Professional Documents

Culture Documents

Hsslive-xii-acc-ca-key-ajith-march-2024

Hsslive-xii-acc-ca-key-ajith-march-2024

Uploaded by

SARVY JOSEPHCopyright:

Available Formats

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Assignment Submission Form: Student Name PG IdDocument4 pagesAssignment Submission Form: Student Name PG IdKartik DharNo ratings yet

- ESENECO (2) Interest Money Time RelationshipDocument50 pagesESENECO (2) Interest Money Time Relationshipjhonel guinto100% (3)

- Nemo Dat Quod Non Habet EssayDocument4 pagesNemo Dat Quod Non Habet Essayshidot100% (1)

- Hsslive Xii Acc CA Key Binoy March 2024Document9 pagesHsslive Xii Acc CA Key Binoy March 2024SARVY JOSEPHNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805No ratings yet

- Admission of PartnersDocument11 pagesAdmission of Partnerssneha sasidharanNo ratings yet

- Amalgamation and Sale of FirmDocument57 pagesAmalgamation and Sale of FirmShrutika singhNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Xyhhj 3 of 1 Aud 1 W EKXw QLDocument11 pagesXyhhj 3 of 1 Aud 1 W EKXw QLhk6206131516No ratings yet

- Retirement - Final RevisionDocument15 pagesRetirement - Final Revisionshahid29juneNo ratings yet

- Partnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)Document6 pagesPartnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)DevanshuNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- ACC 2024 Pre Board PDFDocument12 pagesACC 2024 Pre Board PDFKeshvi.No ratings yet

- Partnership Accounts: Chapter - 8Document46 pagesPartnership Accounts: Chapter - 8Biju PerinkottilNo ratings yet

- 12 Accounts Imp Ch1Document22 pages12 Accounts Imp Ch1Tushar Tyagi100% (1)

- Partnership - Admission of Partner - DPP 02 (Of Lecture 04) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 02 (Of Lecture 04) - (Kautilya)DevanshuNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDocument16 pages12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNo ratings yet

- Accounts ProjectDocument21 pagesAccounts ProjectSaksham SrivastavaNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 01Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 01Rohan RughaniNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- PREMIUM MOCK 01 BY SUNIL SIR_Document11 pagesPREMIUM MOCK 01 BY SUNIL SIR_rsshamithaNo ratings yet

- Company AccountingDocument34 pagesCompany AccountingThierry Dominique Moustaphe GomisNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- Delhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Document3 pagesDelhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Lekhana WesleyNo ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- 12th CBSE CFE Monthly July_solutionDocument12 pages12th CBSE CFE Monthly July_solutionvh7014757No ratings yet

- G Awa Mil 5 D ADIi FZ DJ HV ADocument10 pagesG Awa Mil 5 D ADIi FZ DJ HV APriyankadevi PrabuNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- 67 1 1 Accountancy MsDocument12 pages67 1 1 Accountancy MsEric PottsNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- S No 29Document92 pagesS No 29Kumkum AggarwalNo ratings yet

- Advanced Corporate AccountingDocument2 pagesAdvanced Corporate AccountingVanshika JainNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Accountancy - Class XII SQP (2019-20) : General InstructionsDocument8 pagesAccountancy - Class XII SQP (2019-20) : General Instructionsmohit pandeyNo ratings yet

- 6001q1specimen PaperDocument12 pages6001q1specimen Paperckjoshua819100% (1)

- CBSE Class 12 Accountancy Sample Paper 2019 Solved PDFDocument26 pagesCBSE Class 12 Accountancy Sample Paper 2019 Solved PDFMihir KhandelwalNo ratings yet

- Click Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalDocument59 pagesClick Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalTUHIN SUBHARA PATOWARYNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 03Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 03sneha muralidharanNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set1 PDFDocument42 pages12 Accountancy Lyp 2017 Outside Delhi Set1 PDFAshish GangwalNo ratings yet

- Worksheet Accounts Ut 1 RefrenceDocument10 pagesWorksheet Accounts Ut 1 Refrencemayankkochar216No ratings yet

- Cbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionDocument17 pagesCbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionmeetuNo ratings yet

- A-Levels Accounting RandalDocument36 pagesA-Levels Accounting RandalchauromweaNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument19 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- Corporate AccountingDocument93 pagesCorporate AccountingKalp JainNo ratings yet

- Additional Illustratiions 2Document14 pagesAdditional Illustratiions 2Naman ChotiaNo ratings yet

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDocument7 pagesFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- QP Accountancy XIIDocument9 pagesQP Accountancy XIITûshar ThakúrNo ratings yet

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- Admission Test - QP AcctsDocument6 pagesAdmission Test - QP AcctsRifat MerchantNo ratings yet

- 12 Accountancy Accounting For Partnership Firms FundamentalsDocument6 pages12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNo ratings yet

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Principles of Management Principles of Management 4 Homework Homework Questions QuestionsDocument10 pagesPrinciples of Management Principles of Management 4 Homework Homework Questions QuestionsluckiflyNo ratings yet

- Cash Book Revision o LevelDocument10 pagesCash Book Revision o Levelnajla nisthar0% (1)

- Earned Value ManagementDocument12 pagesEarned Value ManagementNasin BabuNo ratings yet

- TPM 3rd B KSBpumPsDocument44 pagesTPM 3rd B KSBpumPsJawad Ahmad Bin Khan100% (1)

- DQ1 - Calling Script - Post Tele in Follow UpDocument2 pagesDQ1 - Calling Script - Post Tele in Follow UpMalwaHonda GMNo ratings yet

- Prac2 1Document17 pagesPrac2 1Joana Marie SaperaNo ratings yet

- Qntmeth9 PPT ch03Document75 pagesQntmeth9 PPT ch03Daniel AyalaNo ratings yet

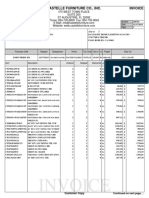

- Invoice: Castelle Furniture Co., Inc. InvoiceDocument4 pagesInvoice: Castelle Furniture Co., Inc. InvoiceNathaly LeivaNo ratings yet

- SS 80-100 1072Document1 pageSS 80-100 1072Rodrigo SantosNo ratings yet

- Region of Sardinia Italy - WellbeignDocument45 pagesRegion of Sardinia Italy - Wellbeignlego mihandNo ratings yet

- 07 GPPBDocument95 pages07 GPPBTrishia Garcia100% (1)

- Construction Assign 3Document14 pagesConstruction Assign 3Sharjeel AliNo ratings yet

- Pressure Welded Steel GratingsDocument1 pagePressure Welded Steel GratingsMD Abu Bakar SiddiqueNo ratings yet

- Chapter 04 Consolidation ofDocument64 pagesChapter 04 Consolidation ofBetty Santiago100% (1)

- Executive Summary PTK-KJP Published 160524 PDFDocument41 pagesExecutive Summary PTK-KJP Published 160524 PDFGuido ContiniNo ratings yet

- Mana Ooru-Mana Badi: Payment Authorization CertificateDocument1 pageMana Ooru-Mana Badi: Payment Authorization CertificateC Chandra ShekarNo ratings yet

- Full Economics 10Th Edition Boyes Test Bank Online PDF All ChapterDocument64 pagesFull Economics 10Th Edition Boyes Test Bank Online PDF All Chaptermauraanaviolat284100% (6)

- An Essay On FriendshipDocument2 pagesAn Essay On FriendshipCosmin Kaze80% (10)

- Demand PerformaDocument12 pagesDemand PerformaMuhammad Asif LillaNo ratings yet

- Demand ForecastingDocument26 pagesDemand Forecastingnuraini9332No ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- 18 International Capital BudgetingDocument49 pages18 International Capital BudgetingBrijesh Chauhan100% (1)

- Tutorial 9: Week Starting October 12th SolutionsDocument8 pagesTutorial 9: Week Starting October 12th SolutionsJonty JenkinsNo ratings yet

- CounterfeitingDocument21 pagesCounterfeitingnujahm1639No ratings yet

- Management The Essentials Australia 4th Edition Robbins Test BankDocument29 pagesManagement The Essentials Australia 4th Edition Robbins Test BankKennethLambertrgekz100% (15)

- Transaction Immovable Property Intimation 18Document2 pagesTransaction Immovable Property Intimation 18rasiya49No ratings yet

- Uniform Standardfor Wood Containers 2009Document44 pagesUniform Standardfor Wood Containers 2009McArthur2010No ratings yet

Hsslive-xii-acc-ca-key-ajith-march-2024

Hsslive-xii-acc-ca-key-ajith-march-2024

Uploaded by

SARVY JOSEPHCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hsslive-xii-acc-ca-key-ajith-march-2024

Hsslive-xii-acc-ca-key-ajith-march-2024

Uploaded by

SARVY JOSEPHCopyright:

Available Formats

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.

in ®

Answer Key – (Unofficial) – by Ajith Kanthi Wayanad

Class 12 – Accountancy CA – March 2024 – Qn Code: SY – 550

PART – A (ACCOUNTING – 40 Score)

1 Score – All Questions from 1 to 4

1 a) Current A/c

2 c) Old Ratio

3 c) Executor’s Loan A/c

4 a) 3:2

2 Score - Any 3 Questions from 5 to 8

5 a) Profit sharing ratio – Equal

b) Interest on loan – 6%pa

6 Rights of a new partner

1. Right to share the assets of the partnership firm

2. Right to share the profits of the partnership firm

7 Loss to be paid: i) first out of profits,

ii) next out of capital

8 Treatment of Goodwill on admission of a partner:

Cash Account Dr 115000

To Sachu’s Capital A/c 75000

To Goodwill A/c 40000

(Amount brought in by the new partner as capital & goodwill)

Goodwill Account Dr 40000

To Aswin’s Capital A/c 25000

To Neha’s Capital A/c 15000

(Goodwill transferred to the old partners’ capital account in their sacrificing ratio – 5:3)

3 Score - All Questions from 9 to 12

9 Difference between Fixed Capital and Fluctuating Capital Methods

FIXED CAPTIAL METHOD FLUCTUATING CAPITAL METHOD

1. Two accounts are maintained, ie, capital a/c 1. Only one account ie, capital a/c is prepared.

and current a/c

2. Usually, the amount of capital remains the 2. The amount of capital is fluctuating

same year after year.

3. Adjustments like interest on capital, 3. Adjustments are made in the capital a/c itself.

drawings, interest on drawings, etc. are made in

the current a/c

4. Both the current a/c and the capital a/c are 4. Only the capital a/c appears in the Balance

appeared in the Balance Sheet Sheet.

5. It should be specifically mentioned in the 6. It is not necessary.

deed.

(Any 3)

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 1

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.in ®

10 Calculation of Goodwill:

Super Profit = Average Profit – Normal Profit.

Normal Profit = Capital Employed x Normal Rate of Return / 100

Goodwill = Super Profit x Number of year’s

Average Profit = (20000+40000+50000+70000) / 4 = 45000

Normal Profit = 200000 x 10% = 20000

:. Super Profit = 45000 – 20000 = 25000

:. Goodwill = 25000 x 4 = 100000

11 Journal Entries:

a) Reserve A/c Dr 3000

To A’s Capital A/c 1000

To B’s Capital A/c 1000

To C’s Capital A/c 1000

(The amount of reserve transferred to all partners in their profit sharing ratio)

b) A’s Capital A/c Dr 2000

B’s Capital A/c Dr 2000

C’s Capital A/c Dr 2000

To Profit & Loss A/c 6000

(Share of Loss transferred to all partners in their profit sharing ratio)

12 Differences between Dissolution of partnership and Dissolution of a firm:

DISSOLUTION OF

BASIS DISSOLUTION OF FIRM

PARTNERSHIP

Economic relation between the Partnership between all the partners

1. Meaning

partners change of a firm comes to an end.

The business of the firm is

2. Termination The business is not terminated

completely closed.

3. Court’s Court may intervene and order for

No court intervention

intervention dissolution of firm.

Assets are sold, liabilities are paid off

Assets and liabilities are revalued

4. Settlement and balance utilized towards

and new balance sheet is prepared

settlement of partners.

5. Closure of Books Books of accounts are not closed All books of accounts are closed.

6. Settlement of Assets are sold and liabilities are paid

Assets and liabilities are revalued

Assets and Liabilities off.

(any 3)

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 2

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.in ®

5 Score - All Questions from 13 to 14

13 Calculation of Interest on Capital:

Amal Bimal

Interest for the first 4 months 40000 x 6% x 4/12 800

30000 x 6% x 4/12 600

Interest for the next 5 months 60000 x 6% 5/12 1500

(Amal 40000+20000 = 60000) 60000 x 6% 5/12 1500

(Bimal 30000+30000 = 60000)

Interest for the last 3 months after

withdrawal

(Amal 60000 - 10000 = 50000) 50000 x 6% 3/12 750

(Bimal 60000 - 0 = 60000) 60000 x 6% 3/12 900

:. Total Interest for the year 3050 3000

14 A’s Loan Account

Date Particulars Amount Date Particulars Amount

st st

1 Year To Cash (20000+6000) 26000 1 Year By A’s Capital A/c 60000

To Balance c/d 40000 By Interest on Loan (10%) 6000

66000 66000

2nd Year To Cash (20000+4000) nd

24000 2 Year By Balance b/d 40000

To Balance c/d 20000 By Interest on Loan 4000

44000 44000

3rd Year To Cash (20000+2000) rd

22000 3 Year By Balance b/d 20000

By Interest on Loan 2000

22000 22000

8 Score - Any 1Question from 15 to 16

15 Revaluation A/c

Particulars Amount Particulars Amount

Stock 5600 Investment (Unrecorded) 8000

Provision for doubtful debts 2000

Partners’ Capital A/c (3:2)

Arjun 240

Bineesh 160 400

8000 8000

Partners’ Capital A/c

Particulars Arjun Bineesh Vimal Particulars Arjun Bineesh Vimal

Cash 7200 4800 Balance b/d 25000 20000 ---

Reserve (3:2) 4800 3200

Cash 35000

Balance c/d 30040 23360 35000 Goodwill (3:2) 7200 4800

Revaluation A/c 240 160

37240 28160 35000 37240 28160 35000

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 3

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.in ®

Balance Sheet (After Admission)

Liabilities Amount Assets Amount

Creditors 67000 Cash in hand (4000+35000) 39000

Capital A/c Sundry Debtors 40000

Arjun 30040 Less: Provision 2000 38000

Bineesh 23360 Stock (56000 – 5600) 50400

Vimal 35000 88400 Land and Buildings 20000

Investment 8000

155400 155400

16 Dissolution of Partnership Firm:

Realisation A/c

Particulars Amount Particulars Amount

To Stock 25000 By Creditors 60000

To Furniture 20000 By Mrs. A’s Loan A/c 6000

To Bank (Creditors 60000-1000) 59000 By Bank (Stock) 23000

To Bank (Realization Exp) 1000 By Bank (Furniture) 24000

To Bank (Mrs. A’s Loan) 6000

To Partners’ Capital A/c (Profit)

A 1200

B 800 2000

110000 113000

Partners’ Capital A/c

Particulars A B Particulars A B

To Profit & Loss A/c 900 600 By Balance b/d 18000 12000

(Accumulated Loss) By Realisation A/c 1200 800

To Bank A/c (Final settlement 18300 12200

to partners)

19200 12800 19200 12800

Bank A/c (Cash A/c)

Particulars Amount Particulars Amount

To Balance b/d 53500 By Realisation A/c (Creditors) 59000

To Realisation A/c (Stock) 23000 By Realisation A/c (Realsn. Exp) 1000

To Realisation A/c (Furniture) 24000 By Realisation A/c (Mrs. A’s Loan) 6000

By B’s Loan A/c 4000

ByPartners’ Capital A/c – A - 18300 30500

B - 12200

100500 100500

Note: In this question Bank balance is given in the balance sheet, hence Bank A/c is prepared instead of

Cash A/c

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 4

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.in ®

PART – B (COMPUTERISED ACCOUNTING – 20 Score)

1 Score – All Questions from 17 to 19

17 b) NOW Function

18 c) Mnemonic codes

19 b) Journal

2 Score – Any 4Questions from 20 to 24

20 a) COUNTBLANK

B) CONCATENATE

21 a) Chart Area

b) Legend

22 Steps to Create Chart: Data Entry - Data Selection - Insert – Chart – Chart Type - Finish.

23 Deleting Ledger Accounts in GNUKhata – Select Edit Account from Master menu - Select the ledger

Account to be deleted, click on Delete Button and confirm the deletion.

24 a) Tables – Tables allows a database designer to create the data tables with their respective field names,

data types and its properties. It is used to store the data.

b) Queries – This component is used to retrieve filtered data and information from the table and to

include computation fields.

3 Score – Any 3 Questions from 25 to 28

25 Accounting Information System (AIS)

1. Cash and Bank Sub system – It deals with the receipts and payments of cash. Both physical cash

and electronic fund cash.

2. Sales and Accounts Receivable sub system – it deals with recording of sales, maintaining of sales

ledger and receivables.

3. Inventory sub system – it deals with recording of different items purchased and issued

specifying the price, quantity and date. (or any other 3 with explanation)

26 Payroll Components:

Earnings Deductions

Basic Pay TDS

HRA PF

DA Professional Tax

27 Features of GNUKhata

a) It is a free and open source accounting software

b) It is based on double entry book keeping

c) Comprehensive financial reports are available like Ledgers, Trial balance, Profit and loss Account,

Balance sheet etc.

d) Source document can be attached along with the voucher entry.

e) Export and import of data from Spread sheet is possible.

f) Password security and data audit facility provided. (any 3)

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 5

Join Now: https://join.hsslive.in Downloaded from https://www.hsslive.in ®

28 a) COUNTIF : This function is used to count the number of cells that meet a criteria. The criteria can be a

number, expression, cell reference, or text string. For example, you can use a number like 32, a

comparison like ">32", a cell like B44, or a word like "apples".

Syntax: =Countif(Range,Criteria) Eg: =Countif(A1:A10,”>=90”)

b) PMT: This function calculates the constant periodic payment required to pay off a loan or investment,

with a constant interest rate, over a specified period. (To calculate EMI of a loan)

Syntax: =PMT( rate, nper, pv, fv, type)

c) SUMIF: This function adds all numbers in a range of cells, only if it meets the given criteria.

Syntax: =Sumif(Range,Criteria,Sum_range)

Prepared by:

Ajith Kanthi @ Ajith P P

SKMJ HSS Kalpetta

Wayanad – Kerala

Ph: 9446162771

Visit HssVoice Blog for latest updates: www.hssplustwo.blogspot.com

Ajith Kanthi @ Ajith P P – SKMJ HSS Kalpetta – Wayanad - 9446162771 Page 6

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Assignment Submission Form: Student Name PG IdDocument4 pagesAssignment Submission Form: Student Name PG IdKartik DharNo ratings yet

- ESENECO (2) Interest Money Time RelationshipDocument50 pagesESENECO (2) Interest Money Time Relationshipjhonel guinto100% (3)

- Nemo Dat Quod Non Habet EssayDocument4 pagesNemo Dat Quod Non Habet Essayshidot100% (1)

- Hsslive Xii Acc CA Key Binoy March 2024Document9 pagesHsslive Xii Acc CA Key Binoy March 2024SARVY JOSEPHNo ratings yet

- ACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020Document7 pagesACCOUNTANCY (CA) Answer Key Kerala +2 Annual Exam March 2020soumyabibin573No ratings yet

- Accounts 3Document42 pagesAccounts 3SubodhSaxenaNo ratings yet

- MLM Xii Accountancy 22-23 PDFDocument34 pagesMLM Xii Accountancy 22-23 PDFayush5sharma805No ratings yet

- Admission of PartnersDocument11 pagesAdmission of Partnerssneha sasidharanNo ratings yet

- Amalgamation and Sale of FirmDocument57 pagesAmalgamation and Sale of FirmShrutika singhNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Xyhhj 3 of 1 Aud 1 W EKXw QLDocument11 pagesXyhhj 3 of 1 Aud 1 W EKXw QLhk6206131516No ratings yet

- Retirement - Final RevisionDocument15 pagesRetirement - Final Revisionshahid29juneNo ratings yet

- Partnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)Document6 pagesPartnership - Admission of Partner - DPP 04 (Of Lecture 06) - (Kautilya)DevanshuNo ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- Accounts SamplepaperDocument29 pagesAccounts SamplepaperPawni JadhavNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- ACC 2024 Pre Board PDFDocument12 pagesACC 2024 Pre Board PDFKeshvi.No ratings yet

- Partnership Accounts: Chapter - 8Document46 pagesPartnership Accounts: Chapter - 8Biju PerinkottilNo ratings yet

- 12 Accounts Imp Ch1Document22 pages12 Accounts Imp Ch1Tushar Tyagi100% (1)

- Partnership - Admission of Partner - DPP 02 (Of Lecture 04) - (Kautilya)Document8 pagesPartnership - Admission of Partner - DPP 02 (Of Lecture 04) - (Kautilya)DevanshuNo ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- 12 Accounts CBSE Sample Papers 2019 Marking SchemeDocument16 pages12 Accounts CBSE Sample Papers 2019 Marking SchemeSalokya KhandelwalNo ratings yet

- Accounts ProjectDocument21 pagesAccounts ProjectSaksham SrivastavaNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 01Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 01Rohan RughaniNo ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- PREMIUM MOCK 01 BY SUNIL SIR_Document11 pagesPREMIUM MOCK 01 BY SUNIL SIR_rsshamithaNo ratings yet

- Company AccountingDocument34 pagesCompany AccountingThierry Dominique Moustaphe GomisNo ratings yet

- Premium Mock 03Document13 pagesPremium Mock 03Rahul MajumdarNo ratings yet

- Delhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Document3 pagesDelhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Lekhana WesleyNo ratings yet

- 12 Accountancy Lyp 2015 Foreign Set1Document42 pages12 Accountancy Lyp 2015 Foreign Set1Ashish GangwalNo ratings yet

- 12th CBSE CFE Monthly July_solutionDocument12 pages12th CBSE CFE Monthly July_solutionvh7014757No ratings yet

- G Awa Mil 5 D ADIi FZ DJ HV ADocument10 pagesG Awa Mil 5 D ADIi FZ DJ HV APriyankadevi PrabuNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- 67 1 1 Accountancy MsDocument12 pages67 1 1 Accountancy MsEric PottsNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument6 pages© The Institute of Chartered Accountants of IndiatilokiNo ratings yet

- S No 29Document92 pagesS No 29Kumkum AggarwalNo ratings yet

- Advanced Corporate AccountingDocument2 pagesAdvanced Corporate AccountingVanshika JainNo ratings yet

- Study Note 4.3, Page 198-263Document66 pagesStudy Note 4.3, Page 198-263s4sahithNo ratings yet

- Accountancy - Class XII SQP (2019-20) : General InstructionsDocument8 pagesAccountancy - Class XII SQP (2019-20) : General Instructionsmohit pandeyNo ratings yet

- 6001q1specimen PaperDocument12 pages6001q1specimen Paperckjoshua819100% (1)

- CBSE Class 12 Accountancy Sample Paper 2019 Solved PDFDocument26 pagesCBSE Class 12 Accountancy Sample Paper 2019 Solved PDFMihir KhandelwalNo ratings yet

- Click Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalDocument59 pagesClick Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalTUHIN SUBHARA PATOWARYNo ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 03Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 03sneha muralidharanNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set1 PDFDocument42 pages12 Accountancy Lyp 2017 Outside Delhi Set1 PDFAshish GangwalNo ratings yet

- Worksheet Accounts Ut 1 RefrenceDocument10 pagesWorksheet Accounts Ut 1 Refrencemayankkochar216No ratings yet

- Cbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionDocument17 pagesCbse Class XII Accountancy All India Board Paper Set 1 - 2019 SolutionmeetuNo ratings yet

- A-Levels Accounting RandalDocument36 pagesA-Levels Accounting RandalchauromweaNo ratings yet

- Account Ch-1 Partnership Firm - FundamentalsDocument19 pagesAccount Ch-1 Partnership Firm - Fundamentalsapsonline8585No ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- Corporate AccountingDocument93 pagesCorporate AccountingKalp JainNo ratings yet

- Additional Illustratiions 2Document14 pagesAdditional Illustratiions 2Naman ChotiaNo ratings yet

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDocument7 pagesFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- QP Accountancy XIIDocument9 pagesQP Accountancy XIITûshar ThakúrNo ratings yet

- Paper 2 Accountancy 2 2pb QP Set 2Document9 pagesPaper 2 Accountancy 2 2pb QP Set 2Harini NarayananNo ratings yet

- Admission Test - QP AcctsDocument6 pagesAdmission Test - QP AcctsRifat MerchantNo ratings yet

- 12 Accountancy Accounting For Partnership Firms FundamentalsDocument6 pages12 Accountancy Accounting For Partnership Firms FundamentalsIqra MughalNo ratings yet

- Fundamentals QuestionsDocument23 pagesFundamentals Questionsdhanvi1259No ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Corporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringFrom EverandCorporate Financial Mastering: Simple Methods and Strategies to Financial Analysis MasteringNo ratings yet

- Principles of Management Principles of Management 4 Homework Homework Questions QuestionsDocument10 pagesPrinciples of Management Principles of Management 4 Homework Homework Questions QuestionsluckiflyNo ratings yet

- Cash Book Revision o LevelDocument10 pagesCash Book Revision o Levelnajla nisthar0% (1)

- Earned Value ManagementDocument12 pagesEarned Value ManagementNasin BabuNo ratings yet

- TPM 3rd B KSBpumPsDocument44 pagesTPM 3rd B KSBpumPsJawad Ahmad Bin Khan100% (1)

- DQ1 - Calling Script - Post Tele in Follow UpDocument2 pagesDQ1 - Calling Script - Post Tele in Follow UpMalwaHonda GMNo ratings yet

- Prac2 1Document17 pagesPrac2 1Joana Marie SaperaNo ratings yet

- Qntmeth9 PPT ch03Document75 pagesQntmeth9 PPT ch03Daniel AyalaNo ratings yet

- Invoice: Castelle Furniture Co., Inc. InvoiceDocument4 pagesInvoice: Castelle Furniture Co., Inc. InvoiceNathaly LeivaNo ratings yet

- SS 80-100 1072Document1 pageSS 80-100 1072Rodrigo SantosNo ratings yet

- Region of Sardinia Italy - WellbeignDocument45 pagesRegion of Sardinia Italy - Wellbeignlego mihandNo ratings yet

- 07 GPPBDocument95 pages07 GPPBTrishia Garcia100% (1)

- Construction Assign 3Document14 pagesConstruction Assign 3Sharjeel AliNo ratings yet

- Pressure Welded Steel GratingsDocument1 pagePressure Welded Steel GratingsMD Abu Bakar SiddiqueNo ratings yet

- Chapter 04 Consolidation ofDocument64 pagesChapter 04 Consolidation ofBetty Santiago100% (1)

- Executive Summary PTK-KJP Published 160524 PDFDocument41 pagesExecutive Summary PTK-KJP Published 160524 PDFGuido ContiniNo ratings yet

- Mana Ooru-Mana Badi: Payment Authorization CertificateDocument1 pageMana Ooru-Mana Badi: Payment Authorization CertificateC Chandra ShekarNo ratings yet

- Full Economics 10Th Edition Boyes Test Bank Online PDF All ChapterDocument64 pagesFull Economics 10Th Edition Boyes Test Bank Online PDF All Chaptermauraanaviolat284100% (6)

- An Essay On FriendshipDocument2 pagesAn Essay On FriendshipCosmin Kaze80% (10)

- Demand PerformaDocument12 pagesDemand PerformaMuhammad Asif LillaNo ratings yet

- Demand ForecastingDocument26 pagesDemand Forecastingnuraini9332No ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- 18 International Capital BudgetingDocument49 pages18 International Capital BudgetingBrijesh Chauhan100% (1)

- Tutorial 9: Week Starting October 12th SolutionsDocument8 pagesTutorial 9: Week Starting October 12th SolutionsJonty JenkinsNo ratings yet

- CounterfeitingDocument21 pagesCounterfeitingnujahm1639No ratings yet

- Management The Essentials Australia 4th Edition Robbins Test BankDocument29 pagesManagement The Essentials Australia 4th Edition Robbins Test BankKennethLambertrgekz100% (15)

- Transaction Immovable Property Intimation 18Document2 pagesTransaction Immovable Property Intimation 18rasiya49No ratings yet

- Uniform Standardfor Wood Containers 2009Document44 pagesUniform Standardfor Wood Containers 2009McArthur2010No ratings yet