Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsBPP Kit Mapping question wise

BPP Kit Mapping question wise

Uploaded by

akokwrtCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Ifrs & Ias Flow Charts: by Mr. Bilal Khalid Khan (Fca)Document40 pagesIfrs & Ias Flow Charts: by Mr. Bilal Khalid Khan (Fca)Bagas Nurfazar100% (2)

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

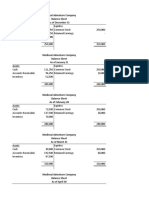

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Chris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFDocument218 pagesChris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFCostache Madalina AlexandraNo ratings yet

- Rev C5Document9 pagesRev C5Richard W YipNo ratings yet

- Advance AccountingDocument12 pagesAdvance AccountingunknownNo ratings yet

- Framework of Accounting (TOA) - ValixDocument42 pagesFramework of Accounting (TOA) - ValixFatima Pasamonte88% (43)

- FSAI EXAM2 Solutions Fraser 10thDocument14 pagesFSAI EXAM2 Solutions Fraser 10thGlaiza Dalayoan Flores0% (1)

- BPP Kit Standard Wise MappingDocument7 pagesBPP Kit Standard Wise Mappingjunk2023No ratings yet

- AuditingDocument22 pagesAuditingawaisNo ratings yet

- Ca Inter Advanced Accounting MCQDocument210 pagesCa Inter Advanced Accounting MCQVikramNo ratings yet

- Accounting Reviewer 1.1Document35 pagesAccounting Reviewer 1.1Ma. Concepcion DesepedaNo ratings yet

- CPA Paper 13Document16 pagesCPA Paper 13sanu sayedNo ratings yet

- CPA Paper 8Document15 pagesCPA Paper 8sanu sayedNo ratings yet

- Framework of Accounting TOA EDITEDDocument48 pagesFramework of Accounting TOA EDITEDMiss A Academic ServicesNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate Governanceroman empireNo ratings yet

- Answer in Assessment (CFAS)Document14 pagesAnswer in Assessment (CFAS)Angelika MoranNo ratings yet

- Which of The Following Is Not A Duty of The International Financial Reporting StandardDocument5 pagesWhich of The Following Is Not A Duty of The International Financial Reporting Standardchristian ReyesNo ratings yet

- Material - Framework of Accounting (Weekend)Document5 pagesMaterial - Framework of Accounting (Weekend)Sharmaine Diane N. CalvaNo ratings yet

- TEST BANK (UCNHS Reviewer For Kingfisher ABM Cup)Document12 pagesTEST BANK (UCNHS Reviewer For Kingfisher ABM Cup)Eya Guerrero Calvarido100% (1)

- Question - September 2018 BackgroundDocument6 pagesQuestion - September 2018 BackgroundAbdullah EjazNo ratings yet

- In-Class Test 2019Document8 pagesIn-Class Test 2019kissmegorgeousNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- Training Material of AuditDocument89 pagesTraining Material of AuditNaeem Uddin100% (10)

- Accounting Principles & Procedures MCQs - FPSC Senior Auditor Tests PDFDocument8 pagesAccounting Principles & Procedures MCQs - FPSC Senior Auditor Tests PDFMuhammad TariqNo ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Accounting & Auditing Paper - I (2000)Document13 pagesAccounting & Auditing Paper - I (2000)Sikandar EjazNo ratings yet

- Paper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsDocument5 pagesPaper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsAslam SiddiqNo ratings yet

- June 2006 Question PaperDocument11 pagesJune 2006 Question PapermanojrkmNo ratings yet

- Unit Ii Short Answer Type QuestionDocument3 pagesUnit Ii Short Answer Type Questionmultanigazal_4254062No ratings yet

- Icaew Diploma in Ifrss Syllabus and Study Guide 811Document11 pagesIcaew Diploma in Ifrss Syllabus and Study Guide 811Muridsultan JanjuaNo ratings yet

- ACCT 621 Practicing 1Document3 pagesACCT 621 Practicing 1Hashitha100% (1)

- SBR Revision NotesDocument294 pagesSBR Revision Notesbubbly100% (2)

- MCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0Document12 pagesMCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0sanz81909No ratings yet

- Making A List of IAS and IFRS As Adopted by BangladeshDocument9 pagesMaking A List of IAS and IFRS As Adopted by BangladeshAbir Hasan ApurboNo ratings yet

- Afacr Dec 2023 Attempt QuestionsDocument8 pagesAfacr Dec 2023 Attempt QuestionsShoaib HafeezNo ratings yet

- FAR Dry Run ReviewerDocument5 pagesFAR Dry Run ReviewerJohn Ace MadriagaNo ratings yet

- Accounting Principles and ProceduresDocument8 pagesAccounting Principles and ProceduresAdnan DaniNo ratings yet

- P20 SPM BV PH 2Document9 pagesP20 SPM BV PH 2Shivam GuptaNo ratings yet

- Ca10 0120Document16 pagesCa10 0120Amit KumarNo ratings yet

- Paspt Paper AnalysisDocument15 pagesPaspt Paper Analysisawais mehmoodNo ratings yet

- Basic Acc Quiz1Document4 pagesBasic Acc Quiz1Angel BiernezaNo ratings yet

- SBR-List of Technical ArticlesDocument1 pageSBR-List of Technical ArticleskeishaelinaNo ratings yet

- SBR Revision NotesDocument294 pagesSBR Revision NotesThembisile P ZwaneNo ratings yet

- Accounting & Auditing Mcqs From Past Papers: (C) Lucas PacioliDocument24 pagesAccounting & Auditing Mcqs From Past Papers: (C) Lucas PacioliAssad BilalNo ratings yet

- Accounting MCQDocument15 pagesAccounting MCQFahad RazaNo ratings yet

- Updates in FRS - Midterm Exam With SolutionDocument10 pagesUpdates in FRS - Midterm Exam With Solutionchristian ReyesNo ratings yet

- 7 CPA FINANCIAL REPORTING Paper 7Document13 pages7 CPA FINANCIAL REPORTING Paper 7dennis greenNo ratings yet

- Materials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesDocument12 pagesMaterials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesMiruna CiteaNo ratings yet

- International Financial Reporting Standards: Presentation and Disclosure Checklist 2007Document160 pagesInternational Financial Reporting Standards: Presentation and Disclosure Checklist 2007Tony PranotoNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- International Accounting and Financial Reporting: Ass. Prof. Mohammed ALASHIDocument16 pagesInternational Accounting and Financial Reporting: Ass. Prof. Mohammed ALASHIOmar YounisNo ratings yet

- CPA Paper 1Document10 pagesCPA Paper 1sanu sayedNo ratings yet

- Conceptual Frame Work QBDocument15 pagesConceptual Frame Work QBnanthini nanthini100% (1)

- ChronologiqueDocument40 pagesChronologiqueSamseer R HNo ratings yet

- Inter Paper12 Revised PDFDocument788 pagesInter Paper12 Revised PDFbhagyashre100% (1)

- 1 Cpa Financial Accounting Paper 1Document20 pages1 Cpa Financial Accounting Paper 1kajalshiroya17No ratings yet

- Acc 416Document7 pagesAcc 4161sirdeeqNo ratings yet

- Prepared By: CA. Abhijeet N. BobadeDocument9 pagesPrepared By: CA. Abhijeet N. Bobadepsawant77No ratings yet

- Accounts ImpDocument24 pagesAccounts ImphamzafarooqNo ratings yet

- An Introduction International Financial Reporting Standards (IFRS)Document34 pagesAn Introduction International Financial Reporting Standards (IFRS)EshetieNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Balance Sheet ProvisionalDocument2 pagesBalance Sheet ProvisionalRaja AdhikariNo ratings yet

- Fixed Assest Management-UltratechDocument6 pagesFixed Assest Management-UltratechMr SmartNo ratings yet

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument290 pagesConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsKim FloresNo ratings yet

- Chapter 11 - Ho Branch - MillanDocument34 pagesChapter 11 - Ho Branch - MillanAngelica Cerio100% (1)

- Indirect and Mutual HoldingsDocument36 pagesIndirect and Mutual HoldingssiwiNo ratings yet

- Methods For Patent Valuation PDFDocument11 pagesMethods For Patent Valuation PDFSantosh PatiNo ratings yet

- Business Combination Lecture Notes. ACC 401Document4 pagesBusiness Combination Lecture Notes. ACC 401Ugbah Chidinma LilianNo ratings yet

- AC2091 ZB Final For UoLDocument16 pagesAC2091 ZB Final For UoLkikiNo ratings yet

- Depreciation: Disposal of Fixed AssetsDocument13 pagesDepreciation: Disposal of Fixed AssetsHassan AliNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Q4-31-03-2022 TMBDocument67 pagesQ4-31-03-2022 TMBDhanush Kumar RamanNo ratings yet

- Accounting For Management Question PaperDocument3 pagesAccounting For Management Question PaperVINOD KUMARNo ratings yet

- DepreciationDocument13 pagesDepreciationHarshitPalNo ratings yet

- Financial Reporting Strathmore University Notes and Revision KitDocument551 pagesFinancial Reporting Strathmore University Notes and Revision KitLazarus AmaniNo ratings yet

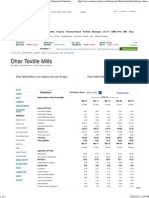

- Dhar Textile Mills Balance Sheet, Dhar Textile Mills Financial Statement & AccountsDocument3 pagesDhar Textile Mills Balance Sheet, Dhar Textile Mills Financial Statement & AccountsAkshay BhattNo ratings yet

- Mini MBA B10 - 01 Financial Management - Day 01Document41 pagesMini MBA B10 - 01 Financial Management - Day 01Reza MonoarfaNo ratings yet

- Montajes - Joelyn Grace 117848 Seatwork 2Document9 pagesMontajes - Joelyn Grace 117848 Seatwork 2Joelyn Grace MontajesNo ratings yet

- ERP Operations: SAP Standard ReportsDocument10 pagesERP Operations: SAP Standard ReportsAnkur RastogiNo ratings yet

- Dabur Financial Modeling-Live Project.Document47 pagesDabur Financial Modeling-Live Project.rahul1094No ratings yet

- Interlocal Agreement 8-2-99Document2 pagesInterlocal Agreement 8-2-99williamblueNo ratings yet

- (ESP Merit and Needs Based Scholarship Program) : Instructions For Filling Out The Scholarship Application FormDocument9 pages(ESP Merit and Needs Based Scholarship Program) : Instructions For Filling Out The Scholarship Application FormIffatNo ratings yet

- Amalgamation NotesDocument28 pagesAmalgamation NotesADARSH MISHRANo ratings yet

- Acc311 2021Document4 pagesAcc311 2021hoghidan1No ratings yet

- ACCT 100-Principles of Financial Accounting - Omair HaroonDocument7 pagesACCT 100-Principles of Financial Accounting - Omair HaroonUmar FarooqNo ratings yet

BPP Kit Mapping question wise

BPP Kit Mapping question wise

Uploaded by

akokwrt0 ratings0% found this document useful (0 votes)

1 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views8 pagesBPP Kit Mapping question wise

BPP Kit Mapping question wise

Uploaded by

akokwrtCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

BPP Kit Mapping

Compiled by Sir. Mohammad Waseem Afzal

Question wise

Section 1 (Preparation questions)

1. Financial Instruments

a) & b) IAS 32 (compound instruments)

2. Leases

IFRS 16 (calculation & extracts)

3. Defined benefit plan

IAS 19 (Defined benefit expense)

4. Sundry standards

a) & b i) IAS 19 (F/S extracts & settlement) ; b ii) IFRS 9 (embedded derivates)

& c) IFRS 9 Classification of F.A

5. Control

IFRS 10 (control)

6. Associate

Consolidation, Goodwill & Associate accounting (C.SOFP)

7. Part disposal

a) Consolidation Sub to Associate disposal b) sub to sub disposal

8. Step acquisition

Consolidation (step acquisition)

9. Foreign operation

IAS 21

10. Consolidated statement of cash flows

Section 2 (Exam-standard questions)

11. Robby

a i) a ii) Goodwill & Joint operations & b) IFRS 9 (factoring arrangement w/

Conceptual Framework)

12. Diamond

a i) Goodwill ; a ii) Disposal ; a iii) IAS 19 a iv) IFRS 16 ; b) IFRS 9 (Debt

factoring)

13. Banana

a i) Goodwill & contingent consideration ; a ii) Equity method ; a iii) gain on

disposal; a iv) 2018 amendments to IAS 19

b) Business combination c) IFRS 9

14. HILL

a i) Deffered consideration; IAS 16 & Goodwill ; a ii) sub to associate

(disposal); a iii) Convertible Bond IAS 32 ; b) IAS 12

15. Angel

a i) IAS 16; a ii) IAS 23 (adjustments to PBT) ; a iii) Cash Flows; b i) Financial

statement differences ; b ii) Non-financial performance measures

16. Moyes

a i) ii) Cash flows & explanation and use of scenario ; b) Purchase

consideration (shares and deferred cash) Impact on consolidated statement

of cash flows of Subsidiary acquisition (including dividend) Subsidiary

disposal ; c) IFRS 5 d) intra group transactions & ethics

17. Weston

a i & ii) Group statements of cash flow & consolidation b) ethical discussion

18. Bubble

a) i) consolidation (intra loan) ii) translation of SOFP) iii) Goodwill b) IAS 21

issues

19. Elevator

a i) Ethical considerations (non financial reporting) ii) comments on Non

Financial performance measures b) Financial reporting (IFRS 15 Revenue

from Contracts) & ethical issues

20. Star

Ethics a) lease Agreement b) Ethical and social responsibility c) Internal

auditor profit-related bonus

21. Farham

a) IFRS 13 F.V; Allocation of impairment loss; Provision; IFRS 5 b) Ethics

22. Ethical issues

a) IFRS 16 (initial recognition & measurement) & ethical issues b) Ethics

23. Chippin

a) Direct method & Indirect method adv & disadv b) Reporting the loan

proceeds as operating cash flow & Ethics

24. Gustoso

a) Accounting issues ( IAS 37 provision; IFRS 9 recognition of a derivative)

b) Ethical implications

25. Fiskerton

a) IFRS 16 (finance lease) b) IFRS 15 (performance satisfied over time or at a

point in time c) Ethics

26. Janne

a i) Ias 40 & IFRS 13 ii) Selection of measurement basis b) Annual report

discussion (Practice Statement 2 Making Materiality Judgements; IAS 1; IAS

24) c) Alternative performance measure;

27. SunChem

a) IAS 38 (licenses & Acquisition of interest in Conew) b i) Practice Statement

2 ii & iii) IAS 24; Related parties & disclosures

28. Egin Group

a) Conceptual framework (Need for a conceptual framework & Resolve

practical accounting issues) b i & ii ) IAS 24 ( Why it is important to disclose

related party transactions; Materiality judgement, Practice Statement 2:

Making Materiality Judgements Nature of related party relationships)

29. Lockfine

a) IFRS 1 and deemed cost b) Fishing rights (IFRS 1; IFRS 3 retrospectively to a

business combination; IAS 38 two criteria to recognise intangible asset) c)

(IAS 38 Intangible asset characteristics) d) IAS 37 (restructuring provisions)

30. Alexandra

a i) Loan – accounting treatment a ii) Ethical implications & impact on

investors analysis b i) Director’s remuneration (IAS 24 Related party

disclosures & Ethical implication)

31. Verge

a) IFRS 15/ IAS 8 (Recognition of revenue; calculation & Correction of prior

period error) b) IAS 37 (Provision) c) IAS 1/16/20 (framework of IAS 1

Presentation of Financial Statements; IAS 16: recognition of building; IAS 20:

Government grant) d) Amendments to IAS 8

32. Avco

a i & ii) IAS 32 (distinction between debt and equity) b i) IAS 32 (Classification

differences between debt and equity) b ii) IAS 32 (Classification differences

between debt and equity) c) Current Issues (Accounting for cryptocurrencies)

33. Pensions

a) IAS 19 (Difference of Defined contribution plans and defined benefit plans)

b i & ii) IAS 19 (Reduction to net pension liability & Amendments to IAS 19)

34. Calendar

a i) IFRS 15; IAS 38 & IAS 8 (revenue recognition & classification of a gain on

derecognition of an intangible asset & retrospective correction) a ii) IFRS 16

Leases b) Materiality (PPE IAS 16 & Disclosure notes IAS 1 & IFRS Practice

Statement 2 Making Materiality Judgements)

35. Lupin

a i) IFRS 2 a ii) IFRS 16 a iii) intra group balances b i) Conceptual framework

(accounting for deferred tax is questionable) b ii) IAS 12 (Tax reconciliation

discussion) c) Principles of ED 2019/5 & effect on Entity

36. Lizzer

a i) IFRS 7 (disclosures of debt risk) a ii) IFRS 7 & IAS 10 (Potential breach of

loan covenants) b i) IFRS Practice Statement 2 Making Materiality

Judgements & ED 2019/6 Disclosure of Accounting Policies (Optimal level of

disclosure; Causes of excessive disclosure) b ii) Barriers to reducing

disclosure

37. Jogger

a) Social and environmental reporting b) APM (EBITDA advantages and

disadvantages; management of earnings; Moral/ethical considerations)

38. Moorland

a) Interpretation of financial statements for different stakeholders.

b i) IFRS 8 (Operating segment) b ii) APM (Underlying earnings per share)

39. Calcula

a) IFRS 5 (Subsidiary held for sale) b i) Integrated reporting (Confusion & IR

guidelines) b ii) Cost-cutting Programme

40. Toobasco

a) APMs (comparability; Extraordinary items; FCF; its description; EBITDAR &

Tax effects) b i) (Adjustment of net cash generated from operating activities

for errors in the statement) b ii) Free cash flow reconciliation b iii) IAS 7 Cash

flows (Purchase and sale of cars; Purchase of associate; Foreign exchange

losses; Pension payments; Interest paid)

41. Tufnell

a i) IFRS 5 (Discontinuance) a ii) IAS 12 (Deferred Tax) a iii) IAS 36

(Impairment) a iv) Ratios (Formation of opinion of impact on ROCE)

b) APM & residual income

42. Amster

a i) Importance of information concerning an entity's capital (Published

information & Integrated reporting) a ii) IAS 32 (classification) b) IFRS 2

(cash settled share based-payment & impact on adjustment)

43. Havanna

a) IFRS 15 (revenue recognition; Contract with sports organisation)

b) IFRS 5 (Sale of division) c i) IFRS 16 (key changes due to IFRS 16 investors

will see) c ii) IFRS 16 & IFRS 15 (sale & Lease back) c iii) Effect on interest

cover

44. Operating Segments

a) IFRS 8 (guidance on allocation and basis as per scenario; Differing amounts

in segment report to financial statements) b i) IFRS 8 (Criteria for

aggregation; Customer base/risk & conculsion) b ii) IFRS 8 (Investor appraisal

and segments; aggregation less useful; conclusion & ethics) c) CSR

(Reconciliation of ethics of CSR disclosure to shareholder expectations)

45. Skizer

a i) Concetual framework & IAS 38 recognition Criteria a ii) IAS 38

(derecognition & impairment assessment) a iii) IFRS 15 (application to entity)

b i) IFRS 3 (recognition of intangible assets) IAS 38 (cost or revaluation &

differences; differences in treatment of R&D and development expenditure)

b ii) Integrated Reporting (measurement choices made in the financial

statements & whether IR can supplement financial statements i.e providing

more info)

46. Cloud

a i) (Current presentation requirements; Conceptual basis)

a ii) Reclassification adjustments (Arguments for and against reclassification)

a iii) Integrated Reporting b) IAS 2 (NRV vs cost)

47. Allsop

a i) IAS 12 & IAS 21 (deferred tax charge) a ii) IFRS 15 (Revenue recognition &

variable consideration) b) IAS 7 & IR (Usefulness of statement of cash flows

and the Integrated Report)

48. Kiki

a i) IFRS 15 (Revenue recognition & unexercised rights as breakage)

a ii) IFRS 15 (Royalty) b) IAS 40 (Investment properties effect of SOFP, SOCI &

SOCF)

49. Holls

a i) IFRS Practice Statement Management Commentary (Arguments for and

against the non-binding framework) a ii) Framework (discussion of

understandability, relevance and comparability & Application to MC) b) IAS

12 (explanation of why taxable profits are different from accounting profit;

Explanation of Tax reconciliation; Tax rates; Deferred taxation)

50. Kayte

a) 2010 Conceptual Framework (Inconsistent application of the probability

criterion; Changes to the recognition criteria in 2018 Conceptual Framework)

b i) IAS 16 (application of IAS 16 (sold after 10 years) IFRS 5 (Accounting

treatment for non-current assets held for sale) b ii) IAS 34 (policies) & IFRS 5

(application) c) Conceptual Framework and interim financial reporting

(accounting policies)

51. Fill

a) IAS 2 (potential measurement basis, NRV and relevant Standards &

application of IAS 2) b) IAS 16 & 36 application to scenario c) Conceptual

framework & IFRS 3 discussion as per scenario (Control)

52. Zedtech

a i) Conceptual Framework (recognition per current Conceptual Framework

& ED's approach to recognition) a ii) IAS 12 (recognition criteria) IAS 37

(recognition criteria) IFRS 3 (recognition in business combinations) b i) IFRS

15 (collectability of consideration & performance obligation) b ii) (application

of above principles to O inventory & inventory X)

53. Royan

a) IAS 37 (Existing Guidiance & critique) b i) IAS 37 treatment ii) Ethics c)

Contingent liability

54. Formatt

a) Conceptual Framework & IFRS 9 (Financial asset) b i, ii & iii) IAS 36 & IFRS

5 ( NCA at cost; NCA @ valuation; NCA @ asset held for sale)

55. Emcee

a) IAS 23 (requirements and calculation of capitalised interest) b) IAS 38

recognition requirements, applicability of IFRS 5 and impairment under IAS

36 c) IFRS 13 and IAS 24 (discussion)

56. Scramble

a) IAS 38 – (Internally developed intangibles) b) IAS 36 – CGU (Discount rate

for impairment & disclosures) c) IAS 38 & IFRS 9- (subjective assessment)

57. Estoil

a) IAS 36 (Changes in circumstances; Market capitalisation; Allocating

goodwill; Valuation issues; Disclosures) b i) IAS 36 (discount rate) b ii) IAS 36

Cash flow forecasts

58. Evolve

a) IAS 32 & IAS 10 (Obligation to purchase own equity instruments);

b) IFRS 5 (Classification as held for sale) c) IAS 16 & 40 (Investment property)

59. Gasnature

a) IFRS 11; IAS 16 & 37 (Joint arrangement) b) IFRS 9 (buy or sell a non-

financial item not settled net in cash) c i) IAS 16 (overhauling) c ii) IAS 10

60. Complexity

a i) IFRS 9 (Identical payment; Carrying amount; Fair value)

a ii) IFRS 9 (Hedging discussion; Effectiveness discussion)

b i) IFRS 9 (model for the classification and measurement of financial

instruments) b ii) Practice Statement 2 & IFRS 7 (suggestion on information)

61. Blackcutt

a) IAS 16 & 40 (accounting issues) b) IFRS 16 (Lease) c) IAS 37 (Provisions) d)

IAS 36 (impairment of Building)

62. Carsoon

a) IFRS 16 (Classification of lease as operating lease not finance lease,

accounting requirements for lease payments and assets and cash flow

implications) b) IFRS 9 & 13 (Type of financial asset, IFRS 13 requirements,

account for financial asset) c) IFRS 15 (penalties, counter claim and additional

costs)

63. Leigh

a) IFRS 2 (Shares issued to the directors; Shares issued to employees)

b) IFRS 2 (Purchase of property, plant and equipment)

c) IAS 28 (Investment in Hardy treatement)

64. Yanong

a) IFRS 13 (Fair value of agricultural vehicles) b) IFRS 13 (Accounting

treatment of maize) c) IFRS 2 & 13 (Share-based payment) d) IFRS 13 (F.V

measurement Farmland)

65. Mehran

a) IFRS 13 (Land and brand name) b) IFRS 13 (Fair value of inventory) c) IFRS

9 & 13 (Investment in Erham)

66. Canto

a) IFRS 13 & IAS 16 & 40 (Fair value MEASUREMENT OF PROEPRTY, PPE to

investment property) b) IAS 38 & IFRS 3 (Order backlog & Water acquisition

rights) c) IAS 36 Impairment of Assets (CGU)

67. Ethan

a) IFRS 13 (Fair value of investment properties) b) IFRS 9 (F.V of options) c)

IAS 32 (B shares)

68. Whitebirk

a) SMEs (Subjective assessment including professional judgement) b i) SME’s

& IFRS 3, IAS 38 R&D, IAS 40 & IAS 38 (business combination, R&D

Investment Property & intangible assets)

69. Lucky Dairy

a) IAS 41, IAS 37, IAS 20, IFRS 5 (The dairy herd, Legal proceedings and

additional compensation, government grant, Planned sale of Dale farms)

You might also like

- Ifrs & Ias Flow Charts: by Mr. Bilal Khalid Khan (Fca)Document40 pagesIfrs & Ias Flow Charts: by Mr. Bilal Khalid Khan (Fca)Bagas Nurfazar100% (2)

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- Chris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFDocument218 pagesChris Moon - Business Ethics - Facing Up To The Issues (2001, Bloomberg Press) PDFCostache Madalina AlexandraNo ratings yet

- Rev C5Document9 pagesRev C5Richard W YipNo ratings yet

- Advance AccountingDocument12 pagesAdvance AccountingunknownNo ratings yet

- Framework of Accounting (TOA) - ValixDocument42 pagesFramework of Accounting (TOA) - ValixFatima Pasamonte88% (43)

- FSAI EXAM2 Solutions Fraser 10thDocument14 pagesFSAI EXAM2 Solutions Fraser 10thGlaiza Dalayoan Flores0% (1)

- BPP Kit Standard Wise MappingDocument7 pagesBPP Kit Standard Wise Mappingjunk2023No ratings yet

- AuditingDocument22 pagesAuditingawaisNo ratings yet

- Ca Inter Advanced Accounting MCQDocument210 pagesCa Inter Advanced Accounting MCQVikramNo ratings yet

- Accounting Reviewer 1.1Document35 pagesAccounting Reviewer 1.1Ma. Concepcion DesepedaNo ratings yet

- CPA Paper 13Document16 pagesCPA Paper 13sanu sayedNo ratings yet

- CPA Paper 8Document15 pagesCPA Paper 8sanu sayedNo ratings yet

- Framework of Accounting TOA EDITEDDocument48 pagesFramework of Accounting TOA EDITEDMiss A Academic ServicesNo ratings yet

- Corporate GovernanceDocument22 pagesCorporate Governanceroman empireNo ratings yet

- Answer in Assessment (CFAS)Document14 pagesAnswer in Assessment (CFAS)Angelika MoranNo ratings yet

- Which of The Following Is Not A Duty of The International Financial Reporting StandardDocument5 pagesWhich of The Following Is Not A Duty of The International Financial Reporting Standardchristian ReyesNo ratings yet

- Material - Framework of Accounting (Weekend)Document5 pagesMaterial - Framework of Accounting (Weekend)Sharmaine Diane N. CalvaNo ratings yet

- TEST BANK (UCNHS Reviewer For Kingfisher ABM Cup)Document12 pagesTEST BANK (UCNHS Reviewer For Kingfisher ABM Cup)Eya Guerrero Calvarido100% (1)

- Question - September 2018 BackgroundDocument6 pagesQuestion - September 2018 BackgroundAbdullah EjazNo ratings yet

- In-Class Test 2019Document8 pagesIn-Class Test 2019kissmegorgeousNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- Training Material of AuditDocument89 pagesTraining Material of AuditNaeem Uddin100% (10)

- Accounting Principles & Procedures MCQs - FPSC Senior Auditor Tests PDFDocument8 pagesAccounting Principles & Procedures MCQs - FPSC Senior Auditor Tests PDFMuhammad TariqNo ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Accounting & Auditing Paper - I (2000)Document13 pagesAccounting & Auditing Paper - I (2000)Sikandar EjazNo ratings yet

- Paper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsDocument5 pagesPaper F-1 Fianancial Operation: Syllabus Content Learning Outcome: Hours Quiz/Home AssignmentsAslam SiddiqNo ratings yet

- June 2006 Question PaperDocument11 pagesJune 2006 Question PapermanojrkmNo ratings yet

- Unit Ii Short Answer Type QuestionDocument3 pagesUnit Ii Short Answer Type Questionmultanigazal_4254062No ratings yet

- Icaew Diploma in Ifrss Syllabus and Study Guide 811Document11 pagesIcaew Diploma in Ifrss Syllabus and Study Guide 811Muridsultan JanjuaNo ratings yet

- ACCT 621 Practicing 1Document3 pagesACCT 621 Practicing 1Hashitha100% (1)

- SBR Revision NotesDocument294 pagesSBR Revision Notesbubbly100% (2)

- MCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0Document12 pagesMCQ - BBA III Semester - BBA3B04 - Corporate Accounting - 0sanz81909No ratings yet

- Making A List of IAS and IFRS As Adopted by BangladeshDocument9 pagesMaking A List of IAS and IFRS As Adopted by BangladeshAbir Hasan ApurboNo ratings yet

- Afacr Dec 2023 Attempt QuestionsDocument8 pagesAfacr Dec 2023 Attempt QuestionsShoaib HafeezNo ratings yet

- FAR Dry Run ReviewerDocument5 pagesFAR Dry Run ReviewerJohn Ace MadriagaNo ratings yet

- Accounting Principles and ProceduresDocument8 pagesAccounting Principles and ProceduresAdnan DaniNo ratings yet

- P20 SPM BV PH 2Document9 pagesP20 SPM BV PH 2Shivam GuptaNo ratings yet

- Ca10 0120Document16 pagesCa10 0120Amit KumarNo ratings yet

- Paspt Paper AnalysisDocument15 pagesPaspt Paper Analysisawais mehmoodNo ratings yet

- Basic Acc Quiz1Document4 pagesBasic Acc Quiz1Angel BiernezaNo ratings yet

- SBR-List of Technical ArticlesDocument1 pageSBR-List of Technical ArticleskeishaelinaNo ratings yet

- SBR Revision NotesDocument294 pagesSBR Revision NotesThembisile P ZwaneNo ratings yet

- Accounting & Auditing Mcqs From Past Papers: (C) Lucas PacioliDocument24 pagesAccounting & Auditing Mcqs From Past Papers: (C) Lucas PacioliAssad BilalNo ratings yet

- Accounting MCQDocument15 pagesAccounting MCQFahad RazaNo ratings yet

- Updates in FRS - Midterm Exam With SolutionDocument10 pagesUpdates in FRS - Midterm Exam With Solutionchristian ReyesNo ratings yet

- 7 CPA FINANCIAL REPORTING Paper 7Document13 pages7 CPA FINANCIAL REPORTING Paper 7dennis greenNo ratings yet

- Materials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesDocument12 pagesMaterials Allowed: Silent, Cordless Calculators (Financial Calculators Are Permitted) Translation DictionariesMiruna CiteaNo ratings yet

- International Financial Reporting Standards: Presentation and Disclosure Checklist 2007Document160 pagesInternational Financial Reporting Standards: Presentation and Disclosure Checklist 2007Tony PranotoNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- International Accounting and Financial Reporting: Ass. Prof. Mohammed ALASHIDocument16 pagesInternational Accounting and Financial Reporting: Ass. Prof. Mohammed ALASHIOmar YounisNo ratings yet

- CPA Paper 1Document10 pagesCPA Paper 1sanu sayedNo ratings yet

- Conceptual Frame Work QBDocument15 pagesConceptual Frame Work QBnanthini nanthini100% (1)

- ChronologiqueDocument40 pagesChronologiqueSamseer R HNo ratings yet

- Inter Paper12 Revised PDFDocument788 pagesInter Paper12 Revised PDFbhagyashre100% (1)

- 1 Cpa Financial Accounting Paper 1Document20 pages1 Cpa Financial Accounting Paper 1kajalshiroya17No ratings yet

- Acc 416Document7 pagesAcc 4161sirdeeqNo ratings yet

- Prepared By: CA. Abhijeet N. BobadeDocument9 pagesPrepared By: CA. Abhijeet N. Bobadepsawant77No ratings yet

- Accounts ImpDocument24 pagesAccounts ImphamzafarooqNo ratings yet

- An Introduction International Financial Reporting Standards (IFRS)Document34 pagesAn Introduction International Financial Reporting Standards (IFRS)EshetieNo ratings yet

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Balance Sheet ProvisionalDocument2 pagesBalance Sheet ProvisionalRaja AdhikariNo ratings yet

- Fixed Assest Management-UltratechDocument6 pagesFixed Assest Management-UltratechMr SmartNo ratings yet

- Consolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument290 pagesConsolidations - Subsequent To The Date of Acquisition: Multiple Choice QuestionsKim FloresNo ratings yet

- Chapter 11 - Ho Branch - MillanDocument34 pagesChapter 11 - Ho Branch - MillanAngelica Cerio100% (1)

- Indirect and Mutual HoldingsDocument36 pagesIndirect and Mutual HoldingssiwiNo ratings yet

- Methods For Patent Valuation PDFDocument11 pagesMethods For Patent Valuation PDFSantosh PatiNo ratings yet

- Business Combination Lecture Notes. ACC 401Document4 pagesBusiness Combination Lecture Notes. ACC 401Ugbah Chidinma LilianNo ratings yet

- AC2091 ZB Final For UoLDocument16 pagesAC2091 ZB Final For UoLkikiNo ratings yet

- Depreciation: Disposal of Fixed AssetsDocument13 pagesDepreciation: Disposal of Fixed AssetsHassan AliNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Q4-31-03-2022 TMBDocument67 pagesQ4-31-03-2022 TMBDhanush Kumar RamanNo ratings yet

- Accounting For Management Question PaperDocument3 pagesAccounting For Management Question PaperVINOD KUMARNo ratings yet

- DepreciationDocument13 pagesDepreciationHarshitPalNo ratings yet

- Financial Reporting Strathmore University Notes and Revision KitDocument551 pagesFinancial Reporting Strathmore University Notes and Revision KitLazarus AmaniNo ratings yet

- Dhar Textile Mills Balance Sheet, Dhar Textile Mills Financial Statement & AccountsDocument3 pagesDhar Textile Mills Balance Sheet, Dhar Textile Mills Financial Statement & AccountsAkshay BhattNo ratings yet

- Mini MBA B10 - 01 Financial Management - Day 01Document41 pagesMini MBA B10 - 01 Financial Management - Day 01Reza MonoarfaNo ratings yet

- Montajes - Joelyn Grace 117848 Seatwork 2Document9 pagesMontajes - Joelyn Grace 117848 Seatwork 2Joelyn Grace MontajesNo ratings yet

- ERP Operations: SAP Standard ReportsDocument10 pagesERP Operations: SAP Standard ReportsAnkur RastogiNo ratings yet

- Dabur Financial Modeling-Live Project.Document47 pagesDabur Financial Modeling-Live Project.rahul1094No ratings yet

- Interlocal Agreement 8-2-99Document2 pagesInterlocal Agreement 8-2-99williamblueNo ratings yet

- (ESP Merit and Needs Based Scholarship Program) : Instructions For Filling Out The Scholarship Application FormDocument9 pages(ESP Merit and Needs Based Scholarship Program) : Instructions For Filling Out The Scholarship Application FormIffatNo ratings yet

- Amalgamation NotesDocument28 pagesAmalgamation NotesADARSH MISHRANo ratings yet

- Acc311 2021Document4 pagesAcc311 2021hoghidan1No ratings yet

- ACCT 100-Principles of Financial Accounting - Omair HaroonDocument7 pagesACCT 100-Principles of Financial Accounting - Omair HaroonUmar FarooqNo ratings yet