Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsBuild your own BOND Portfolio - Sample Portfolio with Yield working

Build your own BOND Portfolio - Sample Portfolio with Yield working

Uploaded by

SMIT PATELCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Demon Slayer Kimetsu No Yaiba Free Download Anime Calendar 2022Document12 pagesDemon Slayer Kimetsu No Yaiba Free Download Anime Calendar 2022Gokul M PNo ratings yet

- Siddha Siddhanta Paddhati Natha YogisDocument35 pagesSiddha Siddhanta Paddhati Natha YogisNilkanth Yengde80% (10)

- Corporate Bond (Taxable) - Secondary Offers (20)Document1 pageCorporate Bond (Taxable) - Secondary Offers (20)Shubham AgrawalNo ratings yet

- Half Yearly Portfolio March 2021Document309 pagesHalf Yearly Portfolio March 2021siva sumanthNo ratings yet

- Portfolio As On 30.11.2019Document275 pagesPortfolio As On 30.11.2019ishan bapatNo ratings yet

- Fortnightly Portfolio As On 15th June 2021Document160 pagesFortnightly Portfolio As On 15th June 2021Vera WhiteheadNo ratings yet

- Security Level Portfolio As On April 30 2020 For 6 Schemes Being Wound Up k9fmj184 PDFDocument15 pagesSecurity Level Portfolio As On April 30 2020 For 6 Schemes Being Wound Up k9fmj184 PDFVignesh RajaramNo ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- BondsDocument1 pageBondsМаниш НахтвандерерNo ratings yet

- Medium Term Bond PDFDocument5 pagesMedium Term Bond PDFGNo ratings yet

- Payment Schedule3039Document10 pagesPayment Schedule3039marblewalaaNo ratings yet

- Bond Portfolio OptimizationAug.2019 For StudentsDocument60 pagesBond Portfolio OptimizationAug.2019 For StudentsMrunalNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- Personal Financial Planning: Assignment - 2Document16 pagesPersonal Financial Planning: Assignment - 2anilk_210No ratings yet

- Retail Bond Paper.Document1 pageRetail Bond Paper.dharam singhNo ratings yet

- MONTHLY - PORTFOLIO - AXISMF-Oct 2019Document117 pagesMONTHLY - PORTFOLIO - AXISMF-Oct 2019Gopal PenjarlaNo ratings yet

- Kotak Gilt Investment Fund GrowthDocument1 pageKotak Gilt Investment Fund GrowthYogi173No ratings yet

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026No ratings yet

- PGDocument300 pagesPGSuraj SinghNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- PDF Download 1717996953431Document3 pagesPDF Download 1717996953431jaiswal.abhinawNo ratings yet

- Aditya Birla Sun Life Floating Rate Fund - Long Term Plan: Savings SolutionsDocument3 pagesAditya Birla Sun Life Floating Rate Fund - Long Term Plan: Savings SolutionsMayank SainiNo ratings yet

- Questions of MTP and RTPDocument144 pagesQuestions of MTP and RTPGaurang ChhanganiNo ratings yet

- MaxsDocument1 pageMaxssushilkumar708No ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- 892Document20 pages892Adam CuencaNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- In MF Monthly Portfolio AxismfDocument163 pagesIn MF Monthly Portfolio AxismfKarthikNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatNo ratings yet

- Morningstarreport 20230811090706Document1 pageMorningstarreport 20230811090706Sunny AhujaNo ratings yet

- Fundcard: Reliance Etf Bank BeesDocument4 pagesFundcard: Reliance Etf Bank BeesChittaNo ratings yet

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Document6 pagesValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNo ratings yet

- Heim 030010293631122022001Document1 pageHeim 030010293631122022001sindiswapinkynkosiNo ratings yet

- Data For The Year 2008: Close - End Mutual FundDocument15 pagesData For The Year 2008: Close - End Mutual FundRana Safdar HussainNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- Franklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Document45 pagesFranklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Ghanshyam Kumar PandeyNo ratings yet

- DocumentsDocument2 pagesDocumentsupsc.bengalNo ratings yet

- Morningstarreport 20231123045134Document1 pageMorningstarreport 20231123045134SHUBHAM STAR PatilNo ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- MMDocument5 pagesMMIntraday TraderNo ratings yet

- Absa Dividend Income FundDocument2 pagesAbsa Dividend Income FundGontse SitholeNo ratings yet

- ELSS Mutual Fund InvestmentDocument6 pagesELSS Mutual Fund InvestmentAshish ShuklaNo ratings yet

- Portfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Industry/Rating Quantity Units of Mutual FundsDocument18 pagesPortfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Industry/Rating Quantity Units of Mutual FundsKrishna KusumaNo ratings yet

- NotesDocument1 pageNotesImranNo ratings yet

- Mba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanDocument10 pagesMba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanHaris AmirNo ratings yet

- KRS 16 RevDocument19 pagesKRS 16 RevSURANA1973No ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- Internet Account Statement: Non-TransferableDocument2 pagesInternet Account Statement: Non-TransferableSatishBaranwalNo ratings yet

- LAPORAN KEUANGAN 2020 TrioDocument3 pagesLAPORAN KEUANGAN 2020 TrioMT Project EnokNo ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- Prof. D. C. Pai: Submitted ToDocument17 pagesProf. D. C. Pai: Submitted ToGirish PalkarNo ratings yet

- CyientDLMAnchor Allocation IntimationDocument3 pagesCyientDLMAnchor Allocation IntimationSaurav Kumar SinghNo ratings yet

- Indonesia Strategy Stronger Growth and Stability PhaseDocument26 pagesIndonesia Strategy Stronger Growth and Stability PhaseNurcahya PriyonugrohoNo ratings yet

- A4 Growealth Survey Oct 2020 PDFDocument1 pageA4 Growealth Survey Oct 2020 PDFAlois KudzaiNo ratings yet

- Avram - RDTSpirit 6Document7 pagesAvram - RDTSpirit 6insan_adNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- RunEco EP600 Datasheet 2018Document2 pagesRunEco EP600 Datasheet 2018widnu wirasetiaNo ratings yet

- Introduction To IEEEDocument13 pagesIntroduction To IEEESunny Tiwary100% (1)

- Reading PashtoDocument17 pagesReading PashtoUmer Khan0% (1)

- Digital Image Processing - S. Jayaraman, S. Esakkirajan and T. VeerakumarDocument4 pagesDigital Image Processing - S. Jayaraman, S. Esakkirajan and T. VeerakumarBenedict IsaacNo ratings yet

- Ministry of Environment, Forest and Climate Change NotificationDocument12 pagesMinistry of Environment, Forest and Climate Change Notificationaridaman raghuvanshiNo ratings yet

- Solved Examples: Axes-Zz and - YyDocument8 pagesSolved Examples: Axes-Zz and - YyDeepak SahNo ratings yet

- English Test - Imterchange 1 - Unit 1-8Document5 pagesEnglish Test - Imterchange 1 - Unit 1-8GabrielaNo ratings yet

- (LN) Gamers! - Volume 03Document246 pages(LN) Gamers! - Volume 03DEATHSTROKENo ratings yet

- Audio Phile 2496Document5 pagesAudio Phile 2496Antonio FernandesNo ratings yet

- ROWEB 03638 Mia UKDocument4 pagesROWEB 03638 Mia UKNounaNo ratings yet

- VentreCanard Trail of A Single Tear Gazellian Series 3Document367 pagesVentreCanard Trail of A Single Tear Gazellian Series 3Lost And Wander100% (1)

- Billing Reports Export 1702384478083Document82 pagesBilling Reports Export 1702384478083vinjamuriraviteja123No ratings yet

- Esoteric Christianity 06 Being Born AgainDocument15 pagesEsoteric Christianity 06 Being Born AgainTortura ChinaNo ratings yet

- Tbaqarah Tafseer Lesson 3 OnDocument221 pagesTbaqarah Tafseer Lesson 3 OnArjumand AdilNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- ARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFDocument371 pagesARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFJuanManuelAmaroLuisNo ratings yet

- Kapandji TrunkDocument245 pagesKapandji TrunkVTZIOTZIAS90% (10)

- Caro PresentationDocument33 pagesCaro PresentationVIJAY GARGNo ratings yet

- MATH CHALLENGE GRADE 2 - Google FormsDocument5 pagesMATH CHALLENGE GRADE 2 - Google FormsAivy YlananNo ratings yet

- Capr-Iii En4115 PDFDocument49 pagesCapr-Iii En4115 PDFYT GAMERSNo ratings yet

- ReadrDocument34 pagesReadrSceptic GrannyNo ratings yet

- User Manual 13398Document44 pagesUser Manual 13398Diy DoeNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- Scope: Airport Planning ManualDocument4 pagesScope: Airport Planning ManualclebersjcNo ratings yet

- Economic and Political WeeklyDocument8 pagesEconomic and Political WeeklynaveensarimallaNo ratings yet

- Uperpowered Estiary: Boleth To YclopsDocument6 pagesUperpowered Estiary: Boleth To YclopsMatheusEnder172No ratings yet

- BMR 2105 PDFDocument6 pagesBMR 2105 PDFSitoraKodirovaNo ratings yet

- Blackwood Aalisa Lesson Plan AssignmentDocument6 pagesBlackwood Aalisa Lesson Plan Assignmentapi-498288988No ratings yet

Build your own BOND Portfolio - Sample Portfolio with Yield working

Build your own BOND Portfolio - Sample Portfolio with Yield working

Uploaded by

SMIT PATEL0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageBuild your own BOND Portfolio - Sample Portfolio with Yield working

Build your own BOND Portfolio - Sample Portfolio with Yield working

Uploaded by

SMIT PATELCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

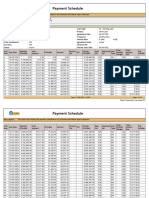

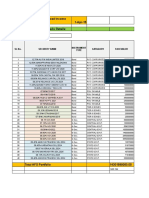

Build your own Bond Portfolio

Sample Bond Portfolio with Weighted Average Yield Working

Security Name ISIN No.

Interest

Nature Credit Rating

Call/Final Offer YTC/YTM/ Assumed Clean Allocation

Frequency Maturity Rate XIRR % Qty. Value %

12.00 Annapurna Finance Unsecured,

INE515Q08267 Monthly A- by CARE 24-Jan-30 103.48 11.75 10 10,34,800 4.95%

Pvt. Ltd. 2030 Listed

9.20 Nido Home Finance

INE530L07566 Monthly Secured A-/Stable by CRISIL 15-Sep-26 96.47 11.50 1000 9,64,700 4.61%

Ltd. 2026

10.40 Satin Creditcare

INE836B07857 Quarterly Secured A/Stable by ICRA 30-Apr-27 99.00 11.25 10 9,90,000 4.73%

Network Ltd. 2027

11.00 ESAF Small Finance Unsecured,

INE818W08123 Half Yearly A /Stable by CARE 20-Apr-30 100.50 11.16 10 10,05,000 4.80%

Bank Ltd. 2030 Tier 2

10.50 Aye Finance Pvt. Ltd. A-/Positive

INE501X07570 Monthly Secured

by India Ratings

30-Apr-27 100.00 11.01 10 10,00,000 4.78%

2027

8.85 Indiabulls Housing AA-/Stable by CARE &

INE148I07GK5 Annual Secured

AA+/Stable by BWR

26-Sep-26 95.65 11.00 1000 9,56,500 4.57%

Finance Ltd. 2026

9.81 Spandana Sphoorty

INE572J07703 Monthly Secured A+/Stable by ICRA 02-Apr-26 99.25 10.75 10 9,92,500 4.74%

Financial Ltd. 2026

A+/Stable by CRISIL &

10.00 Edelweiss Financial

INE532F07EL9 Monthly Secured AA-/ Stable by BWR 26-Oct-33 99.00 10.64 1000 9,90,000 4.73%

Ser. Ltd. 2033

8.88 Edelweiss Retail

INE528S07110 Monthly Secured A+/Stable by CRISIL 22-Mar-28 96.00 10.63 1000 9,60,000 4.59%

Finance Ltd. 2028

10.65 Navi Finserv Ltd. 2027 INE342T07460 Monthly Secured A/Stable by CRISIL 13-Mar-27 101.50 10.51 1000 10,15,000 4.85%

10.03 IIFL Samasta AA by Acuite &

INE413U07269 Monthly Secured 21-Dec-28 100.00 10.49 1000 10,10,000 4.83%

Finance Ltd. 2028 AA- by CRISIL

6.75 Piramal Capital & Hou.

INE516Y07444 Half Yearly Secured AA by CARE & ICRA 26-Sep-31 88.00 10.47 1143 8,80,000 4.21%

Fin. Ltd. 2031

9.55 Muthoot Fincorp

INE549K07DU6 Monthly Secured AA-/Stable by CRISIL 30-Apr-30 100.00 9.98 1000 10,00,000 4.78%

Ltd. 2030

8.20 IIFL Home Finance

INE477L07AN9 Monthly Secured AA/Stable by CRISIL 03-Jan-27 97.00 9.93 1000 9,70,000 4.64%

Ltd. 2027

9.39 Edelweiss Financial

INE532F07BM3 Monthly Secured A+/Stable by CRISIL 08-Jan-26 100.00 9.80 1000 10,00,000 4.78%

Ser. Ltd. 2026

10.00 Arka Fincap Limited

INE03W107223 Annual Secured AA-/Positive by CRISIL 27-Dec-28 100.70 9.76 1000 10,07,000 4.81%

2028

8.95 Kerala Infra. Invest. Unsecured - AA(CE)/Stable by

INE658F08094 Quarterly 22-Dec-31 101.30 8.99 10 10,13,000 4.84%

Fund Board 2031 State Guaranteed IND & ACUITE

8.89 Kerala Financial

Corporation 2034

INE818F07286 Quarterly Secured AA by Infomerics & Acuite 13-Mar-34 101.50 8.94 10 10,15,000 4.85%

9.35 A. K. Capital Finance Call: 13-Jun-2025

INE197P07334 Annual Secured AA-/Stable by CARE

Mat.: 13-May-2027

100.50 8.84 10 10,05,000 4.80%

Ltd. 2027

9.62 Andhra Pradesh State Secured, AA+(CE)/Stable by ACUITE

Beverages Corp. Ltd. 2032

INE0M2307107 Quarterly 31-May-32 106.30 8.76 1 10,63,000 5.08%

State Guaranteed & AA (CE)/Stable by IND

9.95 Uttar Pradesh Power Secured, A+(CE)/Stable

Corporation Limited 2028

INE540P07475 Quarterly 31-Mar-28 105.26 8.44 1 10,52,600 5.03%

State Guaranteed by CRISIL & IND

Weig. Avg. Maturity (Yrs) 4.62 Weig. Avg. Yield 10.20%

Invest in Fixed Income Bond under secondary deal

Long, Face Value Interest

Click on Security Name to download brief about respective issuer company Rating Medium Rs. 1000 to payout –

from and Short Rs. 10 Lacs Monthly to

Click on ISIN No. to download respective Issue Memorandum A to AAA Maturity per Bond Annually

For basic understanding of Bonds refer to https://www.fundzbazar.com/bond

Please contact your RM/Distributor for investing in Bonds Corporate Bond deal will be settled through RFQ on exchange platform only

Disclaimer: The offer price and yield mentioned here are subject to change. Pl. confirm before finalizing the deal. | Avg. Maturity: Where maturity payment is in parts, Final

maturity date has been considered. In case of Perpetual, Call/Put date has been considered. | Investments in debt securities/ municipal debt securities/ securitised debt

instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.

Make Bonds a part of your investment portfolio

You might also like

- Demon Slayer Kimetsu No Yaiba Free Download Anime Calendar 2022Document12 pagesDemon Slayer Kimetsu No Yaiba Free Download Anime Calendar 2022Gokul M PNo ratings yet

- Siddha Siddhanta Paddhati Natha YogisDocument35 pagesSiddha Siddhanta Paddhati Natha YogisNilkanth Yengde80% (10)

- Corporate Bond (Taxable) - Secondary Offers (20)Document1 pageCorporate Bond (Taxable) - Secondary Offers (20)Shubham AgrawalNo ratings yet

- Half Yearly Portfolio March 2021Document309 pagesHalf Yearly Portfolio March 2021siva sumanthNo ratings yet

- Portfolio As On 30.11.2019Document275 pagesPortfolio As On 30.11.2019ishan bapatNo ratings yet

- Fortnightly Portfolio As On 15th June 2021Document160 pagesFortnightly Portfolio As On 15th June 2021Vera WhiteheadNo ratings yet

- Security Level Portfolio As On April 30 2020 For 6 Schemes Being Wound Up k9fmj184 PDFDocument15 pagesSecurity Level Portfolio As On April 30 2020 For 6 Schemes Being Wound Up k9fmj184 PDFVignesh RajaramNo ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- BondsDocument1 pageBondsМаниш НахтвандерерNo ratings yet

- Medium Term Bond PDFDocument5 pagesMedium Term Bond PDFGNo ratings yet

- Payment Schedule3039Document10 pagesPayment Schedule3039marblewalaaNo ratings yet

- Bond Portfolio OptimizationAug.2019 For StudentsDocument60 pagesBond Portfolio OptimizationAug.2019 For StudentsMrunalNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- Personal Financial Planning: Assignment - 2Document16 pagesPersonal Financial Planning: Assignment - 2anilk_210No ratings yet

- Retail Bond Paper.Document1 pageRetail Bond Paper.dharam singhNo ratings yet

- MONTHLY - PORTFOLIO - AXISMF-Oct 2019Document117 pagesMONTHLY - PORTFOLIO - AXISMF-Oct 2019Gopal PenjarlaNo ratings yet

- Kotak Gilt Investment Fund GrowthDocument1 pageKotak Gilt Investment Fund GrowthYogi173No ratings yet

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026No ratings yet

- PGDocument300 pagesPGSuraj SinghNo ratings yet

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- PDF Download 1717996953431Document3 pagesPDF Download 1717996953431jaiswal.abhinawNo ratings yet

- Aditya Birla Sun Life Floating Rate Fund - Long Term Plan: Savings SolutionsDocument3 pagesAditya Birla Sun Life Floating Rate Fund - Long Term Plan: Savings SolutionsMayank SainiNo ratings yet

- Questions of MTP and RTPDocument144 pagesQuestions of MTP and RTPGaurang ChhanganiNo ratings yet

- MaxsDocument1 pageMaxssushilkumar708No ratings yet

- Final Project For Marketing PuneetDocument21 pagesFinal Project For Marketing PuneetSankalp KayathNo ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- 892Document20 pages892Adam CuencaNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- In MF Monthly Portfolio AxismfDocument163 pagesIn MF Monthly Portfolio AxismfKarthikNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund 2019jan03fukkatNo ratings yet

- Morningstarreport 20230811090706Document1 pageMorningstarreport 20230811090706Sunny AhujaNo ratings yet

- Fundcard: Reliance Etf Bank BeesDocument4 pagesFundcard: Reliance Etf Bank BeesChittaNo ratings yet

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Document6 pagesValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNo ratings yet

- Heim 030010293631122022001Document1 pageHeim 030010293631122022001sindiswapinkynkosiNo ratings yet

- Data For The Year 2008: Close - End Mutual FundDocument15 pagesData For The Year 2008: Close - End Mutual FundRana Safdar HussainNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- Franklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Document45 pagesFranklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Ghanshyam Kumar PandeyNo ratings yet

- DocumentsDocument2 pagesDocumentsupsc.bengalNo ratings yet

- Morningstarreport 20231123045134Document1 pageMorningstarreport 20231123045134SHUBHAM STAR PatilNo ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- MMDocument5 pagesMMIntraday TraderNo ratings yet

- Absa Dividend Income FundDocument2 pagesAbsa Dividend Income FundGontse SitholeNo ratings yet

- ELSS Mutual Fund InvestmentDocument6 pagesELSS Mutual Fund InvestmentAshish ShuklaNo ratings yet

- Portfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Industry/Rating Quantity Units of Mutual FundsDocument18 pagesPortfolio As On Aug 31,2020: Company/Issuer/Instrument Name Isin Industry/Rating Quantity Units of Mutual FundsKrishna KusumaNo ratings yet

- NotesDocument1 pageNotesImranNo ratings yet

- Mba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanDocument10 pagesMba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanHaris AmirNo ratings yet

- KRS 16 RevDocument19 pagesKRS 16 RevSURANA1973No ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- Internet Account Statement: Non-TransferableDocument2 pagesInternet Account Statement: Non-TransferableSatishBaranwalNo ratings yet

- LAPORAN KEUANGAN 2020 TrioDocument3 pagesLAPORAN KEUANGAN 2020 TrioMT Project EnokNo ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- Prof. D. C. Pai: Submitted ToDocument17 pagesProf. D. C. Pai: Submitted ToGirish PalkarNo ratings yet

- CyientDLMAnchor Allocation IntimationDocument3 pagesCyientDLMAnchor Allocation IntimationSaurav Kumar SinghNo ratings yet

- Indonesia Strategy Stronger Growth and Stability PhaseDocument26 pagesIndonesia Strategy Stronger Growth and Stability PhaseNurcahya PriyonugrohoNo ratings yet

- A4 Growealth Survey Oct 2020 PDFDocument1 pageA4 Growealth Survey Oct 2020 PDFAlois KudzaiNo ratings yet

- Avram - RDTSpirit 6Document7 pagesAvram - RDTSpirit 6insan_adNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsFrom EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- RunEco EP600 Datasheet 2018Document2 pagesRunEco EP600 Datasheet 2018widnu wirasetiaNo ratings yet

- Introduction To IEEEDocument13 pagesIntroduction To IEEESunny Tiwary100% (1)

- Reading PashtoDocument17 pagesReading PashtoUmer Khan0% (1)

- Digital Image Processing - S. Jayaraman, S. Esakkirajan and T. VeerakumarDocument4 pagesDigital Image Processing - S. Jayaraman, S. Esakkirajan and T. VeerakumarBenedict IsaacNo ratings yet

- Ministry of Environment, Forest and Climate Change NotificationDocument12 pagesMinistry of Environment, Forest and Climate Change Notificationaridaman raghuvanshiNo ratings yet

- Solved Examples: Axes-Zz and - YyDocument8 pagesSolved Examples: Axes-Zz and - YyDeepak SahNo ratings yet

- English Test - Imterchange 1 - Unit 1-8Document5 pagesEnglish Test - Imterchange 1 - Unit 1-8GabrielaNo ratings yet

- (LN) Gamers! - Volume 03Document246 pages(LN) Gamers! - Volume 03DEATHSTROKENo ratings yet

- Audio Phile 2496Document5 pagesAudio Phile 2496Antonio FernandesNo ratings yet

- ROWEB 03638 Mia UKDocument4 pagesROWEB 03638 Mia UKNounaNo ratings yet

- VentreCanard Trail of A Single Tear Gazellian Series 3Document367 pagesVentreCanard Trail of A Single Tear Gazellian Series 3Lost And Wander100% (1)

- Billing Reports Export 1702384478083Document82 pagesBilling Reports Export 1702384478083vinjamuriraviteja123No ratings yet

- Esoteric Christianity 06 Being Born AgainDocument15 pagesEsoteric Christianity 06 Being Born AgainTortura ChinaNo ratings yet

- Tbaqarah Tafseer Lesson 3 OnDocument221 pagesTbaqarah Tafseer Lesson 3 OnArjumand AdilNo ratings yet

- Masonic SymbolismDocument19 pagesMasonic SymbolismOscar Cortez100% (7)

- ARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFDocument371 pagesARMSTRONG-Introduction To The Study of Organic Chemistry-The Chemistry of Carbon and Its Compounds (1 Ed) (1874) PDFJuanManuelAmaroLuisNo ratings yet

- Kapandji TrunkDocument245 pagesKapandji TrunkVTZIOTZIAS90% (10)

- Caro PresentationDocument33 pagesCaro PresentationVIJAY GARGNo ratings yet

- MATH CHALLENGE GRADE 2 - Google FormsDocument5 pagesMATH CHALLENGE GRADE 2 - Google FormsAivy YlananNo ratings yet

- Capr-Iii En4115 PDFDocument49 pagesCapr-Iii En4115 PDFYT GAMERSNo ratings yet

- ReadrDocument34 pagesReadrSceptic GrannyNo ratings yet

- User Manual 13398Document44 pagesUser Manual 13398Diy DoeNo ratings yet

- 1999 Aversion Therapy-BEDocument6 pages1999 Aversion Therapy-BEprabhaNo ratings yet

- Scope: Airport Planning ManualDocument4 pagesScope: Airport Planning ManualclebersjcNo ratings yet

- Economic and Political WeeklyDocument8 pagesEconomic and Political WeeklynaveensarimallaNo ratings yet

- Uperpowered Estiary: Boleth To YclopsDocument6 pagesUperpowered Estiary: Boleth To YclopsMatheusEnder172No ratings yet

- BMR 2105 PDFDocument6 pagesBMR 2105 PDFSitoraKodirovaNo ratings yet

- Blackwood Aalisa Lesson Plan AssignmentDocument6 pagesBlackwood Aalisa Lesson Plan Assignmentapi-498288988No ratings yet