Professional Documents

Culture Documents

SETC Tax Credit Origin 197710

SETC Tax Credit Origin 197710

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright:

Available Formats

You might also like

- SETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meDocument5 pagesSETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meSETC Application for Families First Coronavirus Response Act (FFCRA)No ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- BlackDocument2 pagesBlacksaxvdx100% (1)

- RPM Music Center Had The Following Petty Cash Transactions inDocument1 pageRPM Music Center Had The Following Petty Cash Transactions inAmit Pandey0% (1)

- SETC Tax Credit Origin 125462Document1 pageSETC Tax Credit Origin 125462r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 181249Document1 pageSETC Tax Credit Origin 181249r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 173319Document1 pageSETC Tax Credit Origin 173319ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 189451Document1 pageSETC Tax Credit Origin 189451r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 220344Document1 pageSETC Tax Credit Origin 220344r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 161940Document2 pagesSETC Tax Credit Origin 161940r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 202146Document1 pageSETC Tax Credit Origin 202146ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 141227Document2 pagesSETC Tax Credit Origin 141227r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 215877Document1 pageSETC Tax Credit Origin 215877r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 148838Document1 pageSETC Tax Credit Origin 148838ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 228870Document1 pageSETC Tax Credit Origin 228870ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 124672Document1 pageSETC Tax Credit Origin 124672r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 207692Document1 pageSETC Tax Credit Guide 207692ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 181590Document2 pagesSETC Tax Credit Guide 181590r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 173649Document2 pagesSETC Tax Credit Guide 173649r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 231916Document1 pageWhat Is The SETC Tax Credit? 231916ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 144091Document2 pagesWhat Is The SETC Tax Credit? 144091r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 139950Document2 pagesWhat is the SETC Tax Credit? 139950r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 149468Document1 pageWhat is the SETC Tax Credit? 149468ri.chardcaldw.ellus.a1No ratings yet

- What is the SETC Tax Credit? 156569Document2 pagesWhat is the SETC Tax Credit? 156569r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 229963Document2 pagesWhat is the SETC Tax Credit? 229963r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 171534Document1 pageWhat is the SETC Tax Credit? 171534ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 218816Document1 pageWhat Is The SETC Tax Credit? 218816ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 124756Document1 pageWhat Is The SETC Tax Credit? 124756ri.chardcaldw.ellus.a1No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- Tax Credit One Pager QR-RBCDocument1 pageTax Credit One Pager QR-RBCErick MorenoNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- Payroll and Covid19 InfolineDocument9 pagesPayroll and Covid19 Infolinenh nNo ratings yet

- Understanding The Eligibility Criteria For The Self-Employed Tax Credit 197265Document2 pagesUnderstanding The Eligibility Criteria For The Self-Employed Tax Credit 197265galenajmdtNo ratings yet

- General 1099 Tax CreditDocument1 pageGeneral 1099 Tax CreditCraig Pisaris-HendersonNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- 1099 Tax Credit For TutorsDocument1 page1099 Tax Credit For TutorsCraig Pisaris-HendersonNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- 1099 Tax Credit For Life CoachesDocument1 page1099 Tax Credit For Life CoachesCraig Pisaris-HendersonNo ratings yet

- The Impacts of The Families First Coronavirus Response Act On Self-Employment Taxes 206359Document3 pagesThe Impacts of The Families First Coronavirus Response Act On Self-Employment Taxes 206359galenajmdtNo ratings yet

- 1099 Tax Credit For EditorsDocument1 page1099 Tax Credit For EditorsCraig Pisaris-HendersonNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- 1099 Tax Credit For ConsultantsDocument1 page1099 Tax Credit For ConsultantsCraig Pisaris-HendersonNo ratings yet

- A. Employment Expenses: 1. Registered PlansDocument2 pagesA. Employment Expenses: 1. Registered PlansAndi RavNo ratings yet

- 1099 Tax Credit For Personal TrainersDocument1 page1099 Tax Credit For Personal TrainersCraig Pisaris-HendersonNo ratings yet

- How to Claim the SETC Tax Credit 170982Document2 pagesHow to Claim the SETC Tax Credit 170982r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Supports For Businesses and Individuals in B.CDocument7 pagesSupports For Businesses and Individuals in B.CAbdelkaderNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- Section-By-Section Coronavirus Tax Relief MeasuresDocument4 pagesSection-By-Section Coronavirus Tax Relief MeasuresFox News80% (5)

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- 1099 Tax Credit For LandscapersDocument1 page1099 Tax Credit For LandscapersCraig Pisaris-HendersonNo ratings yet

- Emergency Paid Leave FundDocument5 pagesEmergency Paid Leave FundRob PortNo ratings yet

- 1099 Tax Credit For WritersDocument1 page1099 Tax Credit For WritersCraig Pisaris-HendersonNo ratings yet

- 1099 Tax Credit For PhotographersDocument1 page1099 Tax Credit For PhotographersCraig Pisaris-HendersonNo ratings yet

- 1099 Tax Credit For BookkeepersDocument1 page1099 Tax Credit For BookkeepersCraig Pisaris-HendersonNo ratings yet

- Payroll Accounting 2019 5th Edition Landin Solutions ManualDocument17 pagesPayroll Accounting 2019 5th Edition Landin Solutions Manualsilingvolumedvh2myq100% (24)

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- InvoiceinfinityDocument1 pageInvoiceinfinityAMit PrasadNo ratings yet

- Bank Release OrderDocument2 pagesBank Release Ordercallvk50% (2)

- GSRTC Undva Mandli BorderDocument1 pageGSRTC Undva Mandli BorderNIRMAL PATELNo ratings yet

- InvoiceDocument1 pageInvoiceSdeviitr11 KumarNo ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet

- BZ Payroll Slip OKT 2023-UnlockedDocument1 pageBZ Payroll Slip OKT 2023-UnlockedWidha AgustriaNo ratings yet

- Invoice 1514017325Document4 pagesInvoice 1514017325kqtipowNo ratings yet

- Through Demand Draft (DD) : (Favouring Sr. Accounts Officer (Banking), HPSEBL, Shimla)Document2 pagesThrough Demand Draft (DD) : (Favouring Sr. Accounts Officer (Banking), HPSEBL, Shimla)Viswa BhuvanNo ratings yet

- Taxation PrinciplesDocument22 pagesTaxation PrinciplesHazel Denisse GragasinNo ratings yet

- Debit Vs Credit CardDocument3 pagesDebit Vs Credit CardPreeti100% (1)

- USA TD Bank StatementDocument1 pageUSA TD Bank Statementramiroledererm963No ratings yet

- Case 3-1 PDFDocument3 pagesCase 3-1 PDFZereen Gail Nievera100% (2)

- BankMobile Full Fee Schedules PDFDocument2 pagesBankMobile Full Fee Schedules PDFminipower50No ratings yet

- Case Study 1 Spreadsheet 1 17Document1 pageCase Study 1 Spreadsheet 1 17kTNo ratings yet

- Jaime SerranoDocument3 pagesJaime SerranoMichelle Chris100% (1)

- Gasbill 3432570000 202106 20231030095355Document1 pageGasbill 3432570000 202106 20231030095355M WaqasNo ratings yet

- Invoice No - 20151213 - SoldoutDocument1 pageInvoice No - 20151213 - SoldoutRONALD YUNo ratings yet

- Claimed and Unclaimed Spes ChecksDocument808 pagesClaimed and Unclaimed Spes ChecksgurnaNo ratings yet

- PhonePe Statement Dec2023 Mar2024Document23 pagesPhonePe Statement Dec2023 Mar2024adityasingh3425.fgiNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFDocument60 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFanwalteru32x100% (15)

- ch-07 Dividend and DDTDocument57 pagesch-07 Dividend and DDTdean.socNo ratings yet

- TAXATION Transcript Part 1 PDFDocument28 pagesTAXATION Transcript Part 1 PDFZyshan NainNo ratings yet

- Adzu Tax 01 B Learning Packet 3 Concept of IncomeDocument5 pagesAdzu Tax 01 B Learning Packet 3 Concept of IncomeDanielle JoenNo ratings yet

- Principles of TaxationDocument74 pagesPrinciples of Taxationmutuamutisya306No ratings yet

- Salary Slipaprilmarch PJDocument3 pagesSalary Slipaprilmarch PJSurendra ShardaNo ratings yet

- Schedule of Payments To Consultant & ContrDocument30 pagesSchedule of Payments To Consultant & ContrM ShahidNo ratings yet

- Eusage Guide: Business Credit CardsDocument18 pagesEusage Guide: Business Credit CardsAjay KrishnanNo ratings yet

SETC Tax Credit Origin 197710

SETC Tax Credit Origin 197710

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SETC Tax Credit Origin 197710

SETC Tax Credit Origin 197710

Uploaded by

r.i.c.h.a.rdca.l.dwell.u.sa1Copyright:

Available Formats

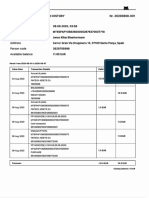

SETC Tax Credit

Opening

The Self-Employed Tax Credit (SETC) was introduced by the government to alleviate the financial strain caused by the

COVID-19 pandemic on self-employed individuals. This refundable tax credit can provide up to $32,220 in assistance to

eligible professionals who faced disruptions in their work due to the pandemic. SETC setc tax credit eligibility

requirements.

To be eligible, individuals must have earned income from self-employment as a sole proprietor, independent

contractor, or single-member LLC in either 2019, 2020, or 2021. Experiencing a work disruption due to COVID-

19 reasons includes being subject to quarantine orders, having symptoms, caring for someone affected by the virus,

or having childcare duties due to school closures.

The eligible time period for claiming the SETC is between April 1, 2020, and September 30, 2021.

SETC has specific criteria that must be met in order to qualify.

Adhering to quarantine/isolation orders mandated by federal, state, or local authorities Following self-quarantine

guidance given by a healthcare professional Seeking a diagnosis for symptoms related to COVID-19. Providing

care for individuals in quarantine Caring for children because of school or facility closures.

The SETC program provides support to individuals in accessing unemployment benefits. Unemployment benefits do not

exclude you from the SETC, but you cannot claim the credit for days when you received unemployment compensation.

SETC calculation and application process The maximum SETC credit of $32,220 is determined by your average daily

self-employment income. Prepare your 2019-2021 tax returns, detail any COVID-19 work interruptions, and fill out IRS

Form 7202 to apply. Keep track of the claim deadlines.

Enhancing Benefits by Overcoming Limitations

The SETC can affect your adjusted gross income and eligibility for other credits/deductions. It cannot be claimed for

days when you received employer sick/family leave wages or unemployment. To optimize advantages, keep precise

records and potentially consult with a tax professional. Familiarity with and proper utilization of the SETC is essential

for securing financial assistance as a self-employed person impacted by the pandemic.

Conclusion

Understanding the eligibility requirements, application process, and how to maximize benefits can help self-employed

professionals facing COVID-19 hardships take full advantage employment subsidy program of the Self-Employed Tax

Credit.

You might also like

- SETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meDocument5 pagesSETC IRS 2024 PDF - COVID-19 Self-Employed Tax Credits: Form 7202 Eligibility & Application - SETC Wikipedia - by WWW - SETC.meSETC Application for Families First Coronavirus Response Act (FFCRA)No ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Potu RavinderreddyNo ratings yet

- BlackDocument2 pagesBlacksaxvdx100% (1)

- RPM Music Center Had The Following Petty Cash Transactions inDocument1 pageRPM Music Center Had The Following Petty Cash Transactions inAmit Pandey0% (1)

- SETC Tax Credit Origin 125462Document1 pageSETC Tax Credit Origin 125462r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 181249Document1 pageSETC Tax Credit Origin 181249r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 173319Document1 pageSETC Tax Credit Origin 173319ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 189451Document1 pageSETC Tax Credit Origin 189451r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 220344Document1 pageSETC Tax Credit Origin 220344r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 161940Document2 pagesSETC Tax Credit Origin 161940r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 202146Document1 pageSETC Tax Credit Origin 202146ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 141227Document2 pagesSETC Tax Credit Origin 141227r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 215877Document1 pageSETC Tax Credit Origin 215877r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Origin 148838Document1 pageSETC Tax Credit Origin 148838ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 228870Document1 pageSETC Tax Credit Origin 228870ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Origin 124672Document1 pageSETC Tax Credit Origin 124672r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 207692Document1 pageSETC Tax Credit Guide 207692ri.chardcaldw.ellus.a1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 181590Document2 pagesSETC Tax Credit Guide 181590r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 173649Document2 pagesSETC Tax Credit Guide 173649r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 231916Document1 pageWhat Is The SETC Tax Credit? 231916ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 144091Document2 pagesWhat Is The SETC Tax Credit? 144091r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 139950Document2 pagesWhat is the SETC Tax Credit? 139950r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 149468Document1 pageWhat is the SETC Tax Credit? 149468ri.chardcaldw.ellus.a1No ratings yet

- What is the SETC Tax Credit? 156569Document2 pagesWhat is the SETC Tax Credit? 156569r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 229963Document2 pagesWhat is the SETC Tax Credit? 229963r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 171534Document1 pageWhat is the SETC Tax Credit? 171534ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 218816Document1 pageWhat Is The SETC Tax Credit? 218816ri.chardcaldw.ellus.a1No ratings yet

- What Is The SETC Tax Credit? 124756Document1 pageWhat Is The SETC Tax Credit? 124756ri.chardcaldw.ellus.a1No ratings yet

- IRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSauceDocument4 pagesIRS Glossary: SETC Tax Credit Terms You Should Be Aware of - WikiSaucePanel Rank (panelrank.com)No ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- Tax Credit One Pager QR-RBCDocument1 pageTax Credit One Pager QR-RBCErick MorenoNo ratings yet

- COVID 19 Unemployment AssistanceDocument4 pagesCOVID 19 Unemployment AssistanceDennis GarrettNo ratings yet

- Payroll and Covid19 InfolineDocument9 pagesPayroll and Covid19 Infolinenh nNo ratings yet

- Understanding The Eligibility Criteria For The Self-Employed Tax Credit 197265Document2 pagesUnderstanding The Eligibility Criteria For The Self-Employed Tax Credit 197265galenajmdtNo ratings yet

- General 1099 Tax CreditDocument1 pageGeneral 1099 Tax CreditCraig Pisaris-HendersonNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- 1099 Tax Credit For TutorsDocument1 page1099 Tax Credit For TutorsCraig Pisaris-HendersonNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- 1099 Tax Credit For Life CoachesDocument1 page1099 Tax Credit For Life CoachesCraig Pisaris-HendersonNo ratings yet

- The Impacts of The Families First Coronavirus Response Act On Self-Employment Taxes 206359Document3 pagesThe Impacts of The Families First Coronavirus Response Act On Self-Employment Taxes 206359galenajmdtNo ratings yet

- 1099 Tax Credit For EditorsDocument1 page1099 Tax Credit For EditorsCraig Pisaris-HendersonNo ratings yet

- Frequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ WorkersDocument2 pagesFrequently Asked Questions During The Coronavirus Emergency: Self-Employed NJ Workersdavid rockNo ratings yet

- 1099 Tax Credit For ConsultantsDocument1 page1099 Tax Credit For ConsultantsCraig Pisaris-HendersonNo ratings yet

- A. Employment Expenses: 1. Registered PlansDocument2 pagesA. Employment Expenses: 1. Registered PlansAndi RavNo ratings yet

- 1099 Tax Credit For Personal TrainersDocument1 page1099 Tax Credit For Personal TrainersCraig Pisaris-HendersonNo ratings yet

- How to Claim the SETC Tax Credit 170982Document2 pagesHow to Claim the SETC Tax Credit 170982r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Supports For Businesses and Individuals in B.CDocument7 pagesSupports For Businesses and Individuals in B.CAbdelkaderNo ratings yet

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- Section-By-Section Coronavirus Tax Relief MeasuresDocument4 pagesSection-By-Section Coronavirus Tax Relief MeasuresFox News80% (5)

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- 1099 Tax Credit For LandscapersDocument1 page1099 Tax Credit For LandscapersCraig Pisaris-HendersonNo ratings yet

- Emergency Paid Leave FundDocument5 pagesEmergency Paid Leave FundRob PortNo ratings yet

- 1099 Tax Credit For WritersDocument1 page1099 Tax Credit For WritersCraig Pisaris-HendersonNo ratings yet

- 1099 Tax Credit For PhotographersDocument1 page1099 Tax Credit For PhotographersCraig Pisaris-HendersonNo ratings yet

- 1099 Tax Credit For BookkeepersDocument1 page1099 Tax Credit For BookkeepersCraig Pisaris-HendersonNo ratings yet

- Payroll Accounting 2019 5th Edition Landin Solutions ManualDocument17 pagesPayroll Accounting 2019 5th Edition Landin Solutions Manualsilingvolumedvh2myq100% (24)

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- How to Claim the SETC Tax Credit 212496Document2 pagesHow to Claim the SETC Tax Credit 212496r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What is the SETC Tax Credit? 181271Document2 pagesWhat is the SETC Tax Credit? 181271r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 217099Document2 pagesSETC Tax Credit Guide 217099r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 135424Document2 pagesSETC Tax Credit Guide 135424r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- What Is The SETC Tax Credit? 193993Document2 pagesWhat Is The SETC Tax Credit? 193993r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- InvoiceinfinityDocument1 pageInvoiceinfinityAMit PrasadNo ratings yet

- Bank Release OrderDocument2 pagesBank Release Ordercallvk50% (2)

- GSRTC Undva Mandli BorderDocument1 pageGSRTC Undva Mandli BorderNIRMAL PATELNo ratings yet

- InvoiceDocument1 pageInvoiceSdeviitr11 KumarNo ratings yet

- ComputationDocument4 pagesComputationIshita shahNo ratings yet

- BZ Payroll Slip OKT 2023-UnlockedDocument1 pageBZ Payroll Slip OKT 2023-UnlockedWidha AgustriaNo ratings yet

- Invoice 1514017325Document4 pagesInvoice 1514017325kqtipowNo ratings yet

- Through Demand Draft (DD) : (Favouring Sr. Accounts Officer (Banking), HPSEBL, Shimla)Document2 pagesThrough Demand Draft (DD) : (Favouring Sr. Accounts Officer (Banking), HPSEBL, Shimla)Viswa BhuvanNo ratings yet

- Taxation PrinciplesDocument22 pagesTaxation PrinciplesHazel Denisse GragasinNo ratings yet

- Debit Vs Credit CardDocument3 pagesDebit Vs Credit CardPreeti100% (1)

- USA TD Bank StatementDocument1 pageUSA TD Bank Statementramiroledererm963No ratings yet

- Case 3-1 PDFDocument3 pagesCase 3-1 PDFZereen Gail Nievera100% (2)

- BankMobile Full Fee Schedules PDFDocument2 pagesBankMobile Full Fee Schedules PDFminipower50No ratings yet

- Case Study 1 Spreadsheet 1 17Document1 pageCase Study 1 Spreadsheet 1 17kTNo ratings yet

- Jaime SerranoDocument3 pagesJaime SerranoMichelle Chris100% (1)

- Gasbill 3432570000 202106 20231030095355Document1 pageGasbill 3432570000 202106 20231030095355M WaqasNo ratings yet

- Invoice No - 20151213 - SoldoutDocument1 pageInvoice No - 20151213 - SoldoutRONALD YUNo ratings yet

- Claimed and Unclaimed Spes ChecksDocument808 pagesClaimed and Unclaimed Spes ChecksgurnaNo ratings yet

- PhonePe Statement Dec2023 Mar2024Document23 pagesPhonePe Statement Dec2023 Mar2024adityasingh3425.fgiNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFDocument60 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFanwalteru32x100% (15)

- ch-07 Dividend and DDTDocument57 pagesch-07 Dividend and DDTdean.socNo ratings yet

- TAXATION Transcript Part 1 PDFDocument28 pagesTAXATION Transcript Part 1 PDFZyshan NainNo ratings yet

- Adzu Tax 01 B Learning Packet 3 Concept of IncomeDocument5 pagesAdzu Tax 01 B Learning Packet 3 Concept of IncomeDanielle JoenNo ratings yet

- Principles of TaxationDocument74 pagesPrinciples of Taxationmutuamutisya306No ratings yet

- Salary Slipaprilmarch PJDocument3 pagesSalary Slipaprilmarch PJSurendra ShardaNo ratings yet

- Schedule of Payments To Consultant & ContrDocument30 pagesSchedule of Payments To Consultant & ContrM ShahidNo ratings yet

- Eusage Guide: Business Credit CardsDocument18 pagesEusage Guide: Business Credit CardsAjay KrishnanNo ratings yet