Professional Documents

Culture Documents

202210-11-Contrarian-Money & Investing

202210-11-Contrarian-Money & Investing

Uploaded by

antoineboutaleb0 ratings0% found this document useful (0 votes)

1 views3 pagesContrarian money

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentContrarian money

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views3 pages202210-11-Contrarian-Money & Investing

202210-11-Contrarian-Money & Investing

Uploaded by

antoineboutalebContrarian money

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

CONTRARIAN MONEY & INVESTING

By Hank Tucker Photograph by Guerin Blask for Forbes

Irrational Exuberance

66

CONTRARIAN • MONEY & INVESTING

Harris Kupperman’s PRAETORIAN CA PITA L seeks out hysteria in every corner

of the market, from bitcoin to natural gas.

O Occasionally the best

seed capital for a successful career in in-

vesting is lucky timing. In 1997, as a ju-

nior in high school, Harris Kupperman

began obsessing over the stock market as

the Asian financial crisis and then dot-

com mania dominated the headlines. By

the time he arrived at Tulane University

two years later, tech stocks had soared

nearly 200% since Netscape’s IPO in the

summer of 1995 and would double again

over the next few months. The future

hedge fund manager noticed that many of

these dot-coms ultimately crashed when

VC lockups expired and early investors

dumped their shares.

In early 2000, Kupperman, known to

his friends and peers as “Kuppy,” took the

$6,000 he had earned over the summer

cleaning pools on the North Shore of Long

Island and began buying put options—ef-

Double-Edged Sword

fectively shorting the stocks—of dot-

bombs like Commerce One and Foundry

Kupperman named his

firm Praetorian after Networks. When the bubble popped in

the bodyguards of the March 2000 and the Nasdaq fell 80%, he

Roman emperor, who

sometimes assassi- made a small fortune.

nated their ruler. He “I had a few thousand dollars in my ac-

wished to protect his

portfolio companies count at the beginning of the year, and at

but also serve as a the end of the year I had a few hundred

“latent threat.”

thousand,” boasts Kupperman, who is

FORBES.COM OCTOBER/NOVEMBER 2022

How to Play It Company Ticker Market Cap Reason

Sprott Physical Uranium Trust UU.TO $3.0 billion Bullish bet on a future shift to nuclear power.

KUPPY’S CART

The St. Joe Company JOE $2.3 billion Low-tax Florida land play. Should grow 30% to 50%

Harris Kupperman

annually.

favors small- and

mid-cap value Builders FirstSource BLDR $9.6 billion Building materials as home construction

stocks. Here are his accommodates population growth.

top four holdings. Valaris VAL $4.2 billion Large oil driller to benefit from recovery in production.

68

now 41. “It opened my eyes to the potential that and coal-rich Mongolia would boom, so he

if you think harder than the other guy, you can took control of a dormant shell company trad-

Insider Info

CONTRARIAN • MONEY & INVESTING

make a lot of money.” ing in Canada, rechristened it Mongolia Growth

Two decades later, his Praetorian Capital has PANHANDLING Group and began investing in real estate in

$180 million under management and is up 593%, There’s lots to do Ulaanbaatar. Unfortunately, soon after Mongo-

along Florida’s

net of a 20% performance fee and 1.25% manage- Emerald Coast, lia Growth Group opened its offices in 2011, the

ment fee since it began taking in outside capital says Harris country’s government began to restrict foreign

in 2019. During both 2020 and 2021, his fund, Kupperman, who investment, and its economic growth slowed

spends a week or

which makes concentrated bets in only about a two there every to a crawl. Today the bulk of Mongolia Growth

dozen investments, returned more than 100%. summer. Here Group’s $2.5 million in revenue comes from a

are a few of his

Kupperman is a go-anywhere, event-driven in- favorite haunts.

data-driven newsletter called Kuppy’s Event

vestor who expects a fivefold return on his posi- Driven Monitor, which has nothing to do with

tions. He’s not afraid to trade manias even if he Mongolia and costs $400 per month.

thinks they have no intrinsic value. In late 2020 In 2019, he relaunched Praetorian with Wes

and early ’21, for example, he made a sixfold Cooper, an Ernst & Young alum, using mostly

profit in bitcoin. their own money. Their biggest positions today

“It’s a Ponzi scheme. It has no real function,” include physical uranium, which has endured a

he says. “But there are moments in time when in- WaterColor Inn 14-year bear market, and crude oil.

vesting in Ponzi schemes is perfectly good. When A family-friendly Energy’s outperformance has helped Prae-

four-star owned

they’re inflating, they’re very profitable to own.” by The St. Joe torian keep rising this year, up 9.1% through July

He believes bitcoin rises when the Fed injects Company (one of compared to the S&P 500’s 13.3% decline. But

Kupperman’s top

liquidity into the market, as it did in the early holdings), Santa

rising interest rates have hurt his stakes in hous-

days of the pandemic, and sinks when the cen- Rosa Beach’s ing stocks like The St. Joe Company, one of his

tral bank tightens. He bought bitcoin at about WaterColor Inn top positions since the fall of 2020 (see “Kuppy’s

has four pools and

$9,200 in the summer of 2020, and by the end of catered beach Cart,” above). St. Joe owns 170,000 acres in the

that year the cryptocurrency was the largest po- bonfires. “It’s the Florida Panhandle, and its revenue grew by 66%

sition in his portfolio. In March and April 2021, nicest hotel in in 2021. Shares tripled from $20 to $60 between

the Panhandle,”

as inflation began breaching the Fed’s stated Kupperman says. September 2020 and April 2022 but have since

2% goal, Kupperman decided the central bank’s retreated to $37.

Grayton Beach

easy-money policies had run their course, so he “Everyone’s freaking out about interest rates

This patch of sand

cashed out when bitcoin traded at $58,000, a ranks among and mortgages,” Kupperman says. “I don’t think

few months before it peaked at close to $70,000. America’s best. it’s going to change anything. In a year, interest

(It currently trades around $20,000.) “They let people rates will go down, but people from New York

who live in that

Other opportunistic pandemic buys were county drive on it will keep coming to Florida.”

small-cap natural gas and firearm stocks. Today so everyone drives Kupperman may be a Florida real estate bull,

their pickup on

he’s bullish on housing, rising interest rates be and sets up tents.

but he’s already moved Praetorian’s operations

damned, in places like Florida, which continue Everyone grills and to beachfront Rincón, Puerto Rico, which is

to attract residents leaving high-tax states. has a grand time.” even more tax-friendly. He’s mulling closing his

“About every 18 to 24 months, one industry AJ’s fund when it hits $250 million in assets. “I have

freaks out and you get to buy one industry cheap,” After some sun at friends that run billions, and they have more

Kupperman says. “That’s the story of my life. I’m Grayton Beach, money than me,” he says, “but I can’t spend all

head to this surf

patient—I wait until they completely lose their shack for some-

the money I’ve made already in my career.”

minds and then buy it.” thing stronger.

In 2003, Kupperman graduated from Tulane “There’s always

FINAL THOUGHT

a band playing.

with a degree in history, opened a hedge fund Everything else “I WOULD RATHER BE AN

and moved to Miami. His fund did reasonably closes at 9 o’clock,

so if you want

OPPORTUNIST AND FLOAT THAN

well, but in the wake of the financial crisis of GO TO THE BOTTOM WITH MY

entertainment

2008, he shuttered it. after 9, go to AJ’s.” PRINCIPLES AROUND MY NECK.”

In 2010 he became convinced that copper- —Stanley Baldwin

FORBES.COM OCTOBER/NOVEMBER 2022

Copyright of Forbes is the property of Forbes Inc. and its content may not be copied or

emailed to multiple sites or posted to a listserv without the copyright holder's express written

permission. However, users may print, download, or email articles for individual use.

You might also like

- Project-Charter (Mohammad Adnan)Document4 pagesProject-Charter (Mohammad Adnan)Mohammad Adnan80% (5)

- Inside Icahn's EmpireDocument6 pagesInside Icahn's Empiredondeos100% (1)

- Grant Article On Henry SingletonDocument4 pagesGrant Article On Henry SingletonYashNo ratings yet

- Former Chase Banker Founded Investcorp, Oversaw Acquisitions of Tiffany and GucciDocument2 pagesFormer Chase Banker Founded Investcorp, Oversaw Acquisitions of Tiffany and GuccijoepajjNo ratings yet

- Rirn100708 A01Document1 pageRirn100708 A01Richmond ReviewNo ratings yet

- WN Pioneers 30 Lo FinalDocument1 pageWN Pioneers 30 Lo FinalSpencer Ante100% (4)

- MoneyWeek 22-03-2024 Freemagazines TopDocument44 pagesMoneyWeek 22-03-2024 Freemagazines TopQuang Le TrongNo ratings yet

- NatatoriumDocument1 pageNatatoriumlizvreedNo ratings yet

- The Phoenix Educator: A LIGHT IN EVERY MIND!: ContactDocument16 pagesThe Phoenix Educator: A LIGHT IN EVERY MIND!: ContactvyslNo ratings yet

- The Phoenix Educator: A LIGHT IN EVERY MIND!: ContactDocument16 pagesThe Phoenix Educator: A LIGHT IN EVERY MIND!: ContactvyslNo ratings yet

- The Phoenix Educator: A LIGHT IN EVERY MIND!: ContactDocument16 pagesThe Phoenix Educator: A LIGHT IN EVERY MIND!: ContactvitaminveysiNo ratings yet

- TheSun 2009-01-28 Page15 Banker Sells US$14mil House To Wife For US$100Document1 pageTheSun 2009-01-28 Page15 Banker Sells US$14mil House To Wife For US$100Impulsive collectorNo ratings yet

- Na0407 PennyDocument1 pageNa0407 PennyroyvuorelaNo ratings yet

- Tribal Casino, Resort Wielding Wider Clout: Global Financial Crisis On Horizon?Document3 pagesTribal Casino, Resort Wielding Wider Clout: Global Financial Crisis On Horizon?Ted AppelNo ratings yet

- MadRiverUnion03 28 18editionDocument18 pagesMadRiverUnion03 28 18editionMad River Union100% (1)

- The Nib Empire Issue SpreadsDocument59 pagesThe Nib Empire Issue SpreadsPablito AguiarNo ratings yet

- Dear ChairmanDocument4 pagesDear ChairmanSrishti 2k22No ratings yet

- May 13thDocument20 pagesMay 13thPCNR100% (2)

- The New York Times 2017-05-11Document62 pagesThe New York Times 2017-05-11stefanoNo ratings yet

- Popular Mechanics 2009-09Document131 pagesPopular Mechanics 2009-09BookshebooksNo ratings yet

- Turning An Anti-VirusDocument1 pageTurning An Anti-Virusrajptr2986No ratings yet

- What Is A Business For?Document8 pagesWhat Is A Business For?Guru Charan ChitikenaNo ratings yet

- Commodities CorpDocument5 pagesCommodities CorpmirceaNo ratings yet

- Lean Sensei in Business in VancouverDocument2 pagesLean Sensei in Business in VancouverleansenseiNo ratings yet

- Distress Investor Tool Kit - Buying Failed Bank Whole Loan Pools From The FDICDocument6 pagesDistress Investor Tool Kit - Buying Failed Bank Whole Loan Pools From The FDICCyberPunk.LawyerNo ratings yet

- The Rise and Fall of Enron PDFDocument8 pagesThe Rise and Fall of Enron PDFsuriya vasanth bNo ratings yet

- Fortune June 2014Document389 pagesFortune June 2014sarah123No ratings yet

- Forbes, Apr-May21Document103 pagesForbes, Apr-May21Muhammad Shah Nidzinski El-ZamaniNo ratings yet

- JR Spahn 11-14-18Document1 pageJR Spahn 11-14-18Price LangNo ratings yet

- Hunters AD 2114 Rule Book v2.0 enDocument36 pagesHunters AD 2114 Rule Book v2.0 enFrancis LaunayNo ratings yet

- Calandro - Turnaround Value Scott Paper PDFDocument13 pagesCalandro - Turnaround Value Scott Paper PDFthomas peterNo ratings yet

- Mariner 79.inddDocument28 pagesMariner 79.inddmugsyNo ratings yet

- Paramount Plus Struggles Leave Shari Redstone Exploring Sale - BloombergDocument1 pageParamount Plus Struggles Leave Shari Redstone Exploring Sale - Bloombergmikarimelody726No ratings yet

- Tri-City Times: Investigation OngoingDocument22 pagesTri-City Times: Investigation OngoingWoodsNo ratings yet

- Library Security Changed: Corp. Fellow Faces New Suit On Day of GM IpoDocument8 pagesLibrary Security Changed: Corp. Fellow Faces New Suit On Day of GM IpoThe Brown Daily HeraldNo ratings yet

- AAB Proceedings - Issue #32Document4 pagesAAB Proceedings - Issue #32The MalumNo ratings yet

- Lesson 1 What Can I DoDocument2 pagesLesson 1 What Can I DoCatherine Claire S. BitangaNo ratings yet

- Wyckoff Part 05Document9 pagesWyckoff Part 05SnookyNo ratings yet

- 01 Compaq in Crisis Business Case Team 01Document9 pages01 Compaq in Crisis Business Case Team 01Bikasita TalukdarNo ratings yet

- This Earnings Season Will Be Tough As Inflation Erodes Margins, Barclays SaysDocument3 pagesThis Earnings Season Will Be Tough As Inflation Erodes Margins, Barclays SaysSunny YaoNo ratings yet

- 258 The Remington Rolling BlockDocument1 page258 The Remington Rolling Blocknhtan2020No ratings yet

- GTR 301Document8 pagesGTR 301jeanyoperNo ratings yet

- Forbes 2016 7 26Document118 pagesForbes 2016 7 26Jame ThanhNo ratings yet

- The Marvel Way: Presented by Group 2Document13 pagesThe Marvel Way: Presented by Group 2HimanshiNo ratings yet

- Beckman, Ericka - Capital Fictions - The Literature of Latin America's Export Age-Univ. of Minnesota Press (2013)Document286 pagesBeckman, Ericka - Capital Fictions - The Literature of Latin America's Export Age-Univ. of Minnesota Press (2013)Tango1680No ratings yet

- "You Don't Bring Bad News To The Cult Leader" - Inside The Fall of WeWork - Vanity FairDocument20 pages"You Don't Bring Bad News To The Cult Leader" - Inside The Fall of WeWork - Vanity FairMonoj ChakrabortyNo ratings yet

- The Electrical Worker July 2009Document20 pagesThe Electrical Worker July 2009Kathryn R. ThompsonNo ratings yet

- 2018-11-01 - Outside, Terror in The Wild PDFDocument100 pages2018-11-01 - Outside, Terror in The Wild PDFAnonymous IGtWHoi0No ratings yet

- P 0 T 4 y 6Document43 pagesP 0 T 4 y 6Philemon SurenNo ratings yet

- The Catholic Worker: TragedyDocument7 pagesThe Catholic Worker: TragedyAlex PalmaNo ratings yet

- Mayor Adams Must Get His NYPD House in Order, As Cop Resignations SoaDocument1 pageMayor Adams Must Get His NYPD House in Order, As Cop Resignations Soaedwinbramosmac.comNo ratings yet

- Junk Bond King' in Line To Profit From Tax Breaks: On One Stage, 4 Operas in 48 HoursDocument1 pageJunk Bond King' in Line To Profit From Tax Breaks: On One Stage, 4 Operas in 48 HoursskhendoNo ratings yet

- The Real Reporter August 6, 2010 IssueDocument18 pagesThe Real Reporter August 6, 2010 IssueThe Real ReporterNo ratings yet

- Is Don Draper Worth ItDocument7 pagesIs Don Draper Worth ItMim PlavinNo ratings yet

- RR 1988 01 29Document96 pagesRR 1988 01 29Vicente PazNo ratings yet

- Case Study The Very Model of A Modern ManagerDocument6 pagesCase Study The Very Model of A Modern ManagerNITIN SINGHNo ratings yet

- Sharesmagazine 2004-06-17Document68 pagesSharesmagazine 2004-06-17ChrisTheodorouNo ratings yet

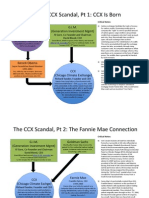

- CCX Scandal, Chicago Carbon ExchangeDocument4 pagesCCX Scandal, Chicago Carbon ExchangeKim HedumNo ratings yet

- Hoodwinked by John Perkins - ExcerptDocument21 pagesHoodwinked by John Perkins - ExcerptCrown Publishing Group22% (9)

- 03 Primeras Planas ExtranjerasDocument7 pages03 Primeras Planas ExtranjerasYuve DgnNo ratings yet

- Ultrasonic InterferometerDocument22 pagesUltrasonic InterferometerakshatguptaNo ratings yet

- Money Exchange: Materials/Equipment You Would NeedDocument7 pagesMoney Exchange: Materials/Equipment You Would NeedEsther Joy PerezNo ratings yet

- Paul CooksDocument4 pagesPaul CooksMicNo ratings yet

- City Center Unifier Deployment PDFDocument35 pagesCity Center Unifier Deployment PDFSachin PatilNo ratings yet

- Indian Standard: Methods of Test For Stabilized SoilsDocument10 pagesIndian Standard: Methods of Test For Stabilized Soilsphanendra kumarNo ratings yet

- Turbine-Less Ducted Fan Jet Engine: Subsonic PropulsionDocument25 pagesTurbine-Less Ducted Fan Jet Engine: Subsonic PropulsionزهديابوانسNo ratings yet

- Western Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterDocument4 pagesWestern Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterMaria Julia DenustaNo ratings yet

- Jyotish - Hindu Panchangam & MuhurtasDocument40 pagesJyotish - Hindu Panchangam & MuhurtasSamir Kadiya100% (1)

- Feasibility StudyyyDocument27 pagesFeasibility StudyyyMichael James ll BanawisNo ratings yet

- Chemical Fume Hood HandbookDocument11 pagesChemical Fume Hood Handbookkumar123rajuNo ratings yet

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- EC Physical Sciences Grade 11 November 2022 P1 and MemoDocument25 pagesEC Physical Sciences Grade 11 November 2022 P1 and MemokhulntandoNo ratings yet

- Bamboo Annals RevisitedDocument14 pagesBamboo Annals RevisitedsreelidNo ratings yet

- Native Son Essay TopicsDocument7 pagesNative Son Essay TopicsafabioemwNo ratings yet

- Experiencing Postsocialist CapitalismDocument251 pagesExperiencing Postsocialist CapitalismjelisNo ratings yet

- Lesson Plan Sience - Body PartsDocument4 pagesLesson Plan Sience - Body Partsapi-307376252No ratings yet

- Electrical Circuit Lab ManualDocument38 pagesElectrical Circuit Lab Manualecessec67% (3)

- Jamboree GRE StudyPlan PDFDocument3 pagesJamboree GRE StudyPlan PDFMd Minhaj Ahmed AhmedNo ratings yet

- KISI USP INGGRIS Kelas 12Document39 pagesKISI USP INGGRIS Kelas 12Deny Cahyo SaputroNo ratings yet

- ScheduleDocument2 pagesScheduleJen NevalgaNo ratings yet

- SkillsDocument7 pagesSkillsRufus RajNo ratings yet

- Biomedx Workshop AgendaDocument6 pagesBiomedx Workshop AgendabiomedxNo ratings yet

- Parasnis - 1951 - Study Rock MidlandsDocument20 pagesParasnis - 1951 - Study Rock MidlandsIsaac KandaNo ratings yet

- Fallas VenezuelaDocument20 pagesFallas VenezuelaDaniel Quintana GaviriaNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- g8 With Answer SheetDocument4 pagesg8 With Answer SheetMICHAEL REYESNo ratings yet

- Person To PersonDocument126 pagesPerson To PersonYalmi AdiNo ratings yet

- Safety Manual (B-80687EN 10)Document35 pagesSafety Manual (B-80687EN 10)Jander Luiz TomaziNo ratings yet

- Comparative Investment ReportDocument8 pagesComparative Investment ReportNelby Actub MacalaguingNo ratings yet