Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

0 viewsSiemens Pakistan (230812 HAMZA)

Siemens Pakistan (230812 HAMZA)

Uploaded by

Abdur-rahman AwanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- LinkedIn ValuationDocument13 pagesLinkedIn ValuationSunil Acharya100% (1)

- PTA Analysis Report (230832-Abdur Rahman)Document4 pagesPTA Analysis Report (230832-Abdur Rahman)Abdur-rahman AwanNo ratings yet

- Tute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Document7 pagesTute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Vigo GroupNo ratings yet

- Are Cash Flows From Operations Positive? What Is The Trend For Three Years?Document7 pagesAre Cash Flows From Operations Positive? What Is The Trend For Three Years?Tariq MehmoodNo ratings yet

- Major 1 Finance Project - 20461Document12 pagesMajor 1 Finance Project - 20461Augum DuaNo ratings yet

- Iktva 2021 - V2Document40 pagesIktva 2021 - V2Hassan Al EidNo ratings yet

- 5 FinDocument35 pages5 FinMansour HamjaNo ratings yet

- Timex India 1997Document28 pagesTimex India 1997ShyamasundaraNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- Buisness RareDocument22 pagesBuisness RareALINA ZohqNo ratings yet

- Combine PDFDocument21 pagesCombine PDFVigo GroupNo ratings yet

- Annual Report of Fy 2021 22Document156 pagesAnnual Report of Fy 2021 22DUBEY ADARSHNo ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- 2022 Iktva GuidelineDocument41 pages2022 Iktva GuidelineHassan HasNo ratings yet

- 2022 Iktva Guideline - Final Version 7.30.23Document41 pages2022 Iktva Guideline - Final Version 7.30.23Hassan Al EidNo ratings yet

- MSA-2-Winter-2017 QNDocument19 pagesMSA-2-Winter-2017 QNAsad TariqNo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- Data AnalysisDocument4 pagesData Analysis61Rohit PotdarNo ratings yet

- Titan Report Analysis FCADocument10 pagesTitan Report Analysis FCA19GPratiksha WaghNo ratings yet

- A Study On The Performance of Capital Budgeting Decisions of Maruthi Suzuki Limited From 2012Document8 pagesA Study On The Performance of Capital Budgeting Decisions of Maruthi Suzuki Limited From 2012Vaibhavi PatelNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- Research Study On Puravankara Limited: Umang ShekarDocument13 pagesResearch Study On Puravankara Limited: Umang ShekarUmang ShekarNo ratings yet

- fa93bdec-70e9-4c68-8978-c2add3549e79Document721 pagesfa93bdec-70e9-4c68-8978-c2add3549e79kareliyaabhishek69No ratings yet

- India Ratings and Research - Most Respected Credit Rating and Research Agency IndiaDocument6 pagesIndia Ratings and Research - Most Respected Credit Rating and Research Agency IndiainfotodollyraniNo ratings yet

- FA PDF - BajajDocument21 pagesFA PDF - BajajAman TiwaryNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- Notes of GE T - D India LTD - March 2020Document2 pagesNotes of GE T - D India LTD - March 2020khurshida.hodavasiNo ratings yet

- Cash Flow Analysis For Nestle India LTDDocument2 pagesCash Flow Analysis For Nestle India LTDVinayak Arun SahiNo ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- Adani AssigDocument15 pagesAdani AssigSandeep SinghNo ratings yet

- Press Release: YFC Projects Private LimitedDocument6 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- Unit 12Document200 pagesUnit 12vaghelavijay2205No ratings yet

- Shree Gautam Construction Co. Ltd.Document7 pagesShree Gautam Construction Co. Ltd.Tanya SNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- SECTION E - 23 ArchidplyDocument24 pagesSECTION E - 23 ArchidplyazharNo ratings yet

- In CroreDocument12 pagesIn CroreGrimisha BandagaleNo ratings yet

- GSL Annual Report 2021-22Document159 pagesGSL Annual Report 2021-22Mayank SinhaNo ratings yet

- 29th Annual Report and Annual Accounts For 2021 22 - Icici Pru TrustDocument41 pages29th Annual Report and Annual Accounts For 2021 22 - Icici Pru TrustIsha GargNo ratings yet

- Consumer Durables Market in India - Financial AnalysisDocument17 pagesConsumer Durables Market in India - Financial AnalysisBablu EscobarNo ratings yet

- Skyscraper Assessment BriefDocument14 pagesSkyscraper Assessment BriefHarish DasariNo ratings yet

- Zinka Logistics Solutions - R-25092020Document8 pagesZinka Logistics Solutions - R-25092020Atiqur Rahman BarbhuiyaNo ratings yet

- Financial Report of JK Lakshmi Cement & JK Cement: Financial Reporting Analysis First AssignmentDocument6 pagesFinancial Report of JK Lakshmi Cement & JK Cement: Financial Reporting Analysis First AssignmentSubir JaiswalNo ratings yet

- Annual Report 2021-22 PDFDocument179 pagesAnnual Report 2021-22 PDFMohnish KhianiNo ratings yet

- C ESCDocument245 pagesC ESCAmit SalarNo ratings yet

- Annual Report 2020 2021Document168 pagesAnnual Report 2020 2021Prachi KabthiyalNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsAmit BelladNo ratings yet

- Date: 22 July 2021Document4 pagesDate: 22 July 2021Mohit MendirattaNo ratings yet

- 3657_Commerce_COMM-CT-302_3rd Sem_L_2 (1)Document2 pages3657_Commerce_COMM-CT-302_3rd Sem_L_2 (1)Guru DattNo ratings yet

- Financial Statement Analysis: Analysis of The Annual Report of Singapore Airlines For The Year 2020-2021Document11 pagesFinancial Statement Analysis: Analysis of The Annual Report of Singapore Airlines For The Year 2020-2021Pratik GiriNo ratings yet

- Statement of Affairs As 31st December 2022Document9 pagesStatement of Affairs As 31st December 2022bolajiNo ratings yet

- AFM - D - Group No. 14Document19 pagesAFM - D - Group No. 14Rohan ShekarNo ratings yet

- 6-Audit QDocument1 page6-Audit Qjohny SahaNo ratings yet

- 22bsphh01c1222 Fsa A Subham DebDocument39 pages22bsphh01c1222 Fsa A Subham Debnilesh.das22hNo ratings yet

- FSA - E - 21BSPHH01C0677-Milan MeherDocument16 pagesFSA - E - 21BSPHH01C0677-Milan MeherMilan MeherNo ratings yet

- Annual report 2020-21Document34 pagesAnnual report 2020-21ansh bhalodiaNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Gna Gears LimitedDocument7 pagesGna Gears Limitedankityad129No ratings yet

- Suggested Answer of Case Study (CS)Document19 pagesSuggested Answer of Case Study (CS)FarhadNo ratings yet

- PG and Tvs ReportDocument15 pagesPG and Tvs ReportSAYALEE MESHRAMNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- NCFM Technical AnalysisDocument173 pagesNCFM Technical AnalysisAdhithyaNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- CS - Global Money NotesDocument14 pagesCS - Global Money NotesrockstarliveNo ratings yet

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedNo ratings yet

- Financial Management Practices of Upl LimitedDocument17 pagesFinancial Management Practices of Upl LimitedSaurabh PrasadNo ratings yet

- CA Final FEMA Amendment Vfinal May'23 OnwardsDocument14 pagesCA Final FEMA Amendment Vfinal May'23 Onwardsfkaam024No ratings yet

- IGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesAdrián Castillo100% (1)

- Brijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaDocument2 pagesBrijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaFaltu AccntNo ratings yet

- Accounting Grade 12 Support 2021 JIT Paper 1Document134 pagesAccounting Grade 12 Support 2021 JIT Paper 1Hunadi BabiliNo ratings yet

- Ias in Square PharmaDocument7 pagesIas in Square Pharmaarif9870% (1)

- SPOM SET B - SCMPE Chapter Wise WeightageDocument5 pagesSPOM SET B - SCMPE Chapter Wise Weightagecakarthi0491695No ratings yet

- Chapter 5Document46 pagesChapter 5vaman kambleNo ratings yet

- T-Accounts E. Tria Systems ConsultantDocument8 pagesT-Accounts E. Tria Systems ConsultantAnya DaniellaNo ratings yet

- Question 2Document37 pagesQuestion 2Mark Earl SantosNo ratings yet

- Chapter 06 Category Strategy Development - MDocument74 pagesChapter 06 Category Strategy Development - MDao Dang Khoa FUG CTNo ratings yet

- FundaTech 7Document111 pagesFundaTech 7Foru FormeNo ratings yet

- Disruptive Innovations Start in Low-End or Emerging MarketsDocument2 pagesDisruptive Innovations Start in Low-End or Emerging MarketsMichael YohannesNo ratings yet

- Gaap Chart Basic Function NatureDocument3 pagesGaap Chart Basic Function NaturearifuddinkNo ratings yet

- 07 Chapter 1Document34 pages07 Chapter 1Janavi chhetaNo ratings yet

- Term Paper of Accounting For Managers: Topic: Financial Analysis of L.I.C Housing FinanceDocument41 pagesTerm Paper of Accounting For Managers: Topic: Financial Analysis of L.I.C Housing FinancehimadrihazraNo ratings yet

- Lectures 5 & 7 - Easy Exercises - Attempt ReviewDocument17 pagesLectures 5 & 7 - Easy Exercises - Attempt ReviewHeidi DaoNo ratings yet

- Forex Simle Best Manual Trading System: Nick HolmzDocument4 pagesForex Simle Best Manual Trading System: Nick HolmznickholmzNo ratings yet

- Cash vs. Accrual Basis AccountingDocument3 pagesCash vs. Accrual Basis AccountingÂngela FerreiraNo ratings yet

- Ias 16 NotesDocument42 pagesIas 16 NotesHaseeb ZuberiNo ratings yet

- Ifs Cia 1.BDocument8 pagesIfs Cia 1.BAnubhav KushwahaNo ratings yet

- Why Lehman Bros Went BustDocument7 pagesWhy Lehman Bros Went BustswapnilimpactNo ratings yet

- CimbDocument3 pagesCimbMOHD KHAIRUL AMIN BIN MOHAMMAD MoeNo ratings yet

- Exit Exam For Accounting and Finance PDFDocument11 pagesExit Exam For Accounting and Finance PDFmesemo tadiwosNo ratings yet

- Topic 57 To 60 QuestionDocument9 pagesTopic 57 To 60 QuestionNaveen SaiNo ratings yet

Siemens Pakistan (230812 HAMZA)

Siemens Pakistan (230812 HAMZA)

Uploaded by

Abdur-rahman Awan0 ratings0% found this document useful (0 votes)

0 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

0 views3 pagesSiemens Pakistan (230812 HAMZA)

Siemens Pakistan (230812 HAMZA)

Uploaded by

Abdur-rahman AwanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

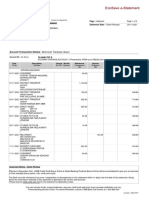

Siemens Pakistan Analysis Report

For the Year 2021-2022

● Introduction

Siemens Pakistan Engineering Co. Ltd. engages in the provision of energy,

industrial, infrastructure, and healthcare solutions. It operates through

following segments: Power and Gas, Smart Infrastructure and Digital

Industries.

● Company’s cash generation and expenditure across its

operational, investment and financing activities:

● Explanation

The cash flow statement you sent is for Siemens (Pakistan) Engineering Co. Ltd. and

covers the year ended September 30, 2022. The statement breaks down the company's

cash flows into three categories: operating activities, investing activities, and financing

activities.

Cash flows from operating activities

This section shows the cash generated from the company's core business activities. In

2022, Siemens (Pakistan) Engineering Co. Ltd. generated a negative cash flow of Rs.

249,366 from operating activities. This means that the company paid out more cash for

expenses than it received from customers. Some of the key items in this section

include:

● Cash generated from operations: This is the net cash inflow from a company's

sales of goods or services after accounting for any returns, allowances, and

discounts. In 2022, Siemens (Pakistan) Engineering Co. Ltd. generated Rs. 41 of

cash from operations.

● Income tax paid: This is the amount of income tax that the company has paid to

the government. In 2022, Siemens (Pakistan) Engineering Co. Ltd. paid Rs.

464,022 in income tax.

Cash flows from investing activities

This section shows the cash used by the company for investing in property, plant, and

equipment, as well as the cash received from the sale of these assets. In 2022,

Siemens (Pakistan) Engineering Co. Ltd. used a net cash of Rs. 113,844 for investing

activities. Some of the key items in this section include:

● Capital expenditure incurred: This is the amount of cash that the company has

spent on property, plant, and equipment. In 2022, Siemens (Pakistan)

Engineering Co. Ltd. incurred a capital expenditure of Rs. 156,433.

● Proceeds from sale of property, plant and equipment: This is the amount of cash

that the company has received from the sale of property, plant, and equipment. In

2022, Siemens (Pakistan) Engineering Co. Ltd. received Rs. 13,562 from the

sale of property, plant, and equipment.

● Cash flows from financing activities

This section shows the cash used by the company to pay dividends to shareholders and

repay debt. In 2022, Siemens (Pakistan) Engineering Co. Ltd. used a net cash of Rs.

564,521 for financing activities. Some of the key items in this section include:

● Dividends paid: This is the amount of cash that the company has paid to its

shareholders. In 2022, Siemens (Pakistan) Engineering Co. Ltd. paid Rs.

383,852 in dividends.

● Repayment of long-term financing: This is the amount of cash that the company

has used to repay its long-term debt. In 2022, Siemens (Pakistan) Engineering

Co. Ltd. repaid Rs. 7 of long-term financing.

Net cash flow and cash at the end of the period

The net cash flow is the sum of the cash flows from operating, investing, and financing

activities. In 2022, Siemens (Pakistan) Engineering Co. Ltd. had a negative net cash

flow of Rs. 927,731. This means that the company paid out more cash than it received

during the year.

The cash at the end of the period is the sum of the net cash flow and the cash at the

beginning of the period. In 2022, Siemens (Pakistan) Engineering Co. Ltd. had Rs.

1,474,580 in cash and cash equivalents at the end of the period.

Overall, the cash flow statement of Siemens (Pakistan) Engineering Co. Ltd. for the

year ended September 30, 2022 shows that the company had a negative net cash flow.

This means that the company paid out more cash than it received during the year. The

company's negative cash flow from operations was partially offset by positive cash flows

from investing and financing activities. However, the company's overall cash flow was

negative.

-----------------------------------------------------------

---------------------------------

You might also like

- LinkedIn ValuationDocument13 pagesLinkedIn ValuationSunil Acharya100% (1)

- PTA Analysis Report (230832-Abdur Rahman)Document4 pagesPTA Analysis Report (230832-Abdur Rahman)Abdur-rahman AwanNo ratings yet

- Tute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Document7 pagesTute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Vigo GroupNo ratings yet

- Are Cash Flows From Operations Positive? What Is The Trend For Three Years?Document7 pagesAre Cash Flows From Operations Positive? What Is The Trend For Three Years?Tariq MehmoodNo ratings yet

- Major 1 Finance Project - 20461Document12 pagesMajor 1 Finance Project - 20461Augum DuaNo ratings yet

- Iktva 2021 - V2Document40 pagesIktva 2021 - V2Hassan Al EidNo ratings yet

- 5 FinDocument35 pages5 FinMansour HamjaNo ratings yet

- Timex India 1997Document28 pagesTimex India 1997ShyamasundaraNo ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- Buisness RareDocument22 pagesBuisness RareALINA ZohqNo ratings yet

- Combine PDFDocument21 pagesCombine PDFVigo GroupNo ratings yet

- Annual Report of Fy 2021 22Document156 pagesAnnual Report of Fy 2021 22DUBEY ADARSHNo ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- 2022 Iktva GuidelineDocument41 pages2022 Iktva GuidelineHassan HasNo ratings yet

- 2022 Iktva Guideline - Final Version 7.30.23Document41 pages2022 Iktva Guideline - Final Version 7.30.23Hassan Al EidNo ratings yet

- MSA-2-Winter-2017 QNDocument19 pagesMSA-2-Winter-2017 QNAsad TariqNo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- Data AnalysisDocument4 pagesData Analysis61Rohit PotdarNo ratings yet

- Titan Report Analysis FCADocument10 pagesTitan Report Analysis FCA19GPratiksha WaghNo ratings yet

- A Study On The Performance of Capital Budgeting Decisions of Maruthi Suzuki Limited From 2012Document8 pagesA Study On The Performance of Capital Budgeting Decisions of Maruthi Suzuki Limited From 2012Vaibhavi PatelNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- Research Study On Puravankara Limited: Umang ShekarDocument13 pagesResearch Study On Puravankara Limited: Umang ShekarUmang ShekarNo ratings yet

- fa93bdec-70e9-4c68-8978-c2add3549e79Document721 pagesfa93bdec-70e9-4c68-8978-c2add3549e79kareliyaabhishek69No ratings yet

- India Ratings and Research - Most Respected Credit Rating and Research Agency IndiaDocument6 pagesIndia Ratings and Research - Most Respected Credit Rating and Research Agency IndiainfotodollyraniNo ratings yet

- FA PDF - BajajDocument21 pagesFA PDF - BajajAman TiwaryNo ratings yet

- SJS Enterprises LimitedDocument7 pagesSJS Enterprises LimitedCA Ankur BariaNo ratings yet

- Notes of GE T - D India LTD - March 2020Document2 pagesNotes of GE T - D India LTD - March 2020khurshida.hodavasiNo ratings yet

- Cash Flow Analysis For Nestle India LTDDocument2 pagesCash Flow Analysis For Nestle India LTDVinayak Arun SahiNo ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- Adani AssigDocument15 pagesAdani AssigSandeep SinghNo ratings yet

- Press Release: YFC Projects Private LimitedDocument6 pagesPress Release: YFC Projects Private Limitedlalit rawatNo ratings yet

- Unit 12Document200 pagesUnit 12vaghelavijay2205No ratings yet

- Shree Gautam Construction Co. Ltd.Document7 pagesShree Gautam Construction Co. Ltd.Tanya SNo ratings yet

- Tube Investments of India LimitedDocument8 pagesTube Investments of India Limitedpraveen kumarNo ratings yet

- SECTION E - 23 ArchidplyDocument24 pagesSECTION E - 23 ArchidplyazharNo ratings yet

- In CroreDocument12 pagesIn CroreGrimisha BandagaleNo ratings yet

- GSL Annual Report 2021-22Document159 pagesGSL Annual Report 2021-22Mayank SinhaNo ratings yet

- 29th Annual Report and Annual Accounts For 2021 22 - Icici Pru TrustDocument41 pages29th Annual Report and Annual Accounts For 2021 22 - Icici Pru TrustIsha GargNo ratings yet

- Consumer Durables Market in India - Financial AnalysisDocument17 pagesConsumer Durables Market in India - Financial AnalysisBablu EscobarNo ratings yet

- Skyscraper Assessment BriefDocument14 pagesSkyscraper Assessment BriefHarish DasariNo ratings yet

- Zinka Logistics Solutions - R-25092020Document8 pagesZinka Logistics Solutions - R-25092020Atiqur Rahman BarbhuiyaNo ratings yet

- Financial Report of JK Lakshmi Cement & JK Cement: Financial Reporting Analysis First AssignmentDocument6 pagesFinancial Report of JK Lakshmi Cement & JK Cement: Financial Reporting Analysis First AssignmentSubir JaiswalNo ratings yet

- Annual Report 2021-22 PDFDocument179 pagesAnnual Report 2021-22 PDFMohnish KhianiNo ratings yet

- C ESCDocument245 pagesC ESCAmit SalarNo ratings yet

- Annual Report 2020 2021Document168 pagesAnnual Report 2020 2021Prachi KabthiyalNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsAmit BelladNo ratings yet

- Date: 22 July 2021Document4 pagesDate: 22 July 2021Mohit MendirattaNo ratings yet

- 3657_Commerce_COMM-CT-302_3rd Sem_L_2 (1)Document2 pages3657_Commerce_COMM-CT-302_3rd Sem_L_2 (1)Guru DattNo ratings yet

- Financial Statement Analysis: Analysis of The Annual Report of Singapore Airlines For The Year 2020-2021Document11 pagesFinancial Statement Analysis: Analysis of The Annual Report of Singapore Airlines For The Year 2020-2021Pratik GiriNo ratings yet

- Statement of Affairs As 31st December 2022Document9 pagesStatement of Affairs As 31st December 2022bolajiNo ratings yet

- AFM - D - Group No. 14Document19 pagesAFM - D - Group No. 14Rohan ShekarNo ratings yet

- 6-Audit QDocument1 page6-Audit Qjohny SahaNo ratings yet

- 22bsphh01c1222 Fsa A Subham DebDocument39 pages22bsphh01c1222 Fsa A Subham Debnilesh.das22hNo ratings yet

- FSA - E - 21BSPHH01C0677-Milan MeherDocument16 pagesFSA - E - 21BSPHH01C0677-Milan MeherMilan MeherNo ratings yet

- Annual report 2020-21Document34 pagesAnnual report 2020-21ansh bhalodiaNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Gna Gears LimitedDocument7 pagesGna Gears Limitedankityad129No ratings yet

- Suggested Answer of Case Study (CS)Document19 pagesSuggested Answer of Case Study (CS)FarhadNo ratings yet

- PG and Tvs ReportDocument15 pagesPG and Tvs ReportSAYALEE MESHRAMNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- NCFM Technical AnalysisDocument173 pagesNCFM Technical AnalysisAdhithyaNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- CS - Global Money NotesDocument14 pagesCS - Global Money NotesrockstarliveNo ratings yet

- Client Portfolio Statement: %mkvalDocument2 pagesClient Portfolio Statement: %mkvalMonjur MorshedNo ratings yet

- Financial Management Practices of Upl LimitedDocument17 pagesFinancial Management Practices of Upl LimitedSaurabh PrasadNo ratings yet

- CA Final FEMA Amendment Vfinal May'23 OnwardsDocument14 pagesCA Final FEMA Amendment Vfinal May'23 Onwardsfkaam024No ratings yet

- IGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesAdrián Castillo100% (1)

- Brijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaDocument2 pagesBrijesh Kakkar: - +91-9654083132 - 06th Aug 1991 House No-41f, Sector 40, Gurgaon, HaryanaFaltu AccntNo ratings yet

- Accounting Grade 12 Support 2021 JIT Paper 1Document134 pagesAccounting Grade 12 Support 2021 JIT Paper 1Hunadi BabiliNo ratings yet

- Ias in Square PharmaDocument7 pagesIas in Square Pharmaarif9870% (1)

- SPOM SET B - SCMPE Chapter Wise WeightageDocument5 pagesSPOM SET B - SCMPE Chapter Wise Weightagecakarthi0491695No ratings yet

- Chapter 5Document46 pagesChapter 5vaman kambleNo ratings yet

- T-Accounts E. Tria Systems ConsultantDocument8 pagesT-Accounts E. Tria Systems ConsultantAnya DaniellaNo ratings yet

- Question 2Document37 pagesQuestion 2Mark Earl SantosNo ratings yet

- Chapter 06 Category Strategy Development - MDocument74 pagesChapter 06 Category Strategy Development - MDao Dang Khoa FUG CTNo ratings yet

- FundaTech 7Document111 pagesFundaTech 7Foru FormeNo ratings yet

- Disruptive Innovations Start in Low-End or Emerging MarketsDocument2 pagesDisruptive Innovations Start in Low-End or Emerging MarketsMichael YohannesNo ratings yet

- Gaap Chart Basic Function NatureDocument3 pagesGaap Chart Basic Function NaturearifuddinkNo ratings yet

- 07 Chapter 1Document34 pages07 Chapter 1Janavi chhetaNo ratings yet

- Term Paper of Accounting For Managers: Topic: Financial Analysis of L.I.C Housing FinanceDocument41 pagesTerm Paper of Accounting For Managers: Topic: Financial Analysis of L.I.C Housing FinancehimadrihazraNo ratings yet

- Lectures 5 & 7 - Easy Exercises - Attempt ReviewDocument17 pagesLectures 5 & 7 - Easy Exercises - Attempt ReviewHeidi DaoNo ratings yet

- Forex Simle Best Manual Trading System: Nick HolmzDocument4 pagesForex Simle Best Manual Trading System: Nick HolmznickholmzNo ratings yet

- Cash vs. Accrual Basis AccountingDocument3 pagesCash vs. Accrual Basis AccountingÂngela FerreiraNo ratings yet

- Ias 16 NotesDocument42 pagesIas 16 NotesHaseeb ZuberiNo ratings yet

- Ifs Cia 1.BDocument8 pagesIfs Cia 1.BAnubhav KushwahaNo ratings yet

- Why Lehman Bros Went BustDocument7 pagesWhy Lehman Bros Went BustswapnilimpactNo ratings yet

- CimbDocument3 pagesCimbMOHD KHAIRUL AMIN BIN MOHAMMAD MoeNo ratings yet

- Exit Exam For Accounting and Finance PDFDocument11 pagesExit Exam For Accounting and Finance PDFmesemo tadiwosNo ratings yet

- Topic 57 To 60 QuestionDocument9 pagesTopic 57 To 60 QuestionNaveen SaiNo ratings yet