Professional Documents

Culture Documents

Case Study on dividend policy 1

Case Study on dividend policy 1

Uploaded by

S LakshmiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study on dividend policy 1

Case Study on dividend policy 1

Uploaded by

S LakshmiCopyright:

Available Formats

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

A STUDY ON DIVIDEND DECISION ANALYSIS OF INFOSYS

TUNIKI BHARGAVI

Assistant Professor, Department of MBA, Princeton PG college of Management, Ramanthapur, Hyderabad

Abstract - The objective of this present study is significant source of financing a firm’s investment

in practice. A firm, which intends to pay dividends

financial management that is to use business funds

and also needs funds to finance its investment

in such a way that the firm’s earnings are

opportunities, will have to use external sources of

maximized. So choose a study to conduct on the

finance. Dividend policy of the firm. Thus has its

dividend decision of “Infosys” using ratios in

effect on both the long-term financing and the

comparison with previous year performance. The

wealth of shareholders. The Moderate view, which

purpose of this paper is how finance managers will

asserts that because of the information value of

take the Dividend Decision towards his

dividends, some dividends should be pa-id as it may

shareholders. This is one of the crucial decisions

have favorable affect on the value of the share.

made by the finance manager relating to the payouts

to the shareholders. The payout is the proportion The theory of empirical evidence about the dividend

of Earning Per Share given to the shareholders in the policy does not matter if we assume a real world

form of dividends. with perfect capital markets and no taxes. The

second theory of dividend policy is that there will

The core objective of this present study is

definitely be low and high payout clients because of

how the decisions are made over dividends owner

the differential personal taxes. The majority of the

for the welfare of a business. These objectives can

holders of this view also show that balance, there

be achieved by Retained earnings and Shareholder’s

will be pre-ponderous low payout clients because of

wealth maximization.

low capital gain taxes.

This study covered of profits and shares of

The third view argues that there does exist an

Infosys drawn from annual report of the company.

optimum dividend policy. An optimum dividend

Ratio analysis is used for evaluating shares and

policy is justified in terms of the information in

earnings. In this study an attempt is made to know

agency costs.

the growth of total investment and earnings of

Infosys for the past 10 years.

1.1 IMPORTANCE OF THE STUDY

Keywords: Diversity, equal opportunities, A Dividend decisions are an important aspect of

valuing diversity, strategic HRM, India corporate financial policy since they can have an

effect on the availability as well as the cost of

capital. The Lintner proposition which asserts that

1.0 INTRODUCTION

the corporate management maintains a constant

target payout ratio has been the most influential.

The term dividend refers to that part of the profits of

However, the concept of primary of dividend

a company which is distributed amongst its

decisions as well as the reasons for it are not

shareholders. It may therefore be defined as the

unambiguously defined. There is a variety of

return that a shareholder

theories which attempt to rationalize the observed

gets from the company, out of its profits, on his share secular constancy of the dividend payout ratio.

holdings. "According to the Institute of Charted

The dividend policy of a firm determines

Accounts of India" dividend is a "Distribution to

what proportion of earnings is paid 'to shareholders

shareholder out of profits or reserves available for

by the way of dividends and what proportion is

this purpose"

ploughed back in the firm reinvestment purposes. If

The Dividend policy has the effect of dividing its net a Firm's capital budgeting decision is independent of

earnings into two Parts: Retained earnings and its dividend of its dividend policy, a higher dividend

dividends. The retained earnings provide funds to payment will entail a greater dependence on external

finance the long-term growth. It is the most financing. On the other hand, if a firm’s capital

www.jespublication.com Page No:1192

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

budgeting decision is dependent on its dividend The period of any research is the period which the

decision, a higher payment will cause shrinkage of data has been collected and analyzed. The period of

its capital budget and vice versa. In such a case the this study has been limited to the period from 01-01-

dividend policy has a bearing on the capital 2010 to 31-12-2019.

budgeting decision.

Sources of data:

1.2 NEED FOR THE STUDY

Data required for conducting this study has been

The principal objective of corporate collected from the various web portals, Books &

financial management is to maximize the market Magazines as the data is basically secondary in

value of the equity shares. Hence the key question of nature. Secondary data is used such as websites,

interest to us in this study is, "What is the discussions with seniors, obtaining information

relationship between dividend policy and market from senior authorities and also make a use of same

price of equity shares?" financial reference book.

Most of the discussion on dividend of 1.5 LIMITATIONS

dividend policy and firm value assumes that the

investment decision of a firm is independent of its Every study has its own limitations.

dividend decision. The need for this study arise from These rise due to the method of sampling used,

the above raised question and the most controversial the method of data collection and the source of

and unresolved doubts about the Relevance and the data apart from many other things. The

Irrelevance of the dividend policy. limitations of this study are as follows:

1.3 OBJECTIVES OF THE STUDY 1. The data collected is of secondary

The basic objective of this study is as follows: nature and hence it is difficult to

ascertain the reliability of the data.

1. To understand the importance of the dividend

2. The scope of the study has been

decision and their impact on the firm's capital

budgeting decision.

limited to the impact of the dividend

2. To know the various dividend policies followed on the market value of the firm's

by the firms. equity.

3. To understand the theoretical backdrop of the 3. The period of the study has been

various divided theories. limited to only ten years.

4. To derive the empirical evidence for the 4. Time period of this study is also

relevance theory of dividend WALTER’S limited.

MODEL.

1.4 RESEARCH METHDOLOGY 2.0 REVIEW OF LITERATURE

Sample: The sample of this study consists of

financial data of “Infosys ” for the past ten years. Dividend decisions, as the very name suggests,

refers to the decision-making mechanism of the

Tool: management to declare dividends. It is crucial for

the top management to determine the portion of

Formulae’s

earnings distributable as the dividend at the end of

Tables

every reporting period. A company’s ultimate

Graphs

objective is the maximization of shareholders

Techiques:

wealth. It must, therefore, be very vigilant about its

Ratio analysis profit-sharing policies to retain the faith of the

shareholders. Dividend payout policies derive

Relevance &

enormous importance by virtue of being a bridge

Irrelevance dividend theories

between the company and shareholders for profit-

Period of the study:

sharing. Without an organized dividend policy, it

would be difficult for the investors to judge the

intentions of the management.

www.jespublication.com Page No:1193

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

Moreover, the dividend policies of an organization Good Dividend Policy

have a significant bearing on the market value of

stocks. Dividends must be distributed in line with There does not exist a single dividend decision

the industry standards. The shareholders will process that works for every organization. A

otherwise perceive this variability negatively. It decision suitable for one company may prove fatal

casts a suspicion on the financial health and motives for another company. For example, businesses with

of the management (signaling effect). In aggregate, a consistent order book such as telecom and banking

an inefficient dividend decision mechanism would are expected to pay regular dividends. It may impact

adversely impact the valuation of the company. the stock prices if they do not pay dividends

regularly. To the contrary, sectors of pharmaceutical

and technology are highly research oriented. Huge

A major decision of financial management is

cash expenses are required to further their

the dividend decision in the sense that the firm has to

operations. Therefore they cannot afford to pay a

choose between distributing the prof-it’s to the

regular dividend. Investors of such stocks earn

shareholders and plugging them back into the business.

income mainly through capital appreciation. In

The choice would obviously hinge on the effect of the

essence, there are a lot of factors affecting dividend

decision on the maximizations of shareholders wealth.

policy or decision.

Given the objective of financial management of

maximizing present values, the firm should be guided We can refer to following renowned theories on

by the considerations as to which alternative use is Dividend Policy:

consistent with the goal of wealth maximization. That

is, the firm would be well advised to use the net prof- 1. Modigliani- Miller Theory on Dividend

its for paying dividends to the shareholders if that Policy

payment will lead to the maximization of wealth of the 2. Gordon’s Theory on Dividend Policy

owners. If not, the firm should rather retain theme to 3. Walter’s Theory on Dividend Policy

finance investment programmers. The relationship

between dividends and value of the firm should

therefore, be the decision criterion. IRRELEVANCE OF DIVIDEDS

Objects of Dividend Decisions MODIGLIANI AND MILLER MODEL:

Cash Requirement M&M Theory 1’s assumption that there are no taxes

is unrealistic. Taxes exist, and interest expense is tax

The financial manager must take into account the

deductible i.e. the ultimate tax burden of a company

capital fund requirements while framing a dividend

with debt in its capital structure is lower than a

policy. Generous distribution of dividends in

company with zero or lower debt. This brings us to

capital-intensive periods may put the company in

M&M Theory 2 which relaxes the zero-tax

financial distress.

assumption.

Evaluation of Price Sensitivity

Proposition 1

Companies chosen by investors for its regularity of In a tax environment, the value of a levered company

dividend must have a more stringent dividend policy is higher than the value of an unlevered company by

than others. It becomes essential for such companies an amount equal to the product of absolute amount

to take effective dividend decisions for maintaining of debt and tax rate.

stock prices.

This can be expressed mathematically as follows:

Stage of Growth

Dividend decision must be in line with the stage of VL = VUL + t × D

the company- infancy, growth, maturity & decline.

Each stage undergoes different conditions and Where VL is the value of levered company i.e.

therefore calls for different dividend decisions. company with some debt in its capital

structure, VUL is the value of an un-levered company

i.e. with no or lower debt, t is the tax rate and D is

the absolute amount of debt.

www.jespublication.com Page No:1194

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

Proposition 2 Walter’s model is based on the following

Since interest expense is tax-deductible, our assumptions:

equation for the weighted average cost of 1. The firm finances all investment through retained

capital modifies as follows: earnings; that is debt or new equity is not issued

E D 2. The firm’s internal rate of return (r), and its cost

WACC = ke × + kd × (1 - t) × of capital (k) are constant

V V

3. All earnings are either distributed as dividend or

All other variables are the same as in Proposition 2 reinvested internally immediately.

of Theory 1 except for the factor of (1 − t) which

represents the tax shield i.e. the decrease in effective 4. Beginning earnings and dividends never change.

cost of debt due to existence of tax benefit of debt. The values of the earnings per share (E), and the

divided per share (D) may be changed in the model

After some mathematical adjustment, we get the to determine results, but any given values of E and

following function for cost of equity in a positive- D are assumed to remain constant forever in

tax environment: determining a given value.

D 5. The firm has a very long or infinite life.

ke = WACC + (WACC − kd) × (1 − t) ×

E

Walter’s formula to determine the market price per

share (P) is as follows.

The above equation is the same as in Proposition 2

P = D/K +r(E-D)/K/K

of Theory 1 except for the factor of (1 − t). The

consequence of debt shield is that cost of

equity increases with an increase in D/E but the The above equation clearly reveals that the market

increase in less pronounced than in a no-tax price per share is the sum of the present value of two

environment. sources of income:

i) The present value of an infinite stream of constant

dividends, (D/K) and

The implication of M&M theory with tax is that

the capital structure is no longer irrelevant. The

value of a company with debt is higher than the ii) The present value of the infinite stream of stream

value of a company with no or lower debt. gains.

RELEVANCE OF DIVIDENDS 2. Gordon’s Model:

One very popular model explicitly relating the

In sharp contrast to the MM position, there are some market value of the firm to dividend policy is

theories that consider dividend decisions to be an developed by Myron Gordon.

active variable in determining the value of a firm. The

dividend decision is, therefore, relevant. We critically Assumptions:

examine below theories representing this notion: Gordon’s model is based on the following

assumptions.

1) WALTERS MODEL

2) GARDENS MODEL

1. The firm is an all Equity firm

1. Walter’s model:

Professor James E. Walter argues that the choice of

2. No external financing is available

dividend policies almost always affects the value of

the enterprise. His model shows clearly the

importance of the relationship between the firm’s 3. The internal rate of return (r) of the firm is

internal rate of return (r) and its cost of capital (k) in constant.

determining the dividend policy that will maximize

the wealth of shareholders. 4. The appropriate discount rate (K) of the firm

remains constant.

www.jespublication.com Page No:1195

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

5. The firm and its stream of earnings are perpetual Chairman of the

Board)

6. The corporate taxes do not exist.

7. The retention ratio (b), once decided upon, is

Mohit Joshi

constant. Thus, the growth rate (g) = br is constant

forever. CONTACT INFO (President)

8. K > br = g if this condition is not fulfilled, we Electronics City, Hosur

cannot get a meaningful value for the share. Road

Ravi Kumar S.

+91.80.28520261

According to Gordon’s dividend capitalisation (President, Deputy

model, the market value of a share (Pq) is equal to https://www.infosys.com/ Chief Operating

the present value of an infinite stream of dividends Officer)

to be received by the share. Thus:

Salil S. Parekh

The above equation explicitly shows the relationship

of current earnings (E,), dividend policy, (b), (Chief Executive

internal profitability (r) and the all-equity firm’s cost Officer, Managing

of capital (k), in the determination of the value of the Director, Whole

share (P0) Time Director)

3.0 company profile.

Nilanjan Roy

Established in 1981, Infosys is a NYSE listed global

consulting and IT services company with more than (Chief Financial

228,000 employees. From a capital of US$ 250, we Office)r

have grown to become a US$ 11.8 billion (FY19

revenues) company with a market capitalization of

approximately US$ 47.7 billion.

4.0 - DATA ANALYSIS &

INTERPRETATION

In our journey of over 37 years, we have catalyzed EARNING PER SHARE

some of the major changes that have led to India's

emergence as the global destination for software Table no:1

services talent. We pioneered the Global Delivery

Model and became the first IT Company from India MONTH/YEAR EPS(Rs.)

to be listed on NASDAQ. Our employee stock

Mar-10 101.1

options program created some of India's first

salaried millionaires. Mar-11 112.26

Mar-12 147.51

INDUSTRY EXECUTIVE

LEADERSHIP Mar-13 158.76

Mar-14 178.39

INDUSTRY: Nandan M. Nilekani

Mar-15 105.91

Software & Programming (Non-Executive

Non-Independent Mar-16 55.26

www.jespublication.com Page No:1196

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

Mar-17 60.16

DPS

Mar-18 71.28

60

Mar-19 33.66 40

20

0

200 EPS

Graph No:2

100 INTERPRETATION

Dividend per share in the year 2010 it was 32 and in

0

the next immediate year it suddenly decreased to 30

and from there it’s slowly the improvement started

year by year and in the year 2014 it went 43, which

is highest among all the years. And for the next years

Graph no:1 there was drastical change it fell down to 10.5.

INTERPRETATION Dividend Payout Ratio

The Earning per share in the year 2014 was 178.39 Table No:3

which was highest among the historical prices till the

MONTH/YEAR DPS EPS DPR

sample period. From the next immediate year

onwards, it’s going on constantly decreasing as we Mar-10 32 101.1 31.65183

can see in the above table year by year. EPS of

Infosys in year of 2019 was 33.66. Dividend Per Mar-11 30 112.26 26.72368

Share

Mar-12 22 147.51 14.91424

Table No:2

Mar-13 27 158.76 17.0068

MONTH/YEAR DPS(Rs.)

Mar-14 43 178.39 24.10449

Mar-10 32

Mar-15 29.5 105.91 27.85384

Mar-11 30

Mar-16 14.25 55.26 25.78719

Mar-12 22

Mar-17 14.75 60.16 24.51795

Mar-13 27

Mar-18 20.5 71.28 28.75982

Mar-14 43

Mar-19 10.5 33.66 31.1943

Mar-15 29.5

Mar-16 14.25

Mar-17 14.75

Mar-18 20.5

Mar-19 10.5

www.jespublication.com Page No:1197

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

DIVIDEND PAYOUT PROFIT AFTER TAX

RATIO 20000

10000

200

0 0

DPS EPS DPR

Graph No:4

Graph No:3

INTERPRETATION

INTERPRATATION:

For every business profit is the ultimate motto to run

DPR for the first three years i.e. 2010-2013 a business, coming to profit after tax for the above

decreases from 31.6 to 14.9. Dividend payout graph and table its constantly increasing year by year

ratio was representing a very good graphical which is a very good sign and it was showing

presentation from 2014 due to its constant consistence increasing year by year till 2019.

increase in ratio year by year, though there was

slight decrease situation in some years the RESERVES & SURPLUS

impact is not there. The highest ratio was in the

year 2019, 31.1. Table No:5

Profit after Tax R&

S(In

Table No: 4 MONTH/YEAR cr.)

MONTH/YEAR PAT(in Cr.) Mar-10 21749

Mar-10 5803 Mar-11 24214

Mar-11 6443 Mar-12 29470

Mar-12 8470 Mar-13 35772

Mar-13 9116 Mar-14 41806

Mar-14 10194 Mar-15 47494

Mar-15 12164 Mar-16 59934

Mar-16 13693 Mar-17 66869

Mar-17 13818 Mar-18 62410

Mar-18 16155 Mar-19 60533

Mar-19 14702

www.jespublication.com Page No:1198

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

RESERVES & WALTER'S MODEL

SURPLUS R& S(In 200

cr.) 100

0

100000

0

M…

M…

M…

M…

M…

M…

M…

M…

M…

M…

D E P=(d+(e-d)*r/ke)/ke

Graph No:5

Graph No:6

INTERPRETATION:

INTERPRETATION

Reserves and surplus for the above graph and table

is a very good example for the consistence growth The price of a share by using Walter’s model

due to which the table and graph are also looking has been decreased from year by year, because the

very neat. It has shown a consistence increase in its assumption for this model is absentism of taxes.

performance year by year and in the year 2017 it has Walter model is very low in year of 2019..

shown a tremendous performance, but after 2017 it

has decreased for next years Dividend Summary of Infosys

WALTER’S MODEL

For the year ending March 2019 Infosys has

Table No:6 declared an equity dividend of 430.00% amounting

to Rs 21.5 per share. At the current share price of Rs

Cost of capital=158.3; r=20 767.85 this results in a dividend yield of 2.8%.

P=(d+(e- The company has a good dividend track report and

MONTH/YEAR D E d)*r/ke)/ke has consistently declared dividends for the last 5

years.

Mar-10 32 101.1 0.26

Di

Mar-11 30 112.26 0.26 Div

Anno vid

Effec ide

Mar-12 22 147.51 0.24 uncem en

tive nd Remarks

ent d

Date Ty

Mar-13 27 158.76 0.28 Date (%

pe

)

Mar-14 43 178.39 0.38

23- Rs.8.0000 per

Mar-15 29.5 105.91 0.25 11-10- Inte 16

10- share(160%)Interim

2019 rim 0

2019 Dividend

Mar-16 14.25 55.26 0.12

13- Rs.10.5000 per

Mar-17 14.75 60.16 0.13 12-04- Fin 21

06- share(210%)Final

2019 al 0

2019 Dividend

Mar-18 20.5 71.28 0.17

24- Rs.4.0000 per

Mar-19 10.5 33.66 0.08 11-01- Spe

01- 80 share(80%)Special

2019 cial

2019 Dividend

www.jespublication.com Page No:1199

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

25- Rs.7.0000 per 30- Rs.27.0000 per

16-10- Inte 14 12-04- Fin 54

10- share(140%)Interim 05- share(540%)Final

2018 rim 0 2013 al 0

2018 Dividend 2013 Dividend

14- Rs.20.5000 per 18- Rs.15.0000 per

12-04- Fin 41 24-09- Inte 30

06- share(410%)Final 10- share(300%)Interim

2018 al 0 2012 rim 0

2018 Dividend 2012 Dividend

14- Rs.10.0000 per Rs. 22.00 per share

13-04- Spe 20

06- share(200%)Special (440%) Final

2018 cial 0 24-

2018 Dividend 13-04- Fin 64 Dividend &

05-

2012 al 0 Rs.10.00 per share

Rs.13.0000 per 2012

31- (200%) Special

10-10- Inte 26 share(260%)Interim Dividend

10-

2017 rim 0 Dividend & Buy

2017

Back of shares 20-

22-09- Inte 30

10- -

01- Rs.14.7500 per 2011 rim 0

13-04- Fin 29 2011

06- share(295%)Final

2017 al 5

2017 Dividend. 26-

15-04- Fin 40

05- -

21- Rs.11.0000 per 2011 al 0

16-09- Inte 22 2011

10- share(220%)Interim

2016 rim 0

2016 Dividend Rs.10.00 per

share(200%)Interim

09- Rs.14.2500 per 21-

15-04- Fin 28 29-09- Inte 80 Dividend &

06- share(285%)Final 10-

2016 al 5 2010 rim 0 Rs.30.00 per

2016 Dividend 2010

share(600%)Special

Dividend.

16- Rs.10.0000 per

15-09- Inte 20

10- share(200%)Interim 26-

2015 rim 0 13-04- Fin 30

2015 Dividend 05- -

2010 al 0

2010

Rs.29.5000 per

share(590%)Final 15-

15- Dividend 22-09- Inte

24-04- Fin 59 10-

06- (equivalent 2009 rim

2015 al 0 2009

2015 to<br>Rs. 14.75/-

per share<br>after

1:1 bonus issue)

5.0 - FINDINGS, SUGGESTIONS &

16- Rs.30.0000 per CONCLUSION

28-08- Inte 60

10- share(600%)Interim

2014 rim 0 5.1 – FINDINGS

2014 Dividend

29- Rs.43.0000 per 1. The Earning per share in the year 2014 was

15-04- Fin 86 178.39 which was highest among the

05- share(860%)Final

2014 al 0 historical prices till the sample period.

2014 Dividend

From the next immediate year onwards, it’s

17- Rs.20.0000 per going on constantly decreasing as we can

26-09- Inte 40

10- share(400%)Interim see in the above table year by year. EPS of

2013 rim 0

2013 Dividend Infosys in year of 2019 was 33.66.

2. Dividend per share in the year 2010 it was

32 and in the next immediate year it

suddenly decreased to 30 and from there

www.jespublication.com Page No:1200

Vol 11, Issue 6,June/ 2020

ISSN NO: 0377-9254

it’s slowly the improvement started year by Dividend decision determines the division of

year and in the year 2014 it went 43, which earnings between payments to shareholders and

is highest among all the years. And for the retained earnings.

next years there was drastical change it fell The Dividend Decision, in Corporate finance, is a

down to 10.5. decision made by the directors of a company about

3. DPR for the first three years i.e. 2010-2013 the amount and timing of any cash payments made

decreases from 31.6 to 14.9. Dividend to the company’s stockholders. The Dividend

payout ratio was representing a very good Decision is an important part of the present day

graphical presentation from 2014 due to its corporate world.

constant increase in ratio year by year,

though there was slight decrease situation The Dividend decision is an important one for the

in some years the impact is not there. The firm as it may influence its capital

highest ratio was in the year 2019, 31.1. structure and stock price. In addition, the Dividend

4. For every business profit is the ultimate decision may determine the amount of taxation that

motto to run a business, coming to profit stockholders pay.

after tax for the above graph and table its

BIBLIOGRAPHY

constantly increasing year by year which is

a very good sign and it was showing BOOKS:

consistence increasing year by year till

2019 1. Prasanna Chandra: `Financial Management-

5. Reserves and surplus for the above graph Theory and Practice' 5’Th Edition, 2001 Tata Mc

and table is a very good example for the Graw Hill Publishing House.

consistence growth due to which the table

and graph are also looking very neat. It has 2. Cooper Donald E, Pamela S Schindler, 8th

shown a consistence increase in its Edition, 2003, Mc Graw Hill Publishing House.

performance year by year and in the year

3.Khan M Y, P Jain: ‘Financial Management-Text

2017 it has shown a tremendous

and problems’ 3rd Edition, 1999

performance, but after 2017 it has

decreased for next years

5.2 - SUGGESTIONS

The following Suggestions are being

provided to Infosys

Investors always prefer the dividend payment for

Capital appreciation. Hence some amount of

Dividend must be paid regularly. Unless the

Payment will reduce the net worth of the industry.

The industry should improve the dividend per

share.

The industry should follow stable dividend policy.

When the industry get the price earning highly,

That industry will Grow.

Company must improve its liquidity position.

5.3 - CONCLUSION

Dividend decision refers to the policy that the

management formulates in regard to earnings for

distribution as dividends among shareholders.

www.jespublication.com Page No:1201

You might also like

- Dividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsDocument17 pagesDividend Policy and Financial Performance of Nigerian Pharmaceutical FirmsRitesh ChatterjeeNo ratings yet

- Dividend Analysis at India Bulls: Project Report ON " "Document77 pagesDividend Analysis at India Bulls: Project Report ON " "Sankar BukkapatnamNo ratings yet

- Analysis of The Factors in Uencing Dividend Policy: Evidence of Indonesian Listed FirmsDocument10 pagesAnalysis of The Factors in Uencing Dividend Policy: Evidence of Indonesian Listed FirmsChan Hui YanNo ratings yet

- PRAVALLIKA - DaDocument13 pagesPRAVALLIKA - DaMohmmed KhayyumNo ratings yet

- "Dividend Decision": Synopsis OnDocument14 pages"Dividend Decision": Synopsis Onferoz khanNo ratings yet

- DD Icici UppalDocument14 pagesDD Icici Uppalferoz khanNo ratings yet

- DEVIDEND DICISION... HDFC Bank-2015Document64 pagesDEVIDEND DICISION... HDFC Bank-2015Tanvir KhanNo ratings yet

- Dividend Policy PresentationDocument13 pagesDividend Policy PresentationWang TomasNo ratings yet

- Narshima Murty - Diveded Decisions-HdfcDocument17 pagesNarshima Murty - Diveded Decisions-HdfcwebstdsnrNo ratings yet

- Financial Management: TO, Faridha.RDocument23 pagesFinancial Management: TO, Faridha.RSrinivasan SrinivasanNo ratings yet

- Factors Affecting Dividend Policy in Manufacturing Companies in Indonesia Stock ExchangeDocument14 pagesFactors Affecting Dividend Policy in Manufacturing Companies in Indonesia Stock ExchangeWindaNo ratings yet

- DividendDocument30 pagesDividendFaruqNo ratings yet

- A Study On Dividend PolicyDocument75 pagesA Study On Dividend PolicyVeera Bhadra Chary ChNo ratings yet

- Analysis of The Effect of Profitability, Liquidity, Leverage and Company Growth Against Dividend Policy in Lq-45 Companies PERIOD 2015-2017Document8 pagesAnalysis of The Effect of Profitability, Liquidity, Leverage and Company Growth Against Dividend Policy in Lq-45 Companies PERIOD 2015-2017DS ReishenNo ratings yet

- A Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesDocument22 pagesA Study To Analyse Effect of Corporate Actions On Stock Market Returns of Selected Indian IT CompaniesAnkit SarkarNo ratings yet

- Dividend Decision ICICI by ImtiazaliDocument26 pagesDividend Decision ICICI by ImtiazaliImtiyazMoverNo ratings yet

- ABID Concept in The Effect of Financial Policy On Firm ValueDocument18 pagesABID Concept in The Effect of Financial Policy On Firm ValueSiti NurkomariyahNo ratings yet

- Chapter-II Literature ReviewDocument32 pagesChapter-II Literature Reviewbikash ranaNo ratings yet

- Impact of Financial Leverage On Dividend Policy of Selected Manufacturing Firms in NigeriaDocument12 pagesImpact of Financial Leverage On Dividend Policy of Selected Manufacturing Firms in NigeriaMayaz AhmedNo ratings yet

- The Role of Profitability On Dividend Policy in Property and Real Estate Registered Subsector Company in IndonesiaDocument8 pagesThe Role of Profitability On Dividend Policy in Property and Real Estate Registered Subsector Company in IndonesiaWiduri PutriNo ratings yet

- Impact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Document5 pagesImpact of Ownership Sturcture On Dividend Policy of Firm: (Evidence From Pakistan)Fahri FitrianaNo ratings yet

- Dividend PolicyDocument6 pagesDividend Policyjimmythiongo.kNo ratings yet

- Impact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaDocument3 pagesImpact of Dividend On Investment Decision: Dasari Sruthi, Ch. Roja Rani, Ch. LavanyaBilal AhmedNo ratings yet

- The Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketDocument9 pagesThe Effect of Dividend Policy On Stock Price: Evidence From The Indian MarketWilson SimbaNo ratings yet

- Determinants of Dividend Policy: Evidence From GCC MarketDocument13 pagesDeterminants of Dividend Policy: Evidence From GCC MarketeferemNo ratings yet

- Dividend Decision - IciciDocument24 pagesDividend Decision - Icicimohammed khayyum100% (1)

- The Effect of Dividend Policy On Corporate ProfitabilityDocument5 pagesThe Effect of Dividend Policy On Corporate ProfitabilityNanditaNo ratings yet

- 1926-Article Text-5067-1-10-20231003Document15 pages1926-Article Text-5067-1-10-20231003Rinanti DANo ratings yet

- A Critical Analysis On The Impact of Dividend Policy On The Value of The FirmDocument95 pagesA Critical Analysis On The Impact of Dividend Policy On The Value of The Firmnaz100% (3)

- 2 PBDocument7 pages2 PBBaekkichanNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Project On Impact of Dividends PolicyDocument45 pagesProject On Impact of Dividends Policyarjunmba119624100% (1)

- Dividend DecisionDocument15 pagesDividend DecisionroadsterNo ratings yet

- FM Notes - Unit - 5Document7 pagesFM Notes - Unit - 5Shiva JohriNo ratings yet

- A Synopsis Report ON AT Icici Bank LTD: Dividend DecisionDocument10 pagesA Synopsis Report ON AT Icici Bank LTD: Dividend DecisionMOHAMMED KHAYYUMNo ratings yet

- Dividend Policy of Everest Bank Limited: A Thesis Proposal byDocument9 pagesDividend Policy of Everest Bank Limited: A Thesis Proposal byRam khadkaNo ratings yet

- Financial Leverage, Earnings and DividendDocument6 pagesFinancial Leverage, Earnings and DividendDeepak PahujaNo ratings yet

- Impact of Dividend Policy On A Firm PerformanceDocument11 pagesImpact of Dividend Policy On A Firm PerformanceMuhammad AnasNo ratings yet

- Dividend PolicyDocument10 pagesDividend PolicyMoguche CollinsNo ratings yet

- Chapter 5 - The Dividend DecisionsDocument18 pagesChapter 5 - The Dividend DecisionsMotiram paudelNo ratings yet

- Dividend Policy and Firm Performance: A Study of Listed Firms On National Stock ExchangeDocument4 pagesDividend Policy and Firm Performance: A Study of Listed Firms On National Stock ExchangeMUZNANo ratings yet

- Project On Impact of Dividends Policy 1Document43 pagesProject On Impact of Dividends Policy 1Soma BanikNo ratings yet

- Unit-4 Study NotesDocument11 pagesUnit-4 Study NotesmahnoorbitNo ratings yet

- The Effect of Stock Prices, Return On Assets, and Firm Size On Dividend Payout Ratio: Evidence From Indonesian Financial Service CompaniesDocument11 pagesThe Effect of Stock Prices, Return On Assets, and Firm Size On Dividend Payout Ratio: Evidence From Indonesian Financial Service CompaniesDira SabillaNo ratings yet

- Dividend PolicyDocument7 pagesDividend PolicyImran AhsanNo ratings yet

- Accounting: Training: 1.1. DividendsDocument40 pagesAccounting: Training: 1.1. DividendsNeha ChoudharyNo ratings yet

- Study of Dividend Policy Adopted by Companies: Master of Business AdministrationDocument125 pagesStudy of Dividend Policy Adopted by Companies: Master of Business AdministrationtechcaresystemNo ratings yet

- FM Ii Handout-2Document85 pagesFM Ii Handout-2Fãhâd Õró ÂhmédNo ratings yet

- Cornell Notes W2Document9 pagesCornell Notes W2Amalia Kusuma DewiNo ratings yet

- Pengaruh Faktor-Faktor Fundamental Dan Teknikal TerhadapDocument11 pagesPengaruh Faktor-Faktor Fundamental Dan Teknikal TerhadapAji PurnomoNo ratings yet

- DIVIDEND POLICY KKDocument14 pagesDIVIDEND POLICY KKAbdulkarim Hamisi KufakunogaNo ratings yet

- Dividend and Dividend PolicyDocument24 pagesDividend and Dividend Policyrudranshawasthi77No ratings yet

- Assignment Pengurusan Kewangan 2Document13 pagesAssignment Pengurusan Kewangan 2william tangNo ratings yet

- Profitabilitas Likuiditas Dan Ukuran PerDocument11 pagesProfitabilitas Likuiditas Dan Ukuran Perachmad tajiNo ratings yet

- Research Papers Dividend Policy TheoriesDocument7 pagesResearch Papers Dividend Policy Theoriesgahezopizez2100% (1)

- Ijerv 10 I 5 So 6 A CEOOverconfidenceDocument14 pagesIjerv 10 I 5 So 6 A CEOOverconfidenceMariam AlraeesiNo ratings yet

- Chapter TwoDocument21 pagesChapter TwoPhilip AsareNo ratings yet

- Financial Theory EssayDocument7 pagesFinancial Theory EssayHuỳnh Ngọc TuyềnNo ratings yet

- 305-Article Text-365-2-10-20200717Document7 pages305-Article Text-365-2-10-20200717Andika CandraNo ratings yet

- Calculating With Standard FormDocument2 pagesCalculating With Standard FormjulucesNo ratings yet

- Tongan LanguageDocument11 pagesTongan LanguageLinas Kondratas100% (4)

- 2020 Ignite K3 Set Up GuideDocument30 pages2020 Ignite K3 Set Up GuidedjeisnerNo ratings yet

- Long-Term Efficiency of Public Service Provision in A Context of Budget PDFDocument17 pagesLong-Term Efficiency of Public Service Provision in A Context of Budget PDFsariNo ratings yet

- VBA Vitals Cheat SheetDocument1 pageVBA Vitals Cheat SheetNilu SinghNo ratings yet

- TJUSAMO 2013-2014 SymmediansDocument7 pagesTJUSAMO 2013-2014 SymmediansChanthana Chongchareon100% (1)

- Flowchart: North Fairview High School - West Fairview AnnexDocument14 pagesFlowchart: North Fairview High School - West Fairview AnnexArchie SalangsangNo ratings yet

- Hysteretic Response of RC Infilled Frames - Altin 1992Document18 pagesHysteretic Response of RC Infilled Frames - Altin 1992Nefeli ChatzatoglouNo ratings yet

- EdmDocument29 pagesEdmGaurav SinghNo ratings yet

- Photosynthesis Review QuestionsDocument4 pagesPhotosynthesis Review Questionsdee eeNo ratings yet

- Mono T7Document1 pageMono T7Syamala KNo ratings yet

- Design, Implementation and Verification of 32-Bit ALU With VIODocument6 pagesDesign, Implementation and Verification of 32-Bit ALU With VIONubia DiazNo ratings yet

- Keepers Smart Contracts Audit v0.1 GingerSecDocument60 pagesKeepers Smart Contracts Audit v0.1 GingerSecAbhishek ShuklaNo ratings yet

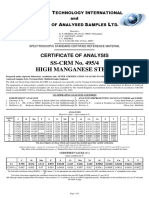

- Ss CRM 495 - 4Document2 pagesSs CRM 495 - 4lehdruk7100No ratings yet

- Id Pengaruh Brand Image Dan Product Design Purchase Decision Purchase IntentionDocument14 pagesId Pengaruh Brand Image Dan Product Design Purchase Decision Purchase IntentionNi Kd Asrilina PutrawanNo ratings yet

- Chemistry Practicals VivaDocument17 pagesChemistry Practicals VivaPriyanshu BajajNo ratings yet

- OPzV Solar PowerDocument2 pagesOPzV Solar PowerSINES FranceNo ratings yet

- Geometry Basics VocabularyDocument39 pagesGeometry Basics VocabularyIsrael Jimenez FelixNo ratings yet

- Data Sheet 6ES7214-1AG40-0XB0: General InformationDocument10 pagesData Sheet 6ES7214-1AG40-0XB0: General InformationPCNo ratings yet

- J. R. Simonson (Auth.) - Engineering Heat Transfer-Palgrave Macmillan UK (1988)Document280 pagesJ. R. Simonson (Auth.) - Engineering Heat Transfer-Palgrave Macmillan UK (1988)Glasst Innovacion 2019100% (2)

- Mmse and MseDocument3 pagesMmse and Mse황춘히No ratings yet

- Section I (Compulsory) Will Contain Short Answer: Class XDocument5 pagesSection I (Compulsory) Will Contain Short Answer: Class XGeorge Stephen TharakanNo ratings yet

- (23 176 of Polycrystalline Nickel: On The Mechanism of Low-Temperature OxidationDocument5 pages(23 176 of Polycrystalline Nickel: On The Mechanism of Low-Temperature OxidationPaty ChiluisaNo ratings yet

- Admin Journal Manager 80 88 GanjarDocument9 pagesAdmin Journal Manager 80 88 Ganjarpanda SipitNo ratings yet

- DPP 5 (Solid State) : 4 Floor, 415, Hariom Tower, Circular Road, Ranchi-1, Ph.:0651-2563332, Mob.: 9334191806, 6206564296Document2 pagesDPP 5 (Solid State) : 4 Floor, 415, Hariom Tower, Circular Road, Ranchi-1, Ph.:0651-2563332, Mob.: 9334191806, 6206564296ajaxNo ratings yet

- Mte 02 e (2016)Document5 pagesMte 02 e (2016)Alok ThakkarNo ratings yet

- IECEx Za Namur Davač ImpulsaDocument12 pagesIECEx Za Namur Davač Impulsajosip miskovicNo ratings yet

- 16-22kw Gaurdian Spec SheetDocument5 pages16-22kw Gaurdian Spec SheetJose RomeroNo ratings yet

- Rahman MD Matiur-2230130236-10noDocument4 pagesRahman MD Matiur-2230130236-10noadnanNo ratings yet

- Chapter 7 - Climate - Solutions For Class 10 ICSE Total Geography Morning Star - KnowledgeBoatDocument5 pagesChapter 7 - Climate - Solutions For Class 10 ICSE Total Geography Morning Star - KnowledgeBoatSuraj Yadav100% (1)