Professional Documents

Culture Documents

Screenshot 2024-06-06 at 9.32.29 AM

Screenshot 2024-06-06 at 9.32.29 AM

Uploaded by

jasvir.9450Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Screenshot 2024-06-06 at 9.32.29 AM

Screenshot 2024-06-06 at 9.32.29 AM

Uploaded by

jasvir.9450Copyright:

Available Formats

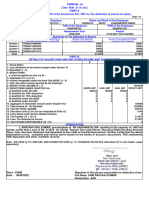

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 2

Employer - PAO CODE Name and Rank of the Employee

72 JASVIR SINGH

PAN of the Deductor TAN of the Deductor PAN of the Employee

BGHPD1719F JBPPO1639B AIRPR6605D

CIT(TDS) Address Assessment Year / Tax Option Period

1(2) 2024-2025 / NEW 01/04/2023 TO 31/03/2024

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1 QVKJBSKB 36168 36168

Quarter 2 QVMUTRKD 19272 19272

Quarter 3 QVOVPMBC 24014 24014

Quarter 4 QVRAQEPF 16846 16846

Total 96300 96300

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary 1262983

2. Standard Deduction 50000

3. Less Allowance to the extent exempt under Section 10 0

4. BALANCE (1 - 2) 1212983

5. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

6. Aggregate of 5 ( a to b ) 0

7. Income chargeable under the Head 'SALARIES' (3 - 5) 1212983

8. Add: Any other income reported by the employee * 0

9. GROSS TOTAL INCOME (6 + 7) 1212983

10. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 0 0 0

b) Qualified for 100% deduction 0 0 0

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

11. Aggregate of deductible amount under Chapter VI-A 0

12. Total Income (8 - 10) Rounded 1212980

13. TAX ON TOTAL INCOME 92596

14. Health & Education Cess @4% (on tax computed at Sl.No.12) 3704

15. Tax Payable (12 + 13) 96300

16. Less: Relief under Section 89(attach Details) 0

17. Less : Tax Deducted 96300

18. TAX PAYABLE/REFUNDABLE (15 - 16) 0

**

VERIFICATION

Note : Health and Education Cess @4% Charged On Income Tax (Rounded off to next higher rupee)

I, Balmukund Dubey, son/daughter of Sh. RAMADHAR DUBEY working in the capacity of AAO do

hereby certify that a sum of Rs. 96300 (in words) Rupees Ninety Six Thousand Three Hundred only has been

deducted and deposited to the credit of Central Government. I further certify that the above information is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and

other available records.

Note * : Sl.No.8 above Other Income includes taxable interest accrued on Fund Subscription above 500000 Rupees

Place : SAUGOR Signature of the person responsible for deduction of tax

Date : 31/05/2024 Full Name Balmukund Dubey

Designation AAO

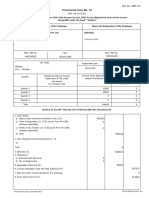

BREAK UP OF TAXABLE EMOLUMENTS FINANCIAL YEARWISE Page 2 2

Employer - PAO Code Name and Rank of the Employee

72 JASVIR SINGH

For the financial year from 01/03/2016 to 28/02/2017 = 9516.0

For the financial year from 01/03/2017 to 28/02/2018 = 15803.0

For the financial year from 01/03/2018 to 28/02/2019 = 15803.0

For the financial year from 01/03/2019 to 29/02/2020 = 15803.0

For the financial year from 01/03/2020 to 28/02/2021 = 15803.0

For the financial year from 01/03/2021 to 28/02/2022 = 15803.0

For the financial year from 01/03/2022 to 28/02/2023 = 85081.0

For the financial year from 01/03/2023 to 29/02/2024 = 1089371.0

Total taxable emoluments 1262983.0

You might also like

- The Rise and Fall of NationsDocument130 pagesThe Rise and Fall of NationsTran100% (1)

- HRM 4112 ReportDocument31 pagesHRM 4112 Reportvijay_dalvoyNo ratings yet

- 2014 Nvca Yearbook PDFDocument127 pages2014 Nvca Yearbook PDFDeepa DevanathanNo ratings yet

- Case DigestDocument3 pagesCase DigestJan Re Espina CadeleñaNo ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Form 1615072023 161901Document2 pagesForm 1615072023 161901Steve BurnsNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form16 W0000000 GS164200X 2021 20211Document1 pageForm16 W0000000 GS164200X 2021 20211gaganNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form 1613062024 094217Document3 pagesForm 1613062024 094217santoshamrute0711No ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Manjit Form16Document1 pageManjit Form16JashanNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Sudhir Jagannath Belose 23-24Document3 pagesSudhir Jagannath Belose 23-24pankajyadav7410No ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- PAYSLIP Nov-2022 - NareshDocument3 pagesPAYSLIP Nov-2022 - NareshDharshan RajNo ratings yet

- Afipg9432r Partb 2023-24Document4 pagesAfipg9432r Partb 2023-24SUPERINTENDENT WOMEN ITI JAMMUNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- G Vittal 16 FrontDocument1 pageG Vittal 16 FrontSRINIVAS MNo ratings yet

- CHLPR4183D Partb 2023-24Document4 pagesCHLPR4183D Partb 2023-24JMLNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bvirajsonawane22No ratings yet

- Form No. 16: Part BDocument3 pagesForm No. 16: Part Bsanjay chauhanNo ratings yet

- New Form 16 AY 11 12Document5 pagesNew Form 16 AY 11 12RMD Financial ServicesNo ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- Form16-2021-2022 Part BDocument3 pagesForm16-2021-2022 Part Bthaarini doraiswamiNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Dbs Ar17 FullDocument211 pagesDbs Ar17 Fullcpwon2No ratings yet

- Maybank ServicesDocument3 pagesMaybank Serviceseggie dan0% (1)

- From Agriculture To Non-Farm: Agrarian Change Among The Scheduled Castes of Central AssamDocument17 pagesFrom Agriculture To Non-Farm: Agrarian Change Among The Scheduled Castes of Central AssamRahmat SiregarNo ratings yet

- Question Paper: National AssemblyDocument2 pagesQuestion Paper: National AssemblyeNCA.comNo ratings yet

- Mohini Sahu - A07 Prabhu Dass FJ - A20 Rohan Singh - A26 Renu Dhillon - A36 Nitish Singh - A47 Deepak B - A50Document12 pagesMohini Sahu - A07 Prabhu Dass FJ - A20 Rohan Singh - A26 Renu Dhillon - A36 Nitish Singh - A47 Deepak B - A50andrew garfieldNo ratings yet

- ICTSD White Paper - James Bacchus - Triggering The Trade Transition - G20 Role in Rules For Trade and Climate Change - Feb 2018Document40 pagesICTSD White Paper - James Bacchus - Triggering The Trade Transition - G20 Role in Rules For Trade and Climate Change - Feb 2018Seni NabouNo ratings yet

- The Legal Guide To Investment in Saudi ArabiaDocument73 pagesThe Legal Guide To Investment in Saudi ArabiaGabriel SteleaNo ratings yet

- On December 1 2014 Boline Distributing Company Had The FollowingDocument1 pageOn December 1 2014 Boline Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- Cyber Risk Communication To Executives Board Members 1617280324Document10 pagesCyber Risk Communication To Executives Board Members 1617280324ferNo ratings yet

- Practice Problems TMVDocument2 pagesPractice Problems TMVShikharSrivastavaNo ratings yet

- Tax LSPU Final Examination March 2016 AnswersDocument10 pagesTax LSPU Final Examination March 2016 AnswersKring de VeraNo ratings yet

- What Is The Thesis (Main Idea) of Generation JoblessDocument7 pagesWhat Is The Thesis (Main Idea) of Generation Joblessmarialackarlington100% (2)

- Competing With Information TechnologyDocument39 pagesCompeting With Information TechnologypatienceNo ratings yet

- The Digital Divide and Its Impact On Economic DevelopmentDocument2 pagesThe Digital Divide and Its Impact On Economic DevelopmentntanirudaNo ratings yet

- Cornerstones: of Managerial Accounting, 6eDocument98 pagesCornerstones: of Managerial Accounting, 6ekhan khanNo ratings yet

- CV en AzmirDocument2 pagesCV en AzmirSiti FirzanaNo ratings yet

- Read Legislative Text of Senate GOP's Tax Overhaul LegislationDocument515 pagesRead Legislative Text of Senate GOP's Tax Overhaul Legislationkballuck1100% (1)

- Sources of RecruitmentDocument13 pagesSources of RecruitmentGaurav MoorjaniNo ratings yet

- Itchellan KeralaDocument2 pagesItchellan KeralaAiju ThomasNo ratings yet

- Career Planning in HRMDocument7 pagesCareer Planning in HRMMahnoor AslamNo ratings yet

- REVIEWERDocument51 pagesREVIEWERChristian Daryll CatacutanNo ratings yet

- Book Economics Organization and ManagementDocument635 pagesBook Economics Organization and ManagementHoBadalaNo ratings yet

- Analysis of Population Density and Family Wellbeing: Cindy Cahyaning AstutiDocument4 pagesAnalysis of Population Density and Family Wellbeing: Cindy Cahyaning AstutiDAMIANNo ratings yet

- The Islamic Finance Trading Framework: Legitimizing Profit MakingDocument91 pagesThe Islamic Finance Trading Framework: Legitimizing Profit MakingYellow CarterNo ratings yet

- Telephone BillDocument4 pagesTelephone BillSankar SundaramNo ratings yet

- Epen AstroDocument2 pagesEpen AstrojfmohamadNo ratings yet