Professional Documents

Culture Documents

Chapter 06 Statement of Cost Sheet

Chapter 06 Statement of Cost Sheet

Uploaded by

kausarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 06 Statement of Cost Sheet

Chapter 06 Statement of Cost Sheet

Uploaded by

kausarCopyright:

Available Formats

CHAPTER

Cost Sheet (or) Statement of Cost

ELEMENTS OF COST

Introduction

Elements of cost are necessary to have a proper classification

and analysis of total cost. Thus, elements of cost provide the

management with necessary information for proper control and

management decisions. For this purpose, the total cost is

analysed by the elements or nature of cost, i.e., material, labour

and overheads. The various elements of costs may be illustrated

as below:

(I) Materials Cost

Materials Costs refer to cost of materials which are the major

substances used in production and are converted into finished

goods and semi-finished goods. Materials are grouped as direct

materials and indirect materials.

Direct Materials: Direct materials are those that form part of a

product. Raw materials, semi-finished products, and finished

products which can be identified with production of a product

are known as direct materials. Sugar cane, cotton, oilseeds,

woods etc. are examples of direct materials. The cost of

materials involves conversion of raw materials into finished

products.

Indirect Materials: Material costs, other than direct material

cost are known as indirect material cost. Indirect materials

cannot be identified with a particular unit of cost or product.

Indirect materials are indirectly used for producing the products.

Lubricating oil, consumable stores, fuel, design, layout etc. are

examples of indirect material cost.

(II) Labour Cost

In actual production of the product, labour is the prime factor

which is physically and mentally involved. The payment of

remuneration of wages is made for their effort. The labour costs

are grouped into (a) Direct Labour and (b) Indirect Labour.

(a) Direct Labour: Direct labour cost or direct wages refer to

those specifically incurred for or can be readily charged to or

identified with a specific job, contract, work order or any other

unit of cost are termed as direct labour cost. Wages for

supervision, wages for foremen, wages for labours who are

actually engaged in operation or process are examples of direct

labour cost.

(b) Indirect Labour: Indirect labour is for work in general. The

importance of the distinction lies in the fact that whereas direct

labour can be identified with and charged to the job, indirect

labour cannot be so charged and has therefore to be treated as

part of the factory overheads to be included in the cost of

production. Examples are salaries and wages of supervisors,

store keepers, maintenance labour etc.

(III) Expenses

All expenses are other than material and labour that are incurred

for a particular product or process. They are defined by ICMA

as "The cost of service provided to an undertaking and the

notional cost of the use of owned assets." Expenses are further

grouped into (a) Direct Expenses and (b) Indirect Expenses. ,

(a) Direct Expenses: Direct expenses which are incurred

directly and identified with a unit of output or process are

treated as direct expenses. Hire charges of special plant or tool,

royalty on product, cost of special pattern etc. are the examples

of direct expenses.

(b) Indirect Expenses: Indirect expenses are expenses other

than indirect materials and indirect labour, which cannot be

directly identified with a unit of output. Rent, power, lighting,

repairs, telephone etc. are examples of indirect expenses.

Overheads

All indirect material cost, indirect labour cost, and indirect

expenses are termed as Overheads. Overheads may also be

classified into (a) Production or Factory Overhead (b) Office

and Administrative Overheads (c) Selling Overhead and (d)

Distribution Overhead.

(a) Production Overhead: Production Overhead is also termed

as Factory Overhead. Factory overhead includes indirect

material, indirect labour and indirect wages which are incurred

in the factory. For example, rent of factory building, repairs,

depreciation, wages of indirect workers, etc.

(b) Office and Administrative Overhead: Office and

Administrative Overhead is the indirect expenditure incurred in

formulating the policies, establishment of objectives, planning,

organizing and controlling the operations of an undertaking. All

office and administrative expenses like rent, staff salaries,

postage, telegram, general expenses etc. are examples.

(c) Selling Overhead: Selling Overhead is the indirect expenses

which are incurred for promoting sales, stimulating demand,

securing orders and retaining customers. For example,

advertisement, salesmen's commission, salaries of salesmen etc.

(d) Distribution Overhead: These costs are incurred from the

time the product is packed until it reaches its destination. Cost of

warehousing, cost of packing, transportation cost etc. are some

of the examples of distribution overhead.

Importance of Cost Sheet

(1) It provides for the presentation of the total cost on the basis

of the logical classification.

(2) Cost sheet helps in determination of cost per unit and total

cost at different stages of production.

(3) Assists in fixing of selling price.

(4) It facilitates effective cost control and cost comparison.

(5) It discloses operational efficiency and inefficiency to the

management for taking corrective actions.

(6) Enables the management in the preparation of cost estimates

to tenders and quotations.

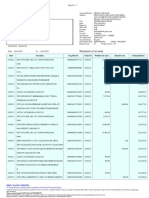

COST SHEET – FORMAT (American method)

Particulars Amount Amount

Opening Stock of Raw Material ***

Add: Purchase of Raw materials ***

Add: Purchase Expenses (carriage inwards) ***

Less: Closing stock of Raw Materials ***

Raw Materials Consumed ***

Direct Wages (Labor) ***

Direct Charges (other direct expenses) ***

Prime cost (1) ***

Add :- Factory Over Heads:

Factory Rent ***

Factory Power ***

Indirect Material ***

Indirect Wages ***

Supervisor (Factory) Salary ***

Factory Insurance ***

Factory Asset Depreciation ***

Others factory related expenses ***

Works cost/ Production cost/ Factory cost ***

(2)

Add: Opening Stock of WIP ***

Less: Closing Stock of WIP ***

Cost of goods manufactured (3) ***

Add: Opening stock of Finished Goods ***

Less: Closing stock of Finished Goods ***

Cost of Goods Sold (4) ***

Add:- Administration Over Heads:-

Office Rent ***

Depreciation of office related assets ***

General Charges ***

Audit Fees ***

Bank Charges ***

Salary of office staff ***

Other Office Expenses ***

Insurance of office ***

Add:- Selling and Distribution OH:- ***

Salesman Commission ***

Sales man salary ***

Traveling Expenses ***

Advertisement ***

Delivery man expenses ***

Sales Tax/import duty ***

Bad Debts

Cost of Sales (5) ***

Profit / Loss (6) ***

Sales (7) ***

Exercise: 1

From the following particulars of Borno Constructions Pvt. Ltd. for the year ended

December 31, 2019, prepare a Cost Sheet showing cost of Materials Consumed,

prime cost, works cost/ production cost/ factory cost, cost of goods manufactured,

cost of goods sold, cost of sales, profit / loss.

Stock of raw materials (31.12.2018) 20,000

Opening stock of work in progress 10,000

Opening stock of finished goods 50,000

Raw materials purchased 5,00,000

Direct wages 3,80,000

Sales for the year 12,00,000

Stock of raw materials (31.12.2019) 75,000

Closing stock of work in progress 15,000

Factory overhead 80,000

Direct expenses 50,000

Office and Administrative overhead 60,000

Selling and Distribution expenses 30,000

Closing stock of Finished Goods 40,000

Solution:

Borno Constructions Pvt. Ltd.

Cost Statement / Cost Sheet

For the year ended December 31st 2019

Particulars Amount Amount Amount

Opening stock of raw materials 20,000

(+) Raw materials purchased 5,00,000

5,20,000

(-) Closing stock of raw materials (75,000)

Materials consumption 4,45,000 4,45,000

(+)Direct wages 3,80,000

(+)Direct expenses 50,000

Prime Cost 8,75,000 8,75,000

(+) Factory overhead 80,000

Works cost / Production cost/Factory 9,55,000 9,55,000

cost

Add: Opening Stock of WIP 10,000

9,65,000

Less: Closing Stock of WIP (15,000)

Cost of goods manufactured 9,50,000 9,50,000

Add: Opening stock of Finished Goods 50,000

10,00,000

Less: Closing stock of Finished Goods (40,000)

Cost of Goods Sold 9,60,000 9,60,000

(+) office and administrative overhead 60,000

10,20,000

Add: Selling and Distribution expenses 30,000

Cost of Sales 10,50,000 10,50,000

Profit 1,50,000

Sales 12,00,000

Exercise: 2

From the following particulars of Inchepta Constructions Ltd. for the year ended

December 31, 2019, prepare a Cost Sheet showing cost of, prime cost, works cost/

production cost/ factory cost, cost of goods manufactured, cost of goods sold, cost

of sales, profit / loss.

Particulars Tk. Particulars Tk.

Raw Materials purchased 5,00,000Up keeping of Vehicles 50,000

Salaries of salesmen 2,50,000Depreciation Plant & Machinery 1,00,000

Direct Wages 3,00,000Bank charges 2,000

Direct Expenses 1,00,000Commission on sales 50,000

Factory Rent and rates 30,000Rent and rates (Office) 75,000

Indirect Wages (Factory) 20,000Stock of W-I-P (01.01.2019) 25,000

Water supply (Factory) 20,000Stock of W-I-P (31.12.2019) 1,00,000

Factory Lighting 10,000Director's Remuneration (Office) 50,000

Factory Heating 25,000Factory Cleaning 20,000

Power (Factory) 15,000Sales (Revenues) 20,00,000

Office Stationery 25,000Sundry Office Expenses 50,000

Director's Remuneration (Factory) 30,000Factory Stationery 2,000

Depreciation of office building 50,000Factory Insurance 5,000

Depreciation of Vehicles 40,000Office Insurance 5,000

Bad debts 50,000Legal Expenses (Office) 10,000

Advertising 1,20,000Rent of Warehouse 20,000

Stock of raw materials 50,000Stock of finished goods 45,000

(01.01.2019) (01.01.2019)

Stock of raw materials 70,000 Stock of finished goods 75,000

(31.12.2019) (31.12.2019)

Inchepta Constructions Ltd.

Cost Statement

For the year ended December 31st 2019

Particulars Amount Amount Amount

Opening stock of raw materials 50,000

(+) Raw materials purchased 5,00,000

5,50,000

(-) Closing stock of raw materials (70,000)

Materials consumption 4,80,000

(+) Direct wages 3,00,000

(+) Direct expenses 1,00,000

Prime Cost 8,80,000 8,80,000

(+) Factory overhead:

Factory Rent and rates 30,000

Indirect Wages (Factory 20,000

Water supply (Factory) 20,000

Factory Lighting 10,000

Factory Heating 25,000

Power (Factory) 15,000

Director's Remuneration (Factory) 30,000

Depreciation Plant & Machinery 1,00,000

Factory Cleaning 20,000

Factory Stationery 2,000

Factory Insurance 5,000

Total factory overhead 2,77,000

Works cost/ Production cost/Factory 11,57,000 11,57,000

cost

Add: Opening Stock of WIP 25,000

11,82,000

Less: Closing Stock of WIP (1,00,000)

Cost of goods manufactured 10,82,000 10,82,000

Add: Opening stock of Finished Goods 45,000

11,27,000

Less: Closing stock of Finished Goods (75,000)

Cost of Goods Sold 10,52,000 10,52,000

Add: Office & administrative overhead:

Office Stationery 25,000

Depreciation of office building 50,000

Bank charges 2,000

Rent and rates (Office 75,000

Director's Remuneration (Office) 50,000

Sundry Office Expenses 50,000

Office Insurance 5,000

Legal Expenses (Office) 10,000

Total 2,67,000

Add: Selling and Distribution expenses:

Depreciation of Vehicles 40,000

Bad debts 50,000

Advertising 1,20,000

Salaries of salesmen 2,50,000

Up keeping of Vehicles 50,000

Commission on sales 50,000

Rent of Warehouse 20,000

Total 5,80,000

Cost of Sales 18,99,000 18,99,000

Profit 1,01,000

Sales 20,00,000

Exercise: 03

From the following particulars of Alpha Developer’s Ltd., prepare a Cost Sheet

showing cost of, prime cost, works cost/ production cost/ factory cost, cost of

goods manufactured, cost of goods sold, cost of sales, profit / loss.

On 1st January 2019: Finished goods in Stock Tk. 50,000, Work in progress Tk.

40,000, and Raw materials Tk. 1,00,000. The information available from cost

records for the year ended 31 December, 2019 was as follows:

Purchase of raw materials 8,00,000

Direct wages 3,00,000

Carriage inward 40,000

Indirect wages 90,000

Factory Lighting 75,000

Power (Factory) 1,00,000

Director's Remuneration (Factory) 1,00,000

Stock on raw materials (31.12.2019) 80,000

Work in progress (31.12.2019) 70,000

Sales (Revenues) 25,00,000

Indirect materials 1,75,000

Legal Expenses 50,000

Audit Fees 30,000

Sales man Commission 50,000

Advertisement 30,000

Sales Tax 30,000

Bad Debts 20,000

Stock on finished goods (31.12.2019) 60,000

Solution:

Alpha Developer’s Ltd.

Cost Statement

For the year ended December 31st 2018

Particulars Amount Amount Amount

Opening stock of raw materials 1,00,000

(+) Purchase of raw materials 8,00,000

(+) Carriage inward 40,000

9,40,000

(-) Closing stock of raw materials 80,000

Materials consumption 8,60,000

Direct wages 3,00,000

Prime Cost 11,60,000 11,60,000

(+) Factory overhead:

Indirect wages 90,000

Factory Lighting 75,000

Power (Factory) 1,00,000

Director's Remuneration (Factory) 1,00,000

Indirect materials 1,75,000

Total factory overhead 5,40,000

Works cost/ Production cost/Factory 17,00,000 17,00,000

cost

Add: Opening Stock of WIP 40,000

17,40,000

Less: Closing Stock of WIP (70,000)

Cost of goods manufactured 16,70,000 16,70,000

Add: Opening stock of Finished Goods 50,000

17,20,000

Less: Closing stock of Finished Goods (60,000)

Cost of Goods Sold 16,60,000 16,60,000

Add: office & administrative overhead:

Legal Expenses

Audit Fees 50,000

Total 30,000

80,000

Add: Selling and Distribution expenses:

Sales man Commission 50,000

Advertisement 30,000

Sales Tax 30,000

Bad Debts 20,000

Total 1,30,000

Cost of Sales 18,70,000 18,70,000

Profit 6,30,000

Sales 25,00,000

Exercise: 04

From the following information of Bissas Builders Ltd. for the year 2019 you are

required to prepare: prime cost, works cost/ production cost/ factory cost, cost of

goods manufactured, cost of goods sold, cost of sales, profit / loss.

Stock of raw materials (1.1.2019) 50,000

Purchase of raw materials 1,70,000

Stock of raw materials (31.12.2019) 80,000

Carriage Inward 10,000

Direct Wages 1,50,000

Indirect Wages 20,000

Other Direct Charges 30,000

Office rent and rates 1,000

Factory rent and rates 10,000

Indirect consumption of materials 1,000

Depreciation on plant 3,000

Depreciation on office furniture 200

Salesmen salary 4,000

Salary to office supervisor 5,000

Other factory expenses 11,400

Other office expenses 1,800

General Manager's remunerations:

Office Dept. 4,000

Factory Dept. 8,000

Selling Dept. 12,000

Other selling expenses 2,000

Traveling expenses of salesmen 2,200

Sales 5,00,000

Advertisement 4,000

Bissas Builders Ltd.

Cost Statement

For the year ended December 31st 2018

Particulars Amount Amount Amount

Opening stock of raw materials 50,000

(+) Purchase of raw materials 1,70,000

(+) Carriage inward 10,000

2,30,000

(-) Closing stock of raw materials 80,000

Materials consumption 1,50,000

Direct wages 1,50,000

Other Direct Charges 30,000

Prime Cost 3,30,000 3,30,000

(+) Factory overhead:

Indirect wages 20,000

Indirect consumption of materials 1,000

Depreciation on plant 3,000

Other factory expenses 11,400

GM remunerations (Factory) 8,000

Total factory overhead 43,400

Works cost/ Production cost/Factory 3,73,400 3,74,400

cost / Cost of goods manufactured /

Cost of Goods Sold

Add: office & administrative overhead:

Office rent and rates 1,000

Depreciation on office furniture 200

Salary to office supervisor 5,000

1,800

Other office expenses

4,000

GM remunerations (Office)

Total 12,000

Add: Selling and Distribution expenses:

Salesmen salary 4,000

GM remunerations (Selling Dept.) 12,000

Other selling expenses 2,000

Traveling expenses of salesmen 2,200

Advertisement 4,000

Total 24,200

Cost of Sales 4,09,600 4,09,600

Profit 90,400

Sales 5,00,000

Exercise: 06

From the following particulars of newly established Jamuna Pharmaceuticals Ltd.

for the year ended December 31, 2019, prepare a Cost Sheet showing cost of,

prime cost, works cost/ production cost/ factory cost, cost of goods manufactured,

cost of goods sold, cost of sales, profit / loss.

Particulars Tk. Particulars Tk.

Raw Materials purchased 5,00,000 Up keeping of delivery Van 5,000

Direct Wages 3,50,000 Bank charges 5,000

Direct Expenses 3,00,000 Commission on sales 10,000

Factory Rent and rates 1,00,000 Rent and rates (Office) 75,000

Indirect Wages (Factory) 30,000 Salaries of salesmen 25,000

Water supply (Factory) 20,000 Depreciation Plant & Machinery 1,00,000

Factory Lighting 20,000 Director's Remuneration (Office) 50,000

Factory Heating 10,000 Factory Cleaning 20,000

Power (Factory) 25,000 Sales 25,00,000

Office Stationery 15,000 Sundry Office Expenses 5,000

Director's Remuneration (Factory) 25,000 Factory Stationery 5,000

Depreciation of office building 30,000 Factory Insurance 10,000

Depreciation of delivery Van 50,000 Office Insurance 20,000

Bad debts 40,000 Legal Expenses (Office) 45,000

Advertising 50,000 Rent of Warehouse 75,000

You might also like

- Full Corporate Offer FcoDocument3 pagesFull Corporate Offer FcoFantania Berry100% (1)

- Answer#1: Scope of Cost Accounting:: Solve The Following Questions and Submit Your Assignment On/or Before April 15Document7 pagesAnswer#1: Scope of Cost Accounting:: Solve The Following Questions and Submit Your Assignment On/or Before April 15muhammad Ammar Shamshad100% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- New Management Challenges For The New AgeDocument22 pagesNew Management Challenges For The New AgeHong Nguyen100% (1)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- SABICDocument1 pageSABICMalik Ansar HayatNo ratings yet

- b85946fc 1608023673050Document23 pagesb85946fc 1608023673050RobinsNo ratings yet

- L3-L4 CostsheetDocument30 pagesL3-L4 CostsheetDhawal RajNo ratings yet

- Chapter 1 - Manufacturing Account (I)Document16 pagesChapter 1 - Manufacturing Account (I)NG JIA LUNGNo ratings yet

- Chapter 12 Cost Sheet or Statement of CostDocument16 pagesChapter 12 Cost Sheet or Statement of CostNeelesh MishraNo ratings yet

- Cost Sheet: FormatDocument4 pagesCost Sheet: Formatkhushboo rajputNo ratings yet

- Manufacturing Accounts: Igcse - 2020 - Accounting (9-1) - Mahdi SamdaniDocument4 pagesManufacturing Accounts: Igcse - 2020 - Accounting (9-1) - Mahdi SamdaniNasif KhanNo ratings yet

- COST ACCOUNTING I Module VDocument4 pagesCOST ACCOUNTING I Module VEmil E. ANo ratings yet

- Cost SheetDocument10 pagesCost SheetAmanNo ratings yet

- Cost I Ch1 Unit 2 Cost Terms & ConceptsDocument28 pagesCost I Ch1 Unit 2 Cost Terms & ConceptsnaaninigistNo ratings yet

- Accounting For Managers, IIAM-VizagDocument13 pagesAccounting For Managers, IIAM-VizagDileep DeepuNo ratings yet

- Cost Accounting Notes Fall 19-1Document11 pagesCost Accounting Notes Fall 19-1AnoshiaNo ratings yet

- Absorption Costing & Variable CostingDocument8 pagesAbsorption Costing & Variable Costingsaidkhatib368No ratings yet

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-2Document14 pagesCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-2Tanvir Ahmed ChowdhuryNo ratings yet

- Cost Accounting With More Illustrations-2Document21 pagesCost Accounting With More Illustrations-2Rohit KashyapNo ratings yet

- Cost and Management Accounting 01 - Class NotesDocument114 pagesCost and Management Accounting 01 - Class NotessaurabhNo ratings yet

- 2 Cost StatementDocument6 pages2 Cost StatementAbdallah SadikiNo ratings yet

- Cost Sheet: Basics and Format 030820Document23 pagesCost Sheet: Basics and Format 030820Shubham Saurav SSNo ratings yet

- Cost Sheet P&SDocument41 pagesCost Sheet P&SJishnuPatilNo ratings yet

- Cost Sheet: Basics and FormatDocument33 pagesCost Sheet: Basics and FormatShubham Saurav SSNo ratings yet

- Cost Estimation Report: 16me327 Production ManangementDocument6 pagesCost Estimation Report: 16me327 Production ManangementRagulNo ratings yet

- Classification of CostsDocument84 pagesClassification of CostsRoyal ProjectsNo ratings yet

- Ma Slide Ta Chap 19Document6 pagesMa Slide Ta Chap 19Le H KhangNo ratings yet

- Cost Sheet SummaryDocument8 pagesCost Sheet SummaryBahi Khata CommerceNo ratings yet

- FIN600 Module 3 Topic 2Document25 pagesFIN600 Module 3 Topic 2Inés Tetuá TralleroNo ratings yet

- Costs - Concepts and ClassificationsDocument5 pagesCosts - Concepts and ClassificationsCarlo B CagampangNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Cost SheetDocument5 pagesCost SheetAnkit YadavNo ratings yet

- Cost Sheet ProblemsDocument11 pagesCost Sheet ProblemsPrem RajNo ratings yet

- 74749bos60489 cp6Document34 pages74749bos60489 cp6tempNo ratings yet

- Cost Sheet: Learning OutcomesDocument15 pagesCost Sheet: Learning OutcomesshubNo ratings yet

- Cost SheetDocument19 pagesCost SheetpraphullmadaneNo ratings yet

- Cost Terms, Concepts and ClassificationDocument12 pagesCost Terms, Concepts and Classificationu1909030No ratings yet

- Cost & Management AccountingDocument5 pagesCost & Management Accountingvinay.jigajinni JigajinniNo ratings yet

- Accounting For Manufacturing Cost Accounting Is Defined As A Systematic Set of Procedures For Recording and ReportingDocument5 pagesAccounting For Manufacturing Cost Accounting Is Defined As A Systematic Set of Procedures For Recording and ReportingEdgardo TangalinNo ratings yet

- Week 5 NotesDocument9 pagesWeek 5 NotescalebNo ratings yet

- CH 01Document22 pagesCH 01Khánh Mai Lê NguyễnNo ratings yet

- Hand Out-6 - CostingDocument19 pagesHand Out-6 - CostingmuhammadNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument11 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomesUmesh KotianNo ratings yet

- Unit 6 - Introduction To Manufacturing EntitiesDocument30 pagesUnit 6 - Introduction To Manufacturing EntitiesIngavalengwa TileingeNo ratings yet

- Cost SheetDocument26 pagesCost SheetPankaj SahaniNo ratings yet

- Cost Sheet: Learning OutcomesDocument26 pagesCost Sheet: Learning OutcomesSusovan SirNo ratings yet

- Cost Accounting, Contract Costing, Transfer Pricing, Responsible Accounting, Target CostingDocument33 pagesCost Accounting, Contract Costing, Transfer Pricing, Responsible Accounting, Target Costinggaurang1111No ratings yet

- Cost Sheet: Practical Problems 05-08-20Document14 pagesCost Sheet: Practical Problems 05-08-20Shubham Saurav SSNo ratings yet

- Explain The Procedure of Reconciliation of Financial and Cost Accounting DataDocument6 pagesExplain The Procedure of Reconciliation of Financial and Cost Accounting DataKritika JainNo ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- mechanicalproperties-180729044352Document36 pagesmechanicalproperties-180729044352kausarNo ratings yet

- Chapter 02 Tabular AnalysisDocument10 pagesChapter 02 Tabular AnalysiskausarNo ratings yet

- Chapter 03 Preperation of Financial StatementsDocument21 pagesChapter 03 Preperation of Financial StatementskausarNo ratings yet

- Chapter 01 Basic concept of AccountingDocument9 pagesChapter 01 Basic concept of AccountingkausarNo ratings yet

- solid works pdfDocument27 pagessolid works pdfkausarNo ratings yet

- Case Study 148 169Document22 pagesCase Study 148 169Vonn GuintoNo ratings yet

- What Is Land ReclassificationDocument7 pagesWhat Is Land ReclassificationPcl Nueva VizcayaNo ratings yet

- In Dis Tree - 4 WhatDocument12 pagesIn Dis Tree - 4 Whatmpho sehlohoNo ratings yet

- La Concepcion College City of San Jose Del Monte, Bulacan Engineering Division Final Examination ES19-Technopreneurship 101 2 Semester-A.Y. 2020-2021Document4 pagesLa Concepcion College City of San Jose Del Monte, Bulacan Engineering Division Final Examination ES19-Technopreneurship 101 2 Semester-A.Y. 2020-2021John Lloyd BallaNo ratings yet

- TLE 9 (HORTICULTURE) - q3 - CLAS4 - Cleaning Storing of Equipment and Waste Disposal Activities - v3 (FOR QA) - Liezl ArosioDocument12 pagesTLE 9 (HORTICULTURE) - q3 - CLAS4 - Cleaning Storing of Equipment and Waste Disposal Activities - v3 (FOR QA) - Liezl ArosioGerlie VillameroNo ratings yet

- Variance CostingDocument7 pagesVariance Costingjayyv28No ratings yet

- Proposal Rice Millers Assessment Consultancy-SungaDocument31 pagesProposal Rice Millers Assessment Consultancy-SungahajiNo ratings yet

- SCMH 7.2.2 APQP Introduction10MAY2017Document40 pagesSCMH 7.2.2 APQP Introduction10MAY2017nivash kumarNo ratings yet

- Unilever Prestige - A Presenation For InvestorsDocument26 pagesUnilever Prestige - A Presenation For Investorsafsana.bba.20210202069No ratings yet

- Ch02 Harrison 8e GE SMDocument96 pagesCh02 Harrison 8e GE SMMuh BilalNo ratings yet

- Sistem Produksi Pupuk Organik Padat (POP) Pada PT. Sirtanio Organik Indonesia Di Kabupaten BanyuwangiDocument7 pagesSistem Produksi Pupuk Organik Padat (POP) Pada PT. Sirtanio Organik Indonesia Di Kabupaten Banyuwangiade fitriNo ratings yet

- ACT102 Quiz No. 1 - Journalizing Merchandising Transactions - Answer KeyDocument3 pagesACT102 Quiz No. 1 - Journalizing Merchandising Transactions - Answer KeyApril SasamNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/21Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/21Sraboni ChowdhuryNo ratings yet

- DSR 2020 AR Web LatestDocument204 pagesDSR 2020 AR Web LatestOnyeuka CharlestonNo ratings yet

- OSCM Assignment - Komolika Kakrani (74022119962) - 240128 - 200644Document10 pagesOSCM Assignment - Komolika Kakrani (74022119962) - 240128 - 200644Komolika KakraniNo ratings yet

- Course Code: MG202 Course Title: Operations ManagementDocument7 pagesCourse Code: MG202 Course Title: Operations ManagementTetzNo ratings yet

- CompReg 19JUNE2023Document963 pagesCompReg 19JUNE2023Saee SuryawanshiNo ratings yet

- Hand Made SoapDocument12 pagesHand Made SoapAstra Cloe100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceChelana JainNo ratings yet

- Hyundai Investment On Electric Vehicles in IndonesiaDocument20 pagesHyundai Investment On Electric Vehicles in IndonesiaAfichNo ratings yet

- Phillips Sakamoto 2012 Global Production Networks, Chronic Poverty and Slave Labour' in BrazilDocument29 pagesPhillips Sakamoto 2012 Global Production Networks, Chronic Poverty and Slave Labour' in BrazilGabriel BozzanoNo ratings yet

- IMT CastrolDocument5 pagesIMT Castroldeepika srivastavaNo ratings yet

- Coconut Chain in GhanaDocument109 pagesCoconut Chain in GhanaHasriadi Ary MasalamNo ratings yet

- Module 6 - The 2 Major Types of Accounts - RevisedDocument15 pagesModule 6 - The 2 Major Types of Accounts - Revisedgerlie gabrielNo ratings yet

- All Shut Down Request For WD-04 GIS&MAX PDFDocument235 pagesAll Shut Down Request For WD-04 GIS&MAX PDFahmed kabilNo ratings yet

- ACT430 Project On QuickBooksDocument23 pagesACT430 Project On QuickBooksAntor Podder 1721325No ratings yet

- Company Profile SS TradingDocument58 pagesCompany Profile SS TradingHarunNo ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)