Professional Documents

Culture Documents

Scheme Document Personal Loan (2)

Scheme Document Personal Loan (2)

Uploaded by

rubhisingh648Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheme Document Personal Loan (2)

Scheme Document Personal Loan (2)

Uploaded by

rubhisingh648Copyright:

Available Formats

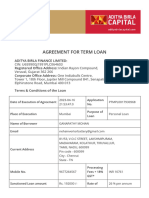

Corporate Office: 2nd Floor, Sadhana House, 570 P. B.

Marg, Worli, Mumbai 400 018, India

Phone: 0226652 3500 | Fax: 0222497 2741

Registered Office: Gateway Building, Apollo Bunder, Mumbai 400 001, India

Website: www.mahindrafinance.com | CIN: L65921MH1991PLC059642

This note explains the salient features of Personal Loans for salaried applicants

Parameters Norms

Loan Amount INR 50,000 – INR 15,00,000

Tenure 24 – 60 months

Repayment Monthly EMI

Product Variant Flexi Loan 1

Pay only interest due during the first 12 months, followed by regular EMI

payments.

Flexi Loan 2

Pay only interest due during the first 24 months, followed by regular EMI

payments.

Easy Loan

Pay regular EMIs from the start of loan tenure.

Process Variants Online process of loan application to sanction

Age Criteria 21 – 60 years

Nationality Indian

• Multiple loan variants to suit customer needs

• Fast disbursement

• Online application process

• No penalty on early closure of loan

• Option to pay only interest for the first 12 or 24 months

Step Request by Applicant Response by Mahindra Finance

No.

Step 1 Visit the Personal Loan Application Portal and provide

basic details for the personal loan application.

Step 2 Email the requested documents to The approval decision will be

PLProcess@mahindra.com communicated by Mahindra Finance.

Sanction letter will be issued for approved

applications.

Step 3 Sign the loan agreement & set up the repayment The loan will be disbursed in your account

mandate digitally by Mahindra Finance.

Note: The final approval and disbursement of the loan will be at the sole discretion of Mahindra Finance.

Following is an indicative list of documents that will be required & verified for processing of Personal

Loan application:

1. PAN card

2. Proof of ID & address (POI/POA): Either of following - Passport /Driving License/Voter ID/

Aadhaar. In case a copy of Aadhaar card is provided, the first 8 digits of Aadhaar number must be

masked.

3. Proof of income:

a. Last 3 month’s salary slip

b. Last 3 month’s bank statement of salary account

Note: Mahindra Finance reserves the right to ask for additional documents, if required.

Fees & Charges

Processing Fees 2% of the loan amount or INR 5000, whichever is lesser + tax

Interest Rates 10.99% - 18% per annum

EMI/Cheque Bounce Charges INR 450 + tax

EMI Overdue – Additional Interest 3% per month of unpaid EMI amount charged on per day basis

Stamp Duty Charges INR 100

Stamping Fees INR 50 + tax

You might also like

- KB240203GPBSU - KFS & Sanction LetterDocument10 pagesKB240203GPBSU - KFS & Sanction Letterdinesh211988No ratings yet

- Welcome Letter PDFDocument4 pagesWelcome Letter PDFVinay KumarNo ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- KB220502AIMCU - Sanction Letter PDFDocument3 pagesKB220502AIMCU - Sanction Letter PDFRatnesh ShuklaNo ratings yet

- Oracle FLEXCUBE AnsswerDocument22 pagesOracle FLEXCUBE AnsswerAMJ TELNo ratings yet

- WelcomeLetter CDDocument2 pagesWelcomeLetter CDAnirban SahaNo ratings yet

- Cash Bean - Pay Day Loan - 190812020137600271 PDFDocument3 pagesCash Bean - Pay Day Loan - 190812020137600271 PDFmanojNo ratings yet

- Singapore Bank and Branch Codes - AchcodeDocument20 pagesSingapore Bank and Branch Codes - Achcodedinesh_s_17No ratings yet

- LXS-H09023-242564415 - Terms & ConditionsDocument23 pagesLXS-H09023-242564415 - Terms & Conditionsdewic29037No ratings yet

- Car Loan WEBSITEDocument57 pagesCar Loan WEBSITENAVEEN ROYNo ratings yet

- Preview AgreementDocument11 pagesPreview Agreementasoukot84No ratings yet

- LXS C09023 242379575 - Terms & ConditionsDocument22 pagesLXS C09023 242379575 - Terms & ConditionsnehainverterbatteryNo ratings yet

- MITCDocument8 pagesMITCajay huddaNo ratings yet

- IFB HL SanctionLetterDocument5 pagesIFB HL SanctionLetterShubhabrata NahaNo ratings yet

- Turtlemint Money LoansDocument25 pagesTurtlemint Money LoansRuchir TiwariNo ratings yet

- Personal Loan Most Important Terms and Conditions 060623Document2 pagesPersonal Loan Most Important Terms and Conditions 060623saigurudevaliveNo ratings yet

- CTS Marriage Loan PolicyDocument5 pagesCTS Marriage Loan PolicyshaannivasNo ratings yet

- Sagar & AnandDocument9 pagesSagar & AnandAnand ChavanNo ratings yet

- Anthony Gaboine - Ola0000398Document4 pagesAnthony Gaboine - Ola0000398joseph taylorNo ratings yet

- Unit 4 Banking MbaDocument18 pagesUnit 4 Banking MbaBadal JaiswalNo ratings yet

- Mortgage Loans in IndiaDocument11 pagesMortgage Loans in IndiaDebobrata MajumdarNo ratings yet

- KB240211FMDUC - KFS & Sanction LetterDocument10 pagesKB240211FMDUC - KFS & Sanction Letterrudraprasad520No ratings yet

- Meta Title: Information About The Personal Loan Number Meta Description: Personal Loans Are One of The Most Common FinancialDocument4 pagesMeta Title: Information About The Personal Loan Number Meta Description: Personal Loans Are One of The Most Common FinancialParag ShrivastavaNo ratings yet

- Loan App List - 200 (2900 Words)Document11 pagesLoan App List - 200 (2900 Words)Kshitij GautamNo ratings yet

- Welcome Letter - 40076922 - 20713455Document3 pagesWelcome Letter - 40076922 - 20713455sarathbharathi27No ratings yet

- PL88005492417Document25 pagesPL88005492417a64588502No ratings yet

- Signed AgreementDocument3 pagesSigned AgreementSandeep KumarNo ratings yet

- 03 Personal - Loan - Supplementary - Abu Daud 02 PDFDocument25 pages03 Personal - Loan - Supplementary - Abu Daud 02 PDFSaiduzzaman DipNo ratings yet

- SettlementLetter (Rajesh B Gupta)Document3 pagesSettlementLetter (Rajesh B Gupta)Nikhil SinhaNo ratings yet

- NOVUS 2015 International Conference at NagpurDocument11 pagesNOVUS 2015 International Conference at NagpurAnonymous 6aK5b2svMNo ratings yet

- Infographics - GenmathDocument1 pageInfographics - GenmathJohn Gil Talangan PadieNo ratings yet

- Sanction LetterDocument1 pageSanction Letterjeya lakshmiNo ratings yet

- Welcome LetterDocument4 pagesWelcome LetterChetan ChoudharyNo ratings yet

- 2.4 Personal LoanDocument13 pages2.4 Personal LoanRadadiya JenilNo ratings yet

- LDW EOYYQDocument1 pageLDW EOYYQMd SerajNo ratings yet

- Welcome Letter 131706428Document3 pagesWelcome Letter 131706428rupesh.gunjan90823No ratings yet

- Loan Agreement SahilDocument17 pagesLoan Agreement SahilitsmesahilshahhNo ratings yet

- Group 9 - Fintech ProjectDocument6 pagesGroup 9 - Fintech ProjectAlka RajpalNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- STLMNT - Letter - LTDEXXXXXXXX8915 - DEVINDER .Document3 pagesSTLMNT - Letter - LTDEXXXXXXXX8915 - DEVINDER .arjuniieiehdhNo ratings yet

- GboDocument5 pagesGborosechaithuNo ratings yet

- Welcome Letter - 75901064 - 17510625Document3 pagesWelcome Letter - 75901064 - 17510625Mohit ChauhanNo ratings yet

- Welcome Letter 193521762Document3 pagesWelcome Letter 193521762Deeptej Singh MatharuNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Document2 pagesTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Vinod Kumar PandeyNo ratings yet

- Terms & Conditions and Schedule of Charges - PL-SmartDocument2 pagesTerms & Conditions and Schedule of Charges - PL-SmartSunil DadhichNo ratings yet

- Stlmnt_Letter_4315XXXXXXXX0008_Sohel RashidDocument3 pagesStlmnt_Letter_4315XXXXXXXX0008_Sohel RashidvijaykumarNo ratings yet

- Comm Training MatDocument8 pagesComm Training MatVadivel NattarayanNo ratings yet

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- CTS Medical Emergencies Loan PolicyDocument5 pagesCTS Medical Emergencies Loan PolicyshaannivasNo ratings yet

- Personal Loan FAQsDocument16 pagesPersonal Loan FAQsAlokThakur143No ratings yet

- Welcome Letter 111306743Document6 pagesWelcome Letter 111306743Tabe alamNo ratings yet

- Bitsyyloan: Loan AgreementDocument10 pagesBitsyyloan: Loan Agreementpintukumar rameshbhaiNo ratings yet

- Loan Sanction-Letter181240016761170869Document3 pagesLoan Sanction-Letter181240016761170869Sanjay MohapatraNo ratings yet

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Document7 pagesIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)parasbhalla97No ratings yet

- How to dispute properly and get paid to fix your own credit: The only credit repair guide you will ever needFrom EverandHow to dispute properly and get paid to fix your own credit: The only credit repair guide you will ever needNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- January 2020: PresentationDocument23 pagesJanuary 2020: PresentationParas GuptaNo ratings yet

- A Project of Management Information System On HDFC Bank Submitted To-Ms - Amandeep Submitted By-Sakshi Virmani Roll No.180Document21 pagesA Project of Management Information System On HDFC Bank Submitted To-Ms - Amandeep Submitted By-Sakshi Virmani Roll No.180Sakshi VirmaniNo ratings yet

- Non Performing Assets BasitDocument20 pagesNon Performing Assets Basitshaykh basharatNo ratings yet

- Special ContractsDocument14 pagesSpecial ContractsSoorya ShrinivasNo ratings yet

- Annual Report 2016: Annapurna Microfinance PVT LTDDocument59 pagesAnnual Report 2016: Annapurna Microfinance PVT LTDJijinNo ratings yet

- Thesis ProposalDocument41 pagesThesis Proposalkassahun mesele100% (4)

- NEGO Gr. 9evangelista Vs Screener IncDocument2 pagesNEGO Gr. 9evangelista Vs Screener IncBiBi JumpolNo ratings yet

- 6 Month PDFDocument5 pages6 Month PDFSubham PradhanNo ratings yet

- Koperasi Sahabat Amanah Ikhtiar BHD V RHB Investment BaDocument44 pagesKoperasi Sahabat Amanah Ikhtiar BHD V RHB Investment Baikmal hishamNo ratings yet

- Iib Fakes, Scams InstrumentssDocument39 pagesIib Fakes, Scams InstrumentssCentro turistico Los rosalesNo ratings yet

- Tugas Bahasa Inggris Retail Banking: By: Group EightDocument5 pagesTugas Bahasa Inggris Retail Banking: By: Group EightOka HagaNo ratings yet

- Bankislami Pakistan Limited: Internship ReportDocument42 pagesBankislami Pakistan Limited: Internship ReportSunbla MariaNo ratings yet

- English For Finance and Banking Case Study 3Document4 pagesEnglish For Finance and Banking Case Study 3Khánh LinhNo ratings yet

- OpTransactionHistoryUX524 08 2023Document2 pagesOpTransactionHistoryUX524 08 2023Praveen SainiNo ratings yet

- Panchaganga Farmers Service Cooperative Society LTD HemmadyDocument55 pagesPanchaganga Farmers Service Cooperative Society LTD HemmadySakshath ShettyNo ratings yet

- My ResumeDocument8 pagesMy ResumeShaikh Mohd ShahbazNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFManoj KolkarNo ratings yet

- Presentation IFMDocument11 pagesPresentation IFMSrikara SimhaNo ratings yet

- Schedule of Charges OBL CardsDocument4 pagesSchedule of Charges OBL CardsShaikh Hassan AtikNo ratings yet

- Risk Management: Basic ApproachDocument15 pagesRisk Management: Basic Approachmtuấn_606116No ratings yet

- AU 2 I COMPARE Select A Financial Account or ProductDocument5 pagesAU 2 I COMPARE Select A Financial Account or ProductMaria SalinasNo ratings yet

- E-Banking Challenges and Opportunities in The Indian Banking SectorDocument4 pagesE-Banking Challenges and Opportunities in The Indian Banking SectorMunni ChukkaNo ratings yet

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancevijaybhaskarthatitNo ratings yet

- Banking Thesis PDFDocument6 pagesBanking Thesis PDFMary Montoya100% (2)

- Ebcl 2022 Part 1Document246 pagesEbcl 2022 Part 1Muskaan ChhabraNo ratings yet

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberDocument3 pagesYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberAyah Dek EchaNo ratings yet

- Tutorial Letter 102/3/2019: Financial Accounting Principles For Law PractitionersDocument41 pagesTutorial Letter 102/3/2019: Financial Accounting Principles For Law Practitionersall green associatesNo ratings yet

- Assessment of Internal Control Over Cash (The Case of Wegagen Bank, Wolkite Branch)Document29 pagesAssessment of Internal Control Over Cash (The Case of Wegagen Bank, Wolkite Branch)kassahun mesele100% (6)