Professional Documents

Culture Documents

Ircon International Limited vs. Dmrc

Ircon International Limited vs. Dmrc

Uploaded by

Vinayak GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ircon International Limited vs. Dmrc

Ircon International Limited vs. Dmrc

Uploaded by

Vinayak GuptaCopyright:

Available Formats

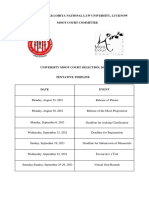

* IN THE HIGH COURT OF DELHI AT NEW DELHI

Reserved on : 21.07.2023

% Pronounced on : 09.10.2023

+ O.M.P. (COMM) 165/2023

IN THE MATTER OF:

IRCON INTERNATIONAL LIMITED ..... Petitioner

Through: Mr. Suman K. Doval, Mr. Hari

Krishan Pandey and Mr. Preetpal

Singh, Advocates.

versus

DELHI METRO RAIL CORPORATION ..... Respondent

Through: Mr. Tarun Johri and Mr. Ankur

Gupta, Advocates

CORAM:

HON'BLE MR. JUSTICE MANOJ KUMAR OHRI

JUDGMENT

MANOJ KUMAR OHRI, J.

1. By way of present petition instituted under Section 34 of the

Arbitration and Conciliation Act, 1996 (hereafter, the ‘A&C Act’), the

petitioner (hereafter, ‘Contractor’) seeks partial setting aside of the Award

dated 22.11.2022 (hereafter, the ‘impugned award’) in relation to Claim

Nos. 2, 3, 4 and 12 delivered by the Arbitral Tribunal (hereafter, the ‘AT’).

2. The impugned award came to be passed in the context of disputes

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 1 of 17

18:14:55

arising w.r.t the work of ‘Supply, Installation, Testing and commissioning of

Ballastless Track of Standard Gauge, Part-I Corridor of sections of

Mukundpur-Lajpat Nagar (excluding) Line-7 in elevated and underground

sections alongwith ballasted/ballastless tracks in Mukundpur Depot of Delhi

MRTS Project of Phase-III’.

3. The respondent (hereafter, ‘DMRC’) invited bids for the said work,

which was awarded to the Contractor vide Letter of Award dated 17.02.2015

for a total contract value of INR 153,65,61,349/- + USD72,65,823/-. The

Contract period was of 24 months with scheduled date of start as 23.02.2015

and scheduled date of completion as 22.02.2017. A formal Contract was also

executed between the parties. The work was completed on 06.08.2018 i.e.,

after a delay of 18 months. DMRC had granted extensions of time

(hereafter, ‘EOT’) for the entire prolongation of contract without levy of any

liquidated damages.

DISPUTES BEFORE THE AT

4. The Contractor filed its statement of claims (hereafter, ‘SOC’) thereby

raising as many as 12 claims. Claim Nos.2, 3, 4 and 12, that are in issue in

the present proceedings, are extracted hereinbelow:-

Claim No. Description of Claim Amount

2(a) Claim on account of extra Rs.6,05,50,281.00

Cost on increased

Establishment Cost

including Overheads,

Salary of Regular and

Contractual Staff,

Inspection Vehicle hire

Charges, etc. due to

prolongation of contract

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 2 of 17

18:14:55

2(b) Claim on account of extra Rs. 43,035.00

cost due to payment of

bank charges for repeated

extension of

Performances Bank

Guarantee beyond

stipulated completion

date

2(c) Claim on account of extra Rs.65,04,290.00

cost due to extension of

CAR and WC Insurance

Policy

2(d) Claim on account of Loss Rs.8,67,59,946.00

of Profit because of

prolongation of contract

2(e) Claim on account of Rs. 12,43,393.00

Extra cost due to

depreciation due to

prolongation of contract

period

3 Claim on account of Rs.1,28,87,297.00

additional cost due to use & USD64,987.00

of 04 bolt fastening

system for radius beyond

700 mt.

4 Claim on account of INR 1,47,44,999.00

abnormal increase in & USD64,987.00

quantity of track

fastenings

12 Claim on account of Rs.56,40,553.00

Additional GST burden

5. The Contractor contended that under the Contract, DMRC was

obligated under the Contract to provide the project site progressively. For

the delay of 18 months in completion of the project, the Contractor laid the

entire blame on DMRC. It was contended that DMRC not only delayed in

handing over the project site but also unilaterally changed the design which

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 3 of 17

18:14:55

resulted in abnormal increase in quantities of Fastening System causing

variation to the extent of 450-900%. Additionally, the DMRC, in deviation

from Bill of Quantity (hereafter, ‘BOQ’), gave new bolt calculations as per

which fastening for curve track radius above 1000 was to be fitted with two

bolts and below 1000 to be fitted with four bolts. The Contractor submitted

the Claim for variation in quantities of Item No.8 of BOQ vide its letter

dated 31.08.2017 (amended by letter dated 12.11.2018). DMRC also asked

the Contractor to execute certain non-scheduled items which were not part

of the Contract. It was further contended that during the execution of the

Project, GST regime came into force resulting in additional tax burden on

the Contractor, for which Contractor raised claims with DMRC. DMRC

agreed to reimburse @1.40% towards additional burden on account of GST

for the work done beyond 01.07.2017.

6. DMRC contested the claims and filed its Statement of Defence

(hereafter, ‘SOD’). It attributed delay in completion of the Project to the

Contractor, for which it referred to the Monthly Progress Reports whereby

the Contractor was repeatedly informed about the shortage of manpower and

material on the Project site. The EOTs were granted without imposition of

liquidated damages and with payment of price escalations in terms of Clause

No.11.1.3 of Special Conditions of Contract (hereafter, ‘SCC’). Insofar as

the aspect of the design was concerned, DMRC contended that the same

was, as per clause 5.1 of General Conditions of Contract (hereafter, ‘GCC’),

within the scope of the work awarded to the Contractor. The design was to

be in conformity with the criteria of fastening system laid down by the

Ministry of Railways which formed part of the Contract. The design

proposed by the Contractor was subject to approval by the

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 4 of 17

18:14:55

Engineer/Employer, who could propose changes thereto as per the

requirement of the overall design. It was contended that the change in design

sought by the EIC was attributable to the Contractor. DMRC also challenged

the variation of quantity of work under Item 8 of BOQ pertaining to “Supply

of Track Fitting”. It was contended that the BOQ rate for Item 8 were

neither sought for by DMRC on the basis of number of bolts nor the same

was quoted by the Contractor. The BOQ rates were differentiated for two

sub-items namely for track with radius flatter than 1750 metres under BOQ

Item 8.1 and for curved tracks under BOQ Item 8.2. Item 8.2 had further

sub-items (a), (b), (c) and (d) for different radius of the curved track.

According to DMRC, the actual variation in quantity from the BOQ quantity

was only 6.55% for which payments have been made in line with Clause

12.5 of the GCC.

IMPUGNED AWARD

7. AT agreed with the Contractor and held that the time was the essence

of the Contract. While considering Claim No.2, the same was sub-divided

into 5 sub-claims as under:-

2(a) Claim on account of Rs.6,05,50,281/-

extra Cost on increased

Establishment Cost

including Overheads.

Salary of Regular and

Contractual Staff,

Inspection Vehicle hire

Charges, etc. due to

prolongation of

contract

2(b) Claim on account of Rs. 43,035/-

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 5 of 17

18:14:55

extra cost due to

payment of bank

charges for repeated

extension of

Performances Bank

Guarantee beyond

stipulated completion

date

2(c) Claim on account of Rs.65,04,290/-

extra cost due to

extension of CAR and

WC Insurance Policy

2(d) Claim on account of Rs. 8,67,59,946/-

Loss of Profit because

of prolongation of

contract

2(e) Claim on account of Rs 12,43,393/-

Extra cost due to

depreciation due to

prolongation of contract

period

While Claim Nos.2(a), (b) and (c) were partially allowed, Claim

Nos.2(d) and (e) were rejected. While doing so, AT relied on Clause 8.3 of

GCC as modified by Sl. No. 22 of SCC. AT further noted that the Contractor

had sought EOT on four occasions and only when EOT was sought on the

third occasion, the Contractor reserved its right for seeking compensation

due to prolongation of Contract on ground of delay in handing over of

stretches and taking over of works. On other occasions, no such right was

reserved. Accordingly, while referring to Clause 4.4 of the Contract and

Clauses 2.2 and 8.3 of the GCC, AT concluded that out of the 18 months of

the period of prolongation, period of 12 months was without any financial

implication as mutually agreed between the parties and thus the claim for

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 6 of 17

18:14:55

compensation with respect to those 12 months was rejected. However,

considering the period of six months under the third EOT i.e., from

01.01.2018 to 30.06.2018, AT awarded proportionate amount under sub-

claim Nos.2(a), (b) and (c). AT did not find any merit in the claims for loss

of profit and extra cost claimed due to depreciation under sub-claim

Nos.2(d) and (e). In concluding so, AT noted that the Contractor did not

provide any cogent evidence for them.

8. Claim Nos.3 and 4 were taken up together for consideration as both

pertained to Ballastless Track Fastening System. Claim No.3 related to

change in design and Claim No.4 related to abnormal variation in the

quantity of Ballastless Track Fitting System. AT observed that the claims

related to deviation in quantity of Item No.8 in BOQ.

AT observed that under Clause 5.1 of the Contract, the design was in

Contractor’s scope, who was obligated to submit the same in accordance

with Clause 6.3.2 of the Contract. The first technical design submitted by the

Contractor on 03.06.2015 was found to be technically deficient with number

of non-compliance issues as indicated by DMRC in its letter dated

08.06.2015 and a reminder dated 02.07.2015. The Contractor changed the

complete design and resubmitted new bolt calculations vide its letter

19.09.2015. This aspect as stated in SOD was not specifically denied by the

Contractor in its rejoinder. On the aspect of ETAG001 (European

Guidelines), AT observed that the Contractor did not place any document on

record evidencing its objection that the same did not form part of the

Contract. AT also observed that vide its Procedure Order No.13, though the

Contractor was asked to submit its point-wise reply to DMRC’s second

report dated 08.07.2015, a bunch of documents was filed without any point-

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 7 of 17

18:14:55

wise reply. AT further observed that the BOQ specified in the Contract was

not based on the number of bolts to be used but was based on the radius of

curve i.e., 1750 m and 500 m without specifying number of bolts to be used

on curves. Thus, AT rejected both the claims.

9. While partially allowing Claim No.12 relating to additional GST

burden, AT noted that the Goods and Services Tax Act came into effect on

01.07.2017. In its claim, the Contractor claimed 18% GST from August,

2017 to February, 2018 and 12% thereafter as per applicable GST rates on

work contracts. AT noted that on claim being raised by the Contractor with

DMRC, the latter was initially willing to reimburse @1.40% towards

additional burden on account of GST after taking into consideration the

taxes that were applicable and payable by the Contractor during the pre-GST

regime which were subsumed in the post-GST regime, and also input credits

availed by the Contractor. The Contractor had rejected DMRC’s offer of

1.4% reimbursement, and the same was withdrawn by the latter. While

referring to Clause 27(v) of the SCC, the AT concluded that though the

contract price was not to be adjusted on account of change in

taxes/duties/levies, GST being a new tax was not barred by the aforesaid

clause. The Contractor was asked to submit documents related to filing of

GST returns and deposit of GST on the invoices raised by DMRC. AT noted

that the total amount of GST deposited matched with the calculation sheets

of the Contractor, however, from the one-page statement submitted by the

Contractor, the amount of input credit availed by it could not be

substantiated. Resultantly, AT allowed the claim by awarding

Rs.26,44,277/- towards the additional GST burden @1.40%. In total, AT

passed an Award holding the Contractor entitled for a sum of

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 8 of 17

18:14:55

Rs.3,93,03,109/- towards various claims along with interest @10% per

annum on the awarded sum from the date of the Award till payment.

10. DMRC has not challenged the Award and the entire award amount

has been paid to the Contractor.

SUBMISSIONS BEFORE THIS COURT

11. It was contended on behalf of the Contractor that the partial rejection

of Claim No.2 by AT suffers from patent illegality, inasmuch, AT while

limiting the compensation to six months, returned a perverse finding that in

seeking EOT on the first, second and fourth occasion, the Contractor had not

reserved its right to seek compensation, which amounted to a waiver. AT

wrongly relied only upon Section 55 of the Indian Contract Act, 1873

(hereafter, ‘ICA’) instead of reading it in conjunction with Section 73, ICA.

The rejection of Claim Nos.3 and 4 is also hit by the vice of patent illegality.

AT overlooked that the insistence of DMRC to use four bolts instead of two

on certain curves was in departure from International and National practice.

Further, AT failed to appreciate that Clause at S.No.31 of SCC had replaced

the earlier Clause No.12.5(ii)(f). The replaced new provision provided that

positive variations above 25% in individual or group of items would be

considered for negotiation of rates. AT also overlooked that the replaced

new clause had equated group of items with individual items. Contractor

also called into question AT’s finding w.r.t. Claim No.12 being patently

illegal. It contended that GST ought to have been granted @12%.

12. DMRC negated Contractor’s contentions and defended the impugned

award. It denied that Clause 31 of SCC brought any change in Clause

12.5(ii)(a) of the GCC as contended by the Contractor. It further stated that

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 9 of 17

18:14:55

AT’s conclusions are findings of facts which cannot be reappreciated by this

Court under Section 34 of the A&C Act.

DISCUSSION & CONCLUSION

13. Contractor’s entire challenge to the impugned Award is premised on

the ground of ‘patent illegality’ which has been explained in plethora of

decisions lastly being Delhi Airport Metro Express (P) Ltd. vs DMRC1,

wherein it was stated that:-

“29. Patent illegality should be illegality which goes to

the root of the matter. In other words, every error of law

committed by the Arbitral Tribunal would not fall within

the expression “patent illegality”. Likewise, erroneous

application of law cannot be categorised as patent

illegality. In addition, contravention of law not linked to

public policy or public interest is beyond the scope of the

expression “patent illegality”. What is prohibited is for

courts to reappreciate evidence to conclude that the

award suffers from patent illegality appearing on the face

of the award, as Courts do not sit in appeal against the

arbitral award. The permissible grounds for interference

with a domestic award under Section 34(2-A) on the

ground of patent illegality is when the arbitrator takes a

view which is not even a possible one, or interprets a

clause in the contract in such a manner which no fair-

minded or reasonable person would, or if the arbitrator

commits an error of jurisdiction by wandering outside the

contract and dealing with matters not allotted to them. An

arbitral award stating no reasons for its findings would

make itself susceptible to challenge on this account. The

conclusions of the arbitrator which are based on no

evidence or have been arrived at by ignoring vital

evidence are perverse and can be set aside on the ground

of patent illegality. Also, consideration of documents

1

(2022) 1 SCC 131

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 10 of 17

18:14:55

which are not supplied to the other party is a facet of

perversity falling within the expression “patent

illegality”.”

14. Through Claim No.2, Contractor had claimed extra cost incurred due

to prolongation of the project. As noted above, the Contract was delayed by

18 months for which, Contractor had sought four EOTs by way of four

letters namely 17.02.2017, 12.10.2017, 26.12.2017 and 23.08.2018, which

were granted by the DMRC.

15. Pertinently, DMRC granted EOT on all the four occasions without

imposing any liquidated damages. Indisputably, the Contractor reserved its

right to seek compensation only at the time of seeking third EOT vide its

letter dated 26.12.2017, and in the earlier requests it did not claim any

monetary compensation due to the extensions.

16. AT declined to compensate the Contractor for the remaining 12-

month period holding that the Contractor had accepted EOT granted by

DMRC without compensation and no right to claim the same was reserved

by the Contractor, unlike the third EOT sought for the period 01.01.2018 to

30.06.2018. According to the Contractor, the AT committed a judicial error

amounting to patent illegality in denying compensation on the ground that

the Contractor had forgone its right to claim compensation for the extension

sought on the other three occasions.

17. Contractor has referred to judgments in K.N. Sathyapalan vs State of

Kerala2, Asian Techs Ltd. vs Union of India3, Bharat Drilling vs State of

2

(2007) 13 SCC 43

3

(2009) 10 SCC 354

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 11 of 17

18:14:55

Jharkhand4 and Simplex Concrete Piles (India) Pvt. Ltd. vs Union of India5

to contend that even though Clause 4.4 of the Contract and Clauses 2.2 and

8.3 of GCC prohibit the payment of monetary compensation in the cases of

EOT however, the Contractor could still claim compensation under Section

73 of the Contract Act, in the event of breach of contract- which the DMRC

did by not handing over the sites to the Contractor by the promised time.

18. According to this Court, the Contractor is not required to go as far as

to invoke Section 73 of the Contract Act and the aforesaid judgments to

assail the award, since the AT has rather recognised the Contractor’s right to

claim compensation regardless of prohibitive nature of Clause 4.4 of the

Contract and Clauses 2.2 and 8.3 of GCC by referring to the judgment in

Simplex Concrete Piles (Supra). AT’s reluctance to award compensation

stems from the Contractor’s own waiver of the right to claim compensation,

that happened in the first, second and fourth EOT sought by the Contractor,

as opined by the AT. AT read the four extension letters sent by the

Contractor and interpreted them to conclude that it was only the third one

dated 26.12.2017, where the right to claim compensation was reserved.

Therefore, according to the AT, out of 18 months of extension, only 6

months were eligible for compensation. The AT does return a finding of fact

and interpretation of the contract clauses, in favour of the Contractor, to

conclude that DMRC was responsible for delaying the progressive handing

over of the sites to the Contractor.

19. The interpretation of the extension letters by AT, is very well within

its judicial prerogative. It will be judicially inappropriate for this court

4

(2009) 16 SCC 705

5

2010 (115) DRJ 616

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 12 of 17

18:14:55

sitting in this jurisdiction, to re-examine the evidence and re-interpret the

same as per its own understanding. The interpretation adopted by the AT of

the evidence is a plausible view and certainly not the kind that will call for

any interference from this court.

20. Coming to Claim Nos.3 and 4, the same relate to deviations in the

quantity of Item No. 8 of BOQ which read as under:

Item 8 Supply of Track Fitting

Item Description Unit Total Rate in Rate in Amount Amount

No. of Items Quantity Indian Foreign in in

Rupees Currency Indian Foreign

(INR) Rupees Currency

(INR)

8. Supply of

Track

Fittings

Item 8.1 for Straight Track & curve having radius flatter than 1750m

Item Descriptio Unit Total Rate Rate in Amount Amount

No. n of Items Quantity in Foreign in in

India Currency Indian Foreign

n Rupees Currency

Rupe (INR)

es

(INR)

8.1 For Set 160000

Straight

Track &

curve

having

radius

flatter than

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 13 of 17

18:14:55

1750m

Item 8.2 for Curved Track

Item Description Unit Total Rate in Rate in Amount Amount

No. of Items Quantity Indian Foreign in in

Rupees Currency Indian Foreign

(INR) Rupees Currency

(INR)

a. Fastening Set 1500

for curve

track

radius

between

1750m to

1000m

(including)

b. Fastening Set 4500

for curve

track

radius

between

1000m to

500m

(including)

c. Fastening Set 19000

for curve

track

radius

between

500m to

300 m

(including)

d. Fastening Set 1500

for curve

track

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 14 of 17

18:14:55

radius less

than 300 m

21. AT rejected the claims by observing that the BOQ specified in the

Contract was not based on number of bolts to be used but on the radius of

the curve. AT also observed that the Contractor was unable to convince that

the increase in number of bolts was due to the new design that the DMRC

required the Contractor to follow. According to the AT, the DMRC’s

insistence on following ETAG001 (European Guideline) was never objected

to by the Contractor at the time of design change suggested by the DMRC or

that the same was not required. AT has further observed that even before the

AT, the Contractor was unable to link the design change to the requirement

of conformity with the European standard and the increase in the number of

bolts.

22. Even otherwise, it is seen that in terms of Clause 5.1 of the Contract,

the Contractor was responsible for submitting the design in accordance with

Clause 6.3.2 of the Contract, which was subject to DMRC’s approval.

Design was submitted by the Contractor on 03.06.2015 and the same was

found to be deficient by DMRC which was conveyed to the Contractor vide

its letter dated 08.06.2015. It is observed by AT in the award that the

Contractor did not challenge DMRC’s comments on the design submitted by

it and on its own re-submitted a new bolt calculation on 19.09.2015.

23. Be that as it may, the rates quoted in Item 8 of the BOQ are for

quantities that are measured in metre length of the track of various radii. The

quantities of individual items of the track fitting system was neither sought

for by DMRC in the BOQ nor quoted by the Contractor when they

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 15 of 17

18:14:55

submitted their rates. It would not have been possible for the AT to order

variation in quantities on account of increase in the number of bolts

installed, due to the design change, as was claimed by the Contractor, since,

the same may have been contrary to the BOQ. In any case, the AT has dealt

with the claim in a judicial manner, referring to the contract provisions and

the evidence produced by the parties.

24. At the cost of repetition, it is never enough to reiterate that under

Section 34, the Court is not called upon to reappreciate evidence or correct

the legal errors that the AT may have committed in appreciating the

evidence or interpret the contract clauses or applying the law. There is no

good reason, to interfere with the AT findings in relation to Claim No.3.

25. The last contention relates to Claim No.12 for non-grant of entire

additional GST burden. AT while partially allowing the claim relied on

Clause 27(v) of the SCC which reads as under:-

“Clause 27(v) - Change in Taxes/Duties: The contract price

shall not be adjusted to take into account any increase or

decrease in cost resulting from any changes in taxes, duties,

levies from the last date of submission of the Tender to the

completion date including the dote of extended period of

Contract.”

26. AT allowed claim to the extent of 1.40% on account of the concession

initially agreed to by DMRC. In the considered opinion of this Court, the AT

had rightly relied upon the aforesaid clause which restricted the Contractor

from seeking any adjustment in the Contract price either on the increase or

decrease in cost as a consequence of change in tax duties/levies. In this

regard, it is pertinent to note that AT also noted that the Contractor failed to

provide any substantiation on the amount of input credit availed by it. This

contention is rejected accordingly.

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 16 of 17

18:14:55

27. In view of the aforesaid discussions, the petition is dismissed.

(MANOJ KUMAR OHRI)

JUDGE

OCTOBER 9, 2023/rd/ga

Signature Not Verified

Digitally Signed

By:NIJAMUDDEEN ANSARI

Signing Date:09.10.2023

O.M.P. (COMM) 165/2023 Page 17 of 17

18:14:55

You might also like

- 1.0 Driver Induction, Agreements & ChecklistDocument10 pages1.0 Driver Induction, Agreements & Checklistdave.muir.25No ratings yet

- Success in Law SchoolDocument25 pagesSuccess in Law SchoolJosephine Berces100% (3)

- LeanIX - Poster - Best Practices To Define Business Capability MapsDocument1 pageLeanIX - Poster - Best Practices To Define Business Capability MapsYasserAl-mansourNo ratings yet

- Judgement 48 494973Document8 pagesJudgement 48 494973Razik MuahmmedNo ratings yet

- Uno Minda Limited Vs Deputy Commissioner Revenue DepartmentDocument8 pagesUno Minda Limited Vs Deputy Commissioner Revenue DepartmentAmitoz SinghNo ratings yet

- J 2022 SCC OnLine Del 839 2022 290 DLT 59 Jciravi Gmailcom 20221124 171802 1 8Document8 pagesJ 2022 SCC OnLine Del 839 2022 290 DLT 59 Jciravi Gmailcom 20221124 171802 1 8adityaNo ratings yet

- GetFile DoDocument3 pagesGetFile DoAman DwivediNo ratings yet

- Bogus PurchaDocument6 pagesBogus Purchatanna dixitNo ratings yet

- 80079cajournal May2024 30Document5 pages80079cajournal May2024 30Puneet MittalNo ratings yet

- Top Edge v. Govt. of NCT of Delhi (Tender Judgment, July 2023)Document16 pagesTop Edge v. Govt. of NCT of Delhi (Tender Judgment, July 2023)Sanchit SubscriptionsNo ratings yet

- Ad235364101123 001002Document2 pagesAd235364101123 001002mitzz39No ratings yet

- National Highways Authority of India Vs Sahakar Global Limited Delhi High CourtDocument17 pagesNational Highways Authority of India Vs Sahakar Global Limited Delhi High CourtAnkur AgrwalNo ratings yet

- Net Sales: (Amounts in Thousand) (Amounts in Thousand)Document1 pageNet Sales: (Amounts in Thousand) (Amounts in Thousand)malihaNo ratings yet

- INTRODUCIONDocument5 pagesINTRODUCIONmalanijayalath61No ratings yet

- Beigh Construction Company Private Limited v. Varaha Infra LimitedDocument10 pagesBeigh Construction Company Private Limited v. Varaha Infra LimitedHeena MalhotraNo ratings yet

- Awarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCDocument33 pagesAwarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCMuthu OrganicsNo ratings yet

- Digitally Signed By:Dushyant RawalDocument31 pagesDigitally Signed By:Dushyant Rawalaridaman raghuvanshiNo ratings yet

- Arbitration Case StudyDocument8 pagesArbitration Case Studyshubham.gaurav.sensibullNo ratings yet

- Venue of Arbitration If MSME ND Arbitration Clause ContradictsDocument22 pagesVenue of Arbitration If MSME ND Arbitration Clause ContradictsVibhor BhatiaNo ratings yet

- Tendernotice 1Document1 pageTendernotice 1krish659No ratings yet

- Burger King Case LawDocument16 pagesBurger King Case LawharshagarwalindoreNo ratings yet

- Construction Arbitration Newsletter Issue 37 Oct 2023 1698805578Document3 pagesConstruction Arbitration Newsletter Issue 37 Oct 2023 1698805578rvsingh17No ratings yet

- Karnata Ka Neera Vari Niga M Limited: Short Term Tender Notification No. 01: 2022-23 Date: 01-04-2022Document5 pagesKarnata Ka Neera Vari Niga M Limited: Short Term Tender Notification No. 01: 2022-23 Date: 01-04-2022Manjunatha BNo ratings yet

- Nuclear Power Corp of IndiaDocument9 pagesNuclear Power Corp of IndiaNeha ShanbhagNo ratings yet

- GM Default - 240308 - 182301Document8 pagesGM Default - 240308 - 182301Raghu DattaNo ratings yet

- Petitioner vs. vs. Respondent: First DivisionDocument6 pagesPetitioner vs. vs. Respondent: First DivisionPolo MartinezNo ratings yet

- Del HC Suo Moto 533035Document6 pagesDel HC Suo Moto 533035Sreejith NairNo ratings yet

- Tendernotice 1Document15 pagesTendernotice 1amitNo ratings yet

- Newton Engineering v. UEM India - para 7Document4 pagesNewton Engineering v. UEM India - para 7adv.adsawlaniNo ratings yet

- National Highways Authority of India v. Reengus Sikar Expressway Ltd.Document11 pagesNational Highways Authority of India v. Reengus Sikar Expressway Ltd.varsha bansodeNo ratings yet

- Arbitration Interest PaymentDocument16 pagesArbitration Interest PaymentkarthichapoNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- M dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. KolkataDocument5 pagesM dt.16.05.2023 - Ms Duttcon Consultant Engrs P Ltd. Kolkataduttcon engineeringNo ratings yet

- Manu SC 0304 2005 Jud20230911151515Document10 pagesManu SC 0304 2005 Jud20230911151515Sushmitha SelvanathanNo ratings yet

- TS 124 ITAT 2022DEL TP Akzo - Nobel - India - LTDDocument10 pagesTS 124 ITAT 2022DEL TP Akzo - Nobel - India - LTDruchimishra673No ratings yet

- Mumbai Bench- Extension beyond 330 daysDocument6 pagesMumbai Bench- Extension beyond 330 daysNishi AgrawalNo ratings yet

- Transmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateDocument10 pagesTransmission Corporation of Andhra Pradesh Limited: by Registered Post With Ack Due in DuplicateTender 247No ratings yet

- E-Tender No 9000022553 For MODU Manning 22 05 2019 PDFDocument67 pagesE-Tender No 9000022553 For MODU Manning 22 05 2019 PDFKUMAR KAUSHIKNo ratings yet

- In The Office of SR - General Manager/Contracts: CC-144/Vol-1/NIT, ITT & FOTDocument17 pagesIn The Office of SR - General Manager/Contracts: CC-144/Vol-1/NIT, ITT & FOTBittudubey officialNo ratings yet

- Calcutta HC Order For MS BBA Infrastructure LimitedDocument14 pagesCalcutta HC Order For MS BBA Infrastructure LimitedhhhhhhhuuuuuyyuyyyyyNo ratings yet

- Gujrat Insecticides Ltd. v. Jainsons Minerals, 2007 SCC OnLine Del 433Document11 pagesGujrat Insecticides Ltd. v. Jainsons Minerals, 2007 SCC OnLine Del 433id21309806823No ratings yet

- up-expressways-industrial-development-authority-versus-sahakar-global-ltd- On Bank GurarnteeDocument38 pagesup-expressways-industrial-development-authority-versus-sahakar-global-ltd- On Bank Gurarnteebalagaliravi2No ratings yet

- Document 37Document7 pagesDocument 37Devesh SharmaNo ratings yet

- ईस्टर्न कोलफील्ड्सलललिटेड Eastern Coalfields LimitedDocument17 pagesईस्टर्न कोलफील्ड्सलललिटेड Eastern Coalfields LimitedYesBroker InNo ratings yet

- 210841-2017-Department of Public Works and Highways V.20220205-11-1oo5z1pDocument30 pages210841-2017-Department of Public Works and Highways V.20220205-11-1oo5z1pSalcedo YehoNo ratings yet

- Delhi HC Indian Hotels Co LTD 414160Document45 pagesDelhi HC Indian Hotels Co LTD 414160ishabajajsterNo ratings yet

- Case Note - Smartwork Coworking Vs Turbot HQ - NCLAT Decision Dated 23rd May 2023Document2 pagesCase Note - Smartwork Coworking Vs Turbot HQ - NCLAT Decision Dated 23rd May 2023vijay.kandpalNo ratings yet

- Vineet Saraf Del HC 483552Document63 pagesVineet Saraf Del HC 483552Jenish lakhaniNo ratings yet

- Naman Gupta 520104Document22 pagesNaman Gupta 520104saif aliNo ratings yet

- Burger King Trademark 470137Document13 pagesBurger King Trademark 470137Shubham JainNo ratings yet

- Harish Sharma vs. Ms. C & C Constructions Ltd.Document10 pagesHarish Sharma vs. Ms. C & C Constructions Ltd.Sparsh JainNo ratings yet

- Tendernotice_1 (89)Document19 pagesTendernotice_1 (89)tridiv.abciNo ratings yet

- Deccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchDocument14 pagesDeccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchSachika VijNo ratings yet

- Tendernotice 1Document115 pagesTendernotice 1rahul nagpurkarNo ratings yet

- BackhoemangalroeDocument47 pagesBackhoemangalroeaeeNo ratings yet

- (OT) (CO) MDWDM MuxponderDocument132 pages(OT) (CO) MDWDM MuxpondersunnyrunninginamazonNo ratings yet

- Civil Appeal 137 of 2018Document7 pagesCivil Appeal 137 of 2018Diana WangamatiNo ratings yet

- BCCI - NCLT ORDERDocument38 pagesBCCI - NCLT ORDERExpress WebNo ratings yet

- Yva30112023fac3152019 141644Document25 pagesYva30112023fac3152019 141644Ausaf AyyubNo ratings yet

- KeyInformationTablePSSA-11 2Document1 pageKeyInformationTablePSSA-11 2gagandeep singhNo ratings yet

- In The High Court of Judicature at Madras: Reserved On Delivered OnDocument23 pagesIn The High Court of Judicature at Madras: Reserved On Delivered OnLatest Laws TeamNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Stringency of Law and Deterrence of CrimeDocument5 pagesStringency of Law and Deterrence of CrimeVinayak GuptaNo ratings yet

- The New IT Rules GuidelineDocument2 pagesThe New IT Rules GuidelineVinayak GuptaNo ratings yet

- HeadsDocument1 pageHeadsVinayak GuptaNo ratings yet

- Stationing Smart Contract As A ContractDocument44 pagesStationing Smart Contract As A ContractVinayak GuptaNo ratings yet

- Locating Indirect Discrimination in IndiaDocument27 pagesLocating Indirect Discrimination in IndiaVinayak GuptaNo ratings yet

- Exclusion Clauses Under The Indian ContractDocument32 pagesExclusion Clauses Under The Indian ContractVinayak GuptaNo ratings yet

- 1 Sam&Co. - Jgls Antitrust Law Moot Court Competition, 2019Document45 pages1 Sam&Co. - Jgls Antitrust Law Moot Court Competition, 2019Vinayak GuptaNo ratings yet

- Umcs 2021 - Moot PropositionDocument9 pagesUmcs 2021 - Moot PropositionVinayak GuptaNo ratings yet

- The Maharashtra Prevention of Gambling Act.Document14 pagesThe Maharashtra Prevention of Gambling Act.Vinayak GuptaNo ratings yet

- Analysing The Overriding EffectDocument24 pagesAnalysing The Overriding EffectVinayak GuptaNo ratings yet

- Crisis Cartels: An Antitrust Solution To COVID-19: Tawishi Beria Harshita FatesariaDocument3 pagesCrisis Cartels: An Antitrust Solution To COVID-19: Tawishi Beria Harshita FatesariaVinayak GuptaNo ratings yet

- Cyber Crime Investigation: S O P FDocument20 pagesCyber Crime Investigation: S O P FVinayak GuptaNo ratings yet

- UMCS Timeline 2021Document1 pageUMCS Timeline 2021Vinayak GuptaNo ratings yet

- JTXT9000244261 Kiit National Moot 06 2018 TM Best R Vinayak0333 Gmailcom 20210831 163129 1 20Document20 pagesJTXT9000244261 Kiit National Moot 06 2018 TM Best R Vinayak0333 Gmailcom 20210831 163129 1 20Vinayak GuptaNo ratings yet

- In The High Court of Gujarat at Ahmedabad: Z.K. Saiyed, JDocument11 pagesIn The High Court of Gujarat at Ahmedabad: Z.K. Saiyed, JVinayak GuptaNo ratings yet

- Karnataka Film 6.4.2017 FinalDocument60 pagesKarnataka Film 6.4.2017 FinalVinayak GuptaNo ratings yet

- In Re Cartelisation in Respect of Zinc Carbon Dry Cell Batteries Market in India 2018 SCC OnLine CCI 5.Document21 pagesIn Re Cartelisation in Respect of Zinc Carbon Dry Cell Batteries Market in India 2018 SCC OnLine CCI 5.Vinayak GuptaNo ratings yet

- Penaltyimposedon Jet Airways, Indi Goand SpicejetforfixDocument5 pagesPenaltyimposedon Jet Airways, Indi Goand SpicejetforfixVinayak GuptaNo ratings yet

- 28-Sept-16sunil Bansa Vs Jaiprakash AssociatesDocument184 pages28-Sept-16sunil Bansa Vs Jaiprakash AssociatesVinayak GuptaNo ratings yet

- The Curious Case of CBB Cartel: A Sophistic Approach of Indian Competition AuthorityDocument3 pagesThe Curious Case of CBB Cartel: A Sophistic Approach of Indian Competition AuthorityVinayak GuptaNo ratings yet

- Dr. Ram Manohar Lohiya National Law University: Indian Penal Code-IDocument21 pagesDr. Ram Manohar Lohiya National Law University: Indian Penal Code-IVinayak GuptaNo ratings yet

- Anand Prasad Agarwalla V Tarkeshwar Prasad & OrsDocument3 pagesAnand Prasad Agarwalla V Tarkeshwar Prasad & OrsVinayak GuptaNo ratings yet

- 10Th Fylc Ranka National Moot Court Competition, 2021-Online Edition (4TH-6TH JUNE, 2021)Document14 pages10Th Fylc Ranka National Moot Court Competition, 2021-Online Edition (4TH-6TH JUNE, 2021)Vinayak GuptaNo ratings yet

- ACTS (Actions Semiconductor Co. LTD.) (20-F) 2011-04-22Document154 pagesACTS (Actions Semiconductor Co. LTD.) (20-F) 2011-04-22Juan Angel RuizNo ratings yet

- Lex DomiciliiDocument3 pagesLex DomiciliiChari100% (5)

- Cases in PartnershipDocument70 pagesCases in PartnershipJaniceNo ratings yet

- Checklist - GoodsDocument2 pagesChecklist - GoodsMelody Frac ZapateroNo ratings yet

- Cruz V CruzDocument14 pagesCruz V CruzJanMikhailPanerioNo ratings yet

- JTGJDocument5 pagesJTGJVinit J PandyaNo ratings yet

- 50% Deposit Topaz 22Document19 pages50% Deposit Topaz 22Pankaj SinghNo ratings yet

- Om - Multistrada v2s - en - My23 - Ed02Document402 pagesOm - Multistrada v2s - en - My23 - Ed02serhat serhatNo ratings yet

- Textbook Contract Law Uk Edition Emily Finch Ebook All Chapter PDFDocument53 pagesTextbook Contract Law Uk Edition Emily Finch Ebook All Chapter PDFjim.shepherd977100% (16)

- General Tender Conditions For Deopots/DivisionsDocument25 pagesGeneral Tender Conditions For Deopots/DivisionsAakash KoradiyaNo ratings yet

- Support Department, Common Cost, and Revenue Allocations: Learning ObjectivesDocument14 pagesSupport Department, Common Cost, and Revenue Allocations: Learning ObjectivesKelvin John RamosNo ratings yet

- Contract LawDocument12 pagesContract LawPurva KhatriNo ratings yet

- 12 DIGEST G R No 165851 and G R No 168875 MANUEL CATINDIG Vs AURORADocument2 pages12 DIGEST G R No 165851 and G R No 168875 MANUEL CATINDIG Vs AURORAJonel L. SembranaNo ratings yet

- CAS 414-Cost of MoneyDocument2 pagesCAS 414-Cost of MoneyArshad MahmoodNo ratings yet

- Indian Contract Act, 1872Document8 pagesIndian Contract Act, 1872lolaNo ratings yet

- IURI 373 - SU1 - Contact Session 1 - 2024 - PDFDocument29 pagesIURI 373 - SU1 - Contact Session 1 - 2024 - PDFMzingisi TuswaNo ratings yet

- Law of CooperativesDocument28 pagesLaw of CooperativesMercy NamboNo ratings yet

- Syllabus For The 2019 Bar Examinations Labor Law and Social Legislation I. General ProvisionsDocument3 pagesSyllabus For The 2019 Bar Examinations Labor Law and Social Legislation I. General ProvisionsBret MonsantoNo ratings yet

- Business Associations OutlineDocument50 pagesBusiness Associations OutlinemasskonfuzionNo ratings yet

- Civ ProDocument17 pagesCiv ProJames SpringerNo ratings yet

- Military ScamsDocument2 pagesMilitary ScamsErnestNo ratings yet

- Investment AgreementDocument42 pagesInvestment AgreementJPFNo ratings yet

- Latest Draft ContractDocument17 pagesLatest Draft ContractFrank TaquioNo ratings yet

- SCWC 16 0000319Document29 pagesSCWC 16 0000319DinSFLANo ratings yet

- Political Law Review Notes (Prof. Carlo L. Cruz)Document98 pagesPolitical Law Review Notes (Prof. Carlo L. Cruz)Daverick PacumioNo ratings yet

- PM Sect B Test 4Document6 pagesPM Sect B Test 4FarahAin FainNo ratings yet

- Final Legal Note On Evacuation of The Leased Property Due To NeedDocument10 pagesFinal Legal Note On Evacuation of The Leased Property Due To NeedHalime DasbilekNo ratings yet