Professional Documents

Culture Documents

BAF Tutorial Question consolidation

BAF Tutorial Question consolidation

Uploaded by

utopoloshetani01Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAF Tutorial Question consolidation

BAF Tutorial Question consolidation

Uploaded by

utopoloshetani01Copyright:

Available Formats

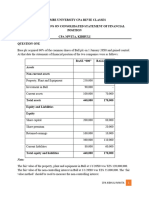

QUESTION TWO

P company Limited acquired 80% of S company limited on 1 December, 2020 paying

TZS.2,250 per share in cash and TZS.2,000,000,000 in three years time. At this date

the balance on S Ltd. retained earnings was TZS.870,000. On 1 March, 2021 P

Limited acquired 30% of A Limited ordinary shares. The consideration was settled by

a share exchange of 4 new shares in P Ltd. for every 3 shares acquired in A Ltd. The

share price of P Ltd. at the date of acquisition was TZS.5,000. P Ltd. has not yet

recorded the acquisition of A in its books.

The statements of financial position of the three companies as at 30 November 2022

are as follows:

P Ltd. S Ltd A Ltd

TZS.'000,000' TZS.'000,000' TZS.'000,000'

Non-current assets:

Property 1,300 850 900

Plant & Equipment 450 210 150

Investments 1,825

Current assets:

Inventory 550 230 200

Receivables 300 340 400

Cash 120 50 140

4,545 1,680 1,790

Equity and liabilities:

Equity:

Share capital TZS.1,000@ 1,800 500 250

Share premium 250 80 -

Retained earnings 1,145 400 1,200

3,195 980 1,450

Non-current liabilities:

10% loan notes 500 300 -

Current liabilities:

Trade payables 520 330 250

Income tax 330 70 90

4,545 1,680 1,790

The following information is relevant:

(i) As at 1 December, 2018 plant in the books of S Ltd was determined to have a

fair value of TZS. 50,000,000 in excess of carrying amount. The plant had a

remaining life of 5 years at this time.

(ii) During the post-acquisition period, S Ltd sold goods to P Ltd for TZS.

400,000,000 at a mark-up of 25%. P had a quarter of these goods still in

inventory at the year end.

(iii) In September A Ltd. sold goods to P Ltd. for TZS.150,000,000. These goods

had cost A Ltd. TZS. 100,000,000. P Ltd had TZS. 90,000,000 (at cost to P

Ltd.) at the year end.

(iv) As a result of the above intercompany sales P’s books showed TZS.

50,000,000 and TZS. 20,000,000 as owing to S and A respectively at the year

end. These amounts agreed with the amounts recorded in S’s and A’s books

(v) Non-controlling interests are measured using the fair value method. The fair

value of non-controlling interests at the date of acquisition was

TZS.368,000,000. Goodwill has impaired by TZS.150,000,000 at the reporting

date. An impairment review found the investment in the associate was to be

impaired by TZS. 15,000,000 at the year end.

(vi) A’s profit after tax for the year was TZS.600,000,000.

REQUIRED:

Prepare

a) Consolidation schedules (10 marks)

b) Consolidated statement of financial position for P Ltd. group as on 31

December, 2021. (10 marks)

(Total 20 marks)

You might also like

- Discussion 1 Second Sem .PDF-1Document11 pagesDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- 6 Figure High Risk Trading Plan!: Instructions (Print and Follow)Document2 pages6 Figure High Risk Trading Plan!: Instructions (Print and Follow)Bangi LotNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- GFA 712S - 2018 Test 2Document4 pagesGFA 712S - 2018 Test 2Nolan TitusNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- AdvancDocument4 pagesAdvancDerick cheruyotNo ratings yet

- UntitledDocument3 pagesUntitledTINOTENDA MUCHEMWANo ratings yet

- Quiz Chapter 17Document1 pageQuiz Chapter 17Zaira UdtohanNo ratings yet

- Week 7 Seminar QuestionsDocument4 pagesWeek 7 Seminar QuestionsBhanu TejaNo ratings yet

- Advacc Midterm AssignmentsDocument11 pagesAdvacc Midterm AssignmentsAccounting MaterialsNo ratings yet

- Corporate Liquidation Practical Accounting IIDocument4 pagesCorporate Liquidation Practical Accounting IIJalieha Mahmod100% (2)

- Afar Short Quiz Business Combination 01Document3 pagesAfar Short Quiz Business Combination 01Sharmaine Clemencio0No ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Exam - Finance Officer With AnsDocument2 pagesExam - Finance Officer With Ansconequip philippines100% (1)

- AFU 08501 - Tutorial Set-2021 - DemosntrationDocument5 pagesAFU 08501 - Tutorial Set-2021 - DemosntrationCunningham LazzNo ratings yet

- Acctg 13 - Unit Test Final Answer KeyDocument4 pagesAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasNo ratings yet

- Group FS (Unrealised Profit)Document6 pagesGroup FS (Unrealised Profit)Bro. JosephNo ratings yet

- Consolidated FS at Date of AcquisitionDocument1 pageConsolidated FS at Date of Acquisitionassoc.uls2324No ratings yet

- 2.0 ACC Test 2 Test and sug sol (2021)Document3 pages2.0 ACC Test 2 Test and sug sol (2021)molemothekaNo ratings yet

- AFR - Question BankDocument31 pagesAFR - Question BankDownloder UwambajimanaNo ratings yet

- Mutual OwingsDocument3 pagesMutual Owingsbriankuria21No ratings yet

- HorsefieldDocument2 pagesHorsefieldMarie Xavier - FelixNo ratings yet

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Consolidated Statement of Financial Position Part 1Document16 pagesConsolidated Statement of Financial Position Part 1Frank AlexanderNo ratings yet

- bài tập - conso 2Document4 pagesbài tập - conso 2Phạm Việt BáchNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Example Sheet 2 AfaDocument4 pagesExample Sheet 2 AfaPrabavathi KarunanithiNo ratings yet

- Abuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionDocument3 pagesAbuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionMarynelle SevillaNo ratings yet

- AFAR001 PartnershipDocument11 pagesAFAR001 PartnershipLen Charisse Sioco100% (1)

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet

- PDF 04Document7 pagesPDF 04Hiruni LakshaniNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument48 pagesThis Paper Is Not To Be Removed From The Examination Hallsduong duongNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Quiz 3 CFS Subsequent To Date of AcquisitionDocument3 pagesQuiz 3 CFS Subsequent To Date of AcquisitionJi Eun VinceNo ratings yet

- Nature of Consolidated StatementsDocument8 pagesNature of Consolidated StatementsRoldan Arca PagaposNo ratings yet

- Activity #3 Separate and Consolidated FS - Date of AcquisitionDocument4 pagesActivity #3 Separate and Consolidated FS - Date of AcquisitionLorelie I. RamiroNo ratings yet

- Afar 3 Quiz 4 Stock AcquisitionDocument4 pagesAfar 3 Quiz 4 Stock AcquisitiondmangiginNo ratings yet

- ConsolidationDocument7 pagesConsolidationJeremie KiamcoNo ratings yet

- ACTREV 4 Business Combination 2019Document6 pagesACTREV 4 Business Combination 2019Prom GloryNo ratings yet

- Problem 7-15 SolutionDocument5 pagesProblem 7-15 SolutionNguyenNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- Eps Tutorial QuestionsDocument15 pagesEps Tutorial QuestionsCostantine Andrew Jr.No ratings yet

- Acctg 10 - Final ExamDocument6 pagesAcctg 10 - Final ExamNANNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- PartnershipDocument10 pagesPartnershipJasmine Marie Ng Cheong50% (2)

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- FR (New) Suggested Ans CA Final Jan 21Document33 pagesFR (New) Suggested Ans CA Final Jan 21ritz meshNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Functions of RbiDocument14 pagesFunctions of RbiSheetal SainiNo ratings yet

- Topic 5-Financial SupervisionDocument43 pagesTopic 5-Financial Supervisionmerlinda ratuNo ratings yet

- Đề Cương Môn Tiếng Anh Lớp 6 -2021-2022Document16 pagesĐề Cương Môn Tiếng Anh Lớp 6 -2021-2022Vuong DangNo ratings yet

- Format IS and BSDocument2 pagesFormat IS and BSckyn greenleafNo ratings yet

- India's Geopolitical and Cultural ConcernsDocument5 pagesIndia's Geopolitical and Cultural ConcernsS SAI BALAJI IYERNo ratings yet

- Preparatory Work For Microeconomics EC202Document7 pagesPreparatory Work For Microeconomics EC202JohnNo ratings yet

- Finance Assignment PDFDocument11 pagesFinance Assignment PDFJoeyChengNo ratings yet

- Stock Market Made EasyDocument16 pagesStock Market Made EasyChellapandiNo ratings yet

- Drive Clean Rebate For Electric Cars: 40+ Qualifying ModelsDocument2 pagesDrive Clean Rebate For Electric Cars: 40+ Qualifying ModelsazurecobaltNo ratings yet

- 234 10302023 Kaia 6a4500593Document3 pages234 10302023 Kaia 6a4500593r56vwdhx7wNo ratings yet

- 2020 - 2021 Fccla Parent LetterDocument3 pages2020 - 2021 Fccla Parent Letterapi-517946986No ratings yet

- Global Economics 13th Edition Robert Carbaugh Solutions ManualDocument4 pagesGlobal Economics 13th Edition Robert Carbaugh Solutions Manualcovinoustomrig23vdx100% (26)

- Something About EquilibriumsDocument4 pagesSomething About EquilibriumsJoble02No ratings yet

- Characteristics of Public AdministrationDocument2 pagesCharacteristics of Public Administrationemma moshi100% (3)

- Estimation of Doubtful AccountsDocument3 pagesEstimation of Doubtful AccountsClar AgramonNo ratings yet

- Table 2.5 SolutionDocument3 pagesTable 2.5 SolutionMarghoob AhmadNo ratings yet

- Bangladesh's Graduation From LDC: Policies That Have Already Been Taken and The Government's PlanDocument14 pagesBangladesh's Graduation From LDC: Policies That Have Already Been Taken and The Government's PlanRafid AbrarNo ratings yet

- The Guide: An Introduction To The Global Precious Metals OTC MarketDocument95 pagesThe Guide: An Introduction To The Global Precious Metals OTC MarketThiti Vanich100% (1)

- Data 70Document4 pagesData 70Abhijit BarmanNo ratings yet

- 9 TH Eco Paper 2Document4 pages9 TH Eco Paper 2Zainab DurraniNo ratings yet

- Moving To Dallas - Best Places To Live in Dallas - NextburbDocument1 pageMoving To Dallas - Best Places To Live in Dallas - NextburbNextburb - Best Places to Live in the USNo ratings yet

- Dap An HSG Lop 9 Bac Ninh 2015-2016 Tieng AnhDocument3 pagesDap An HSG Lop 9 Bac Ninh 2015-2016 Tieng AnhPhạm Trần Tiến KhánhNo ratings yet

- Personal Expenses As of September 2023Document2 pagesPersonal Expenses As of September 2023aqualinawrsNo ratings yet

- READ-National Power Corp. v. Province of PDFDocument10 pagesREAD-National Power Corp. v. Province of PDFBeverly De la CruzNo ratings yet

- Intensive VariancesDocument11 pagesIntensive VariancesZainab SyedaNo ratings yet

- BEC 3100 General EconomicsDocument2 pagesBEC 3100 General EconomicsKelvin MagiriNo ratings yet

- 1058 RADHA KRISHNA SALES - Saneha CreationDocument8 pages1058 RADHA KRISHNA SALES - Saneha CreationZain ShaikhNo ratings yet

- The Time Value of Money (True or False)Document4 pagesThe Time Value of Money (True or False)Mary DenizeNo ratings yet

- Unit-1 - Introduction To Petrochemicals (2) (Autosaved)Document108 pagesUnit-1 - Introduction To Petrochemicals (2) (Autosaved)prathamesh singhNo ratings yet