Professional Documents

Culture Documents

TYU-Question-7 n 8

TYU-Question-7 n 8

Uploaded by

Haseeb RazaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TYU-Question-7 n 8

TYU-Question-7 n 8

Uploaded by

Haseeb RazaCopyright:

Available Formats

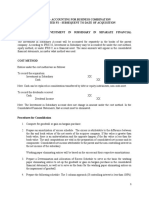

Consolidated statement of financial position

Therefore retained earnings at acquisition will be $12,000 ($15,000 less

$3,000 post-acquisition) and the post-acquisition profits to go to

consolidated retained earnings are $3,000.

Test your understanding 7

Consolidated statement of financial position

On 1 May 20X7 Karl bought 60% of Susan paying $76,000 cash. The

summarised statements of financial position for the two entities as at

30 November 20X7 are:

Karl Susan

$ $

Non-current assets

Property, plant & equipment 138,000 115,000

Investments 98,000 –

Current assets

Inventory 15,000 17,000

Receivables 19,000 20,000

Cash 2,000 –

––––––– –––––––

272,000 152,000

––––––– –––––––

Share capital 50,000 40,000

Retained earnings 189,000 69,000

––––––– –––––––

239,000 109,000

Non-current liabilities: 8% Loan notes – 20,000

Current liabilities 33,000 23,000

––––––– –––––––

272,000 152,000

––––––– –––––––

The following information is relevant:

(i) The inventory of Karl includes $8,000 of goods purchased for

cash from Susan at cost plus 25%.

(ii) On 1 June 20X7 Karl transferred an item of plant to Susan for

$15,000. Its carrying amount at that date was $10,000, and its

remaining useful life was 5 years.

458 KAPLAN PUBLISHING

Chapter 18

(iii) Karl values the non-controlling interest using the fair value

method. At the date of acquisition the fair value of the 40% non-

controlling interest was $50,000.

(iv) An impairment loss of $1,000 is to be charged against goodwill at

the year-end.

(v) Susan earned a profit of $9,000 in the year ended 30 November

20X7.

(vii) The loan note in Susan’s books represents monies borrowed from

Karl on 30 November 20X7.

(vii) Included in Karl’s receivables is $4,000 relating to inventory sold

to Susan during the year. Susan raised a cheque for $2,500 and

sent it to Karl on 29 November 20X7. Karl did not receive this

cheque until 4 December 20X7.

Required:

Prepare the consolidated statement of financial position as at

30 November 20X7.

Test your understanding 8

The following scenario relates to five questions.

Bintou Co purchased its 80% shareholding in Malak Co five years ago

when Malak Co’s retained earnings were $20,000 and had a balance

on its revaluation surplus of $10,000. At the date of acquisition the fair

value of Malak Co’s net assets was equal to their carrying amount.

Nada Co had retained earnings of $16,000 when Bintou Co acquired its

75% shareholding for cash on 1 January 20X9. At the date of

acquisition the fair value of Malak Co’s net assets was equal to their

carrying amount, with the exception of some plant whose fair value was

$10,000 greater than its carrying amount. At this date the plant had a

remaining life of five years.

The following are the summarised statements of financial position of

the companies as at 31 December 20X9.

KAPLAN PUBLISHING 459

Consolidated statement of financial position

Bintou Malak Nada

Co Co Co

$ $ $

Non-current assets:

Property, plant and equipment 180,000 120,000 100,000

Investments:

Malak Co 100,000 – –

Nada Co 110,000 – –

Current assets 406,000 140,000 60,000

––––––– ––––––– ––––––

796,000 260,000 160,000

––––––– ––––––– ––––––

Ordinary $1 share capital 380,000 100,000 80,000

Revaluation surplus – 20,000 –

Retained earnings 116,000 60,000 32,000

––––––– ––––––– ––––––

496,000 180,000 112,000

Current liabilities 300,000 80,000 48,000

––––––– ––––––– ––––––

796,000 260,000 160,000

––––––– ––––––– ––––––

At the end of 20X9, the goodwill impairment review revealed a loss of

$1,000 in relation to the business combination with Malak Co.

During November 20X9, Malak Co had sold goods to Bintou Co for

$12,000 at a mark-up on cost of 20%. Half of these goods were still

held by Bintou Co at 31 December 20X9, and the balance payable was

still outstanding.

Bintou Co measures goodwill and the non-controlling interest using the

proportionate method for Malak Co, and the fair value method for Nada

Co. The fair value of the non-controlling interest of Nada Co at the date

of acquisition was $24,000.

1 What is the value of consolidated property, plant and

equipment on the consolidated statement of financial

position at 31 December 20X9?

$________________

2 What is the value of current assets on the consolidated

statement of financial position at 31 December 20X9?

A $563,000

B $605,000

C $606,000

D $593,000

460 KAPLAN PUBLISHING

Chapter 18

3 What is the value of the non-controlling interest in Malak Co

to be included on the consolidated statement of financial

position at 31 December 20X9?

A $35,800

B $31,800

C $36,000

D $44,750

4 What is the value of goodwill arising on the acquisition of

Nada Co?

$________________

5 What is the value of group retained earnings to be included

on the consolidated statement of financial position at 31

December 20X9?

A $156,900

B $156,100

C $157,600

D $157,700

Please note that the work required to answer some of the above

questions is beyond that expected for two marks in the exam.

Analysis of a company within a group

The FR examination may contain a question involving the analysis of a

company which is part of a group. Whilst intra-group transactions will be

removed from the consolidated financial statements, these will not be removed

from the individual financial statements. Therefore extra attention must be paid

to transactions which may not be at market value, or may be lost if the company

is removed from the group. This can include:

Intra-group loans – these may be at low interest, which may change if the

company is removed from the group

Intra-group receivables/payables – these can be done to manipulate an

entity's cash position prior to a sale.

Inventory/Non-current assets – Assets could have been sold at inflated

prices between the group. The unrealised profits will be removed from the

consolidated financial statements, but the item will remain at the inflated

cost in the individual statements of financial position.

Shared costs/assets – The company may share assets with others in the

group, which would be lost if the company were removed from the group.

Any additional assets (such as office space) that would be required if the

company became a standalone entity should be taken into consideration.

KAPLAN PUBLISHING 461

You might also like

- AfarDocument128 pagesAfarlloyd77% (57)

- Case Solution - A New Financial Policy at Swedish Match - ANIDocument20 pagesCase Solution - A New Financial Policy at Swedish Match - ANIAnisha Goyal33% (3)

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- F3 Final File 2021-2022 ADocument147 pagesF3 Final File 2021-2022 AWWE Gaming0% (1)

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Analysis of Financial State MentDocument13 pagesAnalysis of Financial State MentAbdul RehmanNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Ch10 ProblemDocument2 pagesCh10 ProblempalashndcNo ratings yet

- ABC CorporationDocument6 pagesABC CorporationDemeke HeseboNo ratings yet

- Part 4 Basic ConsolidationDocument3 pagesPart 4 Basic Consolidationtαtmαn dє grєαtNo ratings yet

- Financial Reporting - Assignment 3Document4 pagesFinancial Reporting - Assignment 3SitiFarhanaNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- 06 JUNE QuestionDocument11 pages06 JUNE QuestionkhengmaiNo ratings yet

- Conso B2Document8 pagesConso B2mohedNo ratings yet

- Acct320 LQ5V2Document4 pagesAcct320 LQ5V2laibaNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- 2019 12 December-2019-Cpe-Audit-Question-PaperDocument10 pages2019 12 December-2019-Cpe-Audit-Question-Paperkellz accountingNo ratings yet

- Problem 2Document2 pagesProblem 2Rio De LeonNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Chapter 37-Presentation of FsDocument8 pagesChapter 37-Presentation of FsEmma Mariz GarciaNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- 371 PedanticDocument2 pages371 Pedanticabdirahman farah AbdiNo ratings yet

- Partnership Formation Activity 1 January 28 2023Document12 pagesPartnership Formation Activity 1 January 28 2023Jerlyn SaynoNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Afar PDFDocument128 pagesAfar PDFMelyn Bustamante100% (1)

- f7hkg 2010 Jun QDocument9 pagesf7hkg 2010 Jun QOni SegunNo ratings yet

- ACT 421 Ch. 1Document6 pagesACT 421 Ch. 1Kristilyn CartaNo ratings yet

- General Fund Closing Entries and StatementsDocument3 pagesGeneral Fund Closing Entries and StatementsAshik Uz ZamanNo ratings yet

- CA51024-MODULE 3 - Lecture NotesDocument11 pagesCA51024-MODULE 3 - Lecture NotesNia BranzuelaNo ratings yet

- Prime Company Lane Company: RequiredDocument8 pagesPrime Company Lane Company: RequiredSinta AnnisaNo ratings yet

- Use The Following Information For The Next Three Questions:: Oral QuizDocument6 pagesUse The Following Information For The Next Three Questions:: Oral QuizLourdios EdullantesNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- ASSETACQMDocument5 pagesASSETACQMNicolyn Rae EscalanteNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Accn08bquiz1 pt2 PDF FreeDocument5 pagesAccn08bquiz1 pt2 PDF FreeChi ChiNo ratings yet

- PAS 1 Presentation of FSDocument11 pagesPAS 1 Presentation of FSPatrickMendozaNo ratings yet

- Consolidated Workpaper (Intercompany Sales of Inventory, Plant Assets) (100 Points)Document1 pageConsolidated Workpaper (Intercompany Sales of Inventory, Plant Assets) (100 Points)Yumi ShiwaNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Multi-Year Consolidation: Non-Controlling Interests Recognised at Fair ValueDocument37 pagesMulti-Year Consolidation: Non-Controlling Interests Recognised at Fair ValuewarsidiNo ratings yet

- Financial Reporting: September/December 2017 - Sample QuestionsDocument4 pagesFinancial Reporting: September/December 2017 - Sample QuestionsNurul Nabilah SuhamiNo ratings yet

- ACCTSPTRANS Quiz Corp LiquidationDocument2 pagesACCTSPTRANS Quiz Corp LiquidationShailene DavidNo ratings yet

- Part 2 Joint Arrangements Class Consultation PDFDocument6 pagesPart 2 Joint Arrangements Class Consultation PDFidk520055No ratings yet

- Activity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0Document6 pagesActivity - Consolidated Financial Statement - Part 2 (1) (REVIEWER MIDTERM0PaupauNo ratings yet

- Chapter 21-Debt Restructuring, Corporate ReorDocument2 pagesChapter 21-Debt Restructuring, Corporate ReorLouiza Kyla AridaNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- C1 Buscom Classroom Activity With AnswersDocument3 pagesC1 Buscom Classroom Activity With AnswerskimberlyroseabianNo ratings yet

- Bucom 2Document3 pagesBucom 2dmangiginNo ratings yet

- Prelim Exam - Doc2Document16 pagesPrelim Exam - Doc2alellie100% (1)

- Consolidation ProcedureDocument11 pagesConsolidation ProcedureShamim SarwarNo ratings yet

- PlateauDocument2 pagesPlateauemmanuel stanfordNo ratings yet

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Understanding IFRS Fundamentals: International Financial Reporting StandardsFrom EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- Master TestDocument6 pagesMaster TestHaseeb RazaNo ratings yet

- TYU-Question-1 n 2Document3 pagesTYU-Question-1 n 2Haseeb RazaNo ratings yet

- TYU-Question-9Document2 pagesTYU-Question-9Haseeb RazaNo ratings yet

- C-10-Pub off reg 2017Document24 pagesC-10-Pub off reg 2017Haseeb RazaNo ratings yet

- MTYw OTkw Y2 Ztcy 1 K YzgzDocument8 pagesMTYw OTkw Y2 Ztcy 1 K YzgzHaseeb RazaNo ratings yet

- Ball 2006 PDFDocument24 pagesBall 2006 PDF1111samiNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- Chapter 1 Accounting For Income TaxDocument102 pagesChapter 1 Accounting For Income TaxNejat AhmedNo ratings yet

- Fin 004 Prelim 2Document49 pagesFin 004 Prelim 2Joana Marie Lapuz MaramonteNo ratings yet

- Project Report of Financial Analysis of Blue Star and HitachiDocument16 pagesProject Report of Financial Analysis of Blue Star and HitachiAman VermaNo ratings yet

- T24 Accounting Set-Up - For Consolidation - R16Document95 pagesT24 Accounting Set-Up - For Consolidation - R16adyani_0997100% (2)

- FMVA BrochureDocument2 pagesFMVA BrochureDumeus WidenskyNo ratings yet

- CH06Document35 pagesCH06IntelaCrosoftNo ratings yet

- Fama & French 2015 PDFDocument22 pagesFama & French 2015 PDFFlorencia ReginaNo ratings yet

- Assignment 1 - SolutionDocument10 pagesAssignment 1 - SolutionKhem Raj GyawaliNo ratings yet

- Evaluating Distressed SecuritiesDocument12 pagesEvaluating Distressed Securitieslazaros-apostolidis1179No ratings yet

- MODULE 6A Home Office and Branch AccountingDocument14 pagesMODULE 6A Home Office and Branch AccountingmcespressoblendNo ratings yet

- Acca Afm (P4)Document36 pagesAcca Afm (P4)SamanMurtazaNo ratings yet

- FM I - 3 P1Document11 pagesFM I - 3 P1Henok FikaduNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- قراءة في الخصائص النوعية للمعلومات المالية المفيدة بين منظور النظام المحاسبي المالي ومنظور المعايير المحاسبية الدوليةDocument20 pagesقراءة في الخصائص النوعية للمعلومات المالية المفيدة بين منظور النظام المحاسبي المالي ومنظور المعايير المحاسبية الدوليةOum AbdouNo ratings yet

- Format of Financial StatementsDocument2 pagesFormat of Financial StatementsAmeerul HarithNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesRaihan Eibna RezaNo ratings yet

- Investments in Equity Securities and Debt Securities Problems 7-1 (Dusit, Inc.) Classified As Available For Sale SecuritiesDocument15 pagesInvestments in Equity Securities and Debt Securities Problems 7-1 (Dusit, Inc.) Classified As Available For Sale SecuritiesExequielCamisaCrusperoNo ratings yet

- Compiled FinmanDocument136 pagesCompiled FinmanJhaister Ashley LayugNo ratings yet

- Exercises - Accounting For Merchandising Business Part 2Document10 pagesExercises - Accounting For Merchandising Business Part 2Yzmael Klyde BorjaNo ratings yet

- Chapter 13 IAS 20 Govt GrantDocument11 pagesChapter 13 IAS 20 Govt GrantKelvin Chu JYNo ratings yet

- ACCT 201 Pre-Quiz Number 6 F09Document7 pagesACCT 201 Pre-Quiz Number 6 F09bob_lahblawNo ratings yet

- Redemption of Shares NotesDocument14 pagesRedemption of Shares Notesms.AhmedNo ratings yet

- Cost of CapitalDocument41 pagesCost of CapitalMCDABCNo ratings yet

- F3 Questions Update For AFD-1Document57 pagesF3 Questions Update For AFD-1Shahab ShafiNo ratings yet

- Corporate Finance Report AnalysisDocument64 pagesCorporate Finance Report AnalysisabhdonNo ratings yet