Professional Documents

Culture Documents

SUMMER 2024 IFACC PROJECT

SUMMER 2024 IFACC PROJECT

Uploaded by

Romario AdmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SUMMER 2024 IFACC PROJECT

SUMMER 2024 IFACC PROJECT

Uploaded by

Romario AdmanCopyright:

Available Formats

UNIVERSITY OF TECHNOLOGY JAMAICA

SCHOOL OF BUSINESS ADMINISTRATION

Module Name Introduction to Financial Accounting

Module Code ACC2001

Take Home Assignment Summer 2024

Instructions

This paper has 10 pages and 4 questions. It should be completed as a group assignment.

Each group should consist of 4 members

The completed assignment should be uploaded on Moodle by Friday July 26, 2024.

ACC2001 Summer 2024 Assignment Page 1 of 11

Question One

The Minty Alley is a manufacturer of herbal body wash. The firm has provided the

following details for 2022 :

DETAILS Dr Cr

Purchases of Indirect Material 230,000

Direct Expenses 30,000

Factory General Expenses 40,000

Opening Stock of Indirect Materials 20,000

Loan Interest Paid 40,000

Capital 850,000

Opening stock of Raw Material 70,000

Carriage In on Raw Material 6,500

Commission Income 40,000

Rent Income 75000

Purchases of Raw Material 640,000

Opening Stock of WIP 22,000

Opening Stock of Finished Goods 45,000

Wages 300,000

Insurance 50,000

Utilities 80,000

Property Plant and Equipment PPE 950,000

Motor Vehicle 800,000

Prov for Depn PPE 125,000

Prov for Depn Motor Vehicle 24,000

Provision for Unrealized Profit 12,000

Provision for Bad Debts 8,000

Debtors 65,000

Bank 240,000

Creditors 95,500

10% Loan 500,000

1,500,00

Sales 0

Return Inwards 6,000

Drawings 30,000

Cash 55,000

346950

0 3469500

The following additional information is also provided:

ACC2001 Summer 2024 Assignment Page 2 of 11

1. Closing stock

Raw material 65,000, Indirect Material 35,000. Work in Progress 21125, Finished

Goods 93,500

2. Wages owing by 60,000, insurance prepaid by 10,000

3. Depreciation is to be charges on the non current assets as follows

Property plant and equipment 5% on the reducing balance Motor vehicle 10% on the

straight line basis. All depreciation charges are to be applied equally in the factory and

the office

4. The provision for bad debts is to be adjusted to 10% of the debtors

5. The commission income is owing by 10,000 while the rent income is prepaid by

15,000

6. The goods produced are to be marked up by 10% in the factory before being

transferred as finished goods

7. The wages is to be applied 50% to the office, 30% indirectly to the factory, and 20%

directly in the factory

8. Apportion the insurance and the utilities cost 60% to the factory and the remainder

to the office

Required

ACC2001 Summer 2024 Assignment Page 3 of 11

1. Prepare the Manufacturing Account and Income Statement for the year ending

December 31, 2022; as well as the Statement of Financial Position as at December 31,

2022 ( 55 marks )

2. Explain the classification of closing stock as used in the manufacturing enterprise

(10 marks )

3. Given that the goods produced are to be marked up by a percentage rate before being

transferred as finished goods, briefly explain

a) the accounting treatment for the amount calculated based on the mark up (5 marks )

b) the accounting implications if the finished goods are not all sold off at the end of

the year ( 10 marks )

Question Two

ACC2001 Summer 2024 Assignment Page 4 of 11

Sprat Morrison plc has provided the following data for the year 2022 :

DETAILS Dr Cr

Office Supplies 40,000

Wages and Salaries 210,000

Utilities 65,000

Insurance 80,000

Share Premium 40,000

General Reserves 120,000

Debenture Interest 40,000

Loan Interest 55,000

Retained Earning at January 1, 2022 60,000

Management Fees 80,000

Directors Fees 110,000

10% Preference Shares @ 2. 400,000

Ordinary Share Capital @ $0.50 800,000

10% Debenture 550,000

10% Loan 800,000

Property Plant and Equipment 1,800,000

Motor Vehicle 800,000

Prov for Depreciation PPE 210,000

Prov for Depreciation Motor Vehicle 68,000

Debtors 120,200

Creditors 155,500

Commission Income 80,000

Rent Income 120,000

Goodwill 400,000

Bank 65700

Cash 95500

Interim Ordinary Shares Premium 2000

Interim Preference Shares Dividends 10,000

Stock at December 31 . 2022 580,000

Sales Turnover 2,000,000

Cost of Sales 861,500

5,409,200 5,409,200

The following additional information was also available :

ACC2001 Summer 2024 Assignment Page 5 of 11

1. Wages is owing by $40,000 while insurance is prepaid by $25,000

2. The commission income is prepaid by $20,000 while the rent income of $30,000 is

owing

3. Provide for depreciation as follows : Property Plant and Equipment 10% on the

straight line; motor vehicle 5% on the reducing balance.

4. Transfer $40,000 for the profits to the general reserves

5. Corporation tax is estimated to be $50,000

6. The directors have approved the following : the settlement of the preference share

dividends; a new issue of 600,000 ordinary shares for which $480,000 was received

by cheque from the broker. No further ordinary shares dividends was declared.

7. The Expenses should be appropriated as follows

Expense Admin S & D

Office Supplies 50% 50%

Wages and Salaries 70% 30%

Utilities 80% 20%

Insurance 40% 60%

Management Fees 80% 20%

Directors Fees 50% 50%

Depreciation 60% 40%

8. Write off 25% of the goodwill

Required

ACC2001 Summer 2024 Assignment Page 6 of 11

1. Prepare the Statement of Profit and Loss and the Statement of Change in Equity for

the year ending December 31, 2022; as well as the Statement of Financial Position as

at December 31, 2022 ( 70 marks)

2. Explain five factors that may influence a company’s decision to pay dividends.

(10 marks )

3. Explain four non cash dividends options that a company may pursue ( 10 marks )

4. A company may leverage its financing by way of grants and subsidies. Briefly

explain (a) grants; and (b) subsidies. Give two appropriate examples for each term

(10 marks )

Question Three

ACC2001 Summer 2024 Assignment Page 7 of 11

Yendi Phillips is a former Miss Jamaica (World), Miss Jamaica (Universe), former host of

Digicel Rising Stars and brand ambassador for Toyota. She is also the owner of Odessey

a dietary meal replacement plan. The firm has provided the following data for 2022:

Condensed Income Statement Condensed Balance Sheet

Net Sales 1,600,500 Non Current Assets 2,400,000

Current Assets

Cost of Goods Sold Stock 74,500

220,00

Opening stock 53,000 Debtors 0

100,50

Add Net purchases 410,000 Bank 0

Less Closing stock (74,500) (388,500) Receivables 32,000 427,000

Gross Profit 1,212,000 Total Assets 2,827,000

Net Operating

Expenses (515,500)

Capital & Reserves

500,00

PBIT 696,500 Ordinary Shares @ $1.00 0

450,00

Less interest -40,000 10% Pref Shares @ $1 0

550,00

Profit before tax 656,500 Reserves 0

531,50

Less tax (200,000) Retained Profits 0 2,031,500

PAT 456,500

Non-Current Liability

Retained Earning b/d 300,000 10% Loan 400,000

Total Profit for the Year 756,500

(120,000

Less Transfer to Res ) Current Liabilities

250,00

Less Dividends Creditors 0

145,50

Ordinary (60,000) Accounts Payable 0 395,500

Total Equity &

Preference (45,000) (225,000) Liabilities 2,827,000

Retained Earning c/d 531,500

Market Price per

Share 3.75

ACC2001 Summer 2024 Assignment Page 8 of 11

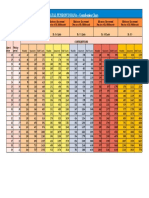

The following comparative ratios relate to

i. Yendi Phillips results in the preceding two years

ii. Jasia Williams a competitor in the dietary meal business

iii. The average performance of the dietary meal industry:

JASIA INDUSTRY YENDI

2020 2021 2022

Dividend Yield 2.45 % 2.75 %

Debtors Turnover 12.54 10.61

Current Ratio 0.85 :1 1.05 : 1

Net Profit Margin 22.47% 25.5%

Fixed Asset Turnover Period 264 days 311 days

Total Assets to Total Liabilities 5.84 : 1 4.12 : 1

Earnings Per Share 0.63 0.70

Gearing Ratio 28.13% 31.5%

ROCE 23.13 % 24.5%

Acid Test Ratio 0.63 : 1 0.75 :1

Required

a. Compute the corresponding ratios for Yendi Phillips for 2022 ( 10 marks )

b. Using appropriate ratios from the table above, comment on the performance of Yendi

Phillips in the areas of liquidity, solvency, profitability, asset management, and market

investment, by way of

i. A Trend Analysis ( 15 marks )

ACC2001 Summer 2024 Assignment Page 9 of 11

ii. A Competitor Analysis ( 15 marks )

c. Discuss five non-financial factors that would be useful in the assessment of the

performance of Yendi Phillips? ( 10 marks )

Question Four

The Calder Estate is a agricultural consultancy firm. The following payroll data was

obtained for the month of September 2022

Sam Burke and Percy Williams are watchmen They work alternative 12 hour shifts. They

basic pay is $60,000 per month, with non taxable meal allowance of $20,000 per month and

protective clothing allowance of $10,000 per month.

Sydney Forbes is the Caretaker and Handiman. His basic pay is $45,000 per month He

receives protective clothing allowance of $20000 per month, and he also works 20 hours

over time at a rate of $1500 per hour.

Shearon Smith and Renae Seymour are Administrative Assistants. Their basic pay is

$165000. They also receives uniform allowance of $25,000 per month as well as $10,000

for material aid and supplies. In August Shearon worked 16 hours of overtime while Rena

worked 20 hours over tine. The overtime rate is $2000 per hour and is paid in September

Bramble Hayles and Sachin Wong are Business Development Officers. They each earn

basic pay of $85,000 per month plus travelling at a rate of $140 per kilometre. They are

also paid a commission on their previous months new business accounts at a rate of 5%.

During August Hayles travelled 180 kilometre and posted new business of $2,500,000

while Wong travelled 220 kilometre and recorded new business for $3,000,000.

Lineat Calder is the General Manager. Her annual basic pay is $9,000,000 She also earns

travelling of $30,000 per month as well as entertainment allowance of $20,000 per month

and housing allowance of $50,000 per month. She qualifies for a 20% duty concession if

she choses to acquire a motor car up to a ceiling of $12,000,000.

All employees participates in a monthly contribution as the following:

- Health insurance at a rate of 1 % of basic pay

- Union dues of $1,200

- Pension funds at a rate of 5% of basic pay

- Staff welfare fund at a rate of 1% of basic pay

Calder has a car loan arrangement and repays $120,000 per month.

Sydney Forbes occasionally washes and maintains the General Manager’s car as a private

arrangement and she hands him an envelop each month with an average of $10,000. Sam

ACC2001 Summer 2024 Assignment Page 10 of 11

Percy and Syd purchase lunch and a rum on credit at Tamoyah’s Tavern. They each pay

$5,000 cash on their account every month All the employees except for Calder join a

partner in the community and throws one hand for $3,000 each month .

Required Draft the payroll for Calder Estate for September 2022. ( 40 marks )

ACC2001 Summer 2024 Assignment Page 11 of 11

You might also like

- PPE, Intangibles, Natural ResourcesDocument43 pagesPPE, Intangibles, Natural ResourcesBrylle TamañoNo ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Ac QuestionsDocument7 pagesAc QuestionssamsherbdtamangNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- PART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyDocument2 pagesPART A: Prepare A Company's Financial Reports Tika Company LTD A Wholesaler CompanyMakeleta VaenukuNo ratings yet

- Assignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Document1 pageAssignment For Accountancy Taxation, BBS 1st Yr, NOU, 2080-2-24Rojila luitelNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- CUAC 408 Group Assignment 1 2021Document6 pagesCUAC 408 Group Assignment 1 2021Blessed Nyama100% (1)

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet

- Homework 2Document2 pagesHomework 2Sudeep0% (1)

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Sample Questions and Solutions - Final ExamDocument4 pagesSample Questions and Solutions - Final ExamNadjah JNo ratings yet

- 8104 MbaexDocument3 pages8104 Mbaexgaurav jainNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Chapter Five Format and ExampleDocument8 pagesChapter Five Format and Examplechris mutungaNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Daa 101 Introduction To Accounting Ii - RispahDocument4 pagesDaa 101 Introduction To Accounting Ii - RispahSpencerNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- ACCE 312 Practical Reader SU4 - Question Papers, Answer Sheets - EngDocument19 pagesACCE 312 Practical Reader SU4 - Question Papers, Answer Sheets - EngPETER MABASSONo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Short-Term ExamDocument6 pagesShort-Term Examymkuzangwe16No ratings yet

- Adjustments To Financial Statements Tutorial No: 13Document6 pagesAdjustments To Financial Statements Tutorial No: 13me myselfNo ratings yet

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21No ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- NFRS Income Statement and Work SheetDocument5 pagesNFRS Income Statement and Work Sheetrohan joshiNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Binny Ma'am MADocument25 pagesBinny Ma'am MA337 Nandawat KanishkaNo ratings yet

- Financial Plan: and Economic ChallengesDocument5 pagesFinancial Plan: and Economic ChallengesEmmanuel AkoloNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- BFC 3225 Intermediate Accounting I 2 - 2Document6 pagesBFC 3225 Intermediate Accounting I 2 - 2karashinokov siwoNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- BACC 233 Assignment 2 Jan-Jun 2024Document5 pagesBACC 233 Assignment 2 Jan-Jun 2024TarusengaNo ratings yet

- Company Financial StatementsDocument6 pagesCompany Financial StatementsHasnain MahmoodNo ratings yet

- Buy Back AssingmentDocument5 pagesBuy Back AssingmentDARK KING GamersNo ratings yet

- Basic exerciseDocument5 pagesBasic exercise23b4epgp142No ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196No ratings yet

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Lecture 5 NotesDocument3 pagesLecture 5 NotesAna-Maria GhNo ratings yet

- Q2: (8+8 16marks) Debit BalancesDocument2 pagesQ2: (8+8 16marks) Debit BalancesMaryam EhsanNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Adobe Scan 31 Jan 2023Document4 pagesAdobe Scan 31 Jan 2023Prasoon PandeyNo ratings yet

- B326 TMA 23-24 (Fall) V1Document9 pagesB326 TMA 23-24 (Fall) V1Reham Abdelaziz100% (2)

- IBCC Challan - 1626244031Document1 pageIBCC Challan - 1626244031AtifNaeem67% (3)

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- American Eagle Outfitters TemplateDocument16 pagesAmerican Eagle Outfitters TemplateVitor Minoru OkadaNo ratings yet

- HDFC PDFDocument43 pagesHDFC PDFAbhijit SahooNo ratings yet

- 08.31.2023 - PSA Monthly Reports - CashDocument121 pages08.31.2023 - PSA Monthly Reports - CashBriltex IndustriesNo ratings yet

- Sbi Persoal LoanDocument7 pagesSbi Persoal Loananon_832837899No ratings yet

- Iibf & Nism AddaDocument290 pagesIibf & Nism AddaAnu PrincesNo ratings yet

- AMFI Sample 500 QuestionsDocument36 pagesAMFI Sample 500 QuestionsSuraj KumarNo ratings yet

- New OpenDocument TextDocument24 pagesNew OpenDocument TextSonia GabaNo ratings yet

- Time Value of MoneyDocument83 pagesTime Value of MoneyKatarame LermanNo ratings yet

- CreditReport Piramal - SURESH KUMAR - 2022 - 11 - 07 - 16 - 04 - 52.pdf 07-Nov-2022Document4 pagesCreditReport Piramal - SURESH KUMAR - 2022 - 11 - 07 - 16 - 04 - 52.pdf 07-Nov-2022razzak kathatNo ratings yet

- Quiz Chapter+9 Income+Taxes+-+Document5 pagesQuiz Chapter+9 Income+Taxes+-+Rena Jocelle NalzaroNo ratings yet

- Januari JuniDocument468 pagesJanuari JuniEdwin MaidhanieNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- BfsiDocument60 pagesBfsishriya shettiwar0% (1)

- Negotiated Dealing System (NDS) in India, Anonymous PDFDocument8 pagesNegotiated Dealing System (NDS) in India, Anonymous PDFShrishailamalikarjunNo ratings yet

- Report On Motor Insurence of Phoenix Insurance Company LTDDocument22 pagesReport On Motor Insurence of Phoenix Insurance Company LTDvvv NainaNo ratings yet

- ISA Audit Guide Volume 1 3rd Edition FINALDocument243 pagesISA Audit Guide Volume 1 3rd Edition FINALcrperezs100% (1)

- Apy ChartDocument1 pageApy ChartMohit PathaniaNo ratings yet

- Compre FAR19Document16 pagesCompre FAR19Gwen Cabarse PansoyNo ratings yet

- Employee Office Activity - Madhuri KanabarDocument1 pageEmployee Office Activity - Madhuri KanabarGajendra AudichyaNo ratings yet

- Goals and Governance of The Corporation Goals and Governance of The CorporationDocument24 pagesGoals and Governance of The Corporation Goals and Governance of The CorporationAbdullah BugshanNo ratings yet

- Malayan Banking BHD V Ching Suit Fee - (2012Document9 pagesMalayan Banking BHD V Ching Suit Fee - (2012Norlia Md DesaNo ratings yet

- Capital Asset Pricing Mode1Document9 pagesCapital Asset Pricing Mode1Shaloo SidhuNo ratings yet

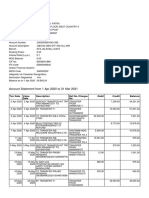

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancesayanNo ratings yet

- Cfas ReviewerDocument4 pagesCfas ReviewerLayla MainNo ratings yet

- Module 2 AnnuitiesDocument20 pagesModule 2 AnnuitiesCatherine CambayaNo ratings yet