Professional Documents

Culture Documents

Wealth_Management_Level_

Wealth_Management_Level_

Uploaded by

rionamoodley4Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wealth_Management_Level_

Wealth_Management_Level_

Uploaded by

rionamoodley4Copyright:

Available Formats

NC: Wealth Management Level 5

Logbook and Workplace Assessments

Qualification Name: NC: Wealth Management ________________________________________________________

Qualification Number: 57608 aligned to SAQA Qualification ID 66611________________________________________

Learnership LGA Nr: _____________________________________________________________________________

Learner Name and Surname: _____________________________________________________________________________

Learner Contact Number: _____________________________________________________________________________

Learner Email Address: _____________________________________________________________________________

Learner ID Number:

Mentor Name and Surname: _____________________________________________________________________________

Mentor Contact Number: _____________________________________________________________________________

Mentor Email Address: _____________________________________________________________________________

Wealth Management (57608) Page 1

Roles and Responsibilities

Employer Responsibilities:

Select and Appoint Accredited Training Provider that has scope for the qualification

Select, inform, induct and sign learnership contract

Submit learnership contract to INSETA timorously as stipulated on the agreement

Adherence to learnership contract

Appoint a internal mentor for every 3 to 5 learners

Relevant resources to be made available to assist learner with completion of assignments e.g Internet, library, subject matter expert, ect

Learners to be rotated or be exposed to all areas within the organisation relevant to the qualification

Submit a motivation to INSETA for approval where rotation is not possible and indicate how exposure is going to be provided

Allow learners time off to write the summative assessment and/or remediation’s

Mentor Responsibilities:

Mentor must meet with the learners on a minimum of bi-monthly basis (or as often as necessary)

Mentor to sign logbook on a monthly basis and ensure that it is submitted to the training provider at the 6 months and 12 months interval of the

learnership

Mentor- learner contract to be signed

Oversee and mentor learners w.r.t. workplace assessments

Oversee that learners meet the submission due dates of formative assessments

Provide guidance in areas needed

Learner Responsibilities:

Adhere to all employer/provider/INSETA codes of conduct, policies and ethics

Attend and actively participate in facilitation sessions

Complete workplace assessments and formative assessments with quality, comprehensive and relevant information

Submit all assessments by the agreed submission due date to be permitted to write the summative assessment

Complete the logbook on a weekly basis, indicating times spent in the workplace e.g. 8am – 4pm = 8 hours per day

Complete the logbook giving a comprehensive outline of functions performed daily e.g. 4 x assessed claims

Present the logbook to the mentor at the monthly meeting for sign-off

Prepare adequately for the summative assessment

Wealth Management (57608) Page 2

Training Provider Responsibilities:

Induction session with mentors at the start of a learnership (Expectations, overview of logbook and workplace assessments, etc)

Provide learner with the logbook template

Ensure that learners’ workplace experience is relevant to the unit standard/qualification being assessed

Present logbook and workplace assessment to the INSETA Verifier at the 6 months and 12 months verification visits during the learnership

Assessor Responsibilities:

Link functions performed to the Associated Assessment Criteria

Record a competency judgment(s)

Make recommendations to the learner and mentor on areas that need exposure within the next month

Give feedback to the learner and mentor within 10 days of monthly submission

Give constructive guidance to the learners on development areas

Stakeholder Signatures Date

Employer

Mentor

Learner

Training Provider

Assessor

Wealth Management (57608) Page 3

Declaration of authenticity

Declaration by Learners

I (learner name and surname) ________________________________, ID Nr __________________________ hereby declare that the work contained herein

was completed by me on my own.

Where assistance or advice was received or where I used resource material form a workbook, policy wording, internet or any other printed sources, this has

been acknowledged and referenced. I further declare that I understand that plagiarism is a punishable offence as it constitutes the theft of another’s

intellectual property rights.

________________ ___________

Learner Signature Date

Declaration by Mentor

I (mentor name and surname) _______________________, ID Nr __________________________ hereby declare that the learner is being mentored by

myself and that the functions listed and the working hours is a true reflection of the learners situation. According to my knowledge I declare that this is his/her

own work.

________________ ___________

Employer Signature Date

Wealth Management (57608) Page 4

Logbook

AAC

1.1 Current events and developments that could impact on the Financial Services Sector in general, and on Wealth Management and Wealth

Creation in particular, are analysed and discussed and an informed personal opinion is expressed and substantiated in the discussion indicating

ability to anticipate or predict future trends and the potential impact on the industry.

1.2 Knowledge learnt in various Unit Standards and current events as they occur are integrated with an informed understanding of the Wealth

Management environment so that knowledge of the industry is applied in authentic situations.

1.3 Information is gathered, analysed, interpreted, summarised and evaluated from a range of sources and presented coherently, reliably and

accurately both verbally and in writing using technological skills.

1.4 Evidence is evaluated and used to substantiate an argument and to interpret changing trends in the macro and micro environments that impact

on wealth management

1.5 Financial and other data is manipulated and interpreted to identify trends.

1.6 The Wealth Management operating environment is explained as a system within the Financial Services Sector and an indication is given of

current issues and changes in the sector.

2.1 The needs, wants and risk profile of a selected client are analysed and specialised technical knowledge is applied to propose a financial

solution based on a

needs analysis.

2.2 Knowledge of the different asset classes and the client’s needs are applied to select an appropriate financial product.

2.3 Essential methods, procedures and techniques of the Financial Services industry are applied within the legislated environment in order to make

a financial

recommendation.

3.1 Methods, procedures and techniques for creating and managing wealth are applied with reference to specific company policy, legislative

requirements and competitive industry practices.

3.2 Decisions are substantiated based on available information with due regard for compliance and within own authority limits, license or mandate,

relevant service agreements and an organisation’s customer service policy.

3.3 The concept of ethics is explained with reference to an organisations code of conduct, and an individual’s personal and property rights.

Note: Assessor to indicate AAC number next to the functions performed in the logbook template below.

Between 40-60% of AACs to be covered in the workplace (depending on the practical component of the qualification)

Unit Standard only achieved after the AACs have been assessed

Wealth Management (57608) Page 5

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 6

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 7

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 8

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 9

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 10

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 11

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 12

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 13

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 14

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 15

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 16

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 17

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 18

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 19

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 20

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 21

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 22

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 23

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 24

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 25

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 26

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 27

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 28

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 29

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 30

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 1: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

E. g. Complete 4 client portfolios 12 hours 3 1.3, 1.4. 1.5, 2.1, 2.2

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 31

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 2: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 32

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 3: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 33

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 4: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Wealth Management (57608) Page 34

JAN FEB MARCH APR MAY JUN JUL AUG SEPT OCT NOV DEC

Month: Tick the month in question

Week 5: ___/___/20____to ___/____/20_____ Department: ________________________________

Functions performed (comprehensive/quantitative) Hours Worked on this Performance Rating by Alignment of AAC to

item during the week Coach/Mentor functions (Assessor)

(1 = poor to 5 = Excellent)

Leave/Public Holidays taken

Learner Comments Learner Signature

Month: _________________________

Coach Signature Coach Comments

Assessor Signature Assessor Comments C NYC

Moderator Signature Moderator Comments C NYC

Wealth Management (57608) Page 35

Wealth Management Level 5 Qualification

Annexure A

Job Description(s)

Wealth Management (57608) Page 36

Workplace Assessment

After successful completion of this Learnership the learner will be;

Qualified in: Wealth Management (57608)

Qualified as: Including but not limited to the following positions:

Financial Advisors Consultants providing advice

Personal Financial Planners Principal Officers

Financial Services Call Centre Agents Trustees

Client Service Providers Medical Scheme Consultants

Brokers Retail Managers who support Advisors

Broker Consultants Collect Investment Scheme Managers

Retirement Fund Consultants/ Account Executives

Retirement Fund Administrators Compliance Officers

Trust Fund Officers Product Developers

Qualified to:

Identify and solve well-defined problems of a routine and non-routine and unfamiliar nature within the

context of Wealth Management in which responses show that responsible decisions have been made,

adjust common solutions to meet changes in the problem and motivate the changes within own limit of

authority.

Work effectively with others as a member of a team, group, organisation or community in that many of

the Unit Standards in the Qualification require interaction with clients.

Organise and manage him/herself and his/her activities responsibly and effectively in that it is expected

that the learner will be responsible for his/her own learning and for organising his/her own work

allocated tasks responsibly in the work environment. She/he is required to complete research

assignments timeously and to demonstrate insight into different aspects of Wealth Management.

Collect, organise and critically evaluate information. These competencies are built into the Assessment

Criteria in many of the Unit Standards and the learner is required to do research projects and analyse

information from the media and industry sources.

Communicate effectively using visual, mathematics and language skills in the modes of oral and/or

written presentations. These competencies are an integral part of all the Unit Standards and are built

into the Assessment Criteria.

Use science and technology effectively and critically in that the Financial Services environment is

technology driven and very few activities take place without the application of technology.

Demonstrate an understanding of the world as a set of related systems by recognising that problem-

solving contexts do not exist in isolation in demonstrating insight into current affairs in the sector and

the interrelationship between the various indicators and trends in the market and understanding the

consequences of non-compliance

Input: Company specific processing and systems training provided.

Exit Level Outcome 1: Gathering, analysing, synthesising and evaluating information, manipulating and

interpreting data and identifying trends, communicating information coherently in

writing and verbally, and showing insight into current affairs in the Financial Services

sector.

Exit Level Outcome 2: Apply knowledge of economics, investment practices, tax and other financial

information to match the needs of clients to financial products.

Exit Level Outcome 3: Applying knowledge of legislation, ethics, and compliance in the context of the

financial services sector in South Africa.

Wealth Management (57608) Page 37

WORKPLACE ASSESSMENT

Entrance Requirements: Wealth Management Learner

Pass Rate: 65% on workplace assessment(s)

Section 1: CASE STUDY (Life Insurance Learners)

You have approached Mr. And Mrs. Nkosi as a representative of your insurance organisation in an attempt to

assist them with their financial planning. The Nkosi’s are ‘orphan’ clients of the organisation as their previous

representative was asked to leave for not having successfully become FAIS compliant before the deadline.

Mr. Vincent Nkosi is a non-smoking 29-year old male who works as an employee of Telkom; he is a qualified

computer engineer who manages the ADSL call-centre in Johannesburg. His annual package (cost to company)

is R220 000. He chose not to include a company car or car allowance in his package but does get R1 400 per

month towards his medical scheme contributions. His own contributions are R2 600 per month. Mr. Nkosi is also

a member of the employers pension fund; R160 000 of his package is retirement funding. He contributes 7.5% to

the fund. His GLA is based on 5 times his annual funding income.

Mrs. Dorkas Nkosi is a non-smoking 26-year old female, and works as an accountant for the Edgars group of

stores in Gauteng. Her annual salary is R125 000. She also qualifies for a company car. The car is a

Volkswagen Polo purchased 6 months ago by the company for R79 000. Dorkas is a member of her husband’s

medical scheme and a non-contributing member of the Edgars Group Provident Fund. The employer

contributions are based on 50% of her annual salary. Her GLA is based on 2 times her annual retirement funding

income.

The Nkosi’s own a house in Houghton, Parktown, which has recently been valued for R1 450 000. The current

bond is R950 000. Mr. & Mrs. Nkosi’s bond is with Nedbank and has been secured with a joint policy of

R500 000, taken out with your organisation.

The Nkosi’s have 2 children –

A son called Daniel (aged 4); and

A daughter called Precious (aged 2).

They have no other dependants.

The Nkosi family car is a 2004 Ford Focus 2000 GL woth a current value of R56 000. There is still R74 000

outstanding on the Hire Purchase agreement. Mr. Nkosi pays for the car but has no credit life insurance.

Other accounts include –

An unsecured overdraft of R18 000 (Mr.);

Credit cards – outstanding R21 000 (Mr.);

A Edgars staff account – outstanding R35 000;

Furniture on Hire Purchase – outstanding R27 000.

Other than the one joint policy with your organisation the Nkosi’s have no other life insurance policies.

The reason they were prepared to see you is because they feel that a funeral policy is important to them at this

stage as Mr. Nkosi’s father recently passed away and the only way that he could afford the funeral was by taking

our the overdraft that he now has to pay off.

They have no other investments and no retirement annuities.

Wealth Management (57608) Page 38

1. Determine which electronic financial needs analysis software is being used within your

organisation to best assist the representatives of the FSP in completing the FNA for a client as

required by the FAIS legislation.

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

2. Prepare a detailed list of the information that is required to be able to effectively complete an FNA

for a client

Score : ____/10 C NYC

Wealth Management (57608) Page 39

3. Access a version of the analysis tool (electronic / manual) that is currently being used within your

organisation and use it to assess the needs of Mr. & Mrs. Nkosi and their family. (Include a copy

of the FNA at the end of this portfolio)

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

Score : ____/10 C NYC

Wealth Management (57608) Page 40

4. Clearly identify each of the needs that were highlighted by the FNA into the categories – actual

AND /OR potential.

IDENTIFIED NEED ACTUAL EVENT POTENTIAL EVENT

Score : ____/10 C NYC

Wealth Management (57608) Page 41

5. Identify those areas of the FNA and its printed report that ensure compliance with the legislation

and regulations currently in force and applicable to the Financial Services Industry.

Financial Advisory and intermediary Service Act

__________________________________________________________________________________________

Financial Intelligence Centre Act

__________________________________________________________________________________________

Long Term Insurance Act

__________________________________________________________________________________________

Policy Holder Protection Rules to the Long Term Insurance Act

__________________________________________________________________________________________

Score : ____/10 C NYC

Wealth Management (57608) Page 42

6. Using the information known about the Nkosi’s and the needs identified by the FNA, prepare a

proposal that, in your opinion will best meet their needs. Note that any proposal needs to be

acceptable to them in terms of their likely socio economic status and in line with the current

political climate in the country (i.e. investment recommendations must take into account

current trends and circumstances.)

Score : ____/10 C NYC

Wealth Management (57608) Page 43

7. Use your resources to obtain quotations of products that will be suitable in matching your

proposals.

Attach quotations

Score : ____/10 C NYC

8. Evaluate the proposal made in question 6 against the cost of the solutions offered by the

quotations obtained for question 7. Determine whether, in your opinion, the Nkosi’s will be in a

position to afford the premiums / contributions required to accept your entire proposal. Justify

your answer.

Score : ____/10 C NYC

Wealth Management (57608) Page 44

9. Work on the assumption that the Nkosi;s can afford the premiums / contributions to all your

proposals. Determine what their financial position would be on the retirement of Mr. Dlamini at

age 65 (ignore inflation).

Score : ____/10 C NYC

10. Obtain the assistance of your coach/mentor or facilitator to prepare a written proposal for

the Nkosi family that complies with current legislation and company practice.

Score : ____/20 C NYC

Grand Total: ________/10 0 C NYC

Assessor Signature: Date:

Moderator Signature: Date:

Wealth Management (57608) Page 45

You might also like

- Astm A370 2020Document50 pagesAstm A370 2020امين100% (1)

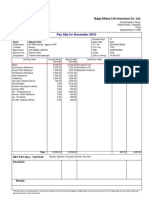

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- SITXFIN004 Assessment 1 - Short AnswersDocument10 pagesSITXFIN004 Assessment 1 - Short AnswersHarkamal singh100% (1)

- CPW4 Business Writing WRT401 Learner Workbook V1.4Document25 pagesCPW4 Business Writing WRT401 Learner Workbook V1.4Jelta James0% (1)

- (NEW) Assessment II - FinanceDocument13 pages(NEW) Assessment II - FinanceCindy Huang50% (8)

- CPW4 Business Writing WRT401 Learner Workbook V1.4Document38 pagesCPW4 Business Writing WRT401 Learner Workbook V1.4Jelta James100% (2)

- Consumer BehaviourDocument19 pagesConsumer Behaviourmarch202067% (3)

- BSBMGT622 Assessment I - Manage ResourcesDocument22 pagesBSBMGT622 Assessment I - Manage ResourcesWeedle67% (3)

- SITXFIN004 Assessment 3 - ProjectDocument9 pagesSITXFIN004 Assessment 3 - Projectdaniela castilloNo ratings yet

- Assessment II - Strategic & Business PlanningDocument44 pagesAssessment II - Strategic & Business PlanningWilliam Tracy Yu75% (4)

- Learner WorkbookDocument13 pagesLearner WorkbookForbetNo ratings yet

- BSBINN601 Case Study AssessmentDocument14 pagesBSBINN601 Case Study AssessmentSummi ShresthaNo ratings yet

- Assessment II - Human ResourcesDocument20 pagesAssessment II - Human ResourcesWeedle0% (1)

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- BSBSUS501 Learner Workbook V1.1 - LOGODocument23 pagesBSBSUS501 Learner Workbook V1.1 - LOGOadhbawa0% (1)

- Assessment 1Document12 pagesAssessment 1Julian Silva0% (2)

- JawhdgfajsgfasfDocument25 pagesJawhdgfajsgfasfNubia DiazNo ratings yet

- Assessment I - Resource ManagementDocument22 pagesAssessment I - Resource ManagementAndrés Reyes0% (1)

- Assessment I LeadershipDocument45 pagesAssessment I LeadershipDani LuttenNo ratings yet

- Apply Project Life Cycle Management Processes Assessment WorkbookDocument26 pagesApply Project Life Cycle Management Processes Assessment WorkbookTanmay JhulkaNo ratings yet

- This Portfolio Must Include A Copy of The Student Agreement (Signed)Document3 pagesThis Portfolio Must Include A Copy of The Student Agreement (Signed)Ileana ContrerasNo ratings yet

- BSBHRM602 Manage Human Resources Strategic Planning: Learner WorkbookDocument40 pagesBSBHRM602 Manage Human Resources Strategic Planning: Learner WorkbookNiomi Golrai100% (1)

- Assessment: InnovationDocument21 pagesAssessment: InnovationBlack DustNo ratings yet

- ACC - Corporate Governance - Assessment 2Document18 pagesACC - Corporate Governance - Assessment 2Sanju LamaNo ratings yet

- 2022 Memorandum LAC New TemplatesDocument17 pages2022 Memorandum LAC New TemplatesJemuelNo ratings yet

- BSBCUS501 Learner Workbook V1.6Document20 pagesBSBCUS501 Learner Workbook V1.6marombaspaul0% (1)

- 9012 9013 7456 - POE AssessmentDocument41 pages9012 9013 7456 - POE AssessmentAy GhostNo ratings yet

- Assessement I - Marketing Plan (PM18) FINALDocument18 pagesAssessement I - Marketing Plan (PM18) FINALSarah FriederikeNo ratings yet

- Sustainability AssesmentDocument26 pagesSustainability AssesmentHadryan AudricNo ratings yet

- BSBRSK501 - Activity 3Document13 pagesBSBRSK501 - Activity 3Boban GorgievNo ratings yet

- BSBMGT517 Assessment 1 - Short AnswerDocument10 pagesBSBMGT517 Assessment 1 - Short Answerozdiploma assignmentsNo ratings yet

- Details of AssessmentDocument21 pagesDetails of AssessmentJaydeep KushwahaNo ratings yet

- Details of AssessmentDocument22 pagesDetails of AssessmentJaydeep KushwahaNo ratings yet

- DocxDocument48 pagesDocxMaria TahreemNo ratings yet

- Ma. Andrea S. FaeldoDocument43 pagesMa. Andrea S. FaeldoandreafaeldollNo ratings yet

- Assessment WorkbookDocument20 pagesAssessment WorkbookMonique Marcolin BugeNo ratings yet

- Assessment 1Document7 pagesAssessment 1zakiatalha0% (1)

- Assessment I - Organisational ChangeDocument50 pagesAssessment I - Organisational ChangeCindy HuangNo ratings yet

- OnlBSBMGT502B Assessment Tasks 22 ModDocument26 pagesOnlBSBMGT502B Assessment Tasks 22 ModGaetano Buongiorno40% (5)

- Work Immersion PortfolioDocument47 pagesWork Immersion Portfoliolaila m. mumarNo ratings yet

- AutoRecovery Save of Assessment 1 - Team Effectiveness (172) .AsdDocument22 pagesAutoRecovery Save of Assessment 1 - Team Effectiveness (172) .Asddoci mitra0% (2)

- ACS Professional Year: Communication and Performance in The Australian Workplace (CPW)Document33 pagesACS Professional Year: Communication and Performance in The Australian Workplace (CPW)Jelta JamesNo ratings yet

- I. Objectives: Rtunities-44673.htmlDocument4 pagesI. Objectives: Rtunities-44673.htmlRaffy Jade SalazarNo ratings yet

- PortfolioDocument44 pagesPortfolioRizzy CerdanNo ratings yet

- Assessment I InnovationDocument22 pagesAssessment I Innovationanon_3289094760% (2)

- Portfolio TemplateDocument38 pagesPortfolio TemplateKimLawrence MulatoNo ratings yet

- New Bsbdiv802 - Conduct Strategic Planning For Diversity Learning Practices - WorkbookDocument38 pagesNew Bsbdiv802 - Conduct Strategic Planning For Diversity Learning Practices - WorkbookAndy LeeNo ratings yet

- Cha Level 5 Mentoring ToolDocument124 pagesCha Level 5 Mentoring Toolhello.kostmagikNo ratings yet

- Marketing Plan - Assessment 1 T321 - CompletedDocument44 pagesMarketing Plan - Assessment 1 T321 - CompletedHuzaifa Bin AtaNo ratings yet

- Assessment Workbook 222Document26 pagesAssessment Workbook 222Oyunsuvd AmgalanNo ratings yet

- Assessment WorkbookDocument28 pagesAssessment WorkbookOyunsuvd AmgalanNo ratings yet

- Final Thesis YaredDocument65 pagesFinal Thesis YaredHana Bogale100% (1)

- PRE IMMERSION PROPER PortfolioDocument22 pagesPRE IMMERSION PROPER PortfoliobauyanmariaNo ratings yet

- Timec Tools 1Document8 pagesTimec Tools 1Wafula WasikeNo ratings yet

- BSBMGT605 Provide Leadership Across The OrganisationDocument39 pagesBSBMGT605 Provide Leadership Across The OrganisationHabeeba MoinuddinNo ratings yet

- Summative AssessmentsDocument10 pagesSummative AssessmentsForbetNo ratings yet

- SITHKOP002 SITHKOP004 Assessment 1 - Written AssessmentDocument27 pagesSITHKOP002 SITHKOP004 Assessment 1 - Written Assessment4mnfv7tp9gNo ratings yet

- Reach - BSBHRM613 - Learner WorkbookDocument46 pagesReach - BSBHRM613 - Learner Workbook민수학No ratings yet

- Universitas Klabat: Fakultas EkonomiDocument5 pagesUniversitas Klabat: Fakultas EkonomiIan SilaenNo ratings yet

- Certification of Residency - Form A - AccomplishedDocument2 pagesCertification of Residency - Form A - AccomplishedjonbertNo ratings yet

- Clerk (Income Maintenance): Passbooks Study GuideFrom EverandClerk (Income Maintenance): Passbooks Study GuideNo ratings yet

- Particle Filter TutorialDocument8 pagesParticle Filter TutorialTanmay NathNo ratings yet

- Strength of Materialspretest Assignment1Document2 pagesStrength of Materialspretest Assignment1Nellai VprNo ratings yet

- Web Lab PDFDocument6 pagesWeb Lab PDFDevesh PandeyNo ratings yet

- Checkpoint Enterprise Security Framework Whitepaper v2Document34 pagesCheckpoint Enterprise Security Framework Whitepaper v2hoangtruc.ptitNo ratings yet

- Kingsmill Materia MedicaDocument32 pagesKingsmill Materia Medicamax quayleNo ratings yet

- Ozone Therapy Is Safest Known TherapyDocument35 pagesOzone Therapy Is Safest Known Therapyherdin2008100% (1)

- Kargil Facts - Indian Soldiers Were RAPED, Then CASTRATED by Pakistani ArmyDocument6 pagesKargil Facts - Indian Soldiers Were RAPED, Then CASTRATED by Pakistani Armyhindu.nation100% (1)

- 04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaDocument10 pages04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaKai XuNo ratings yet

- SoftOne BlackBook ENG Ver.3.3 PDFDocument540 pagesSoftOne BlackBook ENG Ver.3.3 PDFLiviu BuliganNo ratings yet

- Sample QuestionDocument2 pagesSample QuestionSiddartha CHNo ratings yet

- B94-6 R1995 E1984Document21 pagesB94-6 R1995 E1984zojoNo ratings yet

- Tera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018Document14 pagesTera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018deepakNo ratings yet

- Sir Syed University of Engineering & Technology.: OGDCL Internship Report 2021Document16 pagesSir Syed University of Engineering & Technology.: OGDCL Internship Report 2021Aisha KhanNo ratings yet

- The Little Book of Breaks 1840241519 PDFDocument61 pagesThe Little Book of Breaks 1840241519 PDFksrbhaskarNo ratings yet

- Suhas S R: Email-ID: Mobile: 9535610175 / 7019470710Document2 pagesSuhas S R: Email-ID: Mobile: 9535610175 / 7019470710Sachin S KukkalliNo ratings yet

- BGR AnuualReport 2022-23Document88 pagesBGR AnuualReport 2022-23Rk SharafatNo ratings yet

- Anti-Friction Bearings FundamentalsDocument21 pagesAnti-Friction Bearings FundamentalssubrataNo ratings yet

- (LN) Orc Eroica - Volume 01 (YP)Document282 pages(LN) Orc Eroica - Volume 01 (YP)FBINo ratings yet

- M Thermal Heat Pump A4Document34 pagesM Thermal Heat Pump A4Serban TiberiuNo ratings yet

- Turbine-Less Ducted Fan Jet Engine: Subsonic PropulsionDocument25 pagesTurbine-Less Ducted Fan Jet Engine: Subsonic PropulsionزهديابوانسNo ratings yet

- Onco, TSG & CancerDocument8 pagesOnco, TSG & Cancersumera120488No ratings yet

- SkillsDocument7 pagesSkillsRufus RajNo ratings yet

- Christmas Vigil MassDocument106 pagesChristmas Vigil MassMary JosephNo ratings yet

- Deodorization - W. de Greyt and M. KellensDocument43 pagesDeodorization - W. de Greyt and M. KellensGabriel VoglarNo ratings yet

- A Movie Recommendation System (Amrs)Document27 pagesA Movie Recommendation System (Amrs)shanmukhaNo ratings yet

- Support/downloads or Scan Above QR Code For Detailed Policy WordingDocument10 pagesSupport/downloads or Scan Above QR Code For Detailed Policy Wordingraj VenkateshNo ratings yet

- Latest Volleyball News From The NCAA and NAIADocument3 pagesLatest Volleyball News From The NCAA and NAIAFernan RomeroNo ratings yet