Professional Documents

Culture Documents

MEC 57 - PS 1 - DUE 08.22.23

MEC 57 - PS 1 - DUE 08.22.23

Uploaded by

jaybellelatras0 ratings0% found this document useful (0 votes)

1 views1 pageMEC 57

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMEC 57

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageMEC 57 - PS 1 - DUE 08.22.23

MEC 57 - PS 1 - DUE 08.22.23

Uploaded by

jaybellelatrasMEC 57

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

MEC 57 – PRACTICE SET 1 FOR SUBMISSION D.3.

Assuming LISAYAH acquired 90% of the outstanding

ordinary share of JISOYAHH for P243,000 and noncontrolling

Instructions: interest is measured at fair value , compute for total consolidated

Use a clean sheet of paper, write your solutions and assets on the date of acquisition.

box your final answers.

Submit at the faculty on Tuesday, August 22,

10.30am. E. April 30, 2023, Papa Corp. issues 30,000 shares of its no-par

value common stock having a current fair value of P20 a share

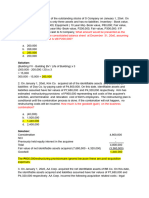

A. On the day of acquisition of S Co. had the following assets for 8,000 shares of Siya Inc,’s P10 par common stock. Out of

and liabilities: pocket costs of the business combination, paid by SIYA on

behalf of Pop on April 30 were as follows:

Professional fees relation to business combination P40,000

SEC registration costs P30,000

Separate balance sheets of the two companies on April 30, 2023

P Company paid P350,000 for 90% of the common stock of S prior to the combination were as follows:

Co. Compute for the goodwill to be reported on the

consolidated balance sheet as of date of acquisition.

B. The PLINK Co. acquired a 70% interest in the SLACK

Company for P4,970,000 when the fair value of SLACK’s

identifiable assets and liabilities was P4,200,000. PLINK

acquired 65% interest in the STARK Co. for P1,050,000 when

the fair value of STARK’s identifiable assets and liabilities was

P2,240,000. PLINK measures noncontrolling interests at the

relevant share of the identifiable net assts at the acquisition

date. Neither SLACK nor STARK had any contingent liabilities

at the acquisition date and the above fair values were the same

as the carrying amounts in their financial statements. Annual

impairment reviews have not resulted in any impairment losses

being recognized.

Current fair value of SIYA’s identifiable net assets were the same

Compute for the goodwill/ gain on bargain purchase at the date as their book values, except for the following:

of acquisition.

Inventories P440,000

Plant assets – net 780,000

C. BLACKPINK Company acquires 25% of YG’s ordinary stock Long-term debt 620,000

for P190,000 cash and carries the investment using the cost

method. After 3 months, BLACKPINK purchases another 60%

of YG’s ordinary stock for P540,000. On this date, acquired Prepare a consolidation working paper for consolidated balance

company reports identifiable net assets with carrying value of sheet of Papa Corp and subsidiary on April 30, 2023.

P720,000 and fair value of P920,000. The Liabilities of the Make sure to show the journal entries supporting the working

acquired company has a book value and a fair value of paper.

P280,000. The fair value of the 15% noncontrolling interest is

P125,000.

Compute for the goodwill/ gain on bargain purchase at the date

of acquisition.

D. On January 2, 2023, the statement of financial position of

LISAYAH and JISOOYAH Inc. prior to the combination are:

The fair value of JISOOYAH’s equipment is P153,000.

Assume the following independent cases:

D.1. Assuming LISAYAH acquired 70% of the outstanding

ordinary share of JISOYAHH for P105,000 and noncontrolling

interest is measured at fair value of P61,000, compute for the

goodwill/ gain on acquisition.

D.2. Assuming LISAYAH acquired 80% of the outstanding

ordinary share of JISOYAHH for P136,800 and noncontrolling

interest is measured at proportionate share of JISOOYAH’s

identifiable net assets, compute for the consolidated

stockholders’ equity on the date of acquisition.

You might also like

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- Paul Tudor JonesDocument11 pagesPaul Tudor JonesPalanisamy BalasubramaniNo ratings yet

- Buscommmmmmmm 1Document7 pagesBuscommmmmmmm 1Erico PaderesNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Bristle Corporation Acquired 75 Percent of Silver CorporationDocument5 pagesBristle Corporation Acquired 75 Percent of Silver CorporationJamhel Marquez100% (1)

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- October 2016 Advanced Financial Accounting Reporting Final Pre BoardDocument18 pagesOctober 2016 Advanced Financial Accounting Reporting Final Pre BoardhellokittysaranghaeNo ratings yet

- 1861 BuffettArbitrage (PDF Reference)Document1 page1861 BuffettArbitrage (PDF Reference)Loni ScottNo ratings yet

- Business Combination Problem SetDocument6 pagesBusiness Combination Problem SetbigbaekNo ratings yet

- Ap 9401-1 SheDocument4 pagesAp 9401-1 SheLuzviminda SaspaNo ratings yet

- Task 1Document1 pageTask 1Robin ScherbatskyNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- Take Home Quiz Consolidated Business AccountingDocument2 pagesTake Home Quiz Consolidated Business AccountingTheodore BayalasNo ratings yet

- Midterms SolutionDocument9 pagesMidterms SolutiondmangiginNo ratings yet

- SEPARATE and CONSOLIDATED STATEMENTSDocument4 pagesSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraNo ratings yet

- Afar 2 ExamDocument3 pagesAfar 2 ExamNurul-Fawzia Balindong0% (4)

- Afar 2Document24 pagesAfar 2KriztleKateMontealtoGelogo100% (1)

- ACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SDocument24 pagesACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SGiner Mabale StevenNo ratings yet

- Afar Section 402: Business CombinationsDocument3 pagesAfar Section 402: Business CombinationsDianna Tercino IINo ratings yet

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- Buscom Part 1 Handouts - 747606051Document7 pagesBuscom Part 1 Handouts - 747606051CLINT SHEEN CABIASNo ratings yet

- Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesBusiness Combination Practical Accounting 2 Date of AcquisitionEdi wow WowNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Aa BcprelimsDocument4 pagesAa BcprelimsJamie RamosNo ratings yet

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- Classroom Exercises On Business Combinations and Consolidation - Date of AcquisitionDocument6 pagesClassroom Exercises On Business Combinations and Consolidation - Date of AcquisitionalyssaNo ratings yet

- Quiz BeeDocument58 pagesQuiz BeeShane Almoguera100% (1)

- Final Exam Advance IIDocument4 pagesFinal Exam Advance IIRobin RossNo ratings yet

- Advanced Financial Accounting and Reporting Business Combination February 14, 2019Document3 pagesAdvanced Financial Accounting and Reporting Business Combination February 14, 2019iptrcrmlNo ratings yet

- Practical Accounting 2 - ExaminationDocument10 pagesPractical Accounting 2 - ExaminationPrincess Claris ArauctoNo ratings yet

- This Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesThis Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionAnneShannenBambaDabuNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- EXAM About INTANGIBLE ASSETS 4Document3 pagesEXAM About INTANGIBLE ASSETS 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Date of Acquisition ExercisesDocument2 pagesDate of Acquisition ExercisesMeleen TadenaNo ratings yet

- 2018cpapassers PDFDocument4 pages2018cpapassers PDFBryan Bryan BacarisasNo ratings yet

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzNo ratings yet

- Business Combination Subsequent To Date of AcquisitionDocument1 pageBusiness Combination Subsequent To Date of AcquisitionAdrian MontemayorNo ratings yet

- Business Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Document1 pageBusiness Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Akako MatsumotoNo ratings yet

- Chap 2 Take Home Activity 1Document2 pagesChap 2 Take Home Activity 1Jhaister Ashley LayugNo ratings yet

- IFRS 3 Business CombinationDocument15 pagesIFRS 3 Business CombinationAquino KimalexerNo ratings yet

- Drill Problems For Second VideoDocument6 pagesDrill Problems For Second VideoNoeme Lansang0% (1)

- Cpar AfarDocument21 pagesCpar AfarFrancheska NadurataNo ratings yet

- Toaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRDocument18 pagesToaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRrodell pabloNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- P2 Business Combination - GuerreroDocument18 pagesP2 Business Combination - GuerreroCelen OchocoNo ratings yet

- 94 - Final Preaboard AFAR - UnlockedDocument17 pages94 - Final Preaboard AFAR - UnlockedJessaNo ratings yet

- Problem 2-BSDocument2 pagesProblem 2-BSteraNo ratings yet

- PP CorporationDocument2 pagesPP CorporationWawex DavisNo ratings yet

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- Resa b45 Far Final PB Exam Questions Answers Solutions CompressDocument21 pagesResa b45 Far Final PB Exam Questions Answers Solutions Compress20100976No ratings yet

- 2nd Exam 2021 With AnswerDocument10 pages2nd Exam 2021 With Answergeraldine martinezNo ratings yet

- P1 ACC 113 Assignment 1Document4 pagesP1 ACC 113 Assignment 1Danica Mae UbeniaNo ratings yet

- Final Exam - Advance IIDocument4 pagesFinal Exam - Advance IIClay Delgado100% (1)

- Finals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document6 pagesFinals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Performance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisFrom EverandPerformance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Week 3-HWDocument19 pagesWeek 3-HWarwa_mukadam03No ratings yet

- How To Choose The Best Stock Valuation MethodDocument3 pagesHow To Choose The Best Stock Valuation MethodJonhmark AniñonNo ratings yet

- International Equity Market PDFDocument16 pagesInternational Equity Market PDFShreyas Dicholkar0% (1)

- The Trend Following Trading StrategyDocument5 pagesThe Trend Following Trading StrategySubhas MishraNo ratings yet

- Financial Management Chapter 5Document60 pagesFinancial Management Chapter 5CA Uma KrishnaNo ratings yet

- Full Download International Financial Management Canadian Perspectives 2nd Edition Eun Test BankDocument8 pagesFull Download International Financial Management Canadian Perspectives 2nd Edition Eun Test Bankdanielmoreno72d100% (32)

- Capital Market Research in AccountingDocument17 pagesCapital Market Research in AccountingRichards Ðånte WisdomNo ratings yet

- Arie WDocument3 pagesArie WArie WidiyasaNo ratings yet

- Mishkin 6ce TB Ch13Document32 pagesMishkin 6ce TB Ch13JaeDukAndrewSeo50% (2)

- Trader Manual: Welcome To The Exciting World of Binary Options Trading!Document26 pagesTrader Manual: Welcome To The Exciting World of Binary Options Trading!aeiouskNo ratings yet

- Name: Group Number: Date: Training Program: InstructorDocument6 pagesName: Group Number: Date: Training Program: InstructorLizet MaciasNo ratings yet

- Lowe's Case StudyDocument10 pagesLowe's Case StudyDani Alvarez100% (1)

- Pointers To ReviewDocument1 pagePointers To ReviewChelseya ParkNo ratings yet

- Derivatives Market in Bangalore Full ProjectDocument58 pagesDerivatives Market in Bangalore Full ProjectLikith sNo ratings yet

- 2017 WB 2633 QuantInsti TradingusingRonInteractiveBrokersDocument23 pages2017 WB 2633 QuantInsti TradingusingRonInteractiveBrokersvirtualrealNo ratings yet

- Oil India DraftDocument555 pagesOil India DraftRajan VijNo ratings yet

- What Is Additional Paid-In CapitalDocument12 pagesWhat Is Additional Paid-In CapitalblezylNo ratings yet

- Chapter One: Dividend and Dividend PolicyDocument34 pagesChapter One: Dividend and Dividend PolicyEyayaw AshagrieNo ratings yet

- Black and Sholes ModelDocument6 pagesBlack and Sholes ModelShreyaHiremathNo ratings yet

- EntriesDocument6 pagesEntriesThato theo mackenzieNo ratings yet

- Dow Theory: II. The Market Has Three TrendsDocument2 pagesDow Theory: II. The Market Has Three TrendsShashank KhandelwalNo ratings yet

- Covid-19: Creation of Jobs and The Management of Workforce: Mr. Saikat KunduDocument113 pagesCovid-19: Creation of Jobs and The Management of Workforce: Mr. Saikat Kundujalender7No ratings yet

- Edelweissmf Booksummary RicherwiserhappierDocument4 pagesEdelweissmf Booksummary Richerwiserhappierpablo pereira magnereNo ratings yet

- Acosta - ADUSA Newsletter - March 2022Document20 pagesAcosta - ADUSA Newsletter - March 2022EvenwatercanburnNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- Country and Currency Currency Code Graphic Image: Code2000: Arial Unicode MS Unicode: Decimal Unicode: HexDocument9 pagesCountry and Currency Currency Code Graphic Image: Code2000: Arial Unicode MS Unicode: Decimal Unicode: Hexcleofe ortegaNo ratings yet

- Stock Mock - Backtest Index Strategies 4 Years Back TestDocument109 pagesStock Mock - Backtest Index Strategies 4 Years Back TestAdvik SahotaNo ratings yet