Professional Documents

Culture Documents

TaRMS FAQs1 (1)

TaRMS FAQs1 (1)

Uploaded by

Accounts NatwecraftCopyright:

Available Formats

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Party 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)Document13 pagesParty 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)NietzscheM82% (11)

- Rse Review 1Document11 pagesRse Review 1Hrithik khanna K BNo ratings yet

- Professional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionDocument10 pagesProfessional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionWahab KNo ratings yet

- Guide On Existing Taxpayers Onboarding To TaRMS v3Document15 pagesGuide On Existing Taxpayers Onboarding To TaRMS v3tedmasangoNo ratings yet

- VAT QuestionnaireDocument20 pagesVAT QuestionnaireSanjib PandaNo ratings yet

- Uaefts FaqDocument3 pagesUaefts FaqPrayag PanchalNo ratings yet

- Ta RMSFAQs 3Document1 pageTa RMSFAQs 3isa kaziNo ratings yet

- Auto Assessment 2Document6 pagesAuto Assessment 2Mark SilbermanNo ratings yet

- Tax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityDocument2 pagesTax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityJessa MaeNo ratings yet

- 4.Web-e-TDS Compliance Solution ProposalDocument9 pages4.Web-e-TDS Compliance Solution ProposalkarthikeyanwebtelNo ratings yet

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- FAQ Virtual Account VF ClientsDocument2 pagesFAQ Virtual Account VF ClientsJack Animesh MaityNo ratings yet

- How GST Would Impact Startups & Small and Medium Size BusinessesDocument12 pagesHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNo ratings yet

- RMC 2010 No. 51 Clarification and Questions On Use of eDST SystemDocument26 pagesRMC 2010 No. 51 Clarification and Questions On Use of eDST SystemBien Bowie A. CortezNo ratings yet

- GST E-Invoices FAQDocument4 pagesGST E-Invoices FAQGarvitNo ratings yet

- Solutions For GST Question BankDocument55 pagesSolutions For GST Question BankVarun VardhanNo ratings yet

- Public Notice 51 of 2024 Submission of Outstanding Returns and Payment of TaxDocument1 pagePublic Notice 51 of 2024 Submission of Outstanding Returns and Payment of TaxElysium GunyereNo ratings yet

- Top 5-ITReFiling Companies IndiaDocument5 pagesTop 5-ITReFiling Companies IndiaLolitambika NeumannNo ratings yet

- The Simplified Tax System For: Frequently Asked QuestionsDocument17 pagesThe Simplified Tax System For: Frequently Asked QuestionsSeán LynchNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument55 pagesDraw A Chart Showin Tax Structure in IndiaShubh ShahNo ratings yet

- Solutions For GSTDocument54 pagesSolutions For GSTtannerushivakumar77No ratings yet

- STP STRDocument4 pagesSTP STRapi-313045815No ratings yet

- Adv & Dis Adv.Document6 pagesAdv & Dis Adv.suyash dugarNo ratings yet

- EFD Frequently Asked Questions PDFDocument2 pagesEFD Frequently Asked Questions PDFSimushi SimushiNo ratings yet

- All Profession Tax RC Holders Enrol For PTRC eDocument20 pagesAll Profession Tax RC Holders Enrol For PTRC eKirti SanghaviNo ratings yet

- Vat Alert July 2018 Requirments ReminderDocument2 pagesVat Alert July 2018 Requirments ReminderSudi Mohamed AbdallahNo ratings yet

- April 2013 EbriefDocument2 pagesApril 2013 EbriefkyliemkaNo ratings yet

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Should I Include Employer's Contribution To NPS IDocument2 pagesShould I Include Employer's Contribution To NPS IruchitssNo ratings yet

- Acm-ICT Tax Payment and Record SystemDocument3 pagesAcm-ICT Tax Payment and Record SystemREYNARD CATAQUEZNo ratings yet

- TATA DOCOMO - Instant Pay-JuneDocument1 pageTATA DOCOMO - Instant Pay-JuneBhushanNo ratings yet

- ERC REFUND WALKTHROUGH ?by @ONLYDIXONSTREETDocument20 pagesERC REFUND WALKTHROUGH ?by @ONLYDIXONSTREETx6wrdzzc6pNo ratings yet

- Stripe Atlas Guide To Business TaxesDocument1 pageStripe Atlas Guide To Business TaxesKeyse BasoraNo ratings yet

- Increased Costs Due To Software Purchase: Disadvantages of GSTDocument2 pagesIncreased Costs Due To Software Purchase: Disadvantages of GSTDr. Mustafa KozhikkalNo ratings yet

- Supplier FAQDocument7 pagesSupplier FAQSenthilNo ratings yet

- A Consideration of GST Training For Business Is Best Practice!Document2 pagesA Consideration of GST Training For Business Is Best Practice!GovReportsIndiaNo ratings yet

- SNAP EBT TPP Guidance PDFDocument6 pagesSNAP EBT TPP Guidance PDFKim JohnsonNo ratings yet

- Helpdesk - FAQs To Be Uploaded29052020Document35 pagesHelpdesk - FAQs To Be Uploaded29052020ebsbmhrd19No ratings yet

- Test Call GeneratorsDocument6 pagesTest Call GeneratorsEdward NjorogeNo ratings yet

- FAQ E-GrasDocument5 pagesFAQ E-GrasVikas JainNo ratings yet

- Tax Deduction at SourceDocument28 pagesTax Deduction at SourcePrabhat Kumar RaiNo ratings yet

- Tax AvoidanceDocument4 pagesTax Avoidancegimata kochomataNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument106 pagesDraw A Chart Showin Tax Structure in IndiagamingNo ratings yet

- UserManual BulkE InvoicegenerationtoolDocument13 pagesUserManual BulkE InvoicegenerationtoolDr. Yashodhan JoshiNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- Blank Petrol Bill ReceiptDocument12 pagesBlank Petrol Bill ReceiptSASI KUMARNo ratings yet

- ACES Registration FaqDocument8 pagesACES Registration FaqJitendra VernekarNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- Online TISSForm Instruction Revenue GatewayDocument7 pagesOnline TISSForm Instruction Revenue GatewayisayaNo ratings yet

- Accounting Toolkit AussieDocument44 pagesAccounting Toolkit AussieExactCPA100% (1)

- TDS BROCHURE Final PDFDocument16 pagesTDS BROCHURE Final PDFCA Hiralal ArsiddhaNo ratings yet

- Sap GST TaxinnDocument9 pagesSap GST TaxinnBhagyesh ZopeNo ratings yet

- Single Touch Payroll SolutionDocument2 pagesSingle Touch Payroll Solutionjawadseo1214No ratings yet

- Taxation Group WorkDocument7 pagesTaxation Group WorkNdam CalsonNo ratings yet

- Can You Please Walkthrough Your Profile?Document3 pagesCan You Please Walkthrough Your Profile?Sudhakar PatnamNo ratings yet

- Changes To Tax RegistrationDocument4 pagesChanges To Tax RegistrationRonald Luckson ChikwavaNo ratings yet

- Deloitte Pagero Webinar 2021 1 Q and ADocument3 pagesDeloitte Pagero Webinar 2021 1 Q and AEugénio VarandasNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Calvince OumaNo ratings yet

- What Is Meaning of Payroll System?: Time-Keeping TransportationDocument4 pagesWhat Is Meaning of Payroll System?: Time-Keeping TransportationYaseenNo ratings yet

- Financial System in NepalDocument8 pagesFinancial System in NepalRajendra LamsalNo ratings yet

- The Fall of United Western BankDocument24 pagesThe Fall of United Western BankradhaindiaNo ratings yet

- Customer Satisfaction in The Indian Banking SectorDocument69 pagesCustomer Satisfaction in The Indian Banking SectorKpramod YadavNo ratings yet

- Welcome To My Presentation: Chapter 26: Fund Transfer PricingDocument20 pagesWelcome To My Presentation: Chapter 26: Fund Transfer PricingNazmul H. PalashNo ratings yet

- Credit or DiscreditDocument1 pageCredit or DiscreditTukneNo ratings yet

- Bank Capital, Deposits and Size Effects Onprofitability of Commercial Banks in NepalDocument74 pagesBank Capital, Deposits and Size Effects Onprofitability of Commercial Banks in NepalRajendra LamsalNo ratings yet

- Case Study Venezuela International FinanceDocument4 pagesCase Study Venezuela International FinanceSairaNo ratings yet

- Business Transactions and Their Anlysis - BSAIS 1A - Group 2Document32 pagesBusiness Transactions and Their Anlysis - BSAIS 1A - Group 2Marydelle De Austria-De GuiaNo ratings yet

- Marketing of Banking ServicesDocument64 pagesMarketing of Banking ServicesPrathick NaiduNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- Case Digest - IntroductionDocument10 pagesCase Digest - IntroductionAnonymous b4ycWuoIcNo ratings yet

- Example of Formal InvitationDocument4 pagesExample of Formal InvitationKevin Tindaon (Sterben)No ratings yet

- Suffolk County Democratic Committee - 11-Day Pre-GeneralDocument47 pagesSuffolk County Democratic Committee - 11-Day Pre-GeneralRiverheadLOCALNo ratings yet

- Bank Reconciliation Statement: 160 AccountancyDocument20 pagesBank Reconciliation Statement: 160 AccountancyAbhijeet NarangNo ratings yet

- Hastert IndictmentDocument7 pagesHastert Indictmentdaniel_halperNo ratings yet

- Bob Rtgs Format NewDocument1 pageBob Rtgs Format NewNeerajNo ratings yet

- Arrieta V NaricDocument6 pagesArrieta V NaricEcnerolAicnelavNo ratings yet

- Financial Markets and Institutions: Ninth Edition, Global EditionDocument46 pagesFinancial Markets and Institutions: Ninth Edition, Global EditionAli El MallahNo ratings yet

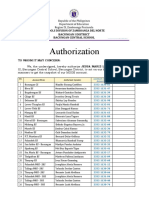

- Authorization: Bacungan I District Bacungan Central SchoolDocument30 pagesAuthorization: Bacungan I District Bacungan Central SchoolJessa Mariz Lecias CalimotNo ratings yet

- INTERNSHIP REPORT UpDocument50 pagesINTERNSHIP REPORT UpFact BeamNo ratings yet

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet

- NBFC NotesDocument2 pagesNBFC NotesHemavathy Gunaseelan100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- Main Conclusions of The Egrant Inc. Inquiry.Document21 pagesMain Conclusions of The Egrant Inc. Inquiry.Transparency MaltaNo ratings yet

- Bank Relationship Manager Resume SampleDocument8 pagesBank Relationship Manager Resume Samplepehygakasyk2100% (1)

- Rupee Max FormccbDocument2 pagesRupee Max FormccbDesikanNo ratings yet

- Case Analysis#1 IPO QuestionsDocument5 pagesCase Analysis#1 IPO QuestionsKunal JainNo ratings yet

- Marketing-of-Financial-Services SAKSHIDocument9 pagesMarketing-of-Financial-Services SAKSHINageshwar SinghNo ratings yet

- Customer Satisfaction of ATM Services inDocument11 pagesCustomer Satisfaction of ATM Services inEswari GkNo ratings yet

TaRMS FAQs1 (1)

TaRMS FAQs1 (1)

Uploaded by

Accounts NatwecraftCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TaRMS FAQs1 (1)

TaRMS FAQs1 (1)

Uploaded by

Accounts NatwecraftCopyright:

Available Formats

TaRMS FREQUENTLY ASKED QUESTIONS

BY ZIMRA STAFF

Can a User register as many companies as he/she How is the system treating an Individual who is in business

wants? and in employment as well?

Yes, as long as he/she is the public officer of They will be required to submit individual income

those companies tax returns

Do we have adequate hardware in terms of servers?

Yes After registration, will the client be issued an automatic

Is SSP available for ZIMRA officials? VAT certificate?

No SSP will only be available to Taxpayers. Yes

E- Taxes is new but will not be available in TaRMS. Why Can taxpayer change the bank linked to the single account?

have e-Taxes? Yes. Taxpayers can change their single account

Taxpayers will now be accessing TaRMS bank as long as they have a nil balance in the

through Self Service Portal (SSP). E-services single account.

will no longer be necessary.

Do we still do interviews for CGT cases?

Do we have adequate network for TaRMS since already Yes, Interviews still remain mandatory.

SAP TRM has network challenges.

Yes we have improved our infrastructure If client has outstanding debts, will the refund be pro-

cessed?

Which data is going to be rolled over from SAP to No Taxpayers will have to extinguish their debt

TaRMS? first

Both Tax data and Master data.

Is TaRMS able to issue Tax Clearances?

Are you going to give out manuals to use? Yes, Compliant tax payers will automatically get

The system has inbuilt manuals found under their tax clearance certificate.

Online Help.

How long does it take for the system to issue an estimated

What will a foreign company that is not registered in assessment when taxpayer fails to submit a return?

Zimbabwe, but pays taxes in Zimbabwe through a 9 Days after due date.

representative taxpayer do about bank account and

single account in the TaRMS system? Are we going to have two TINs in TaRMS for ZWL and USD

Tax payments can be made through the repre- separately?

sentative taxpayers’ bank accounts. No, one TIN will contain transactions for both cur-

rencies.

What happens to individuals and companies who do

not have bank accounts?

Funds can be deposited into the Commission-

er’s General Single account with any bank.

Taxpayer has to cite his/her TIN for refer-

ence.

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Party 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)Document13 pagesParty 1: Joint Venture Agreement On Delivery of Mt103 Funds Swift Two (2) Way For Credit Line (Confirmation)NietzscheM82% (11)

- Rse Review 1Document11 pagesRse Review 1Hrithik khanna K BNo ratings yet

- Professional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionDocument10 pagesProfessional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionWahab KNo ratings yet

- Guide On Existing Taxpayers Onboarding To TaRMS v3Document15 pagesGuide On Existing Taxpayers Onboarding To TaRMS v3tedmasangoNo ratings yet

- VAT QuestionnaireDocument20 pagesVAT QuestionnaireSanjib PandaNo ratings yet

- Uaefts FaqDocument3 pagesUaefts FaqPrayag PanchalNo ratings yet

- Ta RMSFAQs 3Document1 pageTa RMSFAQs 3isa kaziNo ratings yet

- Auto Assessment 2Document6 pagesAuto Assessment 2Mark SilbermanNo ratings yet

- Tax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityDocument2 pagesTax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityJessa MaeNo ratings yet

- 4.Web-e-TDS Compliance Solution ProposalDocument9 pages4.Web-e-TDS Compliance Solution ProposalkarthikeyanwebtelNo ratings yet

- Electronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaDocument94 pagesElectronic Filing and Payment System (eFPS) : Its Importance and Effectiveness To The Taxpayer's of Cauayan City, IsabelaMa Jessica Maramag BaroroNo ratings yet

- FAQ Virtual Account VF ClientsDocument2 pagesFAQ Virtual Account VF ClientsJack Animesh MaityNo ratings yet

- How GST Would Impact Startups & Small and Medium Size BusinessesDocument12 pagesHow GST Would Impact Startups & Small and Medium Size BusinessesSouravNo ratings yet

- RMC 2010 No. 51 Clarification and Questions On Use of eDST SystemDocument26 pagesRMC 2010 No. 51 Clarification and Questions On Use of eDST SystemBien Bowie A. CortezNo ratings yet

- GST E-Invoices FAQDocument4 pagesGST E-Invoices FAQGarvitNo ratings yet

- Solutions For GST Question BankDocument55 pagesSolutions For GST Question BankVarun VardhanNo ratings yet

- Public Notice 51 of 2024 Submission of Outstanding Returns and Payment of TaxDocument1 pagePublic Notice 51 of 2024 Submission of Outstanding Returns and Payment of TaxElysium GunyereNo ratings yet

- Top 5-ITReFiling Companies IndiaDocument5 pagesTop 5-ITReFiling Companies IndiaLolitambika NeumannNo ratings yet

- The Simplified Tax System For: Frequently Asked QuestionsDocument17 pagesThe Simplified Tax System For: Frequently Asked QuestionsSeán LynchNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument55 pagesDraw A Chart Showin Tax Structure in IndiaShubh ShahNo ratings yet

- Solutions For GSTDocument54 pagesSolutions For GSTtannerushivakumar77No ratings yet

- STP STRDocument4 pagesSTP STRapi-313045815No ratings yet

- Adv & Dis Adv.Document6 pagesAdv & Dis Adv.suyash dugarNo ratings yet

- EFD Frequently Asked Questions PDFDocument2 pagesEFD Frequently Asked Questions PDFSimushi SimushiNo ratings yet

- All Profession Tax RC Holders Enrol For PTRC eDocument20 pagesAll Profession Tax RC Holders Enrol For PTRC eKirti SanghaviNo ratings yet

- Vat Alert July 2018 Requirments ReminderDocument2 pagesVat Alert July 2018 Requirments ReminderSudi Mohamed AbdallahNo ratings yet

- April 2013 EbriefDocument2 pagesApril 2013 EbriefkyliemkaNo ratings yet

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Should I Include Employer's Contribution To NPS IDocument2 pagesShould I Include Employer's Contribution To NPS IruchitssNo ratings yet

- Acm-ICT Tax Payment and Record SystemDocument3 pagesAcm-ICT Tax Payment and Record SystemREYNARD CATAQUEZNo ratings yet

- TATA DOCOMO - Instant Pay-JuneDocument1 pageTATA DOCOMO - Instant Pay-JuneBhushanNo ratings yet

- ERC REFUND WALKTHROUGH ?by @ONLYDIXONSTREETDocument20 pagesERC REFUND WALKTHROUGH ?by @ONLYDIXONSTREETx6wrdzzc6pNo ratings yet

- Stripe Atlas Guide To Business TaxesDocument1 pageStripe Atlas Guide To Business TaxesKeyse BasoraNo ratings yet

- Increased Costs Due To Software Purchase: Disadvantages of GSTDocument2 pagesIncreased Costs Due To Software Purchase: Disadvantages of GSTDr. Mustafa KozhikkalNo ratings yet

- Supplier FAQDocument7 pagesSupplier FAQSenthilNo ratings yet

- A Consideration of GST Training For Business Is Best Practice!Document2 pagesA Consideration of GST Training For Business Is Best Practice!GovReportsIndiaNo ratings yet

- SNAP EBT TPP Guidance PDFDocument6 pagesSNAP EBT TPP Guidance PDFKim JohnsonNo ratings yet

- Helpdesk - FAQs To Be Uploaded29052020Document35 pagesHelpdesk - FAQs To Be Uploaded29052020ebsbmhrd19No ratings yet

- Test Call GeneratorsDocument6 pagesTest Call GeneratorsEdward NjorogeNo ratings yet

- FAQ E-GrasDocument5 pagesFAQ E-GrasVikas JainNo ratings yet

- Tax Deduction at SourceDocument28 pagesTax Deduction at SourcePrabhat Kumar RaiNo ratings yet

- Tax AvoidanceDocument4 pagesTax Avoidancegimata kochomataNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument106 pagesDraw A Chart Showin Tax Structure in IndiagamingNo ratings yet

- UserManual BulkE InvoicegenerationtoolDocument13 pagesUserManual BulkE InvoicegenerationtoolDr. Yashodhan JoshiNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- Blank Petrol Bill ReceiptDocument12 pagesBlank Petrol Bill ReceiptSASI KUMARNo ratings yet

- ACES Registration FaqDocument8 pagesACES Registration FaqJitendra VernekarNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- Online TISSForm Instruction Revenue GatewayDocument7 pagesOnline TISSForm Instruction Revenue GatewayisayaNo ratings yet

- Accounting Toolkit AussieDocument44 pagesAccounting Toolkit AussieExactCPA100% (1)

- TDS BROCHURE Final PDFDocument16 pagesTDS BROCHURE Final PDFCA Hiralal ArsiddhaNo ratings yet

- Sap GST TaxinnDocument9 pagesSap GST TaxinnBhagyesh ZopeNo ratings yet

- Single Touch Payroll SolutionDocument2 pagesSingle Touch Payroll Solutionjawadseo1214No ratings yet

- Taxation Group WorkDocument7 pagesTaxation Group WorkNdam CalsonNo ratings yet

- Can You Please Walkthrough Your Profile?Document3 pagesCan You Please Walkthrough Your Profile?Sudhakar PatnamNo ratings yet

- Changes To Tax RegistrationDocument4 pagesChanges To Tax RegistrationRonald Luckson ChikwavaNo ratings yet

- Deloitte Pagero Webinar 2021 1 Q and ADocument3 pagesDeloitte Pagero Webinar 2021 1 Q and AEugénio VarandasNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Calvince OumaNo ratings yet

- What Is Meaning of Payroll System?: Time-Keeping TransportationDocument4 pagesWhat Is Meaning of Payroll System?: Time-Keeping TransportationYaseenNo ratings yet

- Financial System in NepalDocument8 pagesFinancial System in NepalRajendra LamsalNo ratings yet

- The Fall of United Western BankDocument24 pagesThe Fall of United Western BankradhaindiaNo ratings yet

- Customer Satisfaction in The Indian Banking SectorDocument69 pagesCustomer Satisfaction in The Indian Banking SectorKpramod YadavNo ratings yet

- Welcome To My Presentation: Chapter 26: Fund Transfer PricingDocument20 pagesWelcome To My Presentation: Chapter 26: Fund Transfer PricingNazmul H. PalashNo ratings yet

- Credit or DiscreditDocument1 pageCredit or DiscreditTukneNo ratings yet

- Bank Capital, Deposits and Size Effects Onprofitability of Commercial Banks in NepalDocument74 pagesBank Capital, Deposits and Size Effects Onprofitability of Commercial Banks in NepalRajendra LamsalNo ratings yet

- Case Study Venezuela International FinanceDocument4 pagesCase Study Venezuela International FinanceSairaNo ratings yet

- Business Transactions and Their Anlysis - BSAIS 1A - Group 2Document32 pagesBusiness Transactions and Their Anlysis - BSAIS 1A - Group 2Marydelle De Austria-De GuiaNo ratings yet

- Marketing of Banking ServicesDocument64 pagesMarketing of Banking ServicesPrathick NaiduNo ratings yet

- Bank StatementDocument8 pagesBank StatementKayla McKnightNo ratings yet

- Case Digest - IntroductionDocument10 pagesCase Digest - IntroductionAnonymous b4ycWuoIcNo ratings yet

- Example of Formal InvitationDocument4 pagesExample of Formal InvitationKevin Tindaon (Sterben)No ratings yet

- Suffolk County Democratic Committee - 11-Day Pre-GeneralDocument47 pagesSuffolk County Democratic Committee - 11-Day Pre-GeneralRiverheadLOCALNo ratings yet

- Bank Reconciliation Statement: 160 AccountancyDocument20 pagesBank Reconciliation Statement: 160 AccountancyAbhijeet NarangNo ratings yet

- Hastert IndictmentDocument7 pagesHastert Indictmentdaniel_halperNo ratings yet

- Bob Rtgs Format NewDocument1 pageBob Rtgs Format NewNeerajNo ratings yet

- Arrieta V NaricDocument6 pagesArrieta V NaricEcnerolAicnelavNo ratings yet

- Financial Markets and Institutions: Ninth Edition, Global EditionDocument46 pagesFinancial Markets and Institutions: Ninth Edition, Global EditionAli El MallahNo ratings yet

- Authorization: Bacungan I District Bacungan Central SchoolDocument30 pagesAuthorization: Bacungan I District Bacungan Central SchoolJessa Mariz Lecias CalimotNo ratings yet

- INTERNSHIP REPORT UpDocument50 pagesINTERNSHIP REPORT UpFact BeamNo ratings yet

- Dhani Finance PDF-2Document4 pagesDhani Finance PDF-2shaileshkumar443155No ratings yet

- NBFC NotesDocument2 pagesNBFC NotesHemavathy Gunaseelan100% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- Main Conclusions of The Egrant Inc. Inquiry.Document21 pagesMain Conclusions of The Egrant Inc. Inquiry.Transparency MaltaNo ratings yet

- Bank Relationship Manager Resume SampleDocument8 pagesBank Relationship Manager Resume Samplepehygakasyk2100% (1)

- Rupee Max FormccbDocument2 pagesRupee Max FormccbDesikanNo ratings yet

- Case Analysis#1 IPO QuestionsDocument5 pagesCase Analysis#1 IPO QuestionsKunal JainNo ratings yet

- Marketing-of-Financial-Services SAKSHIDocument9 pagesMarketing-of-Financial-Services SAKSHINageshwar SinghNo ratings yet

- Customer Satisfaction of ATM Services inDocument11 pagesCustomer Satisfaction of ATM Services inEswari GkNo ratings yet