Professional Documents

Culture Documents

What's the Difference Between NEFT, RTGS and IMPS - Paisabazaar

What's the Difference Between NEFT, RTGS and IMPS - Paisabazaar

Uploaded by

basilmathew1984Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What's the Difference Between NEFT, RTGS and IMPS - Paisabazaar

What's the Difference Between NEFT, RTGS and IMPS - Paisabazaar

Uploaded by

basilmathew1984Copyright:

Available Formats

Sign In

Di!erence Between NEFT, RTGS

and IMPS

Get your Free

Credit Score

Check Now

Account holders don’t have to wait for days to receive

money in their bank accounts as with the help of the

latest digital payment systems like NEFT, RTGS, and

IMPS, money can be sent and received in an instant

anytime from anywhere. Let us know in detail the

fundamental di!erence between the three.

Free Credit Score

Get your credit report free, with monthly updates.

Full Name

As per your PAN Card

Mobile Number

The bank will contact you on this number

Note: We will verify this number on the next step.

Email Address

As per your bank records

I hereby appoint Paisabazaar as my authorised representative

to receive my credit information from Cibil / Equifax / Experian /

Highmark (bureau).

More

Get your Credit Score

िहं दी में पढ़े

Updated: 22-01-2024 10:17:15 AM

Di!erent payment and settlement systems in India have

made the task of transferring money from one bank

account to another easier and faster. A large number of

banks, private companies and government bodies along

with others are adopting di!erent payment and settlement

methods such as NEFT, RTGS and IMPS. This has helped in

reducing the gap between the entities and their customers

and other concerned people. These methods are fast,

convenient and useful for documentation purposes. Read

on to know more.

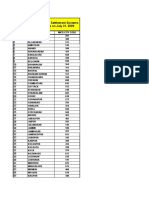

BANK

DIFFERENCE

TRANSACTION

BETWEENNEFT,

RTGSANDIMPS

BASISOF NEFT RTGS IMPS

COMPARISON

Minimum

transfervalue Re.1 Rs.2lakh Re.1

Payment Onlineand Onlineand Online

options offline offline

Maximum

transfervalue

Nolimit Nolimit Rs.2lakh

Settlement Halfhourly Realtime Realtime

type basis

Inward Decidedby

theindividual

transaction Nocharges Nocharges memberbanks

charges andPPIs

paisabazaare

Get Free Credit Report with monthly updates.

Check Now

What are the di!erent ways to transfer

funds online in India?

India currently has various methods to transfer

money online such as digital wallets, UPI, and more.

However, the most commonly used online fund

transfer method has been:

National Electronic Funds Transfer (NEFT)

Real-Time Gross Settlement (RTGS)

Immediate Mobile Payment Service (IMPS)

While NEFT and RTGS were introduced by RBI

(Reserve Bank of India), IMPS was introduced by

National Payments Corporation of India (NPCI). Read

further to learn more about these three payment

systems.

NEFT

National Electronic Funds Transfer (NEFT) is a

payment system that facilitates one-to-one funds

transfer. Using NEFT, people can electronically

transfer money from any bank branch to a person

holding an account with any other bank branch,

which is participating in the payment system. Fund

transfers through the NEFT system do not occur in

real-time basis and the fund transfer settles in 23

half-hourly batches.

RTGS

Real-Time Gross Settlement (RTGS) is another

payment system in which the money is credited in

the beneficiary’s account in real-time and on a gross

basis. The RTGS system is primarily meant for large

value transactions that require and receive

immediate clearing.

IMPS

Immediate Mobile Payment Services(IMPS) is a real-

time instant inter-bank funds transfer

system managed by National payment corporation

of India. IMPS is available 24/7 throughout the year

including bank holidays, unlike NEFT and RTGS.

NEFT, RTGS and IMPS payment systems were

introduced to o!er convenience and flexibility to the

account holders. To use these online fund transfer

services, the remitter must have the basic bank

account details of the beneficiary. The bank account

details include the beneficiary’s name and bank’s

IFSC. Though all three payment systems are used for

funds transfer, they exhibit a few di!erences.

Before learning their di!erences, let’s first learn

some basic terms revolving around payment

systems. These terms will help in understanding the

di!erence between di!erent payment systems

better.

Fund Transfer Limit

The maximum and minimum amount of money

allowed for transfer by each payment system may

di!er. Therefore, fund transfer value is an important

factor in determining which fund transfer method

will be appropriate for a customer.

Service Availability

Some payment systems are available for 24*7 while

others have specific timings. Payment systems that

are available 24*7 allow remitters to initiate money

transfers anytime and any day. However, the funds

will settle only when the service is available.

Fund Settlement Speed

Di!erent fund payment systems have di!erent fund

settlement speeds. Fund settlement speed here is

the total time consumed to settle money from one

account to another after the transfer has been

initiated.

Fund Transfer Charges

Transferring money involves charges. As per RBI,

fund transfer charges for each payment system are

decided by banks. The amount charged is based on

the amount to be transferred, transfer speed, and

other features o!ered by the bank.

Although there are various other important terms,

these are the few basics that will help you

understand the di!erence between NEFT, RTGS, and

IMPS.

Get Free Credit Report with Complete Analysis

of Credit Score

Check Now

Comparison between NEFT, RTGS and

IMPS

Comparison

NEFT RTGS IMP

Category

Settlement Half hourly

Real-time Real-t

Type batches

Minimum

Transfer Re.1 Rs.2 lakh Re

Limit

No Limit

However,

the

maximum

amount per

transaction

is limited to

Rs.50,000/-

Maximum

for cash-

Transfer No limit Rs.2 l

based

Limit

remittances

within India

and Nepal

under the

Indo-Nepal

Remittance

Facility

Scheme.

Available

Service Available 365 Availab

365 days

Timings days 24×7 days

24×7

No charges for

inward

transactions

No Charges for

online

transactions

Charge

No charges

remitt

for inward Charges

throu

transactions applicable for

IMPS

(at outward

decide

destination transactions for

Transaction th

bank amount:

Charges indivi

branches

mem

for credit to Rs.2 lakh – Rs.5

banks

beneficiary lakh: not

PPIs.

accounts) exceeding Rs.25

taxes

includ

Above Rs.5

lakh: not

exceeding Rs.50

GST is also

applicable

Payment Online and Online and

Onli

Options O$ine O$ine

Account Balance by Bank

SBI Balance Check

PNB Balance Enquiry

Indian Bank Balance Enquiry

HDFC Account Balance Check

ICICI Account Balance Check

Bank of Baroda Account Balance Check

Bank of India Account Balance Check

Canara Bank Account Balance Check

Union Bank Balance Enquiry

Axis Bank Balance Enquiry

Kotak Mahindra Bank Balance Enquiry

Karnataka Bank Balance Enquiry

IDFC First Bank Balance Enquiry

DBS Bank Balance Enquiry

Utkarsh SFB Balance Enquiry

Ujjivan SFB Balance Enquiry

Fincare SFB Balance Enquiry

Jana SFB Balance Enquiry

UCO Bank Balance Enquiry

All about Cheques

What is a Cheque

Types of Cheque

Cheque vs Demand Draft

All about Demand Drafts

What is Demand Draft

SBI Demand Draft

DD vs Pay Order

All about Overdrafts

Overdraft Limit

Overdraft Loan

Passbook by Banks

SBI mPassbook

PNB Passbook

Canara Bank Passbook

Cent mPassbook

Savings Account By Banks

Axis Bank Savings Account

Kotak Mahindra Bank Savings Account

YES Bank Savings Account

HSBC Bank Savings Account

ICICI Bank Savings Account

SBI Savings Account

Standard Chartered Bank Savings Account

Canara Bank Savings Account

DBS Bank Savings Account

All about IMPS

What is IMPS

MMID in IMPS

IMPS vs NEFT

ICICI Bank IMPS Charges

HDFC Bank IMPS Charges

SBI IMPS Charges

Axis Bank IMPS Charges

Kotak Mahindra Bank IMPS Charges

NEFT vs RTGS vs IMPS

All about UPI

What is UPI

BHIM App

UPI Apps

Virtual Payment Address

UPI 123Pay

UPI Collect

UPI Lite

UPI vs NEFT

UPI by Banks

SBI UPI

HDFC Bank UPI

ICICI Bank UPI

Axis Bank UPI

PNB UPI

Bank of Maharashtra UPI

Union Bank UPI

YES Bank UPI

Paytm Payments Bank UPI

Bank of India UPI

Indian Overseas Bank UPI

Fincare SFB UPI

UCO Bank UPI

Central Bank of India UPI

Equitas SFB UPI

AU SFB UPI

Utkarsh SFB UPI

ESAF SFB UPI

Suryoday SFB UPI

Indian Bank UPI

All about RTGS

What is RTGS

SBI RTGS

HDFC RTGS

Bank of India RTGS Form

Union Bank RTGS Form

ICICI Bank RTGS Form

Canara Bank RTGS Form

PNB RTGS Form

Axis Bank RTGS Form

Kotak Mahindra Bank RTGS Form

YES Bank RTGS Form

IndusInd Bank RTGS Form

UCO Bank RTGS Form

Central Bank of India RTGS Form

DCB Bank RTGS Form

Mobile Banking

SBI Mobile Banking

HDFC Mobile Banking

ICICI Mobile Banking

Kotak Mahindra Bank Mobile Banking

Axis Bank Mobile Banking

PNB Mobile Banking

Bank of Baroda Mobile Banking

Canara Bank Mobile Banking

Union Bank of India Mobile Banking

Bank of India Mobile Banking

MOST SEARCHED LINKS

OUR INVESTORS

PAISABAZAAR GROUP BRANDS

About Policybazaar.com

Careers Quickfixcars.com

Contact Policybazaar.ae

Awards Docprime.com

Grievance Redressal PB Partners

MoneyWide

Download App

Investors Privacy Policy

Terms of Use Disclaimer

Intellectual Policy Sitemap

Supported Payment Methods

Secured By Certified By

CIN No. U74900HR2011PTC044581 © Copyright 2014-2024 Paisabazaar.com. All

Rights Reserved.

Built with Love

Made in India

Get your FREE Credit Report with monthly

updates

You might also like

- Laki - LakiDocument80 pagesLaki - LakiRachman MercyNo ratings yet

- Criteria Neft RTGS (Retail)Document2 pagesCriteria Neft RTGS (Retail)ammarNo ratings yet

- RTGS (Real Time Gross Settlement)Document10 pagesRTGS (Real Time Gross Settlement)Raghav ThakurNo ratings yet

- Centralized Electronic Payment Systems For More BanksDocument2 pagesCentralized Electronic Payment Systems For More BanksÀŋuj ßhàrgàvNo ratings yet

- Digital BankingDocument13 pagesDigital Bankingmanish100% (1)

- Rtgs and NeftDocument31 pagesRtgs and NeftPravah Shukla100% (5)

- Module 4Document100 pagesModule 4mansisharma8301No ratings yet

- Neft and RtgsDocument15 pagesNeft and Rtgssandhya22No ratings yet

- TNSC It ProjectDocument32 pagesTNSC It ProjectsafanaasmathNo ratings yet

- RtgsDocument13 pagesRtgsOmkar MoreNo ratings yet

- Banking Latest Trends Class 12 ISC CommerceDocument27 pagesBanking Latest Trends Class 12 ISC CommerceHarshada BarhateNo ratings yet

- IFFMDocument8 pagesIFFMNishant AnandNo ratings yet

- Neft Ecs, EftDocument2 pagesNeft Ecs, EftSankalp GuptaNo ratings yet

- World Trade Organization: Dispute Settlement in Case of GattDocument26 pagesWorld Trade Organization: Dispute Settlement in Case of GattBernard EmmanuelNo ratings yet

- Payment and Settlement Systems in IndiaDocument23 pagesPayment and Settlement Systems in IndiagopubooNo ratings yet

- Payment & Settlement SystemDocument29 pagesPayment & Settlement SystemnirajagarwalaNo ratings yet

- NEFT Vs RTGS - What's The Difference - Paytm BlogDocument10 pagesNEFT Vs RTGS - What's The Difference - Paytm BlogGauravSharmaNo ratings yet

- 29730_51645_rtgs (1)Document17 pages29730_51645_rtgs (1)rkjayasurya45No ratings yet

- 29730_51645_rtgsDocument17 pages29730_51645_rtgsrkjayasurya45No ratings yet

- Rtgs/Neft: Fund Remittance FacilitiesDocument17 pagesRtgs/Neft: Fund Remittance FacilitiesIrina JhaNo ratings yet

- NEFTDocument2 pagesNEFTAtharvaNo ratings yet

- Assignment On RTGS Technology Used in Bank: Submitted By: Usha M Sonar (50) Archana D (05) Chetana KDocument4 pagesAssignment On RTGS Technology Used in Bank: Submitted By: Usha M Sonar (50) Archana D (05) Chetana KKiran SonarNo ratings yet

- Commerce Project Topic 1Document5 pagesCommerce Project Topic 1manoj AgarwalNo ratings yet

- Faq Neft RtgsDocument4 pagesFaq Neft RtgskhushigrinNo ratings yet

- HO:Banking Operations Dept. Taking Banking Technology To The Common Man Chennai - 1Document6 pagesHO:Banking Operations Dept. Taking Banking Technology To The Common Man Chennai - 1Firdous HussainNo ratings yet

- Real Time Gross SettlementDocument5 pagesReal Time Gross Settlementveekram123No ratings yet

- Inter Bank TransferDocument22 pagesInter Bank Transferpankajku2020100% (2)

- RTGSDocument14 pagesRTGSAbirami ThevarNo ratings yet

- RtgsDocument13 pagesRtgsBari Rajnish100% (2)

- Bob Neft RtgsDocument3 pagesBob Neft RtgsTarak M ShahNo ratings yet

- NeftDocument16 pagesNeftVinod KumarNo ratings yet

- Functioning & Usage of Electric Money Transfers-Rtgs, Neft, Imps, UpiDocument18 pagesFunctioning & Usage of Electric Money Transfers-Rtgs, Neft, Imps, UpikanikaNo ratings yet

- NEFTDocument2 pagesNEFT2067 SARAN.MNo ratings yet

- RTGS NotesDocument8 pagesRTGS NotesSagar ShirsatNo ratings yet

- Various Modes of Electronic Funds Transfers in India - NEFT, RTGS and IMPSDocument4 pagesVarious Modes of Electronic Funds Transfers in India - NEFT, RTGS and IMPSsajal30No ratings yet

- RTGS. What Is RTGS? Short Notes On Real-Time Gross Settlement (RTGS) - All About Real-Time Gross Settlement (RTGS)Document1 pageRTGS. What Is RTGS? Short Notes On Real-Time Gross Settlement (RTGS) - All About Real-Time Gross Settlement (RTGS)GsnrAdsenseGudimetlaNo ratings yet

- Rtgs & Neft: December 2012Document6 pagesRtgs & Neft: December 2012senthilkumarskNo ratings yet

- RTGS and NEFT PaymentDocument1 pageRTGS and NEFT PaymentSumit RaoNo ratings yet

- RTGSDocument4 pagesRTGSArchana S KumarNo ratings yet

- Innovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Document21 pagesInnovations in Electronic Banking Systen: RTGS (Real Time Gross Settlement)Narinder BhasinNo ratings yet

- Difference Between NEFT, RTGS & IMPS - Transfer, Limits, ChargesDocument8 pagesDifference Between NEFT, RTGS & IMPS - Transfer, Limits, ChargesMegan natNo ratings yet

- Compare Premium Regular Current AccountDocument1 pageCompare Premium Regular Current AccountJay BhushanNo ratings yet

- Neft and RtgsDocument4 pagesNeft and RtgsmukeshkpatidarNo ratings yet

- E-Payment Mechanism of BanksDocument16 pagesE-Payment Mechanism of BanksMeenakshi SharmaNo ratings yet

- About Rtgs & NeftDocument5 pagesAbout Rtgs & NeftAbdulhussain JariwalaNo ratings yet

- Central Bank of India Payment and Settlement SystemDocument11 pagesCentral Bank of India Payment and Settlement SystemAnuradha SinghNo ratings yet

- Payment SystemsDocument7 pagesPayment SystemsGanesh ShankarNo ratings yet

- RTGSDocument15 pagesRTGSSneha KakatkarNo ratings yet

- Unit 7Document92 pagesUnit 7Anuska JayswalNo ratings yet

- Imps Write UpDocument1 pageImps Write UpAnand VijayakumarNo ratings yet

- AEPS Operating and Settlement Guidelines - V2Document52 pagesAEPS Operating and Settlement Guidelines - V2JinoMathewsRajuNo ratings yet

- Limit Enhancement Format - CorporateDocument1 pageLimit Enhancement Format - CorporateAvinash ChandraNo ratings yet

- Real Time Gross Settlement (RTGS)Document5 pagesReal Time Gross Settlement (RTGS)svm kishoreNo ratings yet

- Boi Mobile Banking App Post Login Faqs My Account Operative AccountsDocument7 pagesBoi Mobile Banking App Post Login Faqs My Account Operative AccountsStrikerNo ratings yet

- Real Time Gross Settlement (RTGS)Document4 pagesReal Time Gross Settlement (RTGS)Subrata PradhanNo ratings yet

- January 2017 1483527567 141Document2 pagesJanuary 2017 1483527567 141kundan nishadNo ratings yet

- Day 4Document3 pagesDay 4Hilay PatelNo ratings yet

- Unit 2 Ecommerce NotesDocument29 pagesUnit 2 Ecommerce NotesMRUNAL SHETHIYANo ratings yet

- Roaming Current Account 1Document5 pagesRoaming Current Account 1raviNo ratings yet

- Blockchain Technology Revolution in Business Explained: Why You Need to Start Investing in Blockchain and Cryptocurrencies for your Business Right NowFrom EverandBlockchain Technology Revolution in Business Explained: Why You Need to Start Investing in Blockchain and Cryptocurrencies for your Business Right NowRating: 5 out of 5 stars5/5 (1)

- Cryptocurrencies: How to Safely Create Stable and Long-term Passive Income by Investing in Cryptocurrencies: Cryptocurrency Revolution, #1From EverandCryptocurrencies: How to Safely Create Stable and Long-term Passive Income by Investing in Cryptocurrencies: Cryptocurrency Revolution, #1No ratings yet

- Indian Banking System History and StructureDocument47 pagesIndian Banking System History and StructureRahul SinghNo ratings yet

- List of Top BanksDocument2 pagesList of Top BanksAnonymous QjsvRdNo ratings yet

- CASE LIST - Banking LawsDocument4 pagesCASE LIST - Banking LawsBlue RoseNo ratings yet

- 4375.201.125 Fy 22-23Document99 pages4375.201.125 Fy 22-23Star ColourparkNo ratings yet

- Paytm Powered OTP Bin List 59d48f08b7Document8 pagesPaytm Powered OTP Bin List 59d48f08b7Prashanth NairNo ratings yet

- Account Statement 301022 280423Document9 pagesAccount Statement 301022 280423Saransh Garg (The eXponent)No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceJagdeep Singh DeepiNo ratings yet

- Statement of AccountDocument34 pagesStatement of AccountMVN HodalNo ratings yet

- 2023 Assigned CasesDocument2 pages2023 Assigned CasesForro Danilo Jr.No ratings yet

- RBIDocument32 pagesRBIAjay SinghNo ratings yet

- Paytm CrisisDocument6 pagesPaytm CrisisrishikaNo ratings yet

- Aman Jaiswal MRPDocument59 pagesAman Jaiswal MRPAli ShaikhNo ratings yet

- Charge Slip BillingDocument129 pagesCharge Slip BillingMitch Panghilino CandoNo ratings yet

- Statement: Lloyd Sweetingham 16 Medlock Crescent Newport NP20 7EH United Kingdom Total BalanceDocument6 pagesStatement: Lloyd Sweetingham 16 Medlock Crescent Newport NP20 7EH United Kingdom Total Balance13KARATNo ratings yet

- Chapter 3 - Central Bank and The Conduct of Monetary PolicyDocument27 pagesChapter 3 - Central Bank and The Conduct of Monetary PolicyMai Lan AnhNo ratings yet

- AgustusDocument103 pagesAgustusWahyu KusumaNo ratings yet

- Ibs JLN Beserah, Kuantan 1 31/07/23Document4 pagesIbs JLN Beserah, Kuantan 1 31/07/23Hafizan MatsomNo ratings yet

- Expected Questions of InterviewDocument4 pagesExpected Questions of InterviewAmit RanjanNo ratings yet

- Acct Statement - XX4811 - 11032024Document21 pagesAcct Statement - XX4811 - 11032024amolgorkhe612No ratings yet

- HIRING SALES UNDER TL (Responses)Document4 pagesHIRING SALES UNDER TL (Responses)Gunawan Saefuddin TresnadiNo ratings yet

- Bank NiftyDocument229 pagesBank NiftyGAUTAM PAWARNo ratings yet

- The Complete - Static Banking AwarenessDocument81 pagesThe Complete - Static Banking Awarenessmadhu sudhanNo ratings yet

- Department of Payment & Settlement Systems List of MICR Centres As On July 31, 2009Document19 pagesDepartment of Payment & Settlement Systems List of MICR Centres As On July 31, 2009Gyan RanjanNo ratings yet

- Recent General Knowledge On Bangladesh & World Economy PDFDocument49 pagesRecent General Knowledge On Bangladesh & World Economy PDFarifNo ratings yet

- Source: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIDocument4 pagesSource: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIManikanda Bharathi SNo ratings yet

- Role and Function of Nepal Rastra Bank-2Document37 pagesRole and Function of Nepal Rastra Bank-2notes.mcpu100% (2)

- FIRMS ContactsDocument25 pagesFIRMS Contactspratyush1200No ratings yet

- Mario DraghiDocument3 pagesMario DraghiAdrian BirdeaNo ratings yet

- Home AcctDocument13 pagesHome AcctJennie HorNo ratings yet