Professional Documents

Culture Documents

Salary Slip - April

Salary Slip - April

Uploaded by

Shubhajyoti SahaCopyright:

Available Formats

You might also like

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash Lamani100% (1)

- Chapter 2 Advance Acctg.Document20 pagesChapter 2 Advance Acctg.Clarize R. Mabiog82% (11)

- Accounting For LeaseDocument75 pagesAccounting For LeaseRonnie Salazar53% (15)

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Tasleem MayDocument2 pagesTasleem MayManthan ShahNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- Payslip May 2024Document1 pagePayslip May 2024simplycreated931No ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- CRM Services India Private Limited: Payslip For The Month of January 2020Document1 pageCRM Services India Private Limited: Payslip For The Month of January 2020abhi.90748989No ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- Payslip Mar 2024Document1 pagePayslip Mar 2024simplycreated931No ratings yet

- Sunil Kumar (DELS0210)Document1 pageSunil Kumar (DELS0210)SUNIL KUMARNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Payslip Sep 2023Document1 pagePayslip Sep 2023atozinstitute96No ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Health & Glow Private Limited: Earnings DeductionsDocument1 pageHealth & Glow Private Limited: Earnings DeductionsVishal BawaneNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- One97 Communications Limited: Earnings DeductionsDocument2 pagesOne97 Communications Limited: Earnings Deductionsrusingh932No ratings yet

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- EPF Universal Account Number: 100618268345 LIC ID / Policy IDDocument1 pageEPF Universal Account Number: 100618268345 LIC ID / Policy IDHoly ReaperNo ratings yet

- EmployeeData OctDocument2 pagesEmployeeData OctAnkit SinghNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Master ChartDocument3 pagesMaster ChartShubhajyoti SahaNo ratings yet

- Kolkata -April 2021Document1 pageKolkata -April 2021Shubhajyoti SahaNo ratings yet

- List of Capex Proposals - 27.07.20Document44 pagesList of Capex Proposals - 27.07.20Shubhajyoti SahaNo ratings yet

- Monthly Q - Performance: Date: 8 of NOV 2019Document16 pagesMonthly Q - Performance: Date: 8 of NOV 2019Shubhajyoti SahaNo ratings yet

- KPI TrendDocument6 pagesKPI TrendShubhajyoti SahaNo ratings yet

- Corporate Performance Review: Confidential and PrivilegeDocument44 pagesCorporate Performance Review: Confidential and PrivilegeShubhajyoti SahaNo ratings yet

- Budgetary Quotation PrakrutiDocument2 pagesBudgetary Quotation PrakrutiShubhajyoti SahaNo ratings yet

- SN Action Points Resp. Status RemarksDocument11 pagesSN Action Points Resp. Status RemarksShubhajyoti SahaNo ratings yet

- Augmentation of Pulverized Coal Injection System of Blast FurnaceDocument28 pagesAugmentation of Pulverized Coal Injection System of Blast FurnaceShubhajyoti SahaNo ratings yet

- JD For Strategy Kolkata V1Document4 pagesJD For Strategy Kolkata V1Shubhajyoti SahaNo ratings yet

- Website:Https://Www - Tstransco.In Cin No: U40102T82014Sgco94248Document5 pagesWebsite:Https://Www - Tstransco.In Cin No: U40102T82014Sgco94248satyanarayana reddyNo ratings yet

- Topic 1Document3 pagesTopic 1Benard BettNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Ch.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookDocument23 pagesCh.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookMayank Mall100% (2)

- UNIT IV - Performance of An Economy - MacroeconomicsDocument50 pagesUNIT IV - Performance of An Economy - MacroeconomicsSaravanan ShanmugamNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationDennis LacsonNo ratings yet

- Intercompany Inventory Transactions: Mcgraw-Hill/IrwinDocument123 pagesIntercompany Inventory Transactions: Mcgraw-Hill/IrwinsresaNo ratings yet

- In-Tray Assessment - Supporting Information (362R)Document6 pagesIn-Tray Assessment - Supporting Information (362R)shahedhaque339No ratings yet

- JB Maize CocDocument7 pagesJB Maize CocGirish SalunkheNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Accounting For Income Taxes ExercisessDocument5 pagesAccounting For Income Taxes ExercisessdorothyannvillamoraaNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Financial Accounting 4th Edition Spiceland Test Bank 1Document187 pagesFinancial Accounting 4th Edition Spiceland Test Bank 1barbara100% (53)

- Accounting Theory Godfrey Chapter 4Document65 pagesAccounting Theory Godfrey Chapter 4FELIX PANDIKANo ratings yet

- Chapter 3 InvestmentsDocument44 pagesChapter 3 Investmentssamuel hailuNo ratings yet

- Soal Praktek Myob Perusahaan JasaDocument4 pagesSoal Praktek Myob Perusahaan Jasahani ramadiyantiNo ratings yet

- Should Church Be TaxedDocument4 pagesShould Church Be TaxedDangel MonacoNo ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument50 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- TGAS Less Ending Inv in Pesos: 991, 200 - 294,000Document13 pagesTGAS Less Ending Inv in Pesos: 991, 200 - 294,000cherry blossomNo ratings yet

- Diaspora Action Australia Annual Report 2012-13Document24 pagesDiaspora Action Australia Annual Report 2012-13SaheemNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Econ Macro P1 Past Papers OrganizedDocument5 pagesEcon Macro P1 Past Papers OrganizedElin ChunNo ratings yet

- J FabmDocument192 pagesJ FabmJillian Anika CuerdoNo ratings yet

- Income As ModeratorDocument13 pagesIncome As ModeratorMalik AwanNo ratings yet

- Taxation: Dr. Maina N. JustusDocument10 pagesTaxation: Dr. Maina N. JustusSkyleen Jacy VikeNo ratings yet

- 4the Global Economy (Autosaved)Document176 pages4the Global Economy (Autosaved)Andrea Siladan100% (1)

Salary Slip - April

Salary Slip - April

Uploaded by

Shubhajyoti SahaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary Slip - April

Salary Slip - April

Uploaded by

Shubhajyoti SahaCopyright:

Available Formats

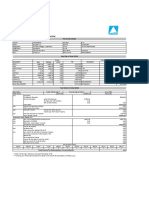

Pinnacle Infotech Solutions

Pay Slip for the month of April-2018

Employee Code : PIS01602 Esi No. :

Name : Mr. Shubhajyoti Saha PF No. : WB/DGP/0041903/000WBDGP00419030000011636

Father Name : Late. Birendra Chandra Saha UAN No. : 101130075867

Location : West Bengal PAN : DGGPS8519M

Designation : Deputy Manager Bank Name : ICICI

Department : CEO Office IFSC Code : ICIC0000188

Sub Department : Bank Ac No. : 031201523726 (ICICI)

Level : WL 4 Arrear Days : 0.00

LWP : 0.00 PAN Number : DGGPS8519M

Payable Days : 31.00

Leave Name Opening Balance Availed Leave Closing Balance

Casual Leave 1.00 1.00 0.00

Privilege Leave 8.25 1.00 8.50

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic + DA 30804.00 30804.00 0.00 30804.00 INCOME TAX 1103.00

HRA 12724.00 12724.00 0.00 12724.00 PF 1800.00

TA 1948.00 1948.00 0.00 1948.00 PROF. TAX 200.00

Medical Reimbursements 1522.00 1522.00 0.00 1522.00

Other Reimbursements 53002.00 53002.00 0.00 53002.00

GROSS EARNINGS 100000.00 100000.00 0.00 100000.00 GROSS DEDUCTIONS 3103.00

Net Pay : 96,897.00

Net Pay in words : INR Ninety Six Thousands Eight Hundreds Ninety Seven Only

Income Tax Worksheet for the Period April 2018 - March 2019(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(METRO)

Basic + DA 369648.00 0.00 369648.00 Investments u/s 80C Exempted Qualifying Rent Paid 204000.00

HRA 152688.00 152688.00 0.00 LIC DIRECT 10000.00 150000.00 From 01/04/2018

TA 23376.00 0 0.00 23376.00 MUTUAL FUND 150000.00 150000.00 To 31/03/2019

Medical Reimbursements 18264.00 0.00 18264.00 PROVIDENT FUND 21600.00 150000.00 1. Actual HRA 152688.00

Other Reimbursements 636024.00 0.00 636024.00 2. 40% or 50% of Basic 184824.00

3. Rent - 10% Basic 167035.00

Least of above is exempt 152688.00

Taxable HRA 0.00

Gross 1200000.00 152688.00 1047312.00 Total of Investments u/s 80C 181600.00 150000.00

Deductions 80D 25000.00 25000.00

Previous Employer Taxable Income 0.00 80DD 125000.00 125000.00 TDS Deducted Monthly

Professional Tax 2400.00 U/S 80C 150000.00 150000.00 Month Amount

Under Chapter VI-A 300000.00 Total of Ded Under Chapter 300000.00 300000.00 April-2018 1103.00

Standard Deduction 40000.00 VI-A Tax Deducted on Perq. 0.00

Any Other Income -200000.00 Total 1103.00

Taxable Income 504912.00

Total Tax 12992.00

Marginal Relief 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 243.00

Net Tax 13235.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 1103.00

Tax to be Deducted 12132.00 Interest on Housing Loan 200000.00

Tax/Month 1103.00 Interest Paid on Housing Loan 350000.00

Tax on Non-Recurring Earnings 0.00 Net House Property(Income/- -350000.00 200000.00

Tax Credit Amount (87A) 0.00 Loss)

Total of Any Other Income -200000.00

Tax Deduction for this month 1103.00

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- Sol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessDocument65 pagesSol. Man. - Chapter 10 - Acctg Cycle of A Merchandising BusinessPeter Piper67% (3)

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash Lamani100% (1)

- Chapter 2 Advance Acctg.Document20 pagesChapter 2 Advance Acctg.Clarize R. Mabiog82% (11)

- Accounting For LeaseDocument75 pagesAccounting For LeaseRonnie Salazar53% (15)

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- SalarySlip MarchDocument2 pagesSalarySlip Marchseenasrinivas113No ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Tasleem MayDocument2 pagesTasleem MayManthan ShahNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- Payslip May 2024Document1 pagePayslip May 2024simplycreated931No ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Compass India Food Services Private LimitedDocument1 pageCompass India Food Services Private LimitedBoopathi ChinnaduraiNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- CRM Services India Private Limited: Payslip For The Month of January 2020Document1 pageCRM Services India Private Limited: Payslip For The Month of January 2020abhi.90748989No ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- Payslip Mar 2024Document1 pagePayslip Mar 2024simplycreated931No ratings yet

- Sunil Kumar (DELS0210)Document1 pageSunil Kumar (DELS0210)SUNIL KUMARNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Payslip Sep 2023Document1 pagePayslip Sep 2023atozinstitute96No ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- FNP00765Document1 pageFNP00765Rajaram RayNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Payslip 147988 202312-27Document1 pagePayslip 147988 202312-27SUNKARA ISNo ratings yet

- Health & Glow Private Limited: Earnings DeductionsDocument1 pageHealth & Glow Private Limited: Earnings DeductionsVishal BawaneNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- One97 Communications Limited: Earnings DeductionsDocument2 pagesOne97 Communications Limited: Earnings Deductionsrusingh932No ratings yet

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- EPF Universal Account Number: 100618268345 LIC ID / Policy IDDocument1 pageEPF Universal Account Number: 100618268345 LIC ID / Policy IDHoly ReaperNo ratings yet

- EmployeeData OctDocument2 pagesEmployeeData OctAnkit SinghNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Payslip Jul2023 EDU - 01098Document1 pagePayslip Jul2023 EDU - 01098PrabhuNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Master ChartDocument3 pagesMaster ChartShubhajyoti SahaNo ratings yet

- Kolkata -April 2021Document1 pageKolkata -April 2021Shubhajyoti SahaNo ratings yet

- List of Capex Proposals - 27.07.20Document44 pagesList of Capex Proposals - 27.07.20Shubhajyoti SahaNo ratings yet

- Monthly Q - Performance: Date: 8 of NOV 2019Document16 pagesMonthly Q - Performance: Date: 8 of NOV 2019Shubhajyoti SahaNo ratings yet

- KPI TrendDocument6 pagesKPI TrendShubhajyoti SahaNo ratings yet

- Corporate Performance Review: Confidential and PrivilegeDocument44 pagesCorporate Performance Review: Confidential and PrivilegeShubhajyoti SahaNo ratings yet

- Budgetary Quotation PrakrutiDocument2 pagesBudgetary Quotation PrakrutiShubhajyoti SahaNo ratings yet

- SN Action Points Resp. Status RemarksDocument11 pagesSN Action Points Resp. Status RemarksShubhajyoti SahaNo ratings yet

- Augmentation of Pulverized Coal Injection System of Blast FurnaceDocument28 pagesAugmentation of Pulverized Coal Injection System of Blast FurnaceShubhajyoti SahaNo ratings yet

- JD For Strategy Kolkata V1Document4 pagesJD For Strategy Kolkata V1Shubhajyoti SahaNo ratings yet

- Website:Https://Www - Tstransco.In Cin No: U40102T82014Sgco94248Document5 pagesWebsite:Https://Www - Tstransco.In Cin No: U40102T82014Sgco94248satyanarayana reddyNo ratings yet

- Topic 1Document3 pagesTopic 1Benard BettNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- Ch.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookDocument23 pagesCh.3 - National Income - Related Aggregates ( (Macro Economics - 12th Class) ) - Green BookMayank Mall100% (2)

- UNIT IV - Performance of An Economy - MacroeconomicsDocument50 pagesUNIT IV - Performance of An Economy - MacroeconomicsSaravanan ShanmugamNo ratings yet

- The Accounting EquationDocument10 pagesThe Accounting EquationDennis LacsonNo ratings yet

- Intercompany Inventory Transactions: Mcgraw-Hill/IrwinDocument123 pagesIntercompany Inventory Transactions: Mcgraw-Hill/IrwinsresaNo ratings yet

- In-Tray Assessment - Supporting Information (362R)Document6 pagesIn-Tray Assessment - Supporting Information (362R)shahedhaque339No ratings yet

- JB Maize CocDocument7 pagesJB Maize CocGirish SalunkheNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Accounting For Income Taxes ExercisessDocument5 pagesAccounting For Income Taxes ExercisessdorothyannvillamoraaNo ratings yet

- Fundamentals PDFDocument103 pagesFundamentals PDFDhairya JainNo ratings yet

- Financial Accounting 4th Edition Spiceland Test Bank 1Document187 pagesFinancial Accounting 4th Edition Spiceland Test Bank 1barbara100% (53)

- Accounting Theory Godfrey Chapter 4Document65 pagesAccounting Theory Godfrey Chapter 4FELIX PANDIKANo ratings yet

- Chapter 3 InvestmentsDocument44 pagesChapter 3 Investmentssamuel hailuNo ratings yet

- Soal Praktek Myob Perusahaan JasaDocument4 pagesSoal Praktek Myob Perusahaan Jasahani ramadiyantiNo ratings yet

- Should Church Be TaxedDocument4 pagesShould Church Be TaxedDangel MonacoNo ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument50 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- TGAS Less Ending Inv in Pesos: 991, 200 - 294,000Document13 pagesTGAS Less Ending Inv in Pesos: 991, 200 - 294,000cherry blossomNo ratings yet

- Diaspora Action Australia Annual Report 2012-13Document24 pagesDiaspora Action Australia Annual Report 2012-13SaheemNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Econ Macro P1 Past Papers OrganizedDocument5 pagesEcon Macro P1 Past Papers OrganizedElin ChunNo ratings yet

- J FabmDocument192 pagesJ FabmJillian Anika CuerdoNo ratings yet

- Income As ModeratorDocument13 pagesIncome As ModeratorMalik AwanNo ratings yet

- Taxation: Dr. Maina N. JustusDocument10 pagesTaxation: Dr. Maina N. JustusSkyleen Jacy VikeNo ratings yet

- 4the Global Economy (Autosaved)Document176 pages4the Global Economy (Autosaved)Andrea Siladan100% (1)