Professional Documents

Culture Documents

Exercise on Company

Exercise on Company

Uploaded by

Yati Shaiful0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesExercise on Company

Exercise on Company

Uploaded by

Yati ShaifulCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

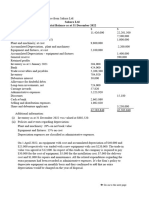

The following is the Trial Balance for Qaseh Sdn. Bhd.

as at 31 December

2022:

Qaseh Sdn. Bhd.

Trial Balance as at 31 December 2022

Debit Credit

(RM) (RM)

Ordinary share RM1 150,000

50% Preference share RM1 10,000

General reserves 8,000

Retained profits as at 31 December 2022 27,300

Inventory at 1 January 2022 33,235

Sales 481,370

Purchases 250,270

Returns outwards 12,460

Returns inwards 13,810

Carriage outwards 4,260

Maintenance 50,380

Salesmen’s salaries 32,145

Administrative wages and salaries 30,470

Plant and machinery 62,500

Hire of motor vehicles 9,600

Accumulated depreciation - Plant and 24,500

Machinery

Goodwill 47,300

General distribution expenses 2,840

General administration expenses 4,890

Directors’ remuneration 14,800

Rent received 3,600

Accounts receivables 164,150

Cash at bank 30,870

Accounts payables 34,290

751,520 751,250

Additional information:

(i) Inventory on 31 December 2022 is valued at RM45,890.

(ii) Plant and machinery is to be depreciated at 20% straight line. 60% of

the depreciation related to distribution expenses and remaining 40%

related to administrative expenses.

(iii) Hire of motor vehicles is to be split of RM6,200 to distribution expenses

and RM3,400 to administrative expenses.

(iv) Audit fees of RM600 is still accrued.

(v) Provision of corporation tax on current year profit is RM9,370.

(vi) The directors proposed to declare a final dividend on the ordinary

shares of RM0.30 per share and preference shares RM0.50 per share.

(vii) RM1,500 to be transferred to general reserves for future usage.

Required to prepare (Show all workings):

(a) Statement of Profit or Loss for the year ended 31 December 2022.

(b) Extract Statement of Financial Position as at 31 December 2022 for

liabilities items.

(c) Statement of Changes in Equity for the year ended 31 December

2022.

You might also like

- FAC1502 Assignment 4 2023Document193 pagesFAC1502 Assignment 4 2023Haat My Later100% (1)

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- A221 MC 5 - StudentDocument6 pagesA221 MC 5 - StudentNajihah RazakNo ratings yet

- UGBS 205 Fundamentals of Accounting Methods: Ben Welcomes You To LEVEL 200Document220 pagesUGBS 205 Fundamentals of Accounting Methods: Ben Welcomes You To LEVEL 200Audrey Kwao86% (7)

- Extra Exercises Company FSDocument6 pagesExtra Exercises Company FSMohd Rafi JasmanNo ratings yet

- Sap Idoc PDFDocument8 pagesSap Idoc PDFb_Randhawa1136100% (1)

- Exercises Accounting for CompaniesDocument5 pagesExercises Accounting for CompaniesYati ShaifulNo ratings yet

- Tutorial 2 - A202 QuestionDocument6 pagesTutorial 2 - A202 QuestionFuchoin ReikoNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- FAR620 Group Project 1Document4 pagesFAR620 Group Project 1hilmanNo ratings yet

- Axia BHD QDocument2 pagesAxia BHD QkkNo ratings yet

- Bursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Document35 pagesBursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Fakhrul Azman NawiNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- Solution Additional Exercise 1 Chapter 6 7Document3 pagesSolution Additional Exercise 1 Chapter 6 7Doreen OngNo ratings yet

- FAR270 - FEB 2022 SolutionDocument8 pagesFAR270 - FEB 2022 SolutionNur Fatin AmirahNo ratings yet

- BKAR3063 Tutorial 2Document3 pagesBKAR3063 Tutorial 2Thermen DarenNo ratings yet

- AFI3512 Test 2 2022 QuestionDocument9 pagesAFI3512 Test 2 2022 Questionkevgoat217No ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- FAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4Document6 pagesFAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4NUR NAJWA MURSYIDAH NAZRINo ratings yet

- Tutorial 1 A172 Interco TransactionDocument5 pagesTutorial 1 A172 Interco TransactionNisrina NSNo ratings yet

- g1 Final Written Answers Bkal1013Document13 pagesg1 Final Written Answers Bkal1013tasya zakariaNo ratings yet

- Example 2Document4 pagesExample 2Raudhatun Nisa'No ratings yet

- Faculty Accountancy 2022 Session 1 - Diploma Far210Document8 pagesFaculty Accountancy 2022 Session 1 - Diploma Far210nafisah rahmanNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- Tutorial 1 Presentation of FS (A)Document7 pagesTutorial 1 Presentation of FS (A)fooyy8No ratings yet

- Tutorial 4 - Consolidated Statement of Cash FlowsDocument6 pagesTutorial 4 - Consolidated Statement of Cash FlowsFatinNo ratings yet

- BDB Annual Report 2021 - Part - 4Document111 pagesBDB Annual Report 2021 - Part - 42023149467No ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Inventory 42,000 RI 3,200Document4 pagesInventory 42,000 RI 3,200Asfatin AmranNo ratings yet

- Test 2 Jan2023 - Tapah Q2 FS SSDocument4 pagesTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNo ratings yet

- Acc Assign 2Document3 pagesAcc Assign 2wenqiang0502No ratings yet

- Financial Statements - Lesson 02 (Part 2) QuestionsDocument3 pagesFinancial Statements - Lesson 02 (Part 2) QuestionsNirmal JayakodyNo ratings yet

- Midterm - Far2 - AmendedDocument2 pagesMidterm - Far2 - AmendedmellNo ratings yet

- MC 5 Cash-1Document4 pagesMC 5 Cash-1lim qsNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Seatwork No. 2 PDFDocument1 pageSeatwork No. 2 PDFSARAH ANDREA TORRESNo ratings yet

- 5309 ITMAX QR 2022-09-30 ITMAXQ3FY2022InterimfinancialreportFINAL08122022 - 1252950768Document21 pages5309 ITMAX QR 2022-09-30 ITMAXQ3FY2022InterimfinancialreportFINAL08122022 - 1252950768Quint WongNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Juishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteDocument11 pagesJuishat Financial Plan: College Park, Dipolog City Tel. No. (065) 212-8049 WebsiteMeosjinNo ratings yet

- Unaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Document21 pagesUnaudited Condensed Consolidated Financial Statement For The Financial Year 2021 Fourth Quarter Ended 31 March 2021Iqbal YusufNo ratings yet

- EPCRDocument71 pagesEPCRYinka JosephNo ratings yet

- Total Administrative Expense 770,126 Schedule of Employee BenefitsDocument4 pagesTotal Administrative Expense 770,126 Schedule of Employee BenefitsAngelica CalubayNo ratings yet

- Tutorial 2 Manufacturing Account 2 AnswerDocument15 pagesTutorial 2 Manufacturing Account 2 AnswerNG JIA LUNGNo ratings yet

- Taliworks - Q4FY23Document31 pagesTaliworks - Q4FY23seeme55runNo ratings yet

- Additional Tutorial Chap 1 2 3Document6 pagesAdditional Tutorial Chap 1 2 3SITI HAMIZAH HAMZAHNo ratings yet

- Appendix A - Trial Balance Group Project March - July 2023Document2 pagesAppendix A - Trial Balance Group Project March - July 2023Nur Fatin AmirahNo ratings yet

- AccrDocument2 pagesAccrlearningcantstop561No ratings yet

- Set_1_FA_SSS_FAR210_FEB2022.pdf (1)Document10 pagesSet_1_FA_SSS_FAR210_FEB2022.pdf (1)Rusyda AzizNo ratings yet

- Caasa EnterpriseDocument2 pagesCaasa Enterpriseaina farisahNo ratings yet

- BBA6113 S2-convertedDocument7 pagesBBA6113 S2-convertedRobert OoNo ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Assignment 5 - Statement of Cash FlowsDocument2 pagesAssignment 5 - Statement of Cash FlowsJezza Mae Gomba RegidorNo ratings yet

- Topic 3 Practical ExampleDocument3 pagesTopic 3 Practical Exampleszh saNo ratings yet

- Tutorial Questions - Accounting Non-Profit OrganizationDocument3 pagesTutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- ACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024Document4 pagesACT 302 - ASSIGNMENT (Statement of Cash Flows) - 2024rafikdaachasalamNo ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- Igacc0906 TG c2Document33 pagesIgacc0906 TG c2Marcel JonathanNo ratings yet

- Tutorial Question - Company AccountDocument3 pagesTutorial Question - Company AccountmaiNo ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- Practical Financial Management 6th Edition Lasher Solutions ManualDocument26 pagesPractical Financial Management 6th Edition Lasher Solutions Manualbarrydixonydazewpbxn100% (8)

- Deva MbaDocument36 pagesDeva MbaSasi RekhaNo ratings yet

- Ac PaperDocument6 pagesAc PaperAshwini SakpalNo ratings yet

- Inventory and Purchase Order ReceiptsDocument51 pagesInventory and Purchase Order ReceiptsPriya NimmagaddaNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- MYOB Chapter 4 Recording Journal EntriesDocument5 pagesMYOB Chapter 4 Recording Journal EntriesRio Anthony AntangNo ratings yet

- 1556955039349Document6 pages1556955039349Suresh RawatNo ratings yet

- Quizbowl 2Document10 pagesQuizbowl 2lorenceabad07No ratings yet

- Tutorial ACW 162 Chapter 3Document13 pagesTutorial ACW 162 Chapter 3raye brahmNo ratings yet

- Mt940 Format DetailsDocument12 pagesMt940 Format DetailsrajiwaniNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- APDocument38 pagesAPCyvee Joy Hongayo OcheaNo ratings yet

- Test Bank 1 - Ia 2Document18 pagesTest Bank 1 - Ia 2Xiena100% (2)

- 9-4B - SolutionDocument2 pages9-4B - SolutionAnish AdhikariNo ratings yet

- 1.industry Profile: 1. Primary FunctionDocument70 pages1.industry Profile: 1. Primary FunctionBhavanams Rao0% (1)

- Bank Accounting ConceptsDocument39 pagesBank Accounting ConceptsSachin YadavNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Mockboard - Practical Accounting 1Document8 pagesMockboard - Practical Accounting 1Jaymee Andomang Os-agNo ratings yet

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDocument15 pagesPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisNo ratings yet

- 2 DoneDocument3 pages2 Donesophia100% (2)

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- Ulangan Laporan KeuanganDocument12 pagesUlangan Laporan KeuanganMaulidian AprilianiNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- Accounting SamplesDocument10 pagesAccounting Samplesleviadain100% (2)

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Accountancy Sample Question PaperDocument20 pagesAccountancy Sample Question PaperrahulNo ratings yet

- ITT Exam QuestionDocument16 pagesITT Exam QuestionJ Anne JoshuaNo ratings yet