Professional Documents

Culture Documents

Taxability-of-capital anarkali

Taxability-of-capital anarkali

Uploaded by

jayabhargaviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxability-of-capital anarkali

Taxability-of-capital anarkali

Uploaded by

jayabhargaviCopyright:

Available Formats

DIRECT TAX

LAWS

Taxability of Capital Gains on

Buy-back of Shares - Debate ignites

after AARs ruling in RSTs case

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

BACKGROUND 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

1. Recently, the Authority for Advance Rulings (AAR) in the case 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

of RST, In re [2012] 19 taxmann.com 215 (AAR - New Delhi) (the 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

applicant) held that the capital gains on buy-back of shares is 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

taxable in India in the hands of the German company, being 99.99 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

shareholders of an Indian public company. 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

The AAR ruled as under : 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

u Section 46A of the Income-tax Act, 1961 (Act) being a specific 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

provision would apply while dealing with capital gains on buy- 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

back of shares, and 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

AMIT AGGARWAL

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

Section 47(iv) (read with section 45) which excludes from the 12345678901234567890123456789012123456789012

u 12345678901234567890123456789012123456789012

Senior Manager

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

definition of taxable transfer, a transfer of capital assets (Tax & Regulatory),

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

KPMG, Gurgaon

(including shares) held by a holding company to a 100 per cent 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

owned subsidiary, is not applicable to a case of buy-back. 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

ALOK PAREEK

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

CA

12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

2. FACTS OF THE CASE 12345678901234567890123456789012123456789012

12345678901234567890123456789012123456789012

u The applicant is a company incorporated in Germany with limited liability. The applicant

files income-tax returns in India as a non-resident.

u The applicant has a wholly owned subsidiary in India, which is a public limited company

incorporated under the Indian Companies Act, 1956.

The applicant holds 99.99 per cent shares in the Indian company. Remaining shares are

held by 6 other companies, who are the applicants nominees, for the compliance of the

Companies Act.

u The shares in the Indian company are held by the applicant as an investment and not

as stock-in-trade.

u Indian subsidiary is proposing a buy-back of shares from the applicant. The buy-back would

result in transfer of shares of the Indian company from the applicant to the Indian company.

12 May 1 to 15, 2012 u TAXMANNS CORPORATE PROFESSIONALS TODAY u Vol. 24 u 14

u The consideration for the proposed trans- Explanation. - For the purposes of

fer is to be determined on the basis of this section, specified securities shall

pricing guidelines prescribed by the Re- have the meaning assigned to it in

serve Bank of India (RBI) as applicable to the Explanation to section 77A of the

transfer of shares by a non-resident to a Companies Act, 1956 (1 of 1956).

resident.

Section 47(iv)

Transactions not regarded as trans-

3. ISSUE BEFORE THE AAR fer. Any transfer of a capital asset

u Whether the transfer of shares in the course by a company to its subsidiary com-

of buy-back of shares by the Indian sub- pany, if -

sidiary from the foreign company is tax- (a) The parent company or its

able in India? nominees hold the whole of the

share capital of the subsidiary

4. STATUTORY PROVISIONS company; and

u Income-tax Act, 1961 (Act) (b) The subsidiary company is an

Indian company;

Section 2(24)(vi)

u Companies Act, 1956

Income includes any capital gains

chargeable under section 45 Section 77A

Section 45 This provision enables a company to

purchase its own securities, subject

Charging section for capital gains to certain conditions. The buy-back

Section 46A should be of 25 per cent or less of

the total paid-up capital. On buy-

Capital gains on purchases by company back, the company has to extinguish

of its own or other specified securities. and physically destroy the securities

Where a shareholder or a holder of bought back. If shares are bought

other specified securities receives any back, there can be no fresh issue of

consideration from any company for shares within six months unless these

purchase of its own shares or other are bonus shares.

specified securities held by such

shareholder or holder of other speci- Section 49

fied securities, then, subject to the Subject to certain savings, all invest-

provisions of section 48, the differ- ments made by a company on its

ence between the cost of acquisition own behalf shall be made and held

and the value of consideration re- by it in its own name. Sub-section

ceived by the shareholder or the holder (3) enables a company to hold shares

of other specified securities, as the in its subsidiary in the name or names

case may be, shall be deemed to be of a nominee or nominees of the

the capital gains arising to such company so as to ensure that the

shareholder or the holder of other number of members of the subsid-

specified securities, as the case may iary is not reduced below seven, if it

be, in the year in which such shares is a public company, and below two,

or other specified securities were if the subsidiary is a private company.

purchased by the company. Sub-section (7) clarifies that securities

include stocks and debentures.

May 1 to 15, 2012 u TAXMANNS CORPORATE PROFESSIONALS TODAY u Vol. 24 u 15 13

DIRECT TAX LAWS

In A. Ramaiyas Guide to the Com- be chargeable to tax under section 45(1), read

panies Act (16th Edition Reprint 2006) with section 46A for computation thereof.

at page 614, the following passage

u The transaction shall be covered under

occurs :

section 45 and section 47(iv) and, there-

When the investment of a fore, the transaction would not be taxable

company consists of shares in in India.

another company the question

u The applicant and its nominees together

arises whether shares held by

held 100 per cent of the shares in the

the company in the name of its

Indian subsidiary. Therefore, the transfer

nominee must be deemed to be

in the course of a buy-back would stand

held by the company and

exempted from taxation under section 47(iv).

whether the investments should

be transferred to the name of u It is enough if a share is a capital asset

the company. In considering this to attract sections 45 and 47.

question, it is necessary to bear u Provisions of India-Germany tax treaty

in mind the provisions of section are not invoked since they are not ben-

153 which provide that no notice

eficial to the applicant and such capital

of any trust, express, implied gains are taxable in source State, i.e., India.

or constructive, shall be entered

in the register of members or

debenture-holders. A company, 6. TAX DEPARTMENTS CONTENTIONS

therefore, is bound to treat the

u Existence of the share after the transfer

person in whose name the shares

is a must for attracting section 47(iv). In

are entered in its register of

a buy-back the shares get destroyed and,

members as a member. If a

hence, section 47(iv) has no application.

company holds shares in the

name of its nominee it is not u Section 47 also does not override section

entitled to any of the rights in 46A.

respect of the shares such as Section 46A was introduced specifically

right to dividend, to allotment to deal with buy-back of shares and the

of rights shares under section rate of tax has to be computed in terms

81, to exercise voting rights in of section 48. Section 47 has no relevance

relation to the shares and other in this context.

privileges which shareholders

have. It does not, therefore, Accordingly, the gains are taxable in India as

appear to be an implication of capital gain, both under section 46A or under

the provisions of section 49 that Article 13(4) of India-Germany tax treaty.

if a company holds shares in

another company in the name AARS RULING

of its nominee, the shares must

be deemed to be held by the 7. The AAR held in favour of the revenue on

company and not by the nominee. following two grounds :

u Section 47(iv) provides exemption if a

5. APPLICANTS CONTENTIONS company holds 100 per cent shares in an

Indian subsidiary, either directly or through

u Section 46A of the Act is not a charging its nominees.

section. Further, buy-back of shares would

14 May 1 to 15, 2012 u TAXMANNS CORPORATE PROFESSIONALS TODAY u Vol. 24 u 16

u In the context of section 49(3) of the Com- Therefore, the gains on proposed buy-back of

panies Act, there cannot exist a subsid- shares would not be exempt under section

iary Indian company, whether public or 47(iv) and liable to be taxed in India under

private, in which the parent company could special provisions dealing with buy-back under

legally hold 100 per cent of the shares. section 46A.

Treating the other six members as not

having independent existence, it would SECTION 47(iv) - THE CONTROVERSY

mean that the subsidiary would become AHEAD - VIEWS

an illegal entity in the face of section

49(3) of the Companies Act. It would mean 8. The AARs conclusion of requirement of

that the applicant would be founding its 100 per cent shareholding by a single shareholder

cause of action on an illegality. [without nominee shareholding to comply with

minimum number of shareholders requirement

Relying on A. Ramaiyas Guide to the as per Companies Act] is highly impracticable,

Companies Act [as above], the AAR held since in such a scenario, practically no holding

that in the applicants case even if it is company will be able to take benefit of transfer

taken that the other six members of the of any capital asset, even other than shares in

subsidiary are the nominees of the appli- a buy-back scheme.

cant, it cannot be claimed that the appli-

cant is holding 100 per cent of the shares This will render operation of section 47(iv)

in the subsidiary. redundant. Such redundancy would not have

been the intention of the Legislature.

If under Indian law, a parent company

cannot hold 100 per cent in a subsidiary, That apart, since the AAR based its conclusion

it would only mean that the Parliament also on the applicability of section 47(iv)

did not intend to confer the benefit of exemption vis-a-vis section 46A [irrespective

section 47(iv) on such a parent company. of the above conclusion], the same needs to

be discussed as below:

Therefore, the AAR held that the applicant is

wrong in assuming the words under section

47(iv) of the Act the parent company or its One view

nominees as the parent company and its u As per section 2(24)(vi) income includes

nominees. any capital gains chargeable under sec-

u Section 46A being a special provision dealing tion 45. Section 46A is not expressly covered

with buy-backs, has to prevail over the and also cannot be said to be covered

general provisions incorporated in sec- under the inclusive definition, since it

tion 45. is not a receipt of a recurrent nature to

fall under the general connotation of income.

u Further, even if the plea of the applicant

is accepted to read or as and in section u When section 47(iv) provides for a trans-

47(iv), it is of no avail to the applicant action of transfer1 of capital asset not to

in view of the fact that section 46A would be regarded as a transfer (subject to

be applicable in the case of a buy-back fulfilment of conditions). Section 46A is

of shares and it is not subjected to section a deeming provision taxing a specific

47 (which only overrides section 45). transaction (i.e., buy-back), irrespective of

whether it is a transfer or not.

u Once section 46A is attracted when there

is a buy-back of shares, the gains have u Going by a strict interpretation of section

to be taxed in terms of said provision, 47(iv) for its applicability to only a select

read with section 48. species of companies, (aligning with the

May 1 to 15, 2012 u TAXMANNS CORPORATE PROFESSIONALS TODAY u Vol. 24 u 17 15

DIRECT TAX LAWS

view of AAR), it can be construed that arising on buy-back of shares to the capital

the benefit of section 47(iv) ought not to gains tax. However, in the light of the

be available to a holding company, where intention of the section alone it cannot be

it does not hold all shares in its subsid- a ground for taxing the buy-back in all

iary and even a single share is held by cases. When a buy-back falls under the

its nominees. exempting provisions [section 47(iv)], it

cannot be taxed under section 46A.

Second view u Section 46A would be rendered otiose if

it was not regarded to fall under the charging

u However, section 45 is the only charging

provisions of section 45 and, hence, un-

section for capital gains as contemplated

der the definition of income under sec-

under section 2(24)(vi). There is only one

tion 2(24).

charging section for each head of income,

i.e. section 15 for salaries, section 23 for The second view appears to be more well-

house property, section 28 for profits from founded based on the provisions of law.

business, section 45 for capital gains and

section 56 for other sources.

9. CONCLUSION

The Supreme Court in CIT v. B.C. Srinivasa

u The force of section 46A alone should not

Setty [1981] 128 ITR 294/5 Taxman 1 has held :

be sufficient to tax capital gains arising

The charging section and the computation on buy-back in every situation. Thus, the

provisions together constitute an integrated benefit of exemption vide provisions of

code And ordinarily the operation of section 47(iv) should be possible in re-

the charging provision cannot be affected spect of transactions involving buy-back

by the construction of a particular of shares by the wholly owned Indian

computation provision. subsidiaries.

Section 46A provides for deemed capital gains. Given that AAR ruling only has a persua-

Consequently, it can be argued that section sive value and is not binding on other

46A derives its chargeability from section 45 taxpayers, it remains to be seen what in-

itself. terpretation is placed by the tax Tribu-

nals/courts in interpretation of these

u Further, use of the words subject to the

provisions.

provisions of section 48 in section 46A

is a reference to the mode of computation u The AAR ruling has opened a debatable

as per the provisions of section 48, mak- issue on interpretation of section 47(iv)

ing section 46A also a computation sec- which could lead to redundancy of the

tion providing the extent of charge, i.e., section in almost all cases, since practi-

the difference between the cost of acqui- cally no holding company will be able to

sition and the buy-back consideration take benefit of transfer of any capital asset,

received by the shareholder. even other than shares (in a buy-back

scheme). This is highly negative fall out

u The intention of the law makers while

of the decision.

inserting section 46A is subjecting the gains

•••

1. The Supreme Court in the case of Anarkali Sarabhai v. CIT [1997] 90 Taxman 509, held that redemption of

preference shares by the company is considered to be a sale and also transfer of asset by shareholder.

DT - Secs. 46A and 47(iv).

16 May 1 to 15, 2012 u TAXMANNS CORPORATE PROFESSIONALS TODAY u Vol. 24 u 18

You might also like

- Tantra - Shree - Meru-Tantram PDFDocument60 pagesTantra - Shree - Meru-Tantram PDFTantra Path77% (73)

- Aakaasa Bhairava TantramDocument56 pagesAakaasa Bhairava Tantramkiran_kandru86% (7)

- 1208 ManualDocument33 pages1208 Manualmg victorNo ratings yet

- Pocket Manual On The Art of History TakingDocument89 pagesPocket Manual On The Art of History TakingAkwu Akwu100% (1)

- Mesa Dew Poin ChartDocument40 pagesMesa Dew Poin ChartSdArNo ratings yet

- Rpmo October Payroll16Document22 pagesRpmo October Payroll16mennaldzNo ratings yet

- Empleyado Brochure PDFDocument3 pagesEmpleyado Brochure PDFRose ManaloNo ratings yet

- Tax Clearance BNDocument1 pageTax Clearance BNNora Goguanco PamplonaNo ratings yet

- Series of Frequency Inverter: Yantai Huifeng Electronics Co.,LtdDocument6 pagesSeries of Frequency Inverter: Yantai Huifeng Electronics Co.,LtdEzequiel Victor HugoNo ratings yet

- K'Sagar Publication GK Book Details PDFDocument5 pagesK'Sagar Publication GK Book Details PDFTilottama Deore50% (4)

- G1V2BL3 PDFDocument12 pagesG1V2BL3 PDFNeha SinghNo ratings yet

- Corrosion and Climatic Effects in Electronics: Risto HienonenDocument420 pagesCorrosion and Climatic Effects in Electronics: Risto HienonenShijumon KpNo ratings yet

- 01 - Cover - gs41Document3 pages01 - Cover - gs41Echa DudoNo ratings yet

- Khadayata Jyoti 2016-03Document104 pagesKhadayata Jyoti 2016-03reachtomrhandsomeNo ratings yet

- Khadayata Jyoti 2016-05Document100 pagesKhadayata Jyoti 2016-05manans_13No ratings yet

- ®KMSV/ Riu Âkk/S Kiul Ata Qv/.Atiuc/ QT/M T/Ek®Pv./M Ek A/L N/Eaac/ 'Ki PM/ Siuk/P OiDocument16 pages®KMSV/ Riu Âkk/S Kiul Ata Qv/.Atiuc/ QT/M T/Ek®Pv./M Ek A/L N/Eaac/ 'Ki PM/ Siuk/P Oithadar thanzawooNo ratings yet

- Anudina Bhava TharangaluDocument186 pagesAnudina Bhava TharangalusudeepraazNo ratings yet

- Preface Junior 2Document8 pagesPreface Junior 2Imam SibawaihiNo ratings yet

- Ganasakti 17 MarchDocument8 pagesGanasakti 17 Marchnirangkush nathNo ratings yet

- Jeff Cot Trot or Active ControlDocument166 pagesJeff Cot Trot or Active ControlHZ. TYMOFEINo ratings yet

- Lakshmi Kubera Poojai AshtothrasDocument28 pagesLakshmi Kubera Poojai AshtothrasNarayanan MuthuswamyNo ratings yet

- Introductory Micro Economics XIDocument116 pagesIntroductory Micro Economics XIarishreang2No ratings yet

- Logica 23Document6 pagesLogica 23teacher_miguelNo ratings yet

- Numbers The FifthDocument279 pagesNumbers The FifthМар'ян ВрюкалоNo ratings yet

- Numbers The ThirdDocument152 pagesNumbers The ThirdМар'ян ВрюкалоNo ratings yet

- Numbers The SeccondDocument76 pagesNumbers The SeccondМар'ян ВрюкалоNo ratings yet

- Numbers 1Document26 pagesNumbers 1Мар'ян ВрюкалоNo ratings yet

- 1234567890Document3 pages1234567890marcesalasNo ratings yet

- Numbers The FourthDocument178 pagesNumbers The FourthМар'ян ВрюкалоNo ratings yet

- CH 1Document27 pagesCH 1Sanjeev DubeyNo ratings yet

- YhdvcdDocument7 pagesYhdvcdFuazXNo ratings yet

- Ch-6 HindiDocument11 pagesCh-6 HindiSwapna GirishNo ratings yet

- earth inner structureDocument2 pagesearth inner structuremihabi5968No ratings yet

- Bhagavan Sri Sri Sri Venkaiahswamy Sadgurukrupa - Feb 2022-TELUGU DEVOTIONAL MONTHLY MAGAZINEDocument36 pagesBhagavan Sri Sri Sri Venkaiahswamy Sadgurukrupa - Feb 2022-TELUGU DEVOTIONAL MONTHLY MAGAZINESeshu VenkaiahswamyNo ratings yet

- Kham 116Document16 pagesKham 116Hari NirmalNo ratings yet

- Fundamental Physical Geography Class XIDocument156 pagesFundamental Physical Geography Class XIanindsNo ratings yet

- BehDocument2 pagesBehphilip.h.eadesNo ratings yet

- 2ND - Grand Olympiad - Question PaperDocument16 pages2ND - Grand Olympiad - Question Paperneetu.pravarshaNo ratings yet

- TORNEIODocument7 pagesTORNEIOClaudioLimaMatosNo ratings yet

- Description: Tags: 0203EFCFormulaGdWkshtDocument29 pagesDescription: Tags: 0203EFCFormulaGdWkshtanon-422641No ratings yet

- 1207A & 1207 ManualDocument70 pages1207A & 1207 ManualNILTON MOR100% (1)

- ODocument1 pageOgimapes258No ratings yet

- The 1 Quick 1 Brown 1 Fox 1 Jumps 1 Over 1 The 1 Lazy 1 DogDocument249 pagesThe 1 Quick 1 Brown 1 Fox 1 Jumps 1 Over 1 The 1 Lazy 1 Doganon_604916838No ratings yet

- VariosDocument3 pagesVariosAdrianNo ratings yet

- Peterson S Ultimate GRE Tool KitDocument351 pagesPeterson S Ultimate GRE Tool Kitlyasa77100% (3)

- SDFGHDocument3 pagesSDFGHpxstelpxwderNo ratings yet

- Abhivyakti Aur Madhyam Class XII HindiDocument16 pagesAbhivyakti Aur Madhyam Class XII HindiPiyush Pastor100% (3)

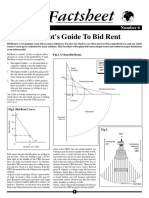

- Geo Factsheet: An Idiot's Guide To Bid RentDocument2 pagesGeo Factsheet: An Idiot's Guide To Bid RentaurennosNo ratings yet

- Dove 37 2Document4 pagesDove 37 2lovelamp88No ratings yet

- 10Document245 pages10dennis aguilar fuentesNo ratings yet

- 1204x 05 PDFDocument56 pages1204x 05 PDFAlberto MattiesNo ratings yet

- Sri Ramachandra Spinning Mills v. Province of MadrasDocument8 pagesSri Ramachandra Spinning Mills v. Province of MadrasjayabhargaviNo ratings yet

- Mario Raposo Vs HM Bhandarkar and Ors 14121993 BO0118m930463COM887859Document3 pagesMario Raposo Vs HM Bhandarkar and Ors 14121993 BO0118m930463COM887859jayabhargaviNo ratings yet

- PIL Case AnalysisDocument56 pagesPIL Case AnalysisjayabhargaviNo ratings yet

- Routledge Handbook of International EnviDocument19 pagesRoutledge Handbook of International EnvijayabhargaviNo ratings yet

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- 2021-09-30T21-06 Transaction #4321966431251448-8519037Document1 page2021-09-30T21-06 Transaction #4321966431251448-8519037fetacademymediaNo ratings yet

- Tax 3 ASSIGNMENTDocument23 pagesTax 3 ASSIGNMENTPui YanNo ratings yet

- RMC No 24-18 - Annexes B1-B5 - Required AttachmentsDocument3 pagesRMC No 24-18 - Annexes B1-B5 - Required AttachmentsGil PinoNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- TAX1-LagguiRichelle 2Document4 pagesTAX1-LagguiRichelle 2Richelle GraceNo ratings yet

- Direct Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5Document23 pagesDirect Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5JayNo ratings yet

- IT Compensation NotesDocument33 pagesIT Compensation NotesWinnie GiveraNo ratings yet

- Best in Sytems Tech. 2021payrollsignedDocument20 pagesBest in Sytems Tech. 2021payrollsignedSombre Sumayo Jackie MarieNo ratings yet

- GP Mobil Bill-Dec-19Document69 pagesGP Mobil Bill-Dec-19biddut782No ratings yet

- Chapter 1 Problems HDocument14 pagesChapter 1 Problems Hbalaji RNo ratings yet

- GST Book Bank AnswersDocument10 pagesGST Book Bank AnswersAditya DasNo ratings yet

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Document2 pagesAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNo ratings yet

- Summary of Cash PaymentsDocument4 pagesSummary of Cash PaymentsmellicentdhaNo ratings yet

- 42.gaston vs. Republic Planter's Bank 158 Scra 626Document1 page42.gaston vs. Republic Planter's Bank 158 Scra 626Jo DevisNo ratings yet

- Customs Duty Calculation FormulaDocument4 pagesCustoms Duty Calculation Formulabibhas1No ratings yet

- Vijaya Po 2Document1 pageVijaya Po 2adrijaswiagenciesNo ratings yet

- Thomas Co LTD Payroll 2019Document2 pagesThomas Co LTD Payroll 2019MaxineNo ratings yet

- Commissioner v. Burroughs, 142 SCRA 324 (1986) PDFDocument4 pagesCommissioner v. Burroughs, 142 SCRA 324 (1986) PDFHazel FernandezNo ratings yet

- Classification of TaxesDocument2 pagesClassification of TaxesJoliza CalingacionNo ratings yet

- Balochistan Sales Tax Special Procedure (Transportation or Carriage of Petroleum Oils Through Oil Tankers) Rules, 2019Document8 pagesBalochistan Sales Tax Special Procedure (Transportation or Carriage of Petroleum Oils Through Oil Tankers) Rules, 2019Tax PerceptionNo ratings yet

- Bipard Prashichhan (Gaya) - 87-2023 2ndDocument2 pagesBipard Prashichhan (Gaya) - 87-2023 2ndtinkulal91No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Spectra Notes Tax Law 2 Compilation PDFDocument197 pagesSpectra Notes Tax Law 2 Compilation PDFKriziaItao100% (1)

- LLPCollegeDocument25 pagesLLPCollegeKeshavNo ratings yet

- Name: Waleed Zahid Roll No: F18-1010 BS Accounting&Finance 6 Assignment No 1 Submitted To: Sir Atif Attique SiddiquiDocument5 pagesName: Waleed Zahid Roll No: F18-1010 BS Accounting&Finance 6 Assignment No 1 Submitted To: Sir Atif Attique SiddiquiFurqan AhmedNo ratings yet

- Black MoneyDocument22 pagesBlack MoneyManish JainNo ratings yet