Professional Documents

Culture Documents

PCL_Report_2023-pages-14

PCL_Report_2023-pages-14

Uploaded by

Prashant MehtaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PCL_Report_2023-pages-14

PCL_Report_2023-pages-14

Uploaded by

Prashant MehtaCopyright:

Available Formats

Drivers and challenges 2.

BESS System Costs are still high for widespread

adoption in commercial, industrial, and residential

Some of the key drivers of global growth in BESS segments in countries without any incentives;

deployment are the following: 3. Supply chain constraints, driven by the EV market

1. Commitments towards low-carbon electrification acceleration has resulted in higher prices in

and energy security concerns will intensify the construction materials, metals, and critical minerals,

deployment of variable RE generation capacity, and exacerbated by the geo-political volatility has

requiring grid-scale storage solutions to address put cost pressure on BESS projects, deferring or even

concerns around grid congestion and achieve canceling a few of them.

effective load balancing;

Despite constraints in the supply of critical minerals

2. Advancements in the EV market and expansion of and materials, shipping and permitting processes, BESS

battery production capacity translate into system is poised for accelerated growth. Governments have

performance improvements and cost reductions; formed and will continue to formulate policies and

3. Government incentives and evolving market plans with long-term effects for renewable energy and

regulations, including time-of-use tariffs, ancillary BESS, a critical element for the much-needed flexibility

services markets, and distributed generation and resilience that modern energy systems require.

rules incentivising self-consumption will improve

feasibility for BESS through creation of alternate

revenue streams;

4. Market maturity will result in improved funding Interested in gaining more in-

availability for manufacturing and deployment of

BESS; depth analysis and insight?

5. Rising benefits of decentralised generation and

Schedule a dialog with Frost & Sullivan team to

storage for C&I and residential customers in the

understand how you can maximize your growth

wake of increasing grid based electricity prices;

potential.

6. Rising events of grid outages coupled with reliability

issues has placed an impetus on developing Frost & Sullivan growth experts can help you with:

alternative reliable sources of backup power by C&I

and residential customers. Strategizing for new business models

Identifying new technologies/product opportunities

Despite a positive growth outlook, several challenges for investment

exist, which if adequately addressed, provide the

Localization/improving in-country value

opportunity to realise the true potential of BESS,

including: Geographic expansion

Strategic partnering

1. In most electricity markets, flat electricity tariffs, Improving market share

inadequate net metering mechanisms, and lack

of BESS access to wholesale markets make the

business case challenging for front and behind-the-

meter installations;

an Informa business intelligence partner

i.

IEA Global Hydrogen Review, 2021 iv.

Installed power generation capacity by source in the Stated

ii.

Frost & Sullivan Analysis Policies Scenario, 2000-2040, IEA 2020 (https://www.iea.org/data-

iii.

Electricity Generation by Energy Source/Activity, US Energy and-statistics/charts/installed-power-generation-capacity-by-

Information Administration, 2020 (https://www.eia.gov/ source-in-the-stated-policies-scenario-2000-2040)

international/data/world/electricity/electricity-capacity) v.

Frost & Sullivan Analysis

42 Middle East and Africa Outlook Report 2023

You might also like

- Ebook - Driving Better Decision Making With Big Data - LNS ResearchDocument36 pagesEbook - Driving Better Decision Making With Big Data - LNS ResearchcbqucbquNo ratings yet

- MasTec Corporate Presentation 051021Document38 pagesMasTec Corporate Presentation 051021girish_patkiNo ratings yet

- Battery Energy Storage Systems BESS 1717085828Document24 pagesBattery Energy Storage Systems BESS 1717085828SaiPraneethNo ratings yet

- JLL Global Data Centre Outlook 2023Document11 pagesJLL Global Data Centre Outlook 2023mailjestNo ratings yet

- At 03430 WP Beyond DigitalizationDocument22 pagesAt 03430 WP Beyond Digitalizationantony grandeNo ratings yet

- Us 2023 Outlook ChemicalDocument12 pagesUs 2023 Outlook ChemicalrajjjjjkumarNo ratings yet

- Report ACN Knowledge Sharing Conference With MUFG Bank (24112023)Document2 pagesReport ACN Knowledge Sharing Conference With MUFG Bank (24112023)nurzatil.othmanNo ratings yet

- MEML3Document1 pageMEML3sushanthNo ratings yet

- Small Scale Concentrated Solar PowerDocument50 pagesSmall Scale Concentrated Solar PowerEnkhbayar KhangaiNo ratings yet

- Aliphatic Hydrocarbon Resins: Investment Opportunity ScorecardDocument5 pagesAliphatic Hydrocarbon Resins: Investment Opportunity Scorecardkashyap8291No ratings yet

- De Martini Irdp Grid Mod 20220519Document24 pagesDe Martini Irdp Grid Mod 20220519Kiran TejaNo ratings yet

- Energy Policy: SciencedirectDocument11 pagesEnergy Policy: SciencedirectKirn ZafarNo ratings yet

- 21 MegaTrends ReportDocument19 pages21 MegaTrends ReportAndhika Herdiawan100% (1)

- Network Economics: Network Innovation Driving Cost Intensity Savings MARCH 2019Document14 pagesNetwork Economics: Network Innovation Driving Cost Intensity Savings MARCH 2019unknownNo ratings yet

- Powgen Sp001 en eDocument8 pagesPowgen Sp001 en evenimecaNo ratings yet

- MXWL - High Voltage Product Line Divestiture - 12.19.18Document10 pagesMXWL - High Voltage Product Line Divestiture - 12.19.18Aziz SabaNo ratings yet

- Active Distribution Network Integrated Planning Incorporating Distributed Generation and Load Response UncertaintiesDocument9 pagesActive Distribution Network Integrated Planning Incorporating Distributed Generation and Load Response Uncertaintiesvarathan.g2022No ratings yet

- 1.autonomous Plant Entering-A-New-Digital-Era MckinseyDocument11 pages1.autonomous Plant Entering-A-New-Digital-Era Mckinseyashutosh chauhanNo ratings yet

- Financing Trends in the CI RE Market JMKResearch Jun 2024Document40 pagesFinancing Trends in the CI RE Market JMKResearch Jun 2024drNo ratings yet

- Apple Adoption of ChatGPT - Implications For Data & Energy Consumption-Nicholas AssefDocument10 pagesApple Adoption of ChatGPT - Implications For Data & Energy Consumption-Nicholas AssefLCC Asia Pacific Corporate FinanceNo ratings yet

- Leap Modernizing From Loans Deposits LD Mortgages MG To Arrangements Architecture AA - Solution OverviewDocument11 pagesLeap Modernizing From Loans Deposits LD Mortgages MG To Arrangements Architecture AA - Solution OverviewLee Zhong De RolleiNo ratings yet

- AutoGrid VPP Policy Brief (2) (1)Document21 pagesAutoGrid VPP Policy Brief (2) (1)ErnestoNo ratings yet

- International Construction Costs 2024Document29 pagesInternational Construction Costs 2024Saumya RastogiNo ratings yet

- 2012-11-28 VodafonePartnership en PDFDocument9 pages2012-11-28 VodafonePartnership en PDFLuis Augusto CarvalhoNo ratings yet

- SWOT AnalysisDocument1 pageSWOT Analysisnahid islamNo ratings yet

- K9BF 01 00 00 00Document17 pagesK9BF 01 00 00 00honey larryNo ratings yet

- Optimization SWPDocument10 pagesOptimization SWPyaser.ahmedNo ratings yet

- IBM Smart MeteringDocument20 pagesIBM Smart MeteringrezaNo ratings yet

- Essential Aspects of Power System Planning in Developing CountriesDocument6 pagesEssential Aspects of Power System Planning in Developing CountriesDBachai84No ratings yet

- AT - 0330 - EB - Digitalization Strategies in Sustainability - 0123Document16 pagesAT - 0330 - EB - Digitalization Strategies in Sustainability - 0123Gaurav GuptaNo ratings yet

- Power & Low Carbon Energy Megatrends To 2050 - Chasing Net Zero Will Require Accelerated Growth & Investment in Key AreasDocument8 pagesPower & Low Carbon Energy Megatrends To 2050 - Chasing Net Zero Will Require Accelerated Growth & Investment in Key Areasnurzulaikha124No ratings yet

- ContentTree - The Data-Driven Approach to Controlling Costs and Maximizing ProductionDocument4 pagesContentTree - The Data-Driven Approach to Controlling Costs and Maximizing ProductionsylvainmailingNo ratings yet

- Energy Reports: Omar Ellabban, Abdulrahman AlassiDocument17 pagesEnergy Reports: Omar Ellabban, Abdulrahman AlassiFrans AdamNo ratings yet

- Electric Car Future Prediction - tcm27-67440Document10 pagesElectric Car Future Prediction - tcm27-67440quantumflightNo ratings yet

- Spectrum Pricing Positioning 2017Document8 pagesSpectrum Pricing Positioning 2017Mohammod FaisolNo ratings yet

- 2023 Telecom Industry OutlookDocument16 pages2023 Telecom Industry Outlooknhungoc3028No ratings yet

- Realising 5Gs Full Potential Setting Policies For Success MARCH20Document36 pagesRealising 5Gs Full Potential Setting Policies For Success MARCH20Popli PatrolNo ratings yet

- Introducing Reliability Based DistributiDocument4 pagesIntroducing Reliability Based Distributiabera alemayehuNo ratings yet

- Capital Investment Is About To Surge Are Your Operations Ready 2022Document10 pagesCapital Investment Is About To Surge Are Your Operations Ready 2022Hitalo GutierrezNo ratings yet

- PPS Placemat-Energy PowerDocument3 pagesPPS Placemat-Energy PowerMike CerreroNo ratings yet

- 3 en EREA Challenges and Policy Recommendations For RE Development KE2 NNDocument14 pages3 en EREA Challenges and Policy Recommendations For RE Development KE2 NNcanquoctuankNo ratings yet

- 10 Cleantech Trends in 2023 WhitepaperDocument17 pages10 Cleantech Trends in 2023 WhitepaperRicardoNo ratings yet

- Solar Outlook REPORT 2020: Middle East Solar Industry AssociationDocument35 pagesSolar Outlook REPORT 2020: Middle East Solar Industry Associationramkiran1989No ratings yet

- Siemens & IOC Partnership for E-mobilityDocument18 pagesSiemens & IOC Partnership for E-mobilityDishank AgrawalNo ratings yet

- PV 5Document23 pagesPV 52guntanNo ratings yet

- HRM GroupDocument9 pagesHRM Groupayen naimNo ratings yet

- Effect of Focus Strategy On The Organizational Performance of Pay-as-You-Go Solar Firms in KenyaDocument6 pagesEffect of Focus Strategy On The Organizational Performance of Pay-as-You-Go Solar Firms in KenyaInternational Journal of Innovative Science and Research Technology100% (1)

- Batteriemonitor 2023 Digital FinalDocument36 pagesBatteriemonitor 2023 Digital Finaltaufiq_hidayat_1982No ratings yet

- DRAFT - NIAC - Addressing The Critical Shortage of Power Transformers To Ensure Reliability of The U.S. Grid - ReportDocument27 pagesDRAFT - NIAC - Addressing The Critical Shortage of Power Transformers To Ensure Reliability of The U.S. Grid - Reportjaehi wooNo ratings yet

- Responding To Inflation and Volatility: Time For Procurement To LeadDocument7 pagesResponding To Inflation and Volatility: Time For Procurement To LeadRicha SharmaNo ratings yet

- Metal Industry Covid 19 Impact Digital TransformationDocument9 pagesMetal Industry Covid 19 Impact Digital TransformationPatrick PrakasaNo ratings yet

- Real Options Supply ChainDocument12 pagesReal Options Supply Chainwilliam ramirezNo ratings yet

- 2023 TMT Outlook TechnologyDocument12 pages2023 TMT Outlook TechnologyJiarong ZhangNo ratings yet

- spacexDocument1 pagespacexpgp39469No ratings yet

- IRCA and Coalition WebinarEnglishUploadDocument28 pagesIRCA and Coalition WebinarEnglishUploadalifdotsNo ratings yet

- EY Five Key Trends Are Impacting The Energy Industry Which Will Drive SignificantDocument8 pagesEY Five Key Trends Are Impacting The Energy Industry Which Will Drive SignificantPhalguniNo ratings yet

- Building To Grid: Industry Transformation For Flexible, Integrated, Value-Generating ResourcesDocument24 pagesBuilding To Grid: Industry Transformation For Flexible, Integrated, Value-Generating Resourcestest testNo ratings yet

- Five Data Center Prediction 2023Document30 pagesFive Data Center Prediction 2023Pandu RizkhiNo ratings yet

- Energy Storage in Grids with High Penetration of Variable GenerationFrom EverandEnergy Storage in Grids with High Penetration of Variable GenerationNo ratings yet

- Innovation Landscape brief: Utility-scale BatteriesFrom EverandInnovation Landscape brief: Utility-scale BatteriesNo ratings yet

- PCL_Report_2023-pages-10Document1 pagePCL_Report_2023-pages-10Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-9Document1 pagePCL_Report_2023-pages-9Prashant MehtaNo ratings yet

- EU MEA Outlook Report 2023-Pages-8Document1 pageEU MEA Outlook Report 2023-Pages-8Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-15Document1 pagePCL_Report_2023-pages-15Prashant MehtaNo ratings yet

- EU MEA Outlook Report 2023-Pages-8Document1 pageEU MEA Outlook Report 2023-Pages-8Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-15Document1 pagePCL_Report_2023-pages-15Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-1Document1 pagePCL_Report_2023-pages-1Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-10Document1 pagePCL_Report_2023-pages-10Prashant MehtaNo ratings yet

- PCL_Report_2023-pages-9Document1 pagePCL_Report_2023-pages-9Prashant MehtaNo ratings yet

- Renewable Energy Snapshot - Myanmar - United States - Report 1Document1 pageRenewable Energy Snapshot - Myanmar - United States - Report 1Prashant MehtaNo ratings yet

- Renewable Energy Snapshot - Myanmar - United States - Report 3Document1 pageRenewable Energy Snapshot - Myanmar - United States - Report 3Prashant MehtaNo ratings yet

- My SQL QuestionsDocument10 pagesMy SQL QuestionsYashasvi BhatnagarNo ratings yet

- Sustainability 10 02443Document19 pagesSustainability 10 02443mercyella prasetyaNo ratings yet

- T.I.M.E. European Summer School June 27 To July 9, 2011: Ustainability ConomicsDocument4 pagesT.I.M.E. European Summer School June 27 To July 9, 2011: Ustainability ConomicsalpalpalpalpNo ratings yet

- Design Guides For Bridges Vulnerable To Coastal StormsDocument27 pagesDesign Guides For Bridges Vulnerable To Coastal StormsjeovanNo ratings yet

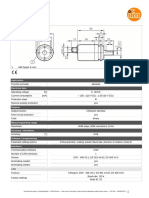

- Multiturn Solid Shaft Encoder: 1 M4 Depth 6 MMDocument2 pagesMultiturn Solid Shaft Encoder: 1 M4 Depth 6 MMSoha EzzaldenNo ratings yet

- Marketing Information SystemDocument3 pagesMarketing Information SystemsanjayNo ratings yet

- Victron With Pylon Configuration SettingsDocument3 pagesVictron With Pylon Configuration Settingswarick mNo ratings yet

- शिक्षामनोविज्ञानDocument2 pagesशिक्षामनोविज्ञानlalit sharmaNo ratings yet

- Chapter 5 Memory and Memory InterfaceDocument56 pagesChapter 5 Memory and Memory InterfacePetra KalasaNo ratings yet

- General Chemistry 1 Module 1 Answer Sheet (Page 1 of 3) : Examples of Physical Properties IncludeDocument6 pagesGeneral Chemistry 1 Module 1 Answer Sheet (Page 1 of 3) : Examples of Physical Properties IncludeJeremiah Se-engNo ratings yet

- Charles H. Hapgood Earths Shifting Crust 331 420Document90 pagesCharles H. Hapgood Earths Shifting Crust 331 420Cesar Ruiz100% (1)

- Job Shop Scheduling Vs Flow Shop SchedulingDocument11 pagesJob Shop Scheduling Vs Flow Shop SchedulingMatthew MhlongoNo ratings yet

- Ship Maintenance Planning With NavCadDocument4 pagesShip Maintenance Planning With NavCadtheleepiper8830No ratings yet

- Altium To q3dDocument3 pagesAltium To q3dWesley de PaulaNo ratings yet

- Fans Static Head Calculation SheetDocument1 pageFans Static Head Calculation SheetFahad NaveedNo ratings yet

- Chigozie PDFDocument73 pagesChigozie PDFJackson KasakuNo ratings yet

- Air Cabin TrainingDocument2 pagesAir Cabin TrainingVyl CebrerosNo ratings yet

- MKT Marunda Center ProfileDocument47 pagesMKT Marunda Center ProfileMuhammad AbidinNo ratings yet

- Lohia (Democracy)Document11 pagesLohia (Democracy)Madhu SharmaNo ratings yet

- Parametric & Non Parametric TestDocument8 pagesParametric & Non Parametric TestAngelica Alejandro100% (1)

- Feature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDocument2 pagesFeature: SFP Optical Module 1 .25G Double Optical Fiber 20kmDaniel Eduardo RodriguezNo ratings yet

- Sungrow-SG3 0RT-SG4 0RTDocument2 pagesSungrow-SG3 0RT-SG4 0RTchris dascalopoulosNo ratings yet

- On Annemarie Mols The Body MultipleDocument4 pagesOn Annemarie Mols The Body MultipleMAGALY GARCIA RINCONNo ratings yet

- Datasheet Af11Document11 pagesDatasheet Af11kian pecdasenNo ratings yet

- Diana Rodríguez - Habilidades Ingles Grados Once PDFDocument4 pagesDiana Rodríguez - Habilidades Ingles Grados Once PDFJuan Felipe Pacheco SanchezNo ratings yet

- Coronel, Kent Kenji B. Sts Final Exam Sat 4-7pmDocument7 pagesCoronel, Kent Kenji B. Sts Final Exam Sat 4-7pmKent CoronelNo ratings yet

- (Tutorial) Mid-Term ReviewDocument60 pages(Tutorial) Mid-Term ReviewCath BienNo ratings yet

- List of NDT EquipmentsDocument1 pageList of NDT EquipmentsAnandNo ratings yet

- SQL JoinsDocument59 pagesSQL Joinssunny11088No ratings yet

- Complex Trauma Inventory (CTI) With Scoring Protocol and Psychometric InformationDocument4 pagesComplex Trauma Inventory (CTI) With Scoring Protocol and Psychometric Informationranti faqoth100% (1)