Professional Documents

Culture Documents

Assessment of general overhead

Assessment of general overhead

Uploaded by

Nantukina TeshomeCopyright:

Available Formats

You might also like

- Introduction For Business and FinanceDocument35 pagesIntroduction For Business and FinanceazizNo ratings yet

- Alaire Corporation Manufactures Several Different Circuit BoardsDocument2 pagesAlaire Corporation Manufactures Several Different Circuit BoardsAmit PandeyNo ratings yet

- ESTIMATING AND COSTING Chapter 1Document3 pagesESTIMATING AND COSTING Chapter 1kaze100% (1)

- Chapter 1Document27 pagesChapter 1fentawmelaku1993No ratings yet

- Effects of Variation OrdersDocument3 pagesEffects of Variation OrdersNicoletaLiviaNo ratings yet

- Lecture - 3Document59 pagesLecture - 3Muleta EjetaNo ratings yet

- Introduction To Built Up RatesDocument20 pagesIntroduction To Built Up Ratessyamly 9802100% (1)

- 4.construction Cost EstimateDocument7 pages4.construction Cost Estimateyodit.fekaduNo ratings yet

- 4Document35 pages4Amanu WorkuNo ratings yet

- TOPIC TWO - Costs ClassificationDocument8 pagesTOPIC TWO - Costs ClassificationABDULSWAMADU KARIMUNo ratings yet

- Hid - COMPONENT OF ESTIMATEDocument4 pagesHid - COMPONENT OF ESTIMATEBereket gebreselassieNo ratings yet

- Lecture ThreeDocument28 pagesLecture ThreeMartaNo ratings yet

- Cost Engineering Sec.1&2Document10 pagesCost Engineering Sec.1&2Ian M OswaldNo ratings yet

- Zaozhuang University 枣 庄 大 学: Subject: Assignment no: - 11 DepartmentDocument7 pagesZaozhuang University 枣 庄 大 学: Subject: Assignment no: - 11 Departmentitsme rehanNo ratings yet

- Cost Classification For Inventory Valuation and ProfitDocument4 pagesCost Classification For Inventory Valuation and ProfitRao EhsanNo ratings yet

- Unit Rates Build UpDocument6 pagesUnit Rates Build UpBernard KagumeNo ratings yet

- Estimation and CostingDocument37 pagesEstimation and CostingrajeshNo ratings yet

- Construction ContractsDocument25 pagesConstruction ContractsTrevor T ParazivaNo ratings yet

- Costing and Project EvaluationDocument37 pagesCosting and Project Evaluationdani2611No ratings yet

- Chapter Five Financial Analysis of ProjectsDocument12 pagesChapter Five Financial Analysis of ProjectsTemesgenNo ratings yet

- Glossary of Construction Cost EstimatingDocument8 pagesGlossary of Construction Cost EstimatingFaty BercasioNo ratings yet

- A Assignment ON "Examples Where Direct Expenses Are Not Included in The Cost of Production"Document7 pagesA Assignment ON "Examples Where Direct Expenses Are Not Included in The Cost of Production"parikharistNo ratings yet

- Chapter SixDocument11 pagesChapter SixhussenNo ratings yet

- Cost Engineering NoteDocument54 pagesCost Engineering NoteBikila M. Kejela100% (1)

- Project Identifying Costs and BenefitsDocument21 pagesProject Identifying Costs and BenefitsSherko SoltanpanahiNo ratings yet

- Unit 2 - Classification of CostDocument4 pagesUnit 2 - Classification of Costavinal malikNo ratings yet

- Unit Price AnalysisDocument5 pagesUnit Price AnalysisSasanka T WijesingheNo ratings yet

- Cost Engineering LectureDocument43 pagesCost Engineering LectureMekuannint DemekeNo ratings yet

- Cost EstimateDocument8 pagesCost EstimateAkunwa GideonNo ratings yet

- 62 - 23335 - CB415 - 2018 - 1 - 1 - 1 - Cost EstimationDocument4 pages62 - 23335 - CB415 - 2018 - 1 - 1 - 1 - Cost EstimationAhmedGhallabNo ratings yet

- Economic Analysis: Tci Fci + Oo DC + Ic + OoDocument3 pagesEconomic Analysis: Tci Fci + Oo DC + Ic + OoAlexander VovaNo ratings yet

- Cost Sheet NewDocument25 pagesCost Sheet Newnagesh dashNo ratings yet

- Cost Engineering Lecture NoteDocument62 pagesCost Engineering Lecture Notefentawmelaku1993No ratings yet

- Cost EstimationDocument3 pagesCost EstimationAmna EhsanNo ratings yet

- Elements of CostDocument38 pagesElements of CostRajyalakshmi.GNo ratings yet

- Khanda Habeeb RaheemDocument12 pagesKhanda Habeeb RaheemHarith EmaadNo ratings yet

- Java NotesDocument15 pagesJava NotesIqbal HawreNo ratings yet

- Manufacturing OverheadDocument5 pagesManufacturing OverheadSheila Mae AramanNo ratings yet

- In Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceDocument20 pagesIn Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceBHUSHAN PATILNo ratings yet

- Chapter Two: Financial Analysis 2.1. Scope and Rational For Financial AnalysisDocument16 pagesChapter Two: Financial Analysis 2.1. Scope and Rational For Financial AnalysisWiz Santa100% (1)

- Accounting For Other ExpensesDocument8 pagesAccounting For Other ExpensesLinyVatNo ratings yet

- Charging For Civil Engineering ServicesDocument3 pagesCharging For Civil Engineering ServicesDonna Cece MelgarNo ratings yet

- Cost & Management Accounting Prepared by Vishal GoelDocument20 pagesCost & Management Accounting Prepared by Vishal Goelgoel76vishalNo ratings yet

- EstimateDocument36 pagesEstimatemohammed100% (1)

- 18ME51 ME Mod 5Document12 pages18ME51 ME Mod 5Sanjay BSNo ratings yet

- CE 4106 Group 5 ReportDocument15 pagesCE 4106 Group 5 ReportGreg Calibo LidasanNo ratings yet

- Cost Planning and Cost ControlDocument25 pagesCost Planning and Cost ControlFranco FungoNo ratings yet

- Cost AccountingDocument38 pagesCost AccountingAayush ShahNo ratings yet

- Cost Sheet Final DocumentDocument26 pagesCost Sheet Final Documentabhi96% (27)

- Cost Sheet AnalysisDocument37 pagesCost Sheet Analysismanjeetkumar93544No ratings yet

- Element of CostDocument3 pagesElement of CostAshik Uz ZamanNo ratings yet

- Section 4. Charging For Civil Engineering ServicesDocument14 pagesSection 4. Charging For Civil Engineering ServicesChan Marie Camacho Pielago100% (1)

- Here We Detail About The Classification of Expenditure IDocument10 pagesHere We Detail About The Classification of Expenditure INeelNo ratings yet

- Summary On Cost Concpts and ClassificationsDocument7 pagesSummary On Cost Concpts and ClassificationsMa. Roycelean PascualNo ratings yet

- Chapter 9 - Other ExpensesDocument13 pagesChapter 9 - Other ExpenseskundiarshdeepNo ratings yet

- Cost Sheet Project - Hindustan Petroleum Corporation LTDDocument20 pagesCost Sheet Project - Hindustan Petroleum Corporation LTDkuldeep100% (1)

- Malta College of Arts & Science & TechnologyDocument3 pagesMalta College of Arts & Science & TechnologyKarl AttardNo ratings yet

- Quantity Surveying and EstimationDocument6 pagesQuantity Surveying and Estimationshubham kadamNo ratings yet

- Business Project Investment: Risk Assessment & Decision MakingFrom EverandBusiness Project Investment: Risk Assessment & Decision MakingNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Cost Estimation Manual power pointDocument114 pagesCost Estimation Manual power pointNantukina TeshomeNo ratings yet

- Daily Labor Paymenent Format (2) 28Document1 pageDaily Labor Paymenent Format (2) 28Nantukina TeshomeNo ratings yet

- Rebar Take Off Office and Store SubstructureDocument1 pageRebar Take Off Office and Store SubstructureNantukina TeshomeNo ratings yet

- 1.cost Break Down EtDocument75 pages1.cost Break Down EtNantukina TeshomeNo ratings yet

- Take Pre-School SubstructureDocument1 pageTake Pre-School SubstructureNantukina TeshomeNo ratings yet

- BFE Child Care and Elderly Support Project Three Years PlanDocument22 pagesBFE Child Care and Elderly Support Project Three Years PlanNantukina TeshomeNo ratings yet

- BFE Education Project FY'17 Plan (DIP)Document7 pagesBFE Education Project FY'17 Plan (DIP)Nantukina TeshomeNo ratings yet

- BFE Local Taxi ExepensesDocument15 pagesBFE Local Taxi ExepensesNantukina TeshomeNo ratings yet

- Price Comparision Table: Suppliers II IIIDocument3 pagesPrice Comparision Table: Suppliers II IIINantukina TeshomeNo ratings yet

- BFE Emergency R Project FY'16 Plan (DIP)Document7 pagesBFE Emergency R Project FY'16 Plan (DIP)Nantukina TeshomeNo ratings yet

- Project FY'17 Plan (DIP)Document2 pagesProject FY'17 Plan (DIP)Nantukina TeshomeNo ratings yet

- Q1 Entrepreneurship M6-1Document20 pagesQ1 Entrepreneurship M6-1karelleasmad6No ratings yet

- Enterpreneurship DevelopmentDocument20 pagesEnterpreneurship Developmentv adamNo ratings yet

- Every SBU Is Profit Center But Every Profit Center Is Not SBUDocument1 pageEvery SBU Is Profit Center But Every Profit Center Is Not SBUNikita NagdevNo ratings yet

- Process Costing TheoryDocument3 pagesProcess Costing TheorycoolchethanNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

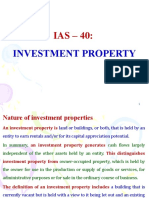

- Ias-40 - Investment PropertyDocument16 pagesIas-40 - Investment PropertyPue Das100% (2)

- Tutorial Week 8 Preparation RequirementsDocument14 pagesTutorial Week 8 Preparation RequirementsBáchHợpNo ratings yet

- How Much Has The Efficiency of Support Functions Improved?: Figure 1: Support Costs 2013 - 2017 ($billion)Document7 pagesHow Much Has The Efficiency of Support Functions Improved?: Figure 1: Support Costs 2013 - 2017 ($billion)Mehadi HasanNo ratings yet

- AccountingDocument6 pagesAccountingCharisse CruzNo ratings yet

- Define Cost Component Structure: The Following Applies To Product CostingDocument9 pagesDefine Cost Component Structure: The Following Applies To Product CostingDundi AkulaNo ratings yet

- General Store.0Document9 pagesGeneral Store.0Nasir MehmoodNo ratings yet

- Wiley CPAexcel - BEC - Assessment Review - 2Document20 pagesWiley CPAexcel - BEC - Assessment Review - 2ABCNo ratings yet

- True/False: Chapter 6: Master Budget and Responsibility AccountingDocument45 pagesTrue/False: Chapter 6: Master Budget and Responsibility Accountingjomari legaspiNo ratings yet

- Masquerade (Regional Eliminations)Document5 pagesMasquerade (Regional Eliminations)Ayvee BlanchNo ratings yet

- CH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionDocument21 pagesCH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionMEGA NURWANINo ratings yet

- Poll Question 3 - ABCDocument1 pagePoll Question 3 - ABCMary Ann NatividadNo ratings yet

- NEW MFRS 116 Property, Plant and EquipmentDocument53 pagesNEW MFRS 116 Property, Plant and EquipmentUmairah HusnaNo ratings yet

- Chaper 1Document8 pagesChaper 1ryan pinkihanNo ratings yet

- Comparing Merchandising and Manufakturing CompanyDocument3 pagesComparing Merchandising and Manufakturing CompanyHermanNo ratings yet

- Unit 2 - Classification of CostDocument4 pagesUnit 2 - Classification of Costavinal malikNo ratings yet

- Definition of Standard CostingDocument10 pagesDefinition of Standard CostingSandeep SinghNo ratings yet

- CH 15Document29 pagesCH 15ReneeNo ratings yet

- Session 2 ProblemsDocument5 pagesSession 2 ProblemsJayene Nicole RazonNo ratings yet

- TQM PDFDocument17 pagesTQM PDFOki RizkiyantoNo ratings yet

- Investment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Document13 pagesInvestment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Farwa SamreenNo ratings yet

- 1 Manage Cost Profiles (Doc ID 2533594.1)Document5 pages1 Manage Cost Profiles (Doc ID 2533594.1)AhmedNo ratings yet

- The Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentDocument24 pagesThe Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentHalimah SheikhNo ratings yet

- Manac ExamDocument6 pagesManac ExamJaime II LustadoNo ratings yet

- Chapter 11 Atkinson Kaplan 2012Document28 pagesChapter 11 Atkinson Kaplan 2012EmmelinaErnestine100% (2)

Assessment of general overhead

Assessment of general overhead

Uploaded by

Nantukina TeshomeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment of general overhead

Assessment of general overhead

Uploaded by

Nantukina TeshomeCopyright:

Available Formats

1.

Assessment of general overhead

Site or Job Overheads

-site management and supervision offices, canteen, storage sheds, cars and other

transport, temporary roads and services

- mobilization and demobilization costs, tender expenses, expertise service costs,

office furniture and equipments, office running expenses, radio communications,

camp facilities, water and power supply, workshops, garages and warehouses,

bank charges for money borrowed to purchase materials or machineries for the

specific project, insurance charges. Ostwald (2001),

Head Office or General or Company Overheads

- general expenses such as head office rent, office insurance, light, supplies,

furniture, telephone, legal expenses, donations, travel, advertising, bidding

expenses and salaries of the executives and office employees.

- expertise service costs such as the services of external auditors, lawyers,

management consultants and external trainings, workshops, garages and

warehouses, bank charges, insurance charges, transportation and travel expenses,

reception charges in to the head office overheads

Each business has certain expenses that are not variable with the amount of work they

have under contract. These expenses must be spread across the projects.

General

overhead costs typically include the following:

• Salaries (home office)

• Employee benefits

• Professional fees

• Insurance

• Office lease or rent

• Office stationery and supplies

• Maintenance

• Job procurement and marketing

• Home office travels (James ,2003).

2. Risk Allowances

- bad whether and the interference with production and programme that it may cause,

the availability of materials for incorporation in the work, delays due to industrial

disputes, the financial stability of the client and the performance of equipment

- contractors incorporate risk allowances in their tender or construction price to

compensate the negative impact of contractual, technical, political and economic risks.

-technical risks are those associated usually with the clarification of the technical

specifications, working drawings, construction technology and difficulties in

understanding new method of constructions. Political and economic risks, according to

Tadesse, reflect the impact of political situations, stability of economic policies,

inflation and price escalation on the execution of the intended construction project

2.Assessment of risk and profit allowance

The profit assigned to a project should recognize the nature of risk that the company is

facing in the project and an appropriate return on the investment being made in the

project.

3.Contingency

It is an amount added to an estimate to allow for items, conditions, or events for which

the state, occurrence, or effect is uncertain, will likely result additional costs and

estimated using statistical analysis or judgment based on past asset or project experience.

T he contingency should absolutely not be treated a s a n a allowance.

4.Allowances

Allowances are costs that are foreseen to be spent, and need to be included in the detail

estimate in the proper construction category of work and not as a total for the project

5. Indirect cost

Indirect costs are also referred to as distributed costs. Indirect costs are not a component

of the actual construction work but are incurred by the contractor in support of the

work.Overhead costs are those costs which cannot be attributed to a single task of

construction

work. These costs include overhead, profit, and bond .Overhead costs are customarily

divided into two categories; namely General or Home office overhead cost and Job or

Field overhead costs

6.Depreciation cost

The cost charged to operations of an asset during a particular year is called depreciation.

from an engineering economics point of view, our primary concern is with accounting

depreciation in which a fraction of the cost of the asset is chargeable as an expense during the

accounting periods or it is the systematic allocation of an asset's value over its depreciable

life.

In order to calculate accounting depreciation, one has to know its cost, its salvage value,

service or depreciable and what method to use.

7. Labour productivity rate

Labour productivity rates in the construction industry are characterized by their tendency

to vary from individual to individual, day to day, and project to project and it has been

historically one of the most inaccurate aspects of estimating (Calin et al., 200)

Productivity rate = Labour hours/ Quantity of work

8.Estimating work duration

Calin et al.(2003) has suggested determining the total work duration for a task involves

knowledge of the quantity of work required for the task and the productivity rate for the

specific crew t hatw ill be performing t he work

Work duration = Quantity of work / Number of crews × Productivity rate

9.Direct costs

Direct cost consists of the cost of materials, labor, equipment and

subcontractors needed to carry out a specific, well-defined item of work

10.Material Cost

According to Chikarta (2001), the direct material cost generally includes:

- Purchase costs, ex-factory or specified delivery location.

- Transportation costs, custom clearance, insurance and handling charges till arrival at site.

- Site manufacturing and fabrication costs to transform raw materials in to products for use

in permanent works.

11.Labor Costs.

Direct labor is the work that transforms materials from one state to another value added

condition. Carpenters, masons, steel setters, heavy equipment operators, plumbers and

electricians are typical titles for direct labor, (Ostwald, 2001)

12.. Equipment and Plant Costs

The cost of equipment involves ownership, operation, maintenance, moving,

set up and tear down

14.. Indirect Costs

In other works all costs other than direct costs are covered under indirect cost

15. Estimating Direct costs

Direct cost = Direct material cost +Direct labor cost + Direct equipment utilization cost...

[3.1]

Direct material cost is the total cost of materials required to execute a unit of specific activity

in a project.

Material unit cost=∑(Material consumption quantity standard x Material’s unit price).......

[3.2]

Material consumption standard is the quantity of material required to execute a unit of

specific activity or work including allowances for wastages and material unit price is

definedas the estimated all-in price of the unit quantity of an item, delivered at the project site

which

includes price at source, wastage costs, transportation costs and taxes involved.

Direct labor hourly cost=∑ (No of labor x Basic salary x Labor index x UF)....................[3.3]

Direct Labor cost is the cost of labor that is incurred to execute a unit of specific activity in a

project.

Direct labor unit cost=Direct labor hourly cost/ hourly crew productivity..........................[3.4]

Direct labor unit cost= Direct Labor hourly cost x Worker’s productivity standard............

[3.5]

Direct equipment hourly cost=∑ (No of equipment x Hourly cost x UF)............................[3.6]

The estimation of equipment hourly rate involves the estimation of equipment owing and

operation costs:

Equipment rate per hour= owing cost per hour + operating cost per hour............................

[3.7]

Where, Owing cost = Depreciation

Operating cost = Fuel cost +Maintenance cost + Major repair cost + Operator’s cost

+ Tyre replacement cost (for rubber tyred equipment).

Direct Equipment cost per unit work= Direct equipment hourly cost/Hourly crew productivity

II. Indirect costs

As Tadesse 2006 stated indirect costs are calculated as a percentage of the direct unit costs.

Accordingly:

Site over head costs=K1 x Direct unit cost....................................................................[3.8]

Where K1= Total site overhead cost/Total project direct cost

Head office over head costs=K2 x Direct unit cost........................................................[3.9]

Where K2= Annual head office over head costs/ Average annual direct cost turn over

Indirect unit cost=Site over head costs +Head office over head costs...............................

[3.10]

-direct labor hourly cost which is the total hourly cost of labor crew required to execute

a specific activity

-Labor index is a multiplying factor of the basic salary which represents the additional

benefits a worker gets such as over time payments, annual leave pay, severance pay, bonus

and other benefits

- UF(Utilization factor) is used for calculating the contribution of a crew member who is

assigned to two or more activities

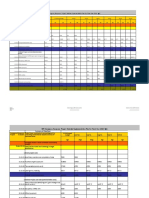

1) Dhaabbata ijaarsaa dhuunfaa XY fi Abbaan taayitaa konstiraakshinii gidduu waliigaltee

ijaarsa piroojektii Wajjiraa Gamoo G+4 ijaarsisuuf waliigaltee taasisanii ijarsii 55% gahee

jira. Haata’u malee, waldhibdee gidduu isaanii irratti uumameen abbaan piroojektii xalayaan

qabeenyi piroojekticha keessaa jiru akka hin sochoone dhorkee jira. Ta’uus walhimanna

mana murtiitti ta’ee, piroojektiin ji’a 6 erga dhaabbatee booda, balleessaan abba piroojektii

ta’uu ibsee, tilmaamni gatii qabeenyaa dhaabbataa ijaarsaa dhuunfaa XY akka tilmaamamuu

murteessee jira. Kontiraakterichii

1) kaffaltii wardiyaa fi hojjetoota humnaa 50 hin kaffallee

2/Mashinarii Dump truck tokko,pick up tokko ,Miikserii tokko,Vibiratorii tokko ,Water

Pump tokko fi Jenereteera

3)Dhagaa 200m3, Sibiila Kg 8000 fi formwork Siibila 100

Kanaafuu,tilmaama isaa haala akkamiin tilmaamtuu ? meeqaa ta’aa ?

You might also like

- Introduction For Business and FinanceDocument35 pagesIntroduction For Business and FinanceazizNo ratings yet

- Alaire Corporation Manufactures Several Different Circuit BoardsDocument2 pagesAlaire Corporation Manufactures Several Different Circuit BoardsAmit PandeyNo ratings yet

- ESTIMATING AND COSTING Chapter 1Document3 pagesESTIMATING AND COSTING Chapter 1kaze100% (1)

- Chapter 1Document27 pagesChapter 1fentawmelaku1993No ratings yet

- Effects of Variation OrdersDocument3 pagesEffects of Variation OrdersNicoletaLiviaNo ratings yet

- Lecture - 3Document59 pagesLecture - 3Muleta EjetaNo ratings yet

- Introduction To Built Up RatesDocument20 pagesIntroduction To Built Up Ratessyamly 9802100% (1)

- 4.construction Cost EstimateDocument7 pages4.construction Cost Estimateyodit.fekaduNo ratings yet

- 4Document35 pages4Amanu WorkuNo ratings yet

- TOPIC TWO - Costs ClassificationDocument8 pagesTOPIC TWO - Costs ClassificationABDULSWAMADU KARIMUNo ratings yet

- Hid - COMPONENT OF ESTIMATEDocument4 pagesHid - COMPONENT OF ESTIMATEBereket gebreselassieNo ratings yet

- Lecture ThreeDocument28 pagesLecture ThreeMartaNo ratings yet

- Cost Engineering Sec.1&2Document10 pagesCost Engineering Sec.1&2Ian M OswaldNo ratings yet

- Zaozhuang University 枣 庄 大 学: Subject: Assignment no: - 11 DepartmentDocument7 pagesZaozhuang University 枣 庄 大 学: Subject: Assignment no: - 11 Departmentitsme rehanNo ratings yet

- Cost Classification For Inventory Valuation and ProfitDocument4 pagesCost Classification For Inventory Valuation and ProfitRao EhsanNo ratings yet

- Unit Rates Build UpDocument6 pagesUnit Rates Build UpBernard KagumeNo ratings yet

- Estimation and CostingDocument37 pagesEstimation and CostingrajeshNo ratings yet

- Construction ContractsDocument25 pagesConstruction ContractsTrevor T ParazivaNo ratings yet

- Costing and Project EvaluationDocument37 pagesCosting and Project Evaluationdani2611No ratings yet

- Chapter Five Financial Analysis of ProjectsDocument12 pagesChapter Five Financial Analysis of ProjectsTemesgenNo ratings yet

- Glossary of Construction Cost EstimatingDocument8 pagesGlossary of Construction Cost EstimatingFaty BercasioNo ratings yet

- A Assignment ON "Examples Where Direct Expenses Are Not Included in The Cost of Production"Document7 pagesA Assignment ON "Examples Where Direct Expenses Are Not Included in The Cost of Production"parikharistNo ratings yet

- Chapter SixDocument11 pagesChapter SixhussenNo ratings yet

- Cost Engineering NoteDocument54 pagesCost Engineering NoteBikila M. Kejela100% (1)

- Project Identifying Costs and BenefitsDocument21 pagesProject Identifying Costs and BenefitsSherko SoltanpanahiNo ratings yet

- Unit 2 - Classification of CostDocument4 pagesUnit 2 - Classification of Costavinal malikNo ratings yet

- Unit Price AnalysisDocument5 pagesUnit Price AnalysisSasanka T WijesingheNo ratings yet

- Cost Engineering LectureDocument43 pagesCost Engineering LectureMekuannint DemekeNo ratings yet

- Cost EstimateDocument8 pagesCost EstimateAkunwa GideonNo ratings yet

- 62 - 23335 - CB415 - 2018 - 1 - 1 - 1 - Cost EstimationDocument4 pages62 - 23335 - CB415 - 2018 - 1 - 1 - 1 - Cost EstimationAhmedGhallabNo ratings yet

- Economic Analysis: Tci Fci + Oo DC + Ic + OoDocument3 pagesEconomic Analysis: Tci Fci + Oo DC + Ic + OoAlexander VovaNo ratings yet

- Cost Sheet NewDocument25 pagesCost Sheet Newnagesh dashNo ratings yet

- Cost Engineering Lecture NoteDocument62 pagesCost Engineering Lecture Notefentawmelaku1993No ratings yet

- Cost EstimationDocument3 pagesCost EstimationAmna EhsanNo ratings yet

- Elements of CostDocument38 pagesElements of CostRajyalakshmi.GNo ratings yet

- Khanda Habeeb RaheemDocument12 pagesKhanda Habeeb RaheemHarith EmaadNo ratings yet

- Java NotesDocument15 pagesJava NotesIqbal HawreNo ratings yet

- Manufacturing OverheadDocument5 pagesManufacturing OverheadSheila Mae AramanNo ratings yet

- In Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceDocument20 pagesIn Production, Research, Retail, and Accounting, A Cost Is The Value of Money That Has Been Used Up To Produce Something or Deliver A ServiceBHUSHAN PATILNo ratings yet

- Chapter Two: Financial Analysis 2.1. Scope and Rational For Financial AnalysisDocument16 pagesChapter Two: Financial Analysis 2.1. Scope and Rational For Financial AnalysisWiz Santa100% (1)

- Accounting For Other ExpensesDocument8 pagesAccounting For Other ExpensesLinyVatNo ratings yet

- Charging For Civil Engineering ServicesDocument3 pagesCharging For Civil Engineering ServicesDonna Cece MelgarNo ratings yet

- Cost & Management Accounting Prepared by Vishal GoelDocument20 pagesCost & Management Accounting Prepared by Vishal Goelgoel76vishalNo ratings yet

- EstimateDocument36 pagesEstimatemohammed100% (1)

- 18ME51 ME Mod 5Document12 pages18ME51 ME Mod 5Sanjay BSNo ratings yet

- CE 4106 Group 5 ReportDocument15 pagesCE 4106 Group 5 ReportGreg Calibo LidasanNo ratings yet

- Cost Planning and Cost ControlDocument25 pagesCost Planning and Cost ControlFranco FungoNo ratings yet

- Cost AccountingDocument38 pagesCost AccountingAayush ShahNo ratings yet

- Cost Sheet Final DocumentDocument26 pagesCost Sheet Final Documentabhi96% (27)

- Cost Sheet AnalysisDocument37 pagesCost Sheet Analysismanjeetkumar93544No ratings yet

- Element of CostDocument3 pagesElement of CostAshik Uz ZamanNo ratings yet

- Section 4. Charging For Civil Engineering ServicesDocument14 pagesSection 4. Charging For Civil Engineering ServicesChan Marie Camacho Pielago100% (1)

- Here We Detail About The Classification of Expenditure IDocument10 pagesHere We Detail About The Classification of Expenditure INeelNo ratings yet

- Summary On Cost Concpts and ClassificationsDocument7 pagesSummary On Cost Concpts and ClassificationsMa. Roycelean PascualNo ratings yet

- Chapter 9 - Other ExpensesDocument13 pagesChapter 9 - Other ExpenseskundiarshdeepNo ratings yet

- Cost Sheet Project - Hindustan Petroleum Corporation LTDDocument20 pagesCost Sheet Project - Hindustan Petroleum Corporation LTDkuldeep100% (1)

- Malta College of Arts & Science & TechnologyDocument3 pagesMalta College of Arts & Science & TechnologyKarl AttardNo ratings yet

- Quantity Surveying and EstimationDocument6 pagesQuantity Surveying and Estimationshubham kadamNo ratings yet

- Business Project Investment: Risk Assessment & Decision MakingFrom EverandBusiness Project Investment: Risk Assessment & Decision MakingNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Cost Estimation Manual power pointDocument114 pagesCost Estimation Manual power pointNantukina TeshomeNo ratings yet

- Daily Labor Paymenent Format (2) 28Document1 pageDaily Labor Paymenent Format (2) 28Nantukina TeshomeNo ratings yet

- Rebar Take Off Office and Store SubstructureDocument1 pageRebar Take Off Office and Store SubstructureNantukina TeshomeNo ratings yet

- 1.cost Break Down EtDocument75 pages1.cost Break Down EtNantukina TeshomeNo ratings yet

- Take Pre-School SubstructureDocument1 pageTake Pre-School SubstructureNantukina TeshomeNo ratings yet

- BFE Child Care and Elderly Support Project Three Years PlanDocument22 pagesBFE Child Care and Elderly Support Project Three Years PlanNantukina TeshomeNo ratings yet

- BFE Education Project FY'17 Plan (DIP)Document7 pagesBFE Education Project FY'17 Plan (DIP)Nantukina TeshomeNo ratings yet

- BFE Local Taxi ExepensesDocument15 pagesBFE Local Taxi ExepensesNantukina TeshomeNo ratings yet

- Price Comparision Table: Suppliers II IIIDocument3 pagesPrice Comparision Table: Suppliers II IIINantukina TeshomeNo ratings yet

- BFE Emergency R Project FY'16 Plan (DIP)Document7 pagesBFE Emergency R Project FY'16 Plan (DIP)Nantukina TeshomeNo ratings yet

- Project FY'17 Plan (DIP)Document2 pagesProject FY'17 Plan (DIP)Nantukina TeshomeNo ratings yet

- Q1 Entrepreneurship M6-1Document20 pagesQ1 Entrepreneurship M6-1karelleasmad6No ratings yet

- Enterpreneurship DevelopmentDocument20 pagesEnterpreneurship Developmentv adamNo ratings yet

- Every SBU Is Profit Center But Every Profit Center Is Not SBUDocument1 pageEvery SBU Is Profit Center But Every Profit Center Is Not SBUNikita NagdevNo ratings yet

- Process Costing TheoryDocument3 pagesProcess Costing TheorycoolchethanNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

- Ias-40 - Investment PropertyDocument16 pagesIas-40 - Investment PropertyPue Das100% (2)

- Tutorial Week 8 Preparation RequirementsDocument14 pagesTutorial Week 8 Preparation RequirementsBáchHợpNo ratings yet

- How Much Has The Efficiency of Support Functions Improved?: Figure 1: Support Costs 2013 - 2017 ($billion)Document7 pagesHow Much Has The Efficiency of Support Functions Improved?: Figure 1: Support Costs 2013 - 2017 ($billion)Mehadi HasanNo ratings yet

- AccountingDocument6 pagesAccountingCharisse CruzNo ratings yet

- Define Cost Component Structure: The Following Applies To Product CostingDocument9 pagesDefine Cost Component Structure: The Following Applies To Product CostingDundi AkulaNo ratings yet

- General Store.0Document9 pagesGeneral Store.0Nasir MehmoodNo ratings yet

- Wiley CPAexcel - BEC - Assessment Review - 2Document20 pagesWiley CPAexcel - BEC - Assessment Review - 2ABCNo ratings yet

- True/False: Chapter 6: Master Budget and Responsibility AccountingDocument45 pagesTrue/False: Chapter 6: Master Budget and Responsibility Accountingjomari legaspiNo ratings yet

- Masquerade (Regional Eliminations)Document5 pagesMasquerade (Regional Eliminations)Ayvee BlanchNo ratings yet

- CH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionDocument21 pagesCH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionMEGA NURWANINo ratings yet

- Poll Question 3 - ABCDocument1 pagePoll Question 3 - ABCMary Ann NatividadNo ratings yet

- NEW MFRS 116 Property, Plant and EquipmentDocument53 pagesNEW MFRS 116 Property, Plant and EquipmentUmairah HusnaNo ratings yet

- Chaper 1Document8 pagesChaper 1ryan pinkihanNo ratings yet

- Comparing Merchandising and Manufakturing CompanyDocument3 pagesComparing Merchandising and Manufakturing CompanyHermanNo ratings yet

- Unit 2 - Classification of CostDocument4 pagesUnit 2 - Classification of Costavinal malikNo ratings yet

- Definition of Standard CostingDocument10 pagesDefinition of Standard CostingSandeep SinghNo ratings yet

- CH 15Document29 pagesCH 15ReneeNo ratings yet

- Session 2 ProblemsDocument5 pagesSession 2 ProblemsJayene Nicole RazonNo ratings yet

- TQM PDFDocument17 pagesTQM PDFOki RizkiyantoNo ratings yet

- Investment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Document13 pagesInvestment Summary: Manufacturing Sector, Karachi Stock Exchange Cherat Cement Company Limited (CHCC)Farwa SamreenNo ratings yet

- 1 Manage Cost Profiles (Doc ID 2533594.1)Document5 pages1 Manage Cost Profiles (Doc ID 2533594.1)AhmedNo ratings yet

- The Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentDocument24 pagesThe Crucial Role of Managerial Accounting in A Dynamic Business EnvironmentHalimah SheikhNo ratings yet

- Manac ExamDocument6 pagesManac ExamJaime II LustadoNo ratings yet

- Chapter 11 Atkinson Kaplan 2012Document28 pagesChapter 11 Atkinson Kaplan 2012EmmelinaErnestine100% (2)