Professional Documents

Culture Documents

2550Q Guidelines April 2024_final

2550Q Guidelines April 2024_final

Uploaded by

lamadridmarian60 ratings0% found this document useful (0 votes)

0 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views1 page2550Q Guidelines April 2024_final

2550Q Guidelines April 2024_final

Uploaded by

lamadridmarian6Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

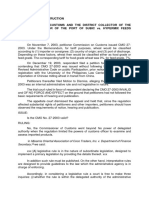

Guidelines and Instructions for BIR Form No.

2550Q [April 2024 (ENCS)]

Quarterly Value-Added Tax Return

Who Shall File PENALTIES:

This return shall be filed in triplicate by the following taxpayers:

1. A VAT-registered person; and For Medium and Large Taxpayers

2. A person required to register as a VAT taxpayer but failed to register. There shall be imposed and collected as part of the tax:

1. A surcharge of twenty-five percent (25%) for the following violations:

This return shall be filed by the aforementioned taxpayers for as long as a. Failure to file any return and pay/remit the amount of tax or installment

the VAT registration has not yet been cancelled, even if there is no taxable due on or before the due date;

transaction during the quarter or the aggregate sales for any 12-month b. Failure to pay/remit the full or part of the amount of tax shown on the

period did not exceed the VAT threshold. return, or the full amount of tax due for which no return is required to be

filed on or before the due date; or

A person who imports goods shall use the form prescribed by the c. Failure to pay/remit the deficiency tax within the time prescribed for its

Bureau of Custom. payment/remittance in the notice of assessment.

2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax [in case

When and Where to File and Pay any payment/remittance has been made before the discovery of the falsity

The return shall be filed within twenty-five (25) days following the close or fraud], for each of the following violations:

of each taxable quarter. a. Willful neglect to file the return within the period prescribed by the Code

or by rules and regulations; or

The return shall be filed electronically in any of the available electronic b. A false or fraudulent return is willfully made.

platforms. However, in case of unavailability of the electronic platforms, 3. Interest at the rate of double the legal interest rate for loans or forbearance

manual filing of VAT return may be allowed. For tax payments, the same shall of any money in the absence of an express stipulation as set by the Bangko

be made either electronically in any of the available electronic platforms or Sentral ng Pilipinas from the date prescribed for payment/remittance until

manually to any Authorized Agent Banks (AABs) or to the Revenue Collection the amount is fully paid/remitted: Provided; That, in no case shall the

Officers (RCOs). deficiency and the delinquency interest prescribed under Section 249

Subsections (B) and (C) of the National Internal Revenue Code, as

Any taxpayer whose registration has been cancelled shall file a return amended, be imposed simultaneously.

and pay the tax due thereon within twenty-five (25) days from date of 4. Compromise penalty as provided under applicable rules and regulations.

cancellation of registration. For taxpayers with branches, only one

consolidated return shall be filed for the principal place of business or head For Micro and Small Taxpayers

office and all the branches. There shall be imposed and collected as part of the tax:

1. A surcharge of ten percent (10%) for the following violations:

When the return is filed with an AAB, taxpayer must accomplish and a. Failure to file any return and pay the tax due thereon, on or before the

submit BIR-prescribed deposit slip, which the bank teller shall machine prescribed due date for its filing;

validate as evidence that payment/remittance was received by the AAB. The b. Failure to pay/remit the full or part of the amount of tax shown on the

AAB receiving the tax return shall stamp mark the word “Received” on the return, or the full amount of tax due for which no return is required to be

return and also machine validate the return as proof of filing and filed on or before the due date; or

payment/remittance of the tax by the taxpayer. The machine validation shall c. Failure to pay/remit the deficiency tax within the time prescribed for its

reflect the date of payment/remittance, amount paid/remitted and payment/remittance in the notice of assessment.

transactions code, the name of the bank, branch code, teller’s code and 2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in case

teller’s initial. Bank debit memo number and date should be indicated in the any payment/remittance has been made before the discovery of the falsity

return for taxpayers paying/remitting under the bank debit system. or fraud, for each of the following violations:

a. Willful neglect to file the return within the period prescribed by the Code

For Electronic Filing and Payment System (eFPS) Taxpayer or by rules and regulations; or

The deadline for electronic filing of return and payment of the taxes due b. A false or fraudulent return is willfully made.

thereon shall be in accordance with the provisions of the existing applicable 3. Interest at the reduced rate of fifty percent (50%) of the interest rate

revenue issuances. mandated in Section 249 of the Tax Code, as amended. The legal interest

imposable to covered taxpayers shall be six percent (6%). In case a new

Rates and Bases of Tax legal interest is prescribed, the Commissioner of Internal Revenue shall

A. On Sale of Goods or Properties – twelve percent (12%) of the gross sales of issue a separate circular therefor.

the goods or properties sold, bartered or exchanged. 4. Compromise penalty at a reduced compromise penalty of fifty percent

B. On Sale of Services and Use or Lease of Properties – twelve percent (12%) (50%) of the applicable rate or amount of compromise under Annex “A” of

of gross sales derived from the sale or exchange of services, including the Revenue Memorandum Order (RMO) No. 7-2015 and its subsequent

use or lease of properties. amendments, if any, shall be applied.

C. On Importation of Goods – twelve percent (12%) based on the total value

used by the Bureau of Customs in determining tariff and customs duties, Attachments

plus customs duties, excise taxes, if any, and other charges, such tax to be 1. Duly issued Certificate of Creditable VAT Withheld at Source, if applicable;

paid by the importer prior to the release of such goods from customs 2. Summary Alphalist of Withholding Agents of Income Payments Subjected

custody: Provided; That, where the customs duties are determined on the to Withholding Tax at Source (SAWT), if applicable;

basis of quantity or volume of the goods, the value added tax shall be 3. Duly approved Tax Debit Memo, if applicable;

based on the landed cost plus excise taxes, if any. 4. Duly approved Tax Credit Certificate, if applicable.

D. On Export Sales and Other Zero-rated Sales - 0%. 5. Proof of the payment and the return previously filed, for amended return.

6. Authorization letter, if return is filed by authorized representative.

Definition of Terms

Input Tax means the value-added tax due from or paid by a VAT- Note: All background information must be properly filled out.

registered person in the course of his trade or business on importation of The last 5 digits of the 14-digit TIN refers to the branch code

goods, or local purchase of goods or services, including lease or use of All returns filed by an accredited tax agent on behalf of a taxpayer shall

property, from a VAT-registered person. It shall also include the transitional bear the following information:

input tax determined in accordance with Section 111 of the National Internal A. For Individual (CPAs, members of GPPs, and others)

Revenue Code, as amended, presumptive input tax and deferred input tax a.1 Taxpayer Identification Number (TIN); and

from previous period. a.2 BIR Accreditation Number, Date of Issue, and Date of Expiry.

B. For members of the Philippine Bar (Lawyers)

Output Tax means the value-added tax due on the sale or lease of b.1 Taxpayer Identification Number (TIN);

taxable goods or properties or services by any person registered or required b.2 Attorney’s Roll Number;

to register under Section 236 of the National Internal Revenue Code, as b.3 Mandatory Continuing Legal Education (MCLE) Compliance

amended. Number; and

b.4 BIR Accreditation Number, Date of Issue, and Date of Expiry

ENCS

You might also like

- 2550Q Guidelines 2023 - FinalDocument1 page2550Q Guidelines 2023 - Finallorenzo ejeNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- PenaltiesDocument2 pagesPenaltiesfatmaaleahNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDocument1 pageGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Tax Deficiency and Tax DeliquencyDocument4 pagesTax Deficiency and Tax DeliquencyJanelleNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- 2551QDocument1 page2551QchelissamaerojasNo ratings yet

- Revenue Regulations 4-2019Document41 pagesRevenue Regulations 4-2019HaRry PeregrinoNo ratings yet

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasNo ratings yet

- TAX-1601 (Additions To Tax)Document4 pagesTAX-1601 (Additions To Tax)lyndon delfinNo ratings yet

- W3 Module 3 - Tax Administration Part IIDocument14 pagesW3 Module 3 - Tax Administration Part IIElmeerajh JudavarNo ratings yet

- Bir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxDocument2 pagesBir Form No. 2551Q - Quarterly Percentage Tax Return Guidelines and Instructions Who Shall File Basis of TaxkehlaniNo ratings yet

- 2000 June 2006 (Back)Document1 page2000 June 2006 (Back)Rica Santos-vallesteroNo ratings yet

- 7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestDocument2 pages7.d Citibank NA vs. CA (G.R. No. 107434 October 10, 1997) - H DigestHarleneNo ratings yet

- 0619-E Jan 2018 GuidelinesDocument1 page0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNo ratings yet

- 1704 MqyDocument1 page1704 MqyRizza Mae RodriguezNo ratings yet

- Title X Statutory Offenses and Penalties Additions To The Tax SEC. 247. General Provisions.Document10 pagesTitle X Statutory Offenses and Penalties Additions To The Tax SEC. 247. General Provisions.Jenny Marie B. AlapanNo ratings yet

- Taxation - Leonen - 2021 Pre-Week MaterialsDocument57 pagesTaxation - Leonen - 2021 Pre-Week MaterialsJonahNo ratings yet

- SEC. 202. Final Deed To PurchaserDocument14 pagesSEC. 202. Final Deed To PurchaserweygandtNo ratings yet

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- Taxation 1 Lesson 1. Returns and Payment of TaxDocument42 pagesTaxation 1 Lesson 1. Returns and Payment of TaxHarui Hani-31No ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- Section 247. General Provisions. - : Sections 247-252, Tax CodeDocument2 pagesSection 247. General Provisions. - : Sections 247-252, Tax CodeEdward Kenneth KungNo ratings yet

- BIR Form 1601 c1Document2 pagesBIR Form 1601 c1Ver ArocenaNo ratings yet

- Revenue Regulations No. 12-99: September 6, 1999Document16 pagesRevenue Regulations No. 12-99: September 6, 1999I.G. Mingo MulaNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaNo ratings yet

- DTS (Directe Tax Service)Document7 pagesDTS (Directe Tax Service)showtime180702No ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- Proposed RR Tax DelinquenciesDocument7 pagesProposed RR Tax DelinquenciesEster RebanalNo ratings yet

- Tax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentDocument9 pagesTax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentJeni ManobanNo ratings yet

- Bir RR 12-99Document21 pagesBir RR 12-99Isaac Joshua AganonNo ratings yet

- Monthly Percentage Tax ReturnDocument3 pagesMonthly Percentage Tax ReturnAu B ReyNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- Pdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFDocument13 pagesPdfdownloader - Lain.in 150469451 2012 Ateneo LawTaxation Law Summer Reviewer 2 PDFJericho PedragosaNo ratings yet

- RR 12-99 Rules On Assessments PDFDocument19 pagesRR 12-99 Rules On Assessments PDFJeremeh PenarejoNo ratings yet

- REMEDIESDocument9 pagesREMEDIESkathlenejane.garciaNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- PF CH 5Document10 pagesPF CH 5kukushajossiNo ratings yet

- BIR Form No. 2553Document2 pagesBIR Form No. 2553fatmaaleahNo ratings yet

- RMC No. 84-2023 GuidelinesDocument1 pageRMC No. 84-2023 GuidelinessandraNo ratings yet

- Statutory Offenses and PenaltiesDocument11 pagesStatutory Offenses and PenaltiesDianna MontefalcoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 1601-FQ Quarterly Remittance Return of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument5 pagesRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsAngela ArleneNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- PDF Chapter 2 Value Added Tax On Importation Multiple Choice Theory Agricultural or Marine Food Products Part 1 - CompressDocument20 pagesPDF Chapter 2 Value Added Tax On Importation Multiple Choice Theory Agricultural or Marine Food Products Part 1 - CompressHoneyleth CorpuzNo ratings yet

- Faqs Sanctions Russia Export Related Restrictions Russia - en PDFDocument72 pagesFaqs Sanctions Russia Export Related Restrictions Russia - en PDFJessica JungNo ratings yet

- A K Banerjee:Is Delhi Customs Facilitating Smugglers To Roam Free by Not Forwarding The Cases To CBI Relating To Fraud and Huge Duty Evasion?Document7 pagesA K Banerjee:Is Delhi Customs Facilitating Smugglers To Roam Free by Not Forwarding The Cases To CBI Relating To Fraud and Huge Duty Evasion?jainNo ratings yet

- CM9 Midterm ReviewerDocument41 pagesCM9 Midterm ReviewerJay Llanera CeaNo ratings yet

- 29 - AUYONG HIAN (HONG WHUA HANG) vs. COURT OF TAX APPEALS, Et. Al. G.R. No. L-53401 November 6, 1989Document3 pages29 - AUYONG HIAN (HONG WHUA HANG) vs. COURT OF TAX APPEALS, Et. Al. G.R. No. L-53401 November 6, 1989Bae IreneNo ratings yet

- Freight Forwarder Selection GuideDocument26 pagesFreight Forwarder Selection GuidececiliaNo ratings yet

- Commissioner of Customs Vs Hypermix FeedsDocument2 pagesCommissioner of Customs Vs Hypermix FeedsMichelle FajardoNo ratings yet

- Customs Clearance in France: Concrete MeasuresDocument20 pagesCustoms Clearance in France: Concrete Measurestantra shivaNo ratings yet

- Oj L 202400573 en TXTDocument67 pagesOj L 202400573 en TXTMahmoud ChihebNo ratings yet

- PMO Deliverables (28 July 2023)Document13 pagesPMO Deliverables (28 July 2023)Clinton SamsonNo ratings yet

- AOPA Bahamas Flying GuideDocument33 pagesAOPA Bahamas Flying GuideKonstantinos Airman100% (1)

- The Chamber of Customs BrokersDocument3 pagesThe Chamber of Customs Brokerscalagosronpaul.b20.1375No ratings yet

- Petitioner Vs Vs Respondents The Solicitor General Jorge G Macapagal Counsel Aurea Aragon-CasianoDocument8 pagesPetitioner Vs Vs Respondents The Solicitor General Jorge G Macapagal Counsel Aurea Aragon-CasianoKirby MalibiranNo ratings yet

- TRANSPO - Macondray and Company Inc. v. Acting Commissioner of CustomsDocument2 pagesTRANSPO - Macondray and Company Inc. v. Acting Commissioner of CustomsJulius Geoffrey TangonanNo ratings yet

- Taylor & Francis, Ltd. Middle Eastern StudiesDocument35 pagesTaylor & Francis, Ltd. Middle Eastern StudiesfauzanrasipNo ratings yet

- 62 - Garcia V Executive Secretary (Sebastian)Document3 pages62 - Garcia V Executive Secretary (Sebastian)Bobby Olavides SebastianNo ratings yet

- Security of Catering Supplies and Stores-2Document8 pagesSecurity of Catering Supplies and Stores-2Marco AlfèNo ratings yet

- Try To Explain About Black Market ActivityDocument6 pagesTry To Explain About Black Market ActivityAang Leo SukmaNo ratings yet

- HSBC Vietnam PaymentDocument2 pagesHSBC Vietnam PaymentcuongNo ratings yet

- Liberia Guide For ImportersDocument2 pagesLiberia Guide For ImportersMOCIdocs100% (2)

- Import Food by Group – Indonesian Trade Promotion Center Jeddah PDFDocument108 pagesImport Food by Group – Indonesian Trade Promotion Center Jeddah PDFFAUZANNo ratings yet

- Coconut Oil Refiners Association Vs TorresDocument2 pagesCoconut Oil Refiners Association Vs TorresShiela Pilar100% (1)

- Substance List Dec10Document25 pagesSubstance List Dec10Ricki_Ogston_4896No ratings yet

- Baker Tilly DHC Budget Snapshot 22-23Document15 pagesBaker Tilly DHC Budget Snapshot 22-23Vi KiNo ratings yet

- Regulation of The Minister of Trade of The Republic of IndonesiaDocument9 pagesRegulation of The Minister of Trade of The Republic of IndonesiaMargaretta Yang Lie CenNo ratings yet

- Republic v. CaguioaDocument3 pagesRepublic v. Caguioavictoria100% (1)

- List of Required International Shipping Documents The Different TypesDocument6 pagesList of Required International Shipping Documents The Different Typesa_rogall7926No ratings yet

- Executive Secretary Vs SouthwingDocument2 pagesExecutive Secretary Vs Southwingmario navalezNo ratings yet

- Food and Agricultural Import Regulations and Standards - Narrative - Caracas - Venezuela - 12!26!2017Document22 pagesFood and Agricultural Import Regulations and Standards - Narrative - Caracas - Venezuela - 12!26!2017eddieNo ratings yet

- 2019 Tax Rev Finals Digests PDFDocument178 pages2019 Tax Rev Finals Digests PDFDooNo ratings yet