Professional Documents

Culture Documents

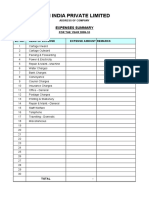

53 Copy of 18 Tax Comp Calculation (1)

53 Copy of 18 Tax Comp Calculation (1)

Uploaded by

Jagbandhu MaharanaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 102 Free Master Card For AccountsDocument2 pages102 Free Master Card For AccountsFairdeal Auto40% (5)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sampath Card Estatement 2020-10-28-4051226 PDFDocument1 pageSampath Card Estatement 2020-10-28-4051226 PDFBuddhika Gihan Wijerathne0% (1)

- Week 5 Individual Assignment Individual Income Taxation Exercise 1202 CLWTAXN K35 TAXATIONDocument15 pagesWeek 5 Individual Assignment Individual Income Taxation Exercise 1202 CLWTAXN K35 TAXATIONVan TisbeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Incoterms 2010 Poster V5Document1 pageIncoterms 2010 Poster V5trafico7387No ratings yet

- PAN Changes or CorrectionDocument2 pagesPAN Changes or Correctionsolanki7585No ratings yet

- Audit Special All Expenses Detail FormatsDocument31 pagesAudit Special All Expenses Detail Formatssolanki7585No ratings yet

- Quotation For Hydraulic PumpDocument1 pageQuotation For Hydraulic Pumpmuhammad ali umarNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- Who Uses Incoterms?: What Are They?Document3 pagesWho Uses Incoterms?: What Are They?FueNo ratings yet

- Quiz BeeDocument127 pagesQuiz BeeCharisse MaticNo ratings yet

- Terms & Conditions Cash Rebate Platinum Credit Card: 1 July 2018Document11 pagesTerms & Conditions Cash Rebate Platinum Credit Card: 1 July 2018Mohd Haris DrahmanNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- Purchases-Adlaw (Month of February 2019)Document121 pagesPurchases-Adlaw (Month of February 2019)Giann Fritz AlvarezNo ratings yet

- Quotation For Langkawi Trip For 30 PaxDocument2 pagesQuotation For Langkawi Trip For 30 PaxSorupanathan SadayanNo ratings yet

- Sales Order: Transportation ManagementDocument4 pagesSales Order: Transportation ManagementpmanikumarNo ratings yet

- Max's Audit Rating - Effective April 1, 2016Document8 pagesMax's Audit Rating - Effective April 1, 2016Noel BactonNo ratings yet

- Analisis Potensi Permintaan (Demand) Angkutan Umum Pada Koridor Jalan Raya Sesetan DenpasarDocument10 pagesAnalisis Potensi Permintaan (Demand) Angkutan Umum Pada Koridor Jalan Raya Sesetan DenpasarAnggeraeni ObinNo ratings yet

- Factura - L MKTP 370973 PDFDocument1 pageFactura - L MKTP 370973 PDFAlexandru MarinaNo ratings yet

- TAX LossDocument38 pagesTAX LossBradNo ratings yet

- Gujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: 1LCI08DDocument2 pagesGujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: 1LCI08DBhavesh ShiyaniNo ratings yet

- Expense Report SampleDocument3 pagesExpense Report SampleadolfguevaraNo ratings yet

- Sap TcodesDocument2 pagesSap TcodesHemachandran Tiruvallur Kannappan100% (1)

- 9 Amd 002423Document2 pages9 Amd 002423Sol SolNo ratings yet

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- Easypaisa Account Transaction Show: 11/10/2020 To 01/01/2021Document1 pageEasypaisa Account Transaction Show: 11/10/2020 To 01/01/2021Hamza NajamNo ratings yet

- Accounting Perpetual TemplateDocument11 pagesAccounting Perpetual TemplatePrincess Kayla BayudanNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- PAFA-115 (Large)Document12 pagesPAFA-115 (Large)Arshad SaqiNo ratings yet

- Terms & Conditions: Citi Rewards Credit CardDocument3 pagesTerms & Conditions: Citi Rewards Credit CardAmarendra SinghaNo ratings yet

- Update: City of Watertown Tax Sale Certificate Auction June 21, 2018Document7 pagesUpdate: City of Watertown Tax Sale Certificate Auction June 21, 2018NewzjunkyNo ratings yet

- 3pl 4pl &cross DockingDocument12 pages3pl 4pl &cross Dockinglalmays100% (1)

- DarkenuDocument4 pagesDarkenuRoseNo ratings yet

53 Copy of 18 Tax Comp Calculation (1)

53 Copy of 18 Tax Comp Calculation (1)

Uploaded by

Jagbandhu MaharanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

53 Copy of 18 Tax Comp Calculation (1)

53 Copy of 18 Tax Comp Calculation (1)

Uploaded by

Jagbandhu MaharanaCopyright:

Available Formats

AY 2009 - 2010.

Income Tax computation For Males

I Income From Salary -

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000) -

Let Out Property

Rent Received

Less: Municipal Taxes

GAV -

Less:30% deduction -

Less: Interest paid (No limit) - -

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses -

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition - -

V Income From other sources

Bank Interest

Any other -

Gross Total Income -

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments -

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U -

Net Total Income -

Rounded of Income -

Tax on Short term gains - -

Tax on Long term gains (with Indexation) - -

Tax on Normal Income - 0 -

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess -

Total Tax Liability -

Less: TDS -

Advance Tax

Self assesment Tax -

Tax Payable/ (refund) -

AY 2009 - 2010.

Income Tax computation For Females

I Income From Salary 0

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 0

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 0

Rounded of Income 0

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 0 0 0

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 0

Total Tax Liability 0

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 0

AY 2010-11

Income Tax computation For Males

I Income From Salary 384,519

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000) -

Let Out Property

Rent Received

Less: Municipal Taxes

GAV -

Less:30% deduction -

Less: Interest paid (No limit) - -

III Income from Business/Profession

Net surplus -

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses -

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition - -

V Income From other sources

Bank Interest

Any other -

Gross Total Income 384,519

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 50,000

(Upto Rs100,000)

U/s 80 D 150,000

Mediclaim 25,000

Other 80G, 80E, 80U 225,000

Net Total Income 159,519

Rounded of Income 159,520

Tax on Short term gains - -

Tax on Long term gains (with Indexation) - -

Tax on Normal Income 159,520 0 -

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess -

Total Tax Liability -

Less: TDS -

Advance Tax

Self assesment Tax -

Tax Payable/ (refund) -

AY 2010-11

Income Tax computation For Females

I Income From Salary 0

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 0

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 0

Rounded of Income 0

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 0 0 0

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 0

Total Tax Liability 0

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 0

AY 2010 - 2011.

Income Tax computation For Senior Citizens

I Income From Salary 384,519

II Income from House Property

Self Occupied

Interest Paid (Upto Rs 150000)

Let Out Property

Rent Received

Less: Municipal Taxes

GAV 0

Less:30% deduction 0

Less: Interest paid (No limit) 0 0

III Income from Business/Profession

Net surplus 0

IV Income From Capital Gains

Short Term Gains

Sale Consideration

Less: cost of purchase

Less: Selling expenses 0

Loss to be carried forward

Long Term Gains

Sale Consideration

Less: Selling expenses

Less: Indexed Cost of acquisition 0 0

V Income From other sources

Bank Interest

Any other 0

Gross Total Income 384,519

Less: Deductions

U/s 80C,CCC,CCD

Tax saving Investments 0

(Upto Rs100,000)

U/s 80 D

Mediclaim

Other 80G, 80E, 80U 0

Net Total Income 384,519

Rounded of Income 384,520

Tax on Short term gains 0 0

Tax on Long term gains (with Indexation) 0 0

Tax on Normal Income 384,520 22,904 22,904

Add: Surcharge (if Net total income > 10lakhs)

Add: education Cess 687

Total Tax Liability 23,591

Less: TDS 0

Advance Tax

Self assesment Tax 0

Tax Payable/ (refund) 23,591

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 102 Free Master Card For AccountsDocument2 pages102 Free Master Card For AccountsFairdeal Auto40% (5)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sampath Card Estatement 2020-10-28-4051226 PDFDocument1 pageSampath Card Estatement 2020-10-28-4051226 PDFBuddhika Gihan Wijerathne0% (1)

- Week 5 Individual Assignment Individual Income Taxation Exercise 1202 CLWTAXN K35 TAXATIONDocument15 pagesWeek 5 Individual Assignment Individual Income Taxation Exercise 1202 CLWTAXN K35 TAXATIONVan TisbeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Incoterms 2010 Poster V5Document1 pageIncoterms 2010 Poster V5trafico7387No ratings yet

- PAN Changes or CorrectionDocument2 pagesPAN Changes or Correctionsolanki7585No ratings yet

- Audit Special All Expenses Detail FormatsDocument31 pagesAudit Special All Expenses Detail Formatssolanki7585No ratings yet

- Quotation For Hydraulic PumpDocument1 pageQuotation For Hydraulic Pumpmuhammad ali umarNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- Who Uses Incoterms?: What Are They?Document3 pagesWho Uses Incoterms?: What Are They?FueNo ratings yet

- Quiz BeeDocument127 pagesQuiz BeeCharisse MaticNo ratings yet

- Terms & Conditions Cash Rebate Platinum Credit Card: 1 July 2018Document11 pagesTerms & Conditions Cash Rebate Platinum Credit Card: 1 July 2018Mohd Haris DrahmanNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- Purchases-Adlaw (Month of February 2019)Document121 pagesPurchases-Adlaw (Month of February 2019)Giann Fritz AlvarezNo ratings yet

- Quotation For Langkawi Trip For 30 PaxDocument2 pagesQuotation For Langkawi Trip For 30 PaxSorupanathan SadayanNo ratings yet

- Sales Order: Transportation ManagementDocument4 pagesSales Order: Transportation ManagementpmanikumarNo ratings yet

- Max's Audit Rating - Effective April 1, 2016Document8 pagesMax's Audit Rating - Effective April 1, 2016Noel BactonNo ratings yet

- Analisis Potensi Permintaan (Demand) Angkutan Umum Pada Koridor Jalan Raya Sesetan DenpasarDocument10 pagesAnalisis Potensi Permintaan (Demand) Angkutan Umum Pada Koridor Jalan Raya Sesetan DenpasarAnggeraeni ObinNo ratings yet

- Factura - L MKTP 370973 PDFDocument1 pageFactura - L MKTP 370973 PDFAlexandru MarinaNo ratings yet

- TAX LossDocument38 pagesTAX LossBradNo ratings yet

- Gujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: 1LCI08DDocument2 pagesGujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: 1LCI08DBhavesh ShiyaniNo ratings yet

- Expense Report SampleDocument3 pagesExpense Report SampleadolfguevaraNo ratings yet

- Sap TcodesDocument2 pagesSap TcodesHemachandran Tiruvallur Kannappan100% (1)

- 9 Amd 002423Document2 pages9 Amd 002423Sol SolNo ratings yet

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- Easypaisa Account Transaction Show: 11/10/2020 To 01/01/2021Document1 pageEasypaisa Account Transaction Show: 11/10/2020 To 01/01/2021Hamza NajamNo ratings yet

- Accounting Perpetual TemplateDocument11 pagesAccounting Perpetual TemplatePrincess Kayla BayudanNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- PAFA-115 (Large)Document12 pagesPAFA-115 (Large)Arshad SaqiNo ratings yet

- Terms & Conditions: Citi Rewards Credit CardDocument3 pagesTerms & Conditions: Citi Rewards Credit CardAmarendra SinghaNo ratings yet

- Update: City of Watertown Tax Sale Certificate Auction June 21, 2018Document7 pagesUpdate: City of Watertown Tax Sale Certificate Auction June 21, 2018NewzjunkyNo ratings yet

- 3pl 4pl &cross DockingDocument12 pages3pl 4pl &cross Dockinglalmays100% (1)

- DarkenuDocument4 pagesDarkenuRoseNo ratings yet