Professional Documents

Culture Documents

Payslip

Payslip

Uploaded by

vishwajeetsingh2436Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payslip

Payslip

Uploaded by

vishwajeetsingh2436Copyright:

Available Formats

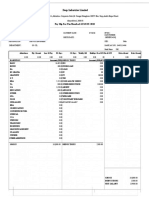

Altruist Technologies Pvt. Ltd.

Personal Details

Emp.ID ATPL242627 Pay Days 31.0

Name Bipul Kumar Singh PAN No. KYQPS3932D

Designation Executive - MIS UAN No. 101620373658

Department MIS/WFM PF No. HPSML/6547/0019684

Location Bangalore ATP ESI No. 5041576266

D.O.J 4-Sep-20 Bank Name CANARA BANK

Bank A/C No. 04142610004517

Pay Slip of Mar 2024

Earning Deduction

Description Rate Monthly Arrear YTD Description Amount YTD

BASIC 7015.00 7015.00 0.00 87785.00 PF 1800.00 21600.00

HRA 3508.00 3508.00 0.00 43897.00 ESI 154.00 1968.00

CONVEYANCE 1600.00 1600.00 0.00 20800.00 P TAX 0.00 800.00

CCA 0.00 0.00 0.00 0.00 Income Tax 0.00 0.00

MEDICAL 0.00 0.00 0.00 0.00 Advance 0.00 20028.00

SPA 7871.00 7871.00 0.00 100042.00 LWF 0.00 20.00

STBONUS 584.00 584.00 0.00 7309.00 Other 0.00 0.00

SHIFT 0.00 0.00 0.00 0.00 Leave Encashment 0.00 0.00

SKILL 0.00 0.00 0.00 0.00

SUPL 0.00 0.00 0.00 0.00

REFINC ALL 0.00 0.00 0.00 3000.00

LTA 0.00 0.00 0.00 0.00

LANGALL 0.00 0.00 0.00 0.00

FOOD ALL 0.00 0.00 0.00 0.00

EFFECIENCY ALL 0.00 0.00 0.00 0.00

TRAINGATTED ALL 0.00 0.00 0.00 0.00

NIGHT ALL 0.00 0.00 0.00 0.00

STIPEND 0.00 0.00 0.00 0.00

INCENTIVE 0.00 0.00 0.00 0.00

BONUS 0.00 0.00 0.00 0.00

TRAVELALL ALL 0.00 0.00 0.00 0.00

EXGRATIA ALL 0.00 0.00 0.00 645.00

Total Earnings 20578.00 20578.00 0.00 263478.00 Total Deduction 1954.00 44416.00

Gross Pay Mar 2024 20578.00 Net Payment 18624.00

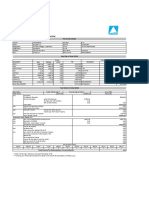

Tax Sheet of Mar 2024

Description Actual YTD Earnings** Proj. Earnings till Mar'24 Annul Total

Total Income 263478.00 0.00 263478.00

Less Exemption

(1) Standard Deduction 50000.00

(2) HRA Exemption Actual HRA Received 43897.00

Rent paid over 10% of salary 0.00

50% or 40% of salary 35114.00 0.00

Gross Salary 213478.00

Add Income from previous employer 0.00

Total income from salary 213478.00

Add Any Other Income Income from Other Sources 0.00

Income/Loss from House Property 0.00

Less Allowance to the extent exempt under section 10 0.00

Prof. Tax recovered by Employer 800.00

Gross Taxable Income 212678.00

Deductions Under Chapter VI A

Less Ded. U/S 80C,80CCC,80CCD Provident fund 21600.00 21600.00

Less Deduction U/S 80CCG 0.00 0.00

Less Other ded. under chapter VI A 0.00 0.00 0.00

Net Taxable Income(rounded off) 191078.00

Income Tax Payable 0.00

Rebate under section 87A, if applicable 0.00

Payable Tax 0.00

Add Education Cess 0.00

0.00

Total Income Tax Payable[I/Tax+E/C] 0.00

Less Less Income Tax deducted by previous employer 0.00

Tax already recovered on Stock Option / RSU 0.00

Balance Tax 0.00

Tax on additional income 0.00

Income Tax deducted till previous month 0.00

Balance Income Tax to be deducted 0.00

Deduction for the month 0.00

Tax deduction details

Apr'23 May'23 Jun'23 Jul'23 Aug'23 Sep'23 Oct'23 Nov'23 Dec'23 Jan'24 Feb'24 Mar'24

0 0 0 0 0 0 0 0 0 0 0 0

Total Income Tax Deducted(Incl. Current Month) 0

** Actual YTD Earning = Total Gross Earning (YTD) Medical (YTD)

*** Currently your monthly tax deductions are based on the Income Tax Declaration submitted by you.

You might also like

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocument35 pagesComputation of Taxable Income and Tax After General Reductions For Corporationsjahcaveman75% (4)

- PW37196 34541005Document2 pagesPW37196 34541005rajan singhNo ratings yet

- Sap SD Configuration WorkbookDocument183 pagesSap SD Configuration WorkbookRaviNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- Pay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedDocument1 pagePay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedAnkush SehgalNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Payslip 03 2024 Vtx1126693Document1 pagePayslip 03 2024 Vtx1126693sushmasamal802No ratings yet

- Payslip 04 2024 Vtx1126693Document1 pagePayslip 04 2024 Vtx1126693sushmasamal802No ratings yet

- M467 Slip Oct22Document1 pageM467 Slip Oct22Bhuvan ChanchaNo ratings yet

- Wa0037.Document1 pageWa0037.Ahsan khanNo ratings yet

- April'2021 Mid007Document1 pageApril'2021 Mid007Rajat SharmaNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- ProjectionReport 20240331Document3 pagesProjectionReport 20240331IaM Rajesh RajNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiNo ratings yet

- Feb SalaryDocument1 pageFeb SalaryDheer SinghNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- 10011488Document1 page10011488Anonymous BtiQTJz00% (1)

- Payslip For The Month May-19: MilltecDocument1 pagePayslip For The Month May-19: MilltecRajen MudiNo ratings yet

- Mahesh MulikDocument1 pageMahesh Mulikhdfcbankcreditcard2024No ratings yet

- March 2022 - SS OPJGUDocument1 pageMarch 2022 - SS OPJGUmohitmohapatra08No ratings yet

- Deep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Document2 pagesDeep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Ankush SehgalNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- Shubham 3 monthsDocument3 pagesShubham 3 monthscspasmoliNo ratings yet

- Sunil Kumar (DELS0210)Document1 pageSunil Kumar (DELS0210)SUNIL KUMARNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- July 2017Document1 pageJuly 2017omkass100% (1)

- Chiripal Poly Films Limited: Salary Slip For The Month of January - 2024Document1 pageChiripal Poly Films Limited: Salary Slip For The Month of January - 2024SHUBHAM PANDEYNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- Dec-2023 Salary SlipDocument1 pageDec-2023 Salary SlipsalimNo ratings yet

- Oct2022Document2 pagesOct2022Rishi KumarNo ratings yet

- Payslip Feb2022Document2 pagesPayslip Feb2022MaruthiNo ratings yet

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- Apr 2021Document1 pageApr 2021Suraj KadamNo ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- Ejercicio PlanillaDocument17 pagesEjercicio Planillamanfredo pastoraNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- PayslipEncrypted 024297 May2021Document1 pagePayslipEncrypted 024297 May2021Sarvesh KumarNo ratings yet

- April 2017Document1 pageApril 2017omkassNo ratings yet

- Cumulative B8983Document1 pageCumulative B8983bharathkumar jNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- Payslip 2018 2019 3 2380 SVATANTRADocument1 pagePayslip 2018 2019 3 2380 SVATANTRAsunil.srfcNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- Poai 2015Document68 pagesPoai 2015omar avilaNo ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Pay Slip For June - 2021: EarningsDocument2 pagesPay Slip For June - 2021: EarningsBagadi AvinashNo ratings yet

- Tax Statement As On Dec 2021: Employee DetailsDocument1 pageTax Statement As On Dec 2021: Employee DetailsElakkiyaNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- Payslip May2022Document2 pagesPayslip May2022MaruthiNo ratings yet

- Accretive Health Services Private Limited: Pay Slip For The Month of July 2022Document1 pageAccretive Health Services Private Limited: Pay Slip For The Month of July 2022Santosh Kumar GuptaNo ratings yet

- P Fled German AsDocument1 pageP Fled German AsPrimansu Pritam behera beheraNo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- Payslip Lyka Labs-Ramjeet PalDocument1 pagePayslip Lyka Labs-Ramjeet PalPankaj PandeyNo ratings yet

- Finacle 100 QueDocument13 pagesFinacle 100 QuesiddNo ratings yet

- Lesco - Web BillDocument1 pageLesco - Web BillRai SahibNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- BIR Transfer of SharesDocument8 pagesBIR Transfer of Sharesjaddls100% (1)

- Revised Negotiable Instruments Law Annotated MPPDocument69 pagesRevised Negotiable Instruments Law Annotated MPPLyka Mae Palarca IrangNo ratings yet

- Roscamadalinastefania 3541001 Ac 1220Document6 pagesRoscamadalinastefania 3541001 Ac 1220Abdul Mohammad KarimNo ratings yet

- Mini Cessna SkyartecDocument9 pagesMini Cessna SkyartecCarlos CrisostomoNo ratings yet

- Misc Remittance Request LetterDocument1 pageMisc Remittance Request LetterNaina ChaudharyNo ratings yet

- Op Transaction HistoryDocument2 pagesOp Transaction Historyhairul islamNo ratings yet

- Income Tax IndividualDocument22 pagesIncome Tax IndividualJohn Oicemen RocaNo ratings yet

- 78290v15n9 High ResDocument10 pages78290v15n9 High ResDane ForgerNo ratings yet

- Tax Invoice: 58 Jattal Road, Near Shiv Chowk, Panipat-132103 State Name: Haryana, Code: 06Document1 pageTax Invoice: 58 Jattal Road, Near Shiv Chowk, Panipat-132103 State Name: Haryana, Code: 06Neha BhardwajNo ratings yet

- 160 Scra 560 (GR L-66838) Cir vs. Procter and GambleDocument37 pages160 Scra 560 (GR L-66838) Cir vs. Procter and GambleRuel FernandezNo ratings yet

- Module 4 Estate Taxation 3Document4 pagesModule 4 Estate Taxation 3Melanie SamsonaNo ratings yet

- Memo Bir sECDocument2 pagesMemo Bir sECalbycadavisNo ratings yet

- Swift Standards Slma Directdebitservicelevelrulesandregulations PDFDocument17 pagesSwift Standards Slma Directdebitservicelevelrulesandregulations PDFion zyto dumitrescuNo ratings yet

- ICAB Last Year Question (Knowledge Level)Document5 pagesICAB Last Year Question (Knowledge Level)Fatema KanizNo ratings yet

- LLTA - Leg Text - 11.16.18Document24 pagesLLTA - Leg Text - 11.16.18MarkWarner100% (1)

- Class 11 Accountancy Chapter-4 Revision NotesDocument13 pagesClass 11 Accountancy Chapter-4 Revision NotesMohd. Khushmeen KhanNo ratings yet

- Claimed and Unclaimed Spes ChecksDocument808 pagesClaimed and Unclaimed Spes ChecksgurnaNo ratings yet

- Account Statement From 13 Sep 2023 To 13 Mar 2024Document2 pagesAccount Statement From 13 Sep 2023 To 13 Mar 2024santoshNo ratings yet

- US Internal Revenue Service: I1040 - 1997Document84 pagesUS Internal Revenue Service: I1040 - 1997IRSNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held bysurendraNo ratings yet

- Acct Statement - XX2519 - 10022024Document1 pageAcct Statement - XX2519 - 10022024rashidfcrfinNo ratings yet

- InvoiceinfinityDocument1 pageInvoiceinfinityAMit PrasadNo ratings yet

- Hotel Confirmation Voucher: Your Booking Is ConfirmedDocument2 pagesHotel Confirmation Voucher: Your Booking Is Confirmedmukul.kumarsainiNo ratings yet

- Foreign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsDocument16 pagesForeign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet