Professional Documents

Culture Documents

Declaration Fom - Customers (1) (1)

Declaration Fom - Customers (1) (1)

Uploaded by

sujitpotnis5512Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration Fom - Customers (1) (1)

Declaration Fom - Customers (1) (1)

Uploaded by

sujitpotnis5512Copyright:

Available Formats

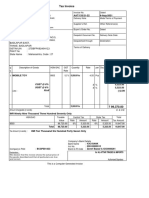

PURCHASE ORDER

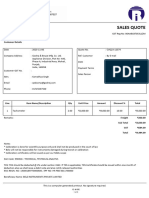

Customer Declaration on Turnover

(Pursuant to Section 194Q & 206CC of Income Tax Act, 1961) 7th December, 2023

Name of the Customer Om Sai Developers PO NO. : OM/PO/23-24/002

Name and Designation of the Authorised Mrs Kalpana Sahebrao Gaikwad, Partner

Signatory providing the declaration

SAP Customer Number (For Existing ORDER INFORMATION

Customers) NA DETAILS

A. Declaration of turnover for

VENDOR DETAILS BILLFinancial

TO Year ended 2020-21 SHIP TO

OM ENTERPRISES, OM SAI DEVELOPERS, MATOSHRI DAIRY FARM,

We hereby declare that SHOP

445,AT KURUND,POST.PADGHA, turnover of the business

NO 16, DHIRAJ REJENCY,carried on by us for Financial

BHATSA Year 2020-21

COLONY,

TAL.BHIWANDI,THANE- is (Tick whichever is applicable)

421101. OPP BHOR INDUSTRIES, BHADANE ROAD,

GST : 27COLPM5935F1ZL BORIVALI EAST, PADGHA - 421101

EMAIL ID: a Below ₹ 10 Crs – ACC will

salesoment444@gmail.com collect

MUMBAI TCS on invoice value.

400066

CONT NO :☐8591476838

Above ₹ 10 Crs - ACC will

GST not collect TCS on invoice value but we will deduct TDS.

: 27AADFO3829N1ZT

EMAIL ID: saidevelopers97@gmail.com

TAN number mandatory CONTfor Customer having turnover exceeds ₹ 10 Crs

NO : 9920222898

HSN CODE UNIT QTY RATE GST TOTAL

DISCRIPTION

B) Declaration for return filing status of Customer

Cu

RMC – IGRADE M30 filed the Income

/ we have 38245010

Tax Return for 1.5 5300 7,950

Mtr previous two assessment years for which the time

limit of filing return of income u/s 139(1) has expired.

☐ Yes

SUB TOTAL 7,950

☐ No

☐ Total TDS / TCS for each of last 2 Assessment Years exceeds

CGST ₹9%50,000/- * 715.5

a Total TDS / TCS for each of last 2 Assessment Years does not exceed ₹ 50,000/-

SGST 9% 715.5

* In this case we understand that TCS at the rate of 5% will be collected by the ACC.

ROUND OFF 0.0

☐ Not Applicable (Tick any of the following*)

☐ New business started in any of last two Assessment yearsTOTAL AMT 9381

☐ Any other reason (Please Mention the reason*)

IN WORD : NINE THOUSAND THREE HUNDRED EIGHTY ONE ONLY

_____________________________________________________

TERMS & CONDITIONS FOR, OM ENTERPRISES,

`I / we further declare that information furnished above is correct. In case any part of the above

declaration is untrue / false, we undertake to indemnify the Company and the Company shall recover

⚫ PURCHASE ORDER NO

the amount TO BE

from us.MENTIONED ON THE BILL &

CHALLAN.

Thanking you,

⚫ PAYMENT TERMS : 50% ADVANCE, 50% AFTER 30 DAYS FROM

DELIVERY

ACCEPTED

⚫ DELIVERY__________________

PERIOD : AS PER SITE REQUIRMENTS. Stamp & Signature

Kalpana

⚫ TAX INVOICE Sahebrao

SHOULD Gaikwad,+91-9920222898,

BR COPIES WITH STAMP AND Saiveleopers97@gmail.com

SIGNATURE.

You might also like

- The 3D Printing Handbook - Technologies, Design and ApplicationsDocument347 pagesThe 3D Printing Handbook - Technologies, Design and ApplicationsJuan Bernardo Gallardo100% (7)

- Louis Hardan Mobile Dental Photography Part I ViaDocument9 pagesLouis Hardan Mobile Dental Photography Part I ViaMuchlis Fauzi ENo ratings yet

- Biller Details GTPL Broadband PVT LTD.: Terms & ConditionsDocument1 pageBiller Details GTPL Broadband PVT LTD.: Terms & ConditionsRajeev SinghNo ratings yet

- Kishore Gym Snap FitnessDocument1 pageKishore Gym Snap Fitnesssathish ananthaneniNo ratings yet

- JCB 191 Bill Bidkin June 19Document1 pageJCB 191 Bill Bidkin June 19arjun dalvi0% (1)

- Organizing The Business Enterprise - PPT CH 7Document10 pagesOrganizing The Business Enterprise - PPT CH 7azkalixNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- LIC Combined ReceiptsDocument6 pagesLIC Combined Receiptssumanpal78No ratings yet

- ilovepdf_merged (24)_compressed_compressed (1) (1)Document35 pagesilovepdf_merged (24)_compressed_compressed (1) (1)bdsconsultant1313No ratings yet

- Declaration Fom - CustomersDocument1 pageDeclaration Fom - Customerssanyogitasawant5No ratings yet

- PF Invoice - OhsDocument1 pagePF Invoice - OhsALOKE GANGULYNo ratings yet

- ilovepdf_merged (24)Document35 pagesilovepdf_merged (24)bdsconsultant1313No ratings yet

- Page 1/3Document3 pagesPage 1/3pankaj kumarNo ratings yet

- Absolute Bill No. 0001Document1 pageAbsolute Bill No. 0001varunclient100No ratings yet

- Bill T25Document1 pageBill T25Sameer PatelNo ratings yet

- LimpiDocument1 pageLimpiAmit AcharyaNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsanyogitasawant5No ratings yet

- Sales GET 24-25 0014Document1 pageSales GET 24-25 0014Himanshu Kr. BhumiharNo ratings yet

- MAC Jan-2022 Pending InvDocument1 pageMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesNo ratings yet

- Piped Natural Gas Invoice DomesticDocument2 pagesPiped Natural Gas Invoice DomesticBalasubramanian GurunathanNo ratings yet

- Invoice Books 1Document1 pageInvoice Books 1Rizvan MasroorNo ratings yet

- Bill SepDocument2 pagesBill SepAbhishek GorisariaNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Declaration Form - JSW Cement FY 23-24Document1 pageDeclaration Form - JSW Cement FY 23-24Raj kumar yadavNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- 23 PFDocument2 pages23 PFSunil PatelNo ratings yet

- Assemble 6-8Document1 pageAssemble 6-8ok okNo ratings yet

- Asad PsidDocument1 pageAsad Psidعمر عمیNo ratings yet

- Salk1000152223-NoidaDocument5 pagesSalk1000152223-NoidaPratik GosaviNo ratings yet

- DG Set Servicing ContractDocument8 pagesDG Set Servicing Contractnibeditapdhy21@gmail.conNo ratings yet

- Clause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotDocument51 pagesClause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotetgrgrfdNo ratings yet

- Karuna No YeeDocument6 pagesKaruna No YeeDebashis MitraNo ratings yet

- Retail Invoice Cash-: RepairDocument1 pageRetail Invoice Cash-: RepairAfiya AliNo ratings yet

- Tax Invoice E76I/T2223/59 04/04/2022 12,213.00: Sharp Business Systems (I) PVT LTDDocument1 pageTax Invoice E76I/T2223/59 04/04/2022 12,213.00: Sharp Business Systems (I) PVT LTDDHIMAN BAURNo ratings yet

- Listing DetailsDocument2 pagesListing DetailsArun DevNo ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Rate Quantity GST Hsn/SacOrchids InternationalNo ratings yet

- AJPL1302Document1 pageAJPL1302shrungar.ornament1No ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Modular Kitchen InvoiceDocument1 pageModular Kitchen InvoiceShubham MishraNo ratings yet

- Tax Invoice: (Duplicate For Transporter)Document1 pageTax Invoice: (Duplicate For Transporter)BisheshNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayDhaval VisariaNo ratings yet

- CVQ23 12574Document3 pagesCVQ23 12574Pawan MishraNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- Proforma CredoDocument1 pageProforma CredoOmkar NiruduNo ratings yet

- Kamini Rice Mill Inv 2Document1 pageKamini Rice Mill Inv 2Saptarshi HalderNo ratings yet

- Color Sac-0025-1Document1 pageColor Sac-0025-1krishnaNo ratings yet

- Tax Invoice: IRNDocument1 pageTax Invoice: IRNCA Shrikant VaranasiNo ratings yet

- A Govt CompanyDocument6 pagesA Govt Companyabhiramreddy3No ratings yet

- Declaration To SSSSDocument1 pageDeclaration To SSSSedyNo ratings yet

- Mumtaz Khan 236 K 6000Document1 pageMumtaz Khan 236 K 6000mazharehsan08No ratings yet

- Customer Receipt: Being Amount Paid For On Just DialDocument2 pagesCustomer Receipt: Being Amount Paid For On Just DialSurinder GhattauraNo ratings yet

- Savvy StudiozDocument4 pagesSavvy Studioza1amarpatelNo ratings yet

- 22-23 All PagesDocument5 pages22-23 All PagesBulbuli DasNo ratings yet

- It 000130635883 2023 12Document1 pageIt 000130635883 2023 12MUHAMMAD MAJID AKHTER USMAN BASHEERNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- Lakshmi Agencies: Tax Invoice (Cash)Document2 pagesLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNo ratings yet

- Accounting VoucherDocument1 pageAccounting Voucherharshbyroji111No ratings yet

- COMP1 - Sales SE 24 25 1335Document1 pageCOMP1 - Sales SE 24 25 1335indrajeetkr9654No ratings yet

- Accounting Voucher DisplayDocument3 pagesAccounting Voucher Displayluckky.999No ratings yet

- SKSE Securities LimitedDocument2 pagesSKSE Securities LimitedsunitdaveNo ratings yet

- Tax Invoice: RD Service - 1 998314 1 375.00 375.00 0.00 375.00 CGST 9% SGST 9% 33.75 33.75Document1 pageTax Invoice: RD Service - 1 998314 1 375.00 375.00 0.00 375.00 CGST 9% SGST 9% 33.75 33.75Abdul mobeenNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Radar Radome and Its Design Considerations: December 2009Document6 pagesRadar Radome and Its Design Considerations: December 2009Suresh MadhevanNo ratings yet

- HTML XML JavaScriptDocument51 pagesHTML XML JavaScriptGone Harikrishna100% (1)

- Lab ManualDocument17 pagesLab ManualMuhammad SaifuddinNo ratings yet

- HYPACK ECHO Brochure 2022 Nautilus OceanicaDocument2 pagesHYPACK ECHO Brochure 2022 Nautilus OceanicaADOUKONo ratings yet

- Neet Code C Question Paper PDFDocument41 pagesNeet Code C Question Paper PDFMagnifestoNo ratings yet

- World History GlossaryDocument20 pagesWorld History GlossaryRana MubasherNo ratings yet

- Concept: 18 Questions Were Answered Correctly. 4 Questions Were Answered IncorrectlyDocument15 pagesConcept: 18 Questions Were Answered Correctly. 4 Questions Were Answered IncorrectlyHugsNo ratings yet

- Pamela or Virtue Rewarded: by Samuel RichardsonDocument24 pagesPamela or Virtue Rewarded: by Samuel RichardsonRazvan Mincu100% (3)

- Squatting Should Not Be Illegal. in Fact, It Should Be EncouragedDocument2 pagesSquatting Should Not Be Illegal. in Fact, It Should Be EncouragedNguyen Trong Phuc (FUG CT)No ratings yet

- Assignment/ Tugasan - Introductory Employment LawDocument9 pagesAssignment/ Tugasan - Introductory Employment LawShasha LovelyNo ratings yet

- Industrial Revolution: How It Effect Victorian Literature in A Progressive or Adverse WayDocument2 pagesIndustrial Revolution: How It Effect Victorian Literature in A Progressive or Adverse WaydjdmdnNo ratings yet

- Operating, Maintenance & Parts Manual: Rated LoadsDocument48 pagesOperating, Maintenance & Parts Manual: Rated LoadsAmanNo ratings yet

- Some ε − δ proofs: Basic StrategyDocument3 pagesSome ε − δ proofs: Basic StrategyItalo SilvaNo ratings yet

- UserGuide - 510 - 570 - 653 PDFDocument25 pagesUserGuide - 510 - 570 - 653 PDFMurugananthamParamasivamNo ratings yet

- The Cold War: DétenteDocument20 pagesThe Cold War: Détentebye hiNo ratings yet

- Haytham Abd Allah Ezbawy ResumeDocument3 pagesHaytham Abd Allah Ezbawy Resumehayssam ezbawyNo ratings yet

- Lectures On The Mechanical Foundations of ThermodynamicsDocument99 pagesLectures On The Mechanical Foundations of ThermodynamicsMarta HerranzNo ratings yet

- GENERAL ACCOUNTING RevisedDocument43 pagesGENERAL ACCOUNTING RevisedAkendombi EmmanuelNo ratings yet

- Internal Motivation Infographics by SlidesgoDocument34 pagesInternal Motivation Infographics by Slidesgoyosua tafulyNo ratings yet

- 33-Compressor SAC To IAC DecDocument6 pages33-Compressor SAC To IAC DecShailesh yadavNo ratings yet

- Topic 7 Reference Group and Word-Of-MouthDocument20 pagesTopic 7 Reference Group and Word-Of-MouthKhang Nguyen DuyNo ratings yet

- British Mathematical Olympiad 2004 British Mathematical Olympiad Round 2Document1 pageBritish Mathematical Olympiad 2004 British Mathematical Olympiad Round 2Ajay NegiNo ratings yet

- Raj'a (Returning) : Sermon of Amir Ul-MomineenDocument3 pagesRaj'a (Returning) : Sermon of Amir Ul-Momineentausif mewawalaNo ratings yet

- The Self As A Social Construct: The Self in The Western and Oriental Thought IndividualismDocument5 pagesThe Self As A Social Construct: The Self in The Western and Oriental Thought IndividualismStef FieNo ratings yet

- Alexis L Orozco-1@ou EduDocument2 pagesAlexis L Orozco-1@ou Eduapi-545872500No ratings yet

- Case 1Document2 pagesCase 1Wanda Marie SingletaryNo ratings yet

- Shadbala NotesDocument10 pagesShadbala NotesRadhika Goel100% (1)