Professional Documents

Culture Documents

The accounting equation

The accounting equation

Uploaded by

Letlotlo Lebete0 ratings0% found this document useful (0 votes)

2 views6 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views6 pagesThe accounting equation

The accounting equation

Uploaded by

Letlotlo LebeteCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 6

The accounting equation=assets=capital+liabilities

Assets are items belonging to the business and used

in starting the running the business…

Liabilities are sums of money owed by the business

to outsiders e.g bank overdraft or loan

Tax to government authorities

Credit purchases as well

The business is a separate entity from its owner this

just says that

A business can owe money to its owners as they

different persons

The assets and liabities of the business are separate

from the owner

Fundamental accounting rule is assets and iabilities

should always be equal…..

Also note that the business owes the owner for the

capital she has contributed into the business

Capital is the investment of money with the

intenstion of earning a return capital is a liability to

a business then.

Profit like capital belongs to the owner of the

business it belongs to neelim sultun exactly

Also as long as the business does not pay anything

to the owner the retained profit became part of the

owners capital

Assets

Stall 1800

Flowers +plants 0

Cash 50 +900 950

2750

The accounting equation 2 as long as business

retains profits owes nothing to owner

Capital introduced +retained profits=liabilities

Assets(1800)

Stock

Cash is 50+900(950)=2750

Capital at start+retained profits(2500)+250=2750

Net assets are total assets-total liabities ame thing

for capital total assets -total liabiltes

Net assets represent capital introduce +retained

profits as well

Net assets total assets -total liabilities

capital at start +at end=retained proft which is an

increase in net assets

Amounts of money taken of the business by the

owner are drawings

Profit earned (it is a surplus on sale of

flowersreamils after another has been utilized on

resources)

Profit retained is kept within its account

Double entry means that every transaction has the

dibit and creditside

Debit side may be an increase in expenses’

In assets

A decrease in liability

Credit side may be

An increase in liability

An increase in income a decrease in assets

Dual effect changes in assets include changes in

capital and also liabilities

Double entry is called so because every transaction

occurs twice in the accounting system……..

Double entry gives into account to make sure that

debit entries are equal to credit entries

Asset liability income and expense has a ledger

account

Capital expenditure is the expenditure spend on

non current assets or an improvement in their

earing capacity

The total amount capital expenditure is not

deducted from earings

It is deemed expenditure that brings benefits to the

business over more than one accounting period

Revenue expenditure is expenditure that is

incuured either on the purpose of trade of the

business or to maintain the existing earning

capacity of non current assets

If capital expenditure is treated at revenue profit

will be understated and if revenue is treated like

capital it will be overstated

Revenue expenditure used in the accounting period

which they are purchased

Capital revenue purchase or improvement of non

current assets

You might also like

- AssignmentDocument13 pagesAssignmentEnz Alba82% (11)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- HEC MSC Internationa Finance PDFDocument7 pagesHEC MSC Internationa Finance PDFJai KamdarNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationCarlo Leandro LaronNo ratings yet

- Introduction To AccountingDocument8 pagesIntroduction To AccountingibrahimhujiratNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting AssignmentAnngela ManahanNo ratings yet

- New Microsoft Office PowerPoint Presentation (Autosaved)Document23 pagesNew Microsoft Office PowerPoint Presentation (Autosaved)Angelica PagaduanNo ratings yet

- Unit I - Accounting EquationDocument6 pagesUnit I - Accounting EquationAnime LoverNo ratings yet

- MGT101 FinalTerm NotesDocument127 pagesMGT101 FinalTerm Notesaafiah100% (1)

- CHAPTER 2 - Accounting EquationDocument16 pagesCHAPTER 2 - Accounting EquationMuhammad AdibNo ratings yet

- T 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementDocument45 pagesT 32fd6f43 3cd3 4d19 b62d 111e849211bfincome StatementthukrishivNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- The Accounting EquationDocument18 pagesThe Accounting EquationEdgar Belono-ac Jr.No ratings yet

- CHAPTER 3 - Accounting EquationDocument16 pagesCHAPTER 3 - Accounting Equationyow jing pei100% (2)

- The Accounting EquationDocument2 pagesThe Accounting EquationWaheeda BibiNo ratings yet

- Principles of AccountingDocument27 pagesPrinciples of AccountingRaahim NajmiNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsJonabed PobadoraNo ratings yet

- Accounting NotesDocument11 pagesAccounting Notesnerocko101No ratings yet

- Income StatementsDocument5 pagesIncome StatementsAdetunbi TolulopeNo ratings yet

- Net SalesDocument10 pagesNet SalesUsman ShabbirNo ratings yet

- Fabm1 10Document14 pagesFabm1 10Francis Esperanza0% (1)

- Accounting EquationDocument9 pagesAccounting EquationZahidul Islam SumonNo ratings yet

- Fundamentals of PTNGN PDFDocument27 pagesFundamentals of PTNGN PDFEdfrance Delos Reyes0% (1)

- Definition of Elements of Financial StatementsDocument1 pageDefinition of Elements of Financial StatementsKc B.No ratings yet

- Chap-2 Quản trị tài chínhDocument12 pagesChap-2 Quản trị tài chínhQuế Anh TrươngNo ratings yet

- Buad 280Document8 pagesBuad 280Matthew KhachigianNo ratings yet

- MGT NotesDocument160 pagesMGT NotesMujtaba KhanNo ratings yet

- Introduction To AccountingDocument49 pagesIntroduction To AccountingGanapathi SubramanianNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Strategic Capital Group Workshop #5: Financial Statement AnalysisDocument39 pagesStrategic Capital Group Workshop #5: Financial Statement AnalysisUniversity Securities Investment TeamNo ratings yet

- Understanding Financial StatementsDocument21 pagesUnderstanding Financial StatementsAbhayNo ratings yet

- Accounting Classification and EquationDocument5 pagesAccounting Classification and EquationGetha ChellaiahNo ratings yet

- Act 110 Module 2Document28 pagesAct 110 Module 2Nashebah A. BatuganNo ratings yet

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisRitik RautNo ratings yet

- Capital Investment: Financial Management Decision MakingDocument14 pagesCapital Investment: Financial Management Decision MakingZahid MalikNo ratings yet

- 재무관리 챕터2Document9 pages재무관리 챕터29dm9h2s48kNo ratings yet

- 2600 Legarda St. Sampaloc, Manila: Arellano University Juan Sumulong Campus Senior High School DepartmentDocument7 pages2600 Legarda St. Sampaloc, Manila: Arellano University Juan Sumulong Campus Senior High School DepartmentTrisha TorresNo ratings yet

- FABM1 Module C3Document11 pagesFABM1 Module C3Nathan CapsaNo ratings yet

- Financial Ratio Summary SheetDocument1 pageFinancial Ratio Summary SheetKeith Tomasson100% (1)

- Basics of AccountingDocument20 pagesBasics of AccountingvirtualNo ratings yet

- 2double EntryDocument22 pages2double EntryJhoanNo ratings yet

- Branches of Accounting: BOOKKEEPING - Is A Mechanical Task Involving The Collection of BasicDocument21 pagesBranches of Accounting: BOOKKEEPING - Is A Mechanical Task Involving The Collection of BasicDejen Nonog SalvadorNo ratings yet

- Salaries Expenses Wages Expenses Labor ExpensesDocument2 pagesSalaries Expenses Wages Expenses Labor ExpensesGenny MaduraNo ratings yet

- Accounting TerminologyDocument11 pagesAccounting TerminologyVu VuNo ratings yet

- Basic Accounting IntroductionsDocument6 pagesBasic Accounting IntroductionsEtsegenet TafesseNo ratings yet

- EL201 Accounting Learning Module Lessons 2Document5 pagesEL201 Accounting Learning Module Lessons 2Code BoredNo ratings yet

- AccountingDocument4 pagesAccountingKathryn LusicaNo ratings yet

- Major Account TitleDocument63 pagesMajor Account TitleElla RamosNo ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- Fin1240 PDFDocument33 pagesFin1240 PDFYusuf DadabhayNo ratings yet

- Acing ConceptsDocument25 pagesAcing ConceptsGanesh KumarNo ratings yet

- What Is AccountingDocument2 pagesWhat Is AccountingMahmudul HasanNo ratings yet

- Account ElementsDocument8 pagesAccount ElementsMae AroganteNo ratings yet

- 02 The Accounting EquationDocument6 pages02 The Accounting EquationEdizon De Andres JaoNo ratings yet

- Accounting Equation For ACCADocument2 pagesAccounting Equation For ACCAtipu1sultan_1No ratings yet

- Introduction To AccountingDocument34 pagesIntroduction To AccountingBianca Mhae De LeonNo ratings yet

- Debit Credit Chart PDFDocument7 pagesDebit Credit Chart PDFdbistaNo ratings yet

- Accounting PrincipleDocument24 pagesAccounting PrincipleMonirHRNo ratings yet

- Questions and AnswersDocument27 pagesQuestions and AnswersAmalia BejenariuNo ratings yet

- Chapter 3 Act 411Document4 pagesChapter 3 Act 411Moin AhmedNo ratings yet

- Trail BalanceDocument2 pagesTrail BalanceLetlotlo LebeteNo ratings yet

- Quality measures theDocument4 pagesQuality measures theLetlotlo LebeteNo ratings yet

- stages in information summaryDocument13 pagesstages in information summaryLetlotlo LebeteNo ratings yet

- The board of directors being people responsible for cnduct and management of the business affairs have responsibilities such asDocument6 pagesThe board of directors being people responsible for cnduct and management of the business affairs have responsibilities such asLetlotlo LebeteNo ratings yet

- The control account will calculate sales from appropreite sales and purchasesDocument3 pagesThe control account will calculate sales from appropreite sales and purchasesLetlotlo LebeteNo ratings yet

- The macro economiceDocument9 pagesThe macro economiceLetlotlo LebeteNo ratings yet

- Authorisation and Control Under Depreciation (Permissions andDocument5 pagesAuthorisation and Control Under Depreciation (Permissions andLetlotlo LebeteNo ratings yet

- The environmemntal business enironmemntDocument6 pagesThe environmemntal business enironmemntLetlotlo LebeteNo ratings yet

- AUTHORISATION AND CONTROL UNDER DEPRECIATION (PERMISSIONS AND (Autosaved)Document4 pagesAUTHORISATION AND CONTROL UNDER DEPRECIATION (PERMISSIONS AND (Autosaved)Letlotlo LebeteNo ratings yet

- Merger and AquisitionDocument75 pagesMerger and AquisitionSaurabh Parashar0% (1)

- Reading Stock Market PDFDocument3 pagesReading Stock Market PDFfiorella lillian tito cerronNo ratings yet

- Straddle StrategyDocument11 pagesStraddle StrategyРуслан СалаватовNo ratings yet

- AC201Document2 pagesAC201Costa Nehemia MunisiNo ratings yet

- Investment Vs FinancingDocument6 pagesInvestment Vs FinancingSolomon, Heren Mae M.No ratings yet

- American Greetings Case 7Document14 pagesAmerican Greetings Case 7shahzad akNo ratings yet

- Intermediate Accounting Ifrs 3rd Edition Kieso Test BankDocument13 pagesIntermediate Accounting Ifrs 3rd Edition Kieso Test BankMichaelOrtizkgqdz100% (11)

- Ch1 HW SolutionsDocument6 pagesCh1 HW SolutionsNuzul Hafidz Yaslin0% (1)

- Financial Statement Analysis of SbiDocument61 pagesFinancial Statement Analysis of SbiGayatri Chiliveri100% (1)

- Financial Reporting RTP CAP-III June 2016Document24 pagesFinancial Reporting RTP CAP-III June 2016Artha sarokarNo ratings yet

- Weekly Post-Class Online Quiz #3Document10 pagesWeekly Post-Class Online Quiz #3Nghi AnNo ratings yet

- Time Value of MoneyDocument53 pagesTime Value of MoneyKritika BhattNo ratings yet

- Lecture 1444 DepreciationDocument22 pagesLecture 1444 DepreciationTesfa negaNo ratings yet

- 3.3. Preparation of Projected Financial Statements: Unit 3: Financial Planning Tools and ConceptsDocument9 pages3.3. Preparation of Projected Financial Statements: Unit 3: Financial Planning Tools and ConceptsTin CabosNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 With SolutionsDocument50 pagesCBSE Class 12 Accountancy Question Paper 2015 With SolutionsRavi AgrawalNo ratings yet

- Topic 57 To 60 QuestionDocument9 pagesTopic 57 To 60 QuestionNaveen SaiNo ratings yet

- FinmanDocument4 pagesFinmanHatake KakashiNo ratings yet

- Assignment 6 - Foreign Currency Transactions and Derivatives PDFDocument8 pagesAssignment 6 - Foreign Currency Transactions and Derivatives PDFKurt Russel AduvisoNo ratings yet

- What Makes A MoatDocument5 pagesWhat Makes A MoatSwastik MishraNo ratings yet

- What Is DAI (DAI) ?: StablecoinDocument3 pagesWhat Is DAI (DAI) ?: StablecoinSharkyFrost StudiosNo ratings yet

- Mutual Funds: PRENTENED BY:-Sher Singh Pradeep KumarDocument18 pagesMutual Funds: PRENTENED BY:-Sher Singh Pradeep Kumarsherrysingh44No ratings yet

- MSFT 10yr OSV Stock Valuation SpreadsheetDocument15 pagesMSFT 10yr OSV Stock Valuation SpreadsheetOld School ValueNo ratings yet

- A Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byDocument23 pagesA Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byVarsha PaygudeNo ratings yet

- Aasb 107 "Cash Flow Statements": Statement of Cash FlowsDocument5 pagesAasb 107 "Cash Flow Statements": Statement of Cash FlowsLin YaoNo ratings yet

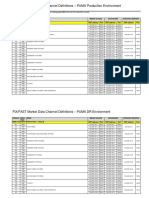

- FIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentDocument3 pagesFIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentVaibhav PoddarNo ratings yet

- PNL PAB181Document8 pagesPNL PAB181NIRANJAN KUMARNo ratings yet

- Core Business ProcessesDocument2 pagesCore Business ProcessesAkhtar QuddusNo ratings yet

- Accounting Case StudyDocument5 pagesAccounting Case Studymatt blankNo ratings yet