Professional Documents

Culture Documents

Sales-Leaseback-V2

Sales-Leaseback-V2

Uploaded by

cpaby2026Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales-Leaseback-V2

Sales-Leaseback-V2

Uploaded by

cpaby2026Copyright:

Available Formats

Sales & Leaseback Transactions

Sale and Leaseback Transactions

• If the transfer of an asset by the seller-lessee satisfies the requirements of IFRS15 to be accounted

for as a sale of the asset:

The right-of-use asset shall be measured by the seller-lessee in the proportion of the

previously carrying amount of the leased asset that relates to the right-of-use retained by the

seller. Accordingly, the seller-lessee shall only recognize gain or loss relating to the right

transferred to the buyer to the buyer-lessor.

Or Computed lease liability

✓ ROU Asset = Carrying amount of Asset x Right Retained/Fair value of asset.

Right retained is equal to the present value of the lease payment (the lease liability)

- If SP > FV, right retained = PV of lease payments – additional financing

- If SP < FV, right retained = PV of lease payments + prepayments

✓ Total gain = Fair value – Carrying amount

• If Operating lease, recognized in full.

• If Finance lease:

− Gain to be recognized = Total Gain x Right transferred/Fair value of asset.

− Gain not to be recognized = Total Gain x Right Retained/Fair value of asset.

Note: ✓ If Selling Price > Fair Value of the underlying asset, the excess is accounted for as additional financing

and will be considered as a deduction adjustment to arrive at the Fair Value of the right retained.

✓ If the Selling Price < the Fair Value of the underlying asset, the excess is accounted for as prepayments

for lease payments and shall be accounted for as an addition adjustment to arrive at the Fair Value of

the right retained.

Illustration 17: On January 1, 2022, LEOPARD Company sold to CHEETAH Inc. its equipment with

carrying amount of P900,000 for P1,500,000. LEOPARD immediately leased back the equipment from

CHEETAH with an annual lease payment of P180,000 for 9 years with lease payment, payable at the end

of the of each year. On this date, the prevailing market rate of interest is 9%. The transaction constitutes

a sale in accordance with IFRS15.

Required: Determine the following on the books of Seller-lessee leaseback assuming the fair value of the

equipment is: (1) P1,500,000, (2) P1,350,000, and (3) P1,575,000.

1. Initial measurement of the lease liability1 4. Gain to be recognized

2. Cost of right-of-use asset 5. Gain not to be recognized

3. Total gain

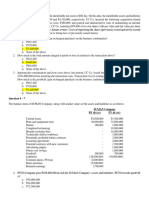

Case 1: Summary

1. Initial measurement of lease liability 180,000 x 5.9952 = P1,079,136

2. Cost of right-of-use asset 1,079,136/1,500,000 x P900,000 = P647,482

3. Total gain P1,500,000 – 900,000 = P600,000

4. Gain to be recognized 420,864/1,500,000 x 600,000 = P168,346

5. Gain not to be recognized 1,079,136/1,500,000 x 600,000 = P431,654.4

Case 1: Selling price of P1,500,000 = Fair value of P1,500,000

Selling Price P1,500,000 Fair value P1,500,000

Less: Fair Value P1,500,000 Less: Carrying amount 900,000

Additional financing (prepayments) - Total Gain P600,000

SUBJECT: ACCO20103 INTERMEDIATE ACCOUNTING 3 1

PREPARED BY: RODISON E. DE GUIA, CPA

Annual lease payment P180,000

PV of an ordinary annuity, @9%, n=9 5.9952

Total present value P1,079,136

Carrying amount Gain (Loss)

Fair Value Fraction or Percent (Fraction x CV of leased asset) (FV – CV)

b

Rights retained P1,079,136 1,079,136/1,500,000 P647,482 P431,654

a C

Rights transferred 420,864 420,864/1,500,000 252,518 168,346

Total P1,500,000 P900,000 P600,000

a

FV of rights transferred = P1,500,000 (Total Fair value) minus P1,079,136 (FV of rights retained) = P420,864

b

CV of rights retained (1,079,136/1,500,000 x P900,000) = P1647,482

C

CV of rights transferred (420,864/1,500,000 x P900,000) = P252,518

FV of rights transferred P420,864

Less: CV of rights transferred 252,518

Gain (loss) on Leaseback P168,346 or

CV of rights transferred x Total gain = P841, 728 x P1, 500, 000 = P168,346

FV of Underlying Asset P1,500,000

The journal entry on the part of LEOPARD Company (seller-lessee)

1/1/2022 Cash 1,500,000

Right-of-Use Asset 647,482

Equipment 900,000

Lease Liability 1,079,136

Gain on rights transferred 168,346

12/31/2022 Interest expense (1,079,136 x 9%) 97,122

Lease Liability (180,000 – 97,122) 82,878

Cash 180,000

The journal entry on the part of CHEETAH Inc. (buyer-lessor), assuming it is a finance lease.

1/1/2022 Equipment (at fair value) 1,500,000

Cash 1,500,000

Lease Receivable (180,000 x 9) 1,620,000

Equipment 1,500,000

Unearned interest income (1,620, 000 – 1,500,000) 120,000

12/31/2022 Cash 180,000

Lease Receivable 180,000

Note: The recognition of interest income shall be based on the implicit rate of the lease computed using

interpolation based on the fair value of the asset.

The journal entry on the part of CHEETAH Inc. (buyer-lessor), assuming it is an operating lease.

1/1/2022 Equipment (at fair value) P1,500,000

Cash 1,500,000

12/31/2022 Cash 180,000

Rent Income 180,000

Case 2: Summary

1. Initial measurement of lease liability (180,000 x 5.9952) – 150,000 = P929,136

2. Cost of the right-of-use asset 929,136/1,350,000 x P900,000 = P619,424

SUBJECT: ACCO20103 INTERMEDIATE ACCOUNTING 3 2

PREPARED BY: RODISON E. DE GUIA, CPA

3. Total gain P1,350,000 – 900,000 = P450,000

4. Gain to be recognized 420,864/1,350,000 x P450,000 = P140,288

5. Gain not to be recognized 929,136/1,350,000 x P450,000 = P309,712

Case 2: Selling price of P1,500,000 M > Fair value of P1,350,000

Selling Price P1,500,000 Fair value P1,350,000

Less: Fair Value 1,350,000 Less: Carrying amount 900,000

Additional financing P150,000 Total Gain P450,000

Selling Price > Fair Value of the underlying asset, the excess is accounted for as additional financing (deduction

adjustment to arrive at the Fair Value of the right retained).

Annual lease payment P180,000 Present value of lease payment P1,079,136

PV of ordinary annuity, @9%, n=9 5.9952 Additional financing (150,000)

Total PV of lease payment P1,079,136 FV of rights retained P929,136

Carrying amount Gain (Loss)

Fair Value Fraction or Percent (Fraction x CV of leased asset) (FV – CV)

b

Rights retained P929,136 929,136/1,350,000 P619,424 P309,712

a C

Rights transferred 420,864 420,864/1,350,000 280,576 140,288

Total P1,350,000 P900, 000 P450,000

a

FV of rights transferred = P1,350,000 (Total Fair value) minus P929,136 (FV of rights retained) = P420,864

b

CV of rights retained (929,136/1,350,000 x P900,000) = P619,424

C

CV of rights transferred (420,864/1,350,000 x P900,000) = P280,576

FV of rights transferred P420,864

Less: CV of rights transferred 280,576

Gain (loss) on Leaseback P140,288 or

CV of rights transferred x Total gain = P420,864 x P450,000 = P140,288

FV of Underlying Asset P1,350,000

The journal entry on the part of LEOPARD Company (seller-lessee)

1/1/2022 Cash 1,500,000

Right-of-Use Asset 619,424

Equipment 900,000

Lease Liability 929,136

Loan Payable 150,000

Gain on rights transferred 140,288

12/31/2022 Interest expense (1,079,136 x 9%) 97,122

Lease Liability (180,000 – 97,122) 82,878

Cash 180,000

The annual lease payment of P180,000 is split between the lease liability and loan payable as follows:

Balances Proportion Allocated amount

Lease liability P929,136 929,136/1,079,136 x P180,000 = P154,980

Loan Payable 150,000 150,000/1,079,136 x P180,000 = 25,020

Total P1,079,136 P180,000

SUBJECT: ACCO20103 INTERMEDIATE ACCOUNTING 3 3

PREPARED BY: RODISON E. DE GUIA, CPA

The journal entry on the part of CHEETAH Inc. (buyer-lessor), assuming it is a finance lease.

1/1/2022 Equipment (at fair value) 1,350,000

Financial Asset (Loan Receivable) 150,000

Cash 1,500,000

Lease Receivable (180,000 x 9) 1,620,000

Equipment 1,500,000

Unearned interest income (1,620, 000 – 1,500,000) 120,000

12/31/2022 Cash 180,000

Lease Receivable 180,000

Note: The recognition of interest income shall be based on the implicit rate of the lease computed using

interpolation based on the fair value of the asset.

The journal entry on the part of CHEETAH Inc. (buyer-lessor), assuming it is an operating lease.

1/1/2022 Equipment (at fair value) 1,350,000

Financial Asset 150,000

Cash 1,500,000

12/31/2022 Cash 180,000

Rent Income (180,000 x 929,136/1,079,136) 154,980

Financial Asset (180,000 x 150,00/1,079,136) 25,020

Case 3: Summary

1. Initial measurement of lease liability 180,000 x 5.9952 = P1,079,136

2. Cost of right-of-use asset 1,154,136/1,575,000 x P900,000 = P659,506

3. Total gain P1,575,000 – 900,000 = 675,000

4. Gain to be recognized 420,864/1,575,000 x P675,000 = P180,370

5. Gain not to be recognized 1,154,136/1,575,000 x P675,000 = P494,630

Case 3: Selling price of P1,500,000 < Fair value of P1,575,000

Selling Price P1,500,000 Fair value P1,575,000

Less: Fair Value 1,575,000 Less: Carrying amount 900,000

Prepayments P75,000 Total Gain P675,000

If Selling Price < Fair Value of the underlying asset, the excess is accounted for as prepayments for lease payments

and shall be accounted for as an addition adjustment to arrive at the Fair Value of the right retained.

Annual lease payment P180,000 Present value of lease payment P1,079,136

PV of ordinary annuity, @9%, n=9 5.9952 Prepayments 75,000

Total PV of lease payment P1,079,136 FV of rights retained P1,154,136

Carrying amount Gain (Loss)

Fair Value Fraction or Percent (Fraction x CV of leased (FV – CV)

asset)

b

Rights retained P1,154,136 1,154,136/1,575,000 P659,506 P494,630

a C

Rights transferred 420,864 420,864/1,575,000 240,494 180,370

Total P1,575,000 P900,000 P675,000

a

FV of rights transferred = P1,575,000 (Total Fair value) minus P1,154,136 (FV of rights retained) = P420,864

SUBJECT: ACCO20103 INTERMEDIATE ACCOUNTING 3 4

PREPARED BY: RODISON E. DE GUIA, CPA

b

CV of rights retained (1,154,136/1,575,000 x P900,000) = P659,506

C

CV of rights transferred (420,864/1,575,000 x P900,000) = P240,494

FV of rights transferred P1,154,136

Less: CV of rights transferred 659,506

Gain (loss) on Leaseback P494,630 or

CV of rights transferred x Total gain = P420,864 x P675,000= P180,370

FV of Underlying Asset P1,575,000

The journal entry on the part of LEOPARD Company (seller-lessee)

1/1/2021 Cash 1,500,000

Right-of-Use Asset 659,506 -75,000

Prepaid asset

Equipment 75,000 900,000

Lease Liability 1,079,136

Gain on rights transferred 180,370

12/31/2022 Interest expense (1,079,136 x 9%) 97,122

Lease Liability (180,000 – 97,122) 82,878

Cash 180,000

The journal entry on the part of CHEETAH Inc. (buyer-lessor), assuming it is a finance lease.

1/1/2021 Equipment (at fair value) P1,575,000

Cash 1,500,000

Unearned rent income 75,000

Lease Receivable (180,000 x 9) 1,620,000

Equipment 1,500,000

Unearned interest income (1,620, 000 – 1,500,000) 120,000

12/31/2021 Cash 180,000

Lease Receivable 180,000

Note: The recognition of interest income shall be based on the implicit rate of the lease computed using

interpolation based on the fair value of the asset.

The journal entry on the part of BACOLOD Company (buyer-lessor), assuming it is an operating lease.

1/1/2021 Equipment (at fair value) P1,575,000

Cash 1,500,000

Unearned rent income 75,000

12/31/2021 Cash 180,000

Rent Income 180,000

Unearned rent income 4,874

Rent income (75,000 x 75,000/1,154,136 4,874

SUBJECT: ACCO20103 INTERMEDIATE ACCOUNTING 3 5

PREPARED BY: RODISON E. DE GUIA, CPA

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Resa p1 First PB 1015Document21 pagesResa p1 First PB 1015Din Rose GonzalesNo ratings yet

- Practice Problems For The Final Exam of ISOM 5700: 1. Short Answer QuestionsDocument5 pagesPractice Problems For The Final Exam of ISOM 5700: 1. Short Answer QuestionsLongyin WangNo ratings yet

- Quiz 1 - Business CombiDocument6 pagesQuiz 1 - Business CombiKaguraNo ratings yet

- AFAR May2021 1st Preboard With AnswerDocument28 pagesAFAR May2021 1st Preboard With Answerlllll100% (3)

- Busicom Prob 6-8Document7 pagesBusicom Prob 6-8JrllsyNo ratings yet

- Ia CH 6 & 7 NR LR 2020Document112 pagesIa CH 6 & 7 NR LR 2020Jm Sevalla57% (14)

- Part 3 - Sale and LeasebackDocument11 pagesPart 3 - Sale and LeasebackPoru SenpiiNo ratings yet

- Learning ResourceDocument5 pagesLearning ResourceRemedios Capistrano CatacutanNo ratings yet

- Chapter 13 (Incomplete)Document22 pagesChapter 13 (Incomplete)Dan ChuaNo ratings yet

- Advanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)Document6 pagesAdvanced Accounting Quiz 9 - Installment Sales (Part 2 of 2)guardian saintsNo ratings yet

- 2019 Vol 2 CH 4 AnswersDocument8 pages2019 Vol 2 CH 4 AnswersElla LopezNo ratings yet

- Nfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Document18 pagesNfjpia Cup - Auditing Problems SGV & Co. Easy Question #1: Answer: P126,816Merliza Jusayan100% (1)

- Installment Sales Nov 2017#1Document3 pagesInstallment Sales Nov 2017#1Angel Alejo AcobaNo ratings yet

- Solution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination ReviewerDocument11 pagesSolution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination Reviewerhpp academicmaterialsNo ratings yet

- Answers, Solutions and ClarificationsDocument4 pagesAnswers, Solutions and ClarificationsAnnie Lind100% (2)

- Seminar Outline 5Document16 pagesSeminar Outline 5cccqNo ratings yet

- IRA No. 2 Answer KeyDocument2 pagesIRA No. 2 Answer KeyProlen AcantoNo ratings yet

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocument6 pagesIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- IA1-Continuation PPEDocument13 pagesIA1-Continuation PPEJhunnie LoriaNo ratings yet

- Chapter 10 - SolutionsDocument25 pagesChapter 10 - SolutionsGerald SusanteoNo ratings yet

- Cash Price Equivalent at The Deferred Beyond Normal CreditDocument5 pagesCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaNo ratings yet

- Cash Price Equivalent at The Deferred Beyond Normal CreditDocument5 pagesCash Price Equivalent at The Deferred Beyond Normal CreditSharmin ReulaNo ratings yet

- Ans 31 To 41Document2 pagesAns 31 To 41Mallet S. GacadNo ratings yet

- Ppe 1Document12 pagesPpe 1Jerome_JadeNo ratings yet

- Joint Arrangements Answer Key Chapter 10 Problems 4 To 7Document3 pagesJoint Arrangements Answer Key Chapter 10 Problems 4 To 7Jeane Mae BooNo ratings yet

- Bucom 2Document3 pagesBucom 2dmangiginNo ratings yet

- Ppe ProblemsDocument8 pagesPpe ProblemsPeter Elijah AntonioNo ratings yet

- c10 Revenue Recognition Contracts With Customer Long Term Construction Solution Dayag 2021 EditionDocument10 pagesc10 Revenue Recognition Contracts With Customer Long Term Construction Solution Dayag 2021 EditionKaizu KunNo ratings yet

- Acc106 - Test 1 - May 2018 - SSDocument5 pagesAcc106 - Test 1 - May 2018 - SSsyahiir syauqiiNo ratings yet

- 5Document3 pages5Dan Shadrach DapegNo ratings yet

- Problem 3: (Notes Issuance) Taylor Swift: C. Interest Expense Over The Credit PeriodDocument9 pagesProblem 3: (Notes Issuance) Taylor Swift: C. Interest Expense Over The Credit PeriodThe Brain Dump PHNo ratings yet

- Far ReviewerDocument9 pagesFar ReviewerKathlen PilarNo ratings yet

- Problem 11&17Document12 pagesProblem 11&17Kaira GoNo ratings yet

- Part 2 - Leases (Accounting by Lessors)Document31 pagesPart 2 - Leases (Accounting by Lessors)Poru SenpiiNo ratings yet

- Unit B Acctg 4Document14 pagesUnit B Acctg 4Karl Lincoln TemporosaNo ratings yet

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Document37 pagesSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- TP A&aDocument7 pagesTP A&aJennie Ann ModeracionNo ratings yet

- 50cb2fca 1597910723873pdf PDF FreeDocument10 pages50cb2fca 1597910723873pdf PDF FreefarandiNo ratings yet

- Sale Leaseback Transactions (Leases)Document4 pagesSale Leaseback Transactions (Leases)Paulo Emmanuel SantosNo ratings yet

- Session 1c Accounting For AssetsDocument20 pagesSession 1c Accounting For AssetsFeku RamNo ratings yet

- Lobrigas Unit5 Topic4 AssessmentDocument5 pagesLobrigas Unit5 Topic4 AssessmentClaudine LobrigasNo ratings yet

- Sale and Leaseback: The Benefits of SLB Transactions Are As FollowsDocument6 pagesSale and Leaseback: The Benefits of SLB Transactions Are As FollowsJoan BartolomeNo ratings yet

- Cup 3 AFAR 1Document9 pagesCup 3 AFAR 1Elaine Joyce GarciaNo ratings yet

- Old Exam Problem 1 With SolutionDocument3 pagesOld Exam Problem 1 With SolutionPaul GeorgeNo ratings yet

- ParCorp Answer KeyDocument176 pagesParCorp Answer KeyAndrew Gino CruzNo ratings yet

- Loss Contingency, Debt Restructuring, Asset SwapDocument2 pagesLoss Contingency, Debt Restructuring, Asset SwapBuenaventura, Elijah B.No ratings yet

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- Finance Lease - LessorDocument4 pagesFinance Lease - LessorRachel RiveraNo ratings yet

- Topic 4 Tutorial QuestionsDocument5 pagesTopic 4 Tutorial QuestionsAbigailNo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- SET-1 Public Procurement Rule - 2004 MCQ'sDocument3 pagesSET-1 Public Procurement Rule - 2004 MCQ'sFalak HanifNo ratings yet

- Chap 011Document15 pagesChap 011Roger PolancoNo ratings yet

- Solution Manual For Principles of Supply Chain Management A Balanced Approach 3rd Edition by WisnerDocument36 pagesSolution Manual For Principles of Supply Chain Management A Balanced Approach 3rd Edition by Wisnerkatevargasqrkbk100% (34)

- Stage 1 Name of The Students:: English IiiDocument6 pagesStage 1 Name of The Students:: English IiiRussell Najera RejonNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- Bare Act Service Rules - Other Acts 1989Document6 pagesBare Act Service Rules - Other Acts 1989Guru charan ReddyNo ratings yet

- Summary Buku Introduction To Management - John SchermerhornDocument5 pagesSummary Buku Introduction To Management - John SchermerhornElyana BiringNo ratings yet

- Introduction To Entrepreneurship Uts SummaryDocument5 pagesIntroduction To Entrepreneurship Uts Summarydeqsha novendraNo ratings yet

- Barabgay ClearanceDocument83 pagesBarabgay ClearanceAi JoieNo ratings yet

- Evaluating IMC EffectivenessDocument36 pagesEvaluating IMC EffectivenessNicole BradNo ratings yet

- 1416191299950-01 1709962772 Mjoyo4oy6pDocument1 page1416191299950-01 1709962772 Mjoyo4oy6pchoudharyibrazNo ratings yet

- Shree Ram Trading DPR and FinancialsDocument31 pagesShree Ram Trading DPR and FinancialsAnshikaNo ratings yet

- GURPS Traveller - Far TraderDocument146 pagesGURPS Traveller - Far TraderMarcos Inki100% (2)

- Rural Telephony: BY Syndicate No. - 5Document43 pagesRural Telephony: BY Syndicate No. - 5nehaNo ratings yet

- SS1 Business Guided Study Worksheet-1Document4 pagesSS1 Business Guided Study Worksheet-1Ruchira Sanket Kale100% (1)

- Rupa ProjectDocument73 pagesRupa ProjectJhansi Janu100% (1)

- Pregunta: Finalizado Puntúa 0,0 Sobre 1,0Document21 pagesPregunta: Finalizado Puntúa 0,0 Sobre 1,0Jhon CardozoNo ratings yet

- Activity 1Document3 pagesActivity 1Tristan Jerald BechaydaNo ratings yet

- Project Report On Marketing Management at Wagh BakriDocument53 pagesProject Report On Marketing Management at Wagh BakriKarshit Modi100% (2)

- Mapping ISO 14001 - 2015 To ISO 14001 - 2004Document3 pagesMapping ISO 14001 - 2015 To ISO 14001 - 2004oscarandelaNo ratings yet

- Court Fee - 2Document3 pagesCourt Fee - 2Anil KumarNo ratings yet

- Consolidated Results 4Q20: AT&T 4Q20 HighlightsDocument3 pagesConsolidated Results 4Q20: AT&T 4Q20 Highlights田原純平No ratings yet

- Ed - Removal of Stay Order On Sra Builders - 001Document2 pagesEd - Removal of Stay Order On Sra Builders - 001NR MNo ratings yet

- How Precision Revenue Growth Management Transforms CPG PromotionsDocument5 pagesHow Precision Revenue Growth Management Transforms CPG PromotionsMichael GiovaniNo ratings yet

- Evolution of MarketingDocument76 pagesEvolution of MarketingNezih KaramanNo ratings yet

- Maxxoil ProfileDocument8 pagesMaxxoil Profileimran22233No ratings yet

- Msme Unit 2Document33 pagesMsme Unit 2PARTH NAIKNo ratings yet

- Marketing Across Boundaries - Marketing PlanDocument44 pagesMarketing Across Boundaries - Marketing PlanCyrine bouzaidiNo ratings yet

- Air Deccan: Revolutionizing The Indian SkiesDocument20 pagesAir Deccan: Revolutionizing The Indian Skiessaroj aashmanfoundationNo ratings yet