence of

caffeine therein. Tea neither nourishes the body nor sustains nor promotes its growth.

It does not have any nutritional value. It does not help formation of enzymes nor does

it enable anabolism. Tea or its beverage does not go into the preparation of any

foodstuff. In common parlance, any one who has taken tea would not say that he has

taken or eaten food. Thus tea is not a food.

Order: “Order” includes a direction issued thereunder [Section 2(c)].

State Government: “State Government”, in relation to a Union territory means the

administrator of such territory [Section 2(d)].

Sugar: “Sugar” means: (i) any form of sugar containing more than 90 per cent of

sucrose, including sugar candy; (ii) Khandsari sugar or bura sugar or crushedsugar, or

any sugar in crystalline or powdered form; or (iii) sugar in process in vacuum pan sugar

factory, or raw sugar [Section 2(e)].

Power to Issue Orders

The Central Government having been vested with power under Section 3(1) can issue order in

the following circumstances providing for regulating or prohibiting the production, supply

and distribution of essential commodities and trade and commerce therein:

CA Mayur Agarwal Inspire Academy

37 | P a g e

(i) when it is necessary or expedient for maintaining or increasing supplies of any essential

commodity;

(ii) for securing the equitable distribution and availability of essential commodities at fair

price; or

(iii) for securing any essential commodity for the defence of India or the

efficient conduct of military operations.

Explanation.—The expression “value chain participant”, in relation to any agricultural

product, means and includes a set of participants, from production of any agricultural

produce in the field to final consumption, involving processing, packaging, storage,

transport and distribution, where at each stage value is added to the product.

xplanation I provides that an order made under this clause in relation to foodgrains, edible

oilseeds or edible oils may, having regard to the estimated production, In the concerned area, of

such foodgrains, edible oilseeds and edible oils, fix the quantity to be sold by the producers

in such area and may also fix, or provide for the fixation of such quantity on a graded basis,

having regard to the aggregate of the area held by, or under the cultivation of the producers.

Explanation II provides that “production” for the purposes of this clause includes

manufacture of edible oils and sugar with its grammatical variation and cognate

expressions;

Issuance and Service of Order

An order made under Section 3 of the Act shall be issued and served in the manner as

provided under Section 3(5) i.e. in the following manner:

(a) in the case of an order of general nature or affecting a class of persons be notified in the

official gazette; and

(b) in the case of an order directed to a specified individual be served on such

individual (i) by delivering or tendering it to that individual, or (ii) if it cannot be so

delivered or tendered, by affixing it on the outer door or some other conspicuous part of

the premises in which that individual lives, and a written report thereof shall be prepared

and witnessed by two persons living in the neighbourhood.

EFFECT OF THE ORDER

The Calcutta High Court had observed that the ultimate effect of Section 6 is that an order

under Section 3 will override existing laws, only on the ground that these are orders validly

made under Section 3 of the Act (Ramananda Agrawala v. State AIR 1951 Calcutta 120).

As rightly pointed out by the Patna High Court, Section 6 is a saving section which

affords protection to the orders made under Section 3 of the Act as against the onslaught

of any law, merely by reason of inconsistency (Mohammad Anwar Hussi v. State of Bihar,

AIR 1955 Patna 220).

Seizure’

The expression ‘seize’ means to take possession contrary to the wishes of the owner of

the property and that such action is unilateral action of the person seizing. The person

CA Mayur Agarwal Inspire Academy

38 | P a g e

from whom anything is seized loses, from the moment of seizure, the right or power to

control or regulate the use of that thing. The dictionary meaning of the word ‘seize’

means to lay hold of suddenly or forcible, to take hold of, to reach and grasp, to

clutch’. It also means ‘to take possession of or appropriate in order to subject to the

force or operation of a warrant, order of Court or other legal processes. A reference to

some provisions of the Codes of Criminal Procedure shows that the term seizure had

been used therein in connection with the taking of actual physical possession of

moveable property.

Confiscation’

‘Confiscation’ according to Wharton’s Law Lexicon, is condemnation and adjudication

of property to the public treasury as of goods seized under the Customs Act.

Confiscation, according to Strouds judicial Dictionary, must be an act done in some

way on the part of the Government of the country where it takes place and in some way

beneficial to that Government, though the proceeds may not strictly speaking be

brought into its treasury. In State of Kerala v. Mathai (1961 K.L.T. 169) it was pointed

out that confiscation is not to be considered part of the sentence for an offence but is

only a mode by which Courts can dispose of property which comes before it in criminal

trials.

Prosecution of Public Servants (Section 15A)

If any public servant is accused of any offence alleged to have been committed by him

while acting, or purporting to act, in the discharge of his duties, in pursuance of any order

made under Section 3, no court can take cognizance of such an offence except with the

previous sanction—(a) of the Central Government in the case of a person who is

employed in connection with the affairs of the Union; and (b) of the State Government in

the case of a person who is employed in connection with the affairs of the State.

ens rea (Sections 6A and 7)

In Nathulal v. State of Madhya Pradesh (AIR 1966 S.C. 43) it was held by the Supreme

Court that mens rea or guilty mind is an ingredient of the offence punishable under Section

7 of the Essential Commodities Act, 1955 i.e., an intentional contravention of an order made

under Section 3, is an essential ingredient of an offence under Section7. In other words, if

the dealer did believe bona fide that he could store the foodgrains for instance, without

infringing any order under Section 3, there could be no contravention under Section 7.

It was observed by the Supreme Court in this case that mens rea is an essential ingredient

of any criminal offence. Mens rea by necessary implication may be excluded from a statute

only where it is absolutely clear that the implementation of the object of the Statute would

otherwise be defeated. The nature of mens rea that would be implied in a Statute creating an

offence depends on the object of the Act and the provisions thereof.

In Hariprasad Rao v. State (AIR 1951 SC 264), it was observed that unless a Statute

either clearly or by necessary implication rules out mens rea as a constituent part of a

crime, an accused cannot be found guilty of an offence against the criminal law unless he

CA Mayur Agarwal Inspire Academy

39 | P a g e

has got a guilty mind. Therefore, mens rea is an essential ingredient of an offence under

Section 7 of the Act.

Culpable Mental State

Section 10-C provides for a presumption of culpable mental state, which includes

intention, motive, knowledge of a fact and the belief in a fact. It is now provided thati n

any prosecution for an offence under the Act which requires a culpable mental state on the

part of the accused, the Court shall presume the existence of mental state. Of course, it is

open to the accused to prove that he had no such mental state with respect of the act

committed by him.

GRANT OF INJUNCTION BY CIVIL COURTS (SECTION 12B)

It is expressly provided by Section 12B that no Civil Court can grant any injunction or

make any order for any other relief against the Central or State Government or any

public officer, in respect of any act done, or purporting to be done, by such person in

his official capacity under the Act, or any Order made thereunder, until after notice of

the application for such injunction or other report is given to the Government or to such

officer.

CA Mayur Agarwal Inspire Academy

40 | P a g e

Chapter: 14 LEGAL METROLOGY ACT 2009

PAST PAPER CONCEPTS

International Organisation of Legal Metrology certificate system for measuring

instrument

Legal metrology

Features of legal metrology act

Pre-packaged commodity

Declaration required to be made by the manufacturer on pre-packaged commodities

and refer penalties

LESSONS TO BE ROUNDED OFF

Consumer Protection Act, 2019 provides for protection of the interests of

consumers and for the said purpose, to establish authorities for timely and effective

administration and settlement of consumers’ disputes and for matters connected

therewith or incidental thereto.

Consumer means any person who (i) buys any goods for a consideration which has

been paid or promised or partly paid and partly promised, or under any system of

deferred payment and includes any user of such goods other than the person who

buys such goods for consideration paid or promised or partly paid or partly

promised, or under any system of deferred payment, when such use is made with

the approval of such person, but does not include a person who obtains such goods

for resale or for any commercial purpose; or (ii) hires or avails of any service for a

consideration which has been paid or promised or partly paid and partly promised,

or under any system of deferred payment and includes any beneficiary of such

service other than the person who hires or avails of the services for consideration

paid or promised, or partly paid and partly promised, or under any system of

deferred payment, when such services are availed of with the approval of the first

mentioned person, but does not include a person who avails of such service for any

commercial purpose.

The expression “commercial purpose” does not include use by a person of goods

bought and used by him exclusively for the purpose of earning his livelihood, by

means of self-employment and the expressions “buys any goods” and “hires or

avails any services” includes offline or online transactions through electronic means

or by teleshopping or direct selling or multi-level marketing.

Direct selling means marketing, distribution and sale of goods or provision of

services through a network of sellers, other than through a permanent retail

location.

E-Commerce means buying or selling of goods or services including digital

products over digital or electronic network.

Electronic service provider means a person who provides technologies or processes

to enable a product seller to engage in advertising or selling goods or services to a

consumer and includes any online market place or online auction sites.

Endorsement in relation to an advertisement, means any message, verbal statement,

demonstration; or depiction of the name, signature, likeness or other identifiable

CA Mayur Agarwal Inspire Academy

41 | P a g e

personal characteristics of an individual; or depiction of the name or seal of any

institution or organisation, which makes the consumer to believe that it reflects the

opinion, finding or experience of the person making such endorsement.

Express warranty means any material statement, affirmation of fact, promise or

description relating to a product or service warranting that it conforms to such

material statement, affirmation, promise or description and includes any sample or

model of a product warranting that the whole of such product conforms to such

sample or model.

Product liability means the responsibility of a product manufacturer or product

seller, of any product or service, to compensate for any harm caused to a consumer

by such defective product manufactured or sold or by deficiency in services relating

thereto.

Section 10 empowers the Central Government to establish a Central Consumer

Protection Authority to be known as the Central Authority to regulate matters

relating to violation of rights of consumers, unfair trade practices and false or

misleading advertisements which are prejudicial to the interests of public and

consumers and to promote, protect and enforce the rights of consumers as a class.

District Commission shall have jurisdiction to entertain complaints where the value

of the goods or services paid as consideration does not exceed one crore rupees.

State Commission shall have jurisdiction to entertain complaints where the value of

the goods or services paid as consideration, exceeds rupees one crore, but does not

exceed rupees ten crore.

National Commission shall have jurisdiction to entertain Complaints where the

value of the goods or services paid as consideration exceeds rupees ten crore.

Product liability action may be brought by a complainant against a product

manufacturer or a product service provider or a product seller, as the case may be,

for any harm caused to him on account of a defective product.

HIGHLITED PART IN MODULE

OIML

According to OIML, Legal Metrology is the entirety of the legislative, administrative and

technical procedures established by, or by reference to public authorities, and

implemented on their behalf in order to specify and to ensure, in a regulatory or

contractual manner, the appropriate quality and credibility of measurements related to

official controls, trade, health, safety and the environment.

Appointment and Power of Director, Controller and legal metrology officers

The Director and every legal metrology officer, appointed, shall exercise such powers and

discharge such functions in respect of such local limits as the Central Government may, by

notification, specify. Every legal metrology officer shall exercise powers and discharge

duties under the general superintendence, direction and control of the Director.

Section 14 of the Act, provides that the State Government may, by notification, appoint a

Controller of legal metrology, Additional Controller, Joint Controller, Deputy Controller,

Assistant Controller, Inspector and other employees for the State for exercising the powers

CA Mayur Agarwal Inspire Academy

42 | P a g e

and discharging the duties conferred or imposed on them by or under this Act in relation to

intra State trade and commerce.

Declarations on pre-packaged commodities

Section 18 states that no person shall manufacture, pack, sell, import, distribute, deliver,

offer, expose or possess for sale any pre-packaged commodity unless such package is in

such standard quantities or number and bears thereon such declarations and particulars in

such manner as may be prescribed. Any advertisement mentioning the retail sale price of a

pre- packaged commodity shall contain a declaration as to the net quantity or number of

the commodity contained in the package in such form and manner as may be prescribed.

APPROVAL OF MODAL

It may be noted that the prescribed authority may, if he is satisfied that the model of any