Professional Documents

Culture Documents

Ambers_546543215455_12312022

Ambers_546543215455_12312022

Uploaded by

Thulasiga YathukulanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ambers_546543215455_12312022

Ambers_546543215455_12312022

Uploaded by

Thulasiga YathukulanCopyright:

Available Formats

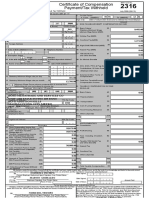

Republic of the Philippines

Department of Finance

For BIR BCS/

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316 Payment/Tax Withheld

September 2021 (ENCS) 2316 09/21ENCS

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the Period

2 0 2 2 0 2 1 6 To (MM/DD) 1 2 3 1

(YYYY) From (MM/DD)

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN 5 4 6 - 5 4 3 - 2 1 5 - 4 5 5 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

29 Basic Salary (including the exempt P250,000 & below) 0.00

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code or the Statutory Minimum Wage of the MWE

AMBERS, TAVARES XXXXXX 5 4 9

30 Holiday Pay (MWE) 0.00

6 Registered Address 6A ZIP Code

31 Overtime Pay (MWE) 0.00

Makati City 5 6 5 4

32 Night Shift Differential (MWE) 0.00

6B Local Home Address 6C ZIP Code

33 Hazard Pay (MWE) 0.00

6D Foreign Address 34 13th Month Pay and Other Benefits 62,807.50

(maximum of P90,000)

35 De Minimis Benefits 3,099.38

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number

36 SSS, GSIS, PHIC & PAG-IBIG Contributions 0.00

0 1 0 1 1 9 9 0 5 4 9 6 8 4 5 4 1 and Union Dues (Employee share only)

37 Salaries and Other Forms of Compensation

9 Statutory Minimum Wage rate per day 0.00 0.00

38 Total Non-Taxable/Exempt Compensation 65,906.88

10 Statutory Minimum Wage rate per month 0.00 Income (Sum of Items 29 to 37)

Minimum Wage Earner (MWE) whose compensation is exempt from B. TAXABLE COMPENSATION INCOME REGULAR

11

withholding tax and not subject to income tax

Part II - Employer Information (Present) 39 Basic Salary 23,062.50

12 TIN 8 7 6 - 5 4 5 - 4 6 5 - 5 5 5

40 Representation 0.00

13 Employer's Name

MGCTEST0711

41 Transportation 0.00

14 Registered Address 14A ZIP Code

Makati City 8 7 9 8 42 Cost of Living Allowance (COLA) 0.00

15 Type of Employer

X Main Employer Secondary Employer

43 Fixed Housing Allowance

0.00

Part III - Employer Information (Previous)

16 TIN - - - 44 Others (specify)

44A 32,030.62

17 Employer's Name

44B

18 Registered Address 18A ZIP Code SUPPLEMENTARY

45 Commission 0.00

Part IVA - Summary

19 Gross Compensation Income from Present Employer 46 Profit Sharing 0.00

121,000.00

(Sum of Items 38 and 52)

20 Less: Total Non-Taxable/Exempt Compensation Income 65,906.88 47 Fees Including Director's Fees 0.00

from Present Employer (From Item 38)

21 Taxable Compensation Income from Present Employer 55,093.12 48 Taxable 13th Month Pay Benefits

(Item 19 Less Item 20) (From Item 52) 0.00

22 Add: Taxable Compensation Income from 0.00

Previous Employer, if applicable 49 Hazard Pay 0.00

23 Gross Taxable Compensation Income 55,093.12

(Sum of Items 21 and 22) 50 Overtime Pay 0.00

24 Tax Due 0.00

51 Others (specify)

25 Amount of Taxes Withheld 51A 0.00

25A Present Employer 0.00

25B Previous Employer, if applicable 0.00 51B 0.00

26 Total Amount of Taxes Withheld as adjusted 0.00 52 Total Taxable Compensation Income 55,093.12

(Sum of Items 25A and 25B) (Sum of Items 39 to 51B)

27 5% Tax Credit (PERA Act of 2008) 0.00

28 Total Taxes Withheld (Sum of Items 26 and 27) 0.00

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

Date Signed

53 _____________________________________________________

Present Employer/ Authorized Agent Signature over Printed Name

CONFORME:

AMBERS, TAVARES XXXXXX

54 _____________________________________________________ Date Signed

Employee Signature over Printed Name

Amount paid, if CTC

CTC/Valid ID No. Place of

Date Issued

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

(BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

reported under BIR Form No. 1604-C which has been filed with the Bureau of for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

Internal Revenue. the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

of Revenue Regulations (RR) No. 3-2002, as amended.

55 _____________________________________________________

Present Employer/ Authorized Agent Signature over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

56 _____________________________________________________

Employee Signature over Printed Name

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

You might also like

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Mania Ki Photo PDFDocument1 pageMania Ki Photo PDFThapliyal PrakashNo ratings yet

- Week 1.basis Period Change in Accounting Dates - With Q ADocument39 pagesWeek 1.basis Period Change in Accounting Dates - With Q Asahrasaqsd0% (1)

- Chapter 4 - Reveneus and Other ReceiptsDocument18 pagesChapter 4 - Reveneus and Other Receiptsweddiemae villariza100% (8)

- Avila_816904401168_12312022Document1 pageAvila_816904401168_12312022Thulasiga YathukulanNo ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- 2316 (1) 1 Sangrades, SchechinaDocument1 page2316 (1) 1 Sangrades, SchechinaLeo GasminNo ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDocument1 pageCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Maricar CoronelDocument1 pageCertificate of Compensation Payment/Tax Withheld: Maricar CoronelAmy P. DalidaNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJexterNo ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Delector, Regine - Bir 2316Document2 pagesDelector, Regine - Bir 2316Marienhela MeriñoNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument1 page2316 Jan 2018 ENCS FinalCaina LeyvaNo ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- BIR ITR 2306 - CastilloDocument1 pageBIR ITR 2306 - CastilloBernadine CastilloNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- 2022 NleDocument24 pages2022 NleFrancis Anthony EspesorNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Ízf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpDocument2 pagesÍzf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpFelipe SorianoNo ratings yet

- Full & Final Pay Calculation: 368507 Nabata, Esathena BalderamaDocument4 pagesFull & Final Pay Calculation: 368507 Nabata, Esathena BalderamaËsatheńā ŃabaťāNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Tax Law PowerpointDocument7 pagesTax Law PowerpointAbhishekNo ratings yet

- Do Not Mail This Worksheet.: FAFSA On The Web Worksheet 2022 2023Document4 pagesDo Not Mail This Worksheet.: FAFSA On The Web Worksheet 2022 2023mortensenkNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- Payroll Final PDFDocument5 pagesPayroll Final PDFtinsae beyeneNo ratings yet

- DDocument24 pagesDNK BooksNo ratings yet

- Ias 10 Q7Document2 pagesIas 10 Q7natlyhNo ratings yet

- Nolo's Essential Retirement Tax GuideDocument436 pagesNolo's Essential Retirement Tax GuideabuaasiyahNo ratings yet

- đề 7Document8 pagesđề 7Hiền NguyễnNo ratings yet

- Pritax Prelim Bsa Summer 2021Document3 pagesPritax Prelim Bsa Summer 2021Sassy BitchNo ratings yet

- Indian Direct Tax Structure - An Analytical StudyDocument10 pagesIndian Direct Tax Structure - An Analytical StudyPremier PublishersNo ratings yet

- Zaibi Electricity BillDocument1 pageZaibi Electricity BillFarooq AhmedNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- College Accounting Chapters 1-27-22nd Edition Heintz Solutions ManualDocument22 pagesCollege Accounting Chapters 1-27-22nd Edition Heintz Solutions Manualmelrosecontrastbtjv1w100% (22)

- ACCA F6 MCQsDocument21 pagesACCA F6 MCQsAbdullahNo ratings yet

- General Anti Avoidance Rules Transfer PricingDocument21 pagesGeneral Anti Avoidance Rules Transfer PricingGEMM89No ratings yet

- Janina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Document3 pagesJanina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Ja CalibosoNo ratings yet

- CIT Revision TestDocument4 pagesCIT Revision TestK58 Nguyễn Hương GiangNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)FARMERS FIGHTNo ratings yet

- (Reviewer) TaxDocument13 pages(Reviewer) TaxchxrlttxNo ratings yet

- Taxation and Fiscal PolicyDocument35 pagesTaxation and Fiscal PolicyLouem GarceniegoNo ratings yet

- Aec10 - Business Taxation Solution Tabag CH4Document8 pagesAec10 - Business Taxation Solution Tabag CH4EdeksupligNo ratings yet

- Part 1: Principles of TaxationDocument5 pagesPart 1: Principles of Taxationxeileen08No ratings yet

- Toaz - Info Invoice Amazonpdf PRDocument1 pageToaz - Info Invoice Amazonpdf PRwakaNo ratings yet

- Commissioner of Internal Revenue vs. Engineering Equipment and Supply CompanyDocument1 pageCommissioner of Internal Revenue vs. Engineering Equipment and Supply CompanyCareyssa MaeNo ratings yet

- Facebook India Online Services Private Limited - Aabcf5150g - q4 - Ay202021 - 16aDocument2 pagesFacebook India Online Services Private Limited - Aabcf5150g - q4 - Ay202021 - 16aJAYDIPVDNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDPrakhar BhargavaNo ratings yet

- Pagcor V Bir Gr. No. 215427Document1 pagePagcor V Bir Gr. No. 215427Oro ChamberNo ratings yet