Professional Documents

Culture Documents

dnBJNVJrVDQzM01iKzhKMVJRZ3NTZz09_invoice

dnBJNVJrVDQzM01iKzhKMVJRZ3NTZz09_invoice

Uploaded by

Yogesh singhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

dnBJNVJrVDQzM01iKzhKMVJRZ3NTZz09_invoice

dnBJNVJrVDQzM01iKzhKMVJRZ3NTZz09_invoice

Uploaded by

Yogesh singhCopyright:

Available Formats

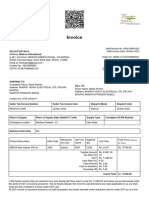

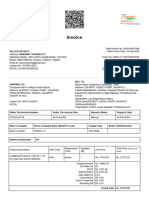

Invoice

GeM Invoice No: GEM-34106459

SELLER DETAILS: GeM Invoice Date: 01-Sep-2023

Address: M/S DREAMLAND

SAHAJ SHOPPING COMPLEX, HYDERABAD GATE, B.H.U., Order No: GEMC-511687763801624

VARANASI, Uttar Pradesh, 221011 Order Date: 31-Aug-2023

Email Id: prakash.bansal2019@gmail.com

Contact No : 09935043397

GSTIN: 09AGFPB0248N1ZE Click here to download seller invoice

BILL TO:

Buyer Name: Kiran Arya , Assistant Director in Physical

Education

SHIPPING TO:

Address: Banaras Hindu University MIRZAPUR UTTAR

Consignee Name: Kiran Arya

PRADESH 231001 Department of Higher Education University

Address: Banaras Hindu University MIRZAPUR

Grants Commission

UTTAR PRADESH 231001

Department: Department of Higher Education

Office Zone:Banaras Hindu University

Organisation: University Grants Commission

Ministry: Ministry of Education

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

2023-24/1088 01-Sep-2023 Manual 01-Sep-2023

Place of Supply Place of Supply State (State/UT Code) Supply Type Buyer GSTIN Number

Buyer Location Uttar Pradesh / 09 Intra-State

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

Canon Multifunction Machines Mfm,

84433100 pieces 1 Rs. 24671.11 Rs. 24671.11

On Site OEM Warranty 1 Year

Taxable Amount Rs. 20907.72

Tax Rate (%) 18

CGST Rs. 1881.69

SGST/UTGST Rs. 1881.69

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.01

Grand Total Rs. 24671.11

I/We hereby declare that we are covered under the ambit of GST e-invoicing provisions and therefore the invoices, debit notes,

credit notes or any other prescribed document under e-invoicing issued/raised by us duly complies with the notified e-invoicing

provisions

Further, any invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in

line with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Solution:: Purchases, Cash Basis P 2,850,000Document2 pagesSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Chapter 1-Basis of Malaysian TaxationDocument17 pagesChapter 1-Basis of Malaysian Taxationoola_8475% (4)

- On August 1 2014 Rafael Masey Established Planet Realty WhichDocument1 pageOn August 1 2014 Rafael Masey Established Planet Realty Whichtrilocksp SinghNo ratings yet

- ZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3Document2 pagesZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3nagasesha ReddyNo ratings yet

- Invoice: Seller DetailsDocument2 pagesInvoice: Seller DetailsMata BharatNo ratings yet

- eFMyQStaTWk0dys2bnAxVjFlaElpZz09 InvoiceDocument2 pageseFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoicenagasesha ReddyNo ratings yet

- Zk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 InvoiceDocument2 pagesZk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 Invoicerajrathwa85No ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- Target Face 150 (PSH)Document2 pagesTarget Face 150 (PSH)sarthakgan29No ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Complition of Various DeliveryDocument22 pagesComplition of Various Deliverydipak kambleNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- TSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceDocument2 pagesTSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceJitender NarulaNo ratings yet

- DFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 InvoiceDocument2 pagesDFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 Invoiceomkar daveNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Tax InvoiceDocument3 pagesTax Invoicekraaz7174No ratings yet

- Invoice: Click Here To Download Seller Tax InvoiceDocument2 pagesInvoice: Click Here To Download Seller Tax InvoiceRaghavendra Rao GNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- TDVRL1FXSlpQSXFUa3FhbnFicEUzQT09_invoiceDocument2 pagesTDVRL1FXSlpQSXFUa3FhbnFicEUzQT09_invoicesatishkumarkarri.skkNo ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceDocument2 pagesN3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceJitender NarulaNo ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceJadhao AjinkyaNo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoicearihantjha36No ratings yet

- V3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceDocument2 pagesV3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceOmkar DaveNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Iteminvoice SampleDocument4 pagesIteminvoice Sampleshashwatsankrit1515No ratings yet

- E-Invoice of PSPCL of Jul-2023Document17 pagesE-Invoice of PSPCL of Jul-2023contactajaysidharNo ratings yet

- Wa0029.Document3 pagesWa0029.soban moriwalaNo ratings yet

- NmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceDocument2 pagesNmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceJitender NarulaNo ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- Invoice - Dhanraj1992 FEB-23 PDDocument1 pageInvoice - Dhanraj1992 FEB-23 PDAinta GaurNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Tika 232400344808Document1 pageTika 232400344808krishngupta2010No ratings yet

- Tax InvoiceDocument3 pagesTax Invoiceabhist9905No ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- Nutriarc: Tax InvoiceDocument1 pageNutriarc: Tax InvoiceARC FitnessNo ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/Sacanshagrawal0000No ratings yet

- Srividya Upasaka: Tax InvoiceDocument1 pageSrividya Upasaka: Tax InvoiceKaliprasad DashNo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- Subha Fertilizer 20-Mar-24: Tax InvoiceDocument1 pageSubha Fertilizer 20-Mar-24: Tax InvoiceSupriya SanpuiNo ratings yet

- Tax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Document1 pageTax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Prince KumarNo ratings yet

- Sales - 1Document1 pageSales - 1Sudhir GhormodeNo ratings yet

- ScrapDocument1 pageScrapVIKASH TIWARYNo ratings yet

- Axis Bank 23Document1 pageAxis Bank 23friends.technicalassociatesNo ratings yet

- GST Suvidha Kendra: Tax InvoiceDocument2 pagesGST Suvidha Kendra: Tax InvoiceashutoshNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- Purchase Order Suprabha Protective Products Pvt. LTDDocument2 pagesPurchase Order Suprabha Protective Products Pvt. LTDMaa Diwri PacksysNo ratings yet

- AAA BILL FORMATE PDFDocument1 pageAAA BILL FORMATE PDFPawan BaudhNo ratings yet

- bkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceDocument2 pagesbkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceInclusive Education BranchNo ratings yet

- Tax InvoiceDocument3 pagesTax Invoicerkmohit9792No ratings yet

- Tds in Tally - Erp 9Document81 pagesTds in Tally - Erp 9DAKSHPREET17100% (1)

- Gam Chap 3Document9 pagesGam Chap 3Johanna VidadNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearKumari KhushbooNo ratings yet

- Tax 2 Midterms Exam ReviewerDocument66 pagesTax 2 Midterms Exam ReviewerFlorence Rosete100% (1)

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- Sapura Energy: Company ReportDocument4 pagesSapura Energy: Company ReportBrian StanleyNo ratings yet

- BAM 127 Day 7 - TGDocument11 pagesBAM 127 Day 7 - TGPaulo BelenNo ratings yet

- Sample MCQ 3Document8 pagesSample MCQ 3varunendra pandeyNo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToSarvesh KumarNo ratings yet

- Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesIncome Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersolafedNo ratings yet

- Samyak Jain - IIM RanchiDocument2 pagesSamyak Jain - IIM RanchiNeha GuptaNo ratings yet

- Debit Note - Cum - Tax Invoice: Sub: Payment of Service TaxDocument1 pageDebit Note - Cum - Tax Invoice: Sub: Payment of Service Taxbha_goNo ratings yet

- Tax Income in GeneralDocument38 pagesTax Income in GeneralRIRI RUMAIZHANo ratings yet

- Alemu Research PaperDocument35 pagesAlemu Research PaperKalayu KirosNo ratings yet

- Shutdown Impact On District's Cash Flow 03262020Document6 pagesShutdown Impact On District's Cash Flow 03262020Martin AustermuhleNo ratings yet

- On November 1 2014 The Following Were The Account BalancesDocument1 pageOn November 1 2014 The Following Were The Account BalancesAmit PandeyNo ratings yet

- Reagan Vs CIRDocument1 pageReagan Vs CIRemmaniago08No ratings yet

- ChecklistDocument8 pagesChecklistumeshburman7026No ratings yet

- SYBAF SEM IV TAXATION Unit IDocument5 pagesSYBAF SEM IV TAXATION Unit ISam RockerNo ratings yet

- Jaypaul Ocampo Acidera,: Three XXXDocument12 pagesJaypaul Ocampo Acidera,: Three XXXronnelNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- ATC Codes 2018Document10 pagesATC Codes 2018AJ QuimNo ratings yet

- Principles of Taxation For Business and Investment Planning 16th Edition Jones Solutions ManualDocument20 pagesPrinciples of Taxation For Business and Investment Planning 16th Edition Jones Solutions Manualkevahanhksf100% (35)

- How To Pay Less Tax Like The Rich Who File Differently Than MostDocument4 pagesHow To Pay Less Tax Like The Rich Who File Differently Than MostKeith Duke JonesNo ratings yet

- CGT Reliefs FA 20Document17 pagesCGT Reliefs FA 20Gayathri SudheerNo ratings yet

- CFAS Exercise 3-1 Even NumbersDocument2 pagesCFAS Exercise 3-1 Even NumbersVince Angelo AparicioNo ratings yet

- Investment Declaration ManualDocument10 pagesInvestment Declaration ManualAbhinav VivekNo ratings yet