Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsIFRS 5 Power Point

IFRS 5 Power Point

Uploaded by

Raquib alam RaadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- CFAS Lecture Notes - Zeus Millan (2021-2022)Document38 pagesCFAS Lecture Notes - Zeus Millan (2021-2022)Aimee Cute83% (6)

- Ifrs 5: Non-Current Assets Held For Sale and Discontinued OperationsDocument15 pagesIfrs 5: Non-Current Assets Held For Sale and Discontinued OperationsangaNo ratings yet

- 06 Ifrs 5Document3 pages06 Ifrs 5Irtiza Abbas100% (1)

- (IV) Statement of Cash-FlowsDocument38 pages(IV) Statement of Cash-FlowsmusthaqhassanNo ratings yet

- Chapter 4 Published AccountsDocument8 pagesChapter 4 Published AccountsNUR IRDINA SOFEA MOHD YUSRINo ratings yet

- 2.preparation of Financial StatementsDocument5 pages2.preparation of Financial StatementsAshutosh MhatreNo ratings yet

- Preparation of Published Financial StatementsDocument19 pagesPreparation of Published Financial StatementsRuth Nyawira100% (1)

- Statement of Comprehensive Income (SCI)Document10 pagesStatement of Comprehensive Income (SCI)Beverly EroyNo ratings yet

- Week 5 Intra group transaction tut 29Document11 pagesWeek 5 Intra group transaction tut 29joehe2625No ratings yet

- FABM2 Module 2 Statement of Comprehensive IncomeDocument7 pagesFABM2 Module 2 Statement of Comprehensive IncomeRaidenhile mae Vicente100% (2)

- FINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Document44 pagesFINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Srinivas Muchantula100% (5)

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNo ratings yet

- CH 4 (Income Statement)Document40 pagesCH 4 (Income Statement)Study OuoNo ratings yet

- Financial Statements Point PresentationDocument34 pagesFinancial Statements Point PresentationRabie Haroun100% (1)

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- Topic 3Document26 pagesTopic 3michaelchris9068No ratings yet

- Ncome: Components of Profit or LossDocument3 pagesNcome: Components of Profit or LossJonathan VidarNo ratings yet

- Installment Sales Reviewer. Problems and Solutions.Document43 pagesInstallment Sales Reviewer. Problems and Solutions.Kate Alvarez91% (22)

- Chapter 2-The Accounting EquationDocument132 pagesChapter 2-The Accounting EquationAmr HassanNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- Discontinued Operations 1Document4 pagesDiscontinued Operations 1rei gbivNo ratings yet

- Installment Sales Reviewer Problems PDFDocument43 pagesInstallment Sales Reviewer Problems PDFUnnamed homosapien100% (1)

- A1 Installment SalesDocument3 pagesA1 Installment SalesMae0% (1)

- Financial Statement Project 1 1Document38 pagesFinancial Statement Project 1 1ABHISHEK SHARMANo ratings yet

- Business Transactions and Their Analysis As Applied To THE Accounting Cycle of A Merchandising Business (Part Ii)Document6 pagesBusiness Transactions and Their Analysis As Applied To THE Accounting Cycle of A Merchandising Business (Part Ii)Tumamudtamud, JenaNo ratings yet

- Finance 2 - Chapter 3Document68 pagesFinance 2 - Chapter 3Ayoub Ben AissaNo ratings yet

- Ifrs5 SN PDFDocument5 pagesIfrs5 SN PDFAmrita TamangNo ratings yet

- Valuation of Goodwill and Shares 1Document31 pagesValuation of Goodwill and Shares 1p66610072No ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Capital Allowances - Basic ComputationsDocument13 pagesCapital Allowances - Basic Computationsjhon berez223344No ratings yet

- Mohammad Ali Jinnah University: AssignmentDocument10 pagesMohammad Ali Jinnah University: AssignmenttuuuhaNo ratings yet

- Revision For CIT & VAT 2017Document2 pagesRevision For CIT & VAT 2017Ý PhanNo ratings yet

- Chapter 6 Tutorial QuestionsDocument3 pagesChapter 6 Tutorial QuestionsAlefosio FonotiNo ratings yet

- Lesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTDocument53 pagesLesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTlorraine barrogaNo ratings yet

- Financial StatementsDocument23 pagesFinancial StatementsShin Shan JeonNo ratings yet

- Reviewer in BFDocument2 pagesReviewer in BFFelicity EspinosaNo ratings yet

- Part 3 Financial statementsDocument104 pagesPart 3 Financial statementsAliaa HabibNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Advanced Accounting Unit 1Document14 pagesAdvanced Accounting Unit 1yasinNo ratings yet

- Finance 1Document6 pagesFinance 1cherryannNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Inert Mediate AccountingDocument41 pagesInert Mediate Accountingalirazakazi69No ratings yet

- Business Studies Form Four NotesDocument66 pagesBusiness Studies Form Four Notestimothy muyumbiNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisnabhayNo ratings yet

- Grade 12 Income Statement AdjustmentsDocument51 pagesGrade 12 Income Statement Adjustmentsrefilwemagolego34No ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- LAS ABM - FABM12 Ic D 5 6 Week 2Document7 pagesLAS ABM - FABM12 Ic D 5 6 Week 2ROMMEL RABONo ratings yet

- ACCOUNTDocument7 pagesACCOUNTgamer rocker landNo ratings yet

- Question One: Choose The Best Answer For Each of The Following Statements: (7.5 Marks)Document4 pagesQuestion One: Choose The Best Answer For Each of The Following Statements: (7.5 Marks)DaliaNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeDocument9 pagesFundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeBea allyssa CanapiNo ratings yet

- Kuis Akuntansi Keuangan Menengah I (Seri 03X) Income StatementDocument4 pagesKuis Akuntansi Keuangan Menengah I (Seri 03X) Income StatementMuhammad makhrojalNo ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- 2019 AFM Unit Test 1 Answer KeyDocument8 pages2019 AFM Unit Test 1 Answer KeyDR. PRASANTH.BNo ratings yet

- Chapter 5. Cost Measurement, Cost Concepts and BehaviorDocument5 pagesChapter 5. Cost Measurement, Cost Concepts and BehaviorMa. Lotie Torres VillamarinNo ratings yet

- Unit 1 Advanced AccountingDocument130 pagesUnit 1 Advanced AccountingNigussie BerhanuNo ratings yet

- Installmen Sales ProblemsDocument10 pagesInstallmen Sales ProblemsKristine GoyalaNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- Statement of IncomeDocument19 pagesStatement of IncomeUgly DucklingNo ratings yet

- Annex 37-Annual Statement of Receipts and PaymentsDocument4 pagesAnnex 37-Annual Statement of Receipts and Paymentsvermon salidoNo ratings yet

- Business Plan: UN Restaurante FilipinoDocument20 pagesBusiness Plan: UN Restaurante FilipinoMon MoronesNo ratings yet

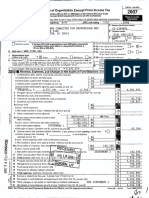

- IRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Document392 pagesIRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Peter M. Heimlich100% (1)

- Test Bank Chapter15 Capital Budgeting2Document29 pagesTest Bank Chapter15 Capital Budgeting2nashNo ratings yet

- CH 3.3 Errors - SDocument10 pagesCH 3.3 Errors - Sসাঈদ আহমদ0% (1)

- Salary SlipDocument1 pageSalary SlipAbhishek BabalNo ratings yet

- CH 8Document13 pagesCH 8doc nurfatkhiyahNo ratings yet

- Pathuma Distributors - MataraDocument3 pagesPathuma Distributors - MataraChamara Chinthaka RanasingheNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Ent300 - Module10 - Organizational PlanDocument34 pagesEnt300 - Module10 - Organizational PlanAnsya19No ratings yet

- Government Accounting Overview of Government AccountingDocument77 pagesGovernment Accounting Overview of Government AccountingMichael Brian Torres100% (1)

- Budgeting NumericalsDocument6 pagesBudgeting NumericalsAll in ONENo ratings yet

- Accommodation OperationDocument21 pagesAccommodation OperationPiyush AgarwalNo ratings yet

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONNo ratings yet

- KPCLDocument14 pagesKPCLBasavaraja K Kamlesh100% (1)

- 5) Handwritten QuizDocument8 pages5) Handwritten QuizAkshit SoniNo ratings yet

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- Chapter 2 IAS 1 Presentation of Financial StatementsDocument85 pagesChapter 2 IAS 1 Presentation of Financial StatementsLidia SamuelNo ratings yet

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- Sustainable Housing Project ProposDocument41 pagesSustainable Housing Project ProposRizqillaahi NaufalNo ratings yet

- Financial StatementsDocument133 pagesFinancial StatementsEmmanuel EngenaNo ratings yet

- UntitledDocument8 pagesUntitledartumangayNo ratings yet

- Glossary of Financial TermsDocument7 pagesGlossary of Financial TermsCalvin Chavez IIINo ratings yet

- Marvin CoDocument4 pagesMarvin CoVaibhav KathjuNo ratings yet

- Douglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Document6 pagesDouglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Scribd Government DocsNo ratings yet

- Teach1 CFMDocument8 pagesTeach1 CFMmuhammad aalyanNo ratings yet

IFRS 5 Power Point

IFRS 5 Power Point

Uploaded by

Raquib alam Raad0 ratings0% found this document useful (0 votes)

1 views18 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views18 pagesIFRS 5 Power Point

IFRS 5 Power Point

Uploaded by

Raquib alam RaadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 18

Non-Current assets held for sale and

discontinued operation (IFRS 5)

Prepared by : Imrul Kayas, ACA,ACGA

Discussion Topic :

1. Concept regrading Non current asset held for sale and discontinuation

operation

2. Conditions for classification as held for sale

3. Measurement of non-current asset held for sale

4. Discontinued operation

5. Changes to a plan of sale

6. Disclosures

Non-Current assets held for sale and discontinued

operation

- A Non-Current asset or disposal group should be classified as held

for sale if its carrying amount will be recovered principally through

sale rather than continuing use.

- A disposal group is a group of assets (and possibly liabilities) that the

entity intends to dispose of in a single transection.

- IFRS 5 applies to disposal groups as well as to individual Non-Current

assets that are held for sale.

- Subsidiaries acquired exclusively with a view to resale are classified

as held for sale, but they meet the condition for classification as held

for sale.

Conditions for classification as held for sale:

IFRS 5 Requires that the following conditions to be met before an

asset or disposal group can be classified as held for sale.

-The item is available for immediate sale in its present condition

-The sale is highly probable

(1) management is committed to a plan to sell the item.

(2) The item is being actively marketed at a reasonable price in

relation to its current fair value.

-The sale is expected to be completed within one year from the date

of classification.

-It is unlikely that the plan will change significantly or be withdrawn.

Example 1:

Habib & Co is preparing its financial statements for the year ended 31 December

2015.

a) On 1st December 2015, the entity became committed to a plan to sell a surplus

office property and has already found a potential buyer. On 15 December 2015 a

survey was carried out and it was discovered that the building had dry rot and

substantial remedial work would be necessary. The buyer is prepared to wait for the

work to be carried out but the property will not be sold until the problem has been

rectified. This is not expected to occur until summer 2016.

Required:

Can the property be classified as held for sale?

Solution:

IFRS 5 states that in order to be classified as ‘held for sale’ the

property should be available for immediate sale in its present

condition. The property will not be sold until the work has been

carried out, demonstrating that the facility is not available for

immediate sale. Therefore, the property cannot be classified as held

for sale.

Example 2:

A subsidiary entity, B, is for sale at a price of taka 3 million. There has

been some interest from prospective buyers but no sale as of yet, one

buyer has made an offer of the 2 million but the director of the HABIB

& CO rejected the offer. The directors have just received advice from

their accountants that the fair value of the business is the Tk 2.5

million. They have decided not to reduce the sale price of B at the

moment.

Required: Can the subsidiary be classified as held for sale?

Solution:

The subsidiary B does not meet the criteria for classification as held

for sale. Although, actions to locate a buyer are in place, the

subsidiary is not for sale at a price that is reasonable compared with

its fair value. The fair value of subsidiary is Tk 2.5 million but it is

advertised for sale at Tk 3 million. It cannot be classified as held for

sale until the sales price is reduced.

Measurement of non-current asset held for sale:

Measurement of non-current asset held for sale: Non-current assets

that qualify as held for sale should be measured at the lower of:

-their carrying amount and - fair value less costs to sell

Held for sale non-current assets should be:

-Presented separately on the face of the statement of financial

position under current assets.

- Not depreciated.

Example 3 :

On 1st January 2011, AB acquires a building for Tk 2,00,000 with an

expected life of 50 years. On 31 December 2014, AB puts the

building up for immediate sale. Costs to sell the building are

estimated at Tk 10,000.

Required:

Outline the accounting treatment of the above if the building had a

fair value at 31st December 2014 of

a) Tk 220,000

b) Tk 110,000

Solution:

Until 31st December 2014 the building is a normal non-current asset and its

accounting treatment is prescribed by IAS 16. The annual depreciation charge was Tk

4000 (2,00,000/50)

Before reclassification, the carrying amount was (2,00,000- 4000x4) = Tk 184,000.

a) On 31 December 2014, the building is reclassified as a non-current asset held for

sale. It is measured at the lower of carrying amount (Tk184,000) and fair value less

costs to sell. This means that the building will continue to be measured at Tk

1,84,000.

b) On 31 December 2014, the building is reclassified as a non-current asset held for

sale. It is measured at the lower of carrying amount (Tk 184,000) and fair value less

costs to sell (Tk110,000-Tk 10,000), i.e. Tk 1,00,000. The building will therefore be

measured at the 1,00,000 as at 31st December 2014. An impairment loss of Tk

84,000 (Tk184,000-100,000) will be charged to the statement of profit or loss.

Discontinued Operations:

A discontinued operation is a component of an entity that has either been disposed of or is classified as held for

sale, and:

-represents a separate major line of business or geographical area of operations.

-Is part of a single coordinated plan to dispose of a separate major line of business or geographical area of

operations or

-is a subsidiary acquired exclusively with a view to resale.

Discontinued operations are required to be shown separately in order to help users to predict future

performance, i.e. based upon continuing operations.

An entity must disclose a single amount in the face of the statement of profit or loss, comprising the total of:

-the post-tax profit or loss of discontinued operation and

-the post-tax gain or loss recognized on the measurement to fair value less costs to sell, or on the disposal, of

the fair value less costs to sell, or on the disposal of the assets constituting the discontinued operation.

An analysis of this single amount must be presented either in the notes or on the face of the statement of profit

or loss.

The analysis must disclose:

- The revenue, expenses and plc tax profit or loss of discontinued operations.

- The related income tax expense.

- The gain or loss recognized on the measurement to fair value less costs to sell, or on the disposal of the

assets constituting the discontinued operation.

Proforma of discontinued operation

Statement of profit or loss presentation (with a discontinued operation).

2015

Continuing operations: Tk

Revenue x

Cost of sales (x)

Gross profit x

Distribution costs (x)

Administrative expenses (x)

Profit from operations x

Finance costs (x)

Profit before tax x

Income tax expenses (x)

Profit from the period from discontinued operation x

Discontinued operations:

Profit from the period from discontinued operations x

Total profit for the period x

The analysis of this single amount would be given in the notes.

Alternatively, the analysis could be given on the face of the statement of profit or loss, with separate columns

for continuing operations discontinuing operations and total amounts.

Example:4

Mr. x produced cards and sold roses. However, half way through the year ended 31 march 2016. The lose

business was closed and the assets sold off, incurring loses on the disposal of non-current assets of tk.

76000 and redundantly costs of tk. 37000. The directors recognized the continuing business at a cost of tk.

98000.

Trading results may be summarized as follows:

Card Roses

Tk. 1000 Tk. 1000

Revenue 650 320

Cost of sales 320 150

Distribution 60 90

Administration 120 110

Other trading information to be allocated to continuing operation is as follows:

Total

Tk. 1000

Finance costs 17

Tax 31

(a) Draft the statement of profit or loss for the year ended 31 march 2016

(b) Explain how an IFRS 5 discontinued operations presentation can make information more useful to the

users of financial statements.

Solution

(a)Working: Calculation of profit or loss of the discontinued operation.

Tk. 1000

Revenue 320

Cost of sales (150)

Gross profit 170

Administration expense (110)

Distribution expense (90)

Operating cost (30)

Loss on disposal (76)

Redundancy costs (37)

Overall loss (143)

The above information shown in the notes to the accounts as disclosure.

Solution ( continuation)

Mr. x

Statement of profit or loss

For the year ended 31 march 2016

Continuing operations:

Revenue 650

Cost of sales (320)

Gross profit 330

Administrative costs (120)

Distribution costs (60)

Operating profit 150

Reorganization costs (98)

52

Finance costs (17)

Profit before tax 35

Income taxes (31)

Profit for period from continuing operation 4

Discontinued operations:

Loss for period from discontinued operations (143)

Loss for period from total operation (139)

Solution ( continuation)

b) IFRS 5 presentation

When a business segment of geographical area has been classified

as a discontinued operation, IFRS 5 requires a separate presentation

to be made on the face of the statement of profit or loss. This

separate presentation enables users to immediately identify that

the performance relating to the discontinued segment or area will

not continue in the future. Hence making the information more

relevant to users decision making. The users can choose to include

the information when evaluating past performance of the company

or ignore it when forecasting future outcomes

Changes to a plan of sale:

If the sale does not take place within one year, an asset or disposal group can still be

classified as held for sale if:

- The delay has been caused by events or circumstances beyond the entity’s control.

- There is sufficient evidence that the entity is still committed to the sale.

If the criteria for held for sale are no longer met, the entity must cause to classify the asset

or disposal group as held for sale. The assets or disposal group must be measured at the lower

of:

- Its carrying amount before it was classified as held for sale adjusted to any depreciation.

Amortization or revaluations that would have been recognized had it not been classified as

held for sale.

- Its recoverable amount at the date of the sub-sequent decision not to sell.

Any adjustment required is recognized in profit or loss as a gain or loss from

continuing operation.

Disclosure:

- A description of the non-current asset for disposal group.

- A description of the facts and circumstances of the sale or expected sale.

You might also like

- CFAS Lecture Notes - Zeus Millan (2021-2022)Document38 pagesCFAS Lecture Notes - Zeus Millan (2021-2022)Aimee Cute83% (6)

- Ifrs 5: Non-Current Assets Held For Sale and Discontinued OperationsDocument15 pagesIfrs 5: Non-Current Assets Held For Sale and Discontinued OperationsangaNo ratings yet

- 06 Ifrs 5Document3 pages06 Ifrs 5Irtiza Abbas100% (1)

- (IV) Statement of Cash-FlowsDocument38 pages(IV) Statement of Cash-FlowsmusthaqhassanNo ratings yet

- Chapter 4 Published AccountsDocument8 pagesChapter 4 Published AccountsNUR IRDINA SOFEA MOHD YUSRINo ratings yet

- 2.preparation of Financial StatementsDocument5 pages2.preparation of Financial StatementsAshutosh MhatreNo ratings yet

- Preparation of Published Financial StatementsDocument19 pagesPreparation of Published Financial StatementsRuth Nyawira100% (1)

- Statement of Comprehensive Income (SCI)Document10 pagesStatement of Comprehensive Income (SCI)Beverly EroyNo ratings yet

- Week 5 Intra group transaction tut 29Document11 pagesWeek 5 Intra group transaction tut 29joehe2625No ratings yet

- FABM2 Module 2 Statement of Comprehensive IncomeDocument7 pagesFABM2 Module 2 Statement of Comprehensive IncomeRaidenhile mae Vicente100% (2)

- FINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Document44 pagesFINANCIAL STATEMENT (CMA) - by CMA Srinivas Reddy (LETSLEARN GLOBAL)Srinivas Muchantula100% (5)

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNo ratings yet

- CH 4 (Income Statement)Document40 pagesCH 4 (Income Statement)Study OuoNo ratings yet

- Financial Statements Point PresentationDocument34 pagesFinancial Statements Point PresentationRabie Haroun100% (1)

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- Topic 3Document26 pagesTopic 3michaelchris9068No ratings yet

- Ncome: Components of Profit or LossDocument3 pagesNcome: Components of Profit or LossJonathan VidarNo ratings yet

- Installment Sales Reviewer. Problems and Solutions.Document43 pagesInstallment Sales Reviewer. Problems and Solutions.Kate Alvarez91% (22)

- Chapter 2-The Accounting EquationDocument132 pagesChapter 2-The Accounting EquationAmr HassanNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- Discontinued Operations 1Document4 pagesDiscontinued Operations 1rei gbivNo ratings yet

- Installment Sales Reviewer Problems PDFDocument43 pagesInstallment Sales Reviewer Problems PDFUnnamed homosapien100% (1)

- A1 Installment SalesDocument3 pagesA1 Installment SalesMae0% (1)

- Financial Statement Project 1 1Document38 pagesFinancial Statement Project 1 1ABHISHEK SHARMANo ratings yet

- Business Transactions and Their Analysis As Applied To THE Accounting Cycle of A Merchandising Business (Part Ii)Document6 pagesBusiness Transactions and Their Analysis As Applied To THE Accounting Cycle of A Merchandising Business (Part Ii)Tumamudtamud, JenaNo ratings yet

- Finance 2 - Chapter 3Document68 pagesFinance 2 - Chapter 3Ayoub Ben AissaNo ratings yet

- Ifrs5 SN PDFDocument5 pagesIfrs5 SN PDFAmrita TamangNo ratings yet

- Valuation of Goodwill and Shares 1Document31 pagesValuation of Goodwill and Shares 1p66610072No ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Capital Allowances - Basic ComputationsDocument13 pagesCapital Allowances - Basic Computationsjhon berez223344No ratings yet

- Mohammad Ali Jinnah University: AssignmentDocument10 pagesMohammad Ali Jinnah University: AssignmenttuuuhaNo ratings yet

- Revision For CIT & VAT 2017Document2 pagesRevision For CIT & VAT 2017Ý PhanNo ratings yet

- Chapter 6 Tutorial QuestionsDocument3 pagesChapter 6 Tutorial QuestionsAlefosio FonotiNo ratings yet

- Lesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTDocument53 pagesLesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTlorraine barrogaNo ratings yet

- Financial StatementsDocument23 pagesFinancial StatementsShin Shan JeonNo ratings yet

- Reviewer in BFDocument2 pagesReviewer in BFFelicity EspinosaNo ratings yet

- Part 3 Financial statementsDocument104 pagesPart 3 Financial statementsAliaa HabibNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Advanced Accounting Unit 1Document14 pagesAdvanced Accounting Unit 1yasinNo ratings yet

- Finance 1Document6 pagesFinance 1cherryannNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Inert Mediate AccountingDocument41 pagesInert Mediate Accountingalirazakazi69No ratings yet

- Business Studies Form Four NotesDocument66 pagesBusiness Studies Form Four Notestimothy muyumbiNo ratings yet

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisnabhayNo ratings yet

- Grade 12 Income Statement AdjustmentsDocument51 pagesGrade 12 Income Statement Adjustmentsrefilwemagolego34No ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- LAS ABM - FABM12 Ic D 5 6 Week 2Document7 pagesLAS ABM - FABM12 Ic D 5 6 Week 2ROMMEL RABONo ratings yet

- ACCOUNTDocument7 pagesACCOUNTgamer rocker landNo ratings yet

- Question One: Choose The Best Answer For Each of The Following Statements: (7.5 Marks)Document4 pagesQuestion One: Choose The Best Answer For Each of The Following Statements: (7.5 Marks)DaliaNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeDocument9 pagesFundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeBea allyssa CanapiNo ratings yet

- Kuis Akuntansi Keuangan Menengah I (Seri 03X) Income StatementDocument4 pagesKuis Akuntansi Keuangan Menengah I (Seri 03X) Income StatementMuhammad makhrojalNo ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- VU Lesson 8Document5 pagesVU Lesson 8ranawaseem100% (1)

- 2019 AFM Unit Test 1 Answer KeyDocument8 pages2019 AFM Unit Test 1 Answer KeyDR. PRASANTH.BNo ratings yet

- Chapter 5. Cost Measurement, Cost Concepts and BehaviorDocument5 pagesChapter 5. Cost Measurement, Cost Concepts and BehaviorMa. Lotie Torres VillamarinNo ratings yet

- Unit 1 Advanced AccountingDocument130 pagesUnit 1 Advanced AccountingNigussie BerhanuNo ratings yet

- Installmen Sales ProblemsDocument10 pagesInstallmen Sales ProblemsKristine GoyalaNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- Statement of IncomeDocument19 pagesStatement of IncomeUgly DucklingNo ratings yet

- Annex 37-Annual Statement of Receipts and PaymentsDocument4 pagesAnnex 37-Annual Statement of Receipts and Paymentsvermon salidoNo ratings yet

- Business Plan: UN Restaurante FilipinoDocument20 pagesBusiness Plan: UN Restaurante FilipinoMon MoronesNo ratings yet

- IRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Document392 pagesIRS 990s For The Physicians Committee For Responsible Medicine (PCRM), 2007 + 2009-Present (2015)Peter M. Heimlich100% (1)

- Test Bank Chapter15 Capital Budgeting2Document29 pagesTest Bank Chapter15 Capital Budgeting2nashNo ratings yet

- CH 3.3 Errors - SDocument10 pagesCH 3.3 Errors - Sসাঈদ আহমদ0% (1)

- Salary SlipDocument1 pageSalary SlipAbhishek BabalNo ratings yet

- CH 8Document13 pagesCH 8doc nurfatkhiyahNo ratings yet

- Pathuma Distributors - MataraDocument3 pagesPathuma Distributors - MataraChamara Chinthaka RanasingheNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256No ratings yet

- Ent300 - Module10 - Organizational PlanDocument34 pagesEnt300 - Module10 - Organizational PlanAnsya19No ratings yet

- Government Accounting Overview of Government AccountingDocument77 pagesGovernment Accounting Overview of Government AccountingMichael Brian Torres100% (1)

- Budgeting NumericalsDocument6 pagesBudgeting NumericalsAll in ONENo ratings yet

- Accommodation OperationDocument21 pagesAccommodation OperationPiyush AgarwalNo ratings yet

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONNo ratings yet

- KPCLDocument14 pagesKPCLBasavaraja K Kamlesh100% (1)

- 5) Handwritten QuizDocument8 pages5) Handwritten QuizAkshit SoniNo ratings yet

- MOD2 Statement of Cash FlowsDocument2 pagesMOD2 Statement of Cash FlowsGemma DenolanNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- Chapter 2 IAS 1 Presentation of Financial StatementsDocument85 pagesChapter 2 IAS 1 Presentation of Financial StatementsLidia SamuelNo ratings yet

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

- XYZ TagumDocument8 pagesXYZ TagumBSA3Tagum MariletNo ratings yet

- Sustainable Housing Project ProposDocument41 pagesSustainable Housing Project ProposRizqillaahi NaufalNo ratings yet

- Financial StatementsDocument133 pagesFinancial StatementsEmmanuel EngenaNo ratings yet

- UntitledDocument8 pagesUntitledartumangayNo ratings yet

- Glossary of Financial TermsDocument7 pagesGlossary of Financial TermsCalvin Chavez IIINo ratings yet

- Marvin CoDocument4 pagesMarvin CoVaibhav KathjuNo ratings yet

- Douglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Document6 pagesDouglas A. Chandler v. Commissioner of Internal Revenue, 226 F.2d 467, 1st Cir. (1955)Scribd Government DocsNo ratings yet

- Teach1 CFMDocument8 pagesTeach1 CFMmuhammad aalyanNo ratings yet