Professional Documents

Culture Documents

Ping_Lik_Ng_January_01_2024_July_05_2024

Ping_Lik_Ng_January_01_2024_July_05_2024

Uploaded by

Ping Lik NgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ping_Lik_Ng_January_01_2024_July_05_2024

Ping_Lik_Ng_January_01_2024_July_05_2024

Uploaded by

Ping Lik NgCopyright:

Available Formats

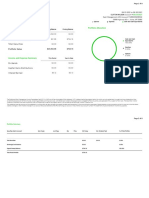

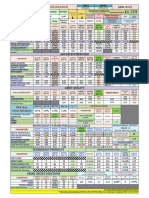

Snapshot Analysis Period: January 1, 2024 - July 5, 2024

NAME: Ping Lik Ng PERFORMANCE MEASURE

ACCOUNT: DU4199863 TWR

ACCOUNT TYPE: Individual BASE CURRENCY

USD

Net Asset Value Cumulative Return Key Statistics

210,000 20.00%

10.44% 0.94% 1.02% 3.02% -2.75%

CUMULATIVE RETURN 5 DAY RETURN 10 DAY RETURN BEST RETURN WORST RETURN

205,000 16.00%

01/01/24 - 07/05/24 07/01/24 - 07/05/24 06/24/24 - 07/05/24 05/15/24 04/19/24

200,000

12.00% Beginning NAV 186,143.97 Max Drawdown 6.54%

195,000 MTM 18,676.97 Peak-To-Valley 04/12/24 - 04/19/24

8.00%

Deposits & Withdrawals 0.00 Sharpe Ratio 1.24

190,000

Dividends 0.00

Standard Deviation 0.73%

4.00%

Interest 1,622.91

185,000

Fees & Commissions -347.07

0.00%

180,000 Other -514.53

Ending NAV 205,582.25

175,000 -4.00%

Change In NAV 19,438.28

170,000 -8.00%

01/01/24 01/29/24 02/26/24 03/25/24 04/22/24 05/20/24 06/17/24 Top Performers Value CTR (%) Bottom Performers Value CTR (%)

QQQ 0.00 4.09 QQQ 240621C004... 0.00 -0.21

DU4199863 NAV SPXTR EFA VT DU4199863 Return

TQQQ 240517C000... 0.00 2.51 QQQ 240603P004... 0.00 -0.14

TQQQ 0.00 1.57 QQQ 240603C004... 0.00 -0.07

Distribution of Returns Allocation

100

Financial Inst. Long (%) Financial Inst. Short (%)

Treasury Bills 200,195.18 97.22 Options -327.96 100.00

80

Bonds 3,800.00 1.85 Total -327.96 100.00

Cash 1,915.03 0.93

60 Total 205,910.21 100.00

40

Asset Class Long (%) Asset Class Short (%)

Fixed Income 203,995.18 99.07 Equities -327.96 100.00

20

Cash 1,915.03 0.93 Total -327.96 100.00

Total 205,910.21 100.00

0

-4% to -2% -2% to 0% 0% to 2% 2% to 4%

SPXTR EFA VT DU4199863

IMPORTANT NOTE:

This portfolio analysis was generated using Interactive Brokers' PortfolioAnalyst tool, which allows Interactive Brokers clients to generate analyses of their accounts using market data provided by third parties along with trade and account data contained in Interactive Brokers' systems. This analysis is for information purposes

only and is provided AS IS. Interactive Brokers makes no warranty of any kind, express or implied, as to this report analysis and its contents. The data provided for use in this Portfolio Analysis is believed to be accurate but completeness and accuracy of the information is not guaranteed, and Interactive Brokers has no liability

with respect thereto. The data regarding accounts held outside of Interactive Brokers is obtained either directly from you or from the financial institutions holding those accounts through a third-party service provider and Interactive Brokers has not reviewed its accuracy.

This material in this analysis is intended only as a reference and should not be relied upon for the maintenance of your books and records for tax, accounting, financial, or regulatory reporting or for any other purposes. This analysis is not an offer or a solicitation of an offer to buy or sell any security. This material does not and

is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

PortfolioAnalyst

You might also like

- MarkamsDocument1 pageMarkamsCynthia MukhwevhoNo ratings yet

- Bank 1 PDFDocument7 pagesBank 1 PDFadam burdNo ratings yet

- 13.target Costing & Activity Based CostingDocument5 pages13.target Costing & Activity Based Costingmercatuz50% (4)

- Architecture Office Organization StructureDocument3 pagesArchitecture Office Organization StructureAnushka Anand67% (3)

- Ping_Lik_Ng_Inception_July_05_2024Document1 pagePing_Lik_Ng_Inception_July_05_2024Ping Lik NgNo ratings yet

- SnapshotDocument1 pageSnapshothsadfj algioNo ratings yet

- Quarterly SnapshotDocument5 pagesQuarterly SnapshotDr. Mukesh JindalNo ratings yet

- UntitledDocument27 pagesUntitledhsadfj algioNo ratings yet

- PRUEBADocument7 pagesPRUEBAIngrid BritoNo ratings yet

- Abr Jun-22Document1 pageAbr Jun-22Detodojuego ProNo ratings yet

- February VATDocument1 pageFebruary VATChris KerorNo ratings yet

- Investor Letter: The Seventh Month in A RowDocument5 pagesInvestor Letter: The Seventh Month in A RowAgustin VeraNo ratings yet

- RMBN Sample Computation 20-20 (11) - 60Document1 pageRMBN Sample Computation 20-20 (11) - 60amiel pugatNo ratings yet

- Woodville General Trias, Cavite JANUARY 11, 2018Document2 pagesWoodville General Trias, Cavite JANUARY 11, 2018Mary FranceNo ratings yet

- Internal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420Document14 pagesInternal Rate of Return: Disscount Rate 12% Year Cash Flow 0 - 800 1 200 2 250 3 300 4 350 5 400 NPV 240.8060420ONASHI DEVNANI BBANo ratings yet

- Cashflow TemplateDocument2 pagesCashflow TemplateeyasNo ratings yet

- Printinvoice RequestDocument1 pagePrintinvoice RequestDesign GrappleNo ratings yet

- Research/Ceylinco Insurance PLC - December 2008Document5 pagesResearch/Ceylinco Insurance PLC - December 2008NilanthapereraNo ratings yet

- View Invoice_ReceiptDocument1 pageView Invoice_ReceiptkhadijahshehuabdullahiNo ratings yet

- Account Statement - Jun 30, 2021Document8 pagesAccount Statement - Jun 30, 2021Clifton WilsonNo ratings yet

- BilledStatements 2950 12-01-23 08.27Document1 pageBilledStatements 2950 12-01-23 08.27Murali KrishnaNo ratings yet

- Projected Profit Rates December 2023Document5 pagesProjected Profit Rates December 2023khanthegreat853No ratings yet

- BPI Creditcard - eSOA 8452449Document4 pagesBPI Creditcard - eSOA 8452449ML MariaWengNo ratings yet

- StatementDocument2 pagesStatementtakudzwa92No ratings yet

- View Invoice ReceiptDocument1 pageView Invoice Receiptfatimamuhammadusman87No ratings yet

- Iya Ado2Document1 pageIya Ado2ayoolaelijah09No ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971yogesh nagarNo ratings yet

- Ajiya ReciptDocument1 pageAjiya ReciptAdamu lawal ajiyaNo ratings yet

- Rochelle C Tugade 106B 7TH 6Th Avenue Caloocan City 1400 Card Number Statement Date 4293-8208-6552-2006 APR 03 2024Document4 pagesRochelle C Tugade 106B 7TH 6Th Avenue Caloocan City 1400 Card Number Statement Date 4293-8208-6552-2006 APR 03 2024ianaaliwakNo ratings yet

- Wa0001.Document2 pagesWa0001.pierrebartos200No ratings yet

- BilledStatements 7146 17-08-23 23.40Document1 pageBilledStatements 7146 17-08-23 23.40Udhasu NayakNo ratings yet

- LN11 BubblesDocument8 pagesLN11 BubblesChiu Tat ChanNo ratings yet

- Analysis On CornDocument39 pagesAnalysis On CornKath Hidalgo100% (1)

- Ipsita Maity d 252Document3 pagesIpsita Maity d 252dipankarmahato.socialmediaNo ratings yet

- 07363345470001 qDocument1 page07363345470001 qalhukam70No ratings yet

- 20180918Document4 pages20180918Nor Fauzi IsmailNo ratings yet

- WOOD Pricelist 110917Document2 pagesWOOD Pricelist 110917Mary FranceNo ratings yet

- BMSN Daily Shipping Report 2021Document506 pagesBMSN Daily Shipping Report 2021JulienneNo ratings yet

- 5197 PDFDocument1 page5197 PDFarpannathNo ratings yet

- Trading Journal by Kunjan - For SharingDocument286 pagesTrading Journal by Kunjan - For Sharingkiran12345zzzNo ratings yet

- 09 - KPI DashboardDocument18 pages09 - KPI DashboardCharlesNo ratings yet

- M27 For Jan 2021Document4 pagesM27 For Jan 2021kittu_sivaNo ratings yet

- Trading Journal by Kunjan - For SharingDocument274 pagesTrading Journal by Kunjan - For SharingJOHAN PRIETONo ratings yet

- Benmarmcoronado : Yamahaschoolofmusic Lowergfsmcityiloilo 5000manduriaoiloiloDocument4 pagesBenmarmcoronado : Yamahaschoolofmusic Lowergfsmcityiloilo 5000manduriaoiloiloBenmar CoronadoNo ratings yet

- View Invoice-ReceiptDocument1 pageView Invoice-ReceiptBeloved OkojieNo ratings yet

- View Invoice - ReceiptDocument1 pageView Invoice - ReceiptAbdullahi MustaphaNo ratings yet

- 202288110 (1)Document2 pages202288110 (1)navaadikeleraNo ratings yet

- Amdavad Municipal Corporation: Mahanagar Sewa SadanDocument1 pageAmdavad Municipal Corporation: Mahanagar Sewa Sadanpratikaparikh123No ratings yet

- Statement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020Document1 pageStatement Tax Invoice: Ms S Daniels 8 Stag Street Gelvandale 6020ShandreNo ratings yet

- Amdavad Municipal Corporation: Mahanagar Sewa SadanDocument1 pageAmdavad Municipal Corporation: Mahanagar Sewa SadanJaydeep ParmarNo ratings yet

- Leomillomendiola : Stpaulhospital Poblaciontagoloan 9000tagoloanDocument4 pagesLeomillomendiola : Stpaulhospital Poblaciontagoloan 9000tagoloanleomillmendiolaNo ratings yet

- 044151715100019Document1 page044151715100019mrrakeshkumar810No ratings yet

- Account Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountDocument1 pageAccount Summary: Statement Date:20/12/2021 Loan No: 0036 1150 XXXX 9510 Payment Due Date Total Dues Loan AmountbimexetNo ratings yet

- Performance of The Branch: Advances PortfolioDocument1 pagePerformance of The Branch: Advances PortfolioarpannathNo ratings yet

- ExtractoDeCuenta 9-2023Document5 pagesExtractoDeCuenta 9-2023lebronvictor830No ratings yet

- PaySlip636893786027292759 PDFDocument1 pagePaySlip636893786027292759 PDFIyyan DuraiNo ratings yet

- BSPlink 1600364413Document1 pageBSPlink 1600364413Leidy TaicusNo ratings yet

- Mass Beauty and Personal Care in Brazil DatagraphicsDocument3 pagesMass Beauty and Personal Care in Brazil DatagraphicsbabiNo ratings yet

- Vanessarramos : Hisglobalbusiinc9Fwilcon Bldg2251Ithubchinoroces 1233avemakatiDocument4 pagesVanessarramos : Hisglobalbusiinc9Fwilcon Bldg2251Ithubchinoroces 1233avemakatiVanessa RamosNo ratings yet

- Sdcap0031281851Document3 pagesSdcap0031281851Sagar RaghavendraNo ratings yet

- BillDocument2 pagesBill24kclipz033No ratings yet

- 3 Drives PatternDocument1 page3 Drives PatternPing Lik NgNo ratings yet

- Case Studies - RulesDocument1 pageCase Studies - RulesPing Lik NgNo ratings yet

- Dealing RangesDocument1 pageDealing RangesPing Lik NgNo ratings yet

- Entry ModelDocument1 pageEntry ModelPing Lik NgNo ratings yet

- T1. 3. How To Structure Business ProcessesDocument12 pagesT1. 3. How To Structure Business ProcessesMarquise BelgradeNo ratings yet

- Case Study of PUNE HotelDocument10 pagesCase Study of PUNE HoteluvavaliyaNo ratings yet

- OR FORUM-The Evolution of Closed-Loop Supply Chain ResearchDocument9 pagesOR FORUM-The Evolution of Closed-Loop Supply Chain Research翁慈君No ratings yet

- Flipkart Labels 30 Mar 2017 11 14 PDFDocument1 pageFlipkart Labels 30 Mar 2017 11 14 PDFbalkar singhNo ratings yet

- Reciept of Vehicle Sale Form July 2019Document1 pageReciept of Vehicle Sale Form July 2019Muhammad waqarNo ratings yet

- DocxDocument5 pagesDocxMithona855No ratings yet

- Updated Class Grouping For Assignment 2Document1 pageUpdated Class Grouping For Assignment 2Omeca JohnstonNo ratings yet

- Notice-Cloud Analogy RegistrationDocument3 pagesNotice-Cloud Analogy Registrationmuazkhan7253No ratings yet

- Z Chapter 4 The Revenue Cycle TamanoDocument4 pagesZ Chapter 4 The Revenue Cycle TamanoBrylle TamanoNo ratings yet

- F-440-001 QMS-ProcessesDocument7 pagesF-440-001 QMS-ProcessesFERNANDO MORANTES100% (1)

- RA - INSTALLATION OF FCU:AHU and FAHUDocument44 pagesRA - INSTALLATION OF FCU:AHU and FAHURAJANo ratings yet

- ME504 PM503 HR505 MIS Exam October 2020Document4 pagesME504 PM503 HR505 MIS Exam October 2020Abdikani Osman HassanNo ratings yet

- Nipfrg-Cqe002 4M Change RegulationDocument10 pagesNipfrg-Cqe002 4M Change RegulationRalph Jason AlvarezNo ratings yet

- The Impact of Warehousing On Customer Satisfaction: Makafui R. Agboyi, David AckahDocument12 pagesThe Impact of Warehousing On Customer Satisfaction: Makafui R. Agboyi, David Ackahmaria saleemNo ratings yet

- Company and Job: Key WordsDocument8 pagesCompany and Job: Key WordsMaría del Pilar Mancha BoteNo ratings yet

- BSBMGT517 - Management Operational Plan - Nicolas Larrarte - V1.1Document79 pagesBSBMGT517 - Management Operational Plan - Nicolas Larrarte - V1.1Nicolas EscobarNo ratings yet

- Ramasamy Subburaj Detailed Table of ContentsDocument8 pagesRamasamy Subburaj Detailed Table of ContentsAnand Mosum100% (1)

- NEW APP Format (RA-11469)Document14 pagesNEW APP Format (RA-11469)JoAnneGallowayNo ratings yet

- Kode Nama Akun Debet Kredit Saldo NormalDocument31 pagesKode Nama Akun Debet Kredit Saldo NormalSamsul PangestuNo ratings yet

- Work Instruction For SAPDocument4 pagesWork Instruction For SAPHiten GuptaNo ratings yet

- Toto - Quotqtion 1 - 240503 - 131449Document4 pagesToto - Quotqtion 1 - 240503 - 131449Norfarahazierah Bt Md ShaniNo ratings yet

- Passport Stats 05-09-2023 0916 GMTDocument1 pagePassport Stats 05-09-2023 0916 GMTФедірNo ratings yet

- Week 1Document17 pagesWeek 1Sabiha Meyra ŞahinlerNo ratings yet

- Financial Spot Check - Tool FinalDocument16 pagesFinancial Spot Check - Tool FinalAnne-Marie OyugaNo ratings yet

- Facilities PerformanceDocument10 pagesFacilities Performancepel2001No ratings yet

- Literature Review Wealth ManagementDocument7 pagesLiterature Review Wealth Managementea2pbjqk100% (1)

- Security Business PlanDocument6 pagesSecurity Business PlanSritam DasNo ratings yet

- Retail Marketing Questions PaperDocument51 pagesRetail Marketing Questions PaperAli ShaikhNo ratings yet