Professional Documents

Culture Documents

TaxForms

TaxForms

Uploaded by

takanaomemihawkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TaxForms

TaxForms

Uploaded by

takanaomemihawkCopyright:

Available Formats

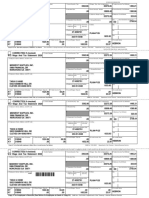

OMB No. 1545-0008 OMB No.

1545-0008

d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld

14316.56 1453.42 14316.56 1453.42

b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld

52-1822806 14316.56 887.63 52-1822806 14316.56 887.63

a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld

594-38-8159 14316.56 207.59 594-38-8159 14316.56 207.59

c Employer’s name, address and ZIP code c Employer’s name, address and ZIP code

AEROTEK, INC AEROTEK, INC

7301 PARKWAY DR 7301 PARKWAY DR

HANOVER MD 21076 HANOVER MD 21076

7 Social security tips 8 Allocated tips 9 Verification code 7 Social security tips 8 Allocated tips 9 Verification code

10 Dependent care benefits 11 Nonqualified plans 12a 10 Dependent care benefits 11 Nonqualified plans 12a

Code

Code

DD 1287.08 DD 1287.08

12b 12c 12d 12b 12c 12d

Code

Code

Code

Code

Code

Code

13 Statutory Retirement Third-party 14 Other 13 Statutory Retirement Third-party 14 Other

employee plan sick pay employee plan sick pay

e Employee’s name, address and ZIP code e Employee’s name, address and ZIP code

VIRACK KUCH VIRACK KUCH

3539 MARY TAYLOR RD 3539 MARY TAYLOR RD

1510A 1510A

BIRMINGHAM AL 35235 BIRMINGHAM AL 35235

2018 15 State

AL 294971

Employer’s state I.D. no. 16 State wages, tips, etc.

14316.56 2018 15 State

AL 294971

Employer’s state I.D. no. 16 State wages, tips, etc.

14316.56

W-2 W-2

Form

Form

Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc. Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc.

Copy C For EMPLOYEE’S 583.70 Copy B To Be Filed With 583.70

RECORDS (See Notice to Employee’s FEDERAL Tax

Employee on back of Copy B.) Return.

This information is being furnished to the This information is being furnished to the

Internal Revenue Service. If you are required 19 Local income tax 20 Locality name Internal Revenue Service. 19 Local income tax 20 Locality name

to file a tax return, a negligence penalty or

other sanction may be imposed on you if this

income is taxable and you fail to report it.

Department of the Treasury – Department of the Treasury –

Internal Revenue Service Internal Revenue Service

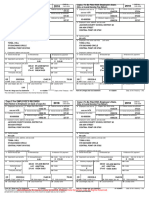

OMB No. 1545-0008 OMB No. 1545-0008

d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld d Control Number 1 Wages, tips, other compensation 2 Federal income tax withheld

14316.56 1453.42 14316.56 1453.42

b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld b Employer identification number (EIN) 3 Social security wages 4 Social security tax withheld

52-1822806 14316.56 887.63 52-1822806 14316.56 887.63

a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld a Employee’s social security number 5 Medicare wages and tips 6 Medicare tax withheld

594-38-8159 14316.56 207.59 594-38-8159 14316.56 207.59

c Employer’s name, address and ZIP code c Employer’s name, address and ZIP code

AEROTEK, INC AEROTEK, INC

7301 PARKWAY DR 7301 PARKWAY DR

HANOVER MD 21076 HANOVER MD 21076

7 Social security tips 8 Allocated tips 9 Verification code 7 Social security tips 8 Allocated tips 9 Verification code

10 Dependent care benefits 11 Nonqualified plans 12a 10 Dependent care benefits 11 Nonqualified plans 12a

Code

Code

DD 1287.08 DD 1287.08

12b 12c 12d 12b 12c 12d

Code

Code

Code

Code

Code

Code

13 Statutory Retirement Third-party 14 Other 13 Statutory Retirement Third-party 14 Other

employee plan sick pay employee plan sick pay

e Employee’s name, address and ZIP code e Employee’s name, address and ZIP code

VIRACK KUCH VIRACK KUCH

3539 MARY TAYLOR RD 3539 MARY TAYLOR RD

1510A 1510A

BIRMINGHAM AL 35235 BIRMINGHAM AL 35235

2018 2018

15 State Employer’s state I.D. no. 16 State wages, tips, etc. 15 State Employer’s state I.D. no. 16 State wages, tips, etc.

AL 294971 14316.56 AL 294971 14316.56

W-2 W-2

Form

Form

Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc. Wage and Tax Statement 17 State income tax 18 Local wages, tips, etc.

Copy 2 To Be Filed With 583.70 Copy 2 To Be Filed With 583.70

Employee’s State, City, or Employee’s State, City, or

Local Income Tax Return. Local Income Tax Return.

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Department of the Treasury – Department of the Treasury –

Internal Revenue Service Internal Revenue Service

Notice to Employee Instructions for Employee Instructions for Employee (Continued) Q-Nontaxable combat pay. See the instructions for Form

Do you have to file? Refer to the Form 1040 instructions Box 1. Enter this amount on the wages line of your tax (Continued from the back of copy B.) 1040 or Form 1040A for details on reporting this amount.

to determine if you are required to file a tax return. Even if return. Box 2. Enter this amount on the federal income tax Elective deferrals (codes D, E, F, and S) and designated R-Employer contributions to your Archer MSA. Report on

you don’t have to file a tax return, you may be eligible for a withheld line of your tax return. Box 5. You may be required Roth contributions (codes AA, BB, and EE) under all plans form 8853, Archer MSAs and Long-Term Care Insurance

refund if box 2 shows an amount or if you are eligible for to report this amount on Form 8959, Additional Medicare are generally limited to a total of $18,500 ($12,500 if you Contracts. S-Employee salary reduction contributions under

any credit. Tax. See the Form 1040 instructions to determine if you are only have SIMPLE plans; $21,500 for section 403(b) plans if a section 408(p) SIMPLE plan (not included in box 1)

Earned income credit (EIC). You may be able to take the required to complete Form 8959. Box 6. This amount you qualify for the 15-year rule explained in Pub. 571). T-Adoption benefits (not included in box 1). Complete Form

EIC for 2018 if your adjusted gross income (AGI) is less includes the 1.45% Medicare Tax withheld on all Medicare Deferrals under code G are limited to $18,500. Deferrals 8839, Qualified Adoption Expenses, to compute any taxable

than a certain amount. The amount of the credit is based wages and tips shown in box 5, as well as the 0.9% under code H are limited to $7,000. However, if you were at and nontaxable amounts. V-Income from exercise of

on income and family size. Workers without children could Additional Medicare Tax on any of those Medicare wages least age 50 in 2018, your employer may have allowed an nonstatutory stock option(s) (included in boxes 1, 3 (up to

qualify for a smaller credit. You and any qualifying children and tips above $200,000. Box 8. This amount is not additional deferral of up to $6,000 ($3,000 for section social security wage base), and 5). See Pub. 525, Taxable

must have valid social security numbers (SSNs). You can’t included in box 1, 3, 5, or 7. For information on how to report 401(k)(11) and 408(p) SIMPLE plans). This additional and Nontaxable Income, for reporting requirements.

take the EIC if your investment income is more than the tips on your tax return, see your Form 1040 instructions. You deferral amount is not subject to the overall limit on elective W-Employer contributions (including amounts the employee

specified amount for 2018 or if income is earned for must file Form 4137, Social Security and Medicare Tax on deferrals. For code G, the limit on elective deferrals may be elected to contribute using a section 125 (cafeteria) plan) to

services provided while you were an inmate at a penal Unreported Tip Income, with your income tax return to report higher for the last 3 years before you reach retirement age. your health savings account. Report on Form 8889, Health

institution. For 2018 income limits and more information, at least the allocated tip amount unless you can prove that Contact your plan administrator for more information. Savings Accounts (HSAs). Y-Deferrals under a section

visit www.irs.gov/EITC. Also see Pub. 596, Earned Income you received a smaller amount. If you have records that Amounts in excess of the overall elective deferral limit must 409A nonqualified deferred compensation plan Z-Income

Credit. Any EIC that is more than your tax liability is show the actual amount of tips you received, report that be included in income. See the “Wages, Salaries, Tips, etc.” under a nonqualified deferred compensation plan that fails

refunded to you, but only if you file a tax return. amount even if it is more or less than the allocated tips. On line instructions for Form 1040. Note: If a year follows code to satisfy section 409A. This amount also is included in box

Clergy and religious workers. If you aren’t subject to Form 4137 you will calculate the social security and D through H, S, Y, AA, BB, or EE, you made a make-up 1. It is subject to an additional 20% tax plus interest. See

pension contribution for a prior year(s) when you were in “Other Taxes” in the Form 1040 instructions.

social security and Medicare taxes, see Pub. 517, Social Medicare tax owed on the allocated tips shown on your

military service. To figure whether you made excess AA-Designated Roth contributions under a section 401(k)

Security and Other Information for Members of the Clergy Form(s) W-2 that you must report as income and on other

deferrals, consider these amounts for the year shown, not plan. BB-Designated Roth contributions under a section

and Religious Workers. tips you did not report to your employer. By filing Form 4137,

the current year. If no year is shown, the contributions are 403(b) plan DD-Cost of employer-sponsored health

Corrections. If your name, SSN, or address is incorrect, your social security tips will be credited to your social security

for the current year. A-Uncollected social security or RRTA coverage. The amount reported with code DD is not

correct Copies B, C, and 2 and ask your employer to record (used to figure your benefits). Box 9. If you are e-filing

tax on tips. Include this tax on Form 1040. See “Other taxable.EE-Designated Roth contributions under a

correct your employment record. Be sure to ask the and if there is a code in this box, enter it when prompted by

Taxes” in the Form 1040 instructions. B-Uncollected governmental section 457(b) plan. This amount does not

employer to file Form W-2c, Corrected Wage and Tax your software. The only valid characters are the letters A-F

Medicare tax on tips. Include this tax on Form 1040. See apply to contributions under a tax-exempt organization

Statement, with the Social Security Administration (SSA) and the digits 0-9. This code assists the IRS in validating the

“Other Taxes” in the Form 1040 instructions. C-Taxable cost section 457(b) plan. FF-Permitted benefits under a qualified

to correct any name, SSN, or money amount error W-2 data submitted with your return. The code is not entered

of group-term life insurance over $50,000 (included in boxes small employer health reimbursement arrangement

reported to the SSA on Form W-2. Be sure to get your on paper-filed returns Box 10. This amount includes the total GG-Income from qualified equity grants under section 83(i)

1, 3 (up to social security wage base), and 5) D-Elective

copies of Form W-2c from your employer for all corrections dependent care benefits that your employer paid to you or HH-Aggregate deferrals under section 83(i) elections as of

deferrals to a section 401(k) cash or deferred arrangement.

made so you may file them with your tax return. If your incurred on your behalf (including amounts from a section the close of the calendar year

Also includes deferrals under a SIMPLE retirement account

name and SSN are correct but aren’t the same as shown 125 (cafeteria) plan). Any amount over $5,000 also is that is part of a section 401(k) arrangement. E-Elective Box 13. If the “Retirement plan” box is checked, special

on your social security card, you should ask for a new card included in box 1. Complete Form 2441, Child and limits may apply to the amount of traditional IRA

deferrals under a section 403(b) salary reduction agreement

that displays your correct name at any SSA office or by Dependent Care Expenses, to compute any taxable and F-Elective deferrals under a section 408(k)(6) salary contributions you may deduct. See Pub. 590-A,

calling 800-772-1213. You also may visit the SSA website nontaxable amounts. Box 11. This amount is (a) reported in reduction SEP G-Elective deferrals and employer Contributions to Individual Retirement Arrangements (IRAs).

at www.SSA.gov. Cost of employer-sponsored health box 1 if it is a distribution made to you from a nonqualified contributions (including nonelective deferrals) to a section Box 14. Employers may use this box to report information

coverage (if such cost is provided by the employer). deferred compensation or nongovernmental section 457(b) 457(b) deferred compensation plan H-Elective deferrals to a such as state disability insurance taxes withheld, union

The reporting in Box 12, using Code DD, of the cost of plan, or (b) included in box 3 and/or 5 if it is a prior year section 501(c)(18)(D) tax-exempt organization plan. See dues, uniform payments, health insurance premiums

employer-sponsored health coverage is for your deferral under a nonqualified or section 457(b) plan that “Adjusted Gross Income” in the Form 1040 instructions for deducted, nontaxable income, educational assistance

information only. The amount reported with Code DD is became taxable for social security and Medicare taxes this how to deduct. J-Nontaxable sick pay (information only, not payments, or a member of the clergy’s parsonage

not taxable. year because there is no longer a substantial risk of forfeiture included in box 1, 3, or 5) K-20% excise tax on excess allowance and utilities. Railroad employers use this box to

Credit for excess taxes. If you had more than one of your right to the deferred amount. This box shouldn’t be golden parachute payments. See “Other Taxes” in the Form report railroad retirement (RRTA) compensation, Tier 1 tax,

employer in 2018 and more than $7,960.80 in social used if you had a deferral and a distribution in the same 1040 instructions. L-Substantiated employee business Tier 2 tax, Medicare tax and Additional Medicare Tax.

security and/or Tier 1 railroad retirement (RRTA) taxes calendar year. If you made a deferral and received a expense reimbursements (nontaxable) M-Uncollected social Include tips reported by the employee to the employer in

were withheld, you may be able to claim a credit for the distribution in the same calendar year, and you are or will be security or RRTA tax on taxable cost of group-term life railroad retirement (RRTA) compensation.

excess against your federal income tax. If you had more age 62 by the end of the calendar year, your employer insurance over $50,000 (former employees only). See Note. Keep Copy C of Form W-2 for at least 3 years after

than one railroad employer and more than $4,674.60 in should file Form SSA-131, Employer Report of Special Wage “Other Taxes” in the Form 1040 instructions. N-Uncollected the due date for filing your income tax return. However, to

Tier 2 RRTA tax was withheld, you also may be able to Payments, with the Social Security Administration and give Medicare tax on taxable cost of group- term life insurance help protect your social security benefits, keep Copy C

claim a credit. See your Form 1040 or Form 1040A you a copy. Box 12. The following list explains the codes over $50,000 (former employees only). See “Other Taxes” in until you begin receiving social security benefits just in case

instructions and Pub. 505, Tax Withholding and shown in box 12. You may need this information to complete the Form 1040 instructions. P-Excludable moving expense there is a question about your work record and/or earnings

Estimated Tax. your tax return. reimbursements paid directly a member of the U.S. Armed in a particular year.

(Instructions for Employee continued on the back of copy C.) Forces (not included in box 1, 3, or 5)

You might also like

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Chapter 19 Homework SolutionDocument3 pagesChapter 19 Homework SolutionJack100% (1)

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturntabithaNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- 2020 W2 FormDocument7 pages2020 W2 FormMaria HowellNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- 2020 - PmaDocument2 pages2020 - Pmalaniya rossNo ratings yet

- TaxForms PDFDocument2 pagesTaxForms PDFLMN214100% (1)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008dashaviaNo ratings yet

- Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Document3 pagesHiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134 Hiep Nguyen 8816 Saint Pierre DR Las Vegas NV 89134Jenn BrownNo ratings yet

- Tax FormsDocument2 pagesTax FormsJose Manuel Aranzazu ManzaneroNo ratings yet

- Reissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Document1 pageReissued Statement Reissued Statement: OMB No. 1545-0008 OMB No. 1545-0008Sadiki LuhandeNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Johnnys w4 PDFDocument2 pagesJohnnys w4 PDFAnthony OrozcooNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Carlosw 2Document2 pagesCarlosw 2winnievaledocsNo ratings yet

- 5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeDocument2 pages5058.00 5058.00 CA CA 65.88 65.88: Notice To EmployeeWenn RamírezNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Returnjenner.domasNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- w2 hh83UtqU4WlQsBEvVnOTDocument1 pagew2 hh83UtqU4WlQsBEvVnOTDutchavelli5thNo ratings yet

- Your 2021 Forms W-2 Are EnclosedDocument7 pagesYour 2021 Forms W-2 Are Enclosednethpas622No ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- US Internal Revenue Service: fw2 - 2000Document12 pagesUS Internal Revenue Service: fw2 - 2000IRSNo ratings yet

- Screenshot 2023-02-07 at 8.19.04 PMDocument1 pageScreenshot 2023-02-07 at 8.19.04 PMKyle FelkinsNo ratings yet

- RCampbell 2020 W2Document2 pagesRCampbell 2020 W2alekseykarp32No ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Document7 pagesYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoNo ratings yet

- Bill W2Document2 pagesBill W2ISSA AWADHNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- US Internal Revenue Service: Fw2as - 1992Document10 pagesUS Internal Revenue Service: Fw2as - 1992IRSNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Misal RomanoDocument2 pagesMisal RomanoJairo RBNo ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- R SwieratDocument2 pagesR SwieratDe Gen G.No ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Revenue Act of 1971 (PL - 92-178)Document78 pagesRevenue Act of 1971 (PL - 92-178)Tax History100% (1)

- Notre Dame Educational Association: Mock Board Examination TaxationDocument10 pagesNotre Dame Educational Association: Mock Board Examination TaxationirishjadeNo ratings yet

- Citizens For Nuclear Free Iran 2015 990Document22 pagesCitizens For Nuclear Free Iran 2015 990eliclifton100% (1)

- Module 8 - Inclusion of Gross IncomeDocument4 pagesModule 8 - Inclusion of Gross IncomeReicaNo ratings yet

- ABC Financial Coaching Worksheet Master File V4Document9 pagesABC Financial Coaching Worksheet Master File V4kapNo ratings yet

- Invoice 1262.274Document1 pageInvoice 1262.274miroljubNo ratings yet

- F6 Taxation (FA07) Course Slides BPPDocument295 pagesF6 Taxation (FA07) Course Slides BPPhrsh444No ratings yet

- Tax 1 PrimerDocument113 pagesTax 1 PrimerPatrice De CastroNo ratings yet

- Telangana Budget 2014-2015 Full TextDocument28 pagesTelangana Budget 2014-2015 Full TextRavi Krishna MettaNo ratings yet

- 26QB Seller DetailsDocument2 pages26QB Seller DetailssuniloffcNo ratings yet

- Delivery ChallanDocument8 pagesDelivery ChallanBALWINDER SINGHNo ratings yet

- Bir Ruling No. JV-187-21Document4 pagesBir Ruling No. JV-187-21Ren Mar CruzNo ratings yet

- Sitel Phil Vs CIRDocument13 pagesSitel Phil Vs CIRMyrnaJoyPajoJaposNo ratings yet

- Ar 508863Document1 pageAr 508863JEFF WONNo ratings yet

- InvoiceDocument1 pageInvoiceHEMANTA SAIKIANo ratings yet

- Manila Gas Corporation v. The Collector of Internal RevenueDocument1 pageManila Gas Corporation v. The Collector of Internal RevenueRNicolo Ballesteros100% (1)

- Padilla - Commissioner of Internal Revenue vs. Court of Appeals - International Freighting vs. CIRDocument11 pagesPadilla - Commissioner of Internal Revenue vs. Court of Appeals - International Freighting vs. CIRPatrick Ramos100% (1)

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- 567 Key AnswersDocument4 pages567 Key AnswerspunithupcharNo ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- Manandhar Anju 218 22Document28 pagesManandhar Anju 218 22MDV VehiclesNo ratings yet

- GST Council 2022: GST Rates 2022 - Complete List of Goods and Service Tax Rates, Slab & RevisionDocument13 pagesGST Council 2022: GST Rates 2022 - Complete List of Goods and Service Tax Rates, Slab & RevisionAkshaya ilangoNo ratings yet

- Opinion On TRAIN LawDocument9 pagesOpinion On TRAIN LawVia Maria MalapoteNo ratings yet

- Chapter 10 - Allowable Deductions: IndividualDocument17 pagesChapter 10 - Allowable Deductions: IndividualKyle BacaniNo ratings yet

- 16064632529045735MDocument3 pages16064632529045735MAmanjot GaurNo ratings yet

- Invoice RakheeDocument1 pageInvoice RakheeRakhee TiwariNo ratings yet

- Cadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceDocument285 pagesCadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceJohnny Castillo SerapionNo ratings yet

- Income Taxation and Tax Rates in The PhilippinesDocument3 pagesIncome Taxation and Tax Rates in The Philippinesओतगो एदतोगसोल एहपोीूदNo ratings yet